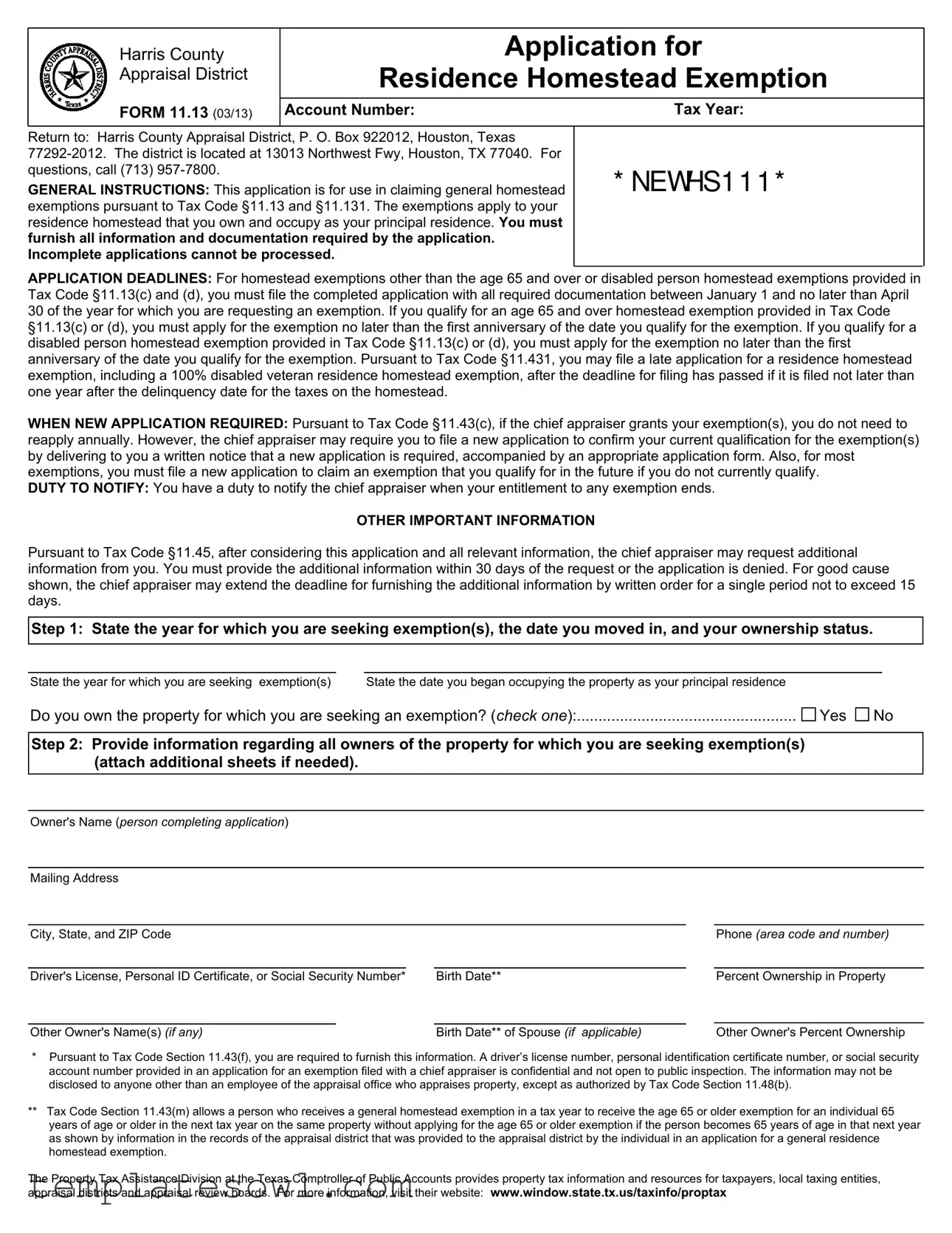

Fill Out Your Texas Homestead Exemption Form

The Texas Homestead Exemption form plays a vital role in providing financial relief to homeowners by reducing the amount of property taxes owed on their primary residences in Harris County. By claiming a homestead exemption, eligible individuals can lower their taxable property value, thereby decreasing their overall tax liability. This application specifically seeks to address various types of exemptions, including the general residence homestead exemption, exemptions for individuals aged 65 and older, and those for disabled persons. To successfully navigate this process, applicants must provide essential details such as ownership status, occupancy dates, and necessary supporting documents. Importantly, deadlines for submission are clearly defined, requiring timely action from applicants to ensure their claims are processed. Furthermore, individuals already granted exemptions do not need to reapply annually unless notified otherwise. Ensuring compliance with required documentation, including proof of identity and residence, is critical for a smooth application process. Understanding these key components will help you make informed decisions while pursuing these important exemptions.

Texas Homestead Exemption Example

Harris County |

|

Application for |

||

Appraisal District |

Residence Homestead Exemption |

|||

|

|

|

||

|

|

|

|

|

FORM 11.13 (03/13) |

Account Number: |

|

Tax Year: |

|

|

|

|

||

Return to: Harris County Appraisal District, P. O. Box 922012, Houston, Texas |

|

|||

|

||||

questions, call (713) |

|

|

* NEWHS1 1 1 * |

|

GENERAL INSTRUCTIONS: This application is for use in claiming general homestead |

||||

|

||||

exemptions pursuant to Tax Code §11.13 and §11.131. The exemptions apply to your |

|

|||

residence homestead that you own and occupy as your principal residence. You must |

|

|||

furnish all information and documentation required by the application. |

|

|

||

Incomplete applications cannot be processed. |

|

|

||

|

|

|

|

|

APPLICATION DEADLINES: For homestead exemptions other than the age 65 and over or disabled person homestead exemptions provided in Tax Code §11.13(c) and (d), you must file the completed application with all required documentation between January 1 and no later than April 30 of the year for which you are requesting an exemption. If you qualify for an age 65 and over homestead exemption provided in Tax Code §11.13(c) or (d), you must apply for the exemption no later than the first anniversary of the date you qualify for the exemption. If you qualify for a disabled person homestead exemption provided in Tax Code §11.13(c) or (d), you must apply for the exemption no later than the first anniversary of the date you qualify for the exemption. Pursuant to Tax Code §11.431, you may file a late application for a residence homestead exemption, including a 100% disabled veteran residence homestead exemption, after the deadline for filing has passed if it is filed not later than one year after the delinquency date for the taxes on the homestead.

WHEN NEW APPLICATION REQUIRED: Pursuant to Tax Code §11.43(c), if the chief appraiser grants your exemption(s), you do not need to reapply annually. However, the chief appraiser may require you to file a new application to confirm your current qualification for the exemption(s) by delivering to you a written notice that a new application is required, accompanied by an appropriate application form. Also, for most exemptions, you must file a new application to claim an exemption that you qualify for in the future if you do not currently qualify.

DUTY TO NOTIFY: You have a duty to notify the chief appraiser when your entitlement to any exemption ends.

OTHER IMPORTANT INFORMATION

Pursuant to Tax Code §11.45, after considering this application and all relevant information, the chief appraiser may request additional information from you. You must provide the additional information within 30 days of the request or the application is denied. For good cause shown, the chief appraiser may extend the deadline for furnishing the additional information by written order for a single period not to exceed 15 days.

Step 1: State the year for which you are seeking exemption(s), the date you moved in, and your ownership status.

State the year for which you are seeking exemption(s) |

State the date you began occupying the property as your principal residence |

|

|

Do you own the property for which you are seeking an exemption? (check one): |

Yes |

No |

|

Step 2: Provide information regarding all owners of the property for which you are seeking exemption(s) (attach additional sheets if needed).

Owner's Name (person completing application)

Mailing Address

City, State, and ZIP Code |

|

|

|

Phone (area code and number) |

|

|

|

|

|

|

|

Driver's License, Personal ID Certificate, or Social Security Number* |

|

Birth Date** |

|

Percent Ownership in Property |

|

|

|

|

|

|

|

Other Owner's Name(s) (if any) |

|

Birth Date** of Spouse (if applicable) |

|

Other Owner's Percent Ownership |

|

*Pursuant to Tax Code Section 11.43(f), you are required to furnish this information. A driver’s license number, personal identification certificate number, or social security account number provided in an application for an exemption filed with a chief appraiser is confidential and not open to public inspection. The information may not be disclosed to anyone other than an employee of the appraisal office who appraises property, except as authorized by Tax Code Section 11.48(b).

**Tax Code Section 11.43(m) allows a person who receives a general homestead exemption in a tax year to receive the age 65 or older exemption for an individual 65 years of age or older in the next tax year on the same property without applying for the age 65 or older exemption if the person becomes 65 years of age in that next year as shown by information in the records of the appraisal district that was provided to the appraisal district by the individual in an application for a general residence homestead exemption.

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards. For more information, visit their website: www.window.state.tx.us/taxinfo/proptax

Step 3: Describe the property for which you are seeking exemption(s).

Street Address, City, State, and ZIP Code |

|

|

|

|

|

|

|

|

|

|

|

Legal Description (if known) |

|

Appraisal District Account Number (if known) |

|||

Number of acres (not to exceed 20) used for residential occupancy of the structure: |

|

|

|

|

|

(Note: the structure and the land and improvements must have identical ownership) |

|

acres |

|||

For a MANUFACTURED HOME, state the make, model and identification number |

|

|

|

|

|

Step 4: Identify exemptions that apply to you and state whether you are transferring a tax ceiling.

Brief descriptions of qualifications for the exemptions listed are provided under each listing; however, to obtain complete information, you should consult the Tax Code. For assistance, you may contact your appraisal district or the Comptroller’s Property Tax Assistance Division. If your appraisal district has not provided with this application a list of taxing units served by the appraisal district with all residential homestead exemptions each taxing unit offers, you may call the appraisal district to determine what homestead exemptions are offered by your taxing units.

GENERAL RESIDENCE HOMESTEAD EXEMPTION (Tax Code §11.13): You may qualify for this exemption if for the current year and, if

filing a late application, for the year for which you are seeking an exemption: (1) you owned this property on January 1; (2) you occupied it as your principal residence on January 1; and (3) you and your spouse do not claim a residence homestead exemption on any other property.

DISABLED PERSON EXEMPTION (Tax Code §11.13(c), (d)): You may qualify for this exemption if you are under a disability for purposes of payment of disability insurance benefits under Federal

AGE 65 OR OLDER EXEMPTION (Tax Code §11.13(c), (d)): You may qualify for this exemption if you are 65 years of age or older. You cannot receive a disability exemption if you receive this exemption.

SURVIVING SPOUSE OF INDIVIDUAL WHO QUALIFIED FOR AGE 65 OR OLDER EXEMPTION UNDER TAX CODE

§11.13(d) (Tax Code §11.13(q)): You may qualify for this exemption if: (1) your deceased spouse died in a year in which he or she qualified for the exemption under Tax Code §11.13(d); (2) you were 55 years of age or older when your deceased spouse died; and (3) the property was your residence homestead when your deceased spouse died and remains your residence homestead. You can’t receive this exemption if you receive an exemption under Tax Code §11.13(d).

Name of Deceased Spouse |

Date of Death |

100% DISABLED VETERANS EXEMPTION (Tax Code §11.131): You may qualify for this exemption if you are a disabled veteran who

receives from the United States Department of Veterans Affairs or its successor: (1) 100 percent disability compensation due to a

SURVIVING SPOUSE OF DISABLED VETERAN WHO RECEIVED THE 100% DISABLED VETERAN’S EXEMPTION (Tax Code §11.131): You may qualify for this exemption if you were married to a disabled veteran who qualified for an exemption under Tax Code §11.131 at the time of his or her death and: (1) you have not remarried since the death of the disabled veteran and (2) the property was your residence homestead when the disabled veteran died and remains your residence homestead.

Name of Deceased Spouse |

Date of Death |

Check if you seek to transfer a school tax limitation from your last home pursuant to Tax Code §11.26(h).

Step 5: Attach required documents.

Include with ALL applications (Note: The chief appraiser may not approve an exemption unless the address on the driver’s license or

1)a copy of the applicant’s driver’s license or

2)a copy of the applicant’s vehicle registration receipt; or

a)if the applicant does not own a vehicle, an affidavit to that effect signed by the applicant; and

b)a copy of a utility bill in the applicant’s name for the property for which exemption is sought.

Include with an application for a request for an AGE 65 OR OLDER OR DISABLED exemption:

In addition to the information identified above, an applicant for an age 65 or older or disabled exemption who is not specifically identified on a deed or other instrument recorded in the applicable real property records as an owner of the residence homestead must provide an affidavit or other compelling evidence establishing the applicant’s ownership of an interest in the homestead.

Include with an application for a request for a 100% DISABLED VETERANS exemption:

In addition to the information identified above, an applicant for a 100% disabled veterans exemption or the surviving spouse of a disabled veteran who qualified for the 100% disabled veteran’s exemption must provide documentation from the United States Department of Veterans Affairs or its successor indicating that the veteran received 100 percent disability compensation due to a

Include with applications for MANUFACTURED HOMES:

For a manufactured home to qualify for a residence homestead, applicant must ALSO include:

1)a copy of the statement of ownership and location for the manufactured home issued by the Texas Department of Housing and Community Affairs showing that the applicant is the owner of the manufactured home;

2)a copy of the purchase contract or payment receipt showing that the applicant is the purchaser of the manufactured home; or

3)a sworn affidavit by the applicant indicating that:

a)the applicant is the owner of the manufactured home;

b)the seller of the manufactured home did not provide the applicant with a purchase contract; and

c)the applicant could not locate the seller after making a good faith effort.

Step 6: (Cooperative Housing Residents) Provide statement regarding your right to occupy the property.

Do you have an exclusive right to occupy this unit because you own stock in a cooperative housing corporation?.....

Yes

No

No

Step 7: Read, sign, and date.

By signing this application, you state that the facts in this application are true and correct, that you do not claim a residence homestead exemption on another residence homestead in Texas, and that you do not claim a residence homestead exemption on a residence homestead outside of Texas.

NOTICE REGARDING PENALTIES FOR MAKING OR FILING AN APPLICATION CONTAINING A FALSE STATEMENT: If you make a false statement on this form, you could be found guilty of a Class A misdemeanor or a state jail felony under Section 37.10, Penal Code.

Your signature on this application constitutes a sworn statement that you have read and understand the Notice Regarding Penalties for Making or Filing an Application Containing a False Statement.

sign here â

Authorized Signature |

Date |

Printed Name

Affidavits: Complete and have notarized, if applicable (see Step 5, above).

STATE OF TEXAS

COUNTY OF

Before me, the undersigned authority, personally appeared |

|

|

|

|

|

|

|

|

|

|

, |

|||||

who, being by me duly sworn, deposed as follows: |

|

|

|

|

|

|

|

|

|

|

|

|||||

“My name is |

|

|

|

|

|

|

|

. I am over 18 years of age and I am otherwise fully competent |

||||||||

to make this affidavit. I have personal knowledge of the facts contained herein and all of same are true and correct. |

|

|

|

|

||||||||||||

I do not own a vehicle. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Further, Affiant sayeth not.” |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Signature of Affiant |

|

|

|

SUBSCRIBED AND SWORN TO before me this, the |

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

day of |

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

Notary Public in and for the State of Texas |

|

|

|

|

||||

|

|

|

|

|

|

|

|

My Commission expires: |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

AGE 65 OR OLDER/DISABLED EXEMPTION AFFIDAVIT |

|

|

|

|

||||||||

STATE OF TEXAS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

COUNTY OF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Before me, the undersigned authority, personally appeared |

|

|

|

|

|

|

|

|

, |

|||||||

who, being by me duly sworn, deposed as follows: |

|

|

|

|

|

|

|

|

|

|

|

|||||

“My name is |

|

|

|

|

|

|

. I am over 18 years of age and I am otherwise fully competent |

|||||||||

to make this affidavit. I have personal knowledge of the facts contained herein and all of same are true and correct. |

|

|

|

|

||||||||||||

I have a |

|

percent ownership in the residence homestead identified in the foregoing exemption application. |

|

|

|

|

||||||||||

Further, Affiant sayeth not.” |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

||||||||

Signature of Affiant |

|

|

|

SUBSCRIBED AND SWORN TO before me this, the |

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

day of |

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

Notary Public in and for the State of Texas |

|

|

|

|

||||

|

|

|

|

|

|

|

|

My Commission expires: |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

MANUFACTURED HOME AFFIDAVIT |

|

|

|

|

||||||

STATE OF TEXAS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

COUNTY OF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Before me, the undersigned authority, personally appeared |

|

|

|

|

|

|

|

|

, |

|||||||

who, being by me duly sworn, deposed as follows: |

|

|

|

|

|

|

|

|

|

|

|

|||||

“My name is |

|

|

|

|

|

|

. I am over 18 years of age and I am otherwise fully competent |

|||||||||

to make this affidavit. I have personal knowledge of the facts contained herein and all of same are true and correct.

I am the owner of the manufactured home identified in the foregoing exemption application. The seller of the manufactured home did not provide me with a purchase contract and I could not locate the seller after making a good faith effort.

Further, Affiant sayeth not.”

Signature of Affiant |

SUBSCRIBED AND SWORN TO before me this, the |

|

|

||||

|

|

|

day of |

|

|

, |

|

|

|

|

|

|

|

||

|

|

Notary Public in and for the State of Texas |

|

|

|||

|

|

My Commission expires: |

|

|

|

||

Form Characteristics

| Fact Title | Description |

|---|---|

| Governing Laws | This application is governed by Texas Tax Code §11.13 and §11.131. |

| Application Deadline | Submit your application between January 1 and April 30 for the tax year you seek an exemption. |

| Automatic Renewal | If your exemption is granted, you do not need to reapply annually, unless notified otherwise by the chief appraiser. |

| Confidential Information | Personal details, such as driver's license numbers provided in this application, are kept confidential and not open to public inspection. |

Guidelines on Utilizing Texas Homestead Exemption

Filling out the Texas Homestead Exemption form is an important step for homeowners seeking potential property tax relief. When preparing your application, ensure that you provide all necessary information accurately and attach the required documents. Incomplete submissions could delay or prevent the approval of your exemption request. Below are the steps to guide you through the process of filling out the form.

-

State the year for which you are seeking exemption(s), the date you moved in, and your ownership status.

- State the year for which you are seeking exemption(s).

- State the date you began occupying the property as your principal residence.

- Do you own the property for which you are seeking an exemption? (check one): Yes or No.

-

Provide information regarding all owners of the property for which you are seeking exemption(s).

- Owner's Name (person completing application).

- Mailing Address, City, State, and ZIP Code.

- Phone (area code and number).

- Driver's License, Personal ID Certificate, or Social Security Number.

- Birth Date.

- Percent Ownership in Property.

- Other Owner's Name(s) (if any, with Birth Date of Spouse if applicable).

- Other Owner's Percent Ownership.

-

Describe the property for which you are seeking exemption(s).

- Street Address, City, State, and ZIP Code.

- Legal Description (if known).

- Appraisal District Account Number (if known).

- Number of acres (not to exceed 20) used for residential occupancy of the structure.

- For a manufactured home, state the make, model, and identification number.

-

Identify exemptions that apply to you and state whether you are transferring a tax ceiling.

- Select the general residence homestead exemption or any additional exemptions that apply.

- Check if you seek to transfer a school tax limitation from your last home.

-

Attach required documents as specified.

- Include a copy of your driver’s license or state-issued ID.

- If applicable, include additional documents relevant to your exemption type.

-

Cooperative Housing Residents: Provide a statement regarding your right to occupy the property.

- Do you have an exclusive right to occupy this unit because you own stock in a cooperative housing corporation? Yes or No.

-

Read, sign, and date the application.

- By signing, you attest that the information provided is true and correct.

- Complete any required affidavits.

What You Should Know About This Form

What is the Texas Homestead Exemption form?

The Texas Homestead Exemption form allows homeowners to claim certain tax exemptions on their principal residence. This application must be completed and submitted to the Harris County Appraisal District. The exemptions reduce the amount of property taxes owed on the home, benefiting homeowners financially.

Who is eligible to apply for the homestead exemption?

To be eligible for the homestead exemption, you must own and occupy the property as your principal residence. Additionally, you should meet specific criteria based on the type of exemption, such as being age 65 or older, being disabled, or being a surviving spouse of someone who qualified for such exemptions.

What are the deadlines for submitting the application?

Applications must be submitted between January 1 and April 30 of the tax year for which you are seeking an exemption. If claiming an exemption due to age or disability, you must apply no later than one year after qualifying for the exemption. Late applications may be submitted within one year after the tax delinquency date.

What information is required to complete the application?

You will need to provide various details, including the year for which you seek exemptions, your ownership status, property details, and information about all owners. Required documentation may include copies of your driver’s license, vehicle registration, and other relevant documents to confirm eligibility.

Do I need to reapply each year for the homestead exemption?

If your exemption was previously granted, you typically do not need to reapply annually. However, the chief appraiser may request a new application to confirm your eligibility. You should notify the chief appraiser if your entitlement to an exemption changes.

What happens if I submit an incomplete application?

If your application is incomplete, it cannot be processed. To avoid delays, ensure you provide all required information and documentation as specified in the application instructions. The chief appraiser may also request additional information within 30 days of the application submission.

How do I know if my application has been approved?

Can I transfer my homestead exemption to a new property?

Yes, if you move, you may qualify to transfer your homestead exemption to a new residence. The application for exemption must be submitted for the new property, and you must meet the eligibility requirements based on the type of exemption you are transferring. It's important to consult the appraisal district for specifics regarding your situation.

Common mistakes

Filling out the Texas Homestead Exemption form can seem straightforward, but it’s easy to make mistakes that could delay or even derail your application. One common error is providing incomplete information. Each section of the application requires attention to detail. If any necessary information is missing, the appraisal district may reject your application outright. To avoid this, always double-check that you’ve filled in all required fields before submitting.

Another mistake people often make involves the misreporting of ownership status. If you are not the sole owner of the property, you’re required to disclose all co-owners. Failing to do so could lead to complications later. Always ensure that you report the correct ownership percentage of the property and include the names of other owners if applicable.

Choosing the wrong tax year can also be problematic. Applicants sometimes select a year prior to when they actually qualified for the exemption. This can lead to confusion and may cause the application to be denied. It’s essential to accurately indicate the tax year for which you’re applying, and ensure it matches the year you became eligible.

People frequently overlook the importance of attaching the necessary documentation. The form requires specific documents, such as a copy of the applicant’s driver’s license and vehicle registration. Applications submitted without these supporting documents can be delayed or denied. Always compile and attach these documents before mailing your application.

Not understanding the deadlines is another pitfall. The application must be submitted between January 1 and April 30 for standard exemptions. Missing this window could mean waiting a whole other year to apply. If you qualify for certain exemptions due to age or disability, it’s crucial to note any specific deadlines that apply to your situation.

Failure to notify the chief appraiser of any changes in your situation can also pose problems. If your entitlement to the exemption ceases—perhaps due to a change in ownership or occupancy—you have a duty to inform the appraisal district. Neglecting this responsibility could result in penalties or retroactive tax liabilities.

Moreover, neglecting to provide additional information when requested by the chief appraiser can lead to denial of the application. If you receive a request for more information, be sure to respond promptly within the 30-day timeframe. Ignoring this request can jeopardize the entire application process.

Lastly, misunderstandings about transferring tax ceilings can cause issues for applicants coming from a previous residence. It’s essential to clearly indicate if you seek to transfer this tax ceiling. Miscommunication here can lead to confusion and may affect your exemption eligibility.

In conclusion, navigating the Texas Homestead Exemption form requires careful attention to detail. By steering clear of these common mistakes, you can help ensure a smoother and more efficient application process. Remember to read the instructions thoroughly, keep all your documentation in check, and respect all deadlines to fully benefit from your homestead exemption.

Documents used along the form

The Texas Homestead Exemption form is an essential document for homeowners seeking to reduce their property tax burden based on their principal residence. To accompany this form, several additional documents may be required to establish eligibility or provide further evidence. Below is a list of related forms and documents that can help support the application process.

- Driver’s License or State ID Copy: A photocopy of a valid Texas driver’s license or state-issued personal identification certificate must be submitted. This verifies the applicant's identity and ensures the address matches the property in question.

- Vehicle Registration Receipt: The applicant must provide a copy of their vehicle registration receipt to confirm residency. If no vehicle is owned, an affidavit stating such must be provided along with a utility bill reflecting the applicant's name and the property address.

- Affidavit of Non-Ownership of Vehicle: This document is necessary for individuals who do not own a vehicle. It must be notarized and state that the applicant has no vehicle ownership while also confirming residency at the homestead property.

- Age 65 or Older/Disabled Exemption Affidavit: This affidavit is required for applicants seeking exemptions due to age or disability, particularly if not listed as an owner on the deed. It certifies the applicant's ownership and confirms their eligibility for the exemption claimed.

- Manufactured Home Affidavit: For those claiming an exemption specifically for a manufactured home, this affidavit must confirm ownership of the home and provide details about the purchase absence of a standard purchase contract.

Collecting these documents ensures the proper processing of the Texas Homestead Exemption application. Submitting a complete set of documents helps avoid delays and potential denials. It is vital for applicants to meticulously follow the guidelines and provide all necessary evidence to achieve the exemption benefits they are entitled to.

Similar forms

The Texas Homestead Exemption form shares similarities with various other legal documents. Here are six such documents, along with their specific relationships to the homestead exemption form:

- Property Tax Exemption Application: Like the homestead exemption form, this document allows property owners to apply for various tax reliefs based on specific criteria. Both require proof of ownership and residency, which must be verified by the district appraisal office.

- Application for Senior Citizen Exemption: This application is designed for individuals 65 years or older who seek tax reductions. It parallels the homestead exemption by requiring personal information, proof of age, and property details.

- Disabled Veterans Tax Exemption Form: This form is for disabled veterans applying for property tax relief. Similar to the homestead exemption application, it necessitates proof of disability and ownership of the property.

- Change of Ownership Notice: Property owners use this document to inform the appraisal district of changes in ownership. It functions similarly by updating records and ensuring correct application of exemptions based on ownership status.

- Affidavit of Residence: This document is utilized to declare a person’s primary residence. It mirrors the homestead exemption form in that it requires personal and property identification to support claims for tax relief.

- Application for Residence Homestead Exemption for Surviving Spouse: This application applies to surviving spouses of individuals who previously qualified for a residence homestead exemption. Like the general homestead exemption application, it requires information regarding the deceased spouse and the property, along with proof of eligibility.

Dos and Don'ts

Things you should do:

- Provide accurate information about your property and ownership status.

- Attach all required documents, including your driver's license and vehicle registration.

- Fill out the application before the April 30 deadline to ensure eligibility.

- Sign and date the application to confirm that all information is true.

Things you shouldn't do:

- Don't leave any sections blank; incomplete applications won’t be processed.

- Never provide false information or statements on your application.

- Don't forget to notify the chief appraiser if your entitlement to an exemption ends.

- Avoid filing late applications unless you meet the specific criteria to do so.

Misconceptions

Misconceptions about the Texas Homestead Exemption Form

- It is not necessary to apply every year: Many people believe that once they receive a homestead exemption, they do not need to apply again. This is not entirely true. While the chief appraiser typically does not require annual reapplications, they might still request a new application to confirm your eligibility. If notified, providing the necessary documentation is essential to maintain your exemption status.

- Deadlines are flexible: Some individuals think they can file the exemption application at any time during the year. However, there are strict deadlines in place. For most exemptions, the completed application must be submitted by April 30 each year. Missing this deadline could mean losing out on the exemption for that year.

- Homeownership is the only requirement: A common misconception is that simply owning a home qualifies you for the exemption. In reality, not only must you own the home, but you must also occupy it as your principal residence. If you're not living in the home, you will not qualify for the exemption.

- All tax exemptions are the same: Many assume that all homestead exemptions offer identical benefits. This is misleading. Different exemptions, such as those for disabled individuals or seniors over 65, have distinct qualifications and benefits. Understanding the differences can significantly affect tax savings.

Key takeaways

Applying for the Texas Homestead Exemption can lead to significant tax savings for homeowners. Here are some key takeaways to ensure you navigate the process smoothly.

- Understand Eligibility: To qualify, you must own and occupy the property as your principal residence on January 1 of the year for which you're requesting the exemption.

- Application Deadline: Most exemptions must be filed between January 1 and April 30. Be aware of this timeline to avoid missing out on potential savings.

- One-Time Reapplication: If your exemption is granted, you generally won’t need to reapply annually. However, you should respond promptly if the chief appraiser requests updated information.

- Notify Changes: It's essential to inform the chief appraiser if your eligibility for the exemption changes or ends.

- Gather Required Documentation: Be prepared to provide documents such as your driver’s license and utility bills. If you do not own a vehicle, an affidavit stating so is necessary.

- Cooperative Housing Considerations: Residents of cooperative housing must confirm their exclusive right to occupy their unit on the application.

- Different Exemptions Available: Various exemptions exist, including those for individuals over 65, disabled persons, and 100% disabled veterans. Review the specific qualifications for each.

- Late Applications: Even after the deadline, you may file a late application within one year if you meet specific criteria.

- Complete and Accurate Information: Ensure all information is true and correct when completing your application, as false statements can result in legal penalties.

Understanding these points can make your experience with the Texas Homestead Exemption form much easier and less stressful. Don’t hesitate to reach out to your local appraisal district for assistance if needed!

Browse Other Templates

Silverscript Plus - Include the prescriber's signature and date for validation of the request.

Template:l4jbryv0qsq= Autopsy Report - Space for listing the diagnoses related to the patient's condition.