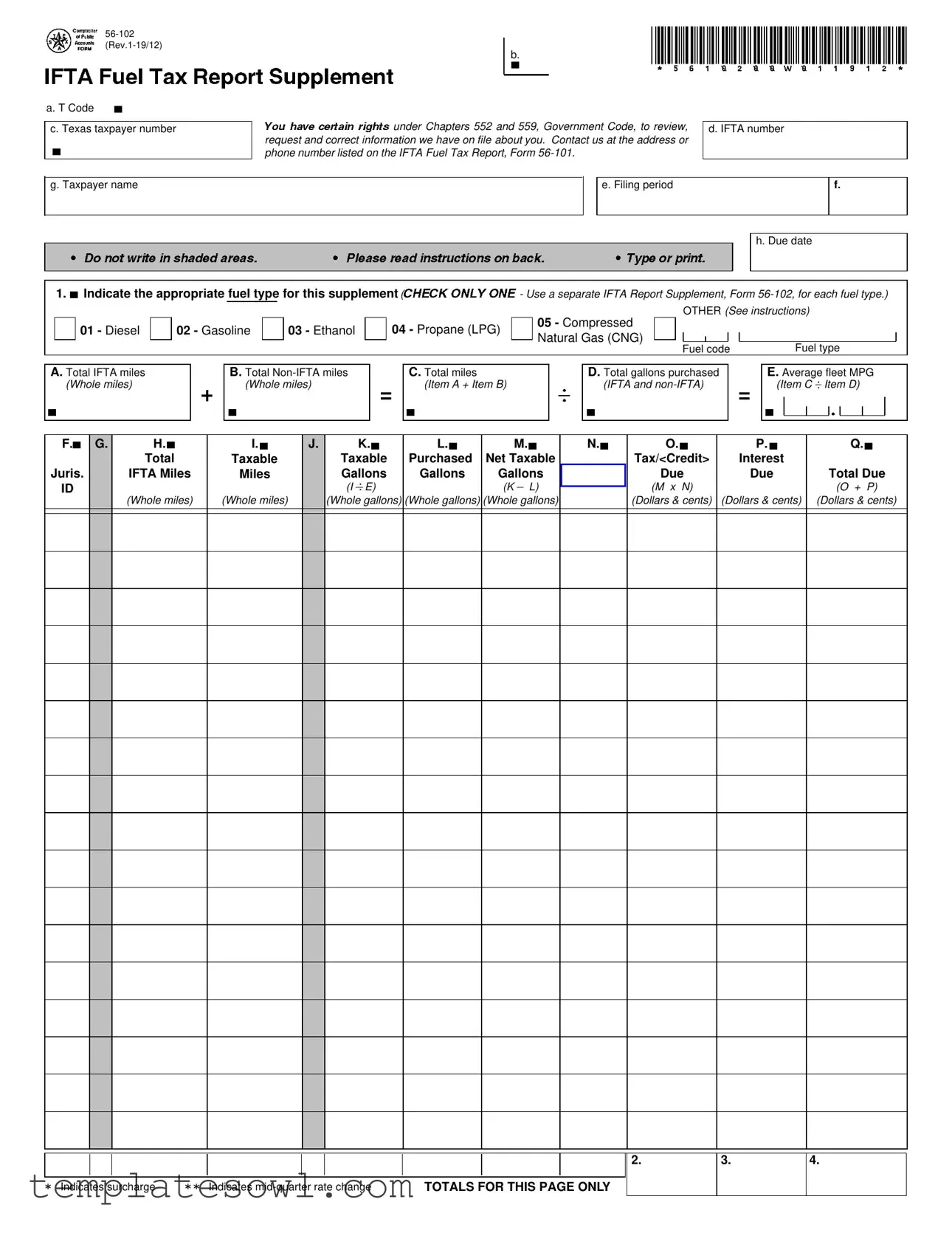

Fill Out Your Texas Ifta Form

The Texas IFTA form, specifically Form 56-102, plays a crucial role in how commercial vehicle operators report their fuel use and travel across multiple jurisdictions. This form is essential for calculating fuel tax for vehicles operating under the International Fuel Tax Agreement (IFTA). It allows drivers to detail their total miles traveled in both IFTA and non-IFTA jurisdictions, distinguishing between different fuel types such as diesel, gasoline, ethanol, and propane. Operators must mention their total gallons purchased, provide their average fleet miles per gallon (MPG), and specify the taxable miles for each jurisdiction. The form requires multiple computations, including taxable gallons and net tax calculations, with entries needed for each jurisdiction where fuel was purchased or used. The purpose of the form goes beyond mere reporting; it helps ensure compliance with state tax regulations while promoting equitable tax distribution among jurisdictions. Additionally, operators must account for surcharges and any mid-quarter rate changes, making precise record-keeping vital. Ultimately, accurately completing the IFTA form can simplify the tax process for operators and foster a more transparent revenue system for participating states and Canadian provinces.

Texas Ifta Example

instructions |

ReportSupplement |

|

back. |

|

|

|

|

||||

a. T Code b56100 |

|

Youhavecertainrights |

|

|

|

|

|

|

|

|

b |

|

|

|

|

|

|

|

|||

c. Texas taxpayer number |

|

under Chapters 552 a d 559, Government Code, to review, |

|

d. IFTA num er |

||||||

IDonotwriteinshadedareas. |

request and correct information we have |

file about you Contact us at the address or |

|

|

|

|||||

phone numberIlistedPleaseon thereadIFTA Fuel Tax Report,onForm |

ITypeorprint. |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

g. Taxpayer name |

|

|

|

|

|

|

e. Filing ri d |

|

f. |

|

|

|

|

|

|

|

|

|

|

|

|

h. Due date

1.bIndicate the appropriate fuel type for this supplement (CHECKONLYONE- Use a separate IFTA Report Supplement, Form

OTHER (See instructions)

01 - Diesel

02 - Gasoline

03 - Ethanol

04 - Propane (LPG)

05 - Compressed

Natural Gas (CNG)

Fuel code |

Fuel type |

A. Total IFTA miles |

|

B. Total |

|

C. Total miles |

|

|

|

D. Total gallons purchased |

|

E. Average fleet MPG |

|

|||||||

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|||

b(Whole miles) |

+ |

b(Whole miles) |

= |

b(Item A + Item B) |

. |

|

b(IFTA and |

= |

b(Item C |

. |

Item.D) |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

F.b

Juris.

ID

G.

H.b

Total

IFTA Miles

(Whole miles)

I.b

Taxable

Miles

(Whole miles)

J.

|

K. |

bbbbbL.M.N. |

O. |

|||||

Taxable |

Purchased |

Net Taxable |

|

Tax/<Credit> |

||||

Gallons |

Gallons |

Gallons |

Tax Rate |

Due |

||||

. |

|

|

|

|

|

|

|

|

(I |

. |

E) |

|

(K |

|

L) |

|

(M x N) |

(Whole gallons) |

(Whole gallons) (Whole gallons) |

|

(Dollars & cents) |

|||||

|

|

|

|

|

|

|

|

|

P.b

Interest

Due

(Dollars & cents)

Q.b

Total Due

(O + P)

(Dollars & cents)

*

Indicates surcharge |

**Indicates |

TOTALS FOR THIS PAGE ONLY |

2.

3.

4.

Form

Item 1 - |

Indicate the |

ppropriate fuel type if it is not preprinted. Place an |

|||||||||||||||||||

|

"X" in the applicable box for Diesel, Gasoline, Ethanol, Propane |

||||||||||||||||||||

|

or Compressed Na ural Gas. For OTHER fuel typ s, place an |

||||||||||||||||||||

|

"X" in the last box and ent |

|

the fuel code and fuel type as |

||||||||||||||||||

|

listed below: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

06 |

|

|

|

|

|

|

11 |

|

|

|

|

Methanol |

|

|

|||||

|

|

07 |

|

|

|

|

|

|

12 |

|

|

|

|

Biod esel |

|

|

|||||

|

|

08 |

|

|

|

|

|

|

13 |

|

|

|

|

Electricity |

|

|

|||||

|

|

09 |

|

|

Gasohol |

|

|

14 |

|

|

|

|

Hydrogen |

|

|

||||||

|

|

10 |

|

|

|

LNG |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Use a sep rate Form |

r |

ch |

|

fu |

|

type. Go |

to |

|||||||||||||

|

www.co |

ptr |

ll |

r.texas.gov/taxes/fu |

s/docs/biodies |

l.pdf |

|

for |

|||||||||||||

|

additional |

information |

repor ing biodies |

l. |

|

|

|

|

|

|

|

|

|||||||||

Item A - |

T |

tal IFTA |

miles |

- |

E ter |

|

ot |

|

|

|

trave |

d |

n |

IFTA |

|||||||

|

jurisdictions by all qual fi |

d motor vehicles in your fleet using |

|||||||||||||||||||

|

the fuel type |

|

icated. Report all mil |

trave |

d whether the |

||||||||||||||||

|

miles are taxable or nont xable. F |

r IFTA jurisdictions with a |

|||||||||||||||||||

|

surcharge, include miles trav led only once f r that juris- |

||||||||||||||||||||

|

diction. The total in C |

lumn H f r all pages must equal item A. |

|||||||||||||||||||

Item B - |

Total |

||||||||||||||||||||

|

traveled in |

dictions of No |

h |

est Territori s and |

|||||||||||||||||

|

Yukon Territory of Canad |

, M xico, Alaska |

nd the D strict of |

||||||||||||||||||

|

Columbia by all qua ifi d |

tor vehi l |

in |

|

|

fle |

t. Report all |

||||||||||||||

|

mileage |

traveled |

whe her |

the |

mileage |

|

is |

taxable |

or |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Item C - |

Total miles - A |

the am unt in Item A and the amount |

n |

||||||||||||||||||

|

Item B to determine the |

tal mil |

trav led |

by |

|

l qualified |

|||||||||||||||

|

motor vehicles in your fleet. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Item D - |

Total Gallons Purcha ed |

- Ent |

the |

total |

gallons |

of |

fuel |

||||||||||||||

|

purchased in both IFTA and |

||||||||||||||||||||

|

qualified |

|

tor |

vehic |

in |

your |

fleet |

u |

ing the |

fu |

l |

type |

|||||||||

|

indicated. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Note: |

||||

|

Fuel is |

sidered "purchas |

d" when it is pump |

|

into your |

||||||||||||||||

|

qualified vehicle.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Item E - |

Average Fleet MPG - Divide It m C by Item D. R und to 2 |

||||||||||||||||||||

|

decimal places. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Column F - |

Jurisdicti n ID - Preprinted are all IFTA member jurisdic- |

||||||||||||||||||||

|

|

ns in which y have indicated oper tions during t |

|

|

|||||||||||||||||

|

|

previ |

us f |

quart rs. If you did not operate in a jurisdic- |

|||||||||||||||||

|

|

listed, make |

o entri |

s for that jurisdiction. If you op |

- |

|

|||||||||||||||

|

|

ated in any ju isdict on other than tho |

|

listed, enter |

e |

||||||||||||||||

|

|

jurisdiction's two |

etter abbreviation from the t |

ble b |

l |

w. |

|

|

|||||||||||||

Column H - |

T tal IFTA Miles - |

En |

|

the |

total mil |

(taxable |

and |

||||||||||||||

|

|

n ntaxable) trav |

d in |

ach IFTA juri |

diction for this fuel |

||||||||||||||||

|

|

ype |

ly. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Column I - |

Taxab e Miles - Enter |

|

IFTA tax ble miles for each |

||||||||||||||||||

|

|

jurisdiction. Trip permit miles are not considered taxable in |

|||||||||||||||||||

|

|

any jurisdiction. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Column K - |

Taxab e Gallons |

- Divide the amount in Column I by the |

|||||||||||||||||||

|

|

amount in Item E to d termine the tot |

l taxable gallons of |

||||||||||||||||||

|

|

fuel |

nsumed in each jurisdiction. |

|

|

|

|

|

|

|

|

|

|

||||||||

Column L - |

Pur hased |

Gallons |

- |

Ent |

the |

total |

gallons |

of |

fuel |

||||||||||||

|

|

purchased |

tax paid |

each IFTA jurisdiction. Ke |

|

your |

|||||||||||||||

|

|

receipts for each purchase claimed. When using bulk |

|||||||||||||||||||

|

|

storage, |

report |

|

nly |

gallons removed |

for use in |

your |

|||||||||||||

|

|

qualified motor vehicles. Fuel remaining in sto age cannot |

|||||||||||||||||||

|

|

be claimed until it is used. Column L cannot be greater |

|||||||||||||||||||

|

|

an Item D. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Column M - Net Taxable Gallons - Subtract Column L from Column K for each jurisdiction.

-If Column K is greater than Column L, enter the taxable gallons.

-If Column L is greater than Column K, enter the credit gallons. Use brackets < > to indicate credit gallons.

Column N - Tax Rate - The tax rate is listed for each preprinted IFTA jurisdiction on your report. If the tax rate is not preprinted, enter the tax rate for the appropriate fuel type from the enclosed tax rate chart. Refer to the IFTA, Inc. web page (www.iftach.org) for tax rate footnotes and exchange rate.

FUEL TAX SURCHARGES - Some jurisdictions impose an additional charge on each taxable gallon of fuel used in that jurisdiction. This surcharge is not paid at the pump or upon withdrawal from bulk storage facilities; the surcharge is collected on the quarterly IFTA report. If you have traveled in any of the jurisdictions that impose a surcharge, you must calculate and pay the surcharge on this report. To calculate the amount due for the surcharge, multiply the number of taxable gallons (K) used in that jurisdiction by the surcharge rate. Fuel tax surcharges need to be reported on separate lines of the report supplements.

RATE CHANGES WITHIN A QUARTER - Sometimes jurisdictions change their tax rate during a quarter. When this occurs, it is necessary to separate the miles traveled during each rate period and report them on separate lines of the report supplement. If you traveled in a jurisdiction that had a

Column O - Tax <Credit> Due - Multiply the amount in Column M by the tax rate for that jurisdiction in Column N to determine the tax or credit. Enter credit amount in brackets < >.

Column P - Interest Due - If you file late, compute interest on the tax due for each jurisdiction for each fuel type. Interest is com- puted on tax due from the due date of the report until the date the payment is postmarked. For current interest rate, refer to www.comptroller.texas.gov/taxes/fuels/ifta.php. Reports must be postmarked no later than the last day of the month following the end of the quarter to be timely. If the last day of the month falls on a Saturday, Sunday or national holiday, the due date will be the next business day.

Column Q - Total Due - For each jurisdiction add the amounts in Column O and Column P, and enter the total dollar amount due or credit amount. Enter credit amount in brackets < >.

Item 2 - Enter the total of amounts in Column O for all jurisdictions listed on this page for the fuel type indicated.

Item 3 - Enter the total of amounts in Column P for all jurisdictions listed on this page for the fuel type indicated.

Item 4 - Enter the total of amounts in Column Q for all jurisdictions listed on this page for the fuel type indicated. This total is necessary to calculate the fuel type totals reported on the corresponding line of the International Fuel Tax Agreement (IFTA) Quarterly Fuel Tax Report, Form

JURISDICTION ABBREVIATIONS

AL |

Alabama |

KY |

Kentucky |

NC |

North Carolina |

WI |

Wisconsin |

AK |

Alaska |

LA |

Louisiana |

ND |

North Dakota |

WY |

Wyoming |

AZ |

Arizona |

ME |

Maine |

OH |

Ohio |

CANADIAN PROVINCES |

|

AR |

Arkansas |

MD |

Maryland |

OK |

Oklahoma |

||

CA |

California |

MA |

Massachusetts |

OR |

Oregon |

AB |

Alberta |

CO |

Colorado |

MI |

Michigan |

PA |

Pennsylvania |

BC |

British Columbia |

CT |

Connecticut |

MN |

Minnesota |

RI |

Rhode Island |

MB |

Manitoba |

DE |

Delaware |

MS |

Mississippi |

SC |

South Carolina |

NB |

New Brunswick |

DC |

Dist. of Columbia |

MO |

Missouri |

SD |

South Dakota |

NL |

Newfoundland |

FL |

Florida |

MT |

Montana |

TN |

Tennessee |

NT |

Northwest Territories |

GA |

Georgia |

NE |

Nebraska |

TX |

Texas |

NS |

Nova Scotia |

ID |

Idaho |

NV |

Nevada |

UT |

Utah |

ON |

Ontario |

IL |

Illinois |

NH |

New Hampshire |

VT |

Vermont |

PE |

Prince Edward Island |

IN |

Indiana |

NJ |

New Jersey |

VA |

Virgina |

QC |

Quebec |

IA |

Iowa |

NM |

New Mexico |

WA |

Washington |

SK |

Saskatchewan |

KS |

Kansas |

NY |

New York |

WV |

West Virginia |

YT |

Yukon |

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Number | The Texas IFTA Form is identified as Form 56-102, used for reporting fuel usage. |

| Submission Frequency | It must be submitted quarterly by all qualifying motor carriers operating in Texas. |

| Purpose | This form tracks fuel usage and mileage for vehicles operating across IFTA jurisdictions. |

| Due Date | Reports are due by the last day of the month following the end of the quarter. |

| Fuel Types | Five primary fuel types can be reported, including Diesel, Gasoline, Ethanol, Propane, and Compressed Natural Gas. |

| Jurisdiction Codes | The form includes preprinted codes for various IFTA jurisdictions, simplifying the reporting process. |

| Interest for Late Filing | If submitted late, interest on tax due is calculated from the due date until payment is postmarked. |

| Taxable Gallons Calculation | Taxable gallons are determined by the formula: {Taxable Miles (Column I) / Average Fleet MPG (Item E)} |

| Surcharge Information | Certain jurisdictions may impose a surcharge on each taxable gallon, which needs separate reporting on the form. |

| Reference Material | Additional instructions and information can be found on the Texas Comptroller's website. |

Guidelines on Utilizing Texas Ifta

Filling out the Texas IFTA form requires careful attention to detail to ensure accurate reporting of fuel use and mileage. After completing the form, it is important to review your entries for accuracy before submitting it to the appropriate authority. Below are the steps to efficiently fill out the Texas IFTA form.

- Type or print clearly on the form.

- Enter your taxpayer name in the designated space.

- Provide your Texas taxpayer number.

- Fill in your IFTA number ID.

- Indicate your filing period and due date.

- For Item 1, check the appropriate box for the fuel type used. Use a separate form for each fuel type if necessary.

- Document the Total IFTA miles in Item A. This includes all miles traveled in IFTA jurisdictions.

- For Item B, enter the Total non-IFTA miles traveled.

- Calculate the Total miles (Item C) by adding Item A and Item B.

- Record the Total gallons purchased (Item D) for fuel used.

- Calculate the Average fleet MPG (Item E) by dividing Item C by Item D, and round to two decimal places.

- In Column F, enter the Jurisdiction ID for each IFTA member jurisdiction where fuel was used.

- In Column H, input the Total IFTA Miles for each jurisdiction.

- For Column I, enter the Taxable Miles for each jurisdiction.

- Calculate Taxable Gallons (Column K) by dividing Column I by Item E.

- In Column L, enter the Purchased Gallons for each jurisdiction and keep your receipts.

- Calculate Net Taxable Gallons (Column M) by subtracting Column L from Column K.

- Input the Tax Rate for each jurisdiction in Column N.

- To find Tax Due (Column O), multiply the amount in Column M by the tax rate in Column N.

- If applicable, calculate Interest Due (Column P), based on late filing.

- Calculate the Total Due (Column Q) by adding Column O and Column P.

- Finally, enter the totals for Items 2, 3, and 4 as required.

What You Should Know About This Form

What is the Texas IFTA form, and who needs to file it?

The Texas IFTA form is a report that motor carriers must file to comply with the International Fuel Tax Agreement (IFTA). This agreement simplifies the reporting of fuel use by carriers operating in multiple jurisdictions. Businesses that operate qualified motor vehicles across state lines and consume fuel will need to file this form. If you drive vehicles weighing over 26,000 pounds or have three or more axles, you are likely required to report and pay IFTA taxes.

How do I complete the Texas IFTA form?

To complete the Texas IFTA form, begin by filling out your taxpayer name and Texas taxpayer number. Ensure you indicate the appropriate fuel type for this report by marking the corresponding box. Make sure to report all IFTA miles traveled and total gallons purchased. You will need to calculate taxable miles and the amount due for taxes. Follow the instructions carefully for each section to ensure accuracy.

What information do I need to report for fuel types?

You need to provide details for each fuel type you used. This includes marking the specific fuel type (like diesel or gasoline) and reporting total IFTA and non-IFTA miles traveled. For each jurisdiction, you'll list taxable miles, gallons purchased, and the applicable tax rates. If you used a fuel type not preprinted on the form, you must specify that fuel type and provide the relevant code.

What is the deadline for submitting the IFTA form?

Reports must be filed by the last day of the month following the end of the quarter. For example, the report for the first quarter (January to March) is due by April 30th. If the due date falls on a weekend or holiday, your report is considered timely if postmarked on the next business day. Late submissions may incur interest charges.

What happens if I do not file the Texas IFTA form?

Failing to file the Texas IFTA form can result in penalties and interest on any unpaid taxes. In addition, your IFTA license may be suspended or revoked, preventing you from operating in participating jurisdictions. It's important to file on time to avoid these serious repercussions.

Where can I find assistance or additional information about the Texas IFTA form?

You can find additional information and resources by visiting the Texas Comptroller's website. They provide detailed instructions, FAQs, and contact information for assistance. If you have specific questions, reach out to their office directly through phone or email for personalized help.

Common mistakes

When filling out the Texas IFTA form, individuals often encounter common pitfalls that can lead to inaccuracies and potential issues with their filings. One frequent mistake is neglecting to indicate the appropriate fuel type. It is important to check only one box for each fuel type. Use a separate Form 56-102 for each type of fuel. Failing to follow this guideline can lead to delays and require additional paperwork to resolve.

Another common error is improperly reporting total IFTA miles. Some individuals may forget to include all miles traveled in IFTA jurisdictions, leading to underreporting. It is crucial to include all miles, both taxable and non-taxable, in the total. Miscalculating these figures can result in incorrect tax assessments.

Many filers also make mistakes by not retaining proper documentation. Keeping receipts for all fuel purchases is essential as these records support the reported amounts on the form. If a discrepancy arises between reported figures and actual receipts, a filer could face audits or penalties. In addition, when using bulk fuel storage, individuals must report only gallons removed for use, not the total stored.

Another area of concern is the calculation of average fleet miles per gallon (MPG). Some individuals incorrectly determine MPG, which can lead to incorrect figures in subsequent calculations for taxable gallons. This metric must be accurate to ensure compliance with tax regulations.

In relation to taxable gallons, errors can occur when filling in Columns K and L of the form. Filers sometimes report amounts greater than what they actually purchased, which is a critical mistake. This should be avoided as Column L cannot exceed the total gallons purchased in Item D.

Tax rates must also be carefully reviewed. Some individuals fail to enter the correct tax rate in Column N, particularly if the rate is not preprinted on the form. Not referencing the enclosed tax rate chart can lead to significant errors in tax calculations.

Filers frequently overlook the necessity to separate reporting for jurisdictions that impose additional surcharges. These surcharges must be calculated and reported on separate lines. Mismanagement of these calculations can result in noncompliance and additional expenses.

Individuals may also neglect to compute interest due correctly for late filings. Understanding interest calculations is essential, as penalties can accumulate over time. Late reports should include the appropriate interest due to avoid further fines.

Lastly, some filers inaccurately sum the totals at the end of the form. Each jurisdiction's totals in Columns O and P must be added accurately to reflect the total due in Column Q. Inaccurate totals can lead to substantial discrepancies in tax payments, potentially resulting in legal and financial ramifications.

Avoiding these mistakes when completing the Texas IFTA form will help ensure a smooth filing process, prevent unnecessary audits, and maintain compliance with tax obligations.

Documents used along the form

When filing the Texas IFTA form, there are several other important documents and forms that can accompany your submission. Each of these plays a role in ensuring compliance with tax regulations and monitoring your fuel usage accurately.

- IFTA Quarterly Tax Report (Form 56-101): This is the primary form used to report total miles traveled and fuel purchased in IFTA jurisdictions for the quarter. Information from this form is summarized from the IFTA Report Supplements.

- IFTA Report Supplement (Form 56-102): This supplement is required each time a specific fuel type is reported. You must use a separate supplement for each fuel type used during the quarter.

- Tax Rate Chart: This document provides the current tax rates for each IFTA jurisdiction. It is essential for calculating the tax due based on the gallons of fuel used.

- Fuel Purchase Receipts: Keep all receipts for fuel purchases as proof of taxable gallons bought. This documentation is critical for ensuring that your claims on the IFTA forms are accurate and verifiable.

- Interest Calculation Worksheet: If you file your IFTA report late, this worksheet helps calculate any interest owed on the tax due. It details how interest accumulates from the due date to the payment date.

- Power of Attorney (if applicable): If you designate someone to file on your behalf, this form grants that person the legal authority to handle your IFTA filings, including any necessary communications with tax authorities.

Each of these forms and documents plays a crucial role in the IFTA filing process. Keeping organized records can make compliance easier and help avoid potential issues with tax authorities.

Similar forms

Quarterly Fuel Tax Report (Form 56-101) - The Texas IFTA form functions similarly to the Quarterly Fuel Tax Report, as both are used to report miles traveled and fuel purchased across various jurisdictions. They serve to reconcile fuel taxes owed to different states based on travel patterns.

Fuel Use Tax Return (Form 01-156) - This return is akin to the Texas IFTA form since both require reporting fuel usage, enabling authorities to assess the correct tax obligations based on vehicle operations in various jurisdictions.

Motor Fuel Tax License Application - Similar in its purpose, this application form establishes a taxpayer's obligation to file reports and pay taxes related to the use of motor fuels, paralleled by the IFTA form's requirements for ongoing compliance.

Fuel Tax Exemption Certificate - This document resembles the Texas IFTA form in that it allows operators to claim exemptions from certain fuel taxes, thereby influencing reporting requirements on the IFTA form when applicable.

Intrastate Fuel Tax Report - Like the Texas IFTA form, this report focuses on fuel usage within state lines, emphasizing the need for accurate tracking of miles and fuel for compliance with tax obligations.

Heavy Highway Vehicle Use Tax Form (Form 2290) - This form parallels the Texas IFTA form as both govern fuel usage for different vehicle types and report tax responsibilities concerning heavy highway vehicles.

State Fuel Tax Refund Application - Similar to the Texas IFTA form, this application provides a means for taxpayers to recover taxes paid on fuel under specific conditions, linking closely to the accounting of fuel purchases.

Commercial Vehicle Registration Application - This document relates to the Texas IFTA form through the requirement for accurate reporting of vehicle usage, ensuring that all commercial operations comply with tax regulations.

Taxpayer Information Update Form - Much like the Texas IFTA, this form allows taxpayers to maintain current and correct information in tax records, pertinent to accurate tax reporting and compliance.

Utility Trailer Registration Form - This form mirrors the Texas IFTA's focus on vehicle usage and registration, as both ensure that operational characteristics align with tax obligations for fuel and services rendered.

Dos and Don'ts

Things to Do When Filling Out the Texas IFTA Form:

- Type or print clearly to ensure legibility.

- Report all miles traveled accurately, including both taxable and non-taxable miles.

- Use a separate Form 56-102 for each fuel type.

- Make sure to keep all receipts for fuel purchases claimed.

Things Not to Do When Filling Out the Texas IFTA Form:

- Do not leave shaded areas blank; they should not be filled in.

- Avoid guessing on your total miles; use record-keeping for accuracy.

- Do not forget to report surcharges if applicable.

- Do not submit the form late, as late submissions may incur interest fees.

Misconceptions

Misconceptions about the Texas IFTA Form can lead to errors in reporting and potential penalties. Here are seven common misunderstandings explained clearly:

- Misconception 1: I can submit just one form for multiple fuel types. Many believe they can report all fuel types on a single Texas IFTA Form 56-102. However, each fuel type requires a separate supplement to ensure correct tracking and reporting of different fuel usage.

- Misconception 2: All miles driven are taxable. It's a common mistake to consider all miles driven as taxable. The form differentiates between IFTA miles, which are taxable, and non-IFTA miles, which are not. It's essential to report both accurately.

- Misconception 3: Fuel purchases include non-IFTA jurisdictions. Some may think that all fuel purchases, regardless of where they were made, can be reported. Only those gallons purchased in IFTA jurisdictions should be included in your calculations for tax reporting.

- Misconception 4: I don’t need to keep fuel purchase receipts. A misconception exists that keeping receipts is unnecessary as long as you report the gallons purchased. In fact, retaining receipts is critical in case of an audit or if any discrepancies arise in reported figures.

- Misconception 5: All jurisdictions have the same tax rates. People often assume that tax rates are consistent across all IFTA jurisdictions. However, each jurisdiction can set its own tax rates and may even impose surcharges, so it’s crucial to check these rates carefully.

- Misconception 6: I can ignore late filing penalties. Some individuals might think late filing won’t significantly affect them. Ignoring penalties can lead to accumulating interest on unpaid taxes, which can increase the total amount due significantly.

- Misconception 7: There’s no need to report IFTA miles traveled during a rate change. It’s a misconception that travelers can disregard the details of miles driven during tax rate changes. The report requires separate entries for miles driven under different tax rates to maintain accurate records.

Understanding these misconceptions can help ensure accurate and efficient filing, ultimately preventing complications in your tax reporting process.

Key takeaways

When filling out the Texas IFTA (International Fuel Tax Agreement) form, understanding the process can simplify your reporting responsibilities. Here are six key takeaways to help you navigate the form effectively:

- Choose the Correct Fuel Type: Ensure to select the appropriate fuel type by marking only one option on the form. If your fuel type is not listed, indicate it under the "OTHER" category and provide the specific fuel code.

- Accurate Mileage Reporting: Report all miles traveled by qualified motor vehicles in both IFTA and non-IFTA jurisdictions. Differentiate between total IFTA miles and non-IFTA miles to ensure accurate calculations.

- Total Gallons Purchased: Enter the total gallons of fuel purchased in all jurisdictions, including both IFTA and non-IFTA areas. Be mindful to report only the fuel that has been dispensed into your qualified vehicle.

- Understand Taxable Miles: Make sure to accurately calculate taxable miles for each jurisdiction. Trip permit miles are not considered taxable, so exclude them from your report.

- Tax Rates and Surcharges: Be aware of the tax rates for each jurisdiction as you fill out the form. If you travel in an area with a fuel tax surcharge, calculate the additional tax to report.

- Timely Submission: Submit the completed form by the last day of the month following the end of the quarter. If that day falls on a weekend or holiday, your due date will shift to the next business day. Late submissions may incur interest, so be proactive.

Filling out the Texas IFTA form correctly is not just about compliance—it's about ensuring that you have a clear understanding of your fuel usage across various jurisdictions. Attention to detail will benefit your operations and maintain accurate records for tax purposes.

Browse Other Templates

Lincoln Financial Distribution Request Form Pdf - Instructions for completing the form are included throughout.

What Is the Highest Income to Qualify for Snap? - Awareness of the form's contents ensures clients can gather necessary documentation ahead of deadlines.

Hhs690 - Failure to comply with assurances on this form may impact future federal funding opportunities.