Fill Out Your Texas Resale Certificate 01 339 Form

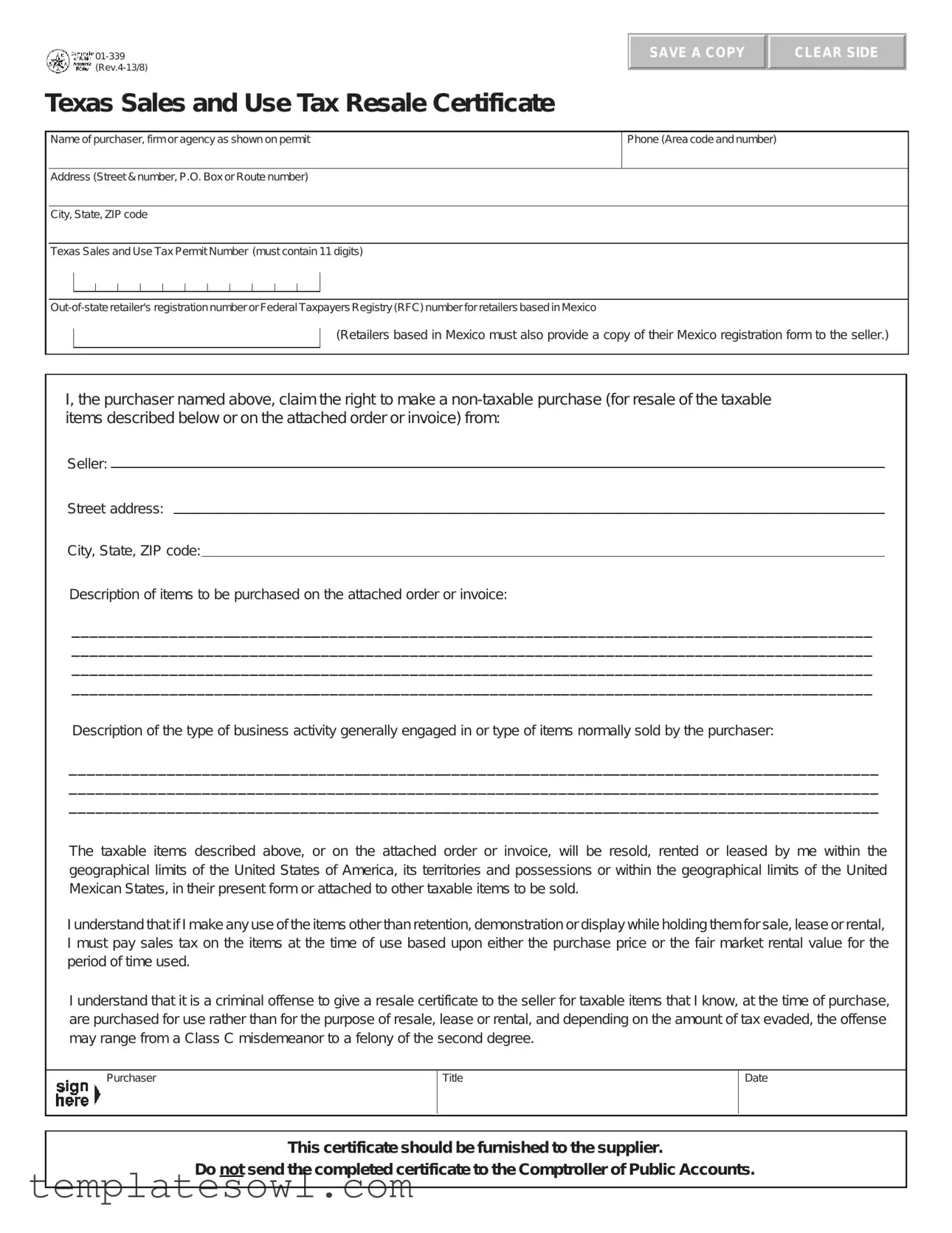

The Texas Resale Certificate 01-339 form plays a crucial role in the sales ecosystem for both buyers and sellers in Texas. Issued by the state, this form allows purchasers to claim non-taxable status on items bought for resale. It requires key information, including the purchaser's name, address, and Texas Sales and Use Tax Permit Number, which must comprise 11 digits. Additionally, out-of-state retailers must provide their registration numbers, with specific provisions outlined for retailers based in Mexico. The form explicitly mandates the description of items being purchased and the type of business activity in which the purchaser typically engages. By issuing this certificate, the purchaser attests that the items will be resold within the geographical limits of the United States or Mexico. Importantly, any misuse of this certificate — such as purchasing items for personal use instead of resale — can lead to serious legal consequences, which may range from misdemeanors to felonies. Furthermore, the Texas Resale Certificate form also includes a section for claiming exemption from sales and use taxes on taxable items, though it cannot be used for the purchase of motor vehicles. Compliance with the form's requirements is essential, as it serves as a safeguard for both parties in any transaction involving taxable items.

Texas Resale Certificate 01 339 Example

SAVE A COPY

CLEAR SIDE

Texas Sales and Use Tax Resale Certificate

Name of purchaser, firm or agency as shown on permit

Phone (Area code and number)

Address (Street & number, P.O. Box or Route number)

City, State, ZIP code

Texas Sales and Use Tax Permit Number (must contain 11 digits)

(Retailers based in Mexico must also provide a copy of their Mexico registration form to the seller.)

I, the purchaser named above, claim the right to make a

Seller:

Street address:

City, State, ZIP code:

Description of items to be purchased on the attached order or invoice:

__________________________________________________________________________________________

__________________________________________________________________________________________

__________________________________________________________________________________________

__________________________________________________________________________________________

Description of the type of business activity generally engaged in or type of items normally sold by the purchaser:

___________________________________________________________________________________________

___________________________________________________________________________________________

___________________________________________________________________________________________

The taxable items described above, or on the attached order or invoice, will be resold, rented or leased by me within the geographical limits of the United States of America, its territories and possessions or within the geographical limits of the United Mexican States, in their present form or attached to other taxable items to be sold.

I understand that if I make any use of the items other than retention, demonstration or display while holding them for sale, lease or rental, I must pay sales tax on the items at the time of use based upon either the purchase price or the fair market rental value for the period of time used.

I understand that it is a criminal offense to give a resale certificate to the seller for taxable items that I know, at the time of purchase, are purchased for use rather than for the purpose of resale, lease or rental, and depending on the amount of tax evaded, the offense may range from a Class C misdemeanor to a felony of the second degree.

Purchaser

Title

Date

This certificate should be furnished to the supplier.

Do not send the completed certificate to the Comptroller of Public Accounts.

Texas Sales and Use Tax Exemption Certification

This certificate does not require a number to be valid.

Name of purchaser, firm or agency

SAVE A COPY

CLEAR SIDE

Address (Street & number, P.O. Box or Route number)

Phone (Area code and number)

City, State, ZIP code

I, the purchaser named above, claim an exemption from payment of sales and use taxes (for the purchase of taxable items described below or on the attached order or invoice) from:

Seller:

Street address: |

|

City, State, ZIP code: |

|

Description of items to be purchased or on the attached order or invoice:

___________________________________________________________________________________________

___________________________________________________________________________________________

___________________________________________________________________________________________

___________________________________________________________________________________________

___________________________________________________________________________________________

___________________________________________________________________________________________

Purchaser claims this exemption for the following reason:

___________________________________________________________________________________________

___________________________________________________________________________________________

___________________________________________________________________________________________

___________________________________________________________________________________________

___________________________________________________________________________________________

___________________________________________________________________________________________

I understand that I will be liable for payment of all state and local sales or use taxes which may become due for failure to comply with the provisions of the Tax Code and/or all applicable law.

I understand that it is a criminal offense to give an exemption certificate to the seller for taxable items that I know, at the time of purchase, will be used in a manner other than that expressed in this certificate, and depending on the amount of tax evaded, the offense may range from a Class C misdemeanor to a felony of the second degree.

Purchaser

Title

Date

NOTE: This certificate cannot be issued for the purchase, lease, or rental of a motor vehicle.

THIS CERTIFICATE DOES NOT REQUIRE A NUMBER TO BE VALID.

Sales and Use Tax "Exemption Numbers" or "Tax Exempt" Numbers do not exist.

This certificate should be furnished to the supplier.

Do not send the completed certificate to the Comptroller of Public Accounts.

Form Characteristics

| Fact Name | Detail |

|---|---|

| Purpose | The Texas Resale Certificate (Form 01-339) allows businesses to purchase items tax-free for resale. |

| Required Information | It requires the purchaser's name, address, Texas Sales and Use Tax Permit Number, and details about the items to be purchased. |

| Use Limitation | The items purchased must be intended for resale, rental, or lease. If used otherwise, sales tax must be paid. |

| Legal Considerations | Issuing a resale certificate for personal use is a criminal offense and can result in severe penalties. |

| Governing Law | This certificate is governed by Texas Tax Code, Chapter 151, relating to sales and use taxes. |

Guidelines on Utilizing Texas Resale Certificate 01 339

Completing the Texas Resale Certificate Form 01-339 requires attention to detail to ensure accuracy. The form must be filled out correctly, as inaccuracies can lead to tax liabilities. Once you have gathered the necessary information, follow the steps below to fill out the form appropriately.

- Begin by entering the name of the purchaser, firm, or agency as it appears on the Texas Sales and Use Tax permit.

- Provide a phone number, including the area code.

- Fill in the address, including street number, P.O. Box, or route number.

- Input the city, state, and ZIP code.

- Enter the Texas Sales and Use Tax Permit Number, ensuring it contains 11 digits.

- If applicable, provide the out-of-state retailer's registration number or the Federal Taxpayers Registry (RFC) number for retailers based in Mexico, along with a copy of the Mexico registration form.

- In the next section, state the seller's name and their street address, followed by the city, state, and ZIP code.

- Describe the items to be purchased on the attached order or invoice, ensuring to fill in all areas provided.

- Indicate the type of business activity typically engaged in or the kind of items normally sold.

- Affirm that the taxable items will be resold, rented, or leased and will remain within specified geographical limits.

- Acknowledge the conditions regarding the use of items and penalties for misuse by signing your name in the designated area.

- Include your title and the date of completion.

After filling out all required sections, the completed form should be provided to the supplier. It is important to retain a copy for your records, but do not send the certificate to the Comptroller of Public Accounts. Being diligent in this process can help prevent future complications with tax compliance.

What You Should Know About This Form

What is the Texas Resale Certificate 01-339?

The Texas Resale Certificate 01-339 is a document that allows a purchaser to buy items intended for resale without paying sales tax on that purchase. This form must be filled out and given to the seller at the time of purchase to validate the exemption from sales tax for items being resold. It is important for businesses that purchase goods for resale to use this certificate appropriately to comply with tax regulations.

Who should use the Texas Resale Certificate?

This certificate is intended for businesses that buy taxable items for resale, rental, or leasing. Wholesalers, retailers, and other businesses involved in the sale of goods can use this form. Each purchaser must have a valid Texas Sales and Use Tax Permit Number or an appropriate registration number if based out of state or in Mexico.

What information is required on the certificate?

The certificate requires several details, including the name and address of the purchaser, the Texas Sales and Use Tax Permit Number, the name and address of the seller, and a description of the items being purchased. Additionally, it must include a declaration of the purchaser's business activities and an acknowledgment that the items will be resold in their current form or as part of a taxable service.

What happens if I misuse the resale certificate?

Using the resale certificate for items that will not be resold constitutes misuse. If a purchaser makes such a purchase while knowing the certificate is being used incorrectly, they may face serious legal consequences. These can range from a Class C misdemeanor to a felony of the second degree, depending on the amount of tax that was evaded. It is crucial to understand the conditions of use to avoid legal repercussions.

Do I need to file the resale certificate with the state?

No, the Texas Resale Certificate should not be sent to the Comptroller of Public Accounts. Instead, it should be provided directly to the seller as proof of the exemption. Keeping a copy of the completed certificate for business records is advisable for future reference.

Can an out-of-state retailer use the Texas Resale Certificate?

Yes, out-of-state retailers can use the Texas Resale Certificate, but they must also provide their state registration number. Retailers based in Mexico need to include their Federal Taxpayers Registry (RFC) number along with a copy of their registration form from Mexico when presenting the resale certificate.

What types of purchases are not eligible for the resale certificate?

The resale certificate cannot be used for the purchase, lease, or rental of motor vehicles. Additionally, it cannot be used for items that the purchaser knows will be used for other than resale purposes. Understanding the restrictions on item categories is vital for compliance.

What constitutes a taxable item for resale?

Taxable items for resale are typically goods that the business purchases with the intent to sell to consumers. These can include merchandise, equipment, or supplies that will be sold in their original form or as part of a service provided by the business. For clarity, it's always beneficial to consult the Texas Comptroller’s Office for guidance on specific items.

Is there an expiration date for the Texas Resale Certificate?

The Texas Resale Certificate itself does not have a specific expiration date; however, it should be updated if there are changes in the business status, such as a change of address or new sales tax permit number. It is wise for sellers to regularly verify the validity of the resale certificates they accept to ensure compliance with state regulations.

What should I do if I lose my resale certificate?

If a business loses its resale certificate, it should complete a new form and provide it to the seller as soon as possible. Maintaining accurate records is vital. Businesses should also keep copies of all certificates they issue or receive to avoid complications during audits or when verifying tax liabilities.

Common mistakes

Filling out the Texas Resale Certificate 01 339 form can be straightforward, but common mistakes can lead to issues with tax compliance. One frequent error occurs when individuals fail to provide their Texas Sales and Use Tax Permit Number. This number must contain exactly 11 digits. Without it, the certificate may be deemed invalid, leading to potential penalties during an audit.

Another common mistake involves incomplete descriptions of the items to be purchased. Purchasers must accurately describe the items they plan to resell. Vague terms can create confusion and may undermine the purpose of the certificate. Therefore, it's crucial to provide detailed descriptions to ensure clarity and compliance with tax regulations.

Many people also overlook the requirement to indicate the type of business activity they engage in. This section is important as it helps verify that the products being purchased truly relate to the purchaser's business operations. Leaving this section blank or providing insufficient detail can raise red flags for both the buyer and seller.

Failing to sign and date the certificate is another significant mistake. A signature verifies that the purchaser understands the legal ramifications of the resale certificate and affirms that the items will only be resold. Without a signature and date, the document lacks authenticity, which can subject the purchaser to taxes and penalties.

Lastly, some individuals mistakenly believe they can use this certificate for items not intended for resale. The certificate is strictly for purchases aimed at resale or lease. Using it for personal items or other purposes can lead to serious legal consequences. It's essential to only use the passage as intended to avoid claims of tax evasion.

Documents used along the form

In Texas, various forms and documents accompany the Texas Resale Certificate 01-339 during transactions involving sales and use tax exemptions. Understanding these documents can enhance compliance and facilitate smooth business operations. Below is a list of key forms utilized in conjunction with the Texas Resale Certificate.

- Texas Sales and Use Tax Exemption Certificate: This document allows purchasers to claim exemption from sales tax on items intended for use by exempt entities, usually non-profit organizations. It outlines the rationale for the exemption and must be provided to the seller, who retains it for their records.

- Texas Sales and Use Tax Permit Application (01-339A): This is the application form that businesses must complete to obtain a Sales and Use Tax Permit in Texas. Having a permit enables businesses to collect and remit sales tax appropriately.

- Texas Form 01-903: This is used when a seller needs to obtain a purchaser's exemption certificate. It serves as a formal request and ensures that any claims for exemption are legitimate and properly documented.

- Purchase Order (PO): Though not a tax form, a Purchase Order is vital in business transactions. It documents the buyer's intent to purchase goods or services. It typically includes item descriptions, prices, and terms of sale, allowing for seamless record-keeping.

- Invoice: An invoice is issued by the seller to detail the sale, including quantity, pricing, and payment terms. It is crucial for both the seller and buyer to know the financial details of a transaction, especially for tax reporting purposes.

Utilizing these forms effectively will not only comply with Texas tax regulations but also streamline your business transactions. Proper documentation safeguards against potential misunderstandings and tax liabilities, ultimately fostering trust between buyers and sellers.

Similar forms

- Texas Sales and Use Tax Exemption Certificate: Similar to the Resale Certificate, this document allows a purchaser to claim an exemption from sales tax. The key difference lies in the reason for use. While the resale certificate applies to items meant for resale, the exemption certificate is used for items that will not be resold but are exempt from tax for other reasons.

- Multi-Jurisdictional Resale Certificate: This document serves a similar purpose, allowing businesses in one state to purchase items for resale without paying sales tax. It streamlines the process across state lines, recognizing resale status in multiple jurisdictions.

- Generic Resale Certificate: Like the Texas Resale Certificate, this form can be used in various states. It provides proof that the purchaser intends to resell the items, helping them avoid paying sales tax at the point of sale.

- Seller's Permit: While this document authorizes a business to collect sales tax, it works in tandem with the Resale Certificate. A seller needs a permit to validate resale transactions and comply with sales tax regulations.

- Certificate of Exemption (or Sales Tax Exemption Certificate): This allows certain entities, like non-profits or government agencies, to make tax-exempt purchases. The purpose is similar, but the eligibility requirements differ based on the type of organization.

- Itemized Receipts for Tax-Deductible Purchases: These receipts function similarly by documenting purchases made for resale or business purposes. They serve as proof that taxes were not paid on items intended for resale, aiding in tax reporting.

- Direct Pay Permits: Used in some states, these permits allow businesses to pay sales tax directly on their purchases rather than at the time of sale. The concept is similar; businesses avoid upfront sales tax but involve different administrative processes.

- Manufacturer's Exemption Certificate: This document allows manufacturers to purchase specific materials tax-free. It’s similar to the resale certificate in that both allow for tax-free purchases, yet they apply to different types of businesses and purchases.

- Out-of-State Resale Certificate: Used by businesses purchasing items to resell across state lines, this certificate serves the same purpose as the Texas Resale Certificate but is tailored for compliance with different states' sales tax laws.

- Purchase Order: While not a tax exemption document, a purchase order confirms the intent to buy goods. It functions similarly in that it outlines the details of the transaction, often accompanying other tax-related documents to prove resale intentions.

Dos and Don'ts

Do's:

- Ensure that all required fields are accurately filled out, including your Texas Sales and Use Tax Permit Number.

- Clearly describe the items you intend to purchase for resale.

- Provide your business address and contact information correctly.

- Sign and date the certificate before submitting it to the supplier.

Don'ts:

- Do not use the certificate if the items are not intended for resale or rental.

- Avoid submitting the completed certificate to the Comptroller of Public Accounts; it should only go to the supplier.

- Do not leave any important sections blank, as this may invalidate the certificate.

- Refrain from misrepresenting your intent to evade sales tax, as this is a criminal offense.

Misconceptions

The Texas Resale Certificate 01 339 can often be misunderstood. Below are seven common misconceptions regarding this form, along with clarifications.

- The resale certificate is only for Texas residents. This certificate can be used by out-of-state retailers as well, particularly those based in Mexico. They must include their registration numbers and sometimes additional documentation.

- A resale certificate does not require any additional information. Incorrect. You must provide details like the purchaser's Texas Sales and Use Tax Permit number and a description of the items being purchased for resale.

- The seller should send the completed certificate to the state. No, the completed certificate should not be submitted to the Comptroller of Public Accounts. It is meant to be furnished directly to the seller.

- If I use the purchased items for personal use, I don’t need to worry. This is false. Using items for personal use instead of resale can lead to tax liability. You must pay sales tax for any unauthorized use.

- Getting a resale certificate is the same as being tax-exempt. Not exactly. A resale certificate allows you to buy items for resale without paying tax at the time of purchase. However, it does not make you exempt from sales tax altogether.

- I can use this certificate to purchase any type of item. No, the certificate is specifically for purchases made with the intent to resell, lease, or rent the items. It cannot be used for personal or unrelated business expenses.

- There's no risk in using a resale certificate incorrectly. This statement is misleading. Wrongfully issuing a resale certificate can result in serious legal consequences, including misdemeanor or felony charges.

Understanding these misconceptions can help ensure that you use the Texas Resale Certificate correctly. Always double-check details and consult with a professional if uncertainties arise.

Key takeaways

Understanding how to properly fill out and utilize the Texas Resale Certificate 01 339 is crucial for businesses engaged in resale activities. Here are key takeaways regarding this form:

- Eligibility Requirement: Only purchases intended for resale can qualify for a tax exemption. Clearly state the items planned for resale on the attached invoice or order.

- Form Completion: Provide accurate details, including the purchaser's Texas Sales and Use Tax Permit Number and the seller's information. Incomplete forms may not be accepted.

- Understanding Liability: Misuse of the certificate can lead to significant legal consequences. If items are used rather than resold, the purchaser must pay applicable sales tax.

- Documentation: Maintain a copy of the completed certificate for records. It is important to furnish the certificate to the seller and not submit it to the state authorities.

- Criminal Implications: Knowingly giving a resale certificate for items not intended for resale can lead to serious criminal charges, reflecting the importance of honesty in its use.

Browse Other Templates

Yourtini Job Application,Yourtini Candidate Form,Yourtini Employment Inquiry,Yourtini Position Application,Yourtini Career Application,Yourtini Job Seeker Form,Yourtini Work Application,Yourtini Applicant Information Sheet,Yourtini Employment Request - Completed forms are securely stored to protect applicant privacy and data security.

An Attending Physician Statement Would Be Appropriate for Which Life Insurance Purpose - By tracking physical capabilities, the form aids in returning patients to work safely if applicable.

What Is a Process Goal - Plan ahead for setbacks to maintain motivation and resilience.