Fill Out Your Texas Vtr 60 Form

The Texas VTR 60 form serves a critical function for vehicle owners experiencing issues with their license plates or registration stickers. Designed specifically for those needing replacements, this form addresses instances where items may be lost, stolen, or damaged. Individuals must complete the application and submit it to their local county tax assessor-collector’s office. A replacement fee of $6, along with an additional automation fee of 50 cents, is required, making the total cost $6.50. It is important to note that cash should not be mailed, and the fees paid are non-refundable. The form also collects essential applicant information, including name, address, email, phone number, and vehicle details such as the Vehicle Identification Number (VIN) and current license plate number. Moreover, the applicant certifies that the item(s) in question are indeed lost or damaged and agrees to return any existing plates or stickers. This process ensures compliance with state laws while facilitating a smooth experience for individuals seeking replacements.

Texas Vtr 60 Example

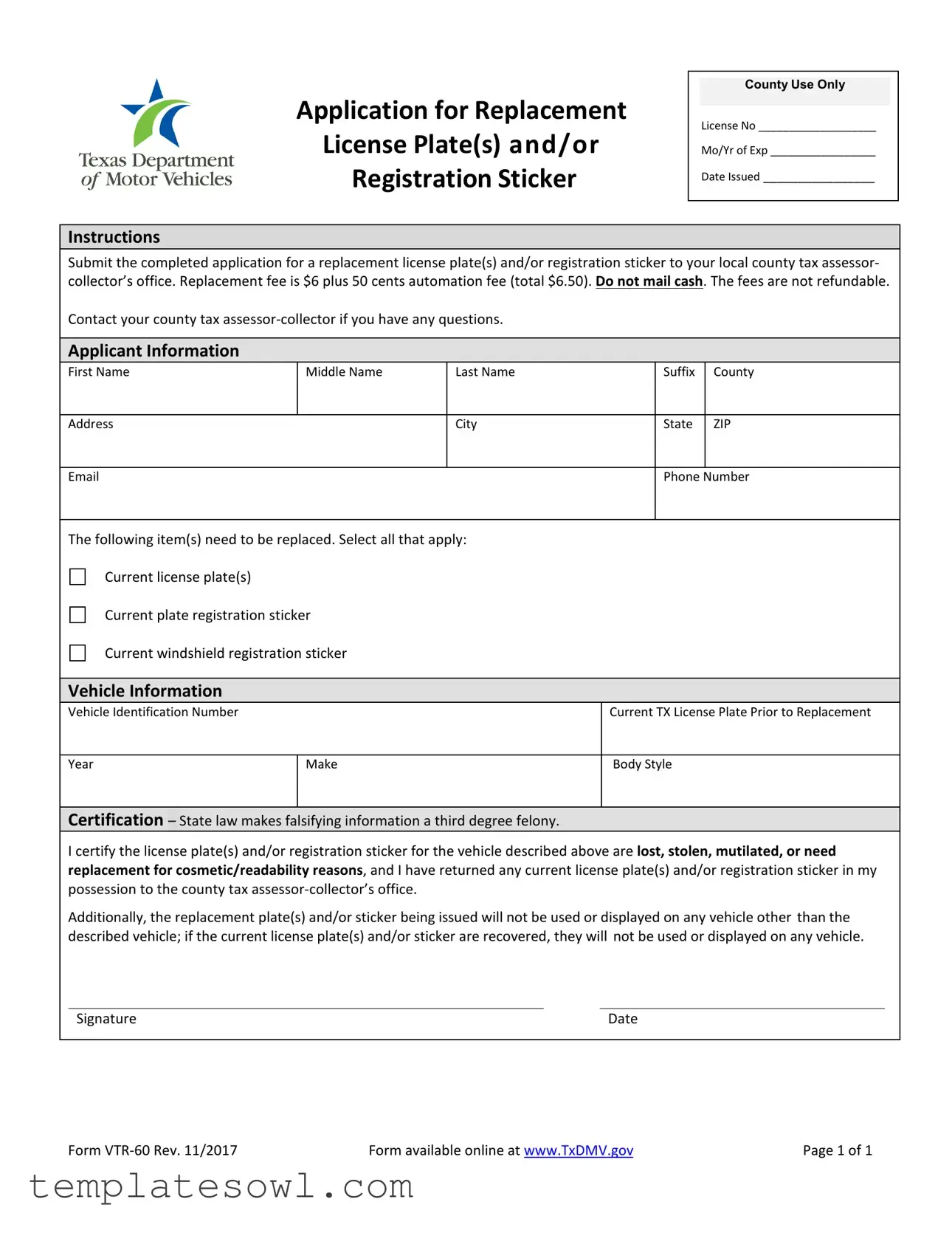

Application for Replacement License Plate(s) and/or Registration Sticker

County Use Only

License No ___________________

Mo/Yr of Exp _________________

Date Issued ________________

Instructions

Submit the completed application for a replacement license plate(s) and/or registration sticker to your local county tax assessor- collector’s office. Replacement fee is $6 plus 50 cents automation fee (total $6.50). Do not mail cash. The fees are not refundable.

Contact your county tax

Applicant Information

First Name

Address

Middle Name |

Last Name |

Suffix |

|

County |

|

City |

State |

|

ZIP |

|

|

Phone |

|

Number |

|

|

|

||

|

|

|

|

|

The following item(s) need to be replaced. Select all that apply:

Current license plate(s)

Current plate registration sticker

Current windshield registration sticker

Vehicle Information

Vehicle Identification Number |

|

Current TX License Plate Prior to Replacement |

|

|

|

Year |

Make |

Body Style |

Certification – State law makes falsifying information a third degree felony.

I certify the license plate(s) and/or registration sticker for the vehicle described above are lost, stolen, mutilated, or need replacement for cosmetic/readability reasons, and I have returned any current license plate(s) and/or registration sticker in my possession to the county tax

Additionally, the replacement plate(s) and/or sticker being issued will not be used or displayed on any vehicle other than the described vehicle; if the current license plate(s) and/or sticker are recovered, they will not be used or displayed on any vehicle.

Signature |

|

Date |

Form |

Form available online at www.TxDMV.gov |

Page 1 of 1 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Texas VTR-60 form is used to apply for replacement license plates and/or registration stickers. |

| Submission | Applicants must submit the completed form to their local county tax assessor-collector's office. |

| Fees | A replacement fee of $6 plus a 50-cent automation fee is required, totaling $6.50. Cash should not be mailed. |

| Refunds | The fees paid for processing the application are non-refundable. |

| Certification | Providing false information on this form is considered a third-degree felony under state law. |

| Information Required | Applicants must provide personal information, including their name, address, and contact details. |

| Law Governing | The Texas Department of Motor Vehicles governs the use and processing of this form as outlined in the Texas Transportation Code. |

Guidelines on Utilizing Texas Vtr 60

Completing the Texas VTR 60 form is an essential step for securing a replacement for your lost or damaged license plate(s) or registration sticker. After you gather the necessary information, proceed to fill out the form carefully. Ensure that all required fields are completed accurately to avoid any delays in processing your request.

- Obtain the Texas VTR 60 form from your local county tax assessor-collector’s office or download it from www.TxDMV.gov.

- Fill in the "License No" field with your vehicle's license number.

- Indicate the month and year of your vehicle's registration expiration in the "Mo/Yr of Exp" box.

- Write the date you are filling out the form in the "Date Issued" section.

- Complete the "Applicant Information" section by entering your first name, middle name, last name, and suffix (if applicable).

- Provide your full address, including city, county, state, and ZIP code.

- Include your phone number and email address for contact purposes.

- In the "The following item(s) need to be replaced" section, check the box next to each item that applies: Current license plate(s), current plate registration sticker, or current windshield registration sticker.

- Enter your vehicle information in the designated fields, including the Vehicle Identification Number (VIN), current Texas license plate, year, make, and body style.

- Read the certification statement carefully. By signing, you confirm that the information provided is accurate and you meet the stated criteria.

- Sign and date the form in the designated areas.

Once you have filled out the form completely, submit it to your local county tax assessor-collector’s office along with the payment for the replacement fee. Remember, the total amount is $6.50, which includes the automation fee. Please do not send cash through the mail. Keep in mind that fees are non-refundable. If you have questions, reach out to your local office for assistance.

What You Should Know About This Form

What is the Texas VTR 60 form?

The Texas VTR 60 form is used to apply for replacement license plates and/or registration stickers in Texas. This form allows vehicle owners to report lost, stolen, damaged, or unreadable license plates or registration stickers. Completing this form is the first step in obtaining new plates or stickers to ensure your vehicle remains legally registered.

How do I submit the VTR 60 form?

You must submit the completed VTR 60 form to your local county tax assessor-collector’s office. It is advisable to deliver it in person or through mail. If you choose to mail the form, avoid sending cash. Instead, include a check or money order for the required fees.

What is the fee for replacing license plates or registration stickers?

The total fee for replacing license plates or registration stickers is $6.50. This includes a $6 replacement fee plus an additional 50 cents for automation. Keep in mind that these fees are not refundable regardless of the circumstances.

What do I do if I have questions about the form or process?

If you have questions about the VTR 60 form or the replacement process, reach out directly to your county tax assessor-collector's office. They can provide specific guidance and address any of your concerns.

What information is required on the VTR 60 form?

You will need to provide personal information such as your name, address, and contact details. Additionally, you must include your vehicle's identification number (VIN), current license plate number, and any other relevant vehicle information. Be sure to indicate which items you need to replace.

What happens if my lost or stolen license plate is found after I apply for a replacement?

If you recover your lost or stolen license plate after receiving a replacement, you should not use or display the original plate on any vehicle. The replacement must only be used on the vehicle described in your application. The original plate must be returned to the county tax assessor-collector’s office.

Is there a risk of providing false information on the VTR 60 form?

Yes, there can be serious consequences for providing false information on the VTR 60 form. State law classifies falsifying information as a third-degree felony. It is essential to provide accurate and truthful information when completing the form.

Can I apply for multiple replacement items on a single VTR 60 form?

Yes, you can apply for replacements for multiple items on a single VTR 60 form. The form allows you to select all applicable items, such as current license plates or registration stickers. Make sure to clearly indicate each item that needs replacement to ensure accurate processing.

Common mistakes

Filling out the Texas VTR-60 form is an essential step in obtaining a replacement for lost or damaged license plates or registration stickers. However, applicants sometimes make mistakes that can delay the process. One common error is failing to provide complete applicant information. This section includes critical details such as the applicant's first and last name, address, and contact information. Omitting any part of this information can result in the form being returned.

Another frequent mistake occurs in the selection of items needing replacement. Applicants often fail to check all applicable boxes, which can lead to incomplete submissions. It is crucial to review the section labeled "The following item(s) need to be replaced." Select all that apply, including current license plates and registration stickers, to prevent delays in processing.

Providing an incorrect Vehicle Identification Number (VIN) is another significant issue. The VIN must accurately reflect the vehicle for which the replacement items are requested. Double-checking this number before submission can help avoid complications that arise from mismatches.

Additionally, some applicants neglect to sign and date the form. A signature is required to certify that the information provided is accurate. Without a signature and date, the application is incomplete and cannot be processed.

The payment section is often overlooked, leading to another common error. The replacement fee is specified, including the automation fee. Applicants sometimes send cash through the mail, which is not acceptable. It is important to follow the stated payment instructions to ensure the application is not rejected due to improper payment methods.

Finally, misunderstandings about the certification statement can lead to issues. The statement includes a warning against falsifying information, which is a serious offense. It is imperative that applicants carefully read this statement and understand their certification duties before signing, as compliance is mandatory for the integrity of the application.

Documents used along the form

The Texas VTR-60 form is a vital document for individuals seeking to replace their lost, stolen, or damaged license plates and registration stickers. While submitting this form is essential, there are several other documents that often accompany it during the application process. Here’s a brief overview of each document.

- VTR-271: This form is used for a title application when a vehicle title is needed or has been lost. It helps facilitate the ownership transfer process.

- VTR-130: The Application for Texas Title and/or Registration allows vehicle owners to register their vehicles and obtain titles simultaneously, covering various scenarios including new purchases.

- VTR-346: This form is for reporting the sale or transfer of a vehicle. It is crucial for ensuring that ownership records are updated when a vehicle changes hands.

- VTR-64: Known as the Affidavit of Motor Vehicle Gift Transfer, this document serves as a declaration that a vehicle was given as a gift, helping to simplify tax matters related to the transfer.

- VTR-30: This document verifies that a vehicle was sold and provides information on the buyer and seller, ensuring proper documentation of vehicle ownership transfers.

- Form 13-110: This form is utilized to request a specialty license plate. Specialty plates may have unique designs that represent personal interests or causes.

- Proof of Insurance: Insurance documentation is often required to confirm that the vehicle is adequately insured, which is a standard legal requirement to operate a vehicle in Texas.

- Identification: Valid identification, such as a driver’s license or state ID, must be presented to verify the identity of the applicant, ensuring that the request for replacements is legitimate.

Gathering these documents in addition to the VTR-60 can facilitate a smoother application experience. Each form plays a unique role in the vehicle registration process, working together to ensure that your vehicle is properly managed from a legal standpoint.

Similar forms

- Form VTR-61: Application for a Specialty License Plate - Similar to the VTR-60 form, the VTR-61 also serves as an application document but specifically requests specialty license plates. Like VTR-60, it requires detailed information about the applicant and vehicle while involving a fee structure.

- Form VTR-130: Application for Texas Title - The VTR-130 form is used for applying for a vehicle title. While the VTR-60 focuses on replacement plates or stickers, they both require identification of the vehicle, including its Vehicle Identification Number (VIN) and owner’s information.

- Form VTR-271: Statement of Physical Inspection - This form, like the VTR-60, involves vehicle verification but is used when the vehicle is not currently titled in Texas. It demands documentation from the vehicle owner, ensuring accurate records, much like the declaration of lost or mutilated plates in VTR-60.

- Form VTR-70: Application for a Temporary Tag - If you need to operate a vehicle while waiting for permanent plates, the VTR-70 serves a similar purpose to the VTR-60. It allows for the use of temporary registration, ensuring compliance with Texas laws while the full application for plates is processed.

- Form VTR-300: Application for Motor Vehicle Registration - This registration application form bears similarities to the VTR-60 in that it involves the completion of vehicle registration. Both use a similar structure, demanding information from the applicant while adhering to state regulations.

Dos and Don'ts

When filling out the Texas VTR 60 form, following the right practices will help ensure a smooth application process. Here’s a list of do's and don'ts:

- Do gather all necessary information before starting, including your vehicle identification number and current license plate details.

- Do double-check your personal information for accuracy, such as your name, address, and contact number.

- Do indicate all items that need replacement by selecting the appropriate checkboxes on the form.

- Do sign and date the application to certify the information provided is correct and compliant with the law.

- Don't submit the form without reviewing it for mistakes. An incomplete or incorrect application can delay processing.

- Don't send cash through the mail. Use a check or money order for payment of the replacement fee.

- Don't forget to contact your local county tax assessor-collector's office if you have questions or need assistance.

- Don't assume that your application will be processed immediately; allow sufficient time for processing and delivery of your replacement items.

Misconceptions

-

Misconception 1: The Texas VTR-60 form is only for lost license plates.

This is not entirely correct. While the form is indeed used to replace lost license plates, it also applies to registration stickers that may be lost, stolen, or damaged. Additionally, it can be used for cosmetic reasons, such as when plates become unreadable. Thus, the form serves multiple purposes beyond just the replacement of a license plate.

-

Misconception 2: I can submit the VTR-60 form online.

There is a common belief that the VTR-60 can be submitted via an online platform. However, applicants must submit the completed form in person to their local county tax assessor-collector's office. This ensures that the request is properly processed and the necessary fees are collected. Verifying local office hours and procedures beforehand can also help avoid surprises.

-

Misconception 3: Fees for the replacement license plate are refundable.

This is a misunderstanding that can lead to frustration. The fees associated with the VTR-60 form, specifically the replacement fee of $6.50, are non-refundable. Regardless of the situation, it’s essential to recognize that once these fees are paid, they cannot be reclaimed. Planning ahead can help in making informed financial decisions.

-

Misconception 4: I can use a replacement sticker or plate on any vehicle.

This misconception overlooks a critical aspect of the application. The law states that the replacement plate(s) and/or sticker can only be used on the specific vehicle described in the form. If an applicant recovers a lost or stolen plate or sticker, it cannot be used on another vehicle. Adhering to this regulation is important for legal compliance.

Key takeaways

When dealing with the Texas VTR-60 form, understanding the process can be crucial for a smooth experience. Here are key takeaways to guide you:

- Purpose of the Form: The VTR-60 form is specifically designed for individuals needing to replace lost, stolen, mutilated, or unreadable license plates and registration stickers.

- Application Submission: Complete the form and submit it to your local county tax assessor-collector’s office to initiate the replacement process.

- Replacement Fees: A fee of $6 is required, along with a 50-cent automation fee, totaling $6.50. Remember, cash should not be mailed.

- Refund Policy: Note that the replacement fees paid are non-refundable, so ensure all information is accurate before submission.

- Information Required: Fill in your personal details such as name, address, and contact information, alongside vehicle identification details.

- Selection of Items: Indicate which items need replacement by checking the appropriate boxes on the form.

- Legal Implications: Be aware that providing false information on the form is considered a third-degree felony.

- Certification Requirement: You must certify that any current license plates and stickers are returned to the county tax assessor-collector's office when asking for replacements.

- Online Access: The VTR-60 form can also be found online at www.TxDMV.gov for convenience.

By keeping these points in mind, navigating the replacement process can become much simpler. Always reach out to your county tax assessor-collector if you encounter uncertainties or have specific questions about your situation.

Browse Other Templates

How to Address a Certified Letter - The total fees are calculated based on the services selected on the form.

Form 540 2ez Vs 540 - Defining your filing period—whether annual or fiscal year—is required at the start of the form.