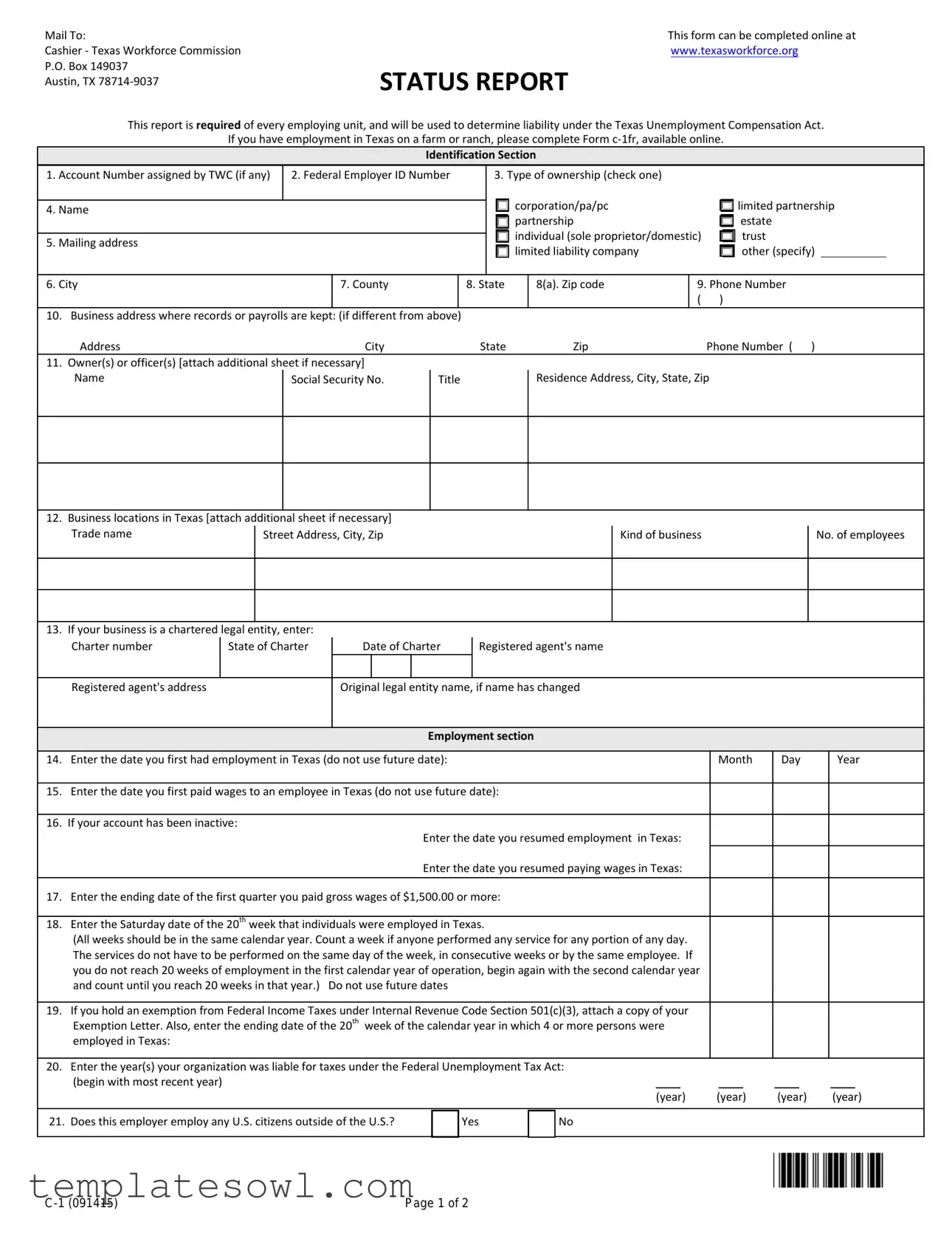

Fill Out Your Texas Workforce Commission Report Form

The Texas Workforce Commission (TWC) Report form is a crucial document for employers engaged in business within the state. This form must be completed and submitted by every employing unit to assess their liability under the Texas Unemployment Compensation Act. It includes vital sections designed to gather information about the business, such as the type of ownership, account numbers, and federal employer identification numbers. Employers must provide details about their business location, employees, and any previous ownership changes. Specific sections address employment history in Texas, domestic employment details, and voluntary election for non-liable employers wishing to contribute to unemployment taxes. Completing this report accurately helps ensure compliance and access to necessary unemployment benefits should the need arise. The TWC offers an online submission option, making the process convenient and efficient for busy employers.

Texas Workforce Commission Report Example

Mail To:

Cashier - Texas Workforce Commission

P.O. Box 149037

Austin, TX

This form can be completed online at

www.texasworkforce.org

STATUS REPORT

This report is required of every employing unit, and will be used to determine liability under the Texas Unemployment Compensation Act.

If you have employment in Texas on a farm or ranch, please complete Form

Identification Section

1. Account Number assigned by TWC (if any) |

2. Federal Employer ID Number |

|

|

3. Type of ownership (check one) |

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

corporation/pa/pc |

|

limited partnership |

|||||

4. Name |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

partnership |

|

estate |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

individual (sole proprietor/domestic) |

trust |

||||||

5. Mailing address |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

limited liability company |

|

other (specify) |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

6. City |

|

|

|

7. County |

|

|

8. State |

|

8(a). Zip code |

9. Phone Number |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

10. |

Business address where records or payrolls are kept: |

(if different from above) |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Address |

|

|

|

City |

|

|

|

State |

|

Zip |

|

Phone Number ( ) |

|||||||

11. |

Owner(s) or officer(s) [attach additional sheet if necessary] |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Name |

|

|

Social Security No. |

Title |

|

|

|

|

Residence Address, City, State, Zip |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12. |

Business locations in Texas [attach additional |

sheet if necessary] |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Trade name |

|

Street Address, City, Zip |

|

|

|

|

|

|

|

Kind of business |

|

No. of employees |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13. |

If your business is a chartered legal |

entity, enter: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Charter number |

State of Charter |

Date of Charter |

|

Registered agent's name |

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Registered agent's address |

|

|

|

Original legal entity name, if name has changed |

|

|

|

|

|

||||||||||

Employment section

14. |

Enter the date you first had employment in Texas (do not use future date): |

|

|

|

|

Month |

Day |

Year |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

15. |

Enter the date you first paid wages to an employee in Texas (do not use future date): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16. |

If your account has been inactive: |

Enter the date you resumed employment in Texas: |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

||||

|

|

Enter the date you resumed paying wages in Texas: |

|

|

|

|

|

|

|

|||

17. |

Enter the ending date of the first quarter you paid gross wages of $1,500.00 or more: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18. |

Enter the Saturday date of the 20th week that individuals were employed in Texas. |

|

|

|

|

|

|

|

|

|

|

|

|

(All weeks should be in the same calendar year. Count a week if anyone performed any service for any portion of any day. |

|

|

|

|

|

|

|

||||

|

The services do not have to be performed on the same day of the week, in consecutive weeks or by the same employee. If |

|

|

|

|

|

|

|

||||

|

you do not reach 20 weeks of employment in the first calendar year of operation, begin again with the second calendar year |

|

|

|

|

|

|

|

||||

|

and count until you reach 20 weeks in that year.) Do not use future dates |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

19. |

If you hold an exemption from Federal Income Taxes under Internal Revenue Code Section 501(c)(3), attach a copy of your |

|

|

|

|

|

|

|

||||

|

Exemption Letter. Also, enter the ending date of the 20th week of the calendar year in which 4 or more persons were |

|

|

|

|

|

|

|

||||

|

employed in Texas: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

20. |

Enter the year(s) your organization was liable for taxes under the Federal Unemployment Tax Act: |

|

|

|

|

|

|

|

||||

|

(begin with most recent year) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(year) |

(year) |

(year) |

(year) |

|||||

|

|

|

|

|

|

|

|

|

|

|||

21. Does this employer employ any U.S. citizens outside of the U.S.? |

Yes |

No |

|

|

|

|

|

|

|

|||

Page 1 of 2 |

Domestic - Household Employment Section

Complete 22 only if you have domestic or household employees (includes maids, cooks, chauffeurs, gardeners, etc.)

22. Enter the ending date of the first calendar quarter in which you paid gross wages of $1,000 or more to employees |

Month |

Day |

Year |

performing domestic service: |

|

|

|

Nature of Activity Section |

|

|

|

|

|

|

|

23.Describe fully the nature of activity in Texas, and list the principal products or services in order of importance:

_________________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________________

24.If the business in Texas was acquired from another legal entity, you must complete items

a) |

Previous owner’s TWC Account Number (if known) |

______________________________________________________________________________ |

|||

b) |

Date of acquisition |

_________________________________________________________________________________________________________ |

|||

c) |

Name of previous owner(s) |

_________________________________________________________________________________________________ |

|||

d) |

Address |

________________________________________________________________________________________________________________ |

|||

e) City |

_______________________ |

What portion of business was acquired? (check one)

State |

__________________________ |

Zip |

_________________________________ |

||

all |

part (specify) |

|

|

|

|

25.On the date of the acquisition, was the previous owner(s), or any partner(s), officer(s), shareholder(s), other owner(s) or a person related by blood or marriage to any of these individuals, holding a legal or equitable interest in the predecessor business, also an owner, partner, officer, shareholder, or other owner of a legal or

equitable interest in the successor business? |

Yes |

No |

If “Yes”, check all that apply:

same owner, officer, partner, or shareholder

sole proprietor incorporating

same parent company

other (describe below)

_________________________________________________

If “No,” on the date of the acquisition, did the previous owner(s), partner(s), officer(s), shareholder(s), other owner(s) or a person related by blood or marriage to any of these individuals, holding a legal or equitable interest in the predecessor business, hold an option to purchase such an interest in the successor business?

yes

no

26.After the acquisition, did the predecessor continue to:

•Own or manage the organization that conducts the organization, trade or business?

•Own or manage the assets necessary to conduct the organization, trade or business?

•Control through security or lease arrangement the assets necessary to conduct the organization, trade or business?

•Direct the internal affairs or conduct of the organization, trade or business?

Yes

No

If “Yes” to any of above, describe: |

_____________________________________________________________________________________________ |

Voluntary Election Section

27.A

Yes, effective Jan. 1, |

|

|

I wish to cover all employees (except those performing service(s) which are specifically exempt in the Texas Unemployment |

Compensation Act). |

|

||

|

|

|

|

|

|

|

Signature Section |

|

|

|

|

I hereby certify that the preceding information is true and correct, and that I am authorized to execute this Status Report on behalf of the employing unit named herein. (this report must be signed by the owner, officer, partner or individual with a valid Written Authorization on file with the Texas Workforce Commission)

Date of signature:

Month ___ Day |

___ Year ___ |

Sign here ________________________________________ |

Title |

_______________ |

|||||

|

|

||||||||

|

|

|

|

|

|

|

|

||

Driver's license number |

__________________ State |

__________ |

______________________________________________ |

||||||

|

|

|

|

|

|

|

|

|

|

Individuals may receive, review and correct information that TWC collects about the individual by emailing to open.records@twc.state.tx.us or writing to: TWC Open

Records, 101 E. 15th St., Rm. 266, Austin, TX

Page 2 of 2 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Mailing Address | The form must be mailed to the Texas Workforce Commission at P.O. Box 149037, Austin, TX 78714-9037. |

| Online Completion | Individuals can complete this form online at the Texas Workforce Commission's website: www.texasworkforce.org. |

| Required Filing | Every employing unit must submit this report to determine liability under the Texas Unemployment Compensation Act. |

| Account Number | An Account Number assigned by the TWC may be required in the identification section. If applicable, it must be included. |

| Employer Identification | The form requests key employer details, such as Federal Employer ID Number and type of ownership. |

| Employment Dates | Employers must provide the date they first had employment in Texas and the date they paid wages for the first time. |

| Domestic Employment Section | If hiring domestic employees, the form instructs Employers to complete section 22 on payments made for household services. |

| Exemption Information | Employers claiming an exemption under Internal Revenue Code Section 501(c)(3) must attach a copy of their Exemption Letter. |

Guidelines on Utilizing Texas Workforce Commission Report

Completing the Texas Workforce Commission Report form is essential for your business to ensure compliance with state laws. The steps below will guide you through the process efficiently. Make sure to gather all the required information before proceeding.

- Access the form online at www.texasworkforce.org or obtain a physical copy if preferred.

- Fill in the identification section:

- Enter the account number assigned by the TWC, if applicable.

- Provide your Federal Employer ID Number.

- Check the appropriate box for the type of ownership (corporation, partnership, etc.).

- Write the business name.

- Input the mailing address, including city, county, state, and zip code.

- Enter your phone number.

- Complete the business address where records are kept if different from your mailing address.

- List owner(s) or officer(s), including their Social Security Number, title, and residence address.

- Detail your business locations in Texas, including trade name, street address, and number of employees.

- If a chartered legal entity, provide the charter number, state of charter, date of charter, registered agent's name and address, and name if it has changed.

- In the employment section, enter the date employment first began in Texas and the date wages were first paid.

- If your account was inactive, provide the resumption dates for employment and wage payments.

- Record the ending date of the first quarter when you paid gross wages of $1,500 or more and the Saturday date of the 20th week of employment.

- If applicable, attach your Exemption Letter for Federal Income Taxes and note the ending date of the 20th week when four or more employees were in Texas.

- Indicate the years your organization was liable for taxes under the Federal Unemployment Tax Act.

- If you have domestic or household employees, fill in the date when $1,000 or more was paid in gross wages to them.

- For activity description, clearly outline the nature of your business in Texas, including principal products/services.

- If applicable, complete items regarding business acquisition from another legal entity.

- Elect to pay state unemployment tax voluntarily, if you choose to do so.

- Finally, review the entirety of the form for accuracy, sign, and date it, ensuring that the signature comes from an authorized individual.

Once the form is filled out, mail it to the following address:

Cashier - Texas Workforce Commission

P.O. Box 149037

Austin, TX 78714-9037

Proper completion and submission of the TWC Report form are crucial for your business’s compliance with Texas labor laws. Ensure you keep a copy for your records.

What You Should Know About This Form

What is the Texas Workforce Commission Report form?

The Texas Workforce Commission Report form is a document required from every employing unit in Texas. This report helps determine an employer's liability under the Texas Unemployment Compensation Act. It's crucial for businesses that hire employees in Texas to complete this report accurately.

How can I submit the Texas Workforce Commission Report form?

You can submit the Texas Workforce Commission Report form online through the Texas Workforce Commission's website at www.texasworkforce.org. Alternatively, you can mail the completed form to the address provided on the form: Cashier - Texas Workforce Commission, P.O. Box 149037, Austin, TX 78714-9037.

Who is required to complete the form?

Every employing unit that has employees working in Texas must complete the Texas Workforce Commission Report form. This includes businesses of various types, such as corporations, partnerships, limited liability companies, and sole proprietorships. If your employment involves work on a farm or ranch, a different form, known as Form c-1fr, is required.

What information is needed to complete the report?

You'll need to provide several pieces of information, including your TWC account number (if you have one), Federal Employer ID Number, type of ownership, business locations, and details regarding your employees and the nature of your business activities. Be prepared to disclose information about any owners, officers, or partners involved in the business as well.

What if my business has been inactive?

If your business has been inactive, you still need to complete the report. You'll have to provide the date you resumed employment in Texas and the date you resumed paying wages to employees. Accurate reporting even during periods of inactivity is important for maintaining compliance with state regulations.

What happens if I elect to pay unemployment taxes voluntarily?

Non-liable employers may choose to voluntarily pay state unemployment taxes. If you choose this option, you will be committed to making tax payments for a minimum of two calendar years, starting from January 1 of the year you make the election. If you decide to withdraw your election, it must be done through a written request at the end of the two-year period.

What should I do if I need to correct information on the form?

If you need to correct information on the Texas Workforce Commission Report form, you have the right to receive and review the information collected about you. To do this, you can either email TWC at open.records@twc.state.tx.us or write to them at: TWC Open Records, 101 E. 15th St., Rm. 266, Austin, TX 78778-0001.

Who must sign the form?

The form must be signed by an owner, officer, partner, or any individual authorized to submit the report on behalf of the employing unit. Ensuring that the report is signed by the appropriate individual is crucial, as it affirms that all the information provided is true and correct.

Common mistakes

Filling out the Texas Workforce Commission Report form can be a bit tricky. Many individuals make common mistakes that can lead to confusion or even delays in processing. One mistake occurs when applicants fail to include the correct Account Number assigned by the Texas Workforce Commission. This number is essential for identifying your business within the system. Omitting or misentering this information could impede your report's accuracy.

Another frequent error involves providing inaccurate dates. For example, when reporting the date employment first began in Texas, some individuals mistakenly use future dates. This misstep not only violates the form's instructions but can also raise red flags regarding the legitimacy of the information being submitted. Always double-check dates to ensure they reflect past activity.

Some applicants neglect to specify the correct type of ownership of the business. There are various categories, including corporation, partnership, and limited liability company. Failing to accurately indicate the type of ownership can lead to misunderstandings about regulatory responsibilities. Ensure that all boxes are checked appropriately to avoid any issues.

Additionally, many individuals forget to provide complete contact information for their business. Specifically, if the business address differs from the mailing address, it's crucial to include that information. Incomplete or missing addresses can frustrate communication between the applicant and the Texas Workforce Commission.

When detailing ownership information, another common mistake involves not including all relevant individuals. Some report only the owner, but if there are officers or partners, their information should also be included. This can be an easy oversight, but it's vital for establishing who officially manages the business and its operations.

Some applicants may mistakenly overlook the Nature of Activity Section. This section requires a clear and concise description of the business operations. Failing to provide this information means that the commission may not fully understand your business, potentially affecting tax status and operational requirements.

Finally, many neglect to sign the report or forget to include the required title and driver’s license number. A signature verifies that the information is accurate and complete. Without it, the report may not be accepted, necessitating re-submission and further delays. Always remember to sign and date the form before sending it in.

Documents used along the form

The Texas Workforce Commission Report form is an essential document for employers in Texas, as it establishes their liability under the Texas Unemployment Compensation Act. It is crucial to understand that, along with this report, several other forms and documents are often required or beneficial in the context of employment and tax compliance. Below are five such forms that are frequently used.

- Form C-1FR: This form is specifically for employers who operate in agricultural settings, such as farms and ranches. Completing Form C-1FR provides additional information necessary for those businesses that may have unique requirements under the Texas unemployment laws.

- Federal Employer Identification Number (FEIN) Application (Form SS-4): This application is required for employers to obtain a unique identification number from the Internal Revenue Service (IRS). The FEIN is used for tax purposes and distinguishes the business entity from others, ensuring compliance with federal taxation laws.

- Texas Unemployment Tax Registration (Form C-3): This registration form is used by employers to declare their intention to report and pay Texas unemployment taxes. It's essential for ensuring that the employer is recognized as an entity liable for unemployment taxes, which allow employees access to unemployment benefits if needed.

- Quarterly Wage Report (Form C-3A): Employers must submit this report to inform the Texas Workforce Commission about the wages paid to their employees during each quarter. This report is crucial for calculating unemployment taxes and ensuring that accurate records of employee wages are maintained.

- Federal Unemployment Tax Act (FUTA) Form 940: This annual federal tax form is required for employers to report and pay unemployment taxes at the federal level. It is important because it helps fund unemployment compensation programs and ensures that businesses comply with federal regulations.

In summary, while the Texas Workforce Commission Report form is central to your obligations as an employer, understanding these additional documents is equally important. Each form plays a specific role in compliance with both state and federal regulations, helping to ensure that your business operates smoothly and legally. If you have questions or need assistance with any of these forms, resources are available to guide you in navigating the requirements effectively.

Similar forms

- IRS Form 940: This document is similar because it is also used to report unemployment taxes for employers at the federal level. Both forms help determine tax liabilities, but the IRS Form 940 focuses on federal unemployment tax obligations.

- Texas Unemployment Compensation Act Registration Form: This form is required for employers registering for unemployment insurance in Texas. Like the Texas Workforce Commission Report form, it collects information on the business, its employment status, and contact details.

- Quarterly Unemployment Tax Report (TX C-3): Similar to the TWC Report, this document is used to report wages and determine unemployment tax owed on a quarterly basis. Both forms serve to ensure businesses remain compliant with unemployment tax regulations.

- Employer’s Job Offer Report: This report is designed for employers offering jobs to individuals. Like the TWC Report, it captures essential details about the employer and their hiring practices, although it is primarily focused on job offers rather than tax reporting.

Dos and Don'ts

When filling out the Texas Workforce Commission Report form, there are several best practices and pitfalls to avoid. Here’s a concise list of what you should and should not do:

- Do read the form carefully to understand all sections that apply to your business.

- Do ensure all information is accurate before submission.

- Do provide contact information where the business records are maintained.

- Do confirm that you have the correct account number and Federal Employer ID Number.

- Do submit the form on time to avoid penalties.

- Don't use future dates when entering employment or wage information.

- Don't leave any required fields blank; every section must be completed as applicable.

- Don't forget to attach necessary additional sheets, especially for ownership and location details.

- Don't sign the form unless you are authorized to do so on behalf of the business.

Misconceptions

Here are nine misconceptions related to the Texas Workforce Commission Report form, along with clarifications for each.

- It can only be submitted by mail. Contrary to this belief, the form can also be completed online at www.texasworkforce.org, providing a convenient option for many users.

- Only large businesses need to file. This report is mandatory for every employing unit in Texas, regardless of the size or number of employees. Small businesses must comply as well.

- It is only for employers who pay Texas unemployment taxes. The form is used to determine liability under the Texas Unemployment Compensation Act, which applies to all employers, even if they are non-liable.

- All employees need to be reported from the start date. Employers should report employees only after they begin paying wages in Texas. This is crucial for accurate reporting.

- You don’t need to include domestic employees. Households employing domestic workers such as maids or gardeners must complete section 22. This information is necessary for proper compliance.

- If you have a federal exemption, you don’t have to fill this out. Even if an employer holds an exemption under Internal Revenue Code Section 501(c)(3), they still need to report their status to the Texas Workforce Commission.

- Changes to business structure don’t require updates to the report. Any changes, including ownership or structure, must be accurately reflected in the report to avoid potential legal complications.

- The report is simply a formality. It plays a critical role in determining an employer’s liability under state unemployment laws. Transparency is essential for maintaining compliance.

- You can submit future dates for reporting. All dates entered must be actual or past dates. Submitting future dates can result in significant delays or issues with your filing.

Key takeaways

Filling out the Texas Workforce Commission Report form can seem daunting, but with attention to detail and some guidance, it becomes manageable. Here are key takeaways that can assist you:

- Ensure you mail the completed form to Cashier - Texas Workforce Commission, P.O. Box 149037, Austin, TX 78714-9037.

- The form can also be completed online at www.texasworkforce.org, providing you with added flexibility.

- Every employing unit must submit the report to establish liability under the Texas Unemployment Compensation Act.

- If you operate a farm or ranch in Texas, use Form C-1FR specifically designed for agricultural employment.

- Fill out Section 1 accurately, including your account number, federal employer ID, and ownership type.

- Provide complete information about your business's location and contact details, ensuring clarity and accuracy in your submission.

- Be mindful of the dates; specify the first employment date and the first date you paid wages to employees without using future dates.

- If your business has been inactive before, note the resumption dates for both employment and wage payments.

- Attach additional sheets if you need more space for owners, officers, or business locations, ensuring all relevant personnel are listed.

- If applicable, indicate if you have any U.S. citizens employed outside the United States, as this can affect your reporting.

Being thorough and accurate on this form is essential. It's not just about compliance; it's also about establishing a solid foundation for your business in Texas. Keep these reminders in mind as you prepare your report.

Browse Other Templates

Gnc Jobs Near Me - Be aware that some documents require validation from associated authorities.

Cra Forms - Remember to check all boxes that apply to your tax status when completing the income verification section.