Fill Out Your Third Party Authorization Form

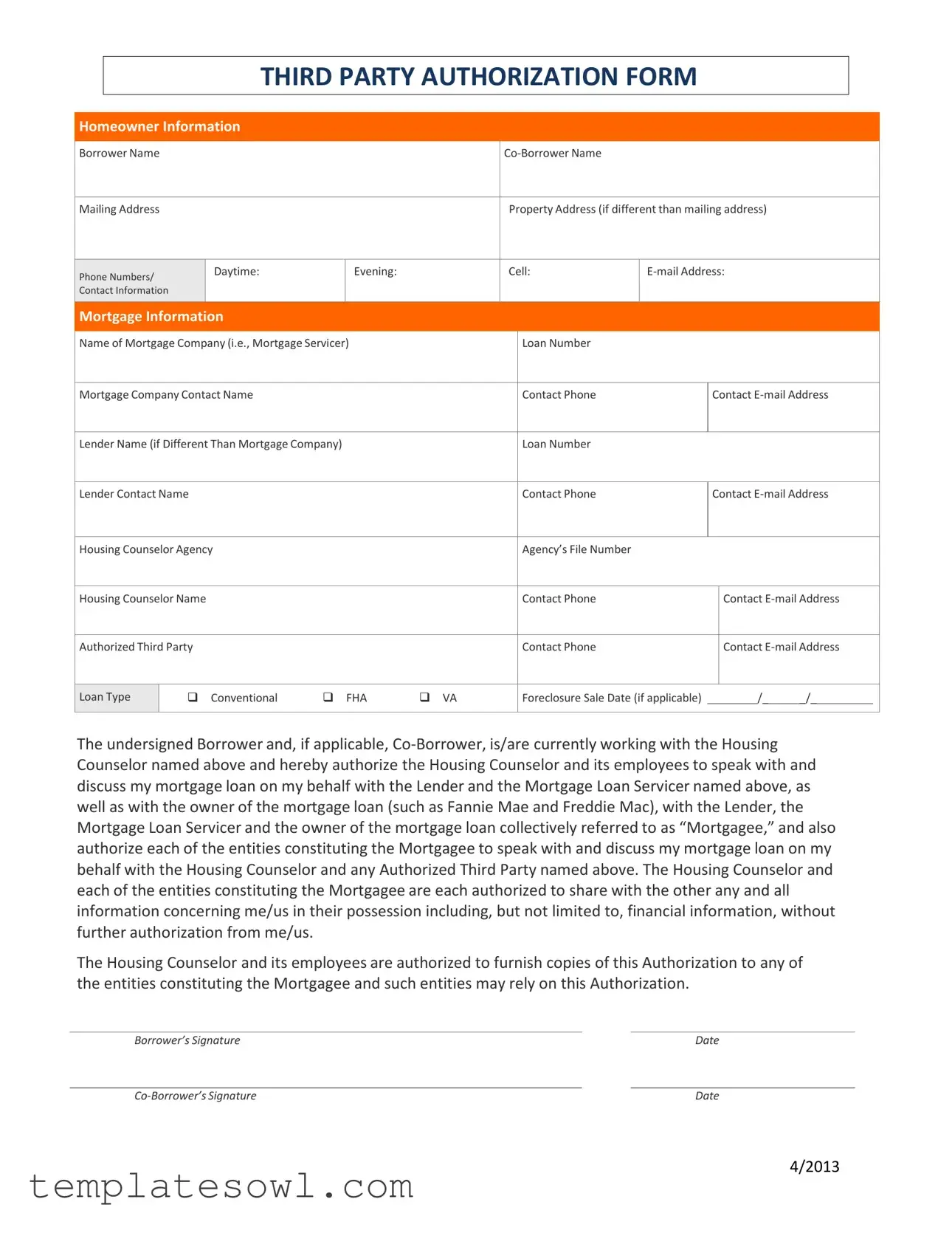

When navigating the complexities of mortgage loans, sometimes homeowners require assistance beyond their own capabilities. One useful tool in such situations is the Third Party Authorization form. This form enables homeowners to designate a housing counselor or an authorized third party to communicate with their mortgage company and lenders on their behalf. Key components of this form include homeowner information such as names, addresses, and contact details. Additionally, mortgage information such as the name of the mortgage company, loan numbers, and contact information for both the lender and the servicer are specified. This form not only ensures that the authorized individual can discuss loan matters but also allows the exchange of vital information between the borrower, the housing counselor, and mortgage entities. Furthermore, it addresses loan types, foreclosure concerns, and includes spaces for signatures to validate the authorization. By providing clear consent for such interactions, the Third Party Authorization form streamlines the process for homeowners seeking help, ensuring that their interests are represented effectively in discussions about their mortgage. Understanding these details can make a significant difference when faced with financial challenges.

Third Party Authorization Example

THIRD PARTY AUTHORIZATION FORM

Homeowner Information

Borrower Name |

|

|

|

|

|

Co‐Borrower Name |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing Address |

|

|

|

|

|

Property Address (if different than mailing address) |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Daytime: |

|

Evening: |

|

Cell: |

E‐mail Address: |

|

|

|

|

||||

Phone Numbers/ |

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Contact Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mortgage Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Name of Mortgage Company (i.e., Mortgage Servicer) |

|

|

Loan Number |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Mortgage Company Contact Name |

|

|

|

|

Contact Phone |

|

Contact E‐mail Address |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Lender Name (if Different Than Mortgage Company) |

|

|

|

Loan Number |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Lender Contact Name |

|

|

|

|

Contact Phone |

|

Contact E‐mail Address |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Housing Counselor Agency |

|

|

|

|

Agency’s File Number |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Housing Counselor Name |

|

|

|

|

Contact Phone |

|

|

Contact E‐mail Address |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Authorized Third Party |

|

|

|

|

Contact Phone |

|

|

Contact E‐mail Address |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Loan Type |

|

Conventional |

|

FHA |

VA |

|

Foreclosure Sale Date (if applicable) |

/_ |

_/_ |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The undersigned Borrower and, if applicable, Co‐Borrower, is/are currently working with the Housing Counselor named above and hereby authorize the Housing Counselor and its employees to speak with and discuss my mortgage loan on my behalf with the Lender and the Mortgage Loan Servicer named above, as well as with the owner of the mortgage loan (such as Fannie Mae and Freddie Mac), with the Lender, the Mortgage Loan Servicer and the owner of the mortgage loan collectively referred to as “Mortgagee,” and also authorize each of the entities constituting the Mortgagee to speak with and discuss my mortgage loan on my behalf with the Housing Counselor and any Authorized Third Party named above. The Housing Counselor and each of the entities constituting the Mortgagee are each authorized to share with the other any and all information concerning me/us in their possession including, but not limited to, financial information, without further authorization from me/us.

The Housing Counselor and its employees are authorized to furnish copies of this Authorization to any of the entities constituting the Mortgagee and such entities may rely on this Authorization.

Borrower’s Signature |

|

Date |

|

|

|

Co‐Borrower’s Signature |

|

Date |

4/2013

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Third Party Authorization form allows homeowners to permit a housing counselor to discuss their mortgage details with lenders on their behalf. |

| Included Information | This form collects crucial details, such as homeowner information, mortgage information, and authorized third-party contact specifics. |

| Legal Authority | The form operates under various federal and state laws, including the Fair Housing Act and state-specific regulations related to mortgage servicing. |

| Data Sharing | It grants permission to share sensitive financial information among the housing counselor and mortgage entities without needing further consent. |

| Signature Requirement | Borrowers and co-borrowers must sign and date the form, confirming their consent and understanding of the authorization granted. |

| Loan Types | Various loan types can be authorized through this form, including Conventional, FHA, and VA loans, reflecting diverse borrowing needs. |

Guidelines on Utilizing Third Party Authorization

To complete the Third Party Authorization form, you will need to gather relevant information about yourself, your mortgage, and the authorized third party. This ensures that your housing counselor can represent you effectively. Follow the steps below to fill out the form correctly.

- Provide Homeowner Information:

- Enter your name in the "Borrower Name" field.

- If applicable, input the "Co-Borrower Name."

- Fill in your mailing address.

- If your property address is different from your mailing address, include it in the designated section.

- List your daytime, evening, and cell phone numbers.

- Input your email address.

- Fill in Mortgage Information:

- Write the name of your mortgage company (the one servicing your loan).

- Provide your loan number associated with that mortgage company.

- Enter the contact name at the mortgage company and their phone number.

- Also, include their email address.

- If your lender differs from the mortgage company, include their name and loan number.

- Add the lender's contact name, phone number, and email address.

- Include Housing Counselor Information:

- Write the name of your housing counselor agency.

- If applicable, enter the agency’s file number.

- Provide the name of your housing counselor and their contact phone number and email address.

- Authorize a Third Party:

- Enter the name of the authorized third party.

- Provide their phone number and email address.

- Identify Loan Type and Foreclosure Sale Date (if applicable):

- Select your loan type: Conventional, FHA, or VA.

- If you are facing foreclosure, write the sale date.

- Sign and Date the Form:

- Sign and date the form under the "Borrower’s Signature" section.

- If applicable, have the Co-Borrower sign and date it as well.

What You Should Know About This Form

What is the purpose of the Third Party Authorization form?

The Third Party Authorization form is designed to allow homeowners, like you, to officially authorize another party, typically a housing counselor, to communicate with your mortgage lender on your behalf. This can be particularly helpful if you need assistance navigating complex mortgage issues or if you are seeking help with foreclosure prevention. By submitting this form, you ensure that your chosen third party can discuss and share necessary information with your lender, making the process smoother and more efficient.

Who should I name as my authorized third party?

When selecting an authorized third party, it is essential to choose someone you trust and who has knowledge about your situation. This could be a housing counselor, a family member, or another advocate. Ensure that the person you choose has the proper experience or background to help with your specific mortgage issues. Remember, this individual will have access to sensitive information about your mortgage, so consider their capabilities and reliability carefully.

What information do I need to provide on the form?

The form requires several pieces of information to ensure clear communication between all parties involved. You will need to provide your name, the co-borrower's name (if applicable), your mailing address, contact information, and details about your mortgage, including the name of the mortgage company and your loan number. Additionally, you will need to include the contact information for your housing counselor or authorized third party. Complete and accurate information helps facilitate effective communication.

What happens after I submit the Third Party Authorization form?

Once you submit the Third Party Authorization form, the authorized parties can begin discussing your mortgage loan. Your housing counselor and the mortgage entities will be able to communicate openly about your financial information and any relevant issues, such as payment plans, options for assistance, or foreclosure prevention strategies. This streamlined communication is crucial in reaching a resolution that best serves your needs.

Can I revoke the authorization at any time?

Yes, you have the right to revoke the authorization at any time. If you decide to do so, it’s always best to notify both your authorized third party and your lender in writing. This ensures that all parties cease discussions regarding your mortgage immediately. Keep in mind that revoking the authorization will prevent your chosen third party from accessing any future information about your mortgage. Be sure to consider the implications of this decision before proceeding.

Is there a deadline for submitting the form?

There is typically no strict deadline for submitting the Third Party Authorization form; however, it is advisable to complete and submit the form as soon as you know you will need assistance. Early submission allows your authorized third party to begin discussions with your lender before issues escalate. If you are facing time-sensitive situations, such as impending foreclosure, prompt action is critical. Always check with your housing counselor or relevant parties for any specific timelines related to your situation.

Common mistakes

Completing the Third Party Authorization form accurately is vital for ensuring that your housing counselor can effectively advocate on your behalf. However, many people make common mistakes that can delay the process or lead to confusion. Understanding these errors can help make the submission smoother.

One frequent mistake is omitting essential contact information. Individuals often forget to fill in either daytime or evening phone numbers. Providing all relevant contact details—such as a mobile number and an email address—ensures that the housing counselor and mortgage company can reach you promptly if needed.

Additionally, people occasionally mix up their names. Borrowers may confuse their names with those of co-borrowers, especially if they use different first names or initials. This can lead to paperwork errors and problematic communication between parties. It is crucial to double-check that all names are written clearly and correctly on the form.

Another common issue arises with the authorization of third-party contacts. Fillers sometimes leave the section for the authorized third-party contact blank or fail to include appropriate details. Selecting a reliable contact and providing accurate information can greatly enhance the effectiveness of communication regarding your loan.

Some individuals neglect to specify the type of mortgage they have, such as FHA or VA loans. This information helps streamline the process, as each type of loan may have different protocols and requirements. Including this detail allows the housing counselor to prepare better for discussions with lenders.

People may also overlook the necessity of signatures. Both the borrower and co-borrower must sign and date the form. Failing to do so can render the document invalid, causing delays in processing. Take the time to review the entire form and ensure all required signatures are present before submission.

Finally, many overlook the importance of submitting the form on time. Depending on your circumstances, delays in authorization can hinder your counselor’s ability to act swiftly on your behalf, particularly during time-sensitive situations like impending foreclosure. Timeliness is essential, so be proactive in completing and returning the form.

By being aware of these common mistakes, you can increase the likelihood that your Third Party Authorization form will be processed smoothly and efficiently, enabling your housing counselor to assist you effectively.

Documents used along the form

When completing a Third Party Authorization form, several additional documents may be required to ensure seamless communication between all parties involved. Here’s an overview of some key forms and documents often utilized alongside the Third Party Authorization form.

- Loan Application: This document captures essential information about the borrower, such as personal details, loan amounts requested, and the purpose of the loan. It initiates the application process and lays the groundwork for further communication.

- Credit Report Consent Form: Borrowers typically provide permission for lenders to access their credit report through this form. It is crucial for determining creditworthiness and lending decisions.

- Financial Statement: A comprehensive summary of a borrower’s financial situation, including income, expenses, assets, and liabilities. This form helps lenders assess the borrower’s ability to repay the loan.

- Mortgage Disclosure Statement: This document outlines key terms and costs associated with the mortgage. It aids borrowers in understanding their financial obligations and rights related to the loan.

- Loan Estimate: Required by federal law, this form provides a detailed estimate of the loan’s terms, monthly payments, and total closing costs. It enables borrowers to compare different loan offers.

- Housing Counseling Certificate: Issued by a certified housing counselor after completing a counseling session, this certificate may be required for specific loan programs, especially those with government backing.

- Authorization to Release Information Form: Similar to the Third Party Authorization, this form specifically allows various organizations, such as lenders or servicers, to share the borrower’s information with designated third parties.

- Payment History Form: This document details the borrower’s past mortgage payments, providing insight into their payment behavior. It can be significant during negotiations for more favorable terms.

Understanding these associated forms and documents can streamline the process of obtaining mortgage assistance or modifying a loan. Ensure all documents are prepared and submitted promptly to prevent delays in communication and processing.

Similar forms

The Third Party Authorization form is designed to grant permission for a third party, such as a housing counselor, to discuss your mortgage loan with relevant entities. Similar documents exist that serve parallel purposes. Here are four of them:

- Power of Attorney: This document gives someone the authority to act on your behalf in a broad range of matters, including financial and legal decisions. It allows the designated person to make choices that you would otherwise make yourself.

- Consent to Release Information Form: This form specifically allows an organization or individual to share your personal information with third parties. It differs from the Third Party Authorization form in that it focuses mainly on consent for information sharing rather than granting broader decision-making powers.

- Healthcare Proxy: Much like the Third Party Authorization form, a healthcare proxy appoints an individual to make medical decisions on your behalf if you are unable to do so. This document emphasizes health-related matters rather than financial ones but serves the same purpose of representation.

- IRS Form 2848: Known as the Power of Attorney for Tax Matters, this form allows an individual to authorize a person to act on their behalf for tax-related issues. Similar to the Third Party Authorization form, it facilitates communication and decision-making with specified entities, in this case, the IRS.

These documents can ensure your interests are represented, whether in financial, healthcare, or tax matters. Understanding the function of each can help you make informed choices about who you trust to act on your behalf.

Dos and Don'ts

When filling out the Third Party Authorization form, there are several best practices and common pitfalls to avoid. Here’s a straightforward list to guide you through the process.

- Check for accuracy: Ensure all names, addresses, and contact information are entered correctly. Mistakes can delay communication.

- Provide complete information: Fill in all required fields, including loan numbers and email addresses. Missing details can lead to confusion.

- Double-check the loan type: Clearly indicate whether your loan is Conventional, FHA, or VA. This helps the authorized parties address your situation appropriately.

- Sign and date: Both the borrower and co-borrower must provide their signatures and the date. Without these, the authorization is invalid.

- Keep a copy: Before submitting, make a copy for your records. This way, you have proof of what was submitted.

- Do not rush: Take your time when completing the form to minimize the potential for errors.

- Avoid leaving blank spaces: If a question doesn’t apply to you, mark it clearly as “N/A” instead of leaving it empty.

- Don’t share sensitive information: Only provide information requested on the form. Avoid unnecessary details that aren’t relevant to the authorization.

- Do not forget to follow up: After submission, reach out to ensure the authorized parties have received and processed your form.

By adhering to these tips, you can streamline the process of authorizing a third party to discuss your mortgage loan, ensuring both clarity and efficiency.

Misconceptions

Misconceptions about the Third Party Authorization form can lead to confusion and result in missed opportunities for assistance. Here are four common misunderstandings:

- Only Certain Individuals Can Be Authorized: Many believe that only family members or friends can be designated as third parties. However, anyone can be authorized, including housing counselors and agencies. This flexibility allows homeowners to receive help from qualified professionals who understand the mortgage process.

- The Form Is Only for Foreclosure Situations: Some people think that this form is only necessary during a foreclosure. In reality, it can be used for various situations, such as loan modifications, refinancing, or general inquiries about mortgage loans. It is a useful tool for communication in multiple contexts.

- This Authorization Is Permanent: There is a misconception that once the form is signed, the authorization lasts indefinitely. However, homeowners retain the right to revoke this authorization at any time. Keeping control over who has access to personal financial information is essential.

- Information Is Not Shared Securely: Some may worry that sharing information through this form will compromise their privacy. The form is designed to ensure that your information is shared securely among the authorized parties. The involved entities are responsible for protecting sensitive financial details.

Key takeaways

Here are some important points to keep in mind when filling out and using the Third Party Authorization form:

- The form allows you to authorize a housing counselor to discuss your mortgage loan on your behalf.

- Include complete contact information for both the borrower and co-borrower to ensure smooth communication.

- Clearly identify the mortgage company and lender, along with their contact details, to avoid any confusion.

- Specify the loan type, such as Conventional, FHA, or VA, to help the counselor understand your situation.

- If applicable, provide the foreclosure sale date to keep all parties informed about urgent timelines.

- Authorizing a third party means they can receive financial information about you; always consider your privacy.

- Sign and date the form to validate your authorization; it won't be effective without your signature.

- Know that the housing counselor can share this authorization with the lender and other relevant parties, facilitating better communication.

Browse Other Templates

Allergy Action Plan Form - Physician signatures are also collected to validate the action plan.

Disability Determination Office - If needed, the Social Security Administration will request medical records directly from providers.