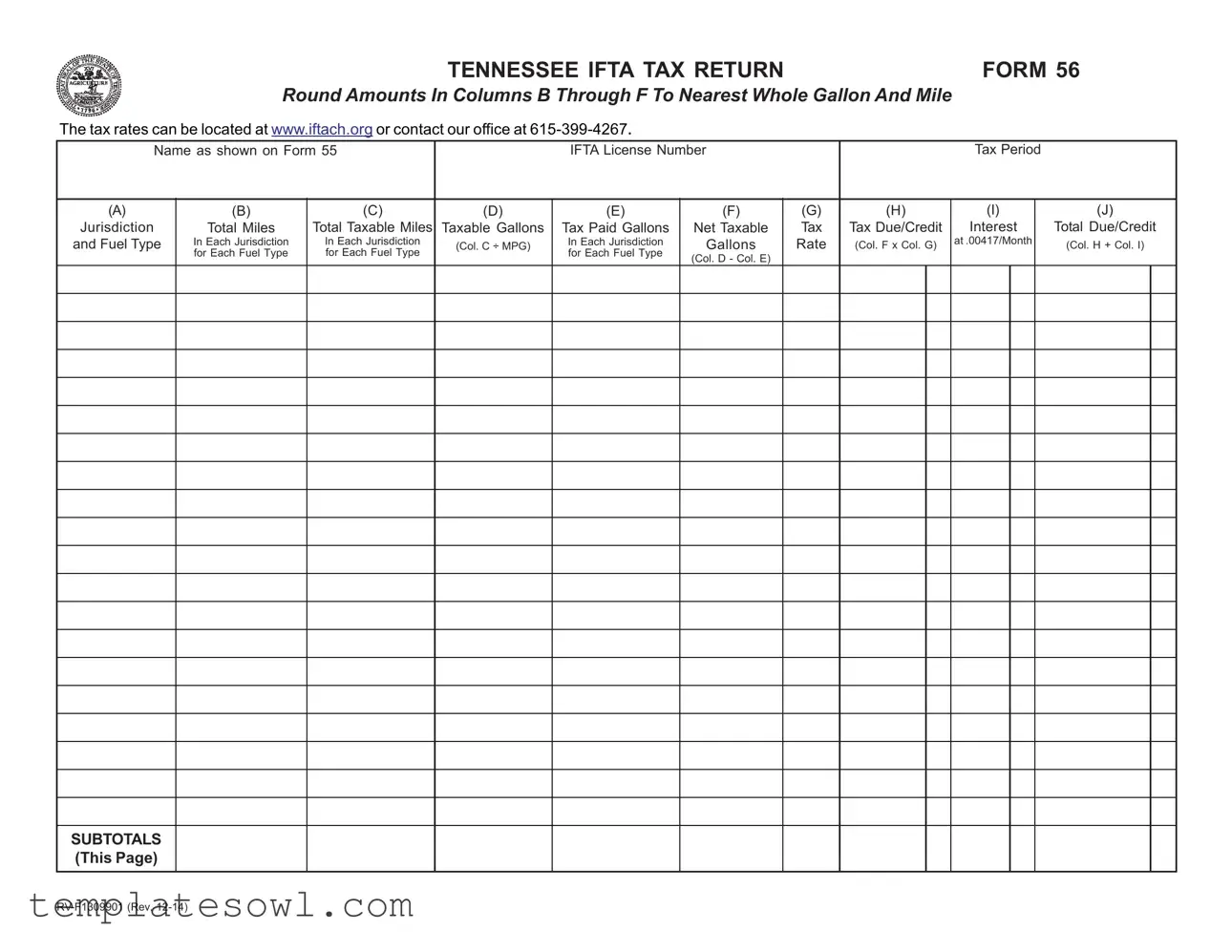

Fill Out Your Tn Ifta 56 Form

The Tennessee IFTA Tax Return Form 56 serves as an essential document for trucking companies and drivers operating within the state. This form facilitates the reporting and payment of fuel taxes under the International Fuel Tax Agreement (IFTA), which aims to simplify the tax process for vehicles that travel across state lines. Individuals and businesses must accurately report their total miles traveled, both taxable and non-taxable, along with the gallons of fuel used in each jurisdiction. Key sections of Form 56 require the taxpayer to fill in specific details such as the IFTA license number, tax period, and fuel types used. It is crucial for users to adhere to the requirement of rounding the amounts in certain columns to the nearest whole gallon and mile, which ensures accurate calculations. Tax rates for the reporting period can be found on the IFTA's official website, and taxpayers have the option to contact the Tennessee Department of Revenue for assistance. Additionally, Form 56 calculates the total tax due or any credits owed by accounting for the gallons paid and the applicable tax rates for each jurisdiction. Completing this form accurately is essential to comply with state regulations and avoid any potential penalties.

Tn Ifta 56 Example

TENNESSEE IFTA TAX RETURN |

FORM 56 |

Round Amounts In Columns B Through F To Nearest Whole Gallon And Mile

The tax rates can be located at www.iftach.org or contact our office at

Name as shown on Form 55 |

|

IFTA License Number |

|

|

Tax Period |

|

|||

|

|

|

|

|

|

|

|

|

|

(A) |

(B) |

(C) |

(D) |

(E) |

(F) |

(G) |

(H) |

(I) |

(J) |

Jurisdiction |

Total Miles |

Total Taxable Miles |

Taxable Gallons |

Tax Paid Gallons |

Net Taxable |

Tax |

Tax Due/Credit |

Interest |

Total Due/Credit |

and Fuel Type |

In Each Jurisdiction |

In Each Jurisdiction |

(Col. C ÷ MPG) |

In Each Jurisdiction |

Gallons |

Rate |

(Col. F x Col. G) |

at .00417/Month |

(Col. H + Col. I) |

|

for Each Fuel Type |

for Each Fuel Type |

|

for Each Fuel Type |

(Col. D - Col. E) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SUBTOTALS (This Page)

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Title | The official name of the form is the Tennessee IFTA Tax Return Form 56. |

| Tax Rates Source | Tax rates can be found at www.iftach.org or by calling 615-399-4267. |

| Reporting Period | The form must be completed for a specified tax period as indicated at the top of the form. |

| Jurisdiction Details | Taxpayers must fill out jurisdictions where they operated, detailing miles and gallons. |

| Column Guidelines | Amounts in columns B through F must be rounded to the nearest whole gallon and mile. |

| Net Tax Calculation | Net Tax is calculated by subtracting the gallons paid from taxable gallons. |

| Interest Rate | Interest accrues monthly at a rate of 0.00417 on the tax due. |

| Filing Requirement | All IFTA license holders whose operations include Tennessee must file this form. |

| Governing Law | This form is governed by the International Fuel Tax Agreement (IFTA) and Tennessee tax laws. |

| Submission Deadlines | Taxpayers should note the due dates to avoid penalties and interest charges. |

Guidelines on Utilizing Tn Ifta 56

After gathering necessary details, you are ready to fill out the Tennessee IFTA Form 56. Accurate completion of this form is crucial for ensuring compliance with tax regulations. The next steps will guide you through the process to avoid delays and potential fines.

- Start by entering your name as it appears on Form 55 in the designated field.

- Fill in your IFTA License Number below your name.

- Specify the Tax Period for which you are filing. Make sure to clearly state the starting and ending dates.

- For each jurisdiction where fuel was purchased or miles were driven, enter the following data:

- Column A: Enter the name of the jurisdiction.

- Column B: Total miles driven in that jurisdiction.

- Column C: Total taxable miles in that jurisdiction.

- Column D: Taxable gallons for that jurisdiction.

- Column E: Tax paid gallons in that jurisdiction.

- Column F: Calculate net taxable gallons (Column C divided by MPG) for that jurisdiction.

- Column G: Input the tax rate at 0.00417 per month for each jurisdiction.

- Column H: Compute the total tax due or credit (Column D minus Column E).

- Column I: If applicable, note any interest.

- Column J: Sum up total due or credit for each fuel type for that jurisdiction (Column H plus Column I).

- After entering all relevant jurisdiction information, add up the entries on this page to create a subtotal.

- Review all entries carefully to ensure accuracy and completeness.

- Sign and date the form before submission, confirming that all information provided is true and correct to the best of your knowledge.

What You Should Know About This Form

What is the TN IFTA 56 form used for?

The Tennessee IFTA 56 form is utilized to file a tax return for the International Fuel Tax Agreement (IFTA). It is designed specifically for motor carriers who operate in more than one jurisdiction and need to report their fuel usage and related taxes. This form helps ensure compliance with state fuel tax regulations.

Who needs to fill out the TN IFTA 56 form?

Any motor carrier who holds an IFTA license and operates commercial vehicles that travel across state lines should complete the TN IFTA 56 form. This applies to those who use fuel in multiple states as part of their business operations.

How do I calculate my taxable gallons on the TN IFTA 56 form?

To determine your taxable gallons, you will divide the total taxable miles by your vehicle's miles per gallon (MPG). This calculation will give you the taxable gallons for each jurisdiction you traveled through during the tax period.

What information do I need to provide on the TN IFTA 56 form?

You will need to provide several key details: your name as it appears on Form 55, your IFTA license number, the tax period, total miles driven, total taxable miles, taxable gallons, tax paid gallons, net taxable gallons, tax rates, and the total amount due or credit for each fuel type.

Where can I find the current tax rates for the TN IFTA 56 form?

Current tax rates can be found on the IFTA official website at www.iftach.org. Alternatively, you may contact the Tennessee IFTA office directly at 615-399-4267 for assistance and the latest rates.

What should I do if I have a credit on my TN IFTA 56 form?

If your calculations result in a credit, you can apply it to future tax periods or request a refund. Make sure to indicate your preference on the form itself when submitting it.

How often do I need to file the TN IFTA 56 form?

The TN IFTA 56 form must be filed quarterly. Each quarter covers a three-month period, and reports are due on specific dates throughout the year, ensuring timely compliance with state tax obligations.

What happens if I submit the TN IFTA 56 form late?

If the form is submitted after the deadline, penalties and interest charges may apply. It is important to file on time to avoid unnecessary fees and complications. If you anticipate a delay, consider reaching out to the appropriate authorities for guidance.

How do I round the amounts in columns B through F on the form?

You should round all amounts in columns B through F to the nearest whole gallon and mile. This means if your totals are anything with a decimal, round to the closest whole number for reporting purposes.

Can I file the TN IFTA 56 form online?

Yes, several states provide online filing options for the IFTA 56 form, making it easier to submit your returns electronically. Check with the Tennessee IFTA office for specific online submission processes and any required documentation.

Common mistakes

Filling out the Tennessee IFTA 56 form can be a straightforward process. However, mistakes are common. One significant error occurs when individuals do not round the amounts correctly. Columns B through F require amounts to be rounded to the nearest whole gallon and mile. Failing to do this can lead to inaccuracies in the reported figures, which may affect overall tax calculations.

Another frequent mistake involves neglecting to verify the jurisdiction information. Each jurisdiction has specific requirements and tax rates. Listings should match the information on Form 55, which includes the IFTA license number and tax period. Incorrect or incomplete details may result in delays or complications during processing.

People often miscalculate their taxable gallons and miles as well. Accurate records of total miles and taxable miles should be kept and reported carefully. Errors in these calculations can significantly misrepresent the tax owed or the credit available. Additionally, ensuring that proper mileage figures are used for each fuel type and jurisdiction is essential to avoid inaccuracies.

Some individuals also overlook the importance of checking tax rates. Tax rates may change or differ from year to year. The rates can be located at the stated website, www.iftach.org. Ignoring the most current rates can lead to discrepancies in tax calculations, impacting the total due or credit balance.

Failing to provide the total due or credit accurately is another common mistake. This amount is derived from various calculations, which should be double-checked. If incorrect figures are reported, it could lead to penalties or a delay in the refund process.

People sometimes forget to include all necessary fuel types on the form. Each fuel type used must be reported. Neglecting to mention a specific fuel type can result in an incomplete return and potential audits.

Leaving out the interest due on any late payments is another oversight. If a payment is missed or late, interest may accumulate, and this should be calculated and included in the total amount due. Being thorough in this aspect helps prevent additional liability.

Lastly, failing to sign and date the form is a mistake that can easily be avoided. Signing the document certifies that the information provided is accurate to the best of the preparer's knowledge. Without a signature, the form may be deemed incomplete.

Documents used along the form

The Tennessee IFTA Tax Return Form 56 is essential for reporting fuel use and calculating taxes owed for interstate travel. Along with this form, other documents may also be necessary for accurate and efficient filing. Below are four forms that are commonly associated with the IFTA process.

- IFTA Application Form: This document is the initial application that needs to be completed to obtain an IFTA license. It includes basic information about the carrier and their vehicles.

- IFTA Recordkeeping Guidelines: This guide provides rules and suggestions on how to maintain appropriate records for fuel purchase and mileage. It helps ensure that all required data is organized and ready for tax reporting.

- IFTA Quarterly Tax Return Forms: These are quarterly reports that drivers must file to detail their fuel use and miles traveled in each jurisdiction. The information filed here feeds into the annual reporting required on Form 56.

- Fuel Purchase Receipts: Keeping records of all fuel purchases is crucial. Receipts validate the amount of fuel purchased and the tax already paid, which directly affects the calculations on Form 56.

Ensuring that these documents are properly filled out and filed can streamline the reporting process. This attention to detail helps avoid potential penalties and promotes compliance with state regulations.

Similar forms

The Tennessee IFTA Form 56 is a tax return form used for reporting fuel taxes. Several other documents serve similar purposes and share similar structures. These forms also cater to vehicle and fuel tax reporting for interstate operations. Below are documents that the TN IFTA 56 form is similar to, along with their key characteristics:

- IFTA Quarterly Tax Return (Form 500): This form is used by carriers to report fuel use and tax liability for the quarter. Both forms require similar calculations of taxable miles and gallons, and they seek to determine tax credits or liabilities.

- IRS Form 2290 (Heavy Highway Vehicle Use Tax Return): This form reports the annual heavy vehicle use tax. Like the IFTA 56, it determines tax liabilities based on vehicle usage and operational data.

- State Fuel Tax Returns: Different states have their own fuel tax reports. These documents often track similar information on fuel gallons purchased and taxes owed, akin to the IFTA 56's structure.

- Fuel Tax Rebate Applications: These applications allow businesses to claim refunds for fuel taxes paid in specific circumstances. They gather much of the same data as the IFTA forms.

- International Fuel Tax Agreement (IFTA) Application: This document is necessary to establish IFTA licensing. It collects basic operational information similar to the introductory information in Form 56.

- Commercial Vehicle Registration Forms: These forms require details on vehicle operations. They may request mileage and fuel use data similar to that in the IFTA 56.

- State Business Licenses for Motor Carriers: These licenses often require reporting similar fuel-related metrics and operational statistics, aligning closely with those in Form 56.

Dos and Don'ts

When filling out the Tennessee IFTA Tax Return Form 56, there are important dos and don’ts to help ensure accuracy and compliance. Here’s a helpful list to guide you.

- Do round amounts in columns B through F to the nearest whole gallon and mile.

- Do list your name exactly as it appears on Form 55.

- Do check the tax rates at www.iftach.org or by contacting the office at 615-399-4267.

- Do ensure all totals are accurate across all columns.

- Don’t forget to fill in all required fields, such as your IFTA license number and tax period.

- Don’t overlook the importance of verifying taxable miles and gallons before submission.

- Don’t neglect to calculate the subtotal on the form correctly.

- Don’t submit the form late to avoid potential penalties.

By adhering to these guidelines, you will improve the chances of a smooth filing process and minimize the likelihood of errors. Taking the time to be thorough pays off in the long run.

Misconceptions

Understanding the IFTA 56 form used in Tennessee can be complicated, and several misconceptions may lead to confusion. Here are some common misunderstandings regarding this tax return form:

- Only large trucking companies need to file. Many believe that only large trucking businesses are required to file the IFTA 56 form. In reality, any motor carrier operating a qualified motor vehicle must file, regardless of the size of the operation.

- It is necessary to file every month. Some individuals think they must submit the form monthly. However, the IFTA 56 form is typically filed quarterly, which means businesses file four times a year.

- Only fuel consumption is reported on the form. Some think the IFTA 56 form solely concerns fuel usage. While fuel details are essential, total miles driven and taxable miles in various jurisdictions are also crucial for accurate reporting.

- All jurisdictions have the same tax rate. The misconception that all states have uniform tax rates can lead to errors. In truth, different jurisdictions have their own unique tax rates, which must be considered when completing the form.

- It is not necessary to keep detailed records. Many assume that keeping minimal records is adequate. On the contrary, maintaining thorough logs of miles driven and fuel purchased is important for accurately filling out the form and justifying reports if requested.

- You can estimate the figures to simplify the process. Some think they can simply estimate the required amounts when filling out the form. However, estimates can lead to inaccuracies and potential audits. Accurate reporting is imperative.

- Tax credits are automatic. There may be a belief that tax credits will automatically be applied. While tax credits can reduce overall tax liability, they must be actively calculated and reported in the respective columns on the IFTA 56 form.

- Filing is the only requirement for compliance. Some people think that submitting the form is all that is needed for compliance. However, carriers also need to ensure that they pay any taxes due promptly to avoid penalties.

- All fuel types are taxed the same. It is a common misconception that every fuel type is subject to the same tax treatment. Different fuel types may have varying tax rates, making it essential to accurately report each type of fuel used.

Clarifying these misconceptions can help streamline the filing process and ensure compliance with Tennessee’s IFTA tax requirements.

Key takeaways

Filling out the Tennessee IFTA Tax Return Form 56 can seem daunting, but understanding its key components will make the process smoother. Here are some important takeaways to keep in mind:

- Accurate Data Entry: It's crucial to enter the correct information in every section, particularly the total miles and taxable gallons. Accuracy will help avoid delays or complications in processing.

- Rounding Guidelines: Remember to round amounts in columns B through F to the nearest whole gallon and mile. This helps ensure uniformity and eases calculations.

- Tax Rates: Always check the current tax rates before completing the form. You can find this information at www.iftach.org or by contacting the office directly.

- Understanding Taxable Gallons: Be aware that taxable gallons are calculated based on miles traveled divided by your vehicle's miles per gallon (MPG). This step is vital for accurate reporting.

- Payment Details: Make sure to check the total due or credit, which is calculated based on various factors including tax paid gallons and taxable gallons. This ensures you're submitting a complete and thorough form.

Filling out the form carefully and methodically can make a significant difference in the processing of your tax return. This attention to detail will alleviate potential issues in the future.

Browse Other Templates

Snap Mid Certification Review Form Online - New York City applicants can apply online or visit any SNAP office for assistance.

Sanofi Patient Connection - Applicants must be at least 19 years old for vaccine assistance, with some exceptions.

Tiaa Revenue - Checks will be issued to the financial institution indicated on the form.