Fill Out Your Tn New Hire Form

The Tennessee New Hire form serves as a crucial tool for employers in complying with state and federal regulations regarding employee reporting. Effective from October 1, 1997, the form must be utilized by all employers within the state to report essential details about newly hired, rehired, or returning employees. Compliance options include completing the form, submitting a copy of the IRS W-4 form, or sending the required information electronically. Employers are required to provide this report within 20 calendar days of the hire date, with a recommendation to assist the Department of Labor and Workforce Development by submitting the report within 5 days. Clear and accurate completion is vital, and responses must be recorded in upper-case letters using a dark pen. The form gathers mandatory employee details such as name, Social Security number, address, and date of hire, alongside important employer information. Additional sections require data on the employee's gender, state of hire, earned income tax credit eligibility, and benefits such as medical insurance. Submission of this report is essential; incomplete forms will not be processed, highlighting the importance of gathering all mandatory information before sending it to the Tennessee New Hire Reporting Program.

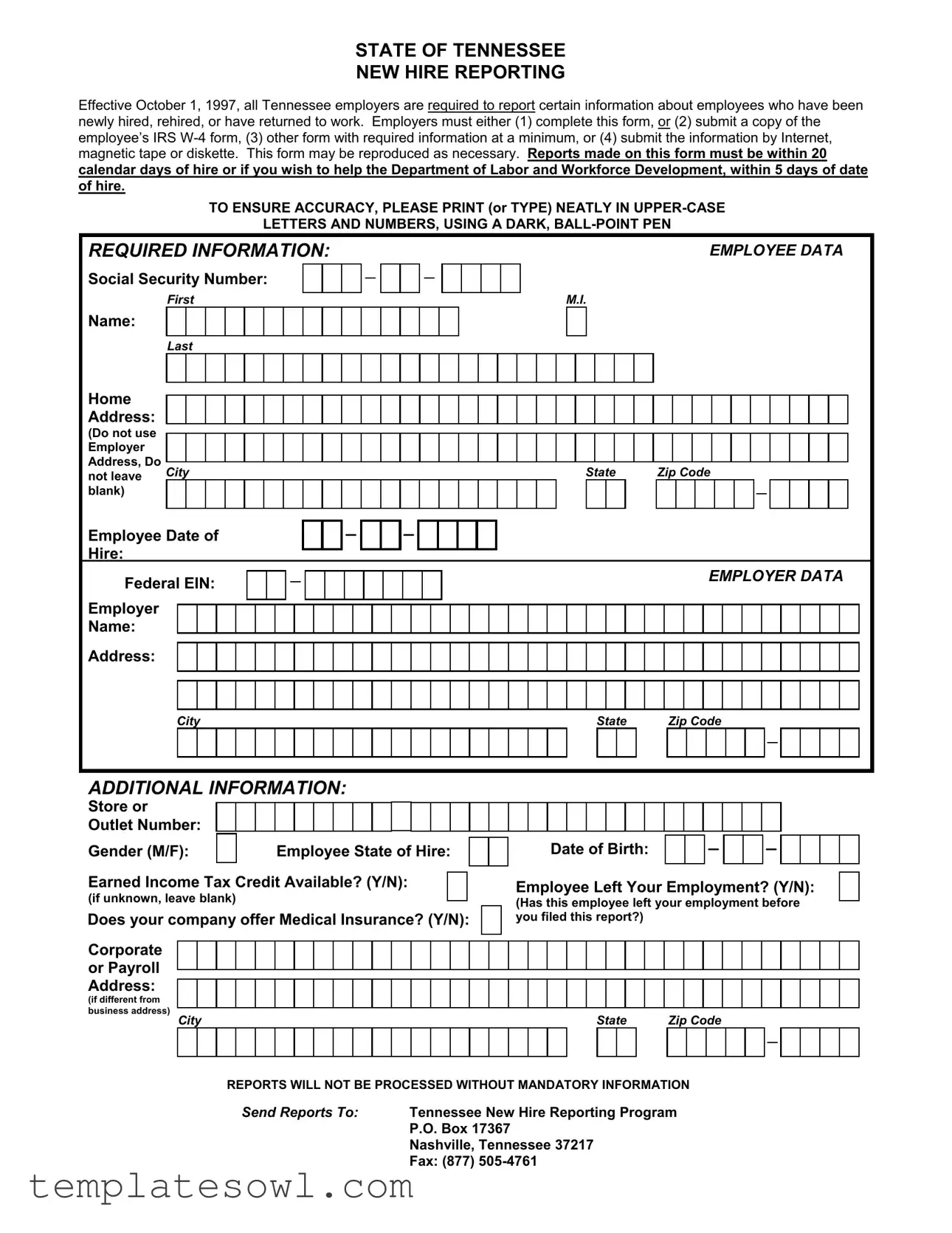

Tn New Hire Example

STATE OF TENNESSEE

NEW HIRE REPORTING

Effective October 1, 1997, all Tennessee employers are required to report certain information about employees who have been newly hired, rehired, or have returned to work. Employers must either (1) complete this form, or (2) submit a copy of the employee’s IRS

TO ENSURE ACCURACY, PLEASE PRINT (or TYPE) NEATLY IN

LETTERS AND NUMBERS, USING A DARK,

REQUIRED INFORMATION: |

|

EMPLOYEE DATA |

||

Social Security Number: |

|

|

||

|

First |

M.I. |

|

|

Name: |

|

|

|

|

|

Last |

|

|

|

Home |

|

|

|

|

Address: |

|

|

|

|

(Do not use |

|

|

|

|

Employer |

|

|

|

|

Address, Do |

City |

State |

Zip Code |

|

not leave |

||||

|

|

|

||

blank) |

|

|

|

|

Employee Date of

Hire:

Federal EIN:

Employer

Name:

Address:

EMPLOYER DATA

City |

State |

Zip Code |

ADDITIONAL INFORMATION:

Store or

Outlet Number:

Gender (M/F): |

Employee State of Hire: |

Earned Income Tax Credit Available? (Y/N):

(if unknown, leave blank)

Does your company offer Medical Insurance? (Y/N):

Corporate or Payroll Address:

Date of Birth:

Employee Left Your Employment? (Y/N):

(Has this employee left your employment before you filed this report?)

(if different from business address)

City |

State |

Zip Code |

REPORTS WILL NOT BE PROCESSED WITHOUT MANDATORY INFORMATION

Send Reports To: Tennessee New Hire Reporting Program

P.O. Box 17367

Nashville, Tennessee 37217

Fax: (877)

Form Characteristics

| Fact Name | Description |

|---|---|

| Reporting Requirement | All employers in Tennessee must report new hires, rehires, or employees returning to work. |

| Effective Date | This requirement has been in effect since October 1, 1997. |

| Submission Options | Employers can either complete the New Hire form, submit the IRS W-4, another required form, or report via digital means. |

| Report Timeline | Reports must be submitted within 20 calendar days of hire. For timely assistance to the Department of Labor, reports should be filed within 5 days. |

| Mandatory Information | Certain details, including social security numbers and employee names, are mandatory for the report to be processed. |

| Privacy Guidelines | The form can contain sensitive information and must be completed accurately and legibly to ensure processing. |

Guidelines on Utilizing Tn New Hire

Once the Tn New Hire form is filled out correctly, it must be submitted to the Tennessee New Hire Reporting Program. Employers have specific timelines for reporting the information. It’s crucial to follow the instructions carefully to ensure the report is processed without delays.

- Obtain the Tn New Hire form, either online or through your employer.

- Fill in the employee data section:

- Enter the employee's Social Security Number.

- Write the employee's first and middle initial.

- Provide the employee's last name.

- Complete the home address; do not use the employer's address.

- Add the city, state, and zip code.

- Record the employee date of hire.

- Complete the employer data section:

- Enter your Federal EIN.

- Provide the employer name.

- Fill in the employer address.

- Include the city, state, and zip code.

- Fill out the additional information section:

- Write the store or outlet number.

- Indicate the gender (M/F).

- Specify the employee state of hire.

- Note if the Earned Income Tax Credit is available (Y/N).

- State if your company offers medical insurance (Y/N).

- Provide the corporate or payroll address if different from the business address.

- Fill in the date of birth.

- Indicate if the employee left your employment (Y/N).

- Review the completed form to ensure all mandatory information is included.

- Submit the form by mailing it to:

- Tennessee New Hire Reporting Program

- P.O. Box 17367

- Nashville, Tennessee 37217

- Alternatively, you can fax it to (877) 505-4761.

What You Should Know About This Form

What is the Tennessee New Hire form?

The Tennessee New Hire form is a document that employers in Tennessee must complete for newly hired, rehired, or returning employees. It collects essential information to help the state monitor employment and fulfill legal obligations. Employers can either fill out this specific form or provide the required information through other means, such as submitting an IRS W-4 form.

When is the New Hire report due?

Employers have to submit the New Hire report within 20 calendar days of the employee's hire date. For those wanting to assist the Department of Labor and Workforce Development, it's recommended that reports be filed within 5 days of hire to ensure prompt processing.

What information is required on the form?

The form requires specific information including the employee's Social Security Number, name, home address, date of hire, and the employer's details such as Federal EIN and address. Furthermore, it includes additional items like gender, state of hire, and whether the employee has left the company before the report was filed.

Can I submit the New Hire report electronically?

Yes, the Tennessee New Hire reporting system allows you to submit the required information electronically via the internet, magnetic tape, or diskette. Ensure that you meet all reporting requirements, regardless of the submission method chosen.

What happens if I do not submit the form on time?

Failure to submit the New Hire report on time may result in penalties for the employer. The state emphasizes the importance of timely reporting to maintain compliance with employment laws, so it's crucial to keep track of deadlines.

Where do I send the completed New Hire report?

Once completed, send the New Hire report to the Tennessee New Hire Reporting Program at P.O. Box 17367, Nashville, Tennessee 37217. You also have the option to fax the report to 877-505-4761 if you prefer a quicker submission method.

Common mistakes

When filling out the TN New Hire form, one common mistake is failing to provide the employee's Social Security Number. This number is critical for payroll and tax purposes. Without it, the form cannot be processed. Be sure to double-check this entry. A missing or incorrect Social Security Number can lead to delays and complications for both the employer and the employee.

Another frequent error involves the employee's home address. Some individuals mistakenly use the employer's address instead of the employee's. This oversight can result in miscommunication and inadequate record-keeping. It is essential to provide the complete home address, including the city, state, and zip code. Do not leave any fields blank.

People often forget to include the date of birth on the form, which is necessary for identification and compliance with federal regulations. Leaving this section incomplete can cause processing issues. Always ensure that the date of birth is entered accurately to avoid any potential complications.

In addition, many applicants neglect to specify whether the company offers medical insurance. This information is vital for understanding employee benefits and obligations. If this section is left blank, it can create confusion regarding the employee's eligibility for health coverage. Make it a point to indicate “Y” or “N” in this section.

Finally, some employers fail to report the date of hire, which is a critical component of the new hire reporting process. This date must be accurate to ensure compliance with state and federal laws. Inaccurate reporting can lead to penalties or issues in future documentation. Always verify the hire date before submitting the form.

Documents used along the form

The TN New Hire form is an important document for employers in Tennessee to report newly hired employees. However, it is often used alongside several other forms and documents to ensure compliance with state regulations and to streamline the onboarding process. Understanding these additional documents can aid both employers and employees in managing the hiring process efficiently.

- IRS W-4 Form: This form allows employees to indicate their tax withholding preferences. Employers use this information to withhold the correct federal income tax from employees' wages.

- I-9 Employment Eligibility Verification: All employers must complete an I-9 form for every new hire to verify their identity and employment eligibility in the United States.

- State Tax Withholding Form: In addition to the federal W-4, Tennessee may require an additional form to determine state tax withholding based on the employee's residence and income.

- Direct Deposit Authorization Form: This document allows employees to authorize their employer to deposit their wages directly into their bank account, ensuring timely access to funds.

- Company Policy Acknowledgment Form: New hires may be required to sign this form to confirm their understanding of company policies and procedures, including code of conduct and safety regulations.

Filling out the TN New Hire form and these associated documents promptly is crucial. Ensure all information is accurate and submitted within the specified deadlines to avoid potential issues with reporting and compliance.

Similar forms

- IRS W-4 Form: This document collects information on an employee's tax withholding preferences. Like the New Hire form, it must be completed upon hiring for accurate tax reporting.

- I-9 Employment Eligibility Verification: This form is used to verify an employee's eligibility to work in the U.S. It shares similarities with the New Hire form in that it must be completed within a designated timeframe after hiring.

- State Employee Registration Form: Many states require registration details similar to those in the New Hire form, including employee and employer information. Both are geared towards tracking workforce demographics.

- Employee Information Form: This form gathers vital employee data for HR records. It parallels the New Hire form in requesting personal details like name and address.

- Payroll Information Form: This document includes details necessary for processing employee pay. Similar to the New Hire form, it requires information about the employee and employer.

- Direct Deposit Authorization Form: Employees use this form to set up direct deposit for their paychecks. It shares the need for employee consent and detailed banking information, akin to the New Hire process.

- Employee Tax Benefit Eligibility Form: Used to determine an employee's eligibility for certain tax benefits, this form collects information on marital status and dependents, similar to considerations made in the New Hire reporting.

- Health Insurance Enrollment Form: This document registers new hires for health benefits. It requires similar personal data as the New Hire form to ensure proper enrollment.

- State Unemployment Insurance Registration: Employers must report new hire information for unemployment insurance purposes, mirroring the requirement for timely reporting seen in the New Hire form.

Dos and Don'ts

When filling out the TN New Hire form, there are key do's and don'ts to ensure accurate and timely submission.

- Do print or type neatly using upper-case letters.

- Do provide complete and accurate information, including Social Security Number and address.

- Do submit the form within 20 calendar days of hire to avoid penalties.

- Do check for errors before submitting the form.

- Don't use the employer's address in place of the employee's home address.

- Don't leave any required fields blank, as this will delay processing.

Misconceptions

Misconceptions about the Tennessee New Hire form can lead to confusion for both employers and employees. Here are ten common misconceptions clarified:

- Only full-time employees need to be reported.

All new hires, including part-time and seasonal employees, must be reported, regardless of their work status.

- The form must be submitted in person.

Employers have several options for submitting the New Hire report, including by mail, fax, or online.

- The employer’s address is sufficient.

Employers must provide the employee's home address; using the employer's address is not acceptable.

- Only employees earning a certain amount need to be reported.

All new hires must be reported, regardless of their earnings.

- Submission can take place at any time after hire.

Reports must be submitted within 20 calendar days of hire, or within 5 days to assist the Department of Labor and Workforce Development.

- You can leave mandatory fields blank if unsure.

Reports will not be processed if mandatory information is missing. It's essential to provide all required details.

- Submitting the W-4 is an alternative to the form.

While submitting the IRS W-4 form is an option, it must include all required information outlined in the New Hire report.

- The form is only for reporting new hires.

This form also applies when rehiring or when employees return to work after a break.

- There are no consequences for late reporting.

Failing to meet the reporting deadline can result in penalties for employers.

- All information is kept confidential.

While some data is protected, certain information may still be accessible to state agencies for various purposes.

Understanding these misconceptions can help ensure compliance with Tennessee's New Hire reporting requirements.

Key takeaways

1. The Tennessee New Hire Report is a mandatory document required by all employers in the state of Tennessee for new hires, rehires, or employees returning to work.

2. Employers have several options for reporting: they can either complete the provided form, submit the employee’s IRS W-4 form, or use other forms, as long as they contain the required information.

3. Timeliness is essential—reports must be submitted within 20 calendar days of the employee’s hire date. For those wishing to assist the Department of Labor and Workforce Development, submitting within 5 days is encouraged.

4. Accuracy in filling out the form is crucial. It is advisable to print or type in upper-case letters and numbers, using a dark ball-point pen to ensure clarity.

5. The form requests essential employee data, including their Social Security number, full name, home address, and date of hire, all of which must be provided without exception.

6. Employers must provide their Federal Employer Identification Number (EIN) as well as their business name and address on the form to ensure proper identification.

7. Additional information, such as the employee's gender and state of hire, must be clearly indicated. There are also questions regarding the availability of earned income tax credits and medical insurance that need to be addressed.

8. If the employee has left employment prior to the submission of the report, this must also be indicated on the form. Failing to provide such mandatory information can result in the report not being processed.

9. Completed forms can be sent to the Tennessee New Hire Reporting Program by mail or fax. The mailing address is P.O. Box 17367, Nashville, Tennessee 37217, while the fax number is (877) 505-4761.

Browse Other Templates

Sinai Hospital Medical Records Phone Number - It is essential to understand potential re-disclosure risks once your information is released.

Bankruptcy Chapter 7 Forms - Avoid using non-standard paper to ensure readability.

Erm-14 - Implementing best practices around the ERM 14 form can reduce processing delays