Fill Out Your Toyota Finacial Payoff Form

The Toyota Financial Payoff form is an essential document for anyone looking to settle the remaining balance on their vehicle lease or loan with Toyota. This form facilitates the authorization process for the payoff and title transfer, allowing account holders to smoothly transition ownership of their vehicles. One crucial aspect of the form is that it must be signed by the account holder and returned to Toyota Motor Credit Corporation (TMCC) before any title release can occur. For leased vehicles, the form specifies that the vehicle can only be sold to the lessee or a licensed dealer. Additionally, it clearly states that the title cannot be assigned to anyone who isn’t part of the original lease agreement. The form collects necessary information, including account and vehicle identification numbers, and requires the customer’s confirmation of the payoff amount. The document also includes instructions for both electronic and mailed payoffs and notes the importance of promptly submitting a completed form along with the payoff check. For further assistance, a dedicated customer service number is provided, ensuring that all questions can be addressed efficiently.

Toyota Finacial Payoff Example

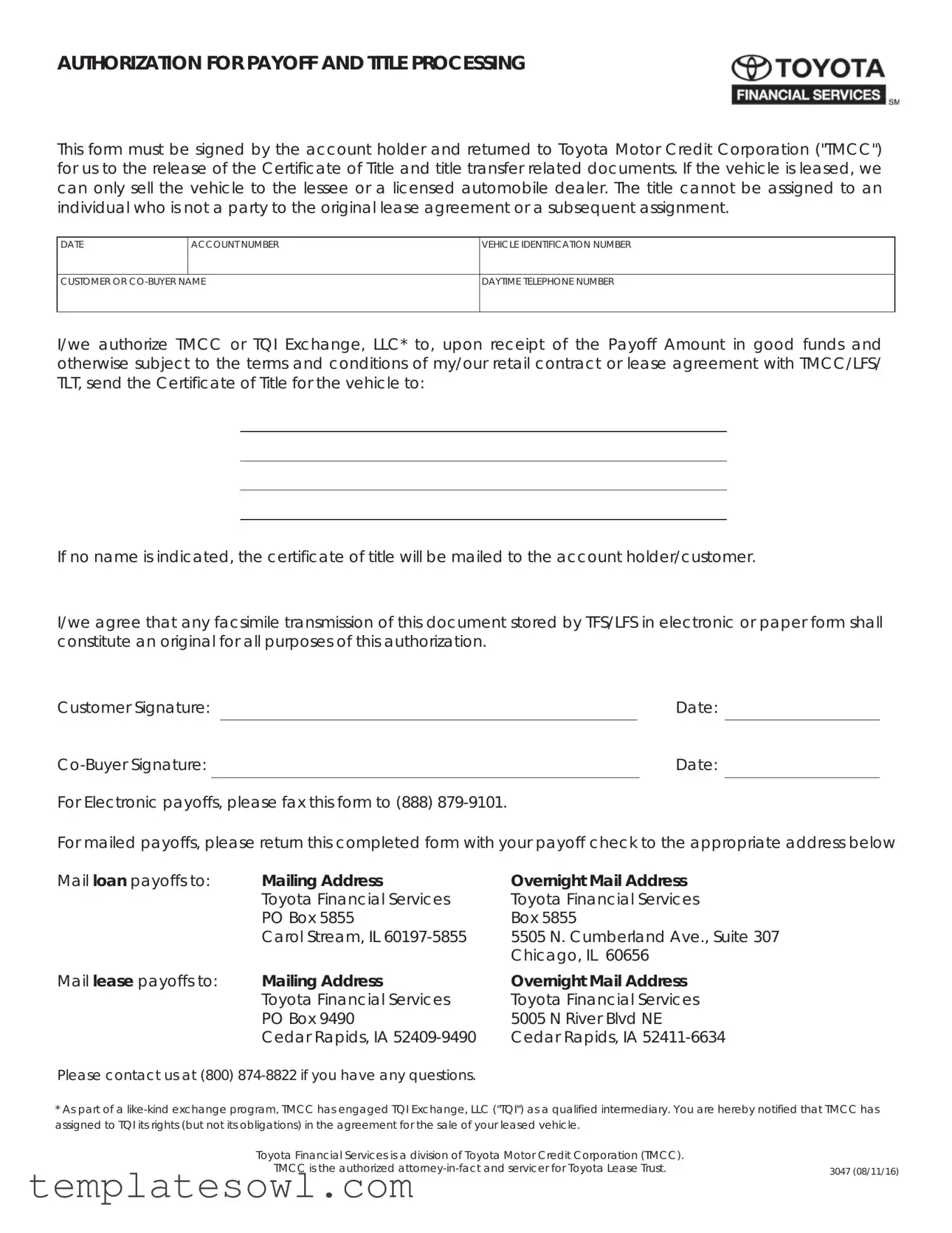

AUTHORIZATION FOR PAYOFF AND TITLE PROCESSING

This form must be signed by the account holder and returned to Toyota Motor Credit Corporation ("TMCC") for us to the release of the Certificate of Title and title transfer related documents. If the vehicle is leased, we can only sell the vehicle to the lessee or a licensed automobile dealer. The title cannot be assigned to an individual who is not a party to the original lease agreement or a subsequent assignment.

DATE

ACCOUNT NUMBER

VEHICLE IDENTIFICATION NUMBER

CUSTOMER OR

DAYTIME TELEPHONE NUMBER

I/we authorize TMCC or TQI Exchange, LLC* to, upon receipt of the Payoff Amount in good funds and otherwise subject to the terms and conditions of my/our retail contract or lease agreement with TMCC/LFS/ TLT, send the Certificate of Title for the vehicle to:

If no name is indicated, the certificate of title will be mailed to the account holder/customer.

I/we agree that any facsimile transmission of this document stored by TFS/LFS in electronic or paper form shall constitute an original for all purposes of this authorization.

Customer Signature: |

|

|

Date: |

|

|

Date: |

|||

|

|

|

|

|

For Electronic payoffs, please fax this form to (888) |

|

|

||

For mailed payoffs, please return this completed form with your payoff check to the appropriate address below

Mail loan payoffs to: |

Mailing Address |

Overnight Mail Address |

|

Toyota Financial Services |

Toyota Financial Services |

|

PO Box 5855 |

Box 5855 |

|

Carol Stream, IL |

5505 N. Cumberland Ave., Suite 307 |

|

|

Chicago, IL 60656 |

Mail lease payoffs to: |

Mailing Address |

Overnight Mail Address |

|

Toyota Financial Services |

Toyota Financial Services |

|

PO Box 9490 |

5005 N River Blvd NE |

|

Cedar Rapids, IA |

Cedar Rapids, IA |

Please contact us at (800)

*As part of a

Toyota Financial Services is a division of Toyota Motor Credit Corporation (TMCC). |

|

TMCC is the authorized |

3047 (08/11/16) |

Form Characteristics

| Fact Name | Details |

|---|---|

| Authorization Requirement | The form must be signed by the account holder before a payoff can be processed by TMCC. |

| Title Processing | This form authorizes TMCC to release the Certificate of Title and related title transfer documents. |

| Leased Vehicle Sales | For leased vehicles, sales can only be made to the lessee or a licensed automobile dealer. |

| Non-Eligible Individuals | The title cannot be transferred to someone not involved in the original lease agreement. |

| Payoff Instructions | For electronic payoffs, fax the completed form to (888) 879-9101. For mail payoffs, send it to the specified addresses. |

| Facsimile Agreement | A faxed copy of the form is considered an original document for all legal purposes. |

| Contact Information | Any inquiries can be directed to TMCC at (800) 874-8822 for assistance. |

| Governing Law | The form is governed by the laws applicable in the states where TMCC operates, which may vary. |

Guidelines on Utilizing Toyota Finacial Payoff

Once you have gathered all necessary information and documents, proceed with filling out the Toyota Financial Payoff form. It's essential to complete it accurately to ensure a smooth process in obtaining your vehicle's title and other related documents.

- Write the date at the top of the form.

- Locate your account number and fill it in.

- Find the Vehicle Identification Number (VIN) and enter it.

- Clearly print your name as the customer or co-buyer.

- Provide your daytime telephone number for contact purposes.

- Indicate where you want the Certificate of Title to be sent. If you leave it blank, it will go to the account holder.

- Sign the form with your customer signature and add the date next to it.

- If there is a co-buyer, ensure they sign the form too and include the date.

- If you are submitting electronically, fax the completed form to (888) 879-9101.

- If sending via mail, include your payoff check and send it to the appropriate address based on whether it’s a loan or lease payoff.

After submitting the form, keep an eye on your mailbox for the Title Certificate. If you have any questions throughout the process, reach out to the provided customer service number for assistance.

What You Should Know About This Form

What is the Toyota Financial Payoff form used for?

The Toyota Financial Payoff form is utilized for authorizing the payoff of an existing lease or retail contract with Toyota Motor Credit Corporation (TMCC). When completed and submitted, this form allows TMCC to release the Certificate of Title and necessary title transfer documents associated with your vehicle. This is an important step if you are looking to close out a lease arrangement or a loan agreement.

Who must sign the Toyota Financial Payoff form?

The form must be signed by the account holder. If there is a co-buyer on the account, their signature is also required. Both parties must provide their signatures to give TMCC authorization to process the payoff and title transfer for the vehicle. This ensures that all parties involved in the agreement consent to the transaction.

What should I do if my vehicle is leased?

If your vehicle is under a lease agreement, the payoff form must specify that the vehicle can only be sold to either the lessee or a licensed automobile dealer. It is not permissible to transfer the title to anyone else who is not a party to the original lease agreement. Following the correct procedure protects all parties' interests and adheres to the terms of the lease.

How can I submit the payoff form?

You may choose to submit the Toyota Financial Payoff form electronically or by mail. For electronic submissions, fax the completed form to (888) 879-9101. If you prefer to submit by mail, include the completed form with your payoff check and send it to the appropriate addresses provided for loan or lease payoffs. Ensure that you select the correct mailing option to avoid delays in processing your request.

Common mistakes

Completing the Toyota Financial Payoff form requires careful attention to detail. One common mistake is neglecting to include the account number or vehicle identification number (VIN). These numbers are crucial for identifying your specific account and vehicle, ensuring that the payoff request is processed correctly. Without this information, delays in processing your form may occur.

Another frequent error involves failing to sign the form. Both the customer and co-buyer, if applicable, must provide their signatures. Omitting a signature can lead to automatic rejection of the form, meaning further delays in obtaining the title or completing the payoff process.

Incorrectly specifying the destination for the Certificate of Title is also a significant oversight. The form contains a section where the recipient's address should be clearly indicated. If omitted, Toyota Motor Credit Corporation (TMCC) will default to mailing the title to the account holder, which may not align with the intended arrangement.

People often overlook providing a valid daytime telephone number. This number is essential for communication purposes. In the event that further clarification or information is needed, having a reachable contact significantly speeds up the process. Failure to include this could result in delays in processing your request.

Moreover, individuals sometimes fail to follow the instructions regarding faxing or mailing their forms. For electronic payoffs, the correct fax number must be used: (888) 879-9101. Misrouting the form can further complicate or lengthen the payoff process.

Confusion regarding the appropriate address for mailing payoffs also represents a common error. It’s important to ensure that the form is sent to the correct address, whether for loan or lease payoffs. The form specifies distinct mailing addresses, and sending to the wrong one will delay the processing of your request.

Another mistake involves not verifying that the information on the form aligns with what is on file. Inaccuracies in the name of the customer or co-buyer can cause major issues. Always double-check your entries to ensure consistency with the original lease agreement.

Lastly, individuals sometimes misinterpret the instructions regarding the nature of the transaction. Those with leased vehicles need to grasp that the only allowable recipients for the vehicle's title are the lessee or a licensed dealer. Misunderstanding this can result in an improper request that cannot be fulfilled.

Documents used along the form

When working through the process of paying off a Toyota vehicle, several other documents may be needed alongside the Toyota Financial Payoff form. Each document plays a vital role in ensuring a smooth transaction. Understanding what these documents are can help streamline the process, making it easier for you to address your vehicle-related needs.

- Power of Attorney: This document grants someone the authority to act on your behalf in legal matters, including managing the title transfer process. It can be particularly useful if you cannot be present during the transaction.

- Vehicle Bill of Sale: This document serves as proof of the sale of the vehicle. It outlines the details of the transaction, including the sale price, date, and the names of the buyer and seller. This can be crucial if any disputes arise later.

- Title Application: When transferring ownership of a vehicle, a title application may be necessary. This document contains the required information to register the vehicle under the new owner’s name after the payoff is complete.

- Identification Documents: Typically, a government-issued ID or driver's license is required to confirm the identity of the person handling the transaction. This helps prevent fraud and ensures that the appropriate party is authorized to make decisions regarding the vehicle.

- Proof of Insurance: Lenders often require proof of insurance before completing the payoff process. This document shows that the vehicle is adequately insured under the new owner’s name, protecting both parties involved in the transaction.

- Loan Payoff Statement: This statement provides a detailed account of the remaining balance owed on the vehicle. It is vital as it specifies the exact amount to be paid off, ensuring there are no discrepancies in the transaction.

- Lease Termination Agreement: If the vehicle is leased, this document outlines the terms under which the lease is terminated. It details any additional fees or obligations that may exist prior to the payoff.

Gathering these documents along with the Toyota Financial Payoff form can help ensure a seamless and efficient vehicle payoff process. Each piece of paperwork serves a specific purpose, making them essential in securing your vehicle's title and ownership transfer smoothly.

Similar forms

The following documents are similar to the Toyota Financial Payoff form in terms of their purpose and function. Each document serves as an authorization or request relating to financial transactions and vehicle ownership:

- Loan Payoff Request Form: This document is used by borrowers to request the payoff amount for their existing loan, similar to how the Toyota Financial Payoff form communicates the need for payoff details.

- Title Transfer Form: This form initiates the process of transferring the vehicle title from one party to another, paralleling the title transfer aspect included in the Toyota Financial Payoff form.

- Lease Termination Agreement: This agreement documents the end of a lease term and outlines the conditions for vehicle return or purchase, similar to how the payoff form addresses lease obligations.

- Authorization to Release Information Form: This document allows a lender or financial institution to release pertinent account information to a third party, resembling the authorization required in the Toyota Financial Payoff form.

- Vehicle Sale Agreement: This agreement governs the sale of a vehicle, including terms related to payment and title transfer, which are also key components of the Toyota Financial Payoff form.

- Power of Attorney Form for Vehicle Transactions: This form grants someone else the authority to act on behalf of the vehicle owner in transactions, similar to how TMCC can handle title-related matters as outlined in the payoff form.

Dos and Don'ts

When filling out the Toyota Financial Payoff form, there are some important guidelines to follow. Here is a list of what to do and what to avoid:

- Do: Make sure to fill in your full name clearly as it appears on the account.

- Do: Provide accurate vehicle identification numbers (VIN) to avoid processing delays.

- Do: Sign the form where indicated to authorize the payoff and title processing.

- Do: Double-check all information for accuracy before submitting.

- Do: Contact customer service if you have any questions about filling out the form.

- Don't: Leave any required sections blank, as this may lead to rejection of the form.

- Don't: Forget to specify where to send the Certificate of Title.

- Don't: Use an outdated version of the form; always use the most recent one.

- Don't: Submit the form without including your payoff check if required.

- Don't: Ignore the instructions for electronic vs. mailed payoffs.

By following these straightforward do's and don'ts, you can help ensure a smooth and efficient payoff process.

Misconceptions

- Misconception 1: The form can be submitted by anyone.

- Misconception 2: I can sell my leased vehicle to anyone.

- Misconception 3: The certificate of title will automatically be sent to the new buyer.

- Misconception 4: Electronic submissions of the form are not valid.

- Misconception 5: Paying off the lease means I automatically own the vehicle.

This misunderstanding arises because many people believe that a friend or family member can simply fill out and submit the payoff form. In reality, the form must be signed by the account holder or authorized individual. This ensures that only the rightful owner can facilitate the sale or transfer of the vehicle.

Many people think they can sell the vehicle to any buyer. However, if the vehicle is leased, it can only be sold to the lessee or a licensed automobile dealer. This restriction exists to protect the leasing company’s interests and ensure that all contractual obligations are honored.

Some believe that the title will be transferred automatically upon submitting the payoff form. In fact, the title will be mailed to the account holder unless specific instructions are given on the form. If you want the title sent elsewhere, you must indicate that clearly.

There is a common belief that only paper forms are accepted. However, a facsimile transmission of the form is considered valid and can be stored electronically or in paper form. This offers flexibility for those who prefer electronic processing.

Many customers mistakenly believe that paying off their lease means they are instantly owners of the vehicle. While paying off a lease is an important step, you must complete the proper title transfer process to establish ownership legally.

Key takeaways

When completing the Toyota Financial Payoff form, consider the following key points:

- Signature Requirement: The account holder must sign the form for processing. If applicable, a co-buyer’s signature is also needed.

- Leased Vehicles: For leased vehicles, only the lessee or a licensed dealer may purchase. Transfers to others are not permitted.

- Payoff Instructions: Provide accurate vehicle identification and account numbers to ensure correct processing.

- Title Mailing: The Certificate of Title will be mailed to the account holder unless otherwise specified.

- Electronic Transactions: For electronic payoffs, fax the completed form to the designated number for efficient processing.

- Contact Information: Reach out to customer service for any questions or clarifications regarding the payoff process.

Browse Other Templates

Us Entry Stamp - The card also aids in understanding demographics of travelers.

Michigan Probate Court Forms - The personal service section requires details about the date and time, enhancing accountability.

Phantom Stock Agreement Sample - The Phantom Compensation Plan is not just a contractual obligation but a strategic investment in human capital.