Fill Out Your Transaction Dispute Pnb Form

In today's fast-paced world, financial transactions are increasingly frequent, and with that comes the occasional need to address disputes. The Transaction Dispute Pnb form serves as a crucial tool for cardholders who wish to formally contest charges on their credit cards. This comprehensive form requires specific information, including the date, credit card number, and cardholder details, to initiate the dispute process effectively. Within the document, cardholders list details of the disputed transactions such as the transaction date, merchant name, and amounts involved. It's essential to accurately select the reason for the dispute from a variety of categories, ranging from unauthorized transactions and duplicate charges to defective merchandise and services not received. Each category allows individuals to provide additional context and documentation, making it clear to the issuer why they are disputing the charges. Also, the form emphasizes the importance of submitting supporting documents, such as receipts or statements, to strengthen the case. By following these steps, cardholders can navigate the sometimes-overwhelming landscape of financial disputes with confidence and clarity, ensuring their interests are represented.

Transaction Dispute Pnb Example

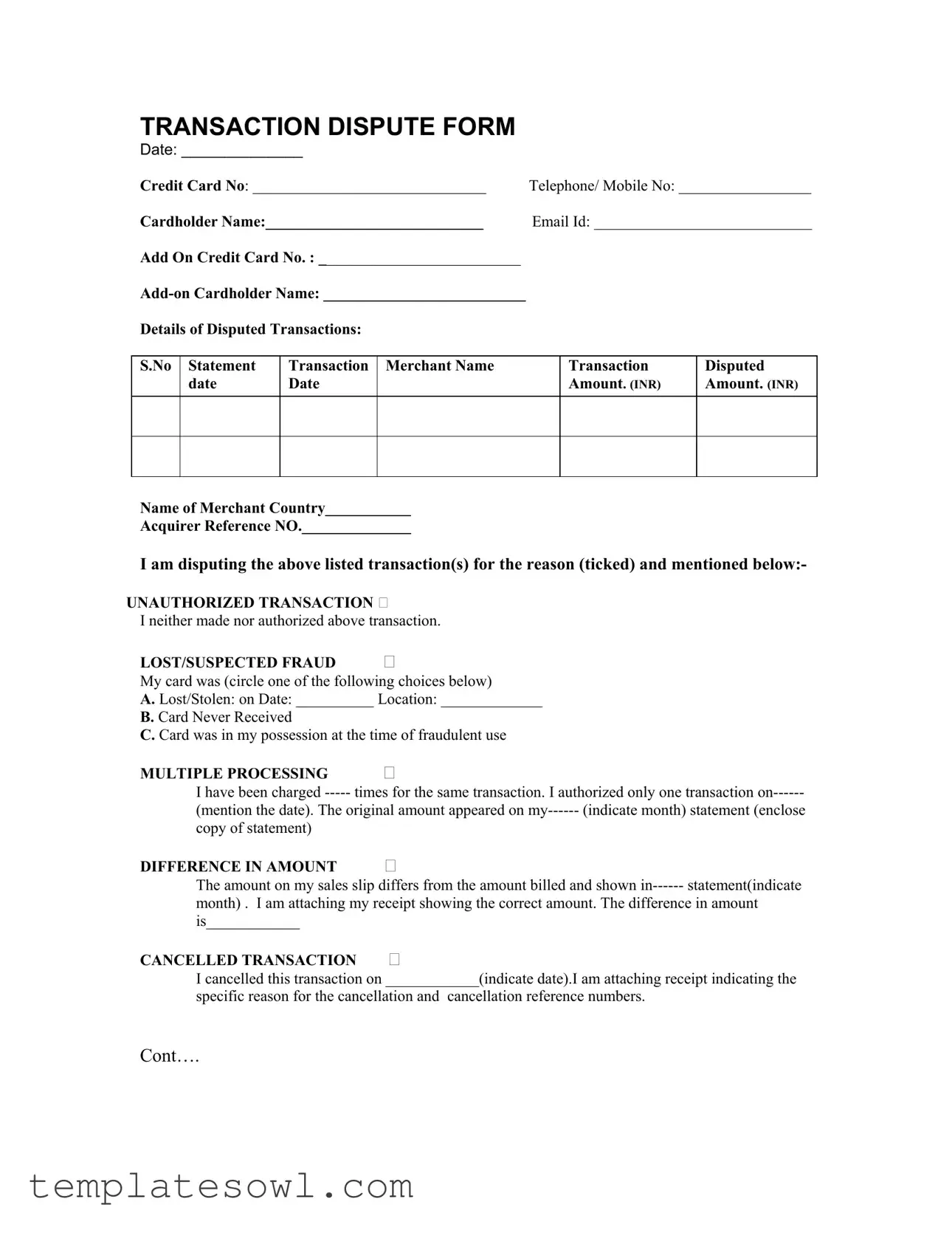

TRANSACTION DISPUTE FORM

DATE: ______________

Credit Card No: ______________________________ |

Telephone/ Mobile No: _________________ |

Cardholder Name:____________________________ |

Email Id: ____________________________ |

Add On Credit Card No. : __________________________ |

|

|

|

Details of Disputed Transactions: |

|

S.No Statement date

Transaction Merchant Name Date

Transaction Amount. (INR)

Disputed Amount. (INR)

Name of Merchant Country___________

Acquirer Reference NO.______________

I am disputing the above listed transaction(s) for the reason (ticked) and mentioned below:-

UNAUTHORIZED TRANSACTION

I neither made nor authorized above transaction.

LOST/SUSPECTED FRAUD

My card was (circle one of the following choices below)

A. Lost/Stolen: on Date: __________ Location: _____________

B. Card Never Received

C. Card was in my possession at the time of fraudulent use

MULTIPLE PROCESSING

I have been charged

(mention the date). The original amount appeared on

copy of statement)

DIFFERENCE IN AMOUNT

The amount on my sales slip differs from the amount billed and shown

month) . I am attaching my receipt showing the correct amount. The difference in amount is____________

CANCELLED TRANSACTION

I cancelled this transaction on ____________(indicate date).I am attaching receipt indicating the

specific reason for the cancellation and cancellation reference numbers.

Cont….

DEFECTIVE MERCHANDISE

I am disputing the quality of goods/services I received from merchant. I have contacted the merchant/retailer . The response to my request for refund, is stated on annexure attached herewith.

CREDIT NOT RECEIVED

I was given a credit slip in the amount of _____________on_________

retailer which has not yet appeared on my

slip is attached.

PAID BY OTHER MEANS |

|

|

I paid for the transaction by Cash |

Cheque Draft |

Other credit card. I attach |

cash receipt |

or copy of cheque / Cheque no. alongwith Bank statement orother credit card |

statement. |

|

MERCHANDISE RETURNED |

|

I have returned the merchandise and requested a refund from the Merchant retailer and have forwarded a copy of the proof of return to him. I attach proof of return herewith.

NOT AS DESCRIBED |

|

The goods/services are different from what was ordered or described. On attached sheet I have explained what was expected, what was received, and indicated my attempt to return the goods. The proof of return is also attached.

GOODS / SERVICES NOT RECEIVED

I have not received the goods/services and for that reason,I contacted the Merchant/retailer

given on separate attached sheet .The copy of letter to the merchant attempting to resolve the dispute is enclosed.

ATM DISCREPANCY

The amount on my ATM slip differs from the amount billed in statement. Attached is my receipt showing the correct amount. The difference in amount is ______________ or I

did not receive cash from ATM.

ANY OTHER (Give full details)

Primary Cardholder Signature: _________________________________

transactions disputed are done through the Add on Card)

IMPORTANT NOTE

•Cardholder is requested to submit card statement highlighting disputed transaction and required documents wherever it is requested

•After dispute charges are resolved, should such charges recur in the statement, you are requested to intimate the Bank for these disputed charges vide this form within 30 days of statement date to enable us to take up the dispute with the member banks. After the lapse of 30 days, it will be construed that all the charges are acceptable and in order.

•A retrieval fee as prescribed in schedule of charges will be levied on per transaction basis to your account

Form Characteristics

| Fact Name | Fact Details |

|---|---|

| Purpose | The Transaction Dispute Form is used to report issues with credit card charges, including unauthorized transactions and discrepancies. |

| Required Information | Cardholders must submit details such as card number, transaction specifics, and supporting documentation to support their claim. |

| Governing Laws | This form is governed by consumer protection and banking laws specific to the state of the cardholder. For example, in California, it adheres to the California Civil Code. |

| Submission Timing | Cardholders must submit the form within 30 days of the statement date to ensure their disputes are addressed. |

| Signature Requirement | Both the primary cardholder and any add-on cardholder must sign the form if transactions are disputed on an add-on card. |

Guidelines on Utilizing Transaction Dispute Pnb

Completing the Transaction Dispute PNB form allows you to address grievances regarding unauthorized or erroneous charges on your credit card. Ensuring you fill it out correctly is crucial for a smooth dispute process. Here are the detailed steps to follow:

- Write the date of filling the form at the top.

- Enter your credit card number in the designated space.

- Provide your telephone or mobile number.

- Fill in your cardholder name and email address.

- If applicable, enter the Add-On credit card number and the name of the Add-On cardholder.

- List the details of disputed transactions including:

- Serial number (S.No)

- Statement date

- Transaction merchant name

- Date of the transaction

- Transaction amount (INR)

- Disputed amount (INR)

- Name of merchant and country

- Acquirer reference number

- Select the reason for your dispute by ticking the appropriate box. The options include:

- Unauthorized Transaction

- Lost/Suspected Fraud

- Multiple Processing

- Difference in Amount

- Cancelled Transaction

- Defective Merchandise

- Credit Not Received

- Paid by Other Means

- Merchandise Returned

- Not as Described

- Goods/Services Not Received

- ATM Discrepancy

- Any other (provide details)

- Sign the form as the primary cardholder. If an add-on cardholder was involved, ensure their signature is included as well.

Once the form is completed, gather your supporting documents such as card statements and receipts, and submit everything to your bank. Keep in mind that after disputing charges, you should monitor your statements for any recurrences within 30 days. If issues persist, a retrieval fee may apply depending on your bank's policies.

What You Should Know About This Form

What is the Transaction Dispute Pnb form used for?

The Transaction Dispute Pnb form is designed for cardholders who wish to contest certain transactions on their credit card statements. This form allows individuals to formally note discrepancies or unauthorized charges they have identified. By submitting this form, cardholders can initiate an investigation into the disputed transactions, ensuring their concerns are addressed appropriately by the financial institution.

How do I complete the form?

Filling out the Transaction Dispute Pnb form requires you to provide crucial information such as your credit card number, contact details, and specific details about the disputed transaction. You will need to list each transaction you are disputing along with the date, amount, and merchant name. It's essential to clearly indicate the reason for each dispute by ticking the corresponding box and providing any additional details or documentation that support your claim, such as receipts or communication with the merchant.

What types of disputes can I report using this form?

This form covers a range of common disputes, including unauthorized transactions, lost or stolen cards, and disputes over multiple charges for the same transaction. You can also report discrepancies in amounts, canceled transactions, defective merchandise, credits not received, and items not received. Additionally, if the goods or services differ from what was described, you can include that as well. Each option on the form is designed to capture the specific nature of your dispute, ensuring accurate processing.

What documents do I need to attach to the form?

When submitting the transaction dispute form, it is important to include any relevant documentation that supports your case. This may involve attaching copies of your credit card statement highlighting the disputed transaction, receipts, or any correspondence with the merchant. Depending on the reason for your dispute, additional documents, such as proof of return or credit slips, may also be necessary. Providing thorough and accurate documentation helps facilitate a smoother resolution process.

What happens after I submit the form?

Once you submit the Transaction Dispute Pnb form with all required documentation, the bank will review your claim. They will conduct an investigation into the disputed transactions based on the information provided. During this time, it is advisable to keep track of any correspondence with the bank concerning your dispute. After the investigation concludes, you will be notified of the outcome and any changes to your account, if applicable.

What should I do if the dispute reoccurs after resolution?

If you notice that a disputed charge reappears on your statement after it has been resolved, you should promptly contact the bank using the same dispute form within 30 days of the statement date. By alerting the bank about recurring issues, they can initiate a further investigation into the matter to ensure your concerns are effectively resolved and prevent future occurrences.

Are there any fees associated with filing a dispute?

Yes, there is a retrieval fee that may be charged to your account for each transaction you dispute, as outlined in the schedule of charges provided by your bank. It is wise to review this schedule before submitting the dispute form to understand any potential financial implications attached to filing your claim.

Common mistakes

When filling out the Transaction Dispute Pnb form, many individuals overlook critical details. One common mistake is failing to provide complete information about the transactions in dispute. Each section requires specific details, including the merchant's name and the transaction amount. Missing this information can delay the processing of your dispute.

Another frequent error occurs when individuals don't indicate the correct reason for their dispute. The form provides various options, but it's vital to select the one that accurately reflects your situation. Selecting the wrong option can lead to a misunderstanding of your claim and may even result in denial.

Some people forget to attach supporting documentation. The form requests evidence, such as receipts or communications with the merchant. Without these documents, proving your case becomes significantly harder, and your dispute may not be resolved effectively.

Additionally, incomplete signatures can cause issues. If you're disputing a transaction as an add-on cardholder, remember to sign the form. A missing signature can halt the process and lead to additional back-and-forth communication.

Another mistake is neglecting to highlight disputed transactions on your card statement. When you submit your statement, it should draw attention to the specific transactions you're disputing. This helps the bank easily identify and address the problems you've raised.

Many forms also suffer from inaccurate dates. Whether you're noting when a transaction occurred or when you contacted the merchant, ensure that the dates are accurate. Mistakes here can lead to confusion and a potential rejection of your claim.

Sometimes, individuals forget to review their contact information. Ensure that your phone number and email address are correct. Providing inaccurate contact details can slow down the communication process if the bank needs to reach you for any additional information.

Additionally, some may not follow the submission guidelines laid out by the bank. It’s important to know whether to submit the form by mail, email, or in person. Following the correct protocol will ensure that your dispute is processed quickly.

Finally, failing to submit your dispute within the 30-day window can be a costly mistake. It’s crucial to be mindful of the timeline set by the bank. If you wait too long to file your dispute, you may be unable to reclaim any funds, making prompt action essential.

Documents used along the form

When dealing with a transaction dispute, there are several forms and documents you may need to submit alongside the Transaction Dispute PNB form. Gathering the right paperwork can streamline the process and help ensure that your case is handled effectively. Below is a list of related forms and documents that are commonly used. Each one serves a specific purpose in supporting your dispute.

- Cardholder's Statement: This document is a summary of the cardholder's transactions for a particular billing period. Highlighting the disputed transaction can provide crucial evidence of what was charged and when.

- Proof of Return: If the dispute involves returned merchandise, this document provides proof that the item was sent back to the merchant. It can include shipping receipts or tracking information.

- Merchant Communications: Any written correspondence with the merchant related to the dispute can be helpful. This may include emails, letters, or notes that show your attempts to resolve the issue directly with the merchant.

- ATM Receipt: For disputes concerning ATM transactions, attaching a copy of the ATM receipt can serve as evidence of the disputed withdrawal or discrepancy in amount.

- Credit Slip: If you received a credit slip for a refund that hasn’t appeared on your statement, include this document to bolster your claim. It shows that the merchant acknowledged the refund.

- Payment Receipt: If you paid for the transaction using a different method (like cash or check), providing a receipt or bank statement showing this payment can clarify the situation and support your dispute.

Compiling these documents not only strengthens your case but also facilitates communication with your bank or financial institution. Be thorough and ensure all relevant details are clear. This approach increases the likelihood of a swift and favorable resolution to your transaction dispute.

Similar forms

The Transaction Dispute Pnb form serves as a means for consumers to report discrepancies or disputes regarding transactions made with their credit cards. Similar forms exist that help consumers address various issues related to their transactions. Below is a list of similar documents, highlighting how they relate to the Transaction Dispute Pnb form:

- Chargeback Request Form: This document allows cardholders to initiate a formal request for a chargeback due to unauthorized transactions, billing errors, or other issues. Like the Transaction Dispute Pnb form, it requires details about the disputed transaction and the reason for the chargeback.

- Fraud Reporting Form: Designed for reporting instances of fraud, this form captures essential details about the fraudulent activity. It parallels the Transaction Dispute Pnb form in gathering transaction specifics and personal information to assist with investigation purposes.

- Dispute Resolution Form: This form is typically used to address other types of disputes related to services or products that didn’t meet expectations. It shares similarities with the Transaction Dispute Pnb form by focusing on the resolution of an issue through clearly stated reasons and attached documentation.

- Merchant Refund Request Form: When customers seek refunds from merchants, this form outlines the reasons for the refund. Similar to the Transaction Dispute Pnb form, it documents the nature of the issue and requires supporting evidence or receipts to process the request.

- Credit Card Statement Dispute Form: Consumers use this form to contest specific charges that appear on their credit card statements. It is similar to the Transaction Dispute Pnb form, as both documents require details about the transaction and reasons for the dispute.

- Unauthorized Transaction Report: This report is specifically for instances where a consumer’s card may have been used without permission. Both forms emphasize the importance of providing transaction details and proof of identity.

- ATM Discrepancy Form: For issues arising when ATM withdrawals do not match the account statement, this form allows users to report such discrepancies. It parallels the Transaction Dispute Pnb form, especially when it comes to documenting the transaction amount and discrepancies noted.

- Billing Error Notification: This notification allows consumers to inform their bank about errors they encounter on their bills. Like the Transaction Dispute Pnb form, it includes the need for comprehensive details to facilitate the resolution process.

- Return Merchandise Authorization (RMA): This form is used when customers want to return products. It includes request procedures that closely align with the process outlined in the Transaction Dispute Pnb form for resolving disputes related to returned items.

These documents play a crucial role in consumer protection and ensuring fair dealings in financial transactions. Each serves its specific purpose, yet all emphasize clear communication and record-keeping to assist in resolving disputes effectively.

Dos and Don'ts

When filling out the Transaction Dispute Pnb form, it's essential to ensure clarity and accuracy. Here’s a simple guide of things you should and shouldn't do:

- Do: Clearly fill in all the required fields, including your name, credit card number, and contact information. This ensures that your dispute can be processed efficiently.

- Do: Attach all relevant documents that support your claim. Include receipts, statements, and correspondence with the merchant for a stronger case.

- Do: Specify the reason for the dispute by selecting the appropriate option. Providing clear justification will expedite the review process.

- Do: Highlight the specific disputed transactions in your card statement. This helps the bank identify the charges in question without confusion.

- Do: Sign the form clearly. Both primary and add-on cardholder signatures are necessary if applicable.

- Don't: Leave any fields blank. Incomplete forms can lead to delays or rejection of your dispute.

- Don't: Provide inaccurate information. Double-check your details to avoid complications during the processing of your dispute.

- Don't: Wait too long to file the dispute. You must submit the request within 30 days from the statement date to ensure consideration.

- Don't: Forget to keep copies of all documents submitted. Keeping records protects you and can help if further issues arise.

- Don't: Assume that the bank will automatically resolve your dispute. Regular follow-ups may be necessary to ensure the matter is addressed.

Misconceptions

- Misconception 1: The form only handles fraud-related disputes.

- Misconception 2: You must dispute all transactions at once.

- Misconception 3: The form guarantees a refund.

- Misconception 4: You need to submit the form immediately after a dispute occurs.

- Misconception 5: Only the primary cardholder can fill out the form.

- Misconception 6: Documentation is not important.

- Misconception 7: The retrieval fee is optional.

This form addresses various issues beyond fraud, including unauthorized transactions, defective merchandise, and canceled transactions. It is a comprehensive tool for multiple dispute types.

You can select and dispute specific transactions. It is not necessary to address all issues in a single submission.

Completing the form does not guarantee that a refund will be issued. Each case is reviewed individually, and outcomes may vary.

You have 30 days from the statement date to submit the form. However, acting quickly is often beneficial to your case.

Both the primary and add-on cardholders can fill out the form if transactions made with the add-on card are disputed. Signatures from both parties may be required.

Proper documentation is crucial. Relevant receipts, statements, and supporting evidence must be attached to strengthen your case.

The retrieval fee is standard practice and will be levied per transaction basis. Understanding this fee upfront can prevent surprises later.

Key takeaways

Here are some important takeaways regarding the Transaction Dispute PNB form:

- Gather Information: Collect all necessary details before filling out the form, including transaction dates, amounts, and merchant information.

- Be Specific: Clearly state the reason for your dispute by ticking the relevant option. This helps expedite the review process.

- Document Everything: Attach any necessary documents, such as receipts, statements, or evidence of communication with the merchant.

- Submit on Time: Make sure to submit the dispute within 30 days from your statement date to ensure your claim is processed.

- Check for Charges: Be aware that a retrieval fee may apply for each dispute you raise. This fee will show up on your account.

- Signatures Required: Both primary and add-on cardholders must sign the form when disputing charges made on an add-on card.

- Follow Up: If disputed charges reappear on future statements after resolution, notify your bank within 30 days again.

- Multiple Issues: If you're disputing multiple transactions, ensure that all disputed transactions are documented clearly on the form.

- Keep Copies: Retain copies of everything you submit for your records. This includes the filled-out form and any attachments.

Browse Other Templates

How to Get Your College Transcript - The form can be printed for physical submission or faxed directly.

Guest Registration Card - Share your email address for confirmation and updates.