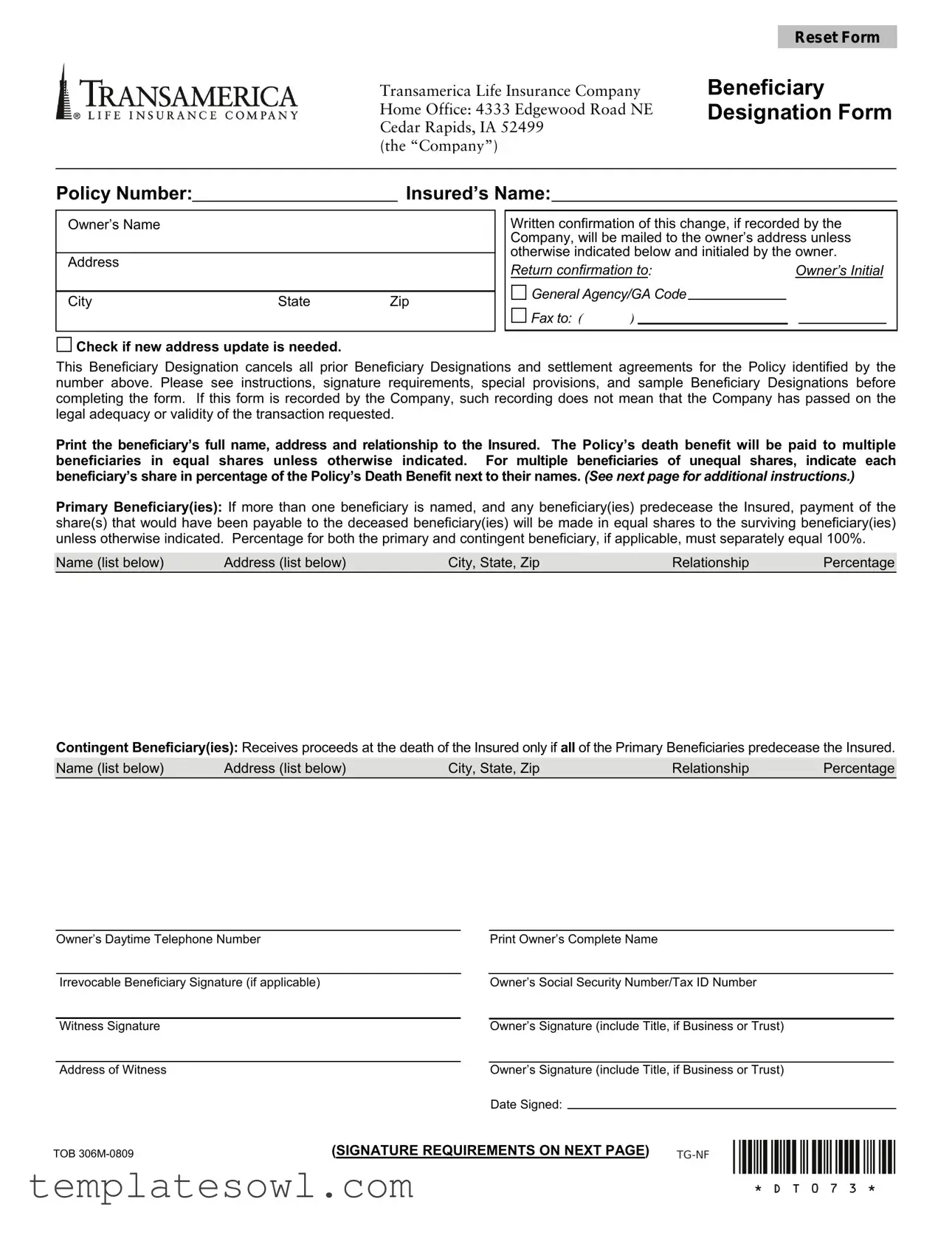

Fill Out Your Transamerica Beneficiary Form

The Transamerica Beneficiary form plays a vital role in determining who receives the benefits from a life insurance policy in the event of the insured's death. This essential document allows policyholders to designate primary and contingent beneficiaries, ensuring that their wishes are clear and legally binding. The form simplifies the process by requesting specific details such as the names, addresses, and relationships of the beneficiaries, along with the percentage of proceeds they will receive. Each completed form cancels any previous beneficiary designations, promoting up-to-date records that reflect the current intentions of the policyowner. Important instructions are included to guide users through the completion process, emphasizing the need for accuracy and thoroughness. Notably, the form also addresses various considerations, such as designations for irrevocable beneficiaries, guardians, or trusts, ensuring that legal requirements are met. This helps avoid potential complications in the future. Clarity is key—whether there are multiple beneficiaries or if specific percentages are required, the form adeptly facilitates these specifications. Additional provisions exist to protect the interests of both policy owners and beneficiaries, particularly in situations where a beneficiary may predecease the insured or if collateral assignments are involved. By understanding and effectively utilizing the Transamerica Beneficiary form, individuals can ensure that their life insurance benefits are directed according to their personal wishes, providing peace of mind to both themselves and their loved ones.

Transamerica Beneficiary Example

|

|

|

|

|

Reset Form |

|

Transamerica Life Insurance Company |

Beneficiary |

|||

|

Home Office: 4333 Edgewood Road NE |

Designation Form |

|||

|

|

|

|||

|

Cedar Rapids, IA 52499 |

|

|

||

|

(the “Company”) |

|

|

||

|

|

|

|

|

|

Policy Number: |

|

Insured’s Name: |

|

|

|

Owner’s Name

Address

City |

State |

Zip |

Written confirmation of this change, if recorded by the Company, will be mailed to the owner’s address unless otherwise indicated below and initialed by the owner.

Return confirmation to: |

|

Owner’s Initial |

||||

|

General Agency/GA Code |

|

|

|

||

|

|

|

|

|||

|

Fax to: ( |

) |

|

|

|

|

|

|

|

|

|

||

Check if new address update is needed.

Check if new address update is needed.

This Beneficiary Designation cancels all prior Beneficiary Designations and settlement agreements for the Policy identified by the number above. Please see instructions, signature requirements, special provisions, and sample Beneficiary Designations before completing the form. If this form is recorded by the Company, such recording does not mean that the Company has passed on the legal adequacy or validity of the transaction requested.

Print the beneficiary’s full name, address and relationship to the Insured. The Policy’s death benefit will be paid to multiple beneficiaries in equal shares unless otherwise indicated. For multiple beneficiaries of unequal shares, indicate each beneficiary’s share in percentage of the Policy’s Death Benefit next to their names. (See next page for additional instructions.)

Primary Beneficiary(ies): If more than one beneficiary is named, and any beneficiary(ies) predecease the Insured, payment of the share(s) that would have been payable to the deceased beneficiary(ies) will be made in equal shares to the surviving beneficiary(ies) unless otherwise indicated. Percentage for both the primary and contingent beneficiary, if applicable, must separately equal 100%.

Name (list below) |

Address (list below) |

City, State, Zip |

Relationship |

Percentage |

|

|

|

|

|

Contingent Beneficiary(ies): Receives proceeds at the death of the Insured only if all of the Primary Beneficiaries predecease the Insured.

|

Name (list below) |

Address (list below) |

City, State, Zip |

Relationship |

Percentage |

Owner’s Daytime Telephone Number Irrevocable Beneficiary Signature (if applicable)

Witness Signature

Address of Witness

Print Owner’s Complete Name

Owner’s Social Security Number/Tax ID Number

Owner’s Signature (include Title, if Business or Trust)

Owner’s Signature (include Title, if Business or Trust) Date Signed:

TOB |

(SIGNATURE REQUIREMENTS ON NEXT PAGE) |

INSTRUCTIONS:

Be sure to show the Policy Number and Insured’s Name at the top of this form. Use a separate form for each Policy. Restate the entire designation, even if only changing a part of the designation. If additional space is required, please attach a separate page (including Policy Number, Date Signed, and Owner’s Signature.)

INDIVIDUAL(S) - The current Owner(s) must sign on the line provided for “Owner’s Signature.”

BUSINESS ENTITY- One officer other than the Insured must sign below the name of the company. The officer’s title (President, General Manager, Vice President, Secretary, etc.) must follow the signature. A corporate resolution or other supporting documentation is required to support each officer’s signature. If the insured is the sole officer of the company, we will require a statement on company letterhead signed and dated by that officer and witnessed by a least one other person, that the insured is the sole officer and that he/she is authorized to act on behalf of the company. If a partnership is the owner, at least two authorized partners must sign below the name of the partnership and the title “Partner” must follow each signature.

TRUST - The complete name and date of the trust should be listed. Individual trustees must sign and add wording similar to the following: “John Doe, trustee under XYZ Trust dated June 1, 1984.” Corporate Trustees must sign and add wording such as “ABC Bank, trustee under XYZ Trust dated June 1, 1984; John Doe, Trust Officer”, and a corporate resolution or other supporting documentation is required to support each corporate trustee officer’s signature. For changes to trust owned policies, a completed Verification of Trust Agreement for Life Insurance Policies (dated within the previous twelve (12) months) must be submitted with the applicable change form.

IRREVOCABLE BENEFICIARIES - Any irrevocable beneficiary must sign subsequent beneficiary designation changes and may be required to sign other requests for changes to or disbursements from the Policy.

GUARDIAN OR CONSERVATOR – A

AGENT ACTING UNDER A POWER OF ATTORNEY - An agent acting under a power of attorney may sign on behalf of the Owner. A complete copy of the Power of Attorney document, the Questionnaire to Accompany Power of Attorney, and the Affidavit of Agent for Power of Attorney must be submitted by the agent. If a complete copy of the Power of Attorney documentation has been submitted to us within the previous twelve months, an additional copy may not be required.

COMMUNITY PROPERTY STATES - Unless we have been notified of a community or marital property interest in this Policy, we will assume that no such interest exists and will assume no responsibility for inquiring whether such interest exists. By signing this form, the Policy owner agrees to indemnify and hold us harmless from the consequences of making the changes requested in this document.

COLLATERAL ASSIGNMENTS - If the Policy has been assigned, a representative of the collateral assignee must also sign the form. A corporate resolution should be provided if the assignee is a business entity, subject to the Business Entity signature requirements stated above. Payment of proceeds to any beneficiary is subject to the interest of any assignee on the Policy.

IF A BENEFICIARY DIES - The interest of any beneficiary who dies before the Insured will terminate at his/her death. The interest of any beneficiary, who dies at the time of, or under certain policies within 30 days after, the Insured’s death, will also terminate if no proceeds have been paid to the beneficiary. If the interest of all named beneficiaries has terminated (including contingent beneficiaries, if named), any proceeds payable will be paid to the Owner of the Policy. If the Owner is not living at that time, any proceeds payable will be paid to the executor or administrator of the Owner’s estate.

TRUST/MINOR BENEFICIARIES - If a trust is named beneficiary, the Company shall not be responsible for the disposition by the trustee of any proceeds paid to the trustee. Any payment to a minor beneficiary shall be made to the legally appointed guardian of the estate or conservator of the minor, unless otherwise permitted by law.

Requests for special settlement arrangements, other than those specified in the Policy, may be sent to the Company for review and assistance with preparation of the proper beneficiary designations.

SAMPLE BENEFICIARY DESIGNATIONS:

PERCENTAGES: Do not specify dollar amounts. Please use percentages totaling 100% for primary and contingent designations. Primary beneficiaries should total 100% and contingent beneficiaries should independently total 100%.

ONE PRIMARY AND ONE CONTIGENT: Primary: Jane Doe, Spouse Contingent: John Doe, Jr., Son

INSURED’S ESTATE:

Estate of Insured

TRUST:

XYZ Trust, dated ________________; ABC Bank, Anytown,

CA 12345, Trustee

SPOUSE OF INSURED, OTHERWISE CHILDREN:

Primary: Jane Doe, Spouse

Contingent: John Doe, Jr., Son, and any other children born to or adopted by the Insured (currently living children must be named)

IRREVOCABLE BENEFICIARY:

Primary: Jane Doe, Spouse, irrevocably designated

TWO BENEFICIARIES IN UNEQUAL AMOUNTS: Primary: Jane Doe, Mother 75%; John Doe, Brother, 25%

PER STIRPES DESIGNATIONS:

Primary: Jane Doe, Spouse

Contingent: Equal shares to John Doe, Jr., Son and Mary Doe, Daughter, per stirpes.

CORPORATE CREDITOR:

Primary: ABC Co., Inc., Creditor, a California Corporation, its successors and assigns, as its interest may appear; remainder, if any, to Jane Doe, Spouse.

INDIVIDUAL CREDITOR:

John Doe, Creditor, his successors and assigns, otherwise to the Executor or Administrator of his Estate, all as their interest may appear; remainder, if any, to Jane Doe, spouse.

TRUSTEE UNDER LAST WILL AND TESTAMENT:

Primary: The trustee or successor trustee, under the Last Will and Testament of the Insured. If the Insured should die intestate or if no trust is created by the Insured’s Last Will and Testament, then to the Executor or Administrator of the Insured’s Estate.

Form Characteristics

| Fact Name | Description |

|---|---|

| Policy Number Requirement | The Transamerica Beneficiary Form must include the specific policy number at the top to ensure proper identification of the policy. |

| Cancellation of Previous Designations | Filing this form cancels all prior beneficiary designations and associated settlement agreements for the specified policy. |

| Multiple Beneficiaries | The policy allows for multiple beneficiaries, with the death benefit being distributed in equal shares unless specified otherwise by the policyholder. |

| Importance of Percentages | Designations must use percentages that total 100% for both primary and contingent beneficiaries, ensuring clear distribution intentions. |

| Signature Requirements | All owners of the policy must sign the form. For business entities, a corporate officer must sign to validate the designation. |

| Irrevocable Beneficiaries | If an irrevocable beneficiary is designated, their consent is required for any future changes to beneficiary designations. |

| Guardian or Conservator Signature | A court-appointed guardian or conservator may sign the form on behalf of the owner, provided designated legal documents are submitted. |

| Effect of Beneficiary's Death | If a named beneficiary passes away before the insured, their share is redistributed equally among the remaining beneficiaries unless stated otherwise. |

Guidelines on Utilizing Transamerica Beneficiary

Filling out the Transamerica Beneficiary form is an important step in ensuring that your insurance policy benefits are distributed according to your wishes upon your passing. Completing this form requires attention to detail to ensure that your instructions are clear and that your beneficiaries receive the intended benefits. Below are the steps to effectively fill out this form.

- Begin by entering the Policy Number and the Insured’s Name at the top of the form.

- Fill in the Owner’s Name and Address, including City, State, and Zip.

- If required, check the box for a new address update.

- Review the section about prior beneficiary designations; the current designation will cancel any previous ones.

- Identify and list your Primary Beneficiary(ies). Include their full name, address, city, state, zip, relationship to the insured, and percentage of the policy’s death benefit they will receive. Ensure the percentages total 100%.

- If needed, add Contingent Beneficiary(ies) in the same manner as the primary beneficiaries. These beneficiaries will receive benefits only if all primary beneficiaries have predeceased the insured.

- Include the Owner’s Daytime Telephone Number.

- If applicable, the Irrevocable Beneficiary should sign the form.

- Have a witness sign and provide their address.

- Print the Owner’s Complete Name and include their Social Security Number/Tax ID Number.

- The Owner’s Signature must be provided along with the date signed. If a business is the owner, ensure that an officer of the business also signs with their title.

After completing the form, double-check for any missing information before submitting it. Properly filled out forms lead to smoother processing and help avoid delays in benefit distribution. If you have questions, consider reaching out to Transamerica for assistance.

What You Should Know About This Form

What is the purpose of the Transamerica Beneficiary form?

The Transamerica Beneficiary form is used to designate individuals or entities who will receive the death benefit from a life insurance policy. By filling out this form, policy owners indicate their preferred beneficiaries and ensure that their wishes are documented. Once completed and submitted, it becomes a formal record that clarifies the distribution of benefits upon the insured's death.

Can I name multiple beneficiaries on the form?

Yes, the form allows for multiple primary and contingent beneficiaries. When listing them, specify each beneficiary's name, address, and relationship to the insured. Additionally, if you wish to split the death benefit between multiple beneficiaries, you can indicate the percentage each beneficiary will receive. All percentages must equal 100% for both primary and contingent designations.

What happens if a beneficiary predeceases the insured?

If a named beneficiary passes away before the insured, their share of the death benefit will typically be divided equally among the surviving beneficiaries, unless otherwise specified in the form. This ensures that the benefits are distributed fairly among those who are still alive at the time of the insured's death.

What are the signature requirements for completing the form?

Is it possible to update or change beneficiaries after completing the form?

Yes, beneficiaries can be changed at any time after submitting the form. However, the owner must complete a new beneficiary designation form to make changes. It’s essential to indicate that this new form revokes all prior beneficiary designations to avoid confusion. Once the change is recorded by the company, written confirmation will be sent to the owner's address, unless otherwise directed.

What should I do if a beneficiary is a minor?

If a minor is designated as a beneficiary, the death benefit must be paid to a legally appointed guardian or conservator for that minor until they reach the age of majority. The company will not be responsible for how the guardian manages the funds. It's advisable to specify a guardian in your will or trust to streamline the process in such cases.

Common mistakes

Filling out the Transamerica Beneficiary form can be a straightforward process, but many people make common mistakes that can lead to complications later. Here, we’ll explore nine frequent errors to help ensure that your beneficiary designations are completed correctly.

One prevalent mistake is failing to include the policy number and the names of the insured at the top of the form. This information is crucial to identify the specific policy for which the beneficiaries are being designated. Without these details, the form may be deemed incomplete, necessitating further communication with the company.

Another common error occurs when individuals do not fully specify the beneficiaries' names and relationships to the insured. While it might seem simple enough to list a beneficiary, not providing full addresses or correct relationships can create confusion. Make sure to follow the instructions and include both the full name and the correct relationship to ensure that claims are processed smoothly.

Some people fail to accurately assign percentages when listing multiple beneficiaries. Each beneficiary's share must add up to 100%, whether they are primary or contingent beneficiaries. Omitting this detail or making arithmetic errors in percentage calculations can cause significant delays or even disputes over who is entitled to what.

Additionally, many forget to indicate the correct allocation when naming contingent beneficiaries. Contingent beneficiaries receive proceeds only if all primary beneficiaries are not living at the time of the insured's death. Clarifying this structure is essential for conveying your intentions effectively.

Signature requirements are often overlooked. Individuals need to sign the form correctly, and additional signatures may be necessary for joint ownership or if an irrevocable beneficiary is named. This oversight can render the change ineffective, leaving beneficiaries without the intended coverage.

People may also mistakenly use dollar amounts instead of percentages when designating shares. The instructions clearly state that only percentages are acceptable. This error can lead to misunderstandings about how the benefits should be distributed, complicating claims for loved ones.

Another error involves neglecting to review the entire form before submission. Even small mistakes, such as typographical errors or missing initials, can invalidate the designation. Taking a moment to double-check all information can save considerable future stress.

Using complex arrangements without proper understanding can lead to confusion. For example, designating beneficiaries “per stirpes” requires a specific understanding of how benefits are passed down in certain family scenarios. Ensure that your choices align correctly with your intentions to avoid any miscommunication.

Finally, individuals sometimes do not update their beneficiary designations after major life changes, such as marriage, divorce, or the birth of children. Regularly reviewing and adjusting the form ensures that your designations reflect your current intentions and family dynamics.

In summary, attention to detail is paramount when filling out the Transamerica Beneficiary form. By avoiding these common mistakes, individuals can help ensure a smooth and clear distribution of benefits according to their wishes.

Documents used along the form

When filling out the Transamerica Beneficiary form, several additional documents can be valuable in ensuring that all legal aspects are handled properly. Each of these forms serves a different purpose, and understanding them can simplify the process of designating beneficiaries and managing life insurance policies.

- Power of Attorney (POA): This legal document allows one person to act on behalf of another in financial or legal matters. If the owner cannot sign the beneficiary form themselves, a designated agent may use the POA to sign instead. Ensure you provide a complete copy of the POA and any required accompanying documents.

- Verification of Trust Agreement: For policies held in a trust, this document confirms the existence and details of the trust, including its name and date. It is necessary for any changes made to trust-owned policies and should be dated within the last twelve months.

- Collateral Assignment Form: If the policy has been assigned as collateral for a loan or other obligation, this document is required. It must be signed by both the owner and the assignee, ensuring that the insurer is aware of any rights or claims against the policy.

- Letters of Guardianship or Conservatorship: When a court appoints a guardian or conservator for someone, certified copies of the letters must be submitted if that person is the owner. This process safeguards the interests of those who may not be able to manage their affairs.

Being familiar with these additional documents will help in properly managing your life insurance beneficiary designations. Each form contributes to a clear and effective foundation for your wishes and ensures that your beneficiaries receive the intended benefits without unnecessary delays or complications.

Similar forms

- Last Will and Testament: Similar to the Transamerica Beneficiary Form, a Last Will and Testament documents an individual's desires about how their assets should be distributed upon their death. Both require clear identification of beneficiaries and often involve legal acknowledgment.

- Power of Attorney: Like the Beneficiary Form, a Power of Attorney grants authority to another individual to act on one's behalf. Both documents must be signed and may require formal witness or notarization to ensure they are valid.

- Trust Agreement: A Trust Agreement establishes a fiduciary relationship and details how assets should be managed and distributed. Both documents require careful specification of beneficiaries, and the trust must comply with legal standards to ensure its effectiveness.

- Life Insurance Policy: The Beneficiary Form specifically pertains to a Life Insurance Policy, detailing who will receive the death benefit. Both documents are needed to clarify beneficiary election and protect the insured's intent regarding benefit distribution.

- Beneficiary Designation for Retirement Accounts: Similar to the Transamerica form, retirement account beneficiary designations specify who will receive the assets of the account upon the owner's death. Ensuring the right percentages and beneficiaries mirrors the requirements outlined in the Beneficiary Form.

- Joint Tenancy Deed: A Joint Tenancy Deed indicates how property ownership is shared and includes rights of survivorship. Both documents can facilitate asset transfer after death, preserving the owners' intentions.

- Collateral Assignment Agreement: This document outlines assignments of rights in a policy as collateral. Similar to how the Beneficiary Form designates the beneficiary's rights, a Collateral Assignment details obligations and claims against the policy's benefits.

- Minors’ Trust Documentation: Unlike the Beneficiary Form, documentation for a trust specifically for minors identifies how assets are to be managed until the beneficiary reaches adulthood. Both establish guidelines for managing and distributing benefits, but the minors’ trust adds a layer of protection for young beneficiaries.

Dos and Don'ts

When completing the Transamerica Beneficiary form, there are certain important practices to follow and common mistakes to avoid. Here’s a helpful list:

- Double-check all information: Ensure that the policy number, insured's name, and beneficiary details are accurate.

- Use clear and complete information: Provide full names, addresses, and relationships to the insured to prevent confusion.

- Signatures are crucial: Make sure that the owner’s signature is included and that all necessary signatures are obtained, particularly if there are irrevocable beneficiaries.

- Specify percentages carefully: If there are multiple beneficiaries, indicate the percentage each one will receive, totaling 100% for both primary and contingent beneficiaries.

- Avoid abbreviations or nicknames: Use full names for beneficiaries to eliminate any ambiguity.

- Do not leave blank spaces: Fill out all required fields completely. Blank fields may lead to delays or complications.

- Don't ignore the instructions: Carefully read through any instructions provided with the form to ensure correct completion.

- Refrain from assuming the company knows your intent: Clearly state any specific wishes you have regarding your beneficiaries to avoid any misunderstandings.

Following these guidelines will help make sure that the beneficiary designation process is smooth and that your intentions are clearly understood.

Misconceptions

Understanding the Transamerica Beneficiary form can be crucial for policy owners. However, several misconceptions often lead to confusion. Here are seven common misunderstandings:

- Only one beneficiary can be named. Many people believe that they must choose only one beneficiary. The form actually allows for multiple primary and contingent beneficiaries. You can designate shares among them.

- Percentages can be specified in dollars. Some mistakenly think they can allocate specific dollar amounts to beneficiaries. The form requires that you specify percentages only, summing up to 100% for both primary and contingent beneficiaries.

- Once designated, beneficiaries cannot be changed. This misconception overlooks that policy owners can update their beneficiary designations whenever necessary. However, changing beneficiaries may require the signatures of irrevocable beneficiaries.

- The insurance company reviews the legality of beneficiary designations. Many assume that the recording of the form by Transamerica signifies that the company has validated the designations. In fact, the company does not confirm the legal adequacy of the request.

- Contingent beneficiaries are unnecessary. Some individuals believe naming contingent beneficiaries is optional. In reality, contingent beneficiaries serve a critical purpose; they only receive benefits if all primary beneficiaries predecease the insured.

- All beneficiaries receive equal shares automatically. Many think that just naming multiple beneficiaries means they will receive equal shares. If unequal shares are desired, the form specifies that policy owners must detail the specific percentages next to each beneficiary's name.

- Trusts cannot be named as beneficiaries. Some people think that only individuals can be beneficiaries. However, the form permits trusts as beneficiaries, provided that the complete name and date of the trust are clearly stated.

Key takeaways

Accurate completion of the Transamerica Beneficiary form is essential to ensure the proper distribution of the policy benefits upon the death of the insured.

When filling out the form, include the policy number and the name of the insured at the top to avoid confusion.

A single form should be used for each insurance policy; if there are multiple policies, complete a separate form for each.

The designation of beneficiaries cancels all previous beneficiary designations for that policy; take care to restate the entire designation when making changes.

Be sure to list all beneficiaries with their full names, addresses, and relationship to the insured. The death benefit will typically be divided equally unless specified otherwise.

Indicate the percentage of the death benefit each beneficiary will receive. Ensure the total equals 100% for both primary and contingent beneficiaries.

In the event that a primary beneficiary predeceases the insured, the shares of the deceased beneficiary will be divided equally among the surviving primary beneficiaries unless stated differently.

For policies owned by businesses or trusts, specific signature requirements must be followed, including the signing titles and possible supporting documentation.

Keep in mind that if a beneficiary dies before the insured, their interest in the policy terminates, which may affect the payout.

Browse Other Templates

How Do I Add Someone to My Wells Fargo Account - Before signing, you should understand the powers you're granting to your agent.

Fort Hood Vehicle Safety Checklist,III Corps Vehicle Examination Form,Fort Hood Auto Compliance Report,Fort Hood Vehicle Inspection Report,III Corps Motor Vehicle Assessment,Fort Hood Driver Safety Evaluation,Fort Hood Vehicle Condition Survey,III Co - It verifies the functionality of seatbelts and brakes.