Fill Out Your Trip Sheet Form

Planning a successful transport operation involves meticulous tracking of numerous details, and the Trip Sheet form plays a vital role in this process. This essential document captures all key information concerning vehicle trips, ensuring accurate accountability and streamlined operations. Key areas include the driver’s name, the vehicle unit number, and crucial mileage readings captured at both the beginning and end of each trip. The form also records jurisdictional details, allowing companies to stay compliant with various regulations. Additionally, it provides a space for documenting fuel purchases, which can significantly impact overall operational costs. The Trip Sheet not only summarizes each trip's mileage but also prepares companies for monthly and quarterly reviews, consolidating totals that highlight driving efficiency and fuel usage. With its organized structure, the Trip Sheet efficiently facilitates data entry and management, enabling companies to focus on what truly matters—providing excellent service while ensuring their operations are running as smoothly as possible.

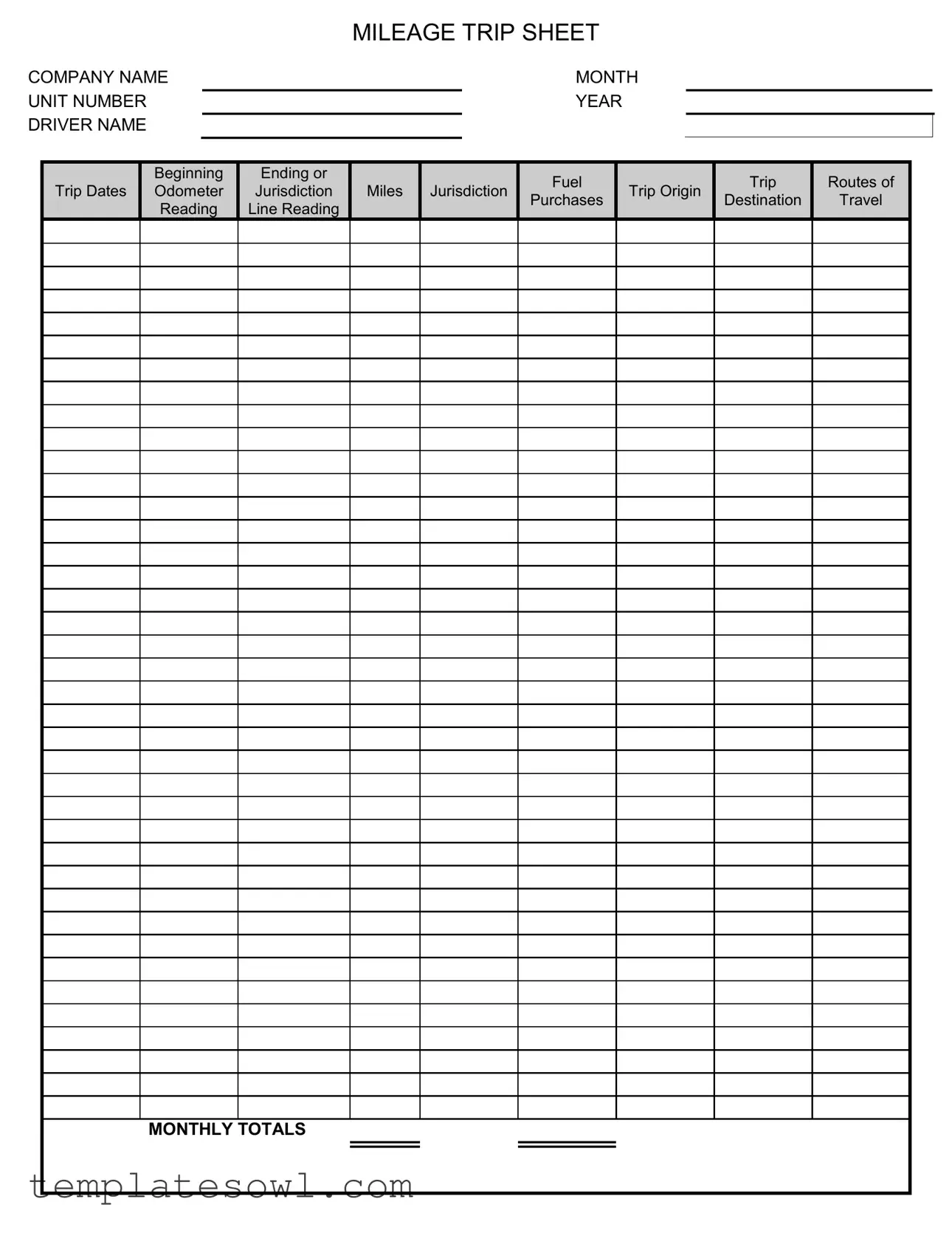

Trip Sheet Example

MILEAGE TRIP SHEET

COMPANY NAME

UNIT NUMBER

DRIVER NAME

|

|

Beginning |

|

Ending or |

|

|

|

|

|

|

Trip Dates |

Odometer |

|

Jurisdiction |

|

|

Miles |

|

Jurisdiction |

|

|

Reading |

|

Line Reading |

|

|

|

|

|

MONTH

YEAR

Fuel

Trip Origin

Purchases

Trip

Destination

Routes of

Travel

MONTHLY TOTALS

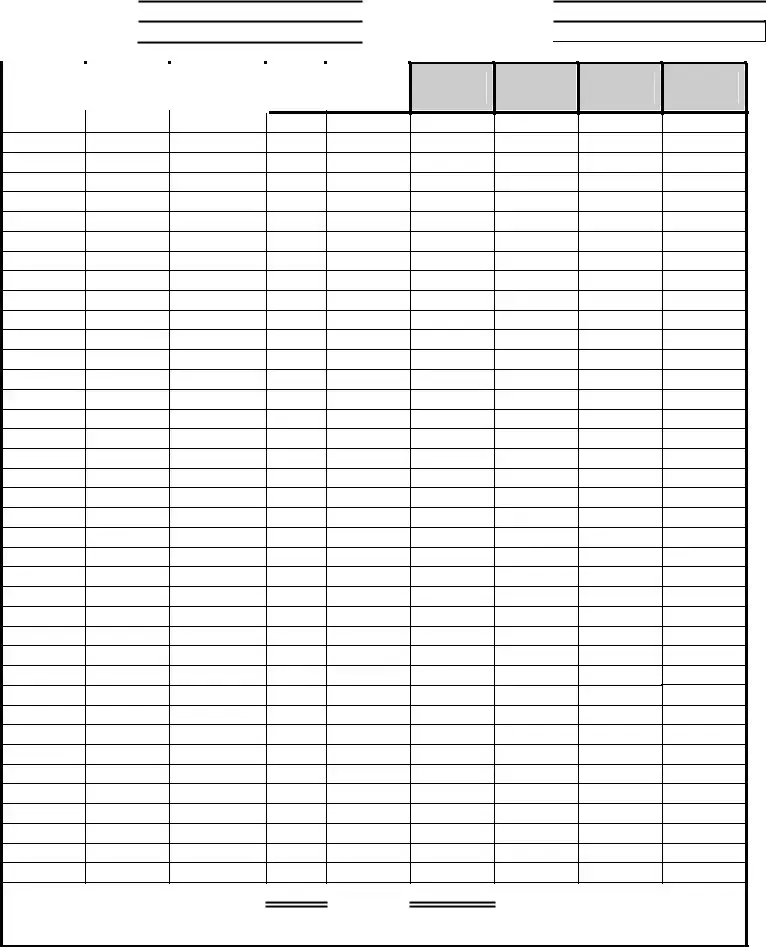

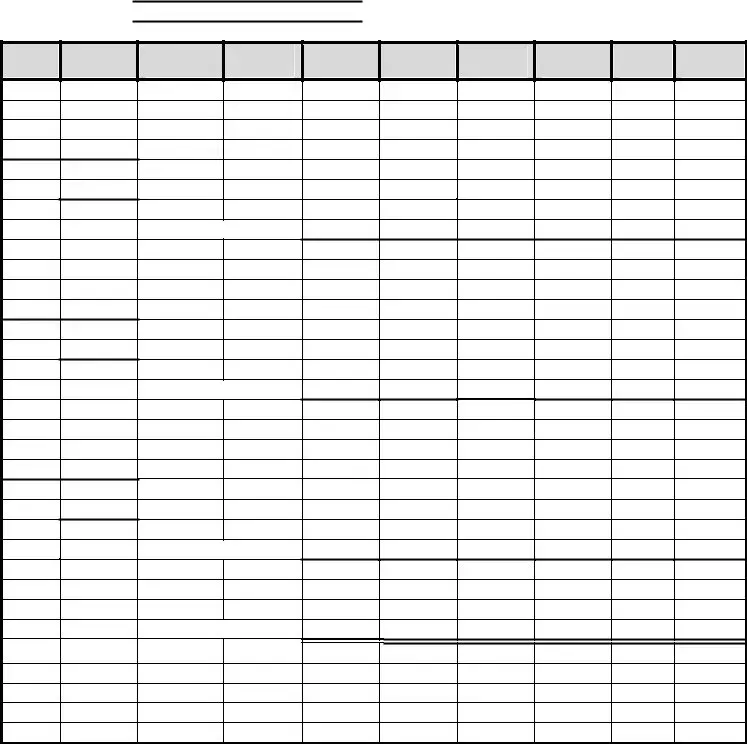

MILEAGE SUMMARY

COMPANY NAME

UNIT NUMBER

Month |

Unit # |

Beginning |

Ending |

Total |

AR |

_____ |

_____ |

_____ |

_____ |

|

Reading |

Reading |

Miles |

Miles |

Miles |

Miles |

Miles |

Miles |

|||

|

|

MONTHLY TOTALS:

MONTHLY TOTALS:

MONTHLY TOTALS

QUARTER TOTALS:

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Trip Sheet serves as a record for tracking mileage and fuel purchases for a specific trip. |

| Key Components | It includes fields for the driver's name, company name, unit number, trip dates, and odometer readings. |

| Mileage Tracking | The form records both beginning and ending odometer readings to calculate total miles traveled. |

| Fuel Purchases | Fuel purchases are documented, allowing for an assessment of fuel efficiency over a given trip. |

| Route Documentation | Routes of travel must be noted, providing insight into the journey taken by the driver. |

| Monthly Totals | The Trip Sheet summarizes mileage and fuel purchases on a monthly basis, aiding in expense tracking. |

| Regulatory Compliance | In some states, maintaining accurate trip sheets is required under transportation regulations. |

| Governing Law | For instance, in California, the California Vehicle Code Sections 40000.1 - 40000.3 govern record-keeping for drivers. |

Guidelines on Utilizing Trip Sheet

Completing the Trip Sheet form is a straightforward process that helps track your journey details. Follow the steps below to ensure all required information is filled out correctly.

- Company Name: Write the name of your company at the top of the form.

- Unit Number: Fill in the unit number associated with the trip.

- Driver Name: Enter the name of the driver operating the vehicle.

- Beginning Date: Input the starting date of the trip in the designated field.

- Ending or Trip Dates: Record the ending date of the trip.

- Odometer Reading: List the odometer reading at the beginning of the trip.

- Jurisdiction: Specify the jurisdiction where the trip is taking place.

- Miles: Calculate and enter the total miles traveled within that jurisdiction.

- Fuel Purchases: Document any fuel purchases made during the trip.

- Trip Origin: Indicate where the trip started.

- Trip Destination: Specify the final destination of the trip.

- Routes of Travel: Describe the routes taken during the trip.

- Monthly Totals: Summarize the monthly totals at the end of the form.

- Mileage Summary: At the end of the sheet, summarize the mileage information and include totals for each month and quarter as required.

What You Should Know About This Form

What is a Trip Sheet form?

The Trip Sheet form is a document used to record various details about a trip taken by a vehicle. It captures essential information such as the vehicle's unit number, driver name, beginning and ending odometer readings, jurisdiction miles, fuel purchases, trip origins and destinations, and routes traveled. This form provides a comprehensive summary of a vehicle's usage over a specific period, helping companies track mileage and fuel expenses accurately.

Why is it important to fill out the Trip Sheet correctly?

Accurate completion of the Trip Sheet is crucial for several reasons. First, it ensures compliance with regulations, especially for commercial drivers who are subject to hours-of-service laws. Second, it helps in monitoring vehicle performance and fuel efficiency, aiding in operational efficiency and cost management. Lastly, correctly recorded mileage and expenses can be invaluable for accounting purposes, audits, and tax deductions.

What information do I need to provide on the Trip Sheet?

You will need to fill out several key pieces of information on the Trip Sheet. This includes your company name, unit number, driver name, trip dates, both the beginning and ending odometer readings, jurisdiction miles, and any fuel purchases. Additionally, you will document the trip origin, destination, and routes taken, as well as collecting monthly totals and summaries for comprehensive record-keeping.

How do I calculate jurisdiction miles on the Trip Sheet?

To calculate jurisdiction miles, you start by determining the total miles driven during the trip as noted in the odometer readings. Then, you must differentiate which of those miles occurred within specific jurisdictions. This often involves referring to state or local regulations and can vary depending on where the trip takes place. It is essential to meticulously track the mileage to ensure accurate reporting.

Can the Trip Sheet be used for personal trips?

While the Trip Sheet primarily serves for business purposes, it may be used for personal trips if you wish to track your mileage and fuel expenses. However, keep in mind that for tax deductions and business accounting, personal trips should be clearly distinguished from those made for business purposes. Mixing personal and business expenses can lead to complications during audits.

What do the monthly totals mean on the Trip Sheet?

The monthly totals section on the Trip Sheet summarizes all the mileage, fuel purchases, and other relevant data gathered throughout the month. It gives a clear picture of how much the vehicle has been used, the total miles driven, and the fuel expenses incurred. This data is vital for assessing vehicle performance and making informed decisions about maintenance and operational costs.

How often should the Trip Sheet be submitted?

Submission frequency for the Trip Sheet often depends on company policy and regulatory requirements. Many companies require daily or weekly submissions for accurate tracking and accountability. However, at the very least, it should be completed and reviewed monthly to reconcile with financial records and ensure all data is documented correctly before making any essential business decisions.

Common mistakes

Filling out the Trip Sheet form accurately is crucial for maintaining proper records and ensuring compliance with company policies and regulations. However, several mistakes often occur that can complicate the process. Recognizing these mistakes can help prevent potential issues.

One common mistake is not filling in the company name and unit number at the top of the form. This information is essential to identify the vehicle and ensure that the data is tied to the correct account. Omitting this information can lead to confusion and misplaced records.

Another frequent error is providing incorrect odometer readings. The form requires both the starting and ending readings. It's vital to double-check these numbers before submission, as inaccurate readings can distort mileage calculations and trip summaries.

Additionally, people sometimes forget to fill out the jurisdiction and routes of travel sections. This oversight can hinder the ability to track where the vehicle has traveled, which is critical for understanding costs, taxes, and compliance with regulations.

Some individuals mistakenly leave out the fuel purchases section. Documenting fuel expenses is necessary not only for accuracy in mileage reporting but also for expense tracking and reimbursements. Without this information, the financial records may appear incomplete.

Moreover, failing to total the monthly or quarterly mileage can complicate financial reporting. It is essential to calculate and include these totals accurately. Missing or incorrect totals can raise red flags during audits or financial reviews.

Lastly, neglecting to date the form appropriately is a mistake that can delay processing. The dates need to correspond with the trip details provided. If the trip dates are unclear or mixed up, questions may arise that could lead to unnecessary complications.

By being aware of these common mistakes, individuals can take steps to ensure their Trip Sheet form is filled out correctly. Attention to detail is key in this process, and taking the time to verify each section will lead to smoother operations and fewer issues down the line.

Documents used along the form

The Trip Sheet form plays a vital role in logging the details of vehicle usage for businesses. However, it often accompanies several other documents that help provide a comprehensive view of operational activities. Below are some additional forms commonly used alongside the Trip Sheet.

- Fuel Receipt Log: This document records all fuel purchases made during trips. It captures details like station location, date of purchase, and amount spent, ensuring accurate tracking of fuel expenses.

- Vehicle Maintenance Log: This log keeps track of all maintenance activities performed on the vehicle, including oil changes, tire rotations, and repairs. Regular updates can prevent costly breakdowns and enhance vehicle performance.

- Driver Accountability Form: This form records driver behavior and compliance with company policies. It includes information on attendance, punctuality, and any incidents during driving, fostering accountability.

- Mileage Reimbursement Request: If drivers use personal vehicles for work purposes, this form outlines the details needed for reimbursement claims based on mileage traveled for business duties.

- Route Planning Document: This document helps in planning effective routes for trips, taking into account factors such as distance, traffic patterns, and road conditions to optimize travel time.

- Incident Report: In case of accidents or issues during travel, this report details what happened, including time, location, and involved parties. These records are crucial for liability and insurance purposes.

- Monthly Summary Report: This report consolidates all trip data for the month, including total miles driven, fuel used, and any incidents. It aids in overall performance analysis and budgeting.

Using these forms along with the Trip Sheet ensures a well-rounded view of vehicle operations. Accurate records contribute to efficient management and can enhance overall productivity.

Similar forms

-

Logbook: Similar to a Trip Sheet, a logbook captures detailed travel information of a vehicle. It includes time logged, distance traveled, and other operational data, helping to maintain compliance with regulatory requirements.

-

Fuel Receipt Record: This document records fuel purchases in detail, tracking the quantity and cost of fuel, similar to how the Trip Sheet summarizes fuel used during a trip.

-

Vehicle Maintenance Log: Like a Trip Sheet, this log tracks the operational state of the vehicle, including mileage at maintenance intervals, ensuring timely services and repairs.

-

Delivery Receipt: A delivery receipt details the cargo delivered and includes information on the trip origin and destination, paralleling the trip origin and destination entries in the Trip Sheet.

-

Accident Report Form: This form documents incidents that occur during trips, providing information on circumstances similar to the trip summary aspect of the Trip Sheet.

-

Driver Trip Reports: These reports summarize trips made by specific drivers, including details on routes taken and conditions faced, akin to the detailed tracking provided by a Trip Sheet.

-

Hours of Service (HOS) Records: Like the Trip Sheet, HOS records document the hours a driver spends operating a vehicle, ensuring compliance with federal regulations on driving limits.

-

Progress Reports: This document provides updates on trip status and progress, similar to the summary and logging functionalities found within the Trip Sheet.

-

Expense Report: An expense report captures costs incurred during travel, much like the fuel and trip purchases documented in the Trip Sheet.

-

Travel Itinerary: This plan outlines the route and key stops during a journey, paralleling the route and travel information recorded in a Trip Sheet.

Dos and Don'ts

When filling out the Trip Sheet form, accuracy and attention to detail are crucial. Here’s a helpful list of what to do and what to avoid.

- Do check your entries for accuracy before submitting the form.

- Do enter the beginning and ending odometer readings clearly.

- Do include all relevant trip details such as fuel purchases and routes traveled.

- Do keep a copy of the completed Trip Sheet for your records.

- Don't leave any sections of the form blank; each entry is important.

- Don't forget to review jurisdiction mileage rules specific to your company.

- Don't estimate fuel purchases; always record them based on actual transactions.

- Don't forget to provide the month and year clearly for each entry.

Following these guidelines can help ensure that your Trip Sheet is filled out correctly and efficiently, reducing errors and streamlining the reporting process.

Misconceptions

Understanding the Trip Sheet form is crucial for both drivers and fleet managers. However, several misconceptions exist about its purpose and function. Here are six common misunderstandings:

- It's just for record-keeping. Many believe the Trip Sheet is only a formality for tracking mileage. In reality, it serves as an essential tool for ensuring compliance with federal and state regulations.

- Only long trips require a Trip Sheet. Some assume that short trips don't need this documentation. However, every trip, regardless of distance, should be logged to maintain accurate records.

- Filling it out is optional. There's a widespread notion that completing the Trip Sheet is optional. In fact, many companies require this form to track vehicle use and expenses, making it mandatory for proper management.

- Anyone can fill it out. While it might seem that anyone can complete the Trip Sheet, accuracy is vital. Only the designated driver should fill it out to ensure the information is correct and consistent.

- Odometer readings are not important. Some may overlook the importance of accurate odometer readings on the form. These readings are critical for calculating mileage correctly which impacts fuel reimbursements and tax deductions.

- It doesn’t affect company finances. Many drivers think the Trip Sheet only serves their own records. However, it plays a significant role in a company’s financial management, influencing budgeting and operational costs.

Recognizing these misconceptions can lead to better practices in utilizing the Trip Sheet, ultimately benefiting both drivers and fleet managers.

Key takeaways

When filling out and using the Trip Sheet form, keep the following key takeaways in mind:

- Always include the company name at the top for clear identification.

- Record the unit number to link the trip to the specific vehicle.

- Document the driver name to ensure accountability.

- Fill in the beginning odometer reading and the ending odometer reading accurately.

- Clearly specify the trip origin and trip destination for tracking purposes.

- Keep track of the jurisdiction for both when the trip starts and ends.

- Include the total miles traveled calculated from your odometer readings.

- Document any fuel purchases made during the trip to keep a complete record.

- Summarize your travel by recording the monthly totals at the end of each month.

- Use the quarter totals section to provide a comprehensive view of your mileage and expenses over a longer period.

Browse Other Templates

Wellpoint Prior Authorization Form - Thorough completion can significantly impact the outcome of the appeal.

Ssi Payee - Payees may need to provide additional details on any unusual spending or saving habits.