Fill Out Your Truck Driver Expenses Worksheet Form

Truck drivers, whether working long hauls or making overnight deliveries, often face a unique financial landscape filled with various expenses. Keeping track of these costs can be vital for maximizing tax deductions, and that's where the Truck Driver Expenses Worksheet comes into play. This practical tool is designed to help truck drivers systematically organize their tax-deductible business expenses, ensuring that they do not overlook ordinary and necessary costs associated with their profession. The worksheet outlines several categories of expenses, including professional permits, fees and licenses, as well as out-of-town travel costs. Furthermore, it encompasses items like uniforms, safety equipment, and even meals, all of which can contribute to a driver's overall tax deductions. Remember, it's essential for employees to exclude any reimbursed expenses, as only unreimbursed business costs can be eligible for deductions. By using this worksheet, drivers can gain clarity on their financial situation, making it easier to prepare for tax filing and ultimately leading to potential savings.

Truck Driver Expenses Worksheet Example

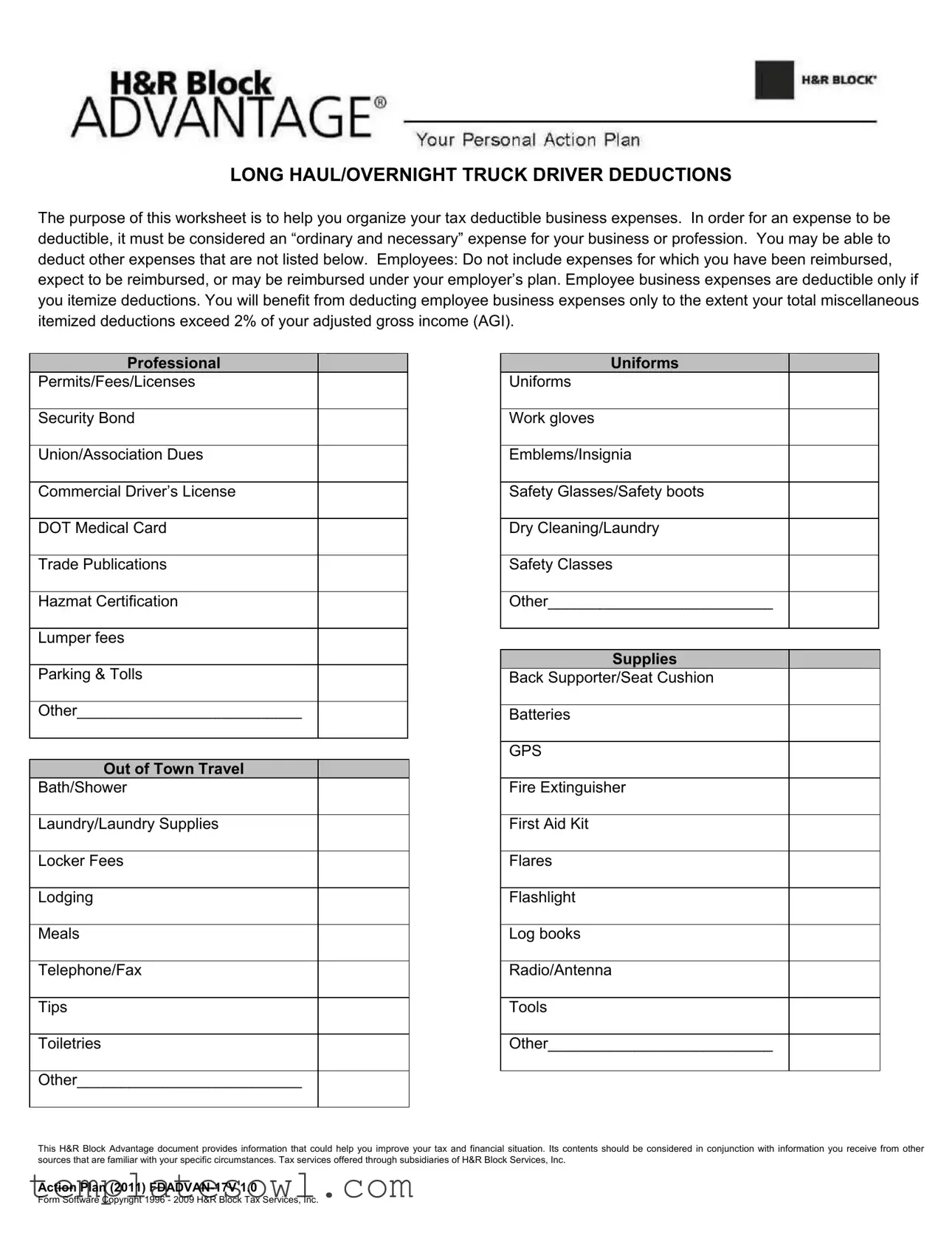

LONG HAUL/OVERNIGHT TRUCK DRIVER DEDUCTIONS

The purpose of this worksheet is to help you organize your tax deductible business expenses. In order for an expense to be deductible, it must be considered an “ordinary and necessary” expense for your business or profession. You may be able to deduct other expenses that are not listed below. Employees: Do not include expenses for which you have been reimbursed, expect to be reimbursed, or may be reimbursed under your employer’s plan. Employee business expenses are deductible only if you itemize deductions. You will benefit from deducting employee business expenses only to the extent your total miscellaneous itemized deductions exceed 2% of your adjusted gross income (AGI).

Professional

Permits/Fees/Licenses

Security Bond

Union/Association Dues

Commercial Driver’s License

DOT Medical Card

Trade Publications

Hazmat Certification

Lumper fees

Parking & Tolls

Other__________________________

Out of Town Travel

Bath/Shower

Uniforms

Uniforms

Work gloves

Emblems/Insignia

Safety Glasses/Safety boots

Dry Cleaning/Laundry

Safety Classes

Other__________________________

Supplies

Back Supporter/Seat Cushion

Batteries

GPS

Fire Extinguisher

Laundry/Laundry Supplies

First Aid Kit

Locker Fees

Flares

Lodging

Flashlight

Meals

Log books

Telephone/Fax

Radio/Antenna

Tips

Tools

Toiletries

Other__________________________

Other__________________________

This H&R Block Advantage document provides information that could help you improve your tax and financial situation. Its contents should be considered in conjunction with information you receive from other sources that are familiar with your specific circumstances. Tax services offered through subsidiaries of H&R Block Services, Inc.

Action Plan (2011)

Form Software Copyright 1996 - 2009 H&R Block Tax Services, Inc.

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of the Worksheet | This worksheet is designed to help truck drivers organize their tax-deductible business expenses efficiently. |

| Deduction Criteria | An expense must be deemed “ordinary and necessary” related to your profession to qualify for a tax deduction. |

| Reimbursement Rule | Expenses for which you have been reimbursed or expect reimbursement cannot be included in this worksheet. |

| Itemization Requirement | For employees, business expenses are deductible only if you choose to itemize your deductions on your tax return. |

| Miscellaneous Deduction Threshold | You can only benefit from employee business expense deductions if your total miscellaneous itemized deductions exceed 2% of your adjusted gross income. |

| State-Specific Law | In many states, including California, the governing law regarding business expenses follows IRS guidelines, emphasizing ordinary and necessary business expenses. |

Guidelines on Utilizing Truck Driver Expenses Worksheet

Filling out the Truck Driver Expenses Worksheet is an important step in managing your tax deductions. It provides a structured way to track your expenses related to your work. This process can help ensure you don’t miss out on potential deductions, which can lead to tax savings. Follow these steps to complete the form accurately.

- Gather all your receipts and records of your work-related expenses for the year.

- Start with the section titled Professional Permits/Fees/Licenses. List any expenses related to permits or licenses you had to pay. Examples include a commercial driver’s license or union dues.

- Move on to the Out of Town Travel section. Document any uniforms and clothing, as well as expenses for bathing facilities if you were traveling overnight.

- Fill out the Supplies section. Include any tools, safety gear, or supplies necessary for carrying out your duties. Think about items like GPS devices and first aid kits.

- In the Other section at the bottom, feel free to list any additional expenses that do not fit into the previous categories. Be as detailed as possible.

- Review your entries and ensure all expenses are categorized correctly. Make sure to check that you have not included any reimbursed expenses.

- After confirming everything, make a copy for your records before finalizing your form.

By following these steps, you can effectively fill out the Truck Driver Expenses Worksheet. Accurate record-keeping is essential as it helps you maximize your deductions in a way that complies with tax regulations.

What You Should Know About This Form

What is the purpose of the Truck Driver Expenses Worksheet?

The Truck Driver Expenses Worksheet is designed to help long haul and overnight truck drivers organize their tax-deductible business expenses. By using this worksheet, drivers can ensure that they have all necessary information when it comes time to file taxes. The form prompts you to list expenses that are considered "ordinary and necessary" for your business, making tax season a bit easier.

Who should use this worksheet?

This worksheet is suitable for truck drivers, specifically those who drive long distances or stay overnight. If an individual incurs expenses related to their driving job, they can benefit from this worksheet. It is important to note that employees should not include expenses reimbursed by their employer, as only out-of-pocket expenses can be claimed. Additionally, deductions can only be taken if you itemize your deductions on your tax return.

What type of expenses can be listed on the worksheet?

The worksheet includes a variety of categories for expenses. These include professional permits, fees, and licenses; out-of-town travel costs; uniform and safety gear expenses; supplies such as tools and toiletries; and other miscellaneous expenses. Each category provides space for drivers to detail their expenses, ensuring they capture all deductible costs relevant to their work.

How does itemizing affect my ability to deduct expenses?

For employees, deducting business expenses is only beneficial if they itemize deductions on their tax return. If total miscellaneous itemized deductions exceed 2% of your adjusted gross income (AGI), you may be able to benefit from these deductions. This means that drivers should calculate their total business expenses to see if they meet this threshold, which can significantly affect their tax liabilities.

Common mistakes

Completing the Truck Driver Expenses Worksheet can be a daunting task. Many individuals overlook critical aspects, which can lead to inaccuracies in their tax returns or missed deductions. A common mistake is failing to ensure that all expenses listed are genuinely "ordinary and necessary." Not all costs associated with truck driving qualify as deductible. It is essential to assess whether each expense relates directly to the work performed.

Another frequent error involves including reimbursed expenses. Taxpayers should not report any expense they have already been compensated for by their employer. Doing so could inflate their expenses and lead to complications if the IRS queries the returns. It's vital that individuals maintain a clear distinction between personal and reimbursed costs, ensuring transparency in their reporting.

Some individuals neglect to review eligibility criteria for itemizing deductions. Expenses for employees can only be deducted if they choose to itemize instead of taking the standard deduction. This choice may impact the potential benefit of listing expenses, so understanding the implications is crucial for accurate filing.

Moreover, failing to categorize expenses properly can pose problems. The worksheet provides multiple categories, such as “Out of Town Travel” and “Supplies.” Misplacing items—like recording a GPS device under “Supplies” instead of “Out of Town Travel”—may lead to confusion and misreporting. Careful attention to where expenses are recorded can prevent such oversights.

Not keeping receipts is another significant hurdle. Without proof of payment, it becomes challenging to substantiate claims made on the worksheet. Taxpayers need to maintain records for all deductible expenses, as these documents provide necessary evidence, helping taxpayers defend their deductions if questioned by the IRS.

Many people also mistakenly think they can deduct personal expenses related to their trucking work. For instance, costs associated with personal clothing or meals, if not directly related to the job, are generally not deductible. It’s crucial to differentiate between work-related expenses and personal expenditures.

A lack of familiarity with specific local regulations can also lead to errors. Some expenses might qualify for deductions in one state but not in another. Therefore, being informed about local laws governing deductions helps in accurately completing the form.

Additionally, individuals may overlook the inclusion of all potential expenses. The form lists several categories, but those who do not think creatively about other expenses might miss out on deductions. Things like safety courses or tools should be considered if they relate directly to enhancing job performance.

Finally, procrastination can hinder accurate completion of the worksheet. Rushing through the process at the last moment often leads to mistakes and missed opportunities. Dedicating ample time for review and completion can result in a more accurate and beneficial reporting of expenses.

Documents used along the form

The Truck Driver Expenses Worksheet is an essential document for organizing and deducting business expenses related to truck driving. Accompanying this form, various other documents may be required to fully support your expense claims. Below is a list of these forms, each playing a crucial role in ensuring a comprehensive tax filing. Take note of these documents, as they may be vital in validating your expenses and maximizing your deductions.

- Itemized Deduction Schedule: This form is used by taxpayers who choose to itemize their deductions instead of taking the standard deduction. It provides a detailed account of all eligible expenses incurred throughout the year.

- Receipt Tracker: A simple log that allows you to keep track of receipts for all your expenses. Organizing receipts can simplify the process of proving expense claims during tax time.

- Business Mileage Log: This document records the miles driven for business purposes. Accurate tracking of mileage is crucial for claiming deductions related to vehicle use.

- Travel Expense Report: Used to summarize all costs associated with business travel, including lodging, meals, and transportation. This report consolidates data making it easier to evaluate travel expenses.

- 1099-MISC Form: If you are an independent contractor, this form reports income to the IRS. Keeping track of this form helps in calculating your total earnings and potential tax obligations.

- State Tax Forms: Each state may have unique tax requirements. Understanding and filling out these forms ensures compliance with state-specific tax laws.

- Employer Reimbursement Forms: If you receive reimbursements from your employer for your expenses, these forms facilitate the recording and validation of those receipts.

- Professional License Renewals: Maintaining proof of professional licenses and certifications is vital. These documents may be required to validate certain deductions related to your profession.

By compiling these documents alongside the Truck Driver Expenses Worksheet, you can create a solid foundation for your tax filing. This approach not only streamlines the process but also enhances the potential for securing greater financial benefits from necessary deductions. Staying organized is key to maximizing your tax situation.

Similar forms

The Truck Driver Expenses Worksheet form is a helpful tool for organizing tax-deductible business expenses specifically for truck drivers. It shares similarities with several other documents. Below are four documents that are comparable to the Truck Driver Expenses Worksheet:

- Employee Business Expenses Worksheet: This form allows employees in different professions to itemize and track their business-related expenses. Like the Truck Driver Expenses Worksheet, it focuses on ordinary and necessary expenses that can be deducted from taxable income.

- Schedule C (Form 1040): Many self-employed individuals use this form to report income and expenses related to their business. Adjustments can be made based on expenses listed in the Truck Driver Expenses Worksheet, helping to simplify the record-keeping process.

- Form 2106 (Employee Business Expenses): For employees, this form details business expenses that can be deducted when itemizing deductions. It not only serves a similar purpose but also contains specific guidelines on what constitutes a deductible expense.

- Tax Deduction Checklist: A more general document, this checklist helps individuals ensure they are capturing and recording all eligible deductions. Similar to the Truck Driver Expenses Worksheet, it encourages thorough documentation of expenses for seasonal or occupational deductions.

Dos and Don'ts

When filling out the Truck Driver Expenses Worksheet form, keep these important tips in mind:

- Do organize all receipts and documentation before you begin filling out the form.

- Do ensure that any expense you list is considered “ordinary and necessary” for your work as a truck driver.

- Don’t include expenses that you have been reimbursed for or expect to be reimbursed for under your employer’s plan.

- Don’t forget to check if your deductions exceed the 2% threshold of your adjusted gross income to ensure you benefit from itemizing.

Misconceptions

Understanding tax forms can often lead to confusion. The Truck Driver Expenses Worksheet is no exception. Below are some common misconceptions regarding this form:

- Truck drivers can deduct any expense incurred while on the road. Not all expenses qualify for deductions. Only those considered “ordinary and necessary” for the business can be claimed.

- All expenses reimbursed by an employer are deductible. If expenses are reimbursed or expected to be reimbursed, they should not be included in the worksheet.

- Those who do not itemize deductions can benefit from employee business expenses. Employee expenses are only deductible if itemized, which limits their benefit for many individuals.

- All driver-related expenses are automatically deductible. Coverage extends only to specific types of expenses, such as permits, uniforms, and supplies related to the job.

- Traveling expenses can include leisure-related costs. Only expenses necessary for business travel, such as lodging and meals while away from home, are deductible.

- The worksheet includes every possible deductible expense. The worksheet lists common deductions but may miss other qualifying expenses that could be deductible.

- Safety classes and uniforms are not included as deductible expenses. Both are examples of expenses that can be deducted if deemed necessary for the job.

- Tips to service providers cannot be deducted. In certain cases, tips may be deductible, so it’s advisable to include them if they are part of the business transaction.

- This worksheet guarantees a tax refund. Completing the worksheet does not guarantee a refund; it merely helps in organizing deductions.

Recognizing these misconceptions can help truck drivers navigate their tax obligations more effectively. It’s always beneficial to consider additional resources or consult a tax professional for personalized advice.

Key takeaways

When using the Truck Driver Expenses Worksheet form, consider the following key takeaways:

- Organize Your Expenses: The worksheet aids in categorizing your tax deductible business expenses, making it easier to complete your tax forms accurately.

- Deductible Expenses Criteria: For an expense to qualify as deductible, it must be deemed “ordinary and necessary” for your trucking business.

- Reimbursement Impact: Do not include any expenses that you have been, or expect to be, reimbursed for by your employer.

- Itemizing Deductions: Employee business expenses can only be deducted if you itemize your deductions and only if the total exceeds 2% of your adjusted gross income (AGI).

Browse Other Templates

High Yield Savings Account Navy Federal - Ensure accuracy in filling out every section to avoid delays in processing your updates.

Florida Homeschool Diploma - Review the process for withdrawing a child from traditional school to homeschool.