Fill Out Your Tsp 13 Form

The Thrift Savings Plan (TSP) is an essential savings and investment tool designed primarily for federal employees and members of the uniformed services. Among the numerous forms associated with this plan, the TSP-13 form stands out for its significant role in facilitating the movement of retirement savings. Notably, in May 2012, the Federal Retirement Thrift Investment Board streamlined the process by consolidating previous forms used for transferring funds into the TSP into a new single entity—the TSP-60. This new form acts as the primary mechanism for participants to request the transfer of tax-deferred funds from eligible retirement accounts into their TSP accounts. Joining the TSP-60, the TSP-60-R form was also introduced to handle Roth transfers, allowing participants to shift Roth balances from eligible employer plans. The TSP-60 and TSP-60-R forms serve crucial functions for both civilian and uniformed services participants, clarifying requirements and processing timelines for seamless transitions of retirement savings. With strict compliance measures and the importance of adhering to deadlines, understanding these forms is vital for effective retirement planning.

Tsp 13 Example

Thrift Savings Plan

BULLETIN for Service TSP Representatives

Subject: Consolidation of Form

Date: May 7, 2012

The Federal Retirement Thrift Investment Board (Agency) has consolidated Form

The implementation of Roth TSP required the Agency to create a new combined form,

I.Purpose of Forms

A.Form

B.Form

C.Forms

(continued on next page)

Inquiries: Questions concerning this bulletin should be directed to the Federal Retirement Thrift Investment Board at

Chapter: This bulletin may be iled in Chapter 2, General Information.

Federal Retirement Thrift Investment Board • 77 K Street, NE • Washington, DC 20002

II.General Requirements and Restrictions to Forms

A.The participant must have an open TSP account with a balance when the TSP receives Form

B.A Roth IRA cannot be transferred or rolled over into the Roth balance of a TSP account. Only Roth balances from Roth accounts maintained by an eligible em- ployer plan can be transferred (but not rolled over) into a TSP account.

C.If the distribution (of traditional,

III.Agency/Service Responsibilities

When participants ask agency/service representatives for information about rollovers or transfers into the TSP, they should direct the participant to the TSP website to print out Form

TSP will accept transfers and rollovers are strict, and because there may be tax consequences, we recommend that participants consult with their tax advisors or inancial planners before they move money into the TSP.

Gisile Goethe

Deputy Director, Education & Agency Liaison

Ofice of Communications and Education

Attachment: Form

Form

- 2 -

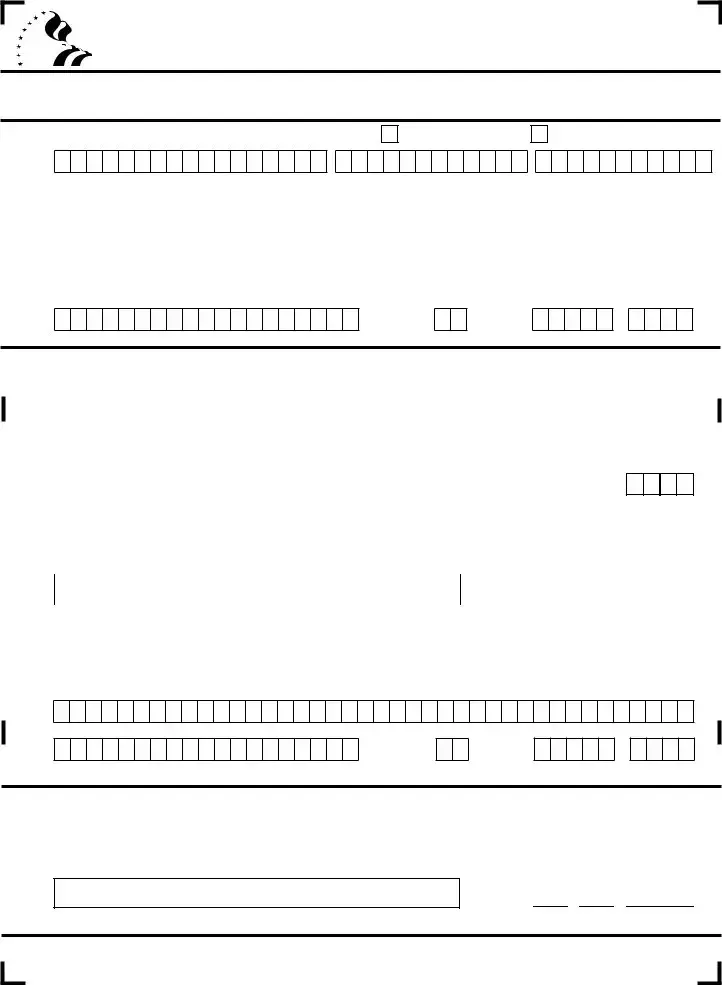

THRIFT SAVINGS PLAN |

Request foR a tRansfeR into the tsp

Use this form to request a transfer or to complete a rollover of

I.INFORMATION ABOUT

Civilian Account OR

Uniformed Services Account

1.

2.

5.

Last NameFirst NameMiddle Name

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

|

|

|

|

/ |

|

|

|

/ |

|

|

|

|

|

|

4. |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TSP Account Number |

|

|

|

|

|

|

|

|

|

|

|

Date of Birth (mm/dd/yyyy) |

|

|

|

|

|

|

|

|

|

Daytime Phone (Area Code and Number) |

||||||||||||||||||||||||||||||

|

Foreign address? |

6. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Check here. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

Street Address or Box Number (For a foreign address, see instructions on back.) |

||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street Address Line 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

7.

City

8.

State

9.

Zip Code

–

II.INFORMATION FROM IRA OR

10. |

This is a: |

|

Transfer (Direct Rollover) |

|

|

|

Rollover |

|

||||||

11. |

This distribution is from a(n): |

|

Traditional IRA |

|

|

|

||||||||

|

|

|

|

|||||||||||

12. |

Gross amount of |

|

|

|

|

|

|

|

|

|||||

|

|

, |

|

|

|

|

|

|||||||

(For definitions, see the General Information section of this form.)

SIMPLE IRA |

|

Eligible Employer Plan |

, |

|

|

|

. |

|

|

13. |

|

|

/ |

|

|

/ |

Date of Distribution (mm/dd/yyyy)

I certify that the funds are being (or have been) distributed from an eligible retirement plan as defined in IRC § 402(c)(8)(B).

14.

16.

18.

19.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Daytime Phone (Direct Number) |

||||||||

Typed or printed name of Financial Institution Representative or Plan Administrator |

|

|

|

|||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

|

|

/ |

|

|

|

|

|

|

17. |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

Signature of Financial Institution Representative or Plan Administrator |

|

|

|

|

Date Signed (mm/dd/yyyy) |

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Financial Institution |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street Address or Box Number

Street Address Line 2

20.

City

21.

State

22.

Zip Code

–

III.CERTIFICATION

23.

Participant’s Signature

24. /

/

/

/

Date Signed (mm/dd/yyyy)

FORM

PREVIOUS EDITIONS OBSOLETE

FORM

Use this form to request a transfer or to complete a rollover of

The TSP is a retirement savings and investment plan for Federal employees and members of the uniformed services. Congress established the TSP in the Federal Employees’ Retirement Sys- tem Act of 1986. The TSP is to be treated as a trust described in 26 U.S.C. § 401(a), which is exempt from taxation under 26 U.S.C. § 501(a). TSP regulations are published in title 5 of the Code of Federal Regulations, Parts

You must complete Sections I and III of this form, then provide the entire package to your IRA trustee or plan administrator to complete Section II. If necessary, have your IRA trustee or plan administrator return the form to you. In order for your request to be processed, it must include a completed Form

Note: If you intend to make a full withdrawal, please wait until you receive confirmation that your transfer or rollover has been completed.

To ensure that your request is not delayed, carefully type or print the required information inside the boxes using black or dark blue ink.

SECTION I. Complete Items

The address on this form cannot be used to update your TSP record.

If you have a foreign address, check the box in Item 5 and enter the foreign address as follows in Items

First address line: Enter the street address or post office box number, and any apartment number.

Second address line: Enter the city or town name, other princi- pal subdivision (e.g., province, state, county), and postal code, if known. (The postal code may precede the city or town.)

City/State/Zip Code fields: Enter the entire country name in the City field; leave the State and Zip Code fields blank.

SECTION II. The instructions for Section II are intended for the IRA or plan representative.

If you are unwilling to complete this section, submit an IRS Let- ter of Determination or a letter (on the organization’s letterhead) confirming that the funds are being transferred from a qualified plan. Otherwise, we cannot deposit the funds into the partici- pant’s account.

If the distribution is being transferred directly to the TSP, you must mail the completed Form

If the distribution is being rolled over, you must submit a let- ter (on the organization’s letterhead) or a distribution statement that shows the date and the gross amount of the

Item 10. Check the “Transfer (Direct Rollover)” box if the funds are being transferred directly to the TSP. Check the “Rollover” box if the distribution has been paid to the participant, and he or she is sending a check in the amount of the distribution to the TSP.

Item 11. Check the appropriate box to indicate whether the distri- bution is from a traditional IRA, SIMPLE IRA, or eligible employer plan. Complete this information whether the distribution is be- ing transferred or rolled over. Note: If this distribution is from a SIMPLE IRA, you must provide written documentation showing the period of participation.

Item 12. Indicate the total gross amount of the

Item 13. If this request is for a rollover, provide the date that the distribution was made to the participant.

Items

SECTION III. Read the General Information section of this form, and sign and date Items 23 and 24 if the information is correct. If you cannot certify that your transfer or rollover meets all of the requirements described, you cannot transfer or roll over your distribution into the TSP.

If you have questions, call the ThriftLine toll free at

Either mail the check and form to: TSP Rollover and Transfer

Processing Unit, P.O. Box 385200, Birmingham, AL

to the TSP.

Form

PREVIOUS EDITIONS OBSOLETE

FORM

Form

If the TSP does not receive a Form

If the TSP receives a check with appropriate identification, but without Form

Be sure to read all of the general information and instructions before you complete this form.

What

The TSP will accept both transfers and rollovers of

Before submitting this form, a TSP participant who would like to transfer or roll over money into the TSP should check with a representative of his or her IRA or plan to determine what portion of a distribution (if any) meets the applicable requirements, as described below.

Note: Participants are required to certify in Section III of this form that the distribution they are seeking to transfer or roll over into the TSP meets the applicable requirements. If a participant can- not sign the certification, the TSP cannot accept the transfer or rollover.

Traditional IRA. This is an individual retirement account de- scribed in IRC § 408(a) or an individual retirement annuity de- scribed in IRC § 408(b). The traditional IRA category does not include a Roth IRA, an inherited IRA, or a Coverdell Education Savings Account (formerly known as an education IRA); distribu- tions from these types of IRAs will not be accepted by the TSP.

The TSP will accept all or a portion of a distribution from a tradi- tional IRA except a distribution that:

•is a minimum distribution required by IRC § 401(a)(9); or

•consists of

SIMPLE IRA. This is a Savings Incentive Match Plan for Employ- ers, an employer sponsored retirement plan available to small businesses. A TSP participant can transfer an amount from a SIMPLE IRA to the TSP, as long as he or she participated in the SIMPLE IRA for at least 2 years. Note: The TSP must receive written documentation showing the period of participation in a

SIMPLE IRA.

Eligible Employer Plan. This is a plan qualified under IRC

§401(a) (including a § 401(k) plan,

To be accepted into the TSP, the distribution from an eligible em- ployer plan must be an “eligible rollover distribution.”

An eligible rollover distribution is a distribution to a participant of all or a portion of his or her account. However, it cannot be:

•one of a series of substantially equal periodic payments made over the life expectancy of the employee (or the joint lives of the employee and designated beneficiary, if appli- cable), or for a period of 10 years or more;

•a minimum distribution required by IRC § 401(a)(9);

•a hardship distribution;

•a plan loan that is deemed to be a taxable distribution be- cause of default; or

•a return of excess elective deferrals.

Examples of eligible rollover distributions include: a lump sum distribution after terminating employment; an

All of the money transferred into the TSP must be money that would have been included in the participant’s gross income for the tax year in which the transfer was made, had the money been distributed without being transferred or rolled over.

What Roth distributions will the TSP accept?

The TSP will only accept transfers of qualified and

The TSP will not accept rollovers of qualified or

If you would like to transfer Roth money into the Roth balance of your TSP account, do not complete this form; instead, complete Form

Form

PREVIOUS EDITIONS OBSOLETE

FORM

What is the difference between a “transfer” and a “rollover”?

A transfer (also known as a “direct rollover”) occurs when the participant instructs the distributing plan to send all or part of his or her eligible rollover distribution directly to the TSP instead of issuing it to the participant.

A rollover occurs when the distributing plan makes a payment to the participant (after withholding the applicable Federal in- come tax) and the participant deposits all or any part of the gross amount of the payment into the TSP within 60 days of receiving it.

How much

There is no limit to the number of transfers or rollovers of tax- deferred money that a participant can make. A participant can transfer or roll over all or any part of a

Note: Any portion of the distribution that the participant choos- es not to transfer or roll over will be taxed as ordinary income. In addition, if the participant is younger than 59½ at the time of distribution, he or she may have to pay a 10% early withdrawal penalty tax on the amount that was not transferred or rolled over.

How does the IRC annual elective deferral limit affect transfers and rollovers?

Money that is transferred or rolled over into the TSP is not ap- plied to the annual elective deferral limit that is imposed on regu- lar employee contributions.

How does a transfer or rollover affect monthly payments?

If a TSP participant is receiving monthly payments at the time of a transfer or a rollover, the TSP will recalculate the amount or the duration of the monthly payments beginning with the first pay- ment the participant receives in the year following the transfer or rollover. If a participant is receiving payments:

•Of a speciic dollar amount, the recalculation will occur only if the participant transferred $1,000 or more, and only the duration of the payments will be affected. However, if the new duration of the payments is 10 years or more, the payments will no longer be eligible for transfer or rollover, and the tax withholding on the payments may change.

•Based on life expectancy, the recalculation should increase the amount of each payment.

For more information, see the TSP tax notice “Tax Information for TSP Participants Receiving Monthly Payments.”

What happens to the money once it reaches the TSP?

Money that is transferred or rolled over into the TSP is allocated to the TSP investment funds according to the participant’s most current contribution allocation on file. Once the money is depos- ited into the participant’s TSP account, it is treated like employee contributions and will be subject to the same plan rules as all other employee contributions in the account. These rules may be different from the rules of the IRA or plan from which the money was distributed.

When you send us a rollover check, it will be converted into an electronic funds transfer (EFT). We will make an electronic im- age of your check and use the account information on it to debit your bank account electronically for the amount of the check.

Although the debit will be reflected on your bank statement, you will not receive the cancelled check because the original will be destroyed after we image it. If for some technical reason the data from the EFT cannot be processed, we will transmit our imaged copy of your check to your bank.

Note: Because the conditions under which the TSP will accept transfers and rollovers are strict, and there may be tax conse- quences, we recommend that you consult your tax advisor before you move money into the TSP.

PRIVACY ACT NOTICE. We are authorized to request the information you provide on this form under 5 U.S.C. chapter 84, Federal Employees’ Retirement System. We will use this information to identify your TSP account and to process your request. In addition, this information may be shared with other Federal agencies for statistical, auditing, or archiving purposes. We may share the information with law enforcement agencies investigating a violation of civil or criminal law, or agencies implementing

a statute, rule, or order. It may be shared with congressional offices, private sector audit firms, spouses, former spouses, and beneficiaries, and their attorneys. We may disclose relevant portions of the information to appropriate parties engaged in litigation and for other routine uses as specified in the Federal Register. You are not required by law to provide this information, but if you do not provide it, we will not be able to process your request.

Form

PREVIOUS EDITIONS OBSOLETE

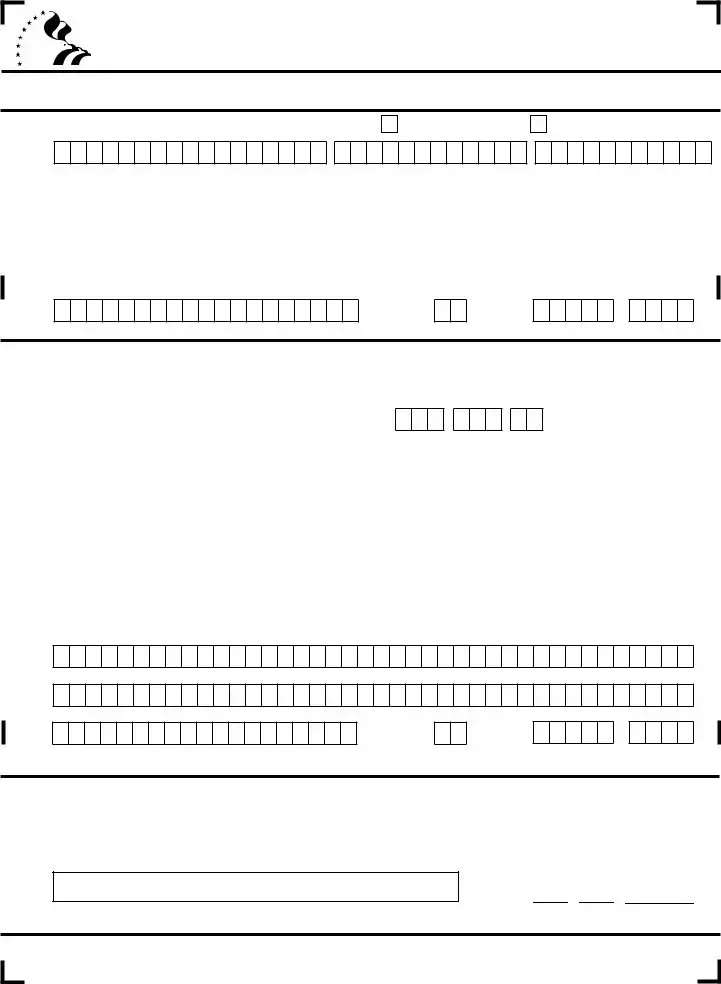

THRIFT SAVINGS PLAN |

Request foR a Roth tRansfeR into the tsp

Use this form to request a transfer of Roth money from an applicable retirement plan into the Roth balance of your Thrift Savings Plan (TSP) account. Funds received by the TSP will not be invested until a properly completed Form

I.INFORMATION ABOUT

Civilian Account OR

Uniformed Services Account

1.

2.

5.

Last NameFirst NameMiddle Name

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

|

|

|

|

/ |

|

|

|

/ |

|

|

|

|

|

|

4. |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

TSP Account Number |

|

|

|

|

|

|

|

|

|

|

Date of Birth (mm/dd/yyyy) |

|

|

|

|

|

|

|

|

|

Daytime Phone (Area Code and Number) |

||||||||||||||||||||||||||||||

|

Foreign address? |

6. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Check here. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

Street Address or Box Number (For a foreign address, see instructions on back.) |

|||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street Address Line 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

7.

City

8.

State

9.

Zip Code

–

II.INFORMATION FROM

10. Gross amount of Roth distribution: |

11. Roth contributions: |

$ |

|

, |

|

|

|

, |

|

|

|

. |

|

|

|

|

|

|

$ |

|

|

||||||

12. Date of first Roth contribution: |

|

|

|

|

|

/ |

|

|

/ |

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

Contribution Date (mm/dd/yyyy) |

|

|||||||||||||

,

,

.

I certify that the funds are being distributed from an applicable retirement plan as defined in IRC § 402A(e)(1).

13.

15.

17.

18.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Daytime Phone (Direct Number) |

||||||||||

Typed or printed name of Financial Institution Representative or Plan Administrator |

|

|

|

|||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16. |

|

|

/ |

|

|

|

/ |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature of Financial Institution Representative or Plan Administrator |

Date Signed (mm/dd/yyyy) |

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Financial Institution

Street Address or Box Number

Street Address Line 2

19.

City

20.

State

21.

Zip Code

–

III.CERTIFICATION

22.

Participant’s Signature

23. /

/

/

/

Date Signed (mm/dd/yyyy)

FORM

PREVIOUS EDITIONS OBSOLETE

FORM

Use this form to request a transfer of Roth money from an appli- cable retirement plan into the Roth balance of your Thrift Savings Plan (TSP) account. You must have an open TSP account with a balance when your request is received by the TSP. Note: Money cannot be transferred into a beneficiary participant account.

The TSP is a retirement savings and investment plan for Federal employees and members of the uniformed services. Congress established the TSP in the Federal Employees’ Retirement Sys- tem Act of 1986. The TSP is to be treated as a trust described in 26 U.S.C. § 401(a), which is exempt from taxation under 26 U.S.C. § 501(a). TSP regulations are published in title 5 of the Code of Federal Regulations, Parts

You must complete Sections I and III of this form, then provide the entire package to your plan administrator to complete Section II. In order for your request to be processed, it must include a com- pleted Form

Note: If you intend to make a full withdrawal, please wait until you receive confirmation that your transfer has been completed.

To ensure that your request is not delayed, carefully type or print the required information inside the boxes using black or dark blue ink.

SECTION I. Complete Items

The address on this form cannot be used to update your TSP record.

If you have a foreign address, check the box in Item 5 and enter the foreign address as follows in Items

First address line: Enter the street address or post office box number, and any apartment number.

Second address line: Enter the city or town name, other princi- pal subdivision (e.g., province, state, county), and postal code, if known. (The postal code may precede the city or town.)

City/State/Zip Code fields: Enter the entire country name in the City field; leave the State and Zip Code fields blank.

SECTION II. The instructions for Section II are intended for the plan representative.

If you are unwilling to complete this section, submit an IRS Let- ter of Determination or a letter (on the organization’s letterhead) confirming that the funds are being transferred from a qualified plan. Otherwise, we cannot deposit the funds into the partici- pant’s account.

You must submit the completed Form

Either mail the check and form to:

|

TSP Rollover and Transfer Processing Unit |

|

P.O. Box 385200 |

|

Birmingham, AL |

Or fax to: |

|

|

If you fax this form, please send your check immediately to the TSP.

Item 10. Indicate the total gross amount of the Roth distribution that is being made from the plan.

Item 11. Indicate the amount of the distribution that comes from the participant’s designated Roth contributions (i.e., tax basis).

Item 12. Provide the specific date of the participant’s first des- ignated Roth contribution to the plan. If you cannot provide the specific date, indicate the year that the participant made his or her first designated Roth contribution to the plan.

Items

SECTION III. Read the General Information section of this form, and sign and date Items 22 and 23 if the information is correct. If you cannot certify that your transfer meets all of the requirements described, you cannot transfer your distribution into the TSP.

If you have questions, call the ThriftLine toll free at

Form

PREVIOUS EDITIONS OBSOLETE

FORM

Form

If the TSP does not receive a Form

If the TSP receives a check with appropriate identification, but without Form

Be sure to read all of the general information and instructions before you complete this form.

What Roth distributions will the TSP accept?

The TSP will only accept transfers of qualified and

§457(b) plan maintained by a governmental employer. It does not include a Roth IRA.

The TSP will not accept rollovers of qualified or

To be accepted into the TSP, the distribution must be an “eligible rollover distribution.” An eligible rollover distribution is a distribu- tion to a participant of all or a portion of his or her account. How- ever, it cannot be:

•one of a series of substantially equal periodic payments made over the life expectancy of the employee (or the joint lives of the employee and designated beneficiary, if appli- cable), or for a period of 10 years or more;

•a minimum distribution required by IRC § 401(a)(9);

•a hardship distribution;

•a plan loan that is deemed to be a taxable distribution be- cause of default; or

•a return of excess elective deferrals.

Examples of eligible rollover distributions include: a lump sum distribution after terminating employment; an

Before submitting this form, a TSP participant who would like to transfer Roth money into the TSP should check with a representa- tive of his or her plan to determine what portion of a distribution (if any) meets the applicable requirements.

Note: Participants are required to certify in Section III of this form that the distribution they are seeking to transfer into the TSP meets the applicable requirements. If a participant cannot sign the certification, the TSP cannot accept the transfer.

What is the difference between a “qualified” and a

A Roth distribution is considered qualified (i.e., paid

What is a “Roth Initiation Date”?

The TSP defines a Roth Initiation Date as the specific date of a participant’s first Roth contribution. The IRS uses January 1 of the year associated with a participant’s first Roth contribution to de- termine whether Roth earnings are qualified.

What happens to a Roth Initiation Date at the time of a transfer?

If a participant has an existing Roth balance in his or her TSP ac- count at the time of the transfer, the Roth Initiation Date will be the earlier of either the start date associated with the incoming Roth balance or the start date associated with the existing TSP Roth balance. This date will be applied to all Roth money already in the participant’s TSP account, as well as any future Roth contri- butions to the TSP.

If a participant does not have an existing Roth balance in his or her TSP account, the transfer will establish one, and the Roth Initiation Date will be the start date associated with the incoming Roth balance.

What

The TSP will accept both transfers and rollovers of

•Traditional IRA. This is an individual retirement account described in IRC § 408(a) or an individual retirement annu- ity described in IRC § 408(b). The traditional IRA category does not include a Roth IRA, an inherited IRA, or a Coverdell Education Savings Account (formerly known as an education IRA); distributions from these types of IRAs will not be ac- cepted by the TSP.

•SIMPLE IRA. This is a Savings Incentive Match Plan for Em- ployers, an employer sponsored retirement plan available to small businesses. A TSP participant can transfer an amount from a SIMPLE IRA to the TSP, as long as he or she partici- pated in the SIMPLE IRA for at least 2 years. Note: The TSP must receive written documentation showing the period of participation in a SIMPLE IRA.

•Eligible Employer Plan. This is a plan qualified under IRC § 401(a) (including a § 401(k) plan,

* The TSP cannot certify to the IRS that you meet the Internal Revenue Code’s definition of disability when your taxes are reported. Therefore, you must provide the justification to the IRS when you file your taxes.

Form

PREVIOUS EDITIONS OBSOLETE

FORM

If you would like to transfer or roll over a distribution from an eli- gible retirement plan into the traditional

What is the difference between a “transfer” and a “rollover”?

A transfer (also known as a “direct rollover”) occurs when the participant instructs the distributing plan to send all or part of his or her eligible rollover distribution directly to the TSP instead of issuing it to the participant.

A rollover occurs when the distributing plan makes a payment to the participant (after withholding the applicable Federal in- come tax) and the participant deposits all or any part of the gross amount of the payment into the TSP within 60 days of receiving it.

How much Roth money can a participant transfer or roll over into the TSP?

There is no limit to the number of transfers of Roth money that a participant can make. A participant can transfer all or any part of a Roth distribution that meets the applicable requirements de- scribed on the previous page. However, a participant cannot roll over any Roth money into the TSP.

How does the IRC annual elective deferral limit affect transfers?

Money that is transferred into the TSP is not applied to the an- nual elective deferral limit that is imposed on regular employee contributions.

How does a transfer affect monthly payments?

If a TSP participant is receiving monthly payments at the time of a transfer, the TSP will recalculate the amount or the duration of the monthly payments beginning with the first payment the par- ticipant receives in the year following the transfer. If a participant is receiving payments:

•Of a specific dollar amount, the recalculation will occur only if the participant transferred $1,000 or more, and only the duration of the payments will be affected. However, if the new duration of the payments is 10 years or more, the payments will no longer be eligible for transfer or rollover, and the tax withholding on the payments may change.

•Based on life expectancy, the recalculation should increase the amount of each payment.

For more information, see the TSP tax notice “Tax Information for TSP Participants Receiving Monthly Payments.”

What happens to the money once it reaches the TSP?

Money that is transferred into the TSP is allocated to the TSP investment funds according to the participant’s most current contribution allocation on file. Once the money is deposited into the participant’s TSP account, it is treated like employee contri- butions and will be subject to the same plan rules as all other employee contributions in the account. These rules may be differ- ent from the rules of the plan from which the transferred amount was distributed.

Note: Because the conditions under which the TSP will accept transfers and rollovers are strict, and there may be tax conse- quences, we recommend that you consult your tax advisor before you move money into the TSP.

PRIVACY ACT NOTICE. We are authorized to request the information you provide on this form under 5 U.S.C. chapter 84, Federal Employees’ Retirement System. We will use this information to identify your TSP account and to process your request. In addition, this information may be shared with other Federal agencies for statistical, auditing, or archiving purposes. We may share the information with law enforcement agencies investigating a violation of civil or criminal law, or agencies implementing

a statute, rule, or order. It may be shared with congressional offices, private sector audit firms, spouses, former spouses, and beneficiaries, and their attorneys. We may disclose relevant portions of the information to appropriate parties engaged in litigation and for other routine uses as specified in the Federal Register. You are not required by law to provide this information, but if you do not provide it, we will not be able to process your request.

Form

PREVIOUS EDITIONS OBSOLETE

Form Characteristics

| Fact Name | Details |

|---|---|

| Consolidation Date | Form TSP-60 was consolidated on May 7, 2012, merging the civilian and uniformed services transfer request processes. |

| Supersession of Previous Forms | The new form supersedes all prior versions of Forms TSP-60 and TSP-U-60 dated before April 2012. |

| Discarding Old Versions | Participants and agencies must immediately discard previous versions; processing of old forms ceased after June 1, 2012. |

| Form Purpose | Form TSP-60 allows participants to request transfers or rollovers of tax-deferred money from eligible retirement plans into TSP accounts. |

| Roth Transfer | Form TSP-60-R was introduced to facilitate Roth transfers, allowing participants to move Roth money into their TSP accounts. |

| Eligibility Requirements | Participants must have an open TSP account with a balance for their requests to be processed. |

| Rollover Timeframe | The TSP must receive Form TSP-60 and the associated funds within 60 calendar days of the participant receiving them. |

| Tax Considerations | Participants are advised to consult tax advisors due to possible tax consequences from transfers and rollovers. |

| No Beneficiary Transfers | Money cannot be transferred into beneficiary participant accounts, reinforcing restrictions on these transactions. |

| Compliance and Certification | Participants must certify that their distributions meet the criteria outlined in the General Information section of Form TSP-60. |

Guidelines on Utilizing Tsp 13

Successfully completing Form TSP-60 is crucial for participants wishing to transfer or rollover tax-deferred money into their Thrift Savings Plan (TSP) accounts. Participants must follow specific steps to ensure the form is filled out correctly and all necessary information is provided. Failure to do so may lead to a delay in processing the transfer.

- Begin with Section I: Fill in your personal information, including your last name, first name, middle name, date of birth, TSP account number, and daytime phone number.

- Indicate whether you are requesting a transfer for your Civilian Account or Uniformed Services Account. Only check one box.

- If applicable, check the box for a foreign address and complete the address details as instructed.

- Proceed to Section II. This part must be completed by the trustee or custodian of your IRA or the administrator of the employer plan.

- In Section II, specify whether your request is a "Transfer (Direct Rollover)" or a "Rollover." Check the appropriate box.

- Identify the source of your distribution by checking the relevant box — Traditional IRA, SIMPLE IRA, or Eligible Employer Plan.

- Provide the gross amount of the tax-deferred distribution.

- Fill in the date of distribution if the request is for a rollover.

- Have the financial institution representative sign and date the form, ensuring their contact information is provided.

- Move to Section III: Read the certification statement carefully. Sign and date this section to confirm the information is accurate.

- Submit the completed Form TSP-60 along with a check made payable to the "Thrift Savings Plan," clearly indicating your name and TSP account number. Ensure all materials are bundled together to avoid processing delays.

Once the form and check are submitted, the TSP will begin processing your request. It is essential to monitor the status to confirm that the funds are applied to your account as expected. Proper completion and submission of this form can help facilitate a smooth transition of your retirement funds.

What You Should Know About This Form

What is the purpose of Form TSP-60?

Form TSP-60 is used by both civilian and uniformed services participants to request a transfer or a rollover of tax-deferred money from an eligible retirement plan or traditional IRA into the traditional (non-Roth) balance of their TSP accounts. This includes money from accounts such as traditional IRAs or eligible employer plans.

What is the purpose of Form TSP-60-R?

Form TSP-60-R serves a different purpose. It allows participants to transfer Roth money from a Roth account maintained by an eligible employer plan directly into the Roth balance of their TSP accounts. This form is specifically for Roth transfers and should not be confused with Form TSP-60.

What are the general requirements for submitting these forms?

To process Form TSP-60 or Form TSP-60-R, participants must have an open TSP account with a balance. Additionally, funds must be transferred directly from an eligible plan or received as a rollover within a specified time frame. Specifically, for rollover funds, TSP must receive both the completed form and the money within 60 calendar days of the distribution date.

Is a Roth IRA eligible for transfer into the TSP?

No, Roth IRAs cannot be transferred into the Roth balance of a TSP account. Only Roth money from Roth accounts maintained by an eligible employer plan can be accepted. Therefore, if you have a Roth IRA, that amount cannot be rolled over into your TSP account.

What happens if I submit an outdated version of TSP-60 or TSP-60-R?

Submitting an outdated version of these forms will result in processing delays. As of June 1, 2012, any forms prior to April 2012 will not be processed. It is essential to use the latest version of the forms available from the TSP website.

Can I transfer money into a beneficiary participant account?

No, money cannot be transferred or rolled over into a beneficiary participant account. Transfers and rollovers are only accepted into the accounts of active or separated participants.

What types of distributions can be transferred into the TSP?

The TSP accepts transfers and rollovers of tax-deferred money from a variety of eligible retirement plans, including traditional IRAs and SIMPLE IRAs, provided certain conditions are met. Participants should consult with their IRA or plan representatives to determine what portion of their distribution qualifies for transfer.

How should the completed forms and checks be submitted?

Participants should mail the completed Form TSP-60 or TSP-60-R, along with any checks, to the designated TSP processing unit. Checks should be made payable to the "Thrift Savings Plan" and include the participant's name and TSP account number, or Social Security number to avoid delays.

Common mistakes

Filling out Form TSP-60 can be straightforward, but many people make common mistakes that can cause delays in processing. One of the most frequent errors is not checking the correct box for the type of account. You must choose whether the request applies to your civilian account or your uniformed services account. If neither option is checked, your form may not be processed, and that will slow down your transfer.

Another common oversight is failing to include an open TSP account with a balance. The TSP will not process your request if they do not have an active account associated with the form. It’s important to ensure that your TSP account is open and sufficiently funded before submitting the form.

Participants often make mistakes in Section II, where the information from the IRA or plan should be completed. Sometimes individuals assume that they can sign this section themselves instead of having the trustee or plan administrator do it. This can lead to rejection of the form, as it must be filled out by the correct party.

Missing appropriate documentation is another issue. If you’re transferring from a SIMPLE IRA, you must provide written proof of your participation period. Skipping this step can cause significant delays. The TSP needs accurate information to ensure that your transfer complies with all regulations.

It’s also vital to provide the precise gross amount of your distribution. Inaccuracies in this area often lead to processing errors. Make sure to double-check the figures before submitting the form to avoid complications.

Moreover, people sometimes neglect to sign and date the certification section. If your form lacks a signature, it cannot be processed. This small but critical step can result in the entire request being sent back, requiring additional time and effort to correct.

Lastly, submitting the form and check separately can create issues, as the TSP requires them together. This practice may delay your transfer process. Always send both items together to ensure everything goes smoothly.

By paying attention to these details, you can make your experience with Form TSP-60 much easier. Focusing on accuracy and completeness will help ensure that your transfer is processed quickly and efficiently.

Documents used along the form

The Thrift Savings Plan (TSP) involves several forms and documents that help streamline the process of managing retirement savings. When dealing with the TSP-13 form, there are additional forms that you may encounter. Here’s a quick overview of some important ones that often accompany it.

- Form TSP-60: This is the primary form used for transferring or rolling over tax-deferred money from an eligible retirement plan into the traditional (non-Roth) balance of a TSP account.

- Form TSP-60-R: Similar to TSP-60, this form specifically requests a transfer of Roth money from a qualified employer plan into the Roth balance of the TSP.

- Form TSP-9: This form is used by separated participants to update their address with the TSP if their address differs from what’s on record.

- Form TSP-10: Participants use this form to withdraw their contributions while still in service under specific conditions.

- Form TSP-75: If participants wish to make a financial hardship withdrawal, this form provides the necessary information required for processing.

- Form TSP-17: This form provides details for a participant to reclaim their annuity if they choose to opt for a TSP annuity instead of a lump-sum payment.

- IRS Form 1099-R: This tax document is crucial when the TSP reports distributions made to participants during the tax year, helping them prepare their taxes accordingly.

- IRS Form W-4P: This form is used to determine the amount of federal income tax withholding from pension payments or distributions, including those from the TSP.

Each of these forms serves a specific purpose, ensuring that participants can effectively manage their retirement funds while complying with regulations. Understanding them can make your navigation through the TSP processes much smoother and more efficient.

Similar forms

- Form 1040: This is the standard IRS form for individual income tax returns. Similar to TSP-13, it requires accurate reporting of financial information, specifically detailing income, deductions, and credits.

- Form W-4: Employees use this form to determine their withholding allowances for federal income tax. Like TSP-13, it involves personal financial information to ensure compliance with tax regulations.

- Form 1099-R: This form reports distributions from pensions, annuities, retirement plans, and IRAs. It serves a similar purpose to TSP-13 in documentarily acknowledging the movement of funds within retirement accounts.

- Form T-60-R: This form is specifically for Roth transfers into the Thrift Savings Plan. Both TSP-60 and TSP-60-R documents share the common function of facilitating transfers from retirement accounts.

- Form 5500: This form is used to report information regarding employee benefit plans. Similar to TSP-13, it involves requirements for disclosures about retirement plan operations and funding.

- Form TSP-9: This form is used to change the address for separated participants. Both forms aim to maintain updated records for individuals within retirement systems.

- Form 8606: This IRS form is used to report nondeductible contributions to traditional IRAs. Like TSP-13, it is crucial for tracking the tax implications of retirement accounts.

- Beneficiary Designation Forms: These forms designate beneficiaries for retirement accounts. Like TSP-13, they must be completed accurately to ensure the correct transfer of benefits after death.

- Withdrawal Request Form: This is utilized by participants requesting distributions from their accounts. Both TSP-13 and withdrawal forms focus on the proper processing of participant funds.

Dos and Don'ts

When filling out Form TSP-60 or TSP-60-R, it’s important to follow specific guidelines to ensure a smooth process.

- Always use the most current version of the form, as older versions will not be processed.

- Ensure that you have an open TSP account with a balance before submitting the form.

- Type or print the required information clearly, using black or dark blue ink.

- Consult with a tax advisor if you have questions about the tax implications of your transfer.

Conversely, certain actions can complicate your request.

- Do not attempt to transfer or roll over money into a beneficiary participant account.

- Avoid waiting until the last minute; the form and funds must be submitted within 60 days of the distribution.

- Do not incomplete any sections of the form, especially Section III; all information must be accurate and complete.

- Never send the form and the check separately; this can delay processing.

Misconceptions

Understanding the TSP-13 form can be challenging, and several misconceptions might lead to confusion. Here's a breakdown of six common misconceptions associated with this form.

- Misconception 1: The TSP-13 form is for all types of retirement accounts.

- Misconception 2: You can transfer funds from any retirement account into your TSP.

- Misconception 3: The TSP-13 form is mandatory for every transaction.

- Misconception 4: You can submit an outdated form for transfers.

- Misconception 5: There are no time constraints when completing a rollover.

- Misconception 6: A separate form is not required for each rollover check.

This form specifically pertains to the Thrift Savings Plan (TSP) and does not apply to other retirement account types like IRAs or Roth IRAs beyond certain conditions.

Only tax-deferred money from eligible employer plans or traditional IRAs can be transferred using this form. Roth money follows a different process.

This is not accurate. It is needed only when transferring tax-deferred funds into a TSP account. For Roth transfers, you must use a different form (TSP-60-R).

No, using an outdated version of the form will cause processing delays. Always utilize the latest version.

Every rollover must be completed within a specific timeframe—60 calendar days from the distribution date. Failure to do so will result in the rollover being rejected.

Incorrect. Each check sent for a rollover must be accompanied by a completed TSP-13 form. Without it, there may be complications in processing your request.

By clarifying these misconceptions, participants can more confidently navigate the transfer process into the Thrift Savings Plan.

Key takeaways

Understanding and utilizing Form TSP-13 effectively can greatly benefit participants in the Thrift Savings Plan (TSP). Here are six key takeaways:

- Know the Purpose: Form TSP-60 is specifically used for transferring tax-deferred funds into a traditional TSP account. Meanwhile, Form TSP-60-R is for transferring Roth funds. Understanding which form to use is fundamental.

- Eligibility Requirements: Participants must have an open TSP account with a balance when submitting Form TSP-60 or TSP-60-R. Without this, the request cannot be processed.

- Time Constraints: For successful rollovers, participants need to submit their completed forms within 60 days of receiving their distribution. Failure to meet this timeline will result in the refusal to process the rollover.

- Check Compatibility: Not all funds are eligible for transfer. For example, Roth IRAs cannot be rolled into a TSP. It's vital to verify the source of the funds to avoid complications.

- Documentation Matters: When submitting the form, ensure all required sections are completed, and any checks are correctly identified with your TSP account information. This attention to detail prevents processing delays.

- Consult Tax Advisors: Before initiating a transfer, consulting with a tax advisor can provide insights into any potential tax implications. This decision should not be made lightly, as it may impact your overall financial health.

Browse Other Templates

Conditional Resident Status Petition,Petition for Removal of Conditions on Residence,Form for Removing Residency Conditions,Application to Eliminate Residency Restrictions,Conditional Resident Adjustment Form,Residency Condition Waiver Application,Re - Attorneys involved in the process must include their credentials on the form.

Free Rabbit Pedigree Template - It encourages accountability in breeding practices within the community.