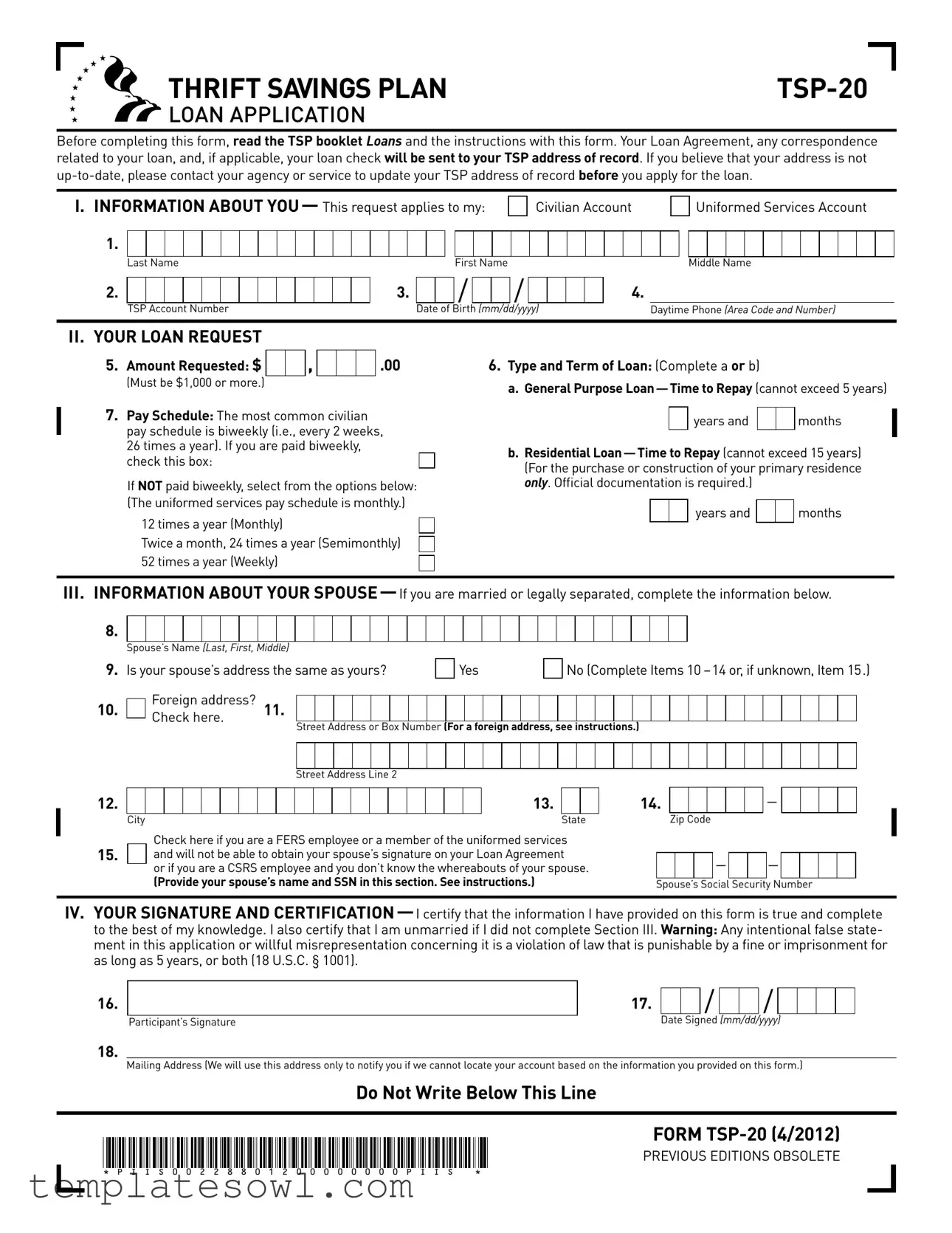

Fill Out Your Tsp 20 Loan Form

The TSP-20 Loan Application serves as a critical tool for individuals seeking to access funds from their Thrift Savings Plan (TSP) accounts. Before initiating the application, it is essential to review the TSP booklet regarding loans, as well as the accompanying instructions. This form gathers important personal information, including the applicant's name, TSP account number, and contact details. It allows users to specify the amount of the loan they are requesting, which must be a minimum of $1,000. Additionally, applicants must indicate their preferred loan terms, whether a general purpose loan, repayable over a maximum of five years, or a residential loan, with a repayment period of up to fifteen years for the purchase or construction of a primary residence. The form also requires information about the applicant's spouse, including their name and address, especially if applicable laws require consent for the loan. Lastly, the applicant must provide certification of accuracy for the information submitted. This application must be signed and dated, and all required fields need to be completed fully to facilitate processing.

Tsp 20 Loan Example

THRIFT SAVINGS PLAN |

LOAN APPLICATION

Before completing this form, read the TSP booklet Loans and the instructions with this form. Your Loan Agreement, any correspondence related to your loan, and, if applicable, your loan check will be sent to your TSP address of record. If you believe that your address is not

I. INFORMATION ABOUT YOU— This request applies to my: |

|

Civilian Account |

||||||||||||||||||||||||||||

1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Last Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Name |

|

|

|

|

|

|

|

|

|

||||||

Uniformed Services Account

Middle Name

2.

3.

/

/

4.

TSP Account Number |

Date of Birth (mm/dd/yyyy) |

Daytime Phone (Area Code and Number) |

|

|

|

|

|

II. YOUR LOAN ReqUeST

5. Amount Requested: $ |

|

|

, |

|

|

|

.00 |

(Must be $1,000 or more.)

7.Pay Schedule: The most common civilian pay schedule is biweekly (i.e., every 2 weeks, 26 times a year). If you are paid biweekly, check this box:

If NOT paid biweekly, select from the options below: (The uniformed services pay schedule is monthly.)

12 times a year (Monthly)

Twice a month, 24 times a year (Semimonthly)

52 times a year (Weekly)

6.Type and Term of Loan: (Complete a or b)

a. General Purpose

years and |

|

|

months |

b.Residential

years and |

|

|

months |

III.INFORMATION ABOUT YOUR

8.

|

|

Spouse’s Name (Last, First, Middle) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

9. |

Is your spouse’s address the same as yours? |

|

|

Yes |

|

|

No (Complete Items 10 |

|||||||||||||||||||||||||||||||||

|

|

|

|

|||||||||||||||||||||||||||||||||||||

10. |

|

|

Foreign address? |

11. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

Check here. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street Address or Box Number (For a foreign address, see instructions.) |

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street Address Line 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

12. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13. |

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

Check here if you are a FERS employee or a member of the uniformed services

15.and will not be able to obtain your spouse’s signature on your Loan Agreement

or if you are a CSRS employee and you don’t know the whereabouts of your spouse.

(Provide your spouse’s name and SSN in this section. See instructions.)

14. |

|

|

|

|

|

– |

|

|

|

|

|

|

|

|

Zip Code |

|||||

– |

|

|

– |

|

|

|

|

Spouse’s Social Security Number

IV. YOUR SIGNATURe AND

16.

Participant’s Signature

18.

17.

/

/

/

Date Signed (mm/dd/yyyy)

Mailing Address (We will use this address only to notify you if we cannot locate your account based on the information you provided on this form.)

Do Not Write Below This Line

FORM

PREVIOUS EDITIONS OBSOLETE

* P I I S 0 0 2 2 8 8 0 1 2 0 0 0 0 0 0 0 0 P I I S |

* |

To ensure that your request is not delayed, type or print the requested information legibly inside the boxes using black or dark blue ink.

Your Loan Agreement and any correspondence related to your loan will be sent to your tsP address of record. Also, unless you request on the Loan Agreement to have your loan paid by direct deposit into your checking or savings account, your loan check will be sent to your ad- dress of record. This address will be provided on the Loan Agreement. If you believe that your address is not

Before completing this application, read the TSP booklet Loans to understand the features of the loan program, eligibility require- ments, and your responsibilities when you borrow from your TSP account. The booklet is available from your agency personnel of- fice, your service, or the TSP website (www.tsp.gov). Make a copy of this completed form for your records and mail the original form to the following address:

thrift savings Plan P.O. Box 385021 Birmingham, AL 35238

Or fax the form to

5:Amount Requested. You may not borrow more than the to- tal amount that you contributed to the TSP and the earnings on that amount. You may not borrow less than $1,000 or more than $50,000. To determine the maximum amount you may borrow, you can visit the TSP website at www.tsp.gov or call the

If you are not eligible to borrow the amount you requested, your Loan Agreement will be generated with the maximum amount you can borrow. Also, if you request a loan for less than $1,000, your loan amount will automatically become $1,000 as long as you have that amount available to borrow.

Note: Your loan will be disbursed proportionally from any tradition- al

6:type and term of Loan. If you are requesting a general purpose loan, complete the requested information in Item a. If you are ap- plying for a residential loan, fill in the information requested in Item b. You can request a residential loan only for the purchase or construction of your primary residence.

•For a General Purpose Loan, the minimum time to repay is 1 year; the maximum time is 5 years. No documentation is required.

•For a Residential Loan, the minimum time to repay is

1 year; the maximum time is 15 years. Documentation of the amount will be required when you return your Loan Agreement. Do not send documentation for the amount of the loan with this form.

If you indicated in Item 6 a payment term of less than 1 year, your loan term will automatically be changed to a term of 1 year. If you indicated more than 5 years for a general purpose loan or more than 15 years for a residential loan, your term will be changed to the maximum term allowed for that type of loan.

7:Pay schedule. Loan payments are deducted from your pay each pay period. Make sure you indicate the correct pay schedule or your loan payments will be incorrect.

First address line: Enter the street address or post office box number, and any apartment number.

Second address line: Enter the city or town name, other principal subdivision (e.g., province, state, county), and postal code, if known. (The postal code may precede the city or town.)

City/State/Zip Code fields: Enter the entire country name in the City field; leave the State and Zip Code fields blank.

If your spouse uses an Air/Army Post Ofice (APO) or Fleet Post Ofice (FPO) address, enter the address in the two available ad- dress lines (include the unit designation). Enter APO or FPO, as appropriate, in the City field. In the State field, enter AE as the state abbreviation for Zip Codes beginning with

15: Notiication or consent of spouse not possible. The TSP must notify the spouse of a CSRS participant before a loan can be made. Spouses of FERS participants and of members of the uniformed services must consent to the loan by signing the Loan Agreement. Check Item 15 and provide your spouse’s Social Security number only if you are:

•FERS or are a member of the uniformed services and you cannot obtain your spouse’s signature because your spouse’s whereabouts are unknown or exceptional circumstances make it impossible to obtain your spouse’s signature, or

•CSRS and your spouse’s whereabouts are unknown.

You may be able to obtain an exception to these spousal rights requirements, but you must submit Form

PRIVAcY Act NOtIcE. We are authorized to request the information you provide on this form under 5 U.S.C. chapter 84, Federal Employees’ Retirement System. We will use this information to identify your TSP account and to process your transac- tion. In addition, this information may be shared with other Federal agencies for statistical, auditing, or archiving purposes. We may share the information with law enforcement agencies investigating a violation of civil or criminal law, or agencies

implementing a statute, rule, or order. It may be shared with congressional offices, private sector audit firms, spouses, former spouses, and beneficiaries, and their at- torneys. We may disclose relevant portions of the information to appropriate parties engaged in litigation and for other routine uses as specified in the Federal Register. You are not required by law to provide this information, but if you do not provide it, we will not be able to process your request.

Form

PREVIOUS EDITIONS OBSOLETE

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Title | TSP-20 Loan Application |

| Loan Amount Requirement | Applicants must request an amount of $1,000 or more. |

| Pay Schedule Options | Common pay schedules include biweekly, monthly, semimonthly, and weekly. |

| Loan Repayment Terms | Repayment terms vary: General Purpose Loans must be repaid in up to 5 years, while Residential Loans have a maximum of 15 years. |

| Spousal Information | Spousal details must be provided if the applicant is married or legally separated. |

| Legal Notifications | False statements in the application can lead to criminal penalties under 18 U.S.C. § 1001. |

Guidelines on Utilizing Tsp 20 Loan

Filling out the TSP-20 Loan form is an important step if you're looking to apply for a loan from your Thrift Savings Plan. Please ensure that all information is accurate and complete to avoid any delays in processing your application.

- Identify your account type. Indicate whether this request applies to your Civilian Account or Uniformed Services Account.

- Fill in your personal details:

- Last Name, First Name, Middle Name

- TSP Account Number

- Date of Birth (mm/dd/yyyy)

- Daytime Phone (area code and number)

- Complete your loan request:

- Enter the Amount Requested (must be $1,000 or more).

- Select your Pay Schedule (biweekly, monthly, semimonthly, or weekly).

- Choose the Type and Term of Loan (General Purpose or Residential) and fill in the repayment time.

- If married or legally separated, provide your spouse’s information:

- Spouse’s Name (Last, First, Middle)

- Check if spouse's address is the same as yours.

- If the address is different, complete the necessary address fields.

- Certify the information provided is true by signing and dating the form.

- Provide your mailing address for notification purposes.

- Make a copy of the completed form for your records.

- Mail the original form to the address provided or fax it as indicated.

Once you've submitted your application, you can monitor its status. Ensure that you've followed all instructions to facilitate timely processing. If you have questions during the process, do not hesitate to reach out for help.

What You Should Know About This Form

What is the TSP-20 Loan Form?

The TSP-20 Loan Form is an application for individuals with a Thrift Savings Plan (TSP) account to request a loan from their account. This form is necessary for specifying loan amounts, repayment terms, and other relevant information regarding the loan process.

Who is eligible to apply for a loan using the TSP-20 form?

Eligibility to apply for a TSP loan generally includes federal employees or members of the uniformed services who have contributions in their TSP accounts. Eligibility requirements may vary, and it is advisable to review the TSP booklet, "Loans," available on the TSP website or from your personnel office to understand your specific circumstances.

What is the minimum and maximum amount I can borrow?

The minimum amount you can borrow is $1,000. There is a maximum borrowing limit of $50,000, which cannot exceed the total amount you have contributed to your TSP account plus the earnings on that amount. If you attempt to request an amount that does not meet these criteria, your loan amount may be adjusted accordingly.

How long do I have to repay the loan?

For a general purpose loan, repayment terms range from a minimum of 1 year up to a maximum of 5 years. In contrast, a residential loan, which is for purchasing or constructing a primary residence, has repayment terms of up to 15 years. Payment terms must be chosen carefully to adhere to these limits.

What information do I need to provide about my spouse?

If you are married, or legally separated, you must provide your spouse's full name and address on the form. If your spouse has a foreign address, specific formatting is required. Moreover, if your spouse’s whereabouts are unknown, you may check relevant boxes on the form and provide additional information such as their Social Security Number.

What happens if I cannot provide my spouse's signature?

If you are a FERS employee or a member of the uniformed services and cannot obtain your spouse’s signature due to their whereabouts being unknown or for other exceptional circumstances, you must check the relevant box and provide their Social Security number. Additionally, you may need to submit Form TSP-16 to request an exception to standard spousal requirements.

How do I submit the TSP-20 Loan Form?

You can mail the completed TSP-20 form to the Thrift Savings Plan at P.O. Box 385021, Birmingham, AL 35238. Alternatively, you have the option to fax the form to 1-866-817-5023. Be sure to keep a copy of the submitted form for your records.

What if I think my TSP address is outdated?

If you suspect your TSP address is not current, contact your agency or service to update your address before submitting the TSP-20 form. Any correspondence related to your loan, including your Loan Agreement, will be sent to your address of record.

Where can I find additional information about the loan process?

You can find more details about the loan program, including eligibility requirements and loan features, in the TSP booklet titled "Loans." This booklet is accessible from your agency personnel office or the TSP website at www.tsp.gov.

Common mistakes

Completing the TSP-20 Loan Application can seem straightforward, yet several common mistakes can lead to delays or complications. One notable error is failing to update personal information before submitting the application. Individuals should ensure their TSP address of record is current; otherwise, any correspondence, including loan agreements, may not reach them.

Another mistake involves entering an incorrect amount for the loan request. The form clearly states that individuals may request a loan between $1,000 and $50,000. Submitting an amount below this threshold results in an automatic adjustment to the minimum loan amount. This error can lead to unnecessary confusion and could also affect the overall loan process.

Providing insufficient or incorrect information about marital status represents yet another common error. If married, applicants must complete the section regarding their spouse, including accurate names and Social Security numbers. Omitting this information or incorrectly checking the boxes can delay loan approval and may even require resubmission of the application.

A frequent issue arises when applicants select an incorrect pay schedule. Understanding one's pay frequency is crucial. Misidentifying the pay schedule can result in incorrect deductions from pay, complicating the repayment process. Ensuring that the correct box is selected helps to streamline the process and maintains consistency in payment schedules.

Furthermore, individuals often neglect the signature requirement. The application must be signed and dated to certify that the information is complete and accurate. Failure to provide a signature leads to automatic rejection of the application, necessitating resubmission and delaying access to funds.

Lastly, many applicants overlook the importance of reading the entire TSP booklet and instructions associated with the TSP-20 Loan Application. Not being fully informed about loan features and requirements can result in missteps that could easily be avoided. Ensuring familiarity with these guidelines enhances the application experience and reduces the likelihood of mistakes.

Documents used along the form

When applying for a loan through the Thrift Savings Plan, several other forms and documents are often required to complete the application process. Understanding these documents can help you navigate the system more smoothly.

- Form TSP-16: Exception to Spousal Requirements - This form is necessary if you are unable to obtain your spouse's signature on your loan agreement due to specific circumstances. It outlines the reasons for this exception and must be submitted alongside the TSP-20 Loan Application.

- Loan Agreement - After your TSP-20 Loan Application is approved, this agreement details the terms of your loan, including repayment schedule, interest rates, and other critical information. You will need to sign this document to formally accept the terms of the loan.

- Documentation for Residential Loan - If you are applying for a residential loan, you must provide official documentation showing the purpose of the loan is for purchasing or constructing your primary residence. This can include purchase agreements or construction contracts.

- Form TSP-1: Enrollment Form - If you are a new participant or need to update your existing information in the TSP, this form may be required. It essentially sets up your account and ensures that you are enrolled in the Thrift Savings Plan.

- Account Statements - Current TSP account statements are often required to verify your account balance and ensure that the amount you wish to borrow is available. These statements help confirm your eligibility for the loan amount requested.

Being aware of these accompanying forms can ease the process of securing your TSP loan. Make sure to gather these documents before submitting your application to avoid any delays or complications.

Similar forms

- FERS Loan Application Form: Both forms are used by Federal Employees Retirement System (FERS) participants to apply for loans from their retirement savings. They collect personal and financial information to process loan requests.

- CSRS Loan Application Form: Similar to the TSP-20, this form is for the Civil Service Retirement System (CSRS) participants. It includes details about the participant's identity, loan amount, and pay schedule.

- TSP-16 Exception to Spousal Requirements: This form allows TSP participants to request an exception to the spousal consent requirement when applying for a loan, comparable in purpose to the spousal notification in the TSP-20.

- TSP Withdrawal Request Form: While the TSP-20 focuses on loans, the withdrawal form serves to request distributions from a TSP account. Both require similar personal identification and reason for the request.

- Hardship Withdrawal Application: This document is for members seeking to withdraw funds due to financial hardship. Like the TSP-20, it requires details about the participant's situation and financial status.

- TSP Change of Address Form: Both documents address the importance of accurate participant information. The TSP-20 requires confirmation of the participant’s current address for correspondence, similar to the Change of Address form.

- Loan Payment Schedule Agreement: This document outlines the payment terms for a loan, akin to the payment schedule section of the TSP-20, ensuring participants are aware of their obligations regarding loan repayments.

Dos and Don'ts

When filling out the TSP-20 Loan form, consider the following recommendations:

- Ensure that all the information provided is accurate and complete. This includes your name, TSP account number, and loan amount.

- Use black or dark blue ink to fill out the form. Clarity is essential for processing your application smoothly.

- Review the pay schedule carefully. Selecting the correct option is crucial as it affects your loan payments.

- Make a copy of the completed form for your records before submitting it. This will be helpful in case there are questions later.

Avoid these common pitfalls:

- Do not request a loan amount below $1,000 or exceed $50,000, as this will delay processing.

- Refrain from leaving any sections blank, especially regarding your personal or spouse’s information.

- Do not sign the form without reading it thoroughly. Understanding the loan’s terms is vital.

- Do not forget to update your TSP address of record before applying if it is not current.

Misconceptions

- Misconception 1: Anyone can borrow unlimited amounts from their TSP account.

- Misconception 2: A spouse's signature is always required for TSP loans.

- Misconception 3: The loan application process is quick and does not require specific documentation.

- Misconception 4: There is no limit to the repayment term for TSP loans.

- Misconception 5: Payments can be made arbitrarily without a set schedule.

- Misconception 6: You can change your loan amount after submission.

- Misconception 7: You cannot access your TSP loan funds if you are in the uniformed services.

- Misconception 8: All communications regarding the loan will be sent via regular mail.

- Misconception 9: The TSP will not notify you if your account information is incomplete.

The TSP guidelines state that you cannot borrow more than the total amount you have contributed, along with the earnings on that amount. Additionally, you must borrow at least $1,000. The maximum amount allowed is $50,000.

While obtaining a spouse's consent is typically necessary, exceptions exist. If you are a FERS employee or a uniformed service member and cannot contact your spouse due to exceptional circumstances, you can indicate this on your application.

Depending on the type of loan, documentation may be required, especially for residential loans. The review process can take time, so planning ahead is important.

The terms for repayment are capped. General purpose loans cannot exceed five years, while residential loans have a maximum term of fifteen years. Always select an appropriate repayment period.

Loan payments are deducted in accordance with your designated pay schedule. It's essential to specify this correctly on your application to avoid incorrect payment amounts.

Once you submit the application, you cannot modify your loan amount. If you request an amount less than $1,000, it will automatically be adjusted to that minimum, as long as you are eligible.

Uniformed service members have the same ability to request a TSP loan as civilian employees, although there are specific forms and processes to follow based on your service status.

Correspondence and the loan agreement will be sent to your TSP address of record. If you prefer communication by other means, ensure your contact details are updated.

It is your responsibility to ensure all information is accurate. If the TSP cannot locate your account because of incorrect details, you may not receive necessary notifications.

Key takeaways

- Read the Instructions: Before completing the TSP-20 form, thoroughly review the TSP booklet titled "Loans" and all associated instructions. This step is critical for a smooth application process.

- Update Your Address: Ensure that your Thrift Savings Plan (TSP) address is current, as all correspondence and loan agreements will be sent there. If it needs updating, contact your agency promptly.

- Loan Amount: You must request a minimum loan amount of $1,000. The maximum loan amount you can borrow is capped at $50,000, depending on your account balance.

- Loan Types: Familiarize yourself with the two types of loans available: General Purpose Loans, which have a repayment period of up to 5 years, and Residential Loans, with a maximum repayment term of 15 years for primary residences.

- Pay Schedule: Correctly indicate your pay schedule on the form (biweekly, monthly, etc.) to avoid errors in loan payment deductions from your salary.

- Spoousal Information: If you are married, provide all required information about your spouse, regardless of whether you live together or are separated.

- Signatures: Your signature is mandatory on the loan agreement, and if applicable, your spouse’s signature is also required to comply with regulations.

- Loan Disbursement: Be aware that loans will be disbursed proportionally from any traditional and Roth balances in your account, impacting your existing funds.

- Documentation for Residential Loans: If applying for a residential loan, gather the necessary official documentation for the purchase or construction of your primary residence, but do not send it with the loan application.

- Privacy Notice: Understand that the information provided on the TSP-20 form is collected under federal law and may be shared with other agencies for auditing and regulatory purposes.

Browse Other Templates

Sc Dmv Form - Verification by a DMV official aids in processing the driver's request efficiently.

Mfa Kaiser - The MFA program serves as a bridge for those waiting for other forms of health coverage approval.

Statement of Affairs - Complete answers are critical for the legitimacy of the bankruptcy claim.