Fill Out Your Tsp 3 Form

The Thrift Savings Plan (TSP) Form TSP-3 serves a crucial function for federal employees and members of the uniformed services by enabling participants to designate beneficiaries for their retirement savings. By completing this form, individuals can specify who will receive the assets in their TSP account upon their death. This designation overrides the statutory order of precedence, which would otherwise dictate the distribution of funds. It is essential to ensure that all sections of the form are filled out correctly, as any mistakes, such as crossing out or altering information, could render the form invalid. The TSP-3 forms remain in effect until a new designation is submitted or all prior designations are canceled. Participants are encouraged to keep their beneficiary designations current, especially during significant life events such as marriage, divorce, or the birth of a child. Should a participant name multiple beneficiaries, it is crucial to ensure the total shares add up to 100%. Upon processing, a confirmation will be sent, providing peace of mind that the designated wishes have been noted. In the event that a participant wishes to cancel previous designations, a simple check in the appropriate section of the form suffices, applying the statutory scheme for distribution.

Tsp 3 Example

Thrift Savings Plan

Form

Designation of Beneficiary

May 2017

For federal civilian employees, members of the uniformed services, and beneficiary participants

If you would like your TSP account to be distributed according to the statutory order of precedence, do not complete this form. (See the first page of the instructions for an explanation of the order of precedence.)

Use this form to designate a beneficiary or beneficiaries to receive your Thrift Savings Plan (TSP) account after your death. This Designation of Beneficiary form will stay in effect until you submit another valid Form

Mail the original to: Thrift Savings Plan

P.O. Box 385021

Birmingham, AL 35238

Or fax to:

If you have questions, call the

You will receive a confirmation of your designation once your form is processed.

Check to make sure of the following:

You provide your name and account number on each page that you submit to the TSP.

You print legibly.

You sign all pages you complete (including any extra pages you add) on the same date.

You have the same witness sign and date all

You do not alter this form or any information you provide on it.

Your primary beneficiaries’ shares add up to 100%.

If you name contingent beneficiaries, you name a primary beneficiary for each contingent beneficiary.

The shares of contingent beneficiaries (if any) total 100% for each primary beneficiary.

You do not submit your will or direct us to make a designation according to your will.

You address this form to:

Thrift Savings Plan

P.O. Box 385021

Birmingham, AL 35238

Form

PREVIOUS EDITIONS OBSOLETE

THRIFT SAVINGS PLAN |

DESIGNATION OF BENEFICIARY

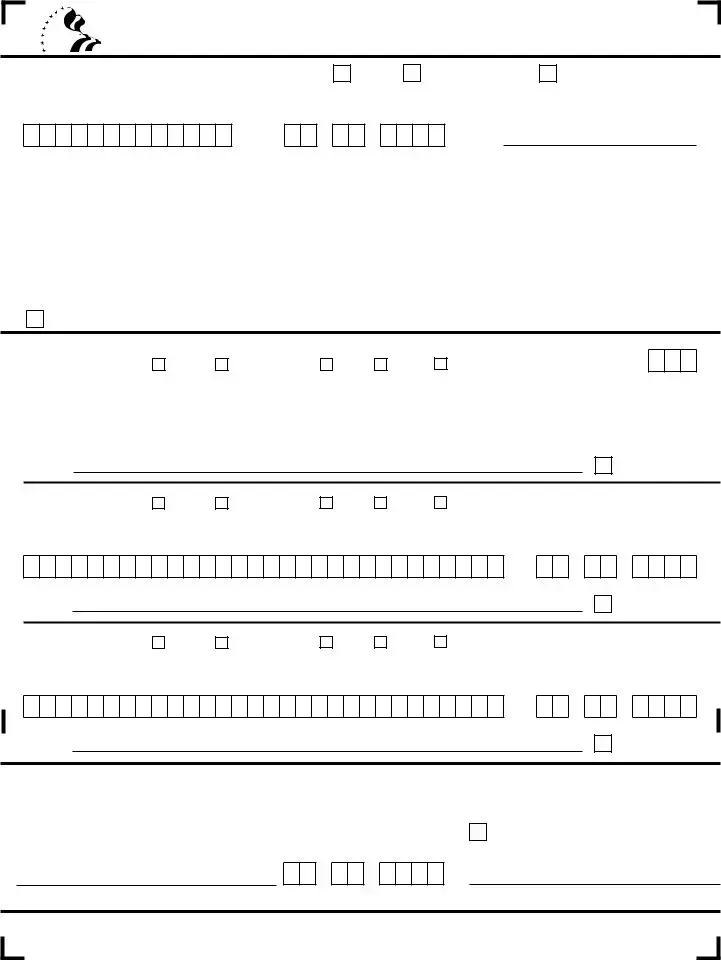

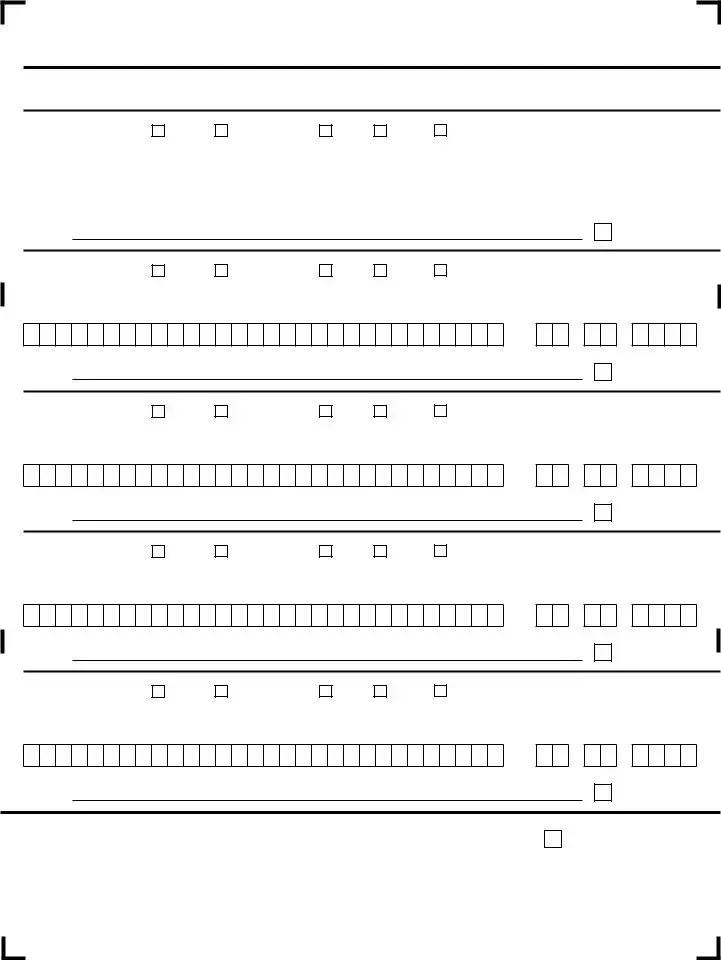

I. PARTICIPANT

Civilian

Uniformed Services

Beneficiary Participant Account

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Last Name |

|

First Name |

|

|

|

|

|

|

|

|

|

|

Middle Name |

||||||||||||||||||||||||||||

/

/

TSP Account NumberDate of Birth (mm/dd/yyyy)Daytime Phone (Area Code and Number)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign address? |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check here. |

||

|

Street Address or Box Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street Address Line 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

State |

|

|

|

|

Zip Code |

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

II.

Check here only to cancel all prior beneficiary designations without naming new beneficiaries. (Also complete Section IV.)

III. PRIMARY BENEFICIARY DESIGNATIONS

Relationship to you: |

|

Spouse |

Other Individual |

|

Trust |

|

Estate |

|

Legal Entity/Corporation |

|

Share: |

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Individual (Last, First, Middle)/Trust/Estate/Legal Entity or Corporation |

|

|

|

|

|

|

|

|

|

|

SSN/EIN/Tax ID |

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Name of Trustee/Executor (if applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of Birth (mm/dd/yyyy) |

|||||||||||||||||||||

%

Address:

Foreign address? Check here.

Relationship to you:

Spouse

Other Individual

Trust

Estate

Legal Entity/Corporation |

|

|

Share: |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SSN/EIN/Tax ID |

Name of Individual (Last, First, Middle)/Trust/Estate/Legal Entity or Corporation |

||||||||||||||||||||||||||||||

/

/

Name of Trustee/Executor (if applicable) |

Date of Birth (mm/dd/yyyy) |

Address:

Foreign address? Check here.

Relationship to you:

Spouse

Other Individual

Trust

Estate

Legal Entity/Corporation |

|

|

Share: |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SSN/EIN/Tax ID |

Name of Individual (Last, First, Middle)/Trust/Estate/Legal Entity or Corporation |

||||||||||||||||||||||||||||||

/

/

Name of Trustee/Executor (if applicable) |

Date of Birth (mm/dd/yyyy) |

Address:

Foreign address? Check here.

IV.

|

|

|

|

/ |

|

|

/ |

|

|

|

|

Participant Signature |

|

Date Signed (mm/dd/yyyy) |

|||||||||

Check here and go to Page 2 if naming more than 3 primary beneficiaries.

/

/

Witness SignatureDate Signed (mm/dd/yyyy)Witness Print Full Name

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FORM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PREVIOUS EDITIONS OBSOLETE |

* P I I S 0 0 2 2 8 7 0 1 2 0 0 0 0 0 0 0 0 P I I S * |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

Do Not Write In This Section

FORM

This form stays in effect until you submit another valid Form

SECTION

Complete this form only if you want payment to be made in a way other than the following statutory order of precedence:

1. |

To your spouse |

2. |

If none, to your child or children equally, with the share due any |

|

deceased child divided equally among that child’s descendants |

3. |

If none, to your parents equally or to your surviving parent |

4. |

If none, to the appointed executor or administrator of your estate |

5. |

If none, to your next of kin who is entitled to your estate under |

|

the laws of the state in which you resided at the time of your |

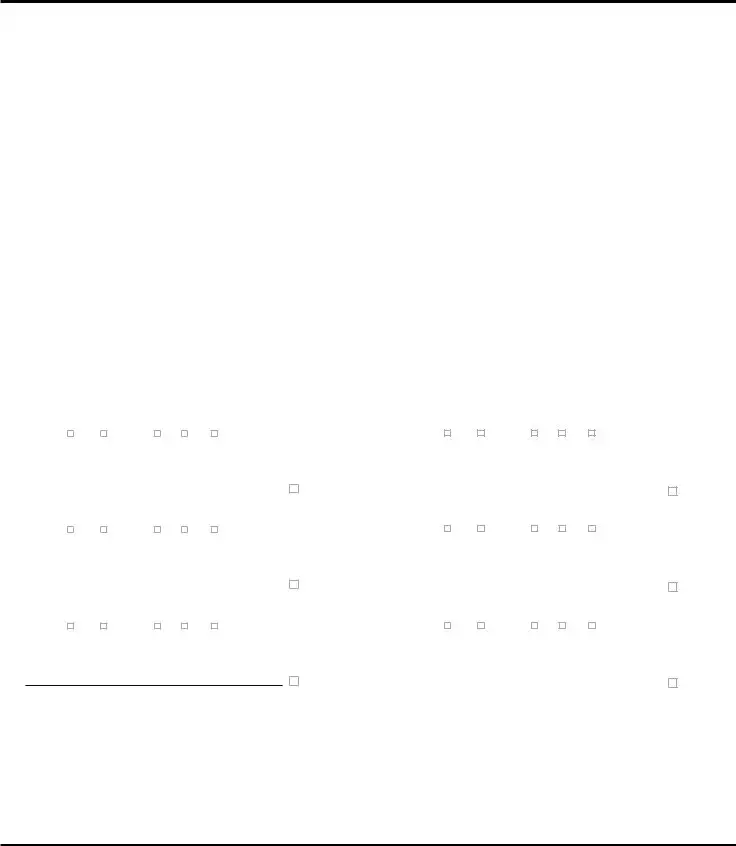

Correct

C  O

O  R

R R

R  E

E  C

C  T

T

3 /

3 /

6 / 1

6 / 1  9

9  8

8  2

2

EXAMPLES

Incorrect

I NCORRECT

NCORRECT

3 / 6 / 19 82

death |

As used here, “child” means either a biological child or a child adopted by the participant. It does not include your stepchild or foster child unless you have adopted the child. Nor does it include your biological child if that child has been adopted by someone other than your spouse.

“Parents” does not include stepparents who have not adopted you.

Making a valid designation. To name specific beneficiaries to receive your TSP account after you die, you must complete this form, and

it must be received by the TSP on or before the date of your death. Only a Form

You are responsible for ensuring that each page of your Form

Changing or canceling your designation of beneficiary. To cancel a Form

Keep your designation (and your beneficiaries’ addresses) current. It is a good idea to review how you have designated your beneficiaries from time to

By law, the TSP must pay your properly designated beneficiary under all circumstances. For example, if you designate your spouse as a beneficiary of your TSP account, that spouse will be entitled to death benefits, even if you are separated or divorced from that spouse and have remarried. This is true even if the spouse you designated gave up all rights to your TSP account(s). Consequently, if your life situation changes, you may want to file a new Form

Unless you designate a contingent beneficiary, the share of any primary beneficiary who dies before you do will be distributed proportionally among the surviving designated TSP beneficiaries. If none of your designated beneficiaries are alive at the time of your death, the statutory order of precedence will be followed.

Check the box that indicates whether you intend your beneficiary(ies) to receive funds from your civilian, uniformed services, or beneficiary participant account (i.e., an account inherited by the spouse of a deceased TSP participant). If you have a civilian and a uniformed services account and want to designate the same beneficiaries and shares for both accounts, check both boxes. To designate different beneficiaries for each account, you must submit two forms. If you have a civilian and/or uniformed services account in addition to a beneficiary participant account, you will need to complete an additional Form

If you have a foreign address, check the box to indicate this.

SECTION

Form

PREVIOUS EDITIONS OBSOLETE

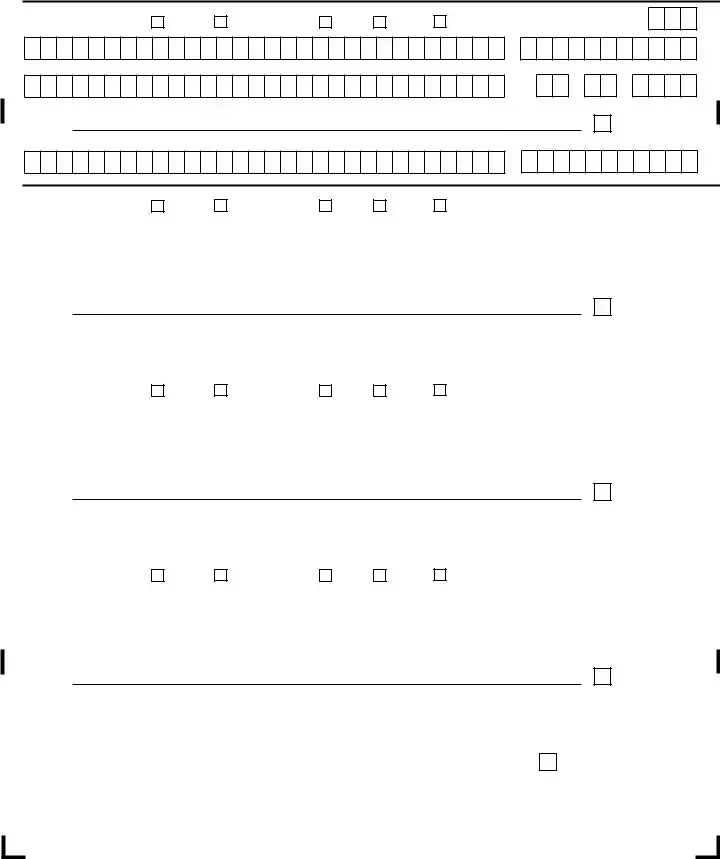

Name: |

TSP Account Number: |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Last, First, Middle)

ADDITIONAL PRIMARY BENEFICIARY DESIGNATIONS

Make a copy of this blank page to designate additional primary beneficiaries.

Relationship to you: |

|

Spouse |

Other Individual |

|

Trust |

|

Estate |

|

Legal Entity/Corporation |

|

Share: |

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Individual (Last, First, Middle)/Trust/Estate/Legal Entity or Corporation |

|

|

|

|

|

|

|

|

|

|

SSN/EIN/Tax ID |

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Name of Trustee/Executor (if applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of Birth (mm/dd/yyyy) |

|||||||||||||||||||||

%

Address:

Foreign address? Check here.

Relationship to you:

Spouse

Other Individual

Trust

Estate

Legal Entity/Corporation |

|

|

Share: |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SSN/EIN/Tax ID |

Name of Individual (Last, First, Middle)/Trust/Estate/Legal Entity or Corporation |

||||||||||||||||||||||||||||||

/

/

Name of Trustee/Executor (if applicable) |

Date of Birth (mm/dd/yyyy) |

Address:

Foreign address? Check here.

Relationship to you:

Spouse

Other Individual

Trust

Estate

Legal Entity/Corporation |

|

|

Share: |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SSN/EIN/Tax ID |

Name of Individual (Last, First, Middle)/Trust/Estate/Legal Entity or Corporation |

||||||||||||||||||||||||||||||

/

/

Name of Trustee/Executor (if applicable) |

Date of Birth (mm/dd/yyyy) |

Address:

Foreign address? Check here.

Relationship to you:

Spouse

Other Individual

Trust

Estate

Legal Entity/Corporation |

|

|

Share: |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SSN/EIN/Tax ID |

Name of Individual (Last, First, Middle)/Trust/Estate/Legal Entity or Corporation |

||||||||||||||||||||||||||||||

/

/

Name of Trustee/Executor (if applicable) |

Date of Birth (mm/dd/yyyy) |

Address:

Foreign address? Check here.

Relationship to you:

Spouse

Other Individual

Trust

Estate

Legal Entity/Corporation |

|

|

Share: |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SSN/EIN/Tax ID |

Name of Individual (Last, First, Middle)/Trust/Estate/Legal Entity or Corporation |

||||||||||||||||||||||||||||||

/

/

Name of Trustee/Executor (if applicable) |

Date of Birth (mm/dd/yyyy) |

Address:

Foreign address? Check here.

|

|

|

|

/ |

|

|

/ |

|

|

|

|

Participant Signature |

Date Signed (mm/dd/yyyy) |

||||||||||

|

|

|

/ |

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Check here if naming more primary beneficiaries. (See instructions for submitting additional pages.)

Witness Signature |

Date Signed (mm/dd/yyyy) |

|

|

Do Not Write In This Section |

FORM |

PREVIOUS EDITIONS OBSOLETE

FORM

SECTION

Enter the share for each beneficiary as a whole percentage. Percentages for the primary beneficiaries must total 100%. Do not use fractions or decimals.

To name a primary beneficiary:

•Check the box that indicates the beneficiary’s relationship to you.

•For each individual you designate, enter the full name, share, address, and date of birth or Social Security number (SSN) or other tax ID (such as an Employer Identification Number [EIN]).

•If the beneficiary is a trust, check the box marked “Trust.” Enter the name of the trust and the trustee’s name and address in the spaces indicated. Enter the EIN, if available. Leave the date of birth boxes blank. Note: Filling out this form will not create a trust; you must have a trust that is already established.

•If the beneficiary is your estate, check the box marked “Estate.” Enter the name of the estate and the executor’s name and address in the spaces indicated. Enter the EIN, if available. Leave the date of birth boxes blank.

•If the beneficiary is a legal entity or corporation, check the box marked “Legal Entity/Corporation.” Enter the name of the entity in the boxes indicated. Enter the legal representative’s name in the boxes marked “Trustee/Executor,” and provide the legal representative’s address. Enter the EIN, if known. Leave the date of birth boxes blank.

If you are naming more than 3 primary beneficiaries, use Page 2 of this form. Use photocopies of a blank Page 2 if you are naming more than that page allows. Enter your name and TSP account number on the top of each page, and follow the instructions for completing Section III. You must sign and date all additional pages. The same witness who signed Page 1 must also sign and date all pages that you submit to the TSP.

If you want to designate contingent beneficiaries, complete Section V on Page 3.

EXAMPLES. Below are examples of how to designate primary beneficiaries.

EXAMPLES OF DESIGNATING PRIMARY BENEFICIARIES

DESIGNATING MULTIPLE PRIMARY BENEFICIARIES

Relationship to you: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share: |

|

3 |

3 |

% |

|||||||||||||||

|

Spouse |

|

Other Individual |

|

Trust |

|

Estate |

Legal Entity/Corporation |

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

G |

R |

E |

E |

N |

W |

O |

O |

D |

|

A |

S |

H |

L |

E |

Y |

|

D |

A |

N |

I |

E |

L |

L |

E |

|

|

|

|

|

|

9 |

2 |

6 |

|

|

3 |

5 |

|

8 |

0 |

7 |

2 |

|

Name of Individual (Last, First, Middle)/Trust/Estate/Legal Entity or Corporation |

|

|

|

|

|

|

|

|

|

|

SSN/EIN/Tax ID |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

|

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

2 |

|

2 |

2 |

1 |

9 |

8 |

4 |

|

||

Name of Trustee/Executor (if applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of Birth (mm/dd/yyyy) |

|

|

|

|

||||||||||||||||||

Address: 1066 CHURCHILL LANE, TUCSON, AZ |

|

|

|

|

|

|

|

|

|

|

|

|

Foreign address? |

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Check here. |

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Relationship to you: |

|

Spouse |

|

Other Individual |

|

Trust |

|

Estate |

Legal Entity/Corporation |

Share: |

|

3 |

3 |

% |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

P |

O |

I |

N |

T |

E |

R |

|

M |

A |

R |

Y |

|

J |

A |

N |

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9 |

1 |

5 |

|

|

9 |

9 |

|

2 |

1 |

3 |

5 |

|

Name of Individual (Last, First, Middle)/Trust/Estate/Legal Entity or Corporation |

|

|

|

|

|

|

|

|

|

|

SSN/EIN/Tax ID |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

0 |

/ |

|

1 |

1 |

/ |

1 |

9 |

6 |

0 |

|

Name of Trustee/Executor (if applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of Birth (mm/dd/yyyy) |

|

|

|

|

||||||||||||||||||

Address: 21 NORTH LAKEWOOD DRIVE, NEW ORLEANS, LA |

|

|

Foreign address? |

||||||||||||||||||||||||||||||||||||||||

|

|

Check here. |

|||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Relationship to you: |

|

Spouse |

|

Other Individual |

|

Trust |

|

Estate |

Legal Entity/Corporation |

Share: |

|

3 |

4 |

% |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

J |

O |

H |

N |

S |

O |

N |

|

C |

H |

R |

I |

S |

T |

O |

P |

H |

E |

R |

|

A |

N |

D |

R |

E |

W |

|

|

|

|

|

9 |

0 |

2 |

|

|

3 |

7 |

|

6 |

6 |

3 |

3 |

|

Name of Individual (Last, First, Middle)/Trust/Estate/Legal Entity or Corporation |

|

|

|

|

|

|

|

|

|

|

SSN/EIN/Tax ID |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

/ |

|

1 |

3 |

/ |

1 |

9 |

9 |

1 |

|

Name of Trustee/Executor (if applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of Birth (mm/dd/yyyy) |

|

|

|

|

||||||||||||||||||

DESIGNATING A TRUST

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Relationship to you: |

|

Spouse |

|

Other Individual |

|

Trust |

Estate |

|

Legal Entity/Corporation |

|

Share: |

1 |

0 |

0 |

% |

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

J |

O |

H |

N |

|

P |

|

M |

|

A |

N |

O |

|

T |

R |

U |

S |

T |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Individual (Last, First, Middle)/Trust/Estate/Legal Entity or Corporation |

|

|

|

|

|

|

|

|

SSN/EIN/Tax ID |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

|

|

|

/ |

|

|

|

|

|

|

||

E |

R |

I |

C |

|

P |

|

M |

A |

N |

O |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Name of Trustee/Executor (if applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of Birth (mm/dd/yyyy) |

|

|

|

|

||||||||||||||||||||||

Address: 1111 DELAWARE LANE, NEW YORK, NY |

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign address? |

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Check here. |

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

DESIGNATING AN ESTATE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Relationship to you: |

|

Spouse |

|

Other Individual |

|

Trust |

Estate |

|

Legal Entity/Corporation |

|

Share: |

1 |

0 |

0 |

% |

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E |

S |

T |

A |

T |

E |

|

O |

F |

|

R |

U |

T |

H |

|

R |

|

J |

O |

N |

E |

S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Individual (Last, First, Middle)/Trust/Estate/Legal Entity or Corporation |

|

|

|

|

|

|

|

|

SSN/EIN/Tax ID |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

|

|

|

|

/ |

|

|

|

|

|

|

|

M |

A |

R |

L |

A |

|

M |

C |

C |

O |

Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Name of Trustee/Executor (if applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of Birth (mm/dd/yyyy) |

|

|

|

|

||||||||||||||||||||||

Address: 150 ROSSMOYNE DRIVE, ALAMEDA, CA |

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign address? |

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Check here. |

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

DESIGNATING A LEGAL ENTITY/CORPORATION |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Relationship to you: |

|

Spouse |

|

Other Individual |

|

Trust |

Estate |

|

Legal Entity/Corporation |

|

Share: |

1 |

0 |

0 |

% |

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

T |

H |

E |

|

X |

Y |

Z |

|

F |

O |

U |

N |

D |

A |

T |

I |

O |

N |

|

|

|

|

|

|

|

|

|

|

|

|

7 |

9 |

|

|

9 |

9 |

9 |

|

9 |

9 |

9 |

9 |

|

|

|||

Name of Individual (Last, First, Middle)/Trust/Estate/Legal Entity or Corporation |

|

|

|

|

|

|

|

|

SSN/EIN/Tax ID |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

E |

L |

E |

A |

N |

O |

R |

|

J |

A |

R |

V |

I |

S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

|

|

|

|

/ |

|

|

|

|

|

|

|

Name of Trustee/Executor (if applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of Birth (mm/dd/yyyy) |

|

|

|

|

||||||||||||||||||||||

Address: 1506 ARBOR ROAD, MIRAMAR, FL

Foreign address? |

Address: 64730 CONNECTICUT AVENUE, SUITE 240A, BETHESDA, MD |

Check here. |

Foreign address? Check here.

SECTION

PRIVACY ACT NOTICE. We are authorized to request the information you provide on this form under 5 U.S.C. chapter 84, Federal Employees Retirement System. We will use this information to identify your TSP account and to process your request. In addition, this information may be shared with other federal agencies for statistical, auditing,

or archiving purposes. We may share the information with law enforcement agencies investigating a violation of civil or criminal law, or agencies implementing a statute, rule,

or order. It may be shared with congressional offices, private sector audit firms, spouses, former spouses, and beneficiaries, and their attorneys. We may disclose relevant portions of the information to appropriate parties engaged in litigation and for other routine uses as specified in the Federal Register. You are not required by law to provide this information, but if you do not provide it, we will not be able to process your request.

Form

PREVIOUS EDITIONS OBSOLETE

|

|

Name: |

TSP Account Number: |

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Last, First, Middle) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

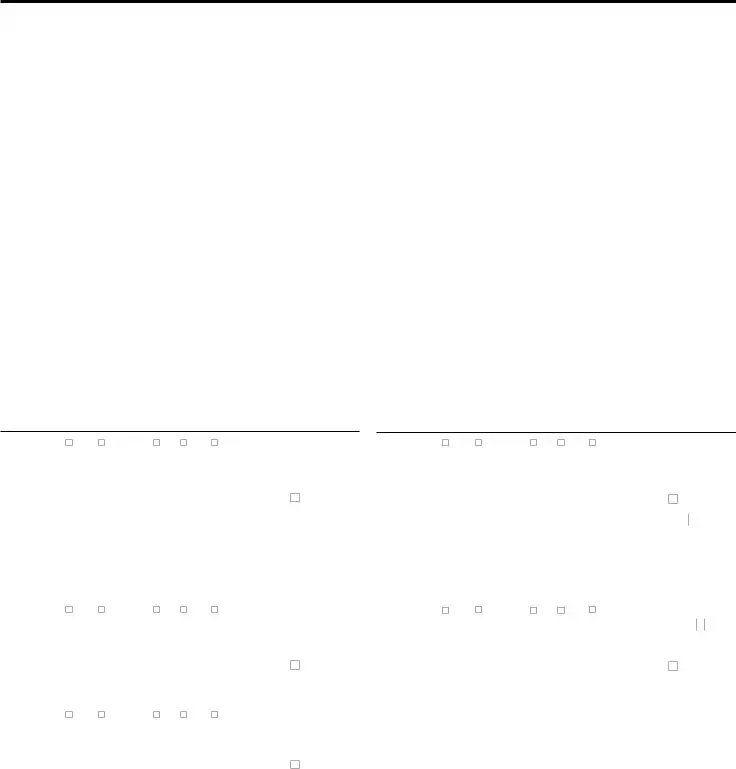

V. CONTINGENT BENEFICIARY DESIGNATIONS— |

ontingent beneficiary must be linked to a primary beneficiary. You |

||||||||||||||||||

cannot link a contingent beneficiary to another contingent beneficiary. Make a copy of this blank page to designate additional contingent beneficiaries. |

||||||

Relationship to you: |

Spouse |

Other Individual |

TrustEEstate |

Legal Entity/Corporation |

Share: |

% |

Relationship to you: |

Spouse |

Other Individual |

|

Trust |

|

Estate |

|

Legal Entity/Corporation |

|

Share: |

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Individual (Last, First, Middle)/Trust/Estate/Legal Entity or Corporation |

|

|

|

|

|

|

|

|

|

|

SSN/EIN/Tax ID |

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Name of Trustee/Executor (if applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of Birth (mm/dd/yyyy) |

|||||||||||||||||||||

%

Address:

Contingent to which primary beneficiary?

Foreign address? Check here.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name (Last, First, Middle)/Trust/Estate/Legal Entity or Corporation |

SSN/EIN/Tax ID or Date of Birth |

|

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Relationship to you: |

Spouse |

Other Individual |

|

Trust |

|

Estate |

|

Legal Entity/Corporation |

|

Share: |

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Individual (Last, First, Middle)/Trust/Estate/Legal Entity or Corporation |

|

|

|

|

|

|

|

|

|

|

SSN/EIN/Tax ID |

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Name of Trustee/Executor (if applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of Birth (mm/dd/yyyy) |

|||||||||||||||||||||

%

Address:

Contingent to which primary beneficiary?

Foreign address? Check here.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name (Last, First, Middle)/Trust/Estate/Legal Entity or Corporation |

SSN/EIN/Tax ID or Date of Birth |

|

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Relationship to you: |

Spouse |

Other Individual |

|

Trust |

|

Estate |

|

Legal Entity/Corporation |

|

Share: |

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Individual (Last, First, Middle)/Trust/Estate/Legal Entity or Corporation |

|

|

|

|

|

|

|

|

|

|

SSN/EIN/Tax ID |

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Name of Trustee/Executor (if applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of Birth (mm/dd/yyyy) |

|||||||||||||||||||||

%

Address:

Contingent to which primary beneficiary?

Foreign address? Check here.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name (Last, First, Middle)/Trust/Estate/Legal Entity or Corporation |

|

|

|

|

|

|

|

|

|

|

|

|

|

SSN/EIN/Tax ID or Date of Birth |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

|

|

/ |

|

|

|

|

|

|

|

|

Check here if naming more |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

contingent beneficiaries. (See |

|||||||||||

|

Participant Signature |

|

Date Signed (mm/dd/yyyy) |

|

|

|

|

|

|

|

instructions for submitting |

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

|

|

/ |

|

|

|

|

|

|

|

|

additional pages.) |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Witness Signature |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

Date Signed (mm/dd/yyyy) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Do Not Write In This Section |

|

|

|

|

|

|

|

|

|

|

FORM |

|||||||||||||||||||||||||||||||

PREVIOUS EDITIONS OBSOLETE

FORM

SECTION

ou are not naming contingent beneficiariesoee. You may tdesignate e one or more contingent beneficiaries for each primary beneficiary you name. The contingent beneficiary(ies) you name will receive the portion of the TSP account that you designated for a specific primary beneficiary who dies before you do.

Example: Joe Brown is one of your two primary beneficiaries, and his share is 30% of your account. If you designate Mary Brown and Sue Brown (Joe‘s daughters) as his contingent beneficiaries, and each is to get 50%, each would get 50% of Joe‘s portion. Since Joe’s share is 30% of your account, each will get 15% of your account. (You cannot designate contingent beneficiaries for contingent beneficiaries. In this case, you cannot designate contingent beneficiaries for Mary or Sue Brown.) For another example of this situation, see Example 2 below.

Check the box that indicates the contingent beneficiary’s relationship to you. If you are only naming one contingent beneficiary for a primary beneficiary, the share for that contingent beneficiary must be 100%. If you name more than one contingent beneficiary for a primary beneficiary, the combined share values for those contingent beneficiaries must equal 100%.

Provide the identifying information for contingent beneficiaries according to the instructions for designating primary beneficiaries

in Section III. For each contingent beneficiary you designate, enter the full name, share, address, and Social Security number (SSN) or other tax ID (such as Employer Identification Number [EIN]). If you do not have all the requested information, you must provide at least the contingent beneficiary’s name and share. You must also provide the primary beneficiary’s name and tax ID information (e.g., SSN or EIN, if available) or date of birth.

If you want to name the same contingent beneficiary for multiple primary beneficiaries, list your contingent beneficiary multiple times in order to link it to each primary beneficiary.

If you are naming more contingent beneficiaries than will fit on one page, photocopy a blank Page 3 of this form. Enter your name and TSP account number on the top of each page and follow the instructions for completing Section V. You must sign and date all additional pages. The same witness who signed Page 1 must also sign and date all pages that you submit to the TSP.

Note: If a named beneficiary dies, you may prefer to submit another Form

EXAMPLES. Below are examples of how to designate contingent beneficiaries.

EXAMPLES OF DESIGNATING CONTINGENT BENEFICIARIES

EXAMPLE 1

Relationship to you: |

Spouse Other Individual |

|

Trust |

Estate |

Legal Entity/Corporation |

Share: |

|

1 |

0 |

0 |

% |

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||

G |

R |

E |

|

E |

N |

W |

O |

O |

D |

|

T |

A |

Y |

L |

O |

R |

|

G |

R |

A |

C |

E |

|

|

|

|

|

|

|

|

|

9 |

7 |

4 |

|

|

0 |

2 |

|

3 |

|

9 |

4 |

|

1 |

|

||||||||||||||||

Name of Individual (Last, First, Middle)/Trust/Estate/Legal Entity or Corporation |

|

|

|

|

|

|

|

|

|

SSN/EIN/Tax ID |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

/ |

|

1 |

8 |

/ |

2 |

|

0 |

0 |

|

3 |

|

Name of Trustee/Executor (if applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of Birth (mm/dd/yyyy) |

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||

Address: 1066 CHURCHILL LANE, TUCSON, AZ |

|

|

|

|

|

|

|

|

|

|

|

|

Foreign address? |

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Check here. |

||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Contingent to which primary beneficiary? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

G |

R |

|

E |

|

|

E |

|

N |

|

W |

|

O |

|

O |

D |

|

|

|

A |

|

S |

|

H |

|

L |

|

E |

|

Y |

|

|

|

D |

A |

N |

I |

E |

L |

L |

E |

|

|

|

|

|

|

9 |

2 |

6 |

|

|

3 |

5 |

|

8 |

0 |

7 |

2 |

|

|||

Name (Last, First, Middle)/Trust/Estate/Legal Entity or Corporation |

|

|

|

|

|

|

|

|

|

|

|

|

|

SSN/EIN/Tax ID or Date of Birth |

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||

I, A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

T |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

EXAMPLE 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse Other Individual |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share: |

|

|

|

|

|

|

|||||||||||||||||||||

Relationship to you: |

|

Trust |

Estate |

Legal Entity/Corporation |

|

|

5 |

0 |

% |

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

H |

A |

L |

T |

|

R |

I |

C |

H |

A |

R |

D |

|

A |

L |

A |

N |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9 |

2 |

6 |

|

|

3 |

5 |

|

8 |

|

0 |

7 |

|

2 |

|

|||||||||||||||||

Name of Individual (Last, First, Middle)/Trust/Estate/Legal Entity or Corporation |

|

|

|

|

|

|

|

|

|

SSN/EIN/Tax ID |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

/ |

2 |

6 |

/ |

1 |

|

9 |

5 |

|

5 |

|

|

Name of Trustee/Executor (if applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of Birth (mm/dd/yyyy) |

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||

Address: 1492 ARIGOLD AENUE, ROCKLAWN, CA |

|

|

Foreign address? |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check here. |

|||||||

Contingent to which primary beneficiary? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

I |

N |

|

T |

|

E |

|

R |

|

|

|

A |

|

R |

Y |

|

|

|

A |

|

N |

|

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9 |

1 |

5 |

|

|

9 |

9 |

|

2 |

1 |

3 |

5 |

|

||||

Name (Last, First, Middle)/Trust/Estate/Legal Entity or Corporation |

|

|

|

|

|

|

|

|

|

|

|

|

|

SSN/EIN/Tax ID or Date of Birth |

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|