Fill Out Your Tsp 78 Form

The TSP-78 form plays a vital role for participants in the Thrift Savings Plan (TSP) by enabling them to manage their monthly disbursements effectively. Whether adjusting how funds are distributed or modifying tax withholdings, this form allows for immediate changes to be made, ensuring that participants can control their finances according to their evolving needs. It facilitates actions such as direct deposit setup or modifications, stops on current direct deposits, and stops on transfers of monthly payments to financial institutions. Users also have the opportunity to alter federal tax withholdings directly through this form, making it more convenient than having to fill out multiple documents. Crucially, the TSP-78 form requires participants to provide accurate information, such as their account details and personal data. Following the completion of specific sections, it is important to submit the form by the deadline set by the TSP, typically by December 15 for payment changes requested in the late fall. Additionally, copies should be kept for personal records to ensure clarity and accuracy in financial planning.

Tsp 78 Example

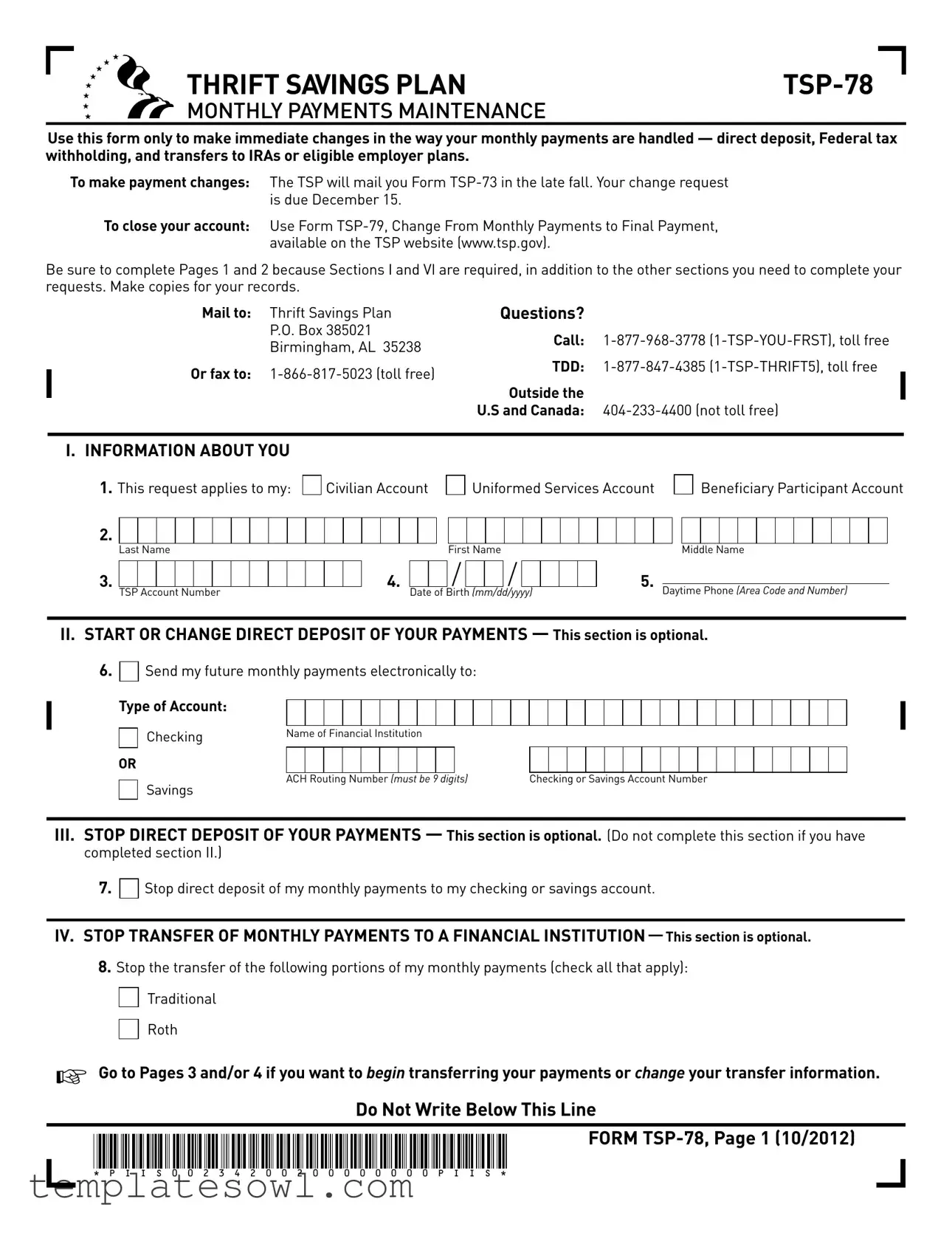

THRIFT SAVINGS PLAN |

MONTHLY PAYMENTS MAINTENANCE

Use this form only to make immediate changes in the way your monthly payments are handled — direct deposit, Federal tax withholding, and transfers to IRAs or eligible employer plans.

To make payment changes: The TSP will mail you Form

To close your account: Use Form

available on the TSP website (www.tsp.gov).

Be sure to complete Pages 1 and 2 because Sections I and VI are required, in addition to the other sections you need to complete your requests. Make copies for your records.

Mail to: |

Thrift Savings Plan |

Questions? |

|

|

|

P.O. Box 385021 |

call: |

||

|

Birmingham, AL 35238 |

|||

|

|

|

|

|

Or fax to: |

TDD: |

|||

|

|

|

||

|

|

Outside the |

|

|

|

|

U.S and canada: |

||

I. INFORMATION ABOUT YOU

1. This request applies to my: |

|

Civilian Account |

2.

Last Name

Uniformed Services Account

First Name

Beneficiary Participant Account

Middle Name

3.

TSP Account Number

4.

/

/

/

Date of Birth (mm/dd/yyyy)

5.

Daytime Phone (Area Code and Number)

II. START OR cHANGe DIRecT DePOSIT OF YOUR PAYMeNTS — This section is optional.

6. |

|

|

Send my future monthly payments electronically to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

Type of Account: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Checking |

Name of Financial Institution |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

Savings |

ACH Routing Number (must be 9 digits) |

|

|

Checking or Savings Account Number |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

III.STOP DIRecT DePOSIT OF YOUR PAYMeNTS — This section is optional. (Do not complete this section if you have completed section II.)

7.

Stop direct deposit of my monthly payments to my checking or savings account.

IV. STOP TRANSFeR OF MONTHLY PAYMeNTS TO A FINANcIAL

8.Stop the transfer of the following portions of my monthly payments (check all that apply):

Traditional

Roth

☞Go to Pages 3 and/or 4 if you want to begin transferring your payments or change your transfer information.

Do Not Write Below This Line

FORM

* P I I S 0 0 2 3 4 2 0 0 2 0 0 0 0 0 0 0 0 P I I S *

You must complete Sections I and VI on Pages 1 and 2. All other sections of this form are optional; complete only the sections that pertain to the changes you want to make in the handling of your TSP monthly payments.

Remember to keep the TSP informed of any change in your address, since the TSP will send any correspondence related to your account to your address of record. You can change your address at any time by logging into the My Account section of the TSP website (www.tsp.gov). You can also use Form

To ensure that your request is not delayed, carefully type or print the requested information inside the boxes using black or dark blue ink.

SecTION I. Information About You. Provide the requested information in Items

Direct Deposit Information

If you have not previously established direct deposit (electronic funds transfer, EFT) of your monthly payments, you can begin by providing bank account information in Section II.

If your monthly payments are currently going into your bank account by direct deposit and you want to change your bank account information, complete Section II.

If you want to stop receiving payments by direct deposit and receive checks mailed to your home, complete Section III.

Note: If you want to continue to receive payments by direct deposit and your bank account information has not changed, do not complete either section.

SecTION II. Start or change Direct Deposit. Check the box in Item 6 either to begin direct deposit of your payments, or to change your direct deposit information. Provide all of the requested information about your account. If you do not know the

Be sure your intentions are clear: If you are providing finan- cial institution information to start or change direct deposit of your monthly payments, remember to check the box in Item 6, but do not also check the box in Item 7. You would be provid- ing conflicting information that could cause your form to be rejected.

SecTION III. Stop Direct Deposit. Check the box in Item 7 if you want the TSP to stop sending your monthly payments via direct deposit to your checking or savings account. Do not provide any information in Section II. Once your form is pro- cessed, you will begin receiving your payments by check at your address of record.

Note: Only the portion of your payment that is not being trans- ferred to an IRA or eligible employer plan can be paid by direct deposit. If the TSP determines that the direct deposit informa- tion you provided is incomplete or invalid, your request will be processed, but you will receive your payment in the form of a check mailed to you.

SecTION IV. Stop Transfer of Monthly Payments. Complete this section only if you have already established transfer of your monthly payments to a traditional IRA, eligible employer plan, or Roth IRA, and you want to stop the transfers.

The transfer of the traditional and Roth portions of your ac- count balance are set up in separate transactions. Therefore, you must elect to stop transfers individually by type. Check the boxes that apply.

If you want to begin transfers, change the financial institution to which your transfers are sent, or change the percentage of your payments that is transferred, complete Page 3 and/or

Page 4.

PRIVAcY AcT NOTIce. We are authorized to request the information you provide on this form under 5 U.S.C. chapter 84, Federal Employees’ Retirement System. We will use this information to identify your TSP account and to process your request. In addition, this information may be shared with other Federal agencies for statistical, auditing, or archiving purposes. We may share the information with law enforcement agencies investigating a violation of civil or criminal law, or agencies implementing

a statute, rule, or order. It may be shared with congressional offices, private sector audit firms, spouses, former spouses, and beneficiaries, and their attorneys. We may disclose relevant portions of the information to appropriate parties engaged in litigation and for other routine uses as specified in the Federal Register. You are not required by law to provide this information, but if you do not provide it, we will not be able to process your request.

Form

Name: |

TSP Account Number: |

(Last, First, Middle)

V.FeDeRAL TAx

9.If your current monthly payment amount results in payments expected to last 10 years or more (120 payments or more), the TSP must withhold taxes on each payment as if you are a married person with 3 dependents, unless you indicate a different withholding choice below. (Note: Payments of this type are not eligible to be transferred to an IRA or eligible em- ployer plan.)

I want:

a. |

No withholding |

b.Withholding based on my marital status and withholding exemptions:

Single

Married

Married, but withhold at higher single rate

Allowances (Enter the total number. If zero, enter 0.)

c.

Withhold this additional dollar amount: $

,

.00 (Note: You must also complete Item 9b.)

10.If your current monthly payment amount results in payments expected to last less than 10 years (less than 120 payments), the TSP must withhold 20% of any taxable amount not transferred to a traditional IRA, eligible employer plan, or Roth IRA. Indicate any additional dollar amount you want the TSP to withhold from each monthly payment:

$ |

, |

.00 |

VI. ceRTIFIcATION AND

11.

Participant’s Signature

13.

12. /

/

/

/

Date Signed (mm/dd/yyyy)

Participant’s Address (We will use this address only to notify you if we cannot locate your account based on the information you provided on this form.)

If you are submitting direct deposit or transfer information on Pages 1, 3, or 4,

you must also have your signature notarized.

14.Notary: Please complete the following. No other acknowledgement is acceptable (see instructions).

The person who signed Item 11 is known to or was identified by me and, before me, signed or acknowledged to have

signed this form. In witness thereof, I have signed below on this |

|

day of |

|

, |

|

|

|

. |

|||

|

|

|

|

|

|

Month |

|

|

|

Year |

|

My commission expires: |

|

|

|

|

|

|

|

|

|

|

|

|

Date (mm/dd/yyyy) |

Notary’s Signature |

|

|

|

|

|

||||

|

|

|

|

|

|

|

( |

) |

|

||

|

|

|

|

|

|

|

|

||||

[seal] |

|

Notary’s Printed Name |

|

|

|

Notary’s Phone Number |

|||||

|

|

|

|

|

|

|

|

|

|

||

Jurisdiction

Go on to Pages 3 and/or 4 if you want to transfer your payments or change transfer information.

Do not write in this section. |

FORM |

SecTION V. Federal Tax Withholding. Complete this section if you want to change the standard Federal tax withholding for the taxable portion of your monthly payments. (There is no tax withholding on any

If you have chosen monthly payments that will last 10 years or more, the TSP will withhold taxes as if you are a married person with 3 dependents. However, you have other withhold- ing options:

–You may choose to have no withholding by checking the box in Item 9a.

OR

–You may change your withholding marital status and allowances by completing Item 9b. You may use

the IRS Withholding Calculator on the IRS website at www.irs.gov/individuals for help in determining how many withholding allowances to claim.

OR

–You may ask the TSP to withhold an additional amount by completing Item 9c. Note: If you request additional withholding, you must also check the box indicating your withholding marital status and the number of allowances you would like in Item 9b. You may use the IRS Withholding Calculator on the IRS website at www.irs.gov/individuals for help in determining how many withholding allowances to claim. If you do not complete Item 9b, your withdrawal will be processed as if you are a married person with 3 dependents.

Be aware that if you elect not to have Federal income tax withheld from your payments or if you do not have a sufficient amount withheld, you may be responsible for the payment of quarterly estimated taxes. Additionally, if any withholding amount and/or payments of quarterly estimated taxes are not sufficient, you may be subject to penalties under the IRS’ estimated tax rules.

For more information about estimated tax requirements and income tax penalties, refer to IRS Publication 505, Tax Withhold- ing and Estimated Tax. You may be able to avoid quarterly esti- mated tax payments by having enough tax withheld from your TSP payments using this form. You may use IRS Publication 919, How Do I Adjust My Tax Withholding?, to see how the dollar amount you are having withheld compares to your projected Federal income tax for the current year.

If you have chosen monthly payments that will last less than 10 years, the taxable portion of your payments that you do not transfer directly to an IRA or plan is subject to 20% mandatory Federal income tax withholding. For those amounts, you may request additional tax withholding by providing a whole dollar amount in the boxes provided in Item 10.

For more information about the tax implications of your with- drawal, read the TSP tax notices “Important Tax Information About Payments From Your TSP Account” and “Tax Information for TSP Participants Receiving Monthly Payments.”

This section is a substitute for IRS Form

If you include an IRS Form

If you complete this section incorrectly or choose a withhold- ing option that does not apply to your payments, and the rest of your form is completed correctly, your withdrawal will be pro- cessed using your withholding rate on file, or the required IRS withholding rates, if applicable.

SecTION VI: certiication and Notarization. Read the certifi- cation carefully; then sign and date the form in Items 11 and 12.

Please note that the address you provide in Item 13 will not be used to change your address in your TSP account record. It will only be used to notify you if we cannot locate your account based on the information you provided on this form. If you need to change your address, log into My Account on the TSP website or use Form

Your signature must be notarized if you are providing direct deposit or transfer information on Pages 1, 3, or 4; otherwise, your request will not be processed.

If you are only using the form to change your tax withholding, you do not need to have your signature notarized.

Because the form will be filed with a Federal agency in Wash- ington, D.C., the notary must complete the notarization in Item 14. No other acknowledgement is acceptable.

After you complete the form, make a copy for your records.

Mail the original to:

Thrift Savings Plan

P.O. Box 385021

Birmingham, AL 35238

Or fax to:

Note: Do not mail and fax your request. The TSP will automati- cally cancel the second request it receives. If you need to make a change or correction on your form, call the TSP to cancel your first request.

If you have questions, call the

Form

Name: |

TSP Account Number: |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Last, First, Middle)

This page is optional. You and the IRA trustee or plan administrator must complete this page if you want to transfer all or part of the traditional

VII. YOUR TRANSFeR eLecTION FOR TRADITIONAL

15.Transfer

.0% of the traditional

or to my current IRA or plan.

VIII. TRANSFeR INFORMATION FOR TRADITIONAL

16.Type of Account:

17.

Traditional IRA

Eligible Employer Plan

Roth IRA

IRA/Plan Account Number or Other Customer ID

18.

Check this box if

19.Provide the name and mailing address information below exactly as it should appear on the front of the check.

Make check payable to

If needed, use these boxes to supplement “check payable to” information above.

Street Address

–

City |

State |

Zip Code |

}The financial institution or plan will need to use this information to identify the account that will receive the transfer.

I confirm the accuracy of the information in this section and the identity of the individual named above. As a representative of the financial institution or plan to which the funds are being transferred, I certify that the financial institution or plan agrees to accept the funds directly from the Thrift Savings Plan and deposit them into the IRA or eligible employer plan identified above.

20.

Typed or Printed Name of Certifying Representative (Last, First, Middle)

21.

Signature of Certifying Representative

()

Daytime Phone (Area Code and Number)

22.

/

/

/

/

Date Signed (mm/dd/yyyy)

Do not write in this section. |

FORM |

General Information for Pages 3 and 4

You may elect to transfer all or part of your monthly payments to a traditional IRA, an eligible employer plan, or a Roth IRA. The type of plan to which you can transfer your payments depends on whether your payments consist of traditional

If you would like to transfer all or any part of the traditional

If you would like to transfer all or any part of the Roth portion of your payments to a Roth IRA or a Roth account maintained by an eligible employer plan, complete Page 4.

If your monthly payments consist of both traditional and Roth portions, and you would like to transfer all or any part of both portions of your payments, you must complete and submit Pages 3 and 4, even if both transfers are going to the same financial institution.

SecTION VII. You may transfer all or any part of the traditional

The taxable portion of payments that are not transferred directly to a traditional IRA, eligible employer plan, or Roth IRA are subject to mandatory 20% Federal income tax withhold- ing. (See Section V.) Read the TSP tax notices “Important Tax Information About Payments From Your TSP Account” and “Tax Information for TSP Participants Receiving Monthly Payments.”

SecTION VIII. If you choose to transfer all or any part of the traditional portion of your payments to a traditional IRA, eligible employer plan, or Roth IRA, your inancial institution or plan administrator must complete this section before you submit this form to the TSP (unless you are currently transferring traditional money and your inancial institution information has not changed).

Do not submit the transfer forms of inancial institutions or plans; the TSP cannot accept them.

The institution or plan to which the payment is to be transferred must be a trust established inside the United States (i.e., the 50 states and the District of Columbia).

The financial institution or plan should retain a copy of Page 3 to identify the account to which the check should be deposited when it is received. If the transfer is to a traditional IRA or Roth IRA, the institution accepting the transfer should submit Form 5498, IRA Contribution Information, to the IRS. The TSP will re- port all payments and transfers to you and to the IRS on Form

Information for the IRA or Plan: Complete Section VIII and re- turn this form to the participant identified at the top of the page. The financial institution or plan administrator must ensure that the account described here is a traditional IRA, eligible em- ployer plan, or Roth IRA.

Type of Account and Account Number. Indicate whether the transfer is to a traditional IRA, eligible employer plan, or Roth IRA in Item 16. In Item 17, enter the account number, if avail- able, of the IRA or plan to which the money is to be transferred. If an account number is not available, provide information that will help you identify the check when it is sent to you.

Transfer of

Name and Mailing Address. Provide the name and mailing address information in the boxes provided in Item 19 exactly as you want it to appear on the front of the transfer check. You will need to identify the account to which the transfer should be deposited from the information contained in these boxes.

The certifying representative must provide the requested information in Items

Form

Name: |

TSP Account Number: |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Last, First, Middle)

This page is optional. You and the IRA trustee or plan administrator must complete this page if you want to transfer all or part of the Roth portion of your payments to a Roth IRA or to a Roth account maintained by an eligible employer plan. Your Roth TSP balance consists of any employee contributions that you designated as Roth when you made your contribution election. Withdrawals of Roth contributions are

Ix. YOUR TRANSFeR eLecTION FOR ROTH

23.Transfer

.0% of the Roth portion of my payments to the IRA or plan identified in Section X, or to my

current IRA or plan.

x.TRANSFeR INFORMATION FOR ROTH

24.Type of Account:

25.

Roth IRA

Eligible Employer Plan — Roth Account

IRA/Plan Account Number or Other Customer ID

26.Provide the name and mailing address information below exactly as it should appear on the front of the check.

Make check payable to

If needed, use these boxes to supplement “check payable to” information above.

Street Address

–

City |

State |

Zip Code |

}The financial institution or plan will need to use this information to identify the account that will receive the transfer.

I confirm the accuracy of the information in this section and the identity of the individual named above. As a representative of the financial institution or plan to which the funds are being transferred, I certify that the financial institution or plan agrees to accept the funds directly from the Thrift Savings Plan and deposit them into the IRA or eligible employer plan identified above.

27.

Typed or Printed Name of Certifying Representative (Last, First, Middle)

28.

Signature of Certifying Representative

()

Daytime Phone (Area Code and Number)

29.

/

/

/

/

Date Signed (mm/dd/yyyy)

Do not write in this section. |

FORM |

General Information for Pages 3 and 4

You may elect to transfer all or part of your monthly payments to a traditional IRA, an eligible employer plan, or a Roth IRA. The type of plan to which you can transfer your payments depends on whether your payments consist of traditional

If you would like to transfer all or any part of the traditional

If you would like to transfer all or any part of the Roth portion of your payments to a Roth IRA or a Roth account maintained by an eligible employer plan, complete Page 4.

If your monthly payments consist of both traditional and Roth portions, and you would like to transfer all or any part of both portions of your payments, you must complete and submit Pages 3 and 4, even if both transfers are going to the same financial institution.

SecTION Ix. You may transfer all or any part of the Roth portion of your payments to a Roth IRA or a Roth account maintained by an eligible employer plan. Enter a percentage between 1 and 100% in Item 23. Do not enter decimals or a percentage over 100%.

Roth contributions are not subject to mandatory Federal income tax withholding because they are not taxable upon distribution. However, if you have not met the conditions neces- sary for your Roth earnings to be qualified (i.e., paid

Read the TSP tax notices “Important Tax Information About Payments From Your TSP Account” and “Tax Information for TSP Participants Receiving Monthly Payments.”

SecTION x. If you choose to transfer all or any part of the Roth portion of your payments to a Roth IRA or a Roth account main- tained by an eligible employer plan, your inancial institution or plan administrator must complete this section before you submit this form to the TSP (unless you are currently trans- ferring Roth money and your inancial institution information has not changed).

Do not submit transfer forms of inancial institutions or plans; the TSP cannot accept them.

The institution or plan to which the payment is to be trans- ferred must be a trust established inside the United States (i.e., the 50 states and the District of Columbia).

The financial institution or plan should retain a copy of Page 4 to identify the account to which the check should be deposited when it is received. If the transfer is to a Roth IRA, the insti- tution accepting the transfer should submit Form 5498, IRA Contribution Information, to the IRS. The TSP will report all payments and transfers to you and to the IRS on Form

Information for the IRA or Plan: Complete Section X and re- turn this form to the participant identified at the top of the page. The financial institution or plan administrator must ensure that the account described here is a Roth IRA or a Roth account maintained by an eligible employer plan.

Type of Account and Account Number. Indicate whether the transfer is to a Roth IRA or to a Roth account maintained by an eligible employer plan in Item 24. In Item 25, enter the account number, if available, of the IRA or plan to which the money is to be transferred. If an account number is not available, provide information that will help you identify the check when it is sent to you.

Name and Mailing Address. Provide the name and mailing address information in the boxes provided in Item 26 exactly as you want it to appear on the front of the transfer check. You will need to identify the account to which the transfer should be deposited from the information contained in these boxes.

The certifying representative must provide the requested information in Items

Form

Form Characteristics

| Fact Name | Detail |

|---|---|

| Purpose | The TSP-78 form is used for making immediate changes to monthly payments from the Thrift Savings Plan, including direct deposit and federal tax withholding. |

| Submission Deadline | Change requests using the TSP-78 form are due by December 15 of each year. |

| Account Closure | To close a TSP account, participants must use Form TSP-79 instead of TSP-78. |

| Notarization Requirement | If the form requests changes to direct deposit or transfer information, notarization of the participant's signature is required. |

| Direct Deposit Options | Participants can initiate or change direct deposit for monthly payments by providing account details on the form. |

| Federal Tax Withholding | The form allows participants to change federal tax withholding for monthly payments; this section is optional. |

| Contact Information | Participants can reach the Thrift Savings Plan for questions at 1-877-968-3778, or by mail at P.O. Box 385021, Birmingham, AL 35238. |

Guidelines on Utilizing Tsp 78

After you have received the TSP-78 form, it’s important to fill it out accurately to ensure your desired changes to monthly payments are processed correctly. Make sure to complete all relevant sections and have your signature notarized if necessary. Keep a copy for your records before submitting the form.

- Gather Required Information: Have your TSP Account Number, personal identification details, and contact information on hand.

- Complete Section I: Fill in your name, TSP account type, account number, date of birth, and daytime phone number.

- Fill Out Direct Deposit Information (if applicable): If you want to start or change direct deposit, complete Section II with your new bank account details.

- Stop Direct Deposit (if applicable): If you wish to stop direct deposit, check the box in Section III. Do not fill out Section II in this case.

- Stop Transfers (if applicable): In Section IV, indicate any transfers you want to stop by checking the appropriate boxes.

- Federal Tax Withholding: Complete Section V to change tax withholding. Make sure to select options based on how long you expect to receive payments.

- Sign the Form: In Section VI, certify that all information is true by signing and dating the form. Ensure the address provided is correct for future correspondence.

- Notarization: If you filled out direct deposit or transfer information on Pages 1, 3, or 4, have your signature notarized.

- Make Copies: Before mailing, make copies of the completed form for your personal records.

- Submit the Form: Mail the original to the address provided for the TSP or fax it, but do not do both to avoid cancellation.

Following these steps will help to ensure that your changes to the TSP monthly payments are processed smoothly. If there are any questions or concerns while filling out the form, assistance can be obtained through the TSP contact details provided on the form.

What You Should Know About This Form

What is the TSP-78 form used for?

The TSP-78 form is specifically designed to facilitate immediate changes to how participants receive their monthly payments from the Thrift Savings Plan (TSP). It covers various payment management aspects, including direct deposits, federal tax withholding adjustments, and transfers to Individual Retirement Accounts (IRAs) or eligible employer plans.

Who should use the TSP-78 form?

This form is intended for TSP participants who want to modify their payment setups, either for their civilian or uniformed services accounts. Beneficiaries of participants can also use the form to manage their payments. If you need to address changes regarding monthly payment distribution, this form is applicable.

How do I initiate changes to my direct deposit using the TSP-78?

To start or change direct deposit of your monthly payments, complete Section II on the form. You will need to provide your bank account information, including the account type (checking or savings), the name of the financial institution, and the ACH routing number. Ensure that the information is accurate to avoid delays or payment issues.

What do I do if I want to stop direct deposit of my TSP payments?

To stop the direct deposit of your monthly payments, you must complete Section III of the TSP-78 form. Do not fill out Section II if you are stopping your direct deposit. Upon processing, future payments will be sent as checks to the address on your file.

Can I change the federal tax withholding for my TSP payments using this form?

Yes, the TSP-78 allows you to change federal tax withholding by completing Section V. Indicate your marital status, the number of allowances, and any additional amount you want withheld. If your payments are expected to last for less than ten years, the form provides specific instructions for mandatory withholding requirements.

What if I want to close my TSP account?

To close your TSP account, you should use the TSP-79 form instead, which is focused on account closure. You can obtain this form from the TSP website. Remember that completing the TSP-78 does not allow account closure; it strictly manages payment alterations.

How should I submit the TSP-78 form once completed?

After thoroughly completing the TSP-78 form, make sure to keep a copy for your records. Send the original to the Thrift Savings Plan at P.O. Box 385021, Birmingham, AL 35238. You may also fax it to 1-866-817-5023. However, do not mail and fax the form simultaneously, as this may lead to cancellation of your requests.

What happens if I need assistance while filling out the TSP-78 form?

If you have questions during the completion of the form, you can call the TSP toll-free at 1-877-968-3778 (1-TSP-YOU-FRST). They provide resources and support for participants to navigate their form submissions, ensuring that changes to payment arrangements are handled efficiently.

Common mistakes

Completing the TSP-78 form requires attention to detail, and errors can lead to delays or rejected requests. One common mistake is failing to fill out all required sections. Sections I and VI must be completed, while other sections are optional. Neglecting to fill in these sections often results in the form being rejected or returned for corrections.

Another frequent error occurs when individuals check multiple options that contradict one another. For instance, someone might check both the boxes to start direct deposit and to stop it. This inconsistency confuses the processing staff and can lead to delays. It is essential to ensure that the information provided is congruent and clear.

Many people also overlook the importance of providing accurate bank account information in Section II. Failing to include the correct ACH routing number or account number can prevent direct deposits from occurring. Always double-check these details to avoid unnecessary setbacks.

A mistake that some may make is misunderstanding the tax withholding options in Section V. Not knowing whether payments will last ten years or more can lead to selecting the wrong withholding option. This miscalculation can have financial implications later, so be sure to use the Monthly Payment Calculator available on the TSP website to make an informed choice.

In addition, submitting the form without a notarized signature when required leads to invalidation. If the request includes direct deposit information or transfer requests, notarization is mandatory. Skipping this step can frustrate the process and extend waiting times for responses.

Furthermore, individuals often fail to keep a copy of the submitted form for their records. This oversight can create challenges if there are discrepancies or issues that arise later. Keeping a copy ensures that one has a reference point and can follow up as needed.

Another issue arises when the address provided on the form does not match the TSP records. If there are any changes in residence, the participant must update their address through the TSP website or by using Form TSP-9. Mismatched addresses can cause communication problems and affect monthly payments.

Lastly, individuals sometimes rush through the process. Taking extra time to review the entire form before submitting can help catch any mistakes. A thorough review minimizes errors and streamlines the processing of the TSP-78 form.

Documents used along the form

The TSP-78 form is an essential document for participants in the Thrift Savings Plan (TSP) who are looking to manage how their monthly payments are distributed. When utilizing the TSP-78, a few additional forms may also be required or helpful in completing your financial management tasks. Here are six documents that are often used alongside the TSP-78 form:

- TSP-79 - Change From Monthly Payments to Final Payment: This form allows account holders to transition from monthly payments to a final payment. For those who have decided that they no longer want to receive monthly distributions, this form is crucial for closing out their accounts.

- TSP-9 - Change in Address for Separated Participants: If you’ve moved or need to change your contact information, this form updates your address in the TSP records. Keeping your address current ensures you receive important account communications.

- TSP-73 - Request for a Withdrawal: This is the form you will receive from the TSP after submitting your request using the TSP-78. It is specifically for those looking to initiate a withdrawal from their TSP account.

- TSP-50 - Investment Allocation: If you're looking to change how your TSP balance is invested, the TSP-50 allows participants to select or change their investment allocations for future contributions, which is relevant before or after adjustments in monthly payments.

- IRS Form W-4P - Withholding Certificate for Pension and Annuity Payments: While Form TSP-78 includes a section for tax withholding changes, some individuals may also choose to submit the W-4P for more detailed tax management, especially if they have complex tax situations.

- IRS Form 8606 - Nondeductible IRAs: If you intend to roll over funds to a Roth IRA, this form documents your contributions that may not be tax-deductible, ensuring proper reporting to the IRS and avoiding double taxation on those funds.

Utilizing the appropriate forms alongside the TSP-78 enhances your control over monthly payments and ensures compliance with TSP requirements and IRS regulations. As you navigate your options, being aware of these additional documents can streamline the process and help you make informed decisions regarding your retirement assets.

Similar forms

The TSP-78 form is critical for participants in the Thrift Savings Plan when they need to modify their monthly payments. Several other forms share similar purposes, structure, or functions. Here are five documents that are comparable to the TSP-78 form:

- Form TSP-70: Like the TSP-78, the TSP-70 is used for requests related to withdrawals from your TSP account. Both forms require personal information and specify how funds should be distributed; however, TSP-70 is dedicated to one-time lump-sum withdrawals rather than ongoing monthly payments.

- Form TSP-79: This form is also related to changes in the payment structure, specifically for switching from monthly payments to a final payment. While the TSP-78 alters the existing monthly payment process, the TSP-79 focuses on terminating that process entirely and receiving a lump sum instead.

- Form TSP-9: This document is used to change a participant’s address. While the TSP-78 can indirectly address participant information, TSP-9 is entirely focused on ensuring all correspondence and account details are updated with the correct address, essential for effective communication.

- IRS Form W-4P: Similar to the Federal Tax Withholding section of TSP-78, this form determines the amount of federal tax withheld from pension-related payments. Both documents serve to adjust tax withholding preferences, providing vital tax information to the entities managing the funds.

- Form TSP-60: This form concerns the transfer of your TSP funds to another retirement account, such as an IRA. While the TSP-78 includes a section on stopping payments that may transfer funds, TSP-60 manages the actual transfer logistics, catering to those looking to shift their retirement savings without any payments being processed.

Dos and Don'ts

Do's and Don'ts when filling out the TSP-78 form:

- Do: Complete Sections I and VI, as they are mandatory.

- Do: Use black or dark blue ink to clearly type or print your responses.

- Do: Double-check all provided information for accuracy before submission.

- Do: Make copies of the completed form for your records.

- Do: Submit only one form per account; use separate forms for multiple accounts.

- Don't: Skip any required sections, as incomplete forms may delay processing.

- Don't: Mix direct deposit and stop payment requests; clarify your intentions in the appropriate sections.

- Don't: Forget to have your signature notarized if submitting direct deposit or transfer information.

- Don't: Submit both a mailed and faxed version of your request; it will lead to cancellation of the second submission.

- Don't: Ignore the guidelines for federal tax withholding unless you are familiar with them.

Misconceptions

- Misconception 1: The TSP-78 form is only for closing an account.

- Misconception 2: You must fill out every section of the TSP-78 form.

- Misconception 3: If I want to stop direct deposit, I need to complete both Sections II and III.

- Misconception 4: There’s no need for notarization unless closing my account.

- Misconception 5: You cannot change your direct deposit after submitting the TSP-78 form.

- Misconception 6: All forms must be mailed to the same address.

- Misconception 7: You need to keep old versions of the TSP-78 form for your records.

- Misconception 8: The TSP cannot provide assistance with completing the form.

- Misconception 9: Submitting a TSP-78 form guarantees the changes will be effective immediately.

This form serves multiple purposes, including making changes to how monthly payments are disbursed, setting up direct deposits, and modifying tax withholding. It's not solely about account closure, which is actually managed through the TSP-79 form.

Contrary to popular belief, only Sections I and VI are mandatory. The other sections are optional and should be completed only if they are applicable to the changes you wish to make.

This is incorrect. If you wish to stop direct deposit, you should only complete Section III. Filling out Section II may cause confusion and potentially delay your request.

This is not true. A notarization is required for any information submitted that pertains to direct deposits or transfers. If you're only changing your tax withholding, notarization is not necessary.

On the contrary, individuals can modify their direct deposit information at any time by submitting a new TSP-78 form, as long as they adhere to the requirements in the instructions.

This is a common error. The TSP-78 form can be faxed or mailed to the designated address. However, you should not submit multiple requests via both mail and fax, as the TSP will automatically cancel the second request.

It's essential to retain a copy of the specific form you submitted, but you do not need to keep outdated versions. Only the updated and relevant submissions need to be kept for your records.

In fact, TSP representatives are available to help answer questions or provide clarification. If uncertainties arise while filling out the form, contacting TSP for guidance is encouraged.

While the TSP strives to process requests efficiently, immediate changes are not always guaranteed. Processing times may vary, and individuals should plan accordingly.

Key takeaways

Here are some essential points to keep in mind when filling out and using the TSP-78 form:

- Type of Account Matters: Make sure you indicate whether your request applies to your Civilian Account, Uniformed Services Account, or Beneficiary Participant Account. Each account requires a separate form for any changes.

- Direct Deposit Preferences: Include your banking details in Section II if you are starting or changing direct deposit. Remember, if you opt to stop direct deposit, you shouldn't fill out this section as it could lead to confusion in processing your request.

- Tax Withholding Information: If you want to modify Federal tax withholding for your monthly payments, complete Section V. The withholding options depend on how long your payments are expected to last, so be sure to consult resources like the TSP Monthly Payment Calculator for accuracy.

- Ensure Notarization if Necessary: Signature notarization is required if you are providing direct deposit or transfer information. If you only wish to change tax withholding, notarization is not necessary. To protect your interests, double-check all sections you fill out before submitting.

Browse Other Templates

Access Transit Los Angeles - Indicate your current travel methods to inform your eligibility assessment.

How to Pay Llc Fee Online - Member consent is crucial for single-member LLCs to comply with state tax obligations.

Clearinghouse Transcripts - Be sure to specify if you did not find your desired major at CNU when filling out the reasons section.