Fill Out Your Tutti Frutti Application Form

The Tutti Frutti Application form is an essential document for individuals engaging in private vehicle transactions in Illinois. This form provides critical guidance on the Illinois Private Party Vehicle Use Tax, effective for transactions occurring from January 1, 2016, through December 31, 2016. Key to this process is understanding that the tax due is determined by the vehicle’s purchase price or its fair market value, compelling applicants to refer to specific tax tables—Table A and Table B—to ascertain the exact amount owed based on the vehicle's age or value. For vehicles valued under $15,000, Table A outlines tax rates that decrease with the vehicle's age, while Table B addresses transactions involving vehicles priced at $15,000 or higher, establishing a fixed structure for tax obligations. Furthermore, certain transactions may qualify for exemptions or exceptions, such as purchases by tax-exempt organizations or transfers made within family relationships, ultimately potentially reducing the tax due or eliminating it altogether in specified circumstances. Notably, the application also addresses the special considerations surrounding motorcycles and all-terrain vehicles, offering a flat tax rate to streamline the process for these particular vehicles. Understanding these aspects is crucial for applicants to ensure compliance and avoid unexpected liabilities.

Tutti Frutti Application Example

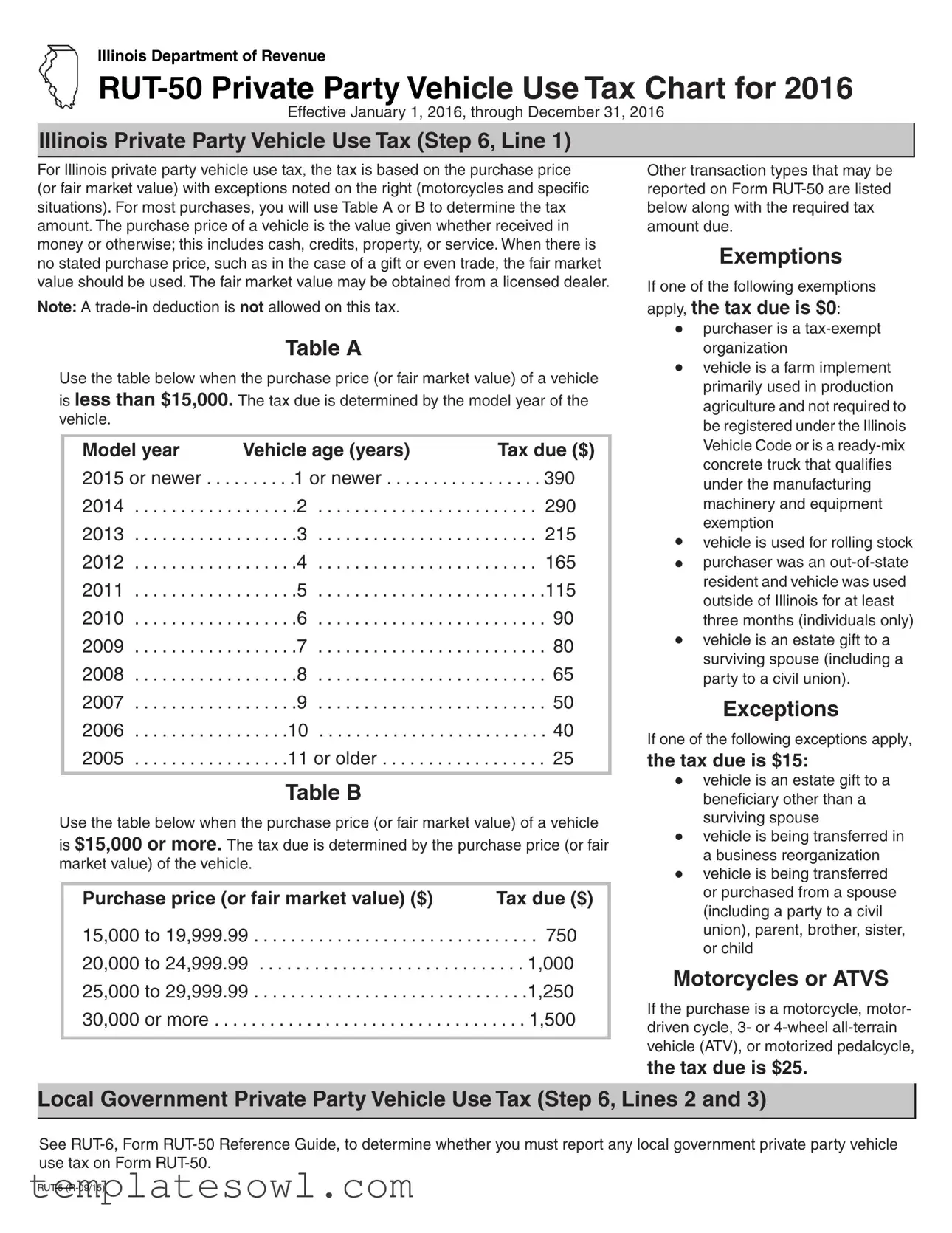

Illinois Department of Revenue

Effective January 1, 2016, through December 31, 2016

Illinois Private Party Vehicle Use Tax (Step 6, Line 1)

For Illinois private party vehicle use tax, the tax is based on the purchase price (or fair market value) with exceptions noted on the right (motorcycles and specific situations). For most purchases, you will use Table A or B to determine the tax amount. The purchase price of a vehicle is the value given whether received in money or otherwise; this includes cash, credits, property, or service. When there is no stated purchase price, such as in the case of a gift or even trade, the fair market value should be used. The fair market value may be obtained from a licensed dealer.

Other transaction types that may be reported on Form

Exemptions

If one of the following exemptions

Note: A

Table A

Use the table below when the purchase price (or fair market value) of a vehicle is less than $15,000. The tax due is determined by the model year of the vehicle.

Model year |

Vehicle age (years) |

Tax due ($) |

2015 or newer . . . . |

. . . . . .1 or newer |

. . . . . 390 |

2014 |

. . . . . .2 |

. . . . 290 |

2013 |

. . . . . .3 |

. . . . 215 |

2012 |

. . . . . .4 |

. . . . 165 |

2011 |

. . . . . .5 |

. . . . .115 |

2010 |

. . . . . .6 |

. . . . . 90 |

2009 |

. . . . . .7 |

. . . . . 80 |

2008 |

. . . . . .8 |

. . . . . 65 |

2007 |

. . . . . .9 |

. . . . . 50 |

2006 |

. . . . .10 |

. . . . . 40 |

2005 |

. . . . .11 or older |

. . . . . 25 |

|

|

|

Table B

Use the table below when the purchase price (or fair market value) of a vehicle is $15,000 or more. The tax due is determined by the purchase price (or fair market value) of the vehicle.

Purchase price (or fair market value) ($) |

Tax due ($) |

15,000 to 19,999.99 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 750 20,000 to 24,999.99 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,000 25,000 to 29,999.99 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .1,250 30,000 or more . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,500

apply, the tax due is $0:

•purchaser is a

•vehicle is a farm implement primarily used in production agriculture and not required to be registered under the Illinois Vehicle Code or is a

•vehicle is used for rolling stock

•purchaser was an

•vehicle is an estate gift to a surviving spouse (including a party to a civil union).

Exceptions

If one of the following exceptions apply,

the tax due is $15:

•vehicle is an estate gift to a beneficiary other than a surviving spouse

•vehicle is being transferred in a business reorganization

•vehicle is being transferred or purchased from a spouse (including a party to a civil union), parent, brother, sister, or child

Motorcycles or ATVS

If the purchase is a motorcycle, motor- driven cycle, 3- or 4‑wheel

the tax due is $25.

Local Government Private Party Vehicle Use Tax (Step 6, Lines 2 and 3)

See

Form Characteristics

| Fact Name | Description |

|---|---|

| Governing Laws | This form is governed by the laws of the State of Illinois. |

| Effective Dates | The form is effective from January 1, 2016, through December 31, 2016. |

| Tax Basis | The tax is based on the purchase price or fair market value of the vehicle. |

| Exemptions | Several exemptions exist, including tax-exempt organizations and certain agricultural vehicles. |

| Tax Tables | Two tables (A and B) are provided to determine tax amounts based on vehicle value and model year. |

| Trade-In Deductions | No trade-in deductions are allowed for this particular tax. |

| Motorcycle Tax | The tax for motorcycles or ATVs is a flat fee of $25 regardless of other conditions. |

| Local Government Tax | Local government vehicle use tax may also apply; refer to RUT-6 for details. |

Guidelines on Utilizing Tutti Frutti Application

The Tutti Frutti Application form requires you to provide specific information related to your vehicle purchase and applicable taxes. Completing this form correctly is essential for proper tax assessment and exemption eligibility. Follow the steps outlined below to ensure your application is filled out accurately.

- Begin by entering your personal information at the top of the form, including your name, address, and phone number.

- Provide details about the vehicle you purchased. Include the make, model, year, and identification number (VIN).

- Next, specify the purchase price of the vehicle or its fair market value if applicable. Refer to the guidelines for the appropriate method of valuation.

- Determine the applicable tax rate using either Table A or Table B, depending on whether the purchase price is below or above $15,000.

- If exemptions apply, indicate them by checking the corresponding boxes noted on the form.

- For motorcycles or ATVs, ensure you input the appropriate tax amount of $25 if that applies to your purchase.

- Review all entered information carefully to ensure accuracy and completeness.

- Finally, sign and date the form before submission to the relevant tax authority.

Once the form is completed and submitted, you may receive further instructions or confirmation regarding your tax assessment and any potential exemptions. Keep a copy of the submitted form for your records.

What You Should Know About This Form

What is the Tutti Frutti Application Form?

The Tutti Frutti Application Form is a specific form designated by the Illinois Department of Revenue for taxpayers who need to report private party vehicle use tax. This form ensures that individuals purchasing vehicles understand their obligations regarding tax payments based on their purchase price or fair market value of a vehicle.

How do I determine the tax amount I owe?

Determining the tax amount involves referencing two tables provided within the form. If the purchase price or fair market value of your vehicle is under $15,000, Table A applies, detailing tax amounts based on the vehicle's model year. For vehicles valued at $15,000 or more, Table B should be used, which outlines tax due based on specific price ranges. Always ensure the purchase price is correctly identified, as it influences the tax calculation.

What if I received the vehicle as a gift?

If you received the vehicle as a gift, you should still assess its fair market value. In situations where there isn't a stated purchase price, the fair market value must be utilized when calculating the tax due. This value can typically be confirmed through a licensed dealer or a reliable source.

Are there any exemptions from paying the vehicle use tax?

Yes, certain exemptions exist. For example, if the purchaser is a tax-exempt organization, or if the vehicle primarily serves agricultural purposes and isn't required to be registered under the Illinois Vehicle Code, tax may not be due. Other exemptions apply to specific transfers, such as an estate gift to a surviving spouse or a vehicle used outside Illinois for several months.

What exceptions reduce the tax due to $15?

In particular situations, the tax due can be minimized to $15. These include instances where the vehicle is gifted to someone other than a surviving spouse, transferred during a business reorganization, or transferred between close relatives, including a spouse, parent, sibling, or child.

Is there a specific tax amount for motorcycles or ATVs?

Indeed, if the vehicle in question is a motorcycle, motor-driven cycle, ATV, or motorized pedalcycle, the established tax due is a flat fee of $25, regardless of the vehicle's monetary value. This simplified approach recognizes the different regulatory context of these vehicles.

What local taxes might I need to report on Form RUT-50?

Report any local government private party vehicle use taxes by consulting the RUT-6 and Form RUT-50 Reference Guide. The requirements can vary by locality; thus, it is critical to check whether any additional local taxes apply to your situation, ensuring full compliance.

What should I do if I have not filed the form on time?

If the form has not been submitted on time, consider filing it as soon as possible. Even if late, it is better to fulfill reporting obligations to avoid accumulating penalties. Provided your return includes accurate information, the department is generally understanding, but timely filing is always encouraged to mitigate any potential issues.

Where can I find assistance with completing the Tutti Frutti Application Form?

Helping hands are available through the Illinois Department of Revenue's website, where you can access resources, guidelines, and contact information. Additionally, seeking advice from a tax professional can further enhance your understanding of the process and provide tailored advice based on your circumstances.

Common mistakes

Filling out the Tutti Frutti Application form can be straightforward, but many people make common mistakes that can lead to delays or issues with their application. One frequent error occurs when applicants neglect to accurately report the purchase price or fair market value of the vehicle. It’s essential to understand that any value given, whether in cash, credits, property, or services, counts towards this figure. If this value is excluded or incorrectly estimated, it could affect the tax amount owed.

Another common mistake is misunderstanding the exemptions. Certain vehicles and purchasers may qualify for exemption from the vehicle use tax, yet applicants often overlook these critical details. For instance, if the purchaser is a tax-exempt organization or if the vehicle is a farm implement used in agriculture, the tax may be $0. Misapplying these exemptions can lead to unnecessary payments or complications in the processing of the form.

Completing the tables provided in the form is crucial, and many applicants fail to do so accurately. For vehicles valued below $15,000, the applicant needs to use Table A, while Table B is for those with a fair market value of $15,000 or more. Miscounting or selecting the wrong table may result in calculating an incorrect tax due, which can complicate the submission of the application.

Additionally, applicants sometimes forget to include information about vehicle types that have specific tax amounts. For example, motorcycles and ATVs incur a flat tax, but failing to mention that the vehicle falls into this category can lead to an incorrect tax amount and potentially a delay in processing. This detail is often overlooked and can cause confusion.

Finally, ensuring all sections of the form are complete is vital. Incomplete applications may be returned or delayed. Each line requires careful attention, from contact details to tax calculations. Leaving blank spaces or failing to double-check the information can hinder the process, leading to frustration and possible penalties down the line.

Documents used along the form

When applying for vehicle use tax in Illinois, the Tutti Frutti Application form is often used alongside other important documents. Each of these forms plays a vital role in ensuring that your application is complete and accurate. Below is a list of the key forms and documents related to the application.

- Form RUT-50: This form is the primary document used to report private party vehicle use tax. It includes detailed tables to help you calculate the correct tax amount based on the vehicle's purchase price or fair market value.

- RUT-6: This reference guide assists taxpayers in identifying local government vehicle use taxes that may be applicable. It outlines the specific circumstances under which a local tax must be reported.

- Dealer Invoice: If you purchased a vehicle from a dealer, the invoice is essential. It provides proof of the purchase price, helping to determine the correct tax liability.

- Title Transfer Document: This document is necessary for proving ownership transfer during a sale. It helps establish the vehicle's previous status and aids in tax calculations.

- Exemption Certificates: If your purchase qualifies for tax exemptions, these certificates must be included. They verify that you meet specific criteria for being exempt from vehicle use tax.

- Fair Market Value Assessment: In cases where the vehicle was not purchased from a dealer, an assessment of its fair market value may be required. This document, often provided by a licensed dealer, supports your claim of value for tax purposes.

Ensure that you have all these documents ready for submission. A complete and accurate application will help you navigate the vehicle use tax process smoothly.

Similar forms

Tennessee Vehicle Use Tax Form: Similar to the Tutti Frutti Application, this form calculates tax based on the vehicle's purchase price or fair market value, and it also provides exemptions based on the buyer's status or vehicle type.

California DMV Use Tax Form: This form requires information about vehicle purchase price and age to determine tax obligations, paralleling the Tutti Frutti process of assessing fair market value.

Florida Title Application Form: Like the Tutti Frutti Application, this document collects details about the vehicle and its owner to facilitate proper tax assessment during title transfer.

Texas Application for Title: This form aids in determining taxes owed based on the vehicle's purchase price, similar to how taxes are computed using the Tutti Frutti Application form.

Michigan Vehicle Use Tax Application: The Michigan form assesses vehicle value akin to the Tutti Frutti Application, focusing on either the sale price or IRS-approved fair market value for tax purposes.

New York State Vehicle Registration Form: Both documents require financial disclosures related to the vehicle's value to ensure all applicable taxes are assessed correctly at the time of purchase.

Massachusetts Use Tax Form: This form mirrors the Tutti Frutti Application by calculating tax obligations based on vehicle value, including exemptions and deductions similar to those outlined in the Illinois form.

Pennsylvania Vehicle Title Transfer Application: This document also computes tax based on the vehicle's sales price or fair market value, reflecting a similar approach to assessing vehicle taxes as seen in the Tutti Frutti Application.

Dos and Don'ts

When filling out the Tutti Frutti Application form, be sure to keep these important points in mind:

- Double-check the purchase price or fair market value of the vehicle, as this is critical in calculating the tax.

- Ensure that you select the correct table (A or B) based on the purchase price of your vehicle.

- Provide accurate information about any exemptions that may apply to your situation.

- Use current values and data when determining the fair market value from a licensed dealer.

- Read instructions carefully before proceeding, as overlooking a detail can lead to errors.

- Review the entire form for completeness before submitting to avoid delays in processing.

To maximize your chances of a smooth application process, avoid the following common pitfalls:

- Do not leave any sections of the form blank; this can raise questions and delay approval.

- Avoid using outdated values for fair market assessments; this could result in penalties.

- Never assume that your situation is automatically exempt without confirming the requirements.

- Do not underestimate the importance of providing honest and accurate information.

- Refrain from submitting the form without attaching necessary documentation that supports your claims.

- Steer clear of vague descriptions of the vehicle; clarity is crucial for processing.

Misconceptions

Misconception 1: The Tutti Frutti Application form is only needed for transactions involving cars.

This belief is incorrect. While the form is often associated with car purchases, it also applies to motorcycles, ATVs, and other motor-driven cycles. Anyone purchasing these types of vehicles must fill out the application.

Misconception 2: The tax amount is the same regardless of the vehicle's price or age.

This is misleading. The tax due is determined by both the purchase price (or fair market value) and the model year of the vehicle. Tables A and B provide specific tax amounts based on these factors.

Misconception 3: If a vehicle is a gift, no tax needs to be paid.

While there are specific exemptions for gifts, it’s essential to note that when there is no stated purchase price, the fair market value of the vehicle must be reported. Therefore, some gifts may still incur a tax obligation.

Misconception 4: A trade-in can be used to reduce the tax liability.

This is inaccurate. The Tutti Frutti Application explicitly states that no trade-in deductions are allowed when calculating the tax amount due.

Misconception 5: All local governments charge the same private party vehicle use tax.

This assumption is not true. Local governments may impose different rates and rules regarding vehicle use tax. It is vital to understand your local government requirements when filing the form.

Misconception 6: The Tutti Frutti Application form can be submitted only once a year.

On the contrary, the form can be submitted multiple times throughout the year based on vehicle purchases and other related transactions. Keeping up with timely submissions will help you avoid penalties or issues with the Illinois Department of Revenue.

Key takeaways

When filling out and using the Tutti Frutti Application form, keep the following key takeaways in mind:

- Understand the Tax Structure: The Illinois Private Party Vehicle Use Tax is based on the purchase price or fair market value of the vehicle being acquired.

- Use the Correct Table: For vehicles valued at less than $15,000, refer to Table A. If the value meets or exceeds $15,000, consult Table B to determine the tax amount.

- Determine Fair Market Value: In cases where no purchase price is stated, like gifts or trade-ins, you need to establish the fair market value, which can often be determined through a licensed dealer.

- Know the Exemptions: Some vehicles are tax-exempt. For instance, if the purchaser is a tax-exempt organization or a vehicle is used for rolling stock, no tax is due.

- Exceptions to Tax Amount: Certain transfers may be subject to a flat tax of $15. This applies to vehicle gifts to beneficiaries other than a surviving spouse or transfers within families.

- Special Rates for Motorcycles: If you are purchasing a motorcycle or ATV, the applicable tax is $25, regardless of its value.

- Local Government Tax Reporting: Check if local government private party vehicle use tax applies by referring to Form RUT-6 or the comprehensive reference guide.

- Keep Records Handy: Maintain supporting documents related to the purchase, as they will be useful should you need to provide proof of value or eligibility for exemptions.

Browse Other Templates

Hsmv 83330 - The form serves as a binding agreement between the driver and the insurance company.

Certificate of Foreign Limited Partnership Amendment,Amendment Application for Limited Partnership,Foreign Partnership Name Change Certificate,New York Limited Partnership Amendment Form,Limited Partnership Authority Modification Certificate,Certific - Options for filling out the form include various sections relevant to the partnership.

Household Budget Template - Track each category diligently for a holistic view of personal finances.