Fill Out Your U 26 3 Form

The U-26.3 form, also known as the New York State Insurance Fund Certificate of Workers’ Compensation Coverage, plays a crucial role in proving that a business has secured the necessary workers' compensation insurance. All employers in New York responsible for employees engaged in hazardous work must obtain this certification, which offers assurance of coverage under the state's Workers' Compensation Law. It is specifically offered by the New York State Insurance Fund, and businesses need this certificate before entering any contracts or gaining permits for work. Often, the certificate holder is an entity like The Research Foundation for The State University of New York, which might require proof for compliance reasons. If you're a policyholder, it’s essential to realize that the U-26.3 serves as valid proof of coverage, reflecting your obligations to protect your employees. Failure to provide this could lead to issues, especially when involved in contracts that mandate such certification. Moreover, other certificates, such as the C-105 and C-105.1, are also relevant in certain contexts, showcasing the interconnected nature of workers' compensation documentation in New York State. Understanding this form is vital for compliance and for securing your operations legally and ethically.

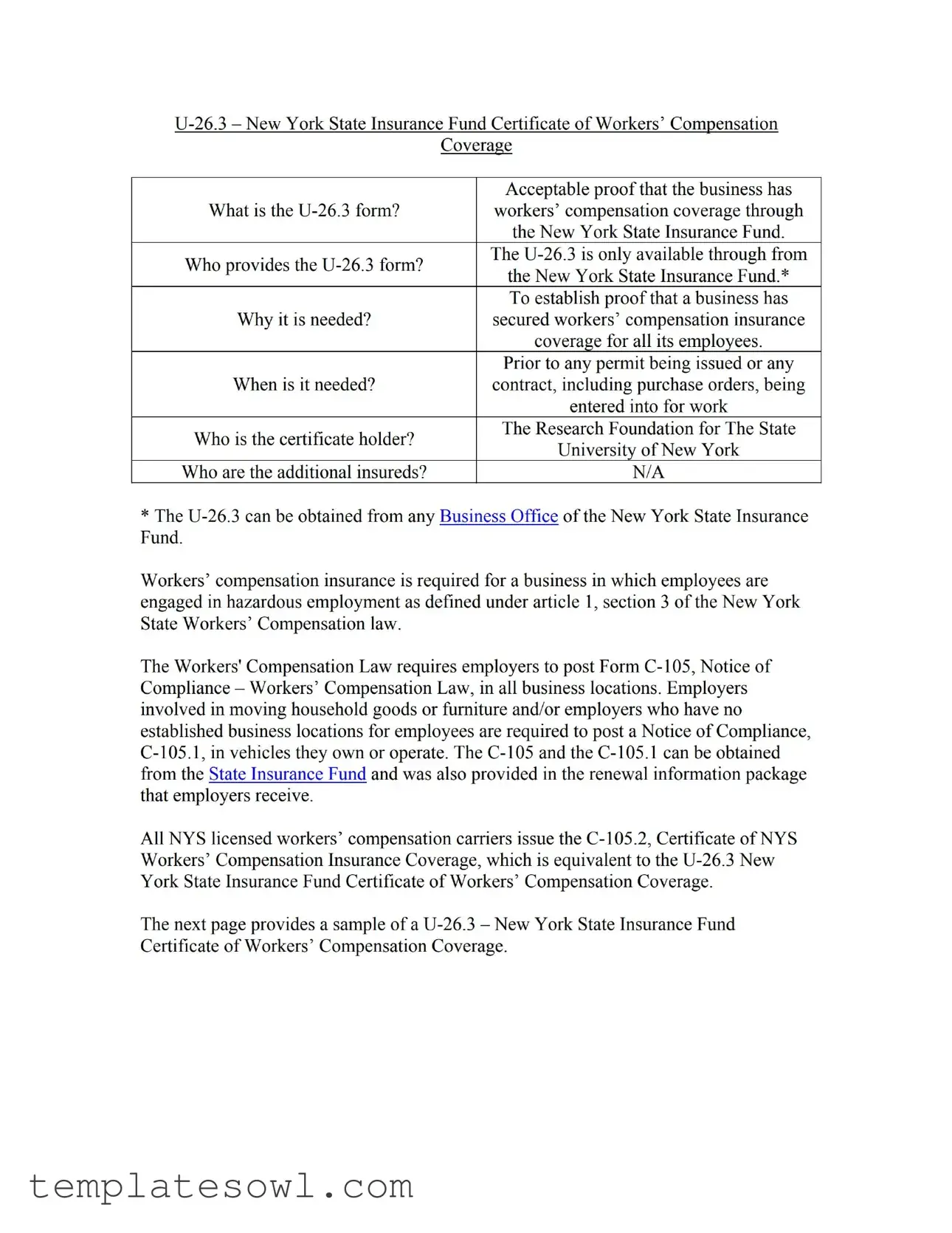

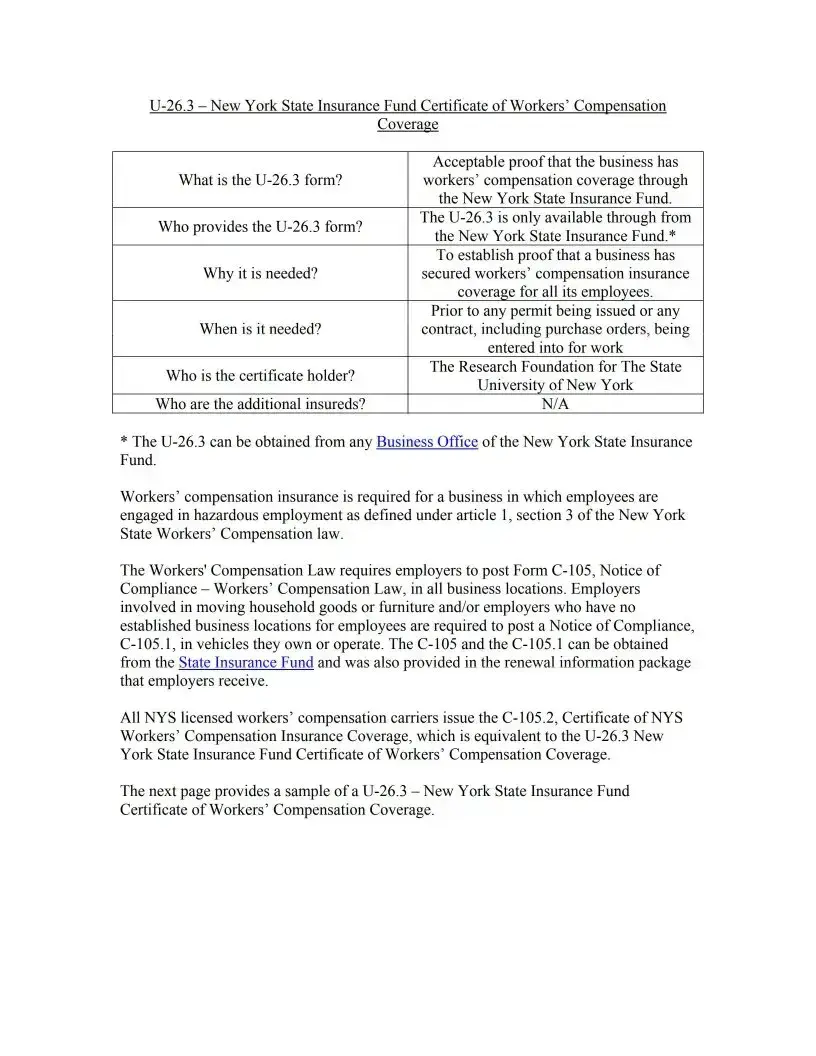

U 26 3 Example

Coverage

What is the

Who provides the

Why it is needed?

When is it needed?

Who is the certificate holder?

Acceptable proof that the business has workers’ compensation coverage through the New York State Insurance Fund. The

Prior to any permit being issued or any contract, including purchase orders, being entered into for work

The Research Foundation for The State

University of New York

Who are the additional insureds? |

N/A |

*The

Workers’ compensation insurance is required for a business in which employees are engaged in hazardous employment as defined under article 1, section 3 of the New York State Workers’ Compensation law.

The Workers' Compensation Law requires employers to post Form

All NYS licensed workers’ compensation carriers issue the

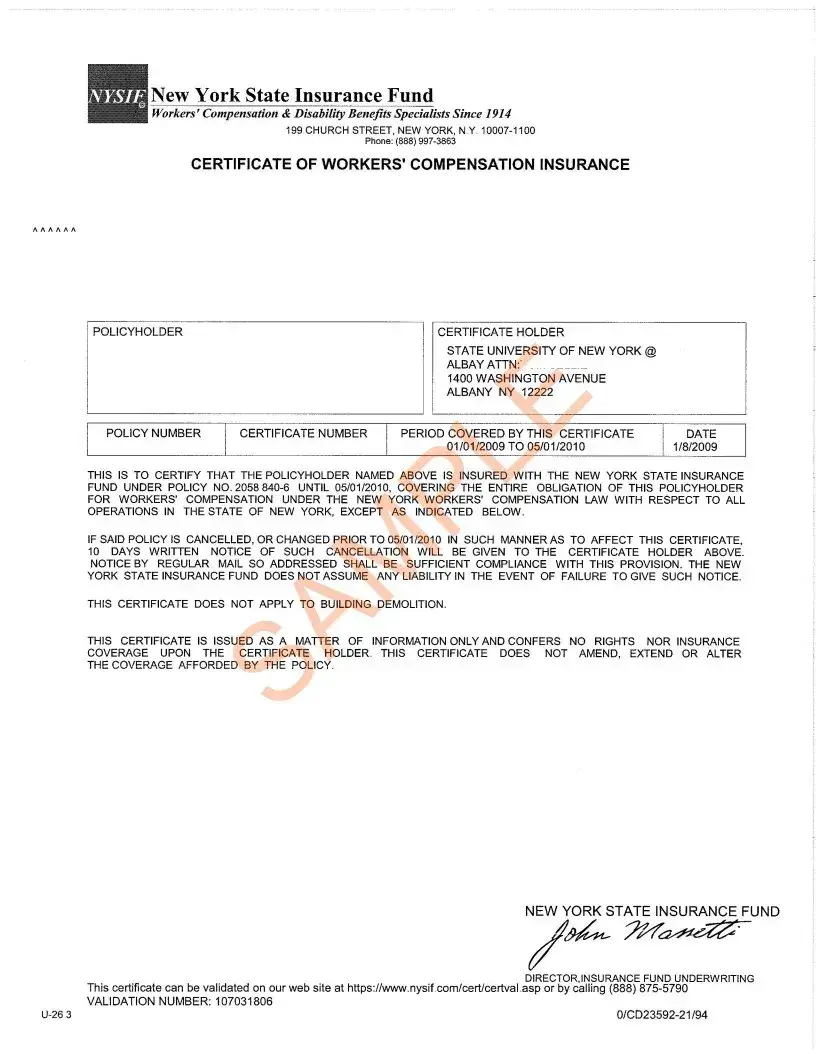

The next page provides a sample of a

New York State Insurance Fund

Workers' Compensation & Disability Benefits Specialists Since 1914

199 CHURCH STREET, NEW YORK, N.Y.

Phone: (888)

CERTIFICATE OF WORKERS' COMPENSATION INSURANCE

Л Л Л Л Л Л

POLICYHOLDER |

|

CERTIFICATE HOLDER |

|

|

|

STATE UNIVERSITY OF NEW YORK @ |

|

|

|

ALBAYATTN:' |

|

|

|

1400 WASHINGTON AVENUE |

|

|

|

ALBANY NY 12222 |

|

POLICY NUMBER |

CERTIFICATE NUMBER |

PERIOD COVERED BY THIS CERTIFICATE |

DATE |

|

|

01/01/2009 TO 05/01/2010 |

1/8/2009 |

THIS IS TO CERTIFY THAT THE POLICYHOLDER NAMED ABOVE IS INSURED WITH THE NEW YORK STATE INSURANCE FUND UNDER POLICY N0.2058

IF SAID POLICY IS CANCELLED, OR CHANGED PRIOR TO 05/01/2010 IN SUCH MANNER AS TO AFFECT THIS CERTIFICATE,

10DAYS WRITTEN NOTICE OF SUCH CANCELLATION WILL BE GIVEN TO THE CERTIFICATE HOLDER ABOVE. NOTICE BY REGULAR MAIL SO ADDRESSED SHALL BE SUFFICIENT COMPLIANCE WITH THIS PROVISION. THE NEW

YORK STATE INSURANCE FUND DOES NOT ASSUME ANY LIABILITY IN THE EVENT OF FAILURE TO GIVE SUCH NOTICE.

THIS CERTIFICATE DOES NOT APPLY TO BUILDING DEMOLITION

THIS CERTIFICATE IS ISSUED AS A MATTER OF INFORMATION ONLY AND CONFERS NO RIGHTS NOR INSURANCE COVERAGE UPON THE CERTIFICATE HOLDER. THIS CERTIFICATE DOES NOT AMEND, EXTEND OR ALTER THE COVERAGE AFFORDED BY THE POLICY..

NEW YORK STATE INSURANCE FUND

|

DIRECTOR,INSURANCE FUND UNDERWRITING |

|

This certificate can be validated on our web site at https://www.nysif.com/cert/certval .asp or by calling (888) |

|

VALIDATION NUMBER: 107031806 |

Form Characteristics

| Fact | Description |

|---|---|

| Name of Form | The U-26.3 is known as the New York State Insurance Fund Certificate of Workers’ Compensation Coverage. |

| Provider of the Form | This form is provided by the New York State Insurance Fund, which has made it available through its Business Offices. |

| Purpose of the Form | It serves as proof that a business has secured workers’ compensation insurance coverage for all employees, as required by New York State law. |

| When is the Form Needed | The U-26.3 is required before any permits are issued or contracts are entered into for work, including purchase orders. |

Guidelines on Utilizing U 26 3

After gathering all necessary information, filling out the U-26.3 form requires specific details about the policyholder, the certificate holder, and the coverage period. Carefully inputting this information ensures proper documentation is maintained for workers' compensation insurance.

- Obtain the U-26.3 form from any Business Office of the New York State Insurance Fund.

- Enter the policyholder's name exactly as it appears on the workers' compensation insurance policy.

- Indicate the certificate holder's name and address. This typically refers to the entity requiring proof of coverage.

- Fill in the policy number, ensuring it matches the information on the insurance documents.

- Provide the certificate number, which serves as a unique identifier for this certificate.

- Specify the period covered by this certificate by entering the start and end dates of the coverage.

- Include a signature or stamp, if applicable, to validate the completion of the form.

- Review all entered information for accuracy, ensuring there are no typographical errors.

- Submit the completed U-26.3 form to the designated certificate holder or required party.

What You Should Know About This Form

What is the U-26.3 form?

The U-26.3 form is a certificate of workers' compensation coverage issued by the New York State Insurance Fund. It serves as proof that a business has secured workers' compensation insurance for all of its employees. This document is crucial for businesses operating in New York, particularly those whose employees are engaged in hazardous activities, as defined by the state's workers' compensation law.

Who provides the U-26.3 form?

The U-26.3 form can only be obtained from the New York State Insurance Fund. This can be done through any of their Business Offices. It's important to ensure that the certificate is issued by a licensed organization to comply with state regulations regarding workers' compensation coverage.

Why is the U-26.3 form needed?

The U-26.3 certificate is necessary to prove that a business has adequate workers' compensation coverage. Many entities require this proof before issuing permits or entering into contracts for work. For example, it might be essential for obtaining permissions from construction sites or securing contracts that involve working with the state or other organizations. Without this certificate, a business may not be able to legally operate or secure necessary contractual agreements.

When is the U-26.3 form needed?

The U-26.3 form is needed before any permits are issued or contracts are entered into, which includes purchase orders for services. If a business is planning to begin operations that involve workers engaged in hazardous jobs, it is critical to secure this documentation ahead of time. Failing to have a U-26.3 certificate when required could lead to legal difficulties or project delays.

Common mistakes

Filling out the U-26.3 form requires accuracy and attention to detail. One common mistake is failing to accurately provide contact information for the certificate holder. If this information is incorrect or incomplete, delays in processing can occur. The certificate holder must be clearly identified to ensure that coverage is acknowledged properly.

Another error frequently encountered is submitting outdated information. Businesses often use previous versions of the form when applying for new coverage. This can lead to complications and may invalidate the coverage. Always ensure that you are using the most current version of the U-26.3 form from the New York State Insurance Fund.

People also tend to overlook the need for proof of workers’ compensation coverage. Before submitting the U-26.3 form, make sure you have the necessary documentation to prove that your business holds valid workers’ compensation coverage. Failure to do so can result in the rejection of the application.

Another common mistake is improperly completing the coverage period. It's essential to accurately specify the period covered by the certificate. If the dates are incorrect, this may create gaps in coverage that could expose the business to risks.

Incomplete details related to the policyholder can create unnecessary complications. Ensure that the name, address, and policy number are all included without any missing elements. Each field must be filled out completely to avoid potential issues with the insurance provider.

Lastly, not understanding the exclusions mentioned in the certificate can lead to misunderstandings. It’s crucial to read the terms carefully, as certain activities, like building demolition, may be excluded from coverage. Failure to recognize these exclusions can leave a business unprotected in critical situations.

Documents used along the form

The U-26.3 form serves as a critical document for businesses in New York that need to demonstrate compliance with workers' compensation insurance requirements. However, it is often accompanied by other forms that also play vital roles in ensuring full compliance. Below is a list of some key documents that are frequently used alongside the U-26.3 form, each serving a specific purpose.

- Form C-105: This is the Notice of Compliance required by New York’s Workers’ Compensation Law, which employers must post in all business locations to inform employees of their workers’ compensation coverage status.

- Form C-105.1: Similar to C-105, but specifically for employers engaged in moving household goods or those without established business locations. This notice must be posted in vehicles owned or operated by the employer.

- Form C-105.2: This form serves as a Certificate of NYS Workers’ Compensation Insurance Coverage, issued by all licensed workers’ compensation carriers in New York. It is an equivalent proof of coverage to the U-26.3.

- Form DB-120: The Certificate of Disability Benefits Insurance Coverage that verifies compliance with New York State's requirements for disability insurance coverage for employees.

- Form DB-120.1: Similar to DB-120, but intended for employers who engage in unique work environments, providing proof of their disability benefits coverage in vehicles used for work.

- Form WCB-133: This form is used to report an injury to the Workers’ Compensation Board. It is essential for maintaining compliance and for filing claims when an employee is injured at work.

- Form WCB-1: This is the Employee Claim form, allowing employees to file for workers' compensation benefits after an injury. It is crucial for both employees and employers to understand this process.

- Form WCB-4: The Notice of Retaliation form that protects employees against employer retaliation for filing a workers’ compensation claim.

- Form C-10: This form is used to request a change in insurance carriers, necessitating that employers maintain proper documentation of ongoing coverage throughout the transition.

- Form C-20: This document outlines the employer's responsibilities under the New York Workers’ Compensation Law and serves as a guide to ensure compliance.

Ensuring that all of these forms and documents are handled meticulously is vital for any business operating in New York. This diligence not only fosters compliance but also enhances employee protection in the workplace. From demonstrating coverage to reporting incidents, each form plays a pivotal role in the larger framework of workers’ compensation insurance.

Similar forms

The U-26.3 form serves an essential function in verifying that a business has the necessary workers’ compensation coverage in New York. Several other documents share similarities with this form in their purpose and requirements. Below is a list detailing those documents and their specific connections to the U-26.3 form:

- Form C-105: This notice confirms compliance with the Workers’ Compensation Law. Employers must post it in all business locations, similar to how the U-26.3 is used to demonstrate coverage.

- Form C-105.1: Required for employers who move household goods and have no established business location, this form serves to inform of compliance in a mobile context, akin to the role of U-26.3.

- Form C-105.2: Issued by licensed workers' compensation carriers, this form is equivalent to the U-26.3 and proves employers' coverage under New York law, highlighting the importance of such documentation.

- Certificate of Insurance: Often provided by insurers, this certificate serves as proof of coverage for various types of insurance, similar to how the U-26.3 demonstrates compliance with workers' compensation obligations.

- Insurance Declaration Page: This document outlines the terms of an insurance policy and verifies coverage, paralleling the purpose of the U-26.3 in proving compliance for work-related injuries.

- State Insurance Fund Coverage Confirmation: This confirmation details the business's workers' compensation coverage through the State Insurance Fund, directly similar to the U-26.3 which certifies such coverage.

- Employer’s Liability Insurance Policy: While focused more broadly on liability, this document often accompanies proof of workers’ compensation coverage, similar to the U-26.3’s role in ensuring compliance.

- Enrollment Confirmation from Workers’ Compensation Carrier: This confirms that a business has enrolled for coverage with a carrier, much like the U-26.3 provides certification of such enrollment with the State Insurance Fund.

Each of these documents plays a vital role in ensuring compliance with workers’ compensation laws, reflecting the shared goal of protecting both employees and employers in New York State.

Dos and Don'ts

When filling out the U-26.3 form for the New York State Insurance Fund, it's essential to be meticulous. This ensures you provide accurate and complete information, facilitating a smooth process.

- Do double-check all information before submission. Accuracy is critical.

- Don't leave any required fields blank. Each section may contain vital details.

- Do clearly identify the policyholder and certificate holder. Ensure names and addresses are correct.

- Don't confuse the policy number with the certificate number. They are distinct and crucial for identification.

- Do use a permanent pen if filling out a physical form. This prevents smudging or fading.

- Don't copy information from old forms unless you confirm its accuracy. Policies can change over time.

- Do keep a copy of the completed form for your records. Documentation is key for future reference.

- Don't submit the form without understanding its implications. Be aware of what the coverage entails.

- Do reach out to the New York State Insurance Fund for clarification if unsure about any part of the form.

Misconceptions

Here are five common misconceptions about the U-26.3 form, along with clarifications to ensure a better understanding:

- The U-26.3 form can be obtained from any insurance company. Many believe that they can get this form from various insurance providers. However, it is specifically issued by the New York State Insurance Fund.

- Receiving the U-26.3 form guarantees coverage. Some may think that simply having the U-26.3 form means they are fully covered under workers' compensation. In reality, the U-26.3 is proof of coverage but does not alter any existing coverage agreements.

- The U-26.3 form is necessary only for large businesses. There is a misconception that only larger corporations need this form. In truth, any business with employees engaged in hazardous work must provide proof of workers’ compensation coverage, regardless of size.

- The U-26.3 form is the only acceptable proof of insurance. While the U-26.3 form serves as important documentation, other forms, such as the C-105.2 from any licensed workers' compensation carrier, are also valid proof of coverage.

- Once issued, the U-26.3 form is permanent and does not need updating. Some individuals assume that the U-26.3 is a one-time requirement. However, it is important to update this certificate if there are changes in coverage, such as cancellation or alterations to the policy.

Key takeaways

The U-26.3 form is an essential document for businesses operating in New York. Here are key points to consider when filling out and using this form.

- Definition: The U-26.3 form serves as a Certificate of Workers’ Compensation Coverage provided by the New York State Insurance Fund.

- Provider: The New York State Insurance Fund is the sole provider of the U-26.3 form.

- Purpose: This form is necessary to establish proof that a business has workers’ compensation insurance for its employees.

- Timing: The U-26.3 must be obtained before any contract or permit is issued for work to commence.

- Certificate Holder: The certificate holder is typically the entity or individual that requires proof of workers' compensation coverage.

- Proof of Coverage: The U-26.3 serves as acceptable proof of workers’ compensation coverage acquired through the New York State Insurance Fund.

- Accessibility: The form can be obtained from any Business Office of the New York State Insurance Fund.

- Legal Requirement: Employers engaged in hazardous activities must have this coverage as stipulated by New York State Workers' Compensation Law.

- Certification Validity: If the policy is canceled or changed, written notice must be provided to the certificate holder at least 10 days prior to such action.

Properly filling out and utilizing the U-26.3 form is crucial for ensuring compliance with state laws regarding workers' compensation coverage.

Browse Other Templates

Return Authorization Request,Exchange and Return Form,UrbanOG Product Return Sheet,Customer Return Submission,Refund and Exchange Application,UrbanOG Return & Exchange Request,Merchandise Return Form,UrbanOG Return Processing Form,Return and Refund F - Be sure to check if the item is eligible for return based on the policy.

Can I Buy Sperm From a Sperm Bank - Involvement in this program requires careful consideration of health backgrounds.