Fill Out Your U Haul Stirage Contract Form

The U-Haul Storage Contract form is a crucial document for anyone looking to rent or lease U-Haul equipment. This form outlines important terms and conditions related to the rental, ensuring both the company and the renter have a mutual understanding of their rights and responsibilities. Among its key aspects are the declaration of coverage under Republic Western Insurance, which includes protections for both the renter and their cargo throughout the rental period. The insurance coverage, referred to as SafeMove, specifies what is included, such as loss due to external damage while the cargo is in the rented vehicle, up to a limit of $25,000. However, it’s important to note the various exclusions, such as theft or damage resulting from improper packing. The form also covers significant definitions that clarify terms like "Lessee" and "Equipment," ensuring clarity in the agreement. Additionally, it includes monetary provisions, indicating that all transactions and claims will be processed in U.S. currency. The document highlights the effective term of the insurance, details on how claims must be reported, and outlines the responsibilities of both the named insured and the lessee in navigating any claims-related situations. Overall, this form serves as a comprehensive guide to understanding the scope of coverage and obligations involved in renting U-Haul equipment.

U Haul Stirage Contract Example

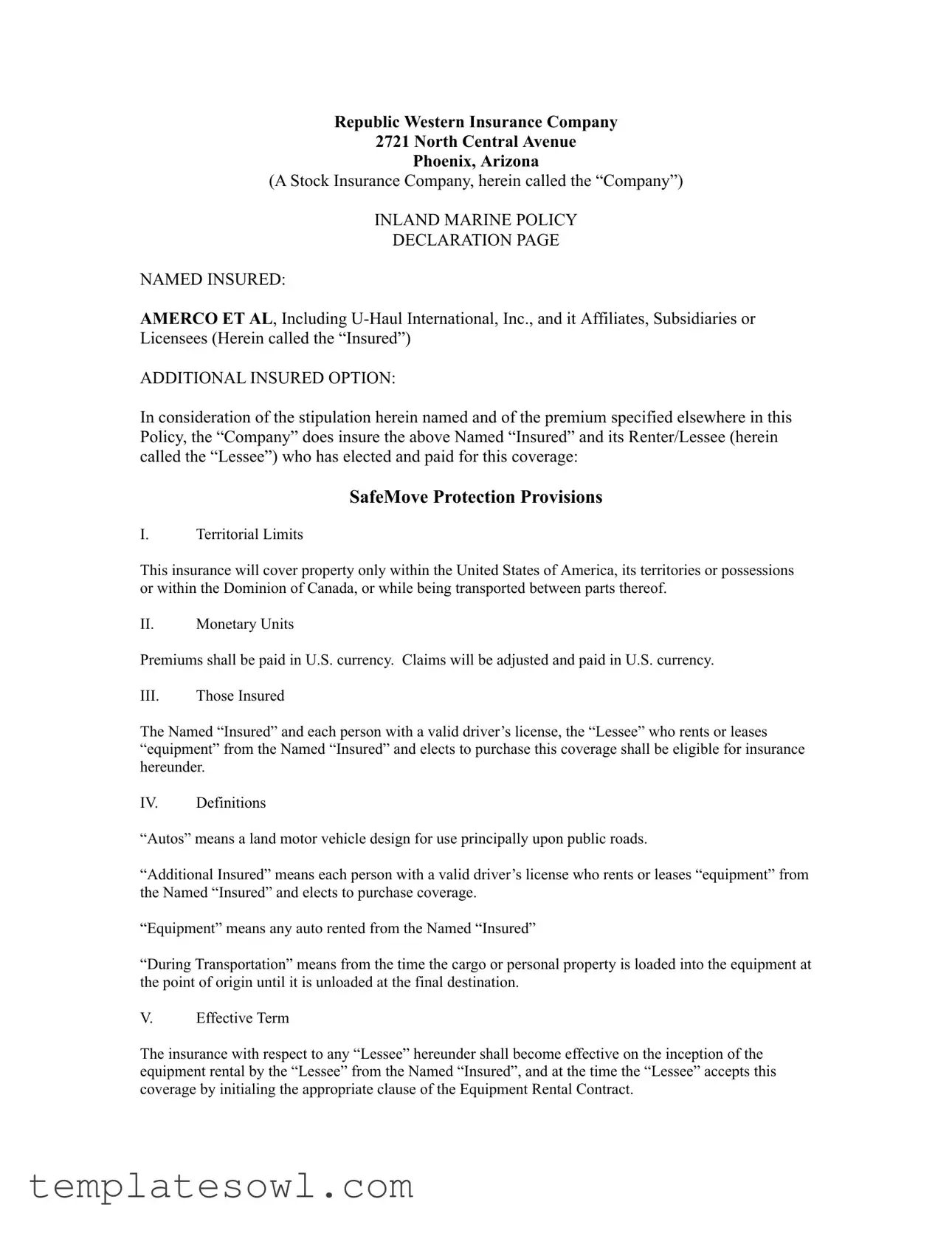

Republic Western Insurance Company

2721 North Central Avenue

Phoenix, Arizona

(A Stock Insurance Company, herein called the “Company”)

INLAND MARINE POLICY

DECLARATION PAGE

NAMED INSURED:

AMERCO ET AL, Including

ADDITIONAL INSURED OPTION:

In consideration of the stipulation herein named and of the premium specified elsewhere in this Policy, the “Company” does insure the above Named “Insured” and its Renter/Lessee (herein called the “Lessee”) who has elected and paid for this coverage:

SafeMove Protection Provisions

I.Territorial Limits

This insurance will cover property only within the United States of America, its territories or possessions or within the Dominion of Canada, or while being transported between parts thereof.

II.Monetary Units

Premiums shall be paid in U.S. currency. Claims will be adjusted and paid in U.S. currency.

III.Those Insured

The Named “Insured” and each person with a valid driver’s license, the “Lessee” who rents or leases “equipment” from the Named “Insured” and elects to purchase this coverage shall be eligible for insurance hereunder.

IV. Definitions

“Autos” means a land motor vehicle design for use principally upon public roads.

“Additional Insured” means each person with a valid driver’s license who rents or leases “equipment” from the Named “Insured” and elects to purchase coverage.

“Equipment” means any auto rented from the Named “Insured”

“During Transportation” means from the time the cargo or personal property is loaded into the equipment at the point of origin until it is unloaded at the final destination.

V.Effective Term

The insurance with respect to any “Lessee” hereunder shall become effective on the inception of the equipment rental by the “Lessee” from the Named “Insured”, and at the time the “Lessee” accepts this coverage by initialing the appropriate clause of the Equipment Rental Contract.

VI. |

Individual Terminations |

The “Additional Insured” status shall terminate at the earlier of the following dates:

(1)On the date the Policy is terminated;

(2)At the time the “Lessee” ceases to be a “Lessee” of the Named “Insured” or the return date indicated on the rental contract, whichever is earlier.

(3)***SAFEMOVE***At the time the “Lessee’s” cargo or personal property has been unloaded.

Termination of coverage in accordance with this Part shall be without prejudice to any claim of the “Lessee”, originating prior to the date of such termination.

VII. Insurance Coverage

***SAFEMOVE***

“Lessee’s” cargo is covered (except as hereinafter provided) during period of rental or lease of equipment from the Policyholder for all risks of direct and accidental physical loss of or damage to cargo while inside

VIII. Amount of Insurance

Truck : “Lessee’s” interest in cargo during transportation is insured for a limit of $25,000, for a

IX. Exclusions

No payment of any kind shall be made for loss or damage caused or sustained wholly or partly, directly or indirectly, by:

1)Theft, burglary, robbery, or mysterious disappearance.

2)Water or dampness of any kind or from any source except as a result of collision, fire, lightning, windstorm, hail, explosion, riot or civil commotion, flood, vandalism, or malicious mischief. Loss or damage caused by improper packing, leakage, breakage, shifting of cargo, marring, scratching, dampness of atmosphere, dryness of atmosphere, extremes of changes of temperature, shrinkage, evaporation, loss of weight, rust, contamination, changes in flavor or color or texture or finish, unless loss or damage is caused directly by collision, fire, lightning, windstorm, hail, explosion, riot or civil commotion, flood, vandalism or malicious mischief.

3)Interruption of business or other consequential loss beyond actual physical damage to property insured.

4)Loss or damage to accounts, bills, currency, furs, antiques, evidences of debt, securities, money, notes, jewelry and similar valuables, paintings, statuary and other works of art, and any personal property that is not lawfully in the possession or possessed by the “Lessee”.

5)Wear and tear, gradual deterioration, inherent vice, moths, and vermim.

6)Death or destruction of livestock or animals.

7)An occurrence during loading or unloading.

8)Nuclear reaction or nuclear radiation or radioactive contamination, all whether controlled or uncontrolled, and whether such loss be direct or indirect, proximate or remote, or be in whole or impart caused by, contributed to, or aggravated by the perils insured against in this policy; however, subject to the foregoing and all provisions of this policy, direct loss by fire resulting from nuclear reaction or nuclear radiation or radioactive contamination is insured against by this Policy.

9)A) Hostile or warlike action in time of peace or war, including action in hindering, combating, or defending against an actual, impending or expected attack, (1) by any government or sovereign power (de jure de facto), or by any authority maintaining or using military, naval, or air forces, or (2) by an agent of any such government, power, authority, or forces; (B) any weapon of war employing atomic fission, atomic fusion, radioactive force or material whether in time of peace or war; (C) insurrection, rebellion, civil war, terrorism, usurped power or action taken by governmental authority in hindering, combating or defending against such an occurrence, seizure, or destruction under quarantine or customs regulations, confiscation by order of any government or public authority, or risks of contraband or illegal transportation or trade.

VALUATION: This insurance shall not be liable for more than the actual cash value of the property at the time the loss or damage occurs and the loss or damage shall be ascertained or estimated according to such actual cash value WITH PROPER DEDUCTION FOR DEPRECIATION and shall in no event exceed what it would cost to repair or replace the same with material of like kind and quality. In case of loss or damage to any part of the insured property consisting, when complete for sale or use, of several parts, the “Company” shall be liable for the insured value of the part lost or damaged.

X.Report of Claims

The Named “Insured” and/or “Lessee” shall immediately report to “Company” every accident which may become a claim under this Policy and shall also file with the “Company” within ninety (90) days of such loss written Proof of Loss in the form prescribed by “Company”. Any memorandum or advice of insurance shall contain a provision that the “Lessee” shall immediately notify the Named “Insured” or “Company” of all accidents regardless of the amount of damage or who is at fault. Failure to give notice of such loss or failure to cooperate in the investigation of the accident shall invalidate the claim.

XI. |

Examination Under Oath |

The “Lessee”, as often as may be reasonably required, shall exhibit to any person designated by the “Company” all that remains of any property herein described, and shall themselves, and insofar as is within his or their power cause his or their employees, members of the household and others to submit to examination under oath by any person named by the “Company” and subscribe the same; as often as may be reasonable required, shall produce for examination vehicle titles and registrations, proofs of purchase and ownership, all writings, books of account, bills, invoices and other vouchers, or certified copies thereof if originals be lost, at such reasonable time and place as may be designated by the “Company” or its representatives in connection with the investigation of any loss of claim hereunder, shall be deemed a waiver of any defense which the “Company” might otherwise have respect to any loss or claim but all such examinations and acts shall be deemed to have been made or done without prejudice to the “Company’s” liability.

XII. Suit

No suit, action or proceeding for the recovery of any claim under this Policy shall be sustainable in any court of law or equity unless the same be commenced within twelve (12) months next after discovery by the “Lessee” of the occurrence which gives rise to the claim, provided however, that if by the laws of the State within this Policy is issued such limitation is invalid, then any such claims shall be void unless such action, suit or proceedings be commenced within the shortest limit of time permitted by the laws of such State.

XIII. Appraisal

If the “Lessee” and the “Company” fail to agree as to the amount of loss, each shall, on the written receipt of proof of loss by the “Company”, select a competent and disinterested appraiser and the appraisal shall be made at a reasonable time and place. The appraisers shall first select a competent and disinterested umpire, and failing for fifteen (15) days to agree, upon such umpire, then, on the request of the “Lessee” or the “Company”, such umpire shall be selected by a judge of a court of record in the State in which such appraisal is pending. The appraisers shall then appraise the loss, stating separately the actual cash value at the time of the loss and the amount of loss, and failing to agree, shall submit their differences to the umpire. An award in writing of nay two shall determine the amount of loss. The “Lessee” and the “Company” shall each pay his or its chosen appraiser and shall bear equally the other expenses of the appraisal and umpire. The “Company” shall not be held to have waived any of its rights by any act relating to appraisal.

XIV. Payment of Claims

Any claim for loss under this Policy shall be paid to the Named “Insured”, “Lessee” or others as their interests may appear.

If other insurance is not available, payment of loss shall be made to the Named “Insured”, “Lessee” or others as their interest may appear.

If there is a secured lienholder, payment of loss shall be made jointly to the “Lessee” and lienholder.

In no event shall the payment of loss exceed the applicable limits.

XV. Individual Memorandums

The Named “Insured” to each insured “Lessee” will furnish individual Memorandums describing the coverage. See

XVI. Assignment

Neither the Named “Insured” nor “Lessee” may assign this Policy nor any insurance afforded hereunder without first obtaining written consent of “Company”.

XVII. Other Insurance

This insurance is primary coverage and other insurance shall apply only as excess and in no event as contributing insurance.

XVIII. Subrogation

In the event of any payment under this Policy, the “Company” shall be subrogated to all the Named “Insured’s” and “Lessee’s” rights of recovery therefore against any person or organization and the Named “Insured” and “Lessee” shall execute and deliver instruments and papers and do whatever else is necessary to secure such rights. Neither the Named “Insured” nor “Lessee” shall do anything after loss to prejudice such rights.

ACCIDENTAL DEATH BENEFITS AND MEDICAL EXPENSE BENEFITS COVERAGE FOR THOSE RENTAL CUSTOMERS WHO ELECT THE

SAFEMOVE AND/OR SAFETOW PROTECTION

This endorsement modifies the insurance provided under this policy as follows, except where otherwise provided by law:

A. Coverage

Subject to the scheduled limits, the benefits consist of the following:

(1)“Medical Expense” Benefits

We will pay “Medical Expenses” to or for an “Insured” who sustains an “Injury” in an accident during the period of a valid rental contract wherein the Safemove/Safetow protection has been purchased.

(2)“Accidental Death” Benefits

We will pay a death benefit for an “Insured” when the death results directly from “Injury” caused by an accident during the period of a valid rental contract when the Safemove/Safetow protection has been purchased. Death must occur within two years from the date of the accident.

B.Who is An Insured

The following are “Insureds” with respect to the coverages provided under the “Accidental Death” Benefits and Medical Expense Benefits Coverage part.

(1)Any “lessee while “Occupying” a rental truck or a towing vehicle during the period of a valid Rental contract for “Equipment”, whose rental contract specifies that Safemove/Safetow coverage has been purchased.

(2)Passengers while “Occupying” a rental truck or a towing vehicle when there is a valid rental contract and Safemove/Safetow has been purchased. A towing vehicle is an auto that is attached to “Equipment” rented or leased for the “Named Insured”.

C.Limit of Insurance

Regardless of the number of “Insureds”, policies or claims made to which this coverage applies, the most we will pay for benefits for “injury” sustained by an “Insured” in any one accident is subject to the Per Person and Aggregate Limit as shown in the Schedule of Limits.

If the “Insured” has coverage for more than one covered “Equipment”, the limit of insurance would apply per each covered “Equipment” subject to the Per Person and aggregate Limit on the Schedule of Limits.

D. Exclusions

We will not pay any benefits for “Injury”:

(1)Sustained by any person;

a.caused by his or her own intentional act;

b.while “Occupying” a truck without the express or implied consent of the owner or lessor or while not in lawful possession of any equipment; or

c.while “Occupying” any “equipment” other than a truck or towing vehicle.

(2)Due to war, whether or not declared. War includes civil war, insurrection, rebellion or revolution or any action or condition incident to any of the foregoing.

(3)Due to the use of intoxicants, drugs or narcotics subject to the Drug Abuse Control Act, unless administered in accordance with and on the advice of a physician.

(4)Caused by any race or speed contest. E. Additional Definitions

(1)“Equipment” means rental equipment including: truck, car top carrier, trailer, auto transport, tow bar or tow dolly.

(2)“Injury” means bodily injury caused by an accident during the period of a valid rental contract.

(3)“Lessee” is each person with a valid driver’s license who rents or leases “Equipment from the owner or lessor. If the Rental Agreement is signed by more than one person, the life of only the individual whose signature first appears on the agreement shall be the Insured Lessee.

(4)“Medical Expenses” means reasonable and necessary expenses incurred within two years from the date of the accident for medical, dental, surgical, ambulance, prosthetic care and treatment rendered in accordance with the recognized religious method of healing, however, it does not include expenses in excess of those for a

(5)“Occupying” means riding in the enclosed ‘cab’ portion of an auto.

ACCIDENTAL DEATH BENEFITS AND MEDICAL EXPENSE BENEFITS

|

|

LIMITS |

|

|

TRAILER/CAMPER TRAILER |

|

|

CAR TOP CARRIER/TOW BAR |

|

TRUCK |

TOW DOLLY / SUTO TRANSPORT |

LESSEE |

|

|

Accidental Death |

$25,000 |

$10,000 |

Medical Expenses |

1,000 |

500 |

PASSENGERS |

|

|

Accidental Death |

$15,000 |

$5,000 |

Medical Expenses |

1,000 |

500 |

Aggregate Limit will apply for Accidental Death in the amount of $100,000 for any one accident.

Form Characteristics

| Fact Name | Fact Details |

|---|---|

| Named Insured | The Named Insured includes AMERCO ET AL, U-Haul International, Inc., and its affiliates. |

| Coverage Territory | This policy covers property within the United States, its territories, and Canada. |

| Eligibility | Individuals with a valid driver’s license renting equipment from the Named Insured are eligible for coverage. |

| Coverage Start | Coverage is effective upon the rental inception and the Lessee's acceptance of the terms. |

| Exclusions | Certain exclusions apply such as theft, wear and tear, and losses during loading or unloading. |

| Claim Reporting | The Named Insured or Lessee must report accidents leading to claims within 90 days. |

| Policy Assignment | Neither the Named Insured nor the Lessee may assign this policy without written consent from the Company. |

| Limitations | No suits can be brought more than 12 months after discovering the occurrence leading to the claim. |

Guidelines on Utilizing U Haul Stirage Contract

Completing the U-Haul Storage Contract form is essential for ensuring all terms and conditions are clearly understood by all parties involved. Following these steps will help ensure that each required detail is accurately captured, making the process smoother for both the renter and U-Haul.

- Begin with the Named Insured section. Write down the name of the individual or entity renting the equipment.

- Next, provide the Additional Insured Option. Include any other individuals who will be covered under the policy.

- In the Effective Term section, indicate the starting date of the rental and check the box to confirm acceptance of coverage.

- Fill in the Equipment details, specifying the type of vehicle or item that is being rented.

- In the Monetary Units section, specify that all premiums and claims will be processed in U.S. currency.

- Complete the Insurance Coverage details. Indicate whether you would like to purchase the SafeMove coverage and any specific limits on insurance.

- For the Claims Reporting section, provide information on how to report accidents and the actions required after an incident.

- Finally, review all entered information for accuracy, making corrections as necessary, before signing the form.

What You Should Know About This Form

What is the U-Haul Storage Contract form?

The U-Haul Storage Contract form outlines the terms and conditions of renting storage equipment from U-Haul. This contract includes details about insurance coverage, rental responsibilities, and what to do in case of a claim. It is important for renters to read this document carefully to understand their rights and obligations while using U-Haul services.

What insurance coverage is provided under the U-Haul Storage Contract?

The U-Haul Storage Contract offers the SafeMove protection, which insures cargo during transportation for a limit of $25,000 for one-way hauls or $15,000 for round trips. A deductible of $100 applies to both scenarios. The coverage protects against various risks of physical loss or damage while the cargo is loaded onto the rented equipment, unless excluded by the terms, such as theft or improper packing.

How does the termination of insurance coverage work?

Insurance coverage under the U-Haul Storage Contract will end if the rental is terminated, when the lessee stops being a renter, or when the cargo has been unloaded. This means that once you return the rental equipment or empty it of your belongings, the insurance coverage ceases. It is important to be aware of these points to avoid unexpected gaps in coverage.

How should claims be reported under the U-Haul Storage Contract?

If an incident occurs that may lead to a claim, the lessee should immediately report the accident to the insurance company. A written Proof of Loss must be submitted within 90 days of the incident. Failing to do so could invalidate the claim, so timely communication is key.

What happens if there is a disagreement on the amount of loss during a claim?

In case the lessee and the insurance company cannot agree on the amount of loss, each party will select a competent appraiser to evaluate the situation. Both appraisers will work together to determine the amount of loss, and if they can't reach a consensus, an umpire will decide. This process ensures a fair assessment if discrepancies arise.

Common mistakes

Filling out the U-Haul Storage Contract form can be straightforward, but even minor mistakes can lead to issues down the road. Here are seven common mistakes that people often make when completing this form.

One of the most frequent errors is not reading the fine print. The insurance policy and coverage details are typically included in the contract. Skipping over these sections can lead to misunderstandings later. Reviewing the entire document ensures that renters know what is covered and what exclusions apply, allowing for informed decisions.

Another mistake is failing to provide accurate personal information. When entering your name, contact number, and address, ensure that all details are current and correct. Inaccurate or incomplete information can complicate the rental process and affect communication regarding any issues that may arise.

People often overlook insurance options available under the contract. While some may automatically decline coverage, it’s important to evaluate whether extra protection may be beneficial. Many renters neglect to check whether they can purchase additional coverage, which might save them from financial headaches if something goes wrong.

Not documenting equipment condition before leaving the rental location is a common pitfall. Renters often forget to take photos or jot down any existing damage. This can lead to disputes about liability when returning the vehicle, costing time and money to resolve issues that could have easily been avoided with proper documentation.

Another key mistake is overlooking the return policy. Each rental agreement has specific terms for returning the equipment. Ignoring these instructions might lead to late fees or other charges. Always review the return times and procedures thoroughly to ensure compliance.

Additionally, people sometimes neglect to verify the rental duration. Often, customers underestimate how long they may need the vehicle. The agreed-upon duration should be realistic and account for potential delays. This will help avoid unexpected charges for additional days.

Finally, one of the worst mistakes is not retaining a copy of the signed contract. After making all those important decisions and signing the form, forgetting to keep a copy can pose challenges later on. It's best to have this documentation available for reference to clarify any misunderstandings that may come up during or after the rental period.

Documents used along the form

The U-Haul Storage Contract form is a critical document that outlines the rental agreement between the lessee and U-Haul. Along with it, several other documents often play a vital role in the rental experience. Each document serves its specific purpose to ensure clarity, protection, and compliance for all parties involved. Below is a list of forms commonly associated with the U-Haul Storage Contract.

- Rental Agreement: This document details the terms of the rental, including the duration, fees, and conditions under which the equipment can be used. Both parties must sign it to formalize the agreement.

- Insurance Declaration Page: This page outlines the insurance coverage options available to the lessee. It details the types of coverage, terms, and conditions that apply during the rental period.

- Equipment Condition Report: Before taking possession of the rented equipment, the lessee and U-Haul personnel complete this form to document the current condition of the equipment. This helps prevent disputes over damages upon return.

- Proof of Identity Form: Lessees are usually required to provide valid identification to confirm their identity and eligibility to rent equipment. This helps ensure that the rental process is secure.

- Payment Authorization Form: This form allows U-Haul to process payment for the rental and any additional services. It usually requires details such as credit card information or bank account specifics.

- Liability Waiver: This document outlines the lessee's understanding of risks associated with the rental and waives certain rights to liability claims against U-Haul in specific scenarios.

- Emergency Contact Form: Providing an emergency contact is oftentimes required for safety reasons. This form collects relevant information in case of accidents or emergencies during the rental period.

- Return Instructions Form: This document includes guidelines on how to properly return the rented equipment. It primarily aims to streamline the return process and outline all necessary checks to prevent additional charges.

Understanding these associated forms ensures a smoother rental experience and clarifies the rights and responsibilities of everyone involved. It is crucial for both the lessee and U-Haul to be aware of the details laid out in each document to minimize potential issues and enhance overall satisfaction.

Similar forms

-

Rental Agreement: Similar to the U-Haul Storage Contract, a rental agreement outlines the terms and conditions under which goods or property can be rented. It specifies rental amounts, duration, and obligations of both parties.

-

Lease Agreement: Like the storage contract, a lease agreement establishes a relationship between the lessor and lessee, detailing usage terms, payments, and responsibilities related to property leased for a set time.

-

Insurance Policy: The U-Haul Storage Contract includes provisions for insurance coverage, akin to standard insurance policies that outline coverage details, exclusions, and claim procedures for protection against loss or damage.

-

Service Agreement: This document, similar to the U-Haul Storage Contract, sets out the services provided, liabilities, and terms of service, ensuring both parties are clear on their rights and obligations.

-

Bill of Lading: Much like the storage contract, a bill of lading is used in shipping and freight. It acts as a contract for the transport of goods, detailing the cargo, destination, and terms for handling the property.

-

Indemnity Agreement: This document, similar to aspects of the U-Haul Storage Contract, involves a party agreeing to compensate another for any losses or damages incurred. It outlines responsibilities regarding liabilities and claims.

Dos and Don'ts

When filling out the U-Haul Storage Contract form, it is essential to follow certain best practices to ensure accuracy and compliance. Here are 10 important things to do and avoid:

- Do read all instructions carefully before beginning the form.

- Do fill out each section completely and accurately. Incomplete forms may cause delays.

- Do provide your current and valid contact information, including phone number and email.

- Do review the insurance options available and consider choosing coverage that suits your needs.

- Do ask questions if any part of the form is unclear or confusing.

- Don’t rush through the form. Take your time to ensure that all information is correct.

- Don’t leave any blank spaces unless the section specifically allows it.

- Don’t provide false information or misrepresent any details on the form.

- Don’t forget to sign and date the contract after completing it.

- Don’t ignore the terms and conditions; ensure you understand them before submitting the form.

Misconceptions

Misconceptions about the U-Haul Storage Contract can lead to confusion and potentially result in inadequate protection or unforeseen liabilities. Below are six common misconceptions and clarifications surrounding the contract form.

- The coverage is automatic with every rental. Many assume that purchasing protection comes standard. In reality, coverage like SafeMove must be elected and paid for explicitly by the renter at the time of the equipment rental.

- All types of damage are covered under the policy. Not every damage scenario qualifies for coverage. Exclusions exist, including theft, damage due to improper packing, and losses caused during loading or unloading, among others.

- The insurance covers all items stored within the rented equipment. This is misleading. High-value items and certain types of property are not covered. For example, valuables like jewelry, artwork, and documents may not qualify for compensation under the policy.

- Coverage lasts indefinitely once activated. This is not true. The coverage terminates either on the return date indicated in the rental contract or when the Lessee’s property has been unloaded, whichever comes first.

- Filing a claim is a straightforward process. While it may seem easy, specific steps must be followed to successfully file a claim. For instance, notice of an accident must be reported immediately, and proof of loss should be submitted within 90 days.

- Insurance claims do not have a time limit for filing. This misconception poses a significant risk. Claims must be initiated within twelve months after the discovery of the incident that caused the loss or damage.

Understanding the details of the U-Haul Storage Contract is crucial. Being well-informed will help renters avoid unnecessary pitfalls and ensure adequate protection for their belongings during the rental period.

Key takeaways

When filling out and using the U-Haul Storage Contract form, it's crucial to understand several key points:

- Understand Coverage Limits: The insurance covers your cargo during transportation with a limit of $25,000 for one-way trips, which comes with a $100 deductible. Knowing this helps in assessing potential risks and planning appropriate insurance needs.

- Initials Matter: Make sure to initial the appropriate clause for SafeMove protection in the contract. This action signifies that you accept the coverage, and it becomes effective as soon as you begin your rental.

- Report Accidents Promptly: If any incidents occur, report them immediately to U-Haul. Additionally, you have 90 days to file a written Proof of Loss. Any delay can affect your claim, so stay vigilant.

- Know the Exclusions: Familiarize yourself with what is not covered, like theft, damage due to improper packing, or losses that occur during loading and unloading. This knowledge will help you take preventive measures with your belongings.

Browse Other Templates

What Does Dismissed Without Prejudice Mean - The form serves as proof of service, outlining how documents were delivered to parties involved.

City of Dallas Alarm Permit - The application also requires the social security number of the permit holder.

Family Heritage Record,Ancestral Family Document,Genealogy Group Chart,Descendant Information Sheet,Kinship Record,Clan Data Form,Relational Family Overview,Hereditary Profile Form,Family Lineage Tracker,Household History Record - Having a section for religion reflects the cultural backgrounds of family members.