Fill Out Your Uasa Dd Form

The Uasa Dd form is an important document designed to facilitate the direct deposit of annuity withdrawals from United American Insurance Company into the policyholder's chosen account. By completing this form, users grant the company permission to deposit funds directly into their bank account, ensuring timely access to their money. It contains essential information, including the policy number, account details, and contact information, which must be provided accurately. Users must also attach a voided check or deposit slip to confirm their account information, as this helps prevent errors during the deposit process. This authorization remains active until the policyholder submits a written request for cancellation, allowing for convenience and flexibility. Understanding the details of the Uasa Dd form is crucial for anyone looking to manage their finances effectively while ensuring a seamless transfer of funds directly to their banking institution.

Uasa Dd Example

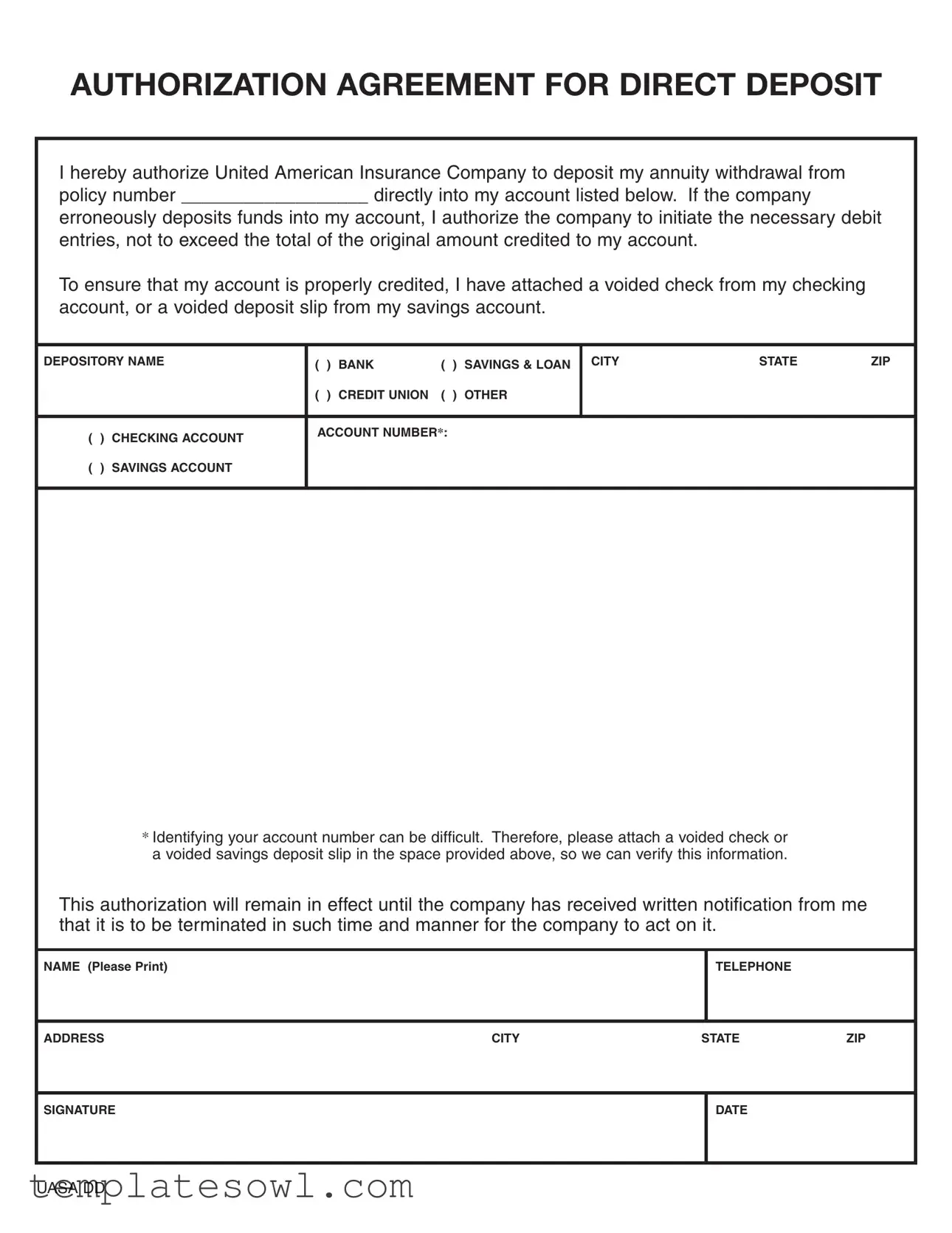

AUTHORIZATION AGREEMENT FOR DIRECT DEPOSIT

I hereby authorize United American Insurance Company to deposit my annuity withdrawal from policy number __________________ directly into my account listed below. If the company

erroneously deposits funds into my account, I authorize the company to initiate the necessary debit entries, not to exceed the total of the original amount credited to my account.

To ensure that my account is properly credited, I have attached a voided check from my checking account, or a voided deposit slip from my savings account.

DEPOSITORY NAME |

( ) BANK |

( ) SAVINGS & LOAN |

CITY |

STATE |

ZIP |

|

|

|

|

||

|

( ) CREDIT UNION |

( ) OTHER |

|

|

|

|

|

|

|

|

|

( ) CHECKING ACCOUNT |

ACCOUNT NUMBER*: |

|

|

|

|

|

|

|

|

|

|

( ) SAVINGS ACCOUNT |

|

|

|

|

|

|

|

|

|

|

|

*Identifying your account number can be difficult. Therefore, please attach a voided check or a voided savings deposit slip in the space provided above, so we can verify this information.

This authorization will remain in effect until the company has received written notification from me that it is to be terminated in such time and manner for the company to act on it.

NAME (PLEASE PRINT)

TELEPHONE

ADDRESS |

CITY |

STATE |

ZIP |

SIGNATURE

DATE

UASA DD

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | This form is used to authorize direct deposits of annuity withdrawals from United American Insurance Company into a designated bank account. |

| Account Verification | The form requires a voided check or deposit slip to verify the account information provided by the user. |

| Refund Option | If an error occurs, the company is authorized to debit the original amount from the user’s account. |

| Termination Clause | The authorization remains valid until written notice for termination is provided to the company. |

| Information Required | Users must provide personal details like name, address, phone number, and the account number of the financial institution. |

| Governing Law | The governing laws for the use of this form may vary by state. Users should check specific state regulations for direct deposit authorizations. |

| Deposit Options | Depository options include checking accounts, savings accounts, and accounts from credit unions or other financial institutions. |

| Signature Requirement | A signature and date are required at the end of the form to validate the authorization agreement. |

Guidelines on Utilizing Uasa Dd

Completing the Uasa DD form is an important step in setting up your direct deposit. It allows for the smooth transfer of your annuity withdrawal into your bank account. Follow these steps carefully to ensure that all information is accurately provided.

- Begin by filling in your policy number in the designated space at the top of the form.

- Attach a voided check from your checking account or a voided deposit slip from your savings account. This ensures your account information can be verified.

- In the section for the depository name, write the name of your bank or financial institution.

- Indicate the type of account you are using by checking the appropriate box: Checking Account, Savings Account, Credit Union, or Other.

- Provide your account number in the space provided. Remember that identifying your account number can be tricky, hence the voided check or deposit slip you attached.

- Fill in the address fields, including your city, state, and ZIP code.

- Print your name clearly in the space that asks for it.

- Provide your telephone number for any necessary contact regarding your account.

- Sign and date the form at the bottom to finalize your authorization.

After completing the Uasa DD form, double-check all the provided information for accuracy. Ensure your signatures and attached documents are clear, as this will help prevent any delays in processing your direct deposit request.

What You Should Know About This Form

What is the Uasa DD form?

The Uasa DD form is an authorization agreement that allows United American Insurance Company to directly deposit your annuity withdrawal into your specified bank account. By completing this form, you give permission to the company to manage the transfer of funds securely and efficiently.

Why do I need to attach a voided check or deposit slip?

Attaching a voided check or deposit slip helps verify your bank account details. This step ensures that the funds are directed correctly, minimizing the risk of errors in the deposit process.

Can I change my bank account information after submitting the form?

Yes, you can change your bank account information. To do so, a new Uasa DD form must be completed and submitted. Additionally, any changes should be communicated in writing to United American Insurance Company to ensure proper handling.

How will I know if my funds have been deposited?

You can confirm the deposit by checking your bank account statement or online banking portal. The transaction should reflect the annuity withdrawal once processed. If you have concerns about a deposit, it is advisable to contact your bank or United American Insurance Company for clarification.

What happens if the company mistakenly deposits funds into my account?

If an error occurs and funds are deposited erroneously, you authorize United American Insurance Company to initiate a debit entry. This action will not exceed the original amount that was credited to your account, ensuring that the company can rectify the mistake without excessive impact on your finances.

How long will the authorization stay in effect?

The authorization you provide will remain in effect until you send written notification to United American Insurance Company to terminate it. The company requires this notice to take action in a timely manner, so be sure to provide clear communication regarding any changes.

What information do I need to provide on the Uasa DD form?

You will need to provide your account details, including the bank's name, your account type (checking or savings), and your account number. Additionally, your personal contact information, such as your name, address, and telephone number, will also be required to maintain accurate records.

Is this form secure?

Yes, this form is designed to ensure the secure handling of your personal and bank information. It is best practice to send the form through a secure method, such as registered mail or a secure electronic submission if available, to protect your information.

What if I have further questions about the form?

If you have additional questions or need assistance, it is encouraged to reach out directly to United American Insurance Company. Their customer service team should be able to provide further guidance and address any specific concerns related to the Uasa DD form.

Do I need to submit this form every month?

No, you do not need to submit the Uasa DD form every month. Once you have authorized the direct deposit, it will continue until you decide to cancel it or update your account information. Always remember to keep the company informed of any changes to ensure seamless transactions.

Common mistakes

One common mistake individuals make when filling out the Uasa Dd form is neglecting to provide the correct account number. This number is crucial for ensuring funds are deposited accurately. It is important to double-check both the account number and the attached voided check or deposit slip for accuracy.

Another frequent error is failing to include a voided check or deposit slip. The form specifies that these documents are necessary for account verification. Without them, the processing of the direct deposit may be delayed or even canceled.

People often overlook the importance of providing complete address information. Incomplete addresses can lead to difficulties in contacting the individual should any issues arise. Ensure that every line of the address, including city, state, and zip code, is fully completed.

Additionally, some individuals submit the form without signing it. This can result in the entire form being rejected, as a signature serves as a necessary authorization for the transaction. Always remember to sign and date the form before submission.

A mistake that can go unnoticed is incorrect designation of the bank type, such as labeling a checking account as a savings account. Clearly indicating the correct type is essential for the company to process the direct deposit accurately.

Lastly, individuals sometimes fail to include a phone number. A contact number can be very helpful for the company if they need to follow up. Providing a reliable phone number ensures that communication remains open and any potential issues can be resolved quickly.

Documents used along the form

When dealing with financial transactions involving direct deposits, several important documents complement the Uasa Dd form. Understanding these documents can streamline the process and ensure everything runs smoothly.

- Voided Check: A check from your checking account with “VOID” written across it. It serves as proof of your banking information and helps to verify that the account number is accurate.

- Voided Deposit Slip: This is a deposit slip from your savings account marked "VOID." Like the voided check, it confirms the account details you provided for the deposit.

- Direct Deposit Authorization Form: Apart from the Uasa Dd, this form allows you to authorize your employer or financial institution to deposit funds directly into your account. It may require similar banking details.

- Account Change Request Form: If you wish to change the account to which deposits go, this form communicates your intentions to your financial institution effectively.

- Tax Identification Form: Certain institutions may require this document for tax reporting purposes, ensuring compliance with IRS regulations.

- Withdrawal Request Form: If you are withdrawing funds from your annuity policy, this form is often necessary to specify the amount and confirm your authorization.

- Bank Authorization Form: This grants permission for the insurance company to access your bank information to verify your account, a step often required to prevent errors.

- Confirmation of Direct Deposit: After the setup, this document confirms that your direct deposit instructions have been received and processed by your financial institution.

These documents collectively enhance the reliability and efficiency of your financial transactions. By providing comprehensive information, you help ensure that your direct deposit is processed without delay.

Similar forms

The Uasa DD form is a document used for authorizing direct deposit payments. There are several other documents that serve similar purposes in varying contexts. Here’s a summary of four such documents:

- Direct Deposit Authorization Form: This form allows employees to authorize their employers to deposit their salaries directly into their bank accounts. Like the Uasa DD form, it requires the employee's account information and continues until canceled.

- Automatic Payment Authorization Form: This document allows individuals to authorize recurring payments, such as utility bills or loan payments, to be automatically deducted from their bank account. It includes similar account verification steps to ensure accuracy.

- Social Security Administration Direct Deposit Form: This form is used to set up direct deposit for Social Security benefits. It mirrors the Uasa DD form by requiring the recipient’s personal information and account details, also remaining effective until canceled.

- ACH Credit Authorization Form: This document permits businesses to initiate credit transfers to individuals’ bank accounts. Much like the Uasa DD form, it mandates the inclusion of specific account information and remains in effect until a written cancellation is submitted.

Dos and Don'ts

When filling out the Uasa Dd form, it's important to be careful and thorough. Here are some guidelines to follow:

- Do double-check your personal information, like your name and address.

- Do ensure that you attach a voided check or deposit slip to verify your account number.

- Do provide accurate account information, including the correct account type (checking or savings).

- Do keep a copy of the completed form for your records.

- Do notify the company in writing if you wish to terminate the authorization.

- Don't leave any sections of the form blank; fill in all required fields.

- Don't use abbreviations or nicknames for your name.

- Don't forget to sign and date the form.

- Don't submit the form without checking for errors or typos.

Misconceptions

Understanding the Uasa Dd form is crucial for ensuring smooth transactions with United American Insurance Company. However, several misconceptions often arise about it. Below are ten common misconceptions clarified:

- Direct deposit is optional. Some believe that using direct deposit is merely a preference. In fact, it is a requirement for receiving certain payments efficiently.

- I can use any bank account. While you can use your checking or savings account, the bank must be able to process direct deposit to ensure proper transactions.

- The authorization is permanent. The authorization remains active until you provide written notice to terminate it. It can be changed if necessary.

- Only one account can be used. You can authorize multiple accounts for deposit, but each must be set up separately with appropriate documentation.

- Voided checks are not necessary. Attaching a voided check or deposit slip is a requirement. This step ensures accurate account verification.

- The company can withdraw any amount. The company can only debit the amount that was incorrectly deposited, up to the original credited amount.

- My privacy is not protected. Personal information provided on the form is kept confidential and used solely for the purpose of direct deposit.

- Any changes take immediate effect. Once you notify the company of changes, they must process the request in a timely manner, which may take some time.

- The form can be submitted without my signature. Your signature is mandatory. Without it, the form will not be accepted.

- Only physical forms can be used. Electronic submissions may be accepted, but it depends on the company's policy. Always verify what is allowed.

Being informed about these misconceptions can help facilitate a smoother experience. Ensure you follow the protocol and complete the necessary steps for effective management of your direct deposits.

Key takeaways

Here are some key takeaways about filling out and using the Uasa Dd form:

- Direct Deposit Authorization: This form allows you to authorize United American Insurance Company to deposit your annuity withdrawal directly into your bank account.

- Account Information: You must provide details about your bank, including the account type, name, and account number.

- Voided Check Requirement: To ensure accuracy, attach a voided check or deposit slip to confirm your account details.

- Error Resolution: If the company mistakenly deposits funds into your account, you give them permission to withdraw the incorrect amount.

- Written Termination: The authorization remains active until you submit a written notice to terminate it.

- Contact Information: Complete your personal contact details, such as your name, address, and telephone number.

- Legal Capacity: You must sign and date the form to make it legally binding.

- Account Types: Specify the type of account (checking, savings & loan, credit union, etc.) to avoid confusion.

- Clear Instructions: Follow the instructions carefully to ensure prompt processing of your direct deposit.

Browse Other Templates

Special Interest Plate Request,Unique Plate Application,California Personalized Plate Form,Specialty License Plate Request,Custom Vehicle Plate Application,Special Plate Ownership Form,Interest Plate Assignment Form,California Custom Plate Applicatio - The application can be submitted online or by mail to the DMV's designated address.

How to Get Gun License in California 2023 - Proof of citizenship is required if you were born outside the United States.