Fill Out Your Ub 94 Form

The UB-94 form, also known as the CMS-1450, serves as a crucial document for healthcare institutions when it comes to submitting claims for reimbursement for services rendered. Designed to capture a wide range of essential information, it includes fields for billing provider details, patient identification, service dates, and billing codes. Each section of the form plays a significant role in ensuring accurate processing of claims. For instance, the billing provider information must reflect the physical address of the healthcare facility, not a P.O. Box, to avoid payment discrepancies. Additionally, correct usage of codes is vital; any errors in entries, such as the type of bill or a missing federal tax ID, could lead to claim rejection or delayed payments. The UB-94 is structured to facilitate communication between providers and payers, making it easier to track patient care from admission to discharge, while also supporting the accurate reflection of billed services. With attention to detail in filling out the form, providers can enhance their chances of receiving timely and correct payment for the care they deliver.

Ub 94 Example

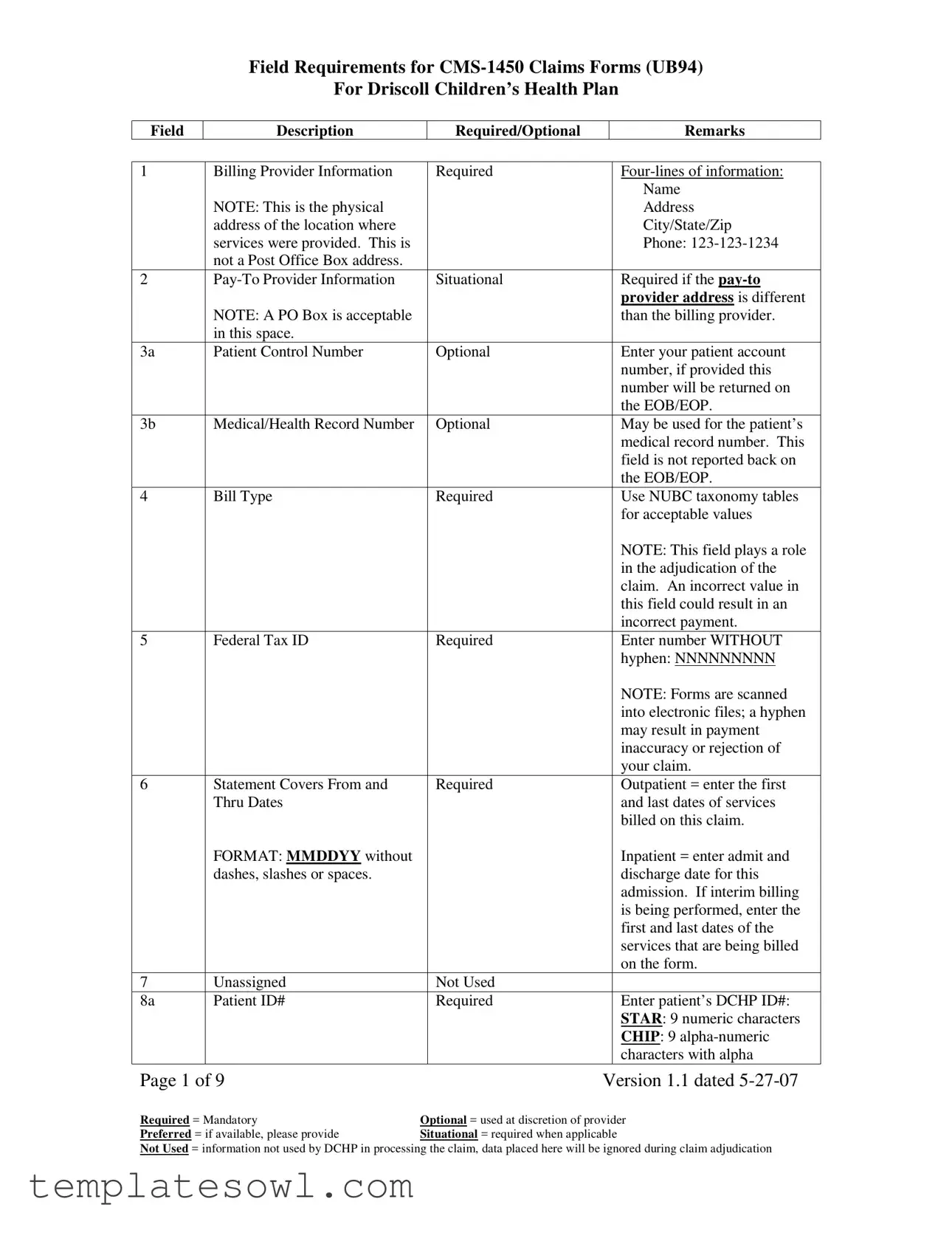

Field Requirements for

For Driscoll Children’s Health Plan

Field

Description

Required/Optional

Remarks

1 |

Billing Provider Information |

|

Required |

|

|

|

|

|

|

|

Name |

|

NOTE: This is the physical |

|

|

|

Address |

|

address of the location where |

|

|

|

City/State/Zip |

|

services were provided. This is |

|

|

|

Phone: |

|

not a Post Office Box address. |

|

|

|

|

2 |

|

Situational |

|

Required if the |

|

|

|

|

|

|

provider address is different |

|

NOTE: A PO Box is acceptable |

|

|

|

than the billing provider. |

|

in this space. |

|

|

|

|

3a |

Patient Control Number |

|

Optional |

|

Enter your patient account |

|

|

|

|

|

number, if provided this |

|

|

|

|

|

number will be returned on |

|

|

|

|

|

the EOB/EOP. |

3b |

Medical/Health Record Number |

|

Optional |

|

May be used for the patient’s |

|

|

|

|

|

medical record number. This |

|

|

|

|

|

field is not reported back on |

|

|

|

|

|

the EOB/EOP. |

4 |

Bill Type |

|

Required |

|

Use NUBC taxonomy tables |

|

|

|

|

|

for acceptable values |

|

|

|

|

|

NOTE: This field plays a role |

|

|

|

|

|

in the adjudication of the |

|

|

|

|

|

claim. An incorrect value in |

|

|

|

|

|

this field could result in an |

|

|

|

|

|

incorrect payment. |

5 |

Federal Tax ID |

|

Required |

|

Enter number WITHOUT |

|

|

|

|

|

hyphen: NNNNNNNNN |

|

|

|

|

|

NOTE: Forms are scanned |

|

|

|

|

|

into electronic files; a hyphen |

|

|

|

|

|

may result in payment |

|

|

|

|

|

inaccuracy or rejection of |

|

|

|

|

|

your claim. |

6 |

Statement Covers From and |

|

Required |

|

Outpatient = enter the first |

|

Thru Dates |

|

|

|

and last dates of services |

|

|

|

|

|

billed on this claim. |

|

FORMAT: MMDDYY without |

|

|

|

Inpatient = enter admit and |

|

dashes, slashes or spaces. |

|

|

|

discharge date for this |

|

|

|

|

|

admission. If interim billing |

|

|

|

|

|

is being performed, enter the |

|

|

|

|

|

first and last dates of the |

|

|

|

|

|

services that are being billed |

|

|

|

|

|

on the form. |

7 |

Unassigned |

|

Not Used |

|

|

8a |

Patient ID# |

|

Required |

|

Enter patient’s DCHP ID#: |

|

|

|

|

|

STAR: 9 numeric characters |

|

|

|

|

|

CHIP: 9 |

|

|

|

|

|

characters with alpha |

Page 1 of 9 |

|

|

Version 1.1 dated |

||

Required = Mandatory |

Optional = used at discretion of provider |

||||

Preferred = if available, please provide |

Situational = required when applicable |

||||

Not Used = information not used by DCHP in processing the claim, data placed here will be ignored during claim adjudication

Field Requirements for

For Driscoll Children’s Health Plan

Field

Description

Required/Optional

Remarks

|

|

|

|

|

character appearing in the lead |

|

|

|

|

|

position. |

8b |

Patient Name |

|

Required |

|

Patient name: |

|

|

|

|

|

Last, First Middle |

|

|

|

|

|

Sample: SMITH, MARY JO |

9a |

Patient Address |

|

Required |

|

Patient’s street address |

9b |

Patient City |

|

Required |

|

Patient’s city |

9c |

Patient State |

|

Required |

|

Patient’s state – |

|

|

|

|

|

abbreviation required |

9d |

Patient Zip Code |

|

Required |

|

Patient’s zip code – 5 digits |

|

|

|

|

|

are required. |

|

|

|

|

|

optional. If |

|

|

|

|

|

DO NOT use a hyphen. |

9e |

Patient County Code |

|

Optional |

|

If used, must use codes |

|

|

|

|

|

provided by American |

|

|

|

|

|

National Standards Institute in |

|

|

|

|

|

ISO3166 |

10 |

Date of Birth |

|

Required |

|

Enter date: MMDDYYYY |

|

|

|

|

|

without hyphens, slashes or |

|

|

|

|

|

spaces |

11 |

Sex |

|

Required |

|

M = male |

|

|

|

|

|

F = female |

|

|

|

|

|

U = unknown |

12 |

Admission or Start of Care Date |

|

Required on both inpatient |

|

Enter date: MMDDYY |

|

|

|

and outpatient claims |

|

without hyphens, slashes or |

|

|

|

|

|

spaces |

13 |

Admission Hour |

|

Required |

|

Use NUBC taxonomy tables |

|

|

|

|

|

for acceptable values: 00 |

|

|

|

|

|

through 23 to define the hour |

14 |

Admission Type |

|

Required on Inpatient |

|

1 = emergency |

|

|

|

|

|

2 = urgent |

|

|

|

Optional on Outpatient |

|

3 = elective |

|

|

|

|

|

4 = newborn |

|

|

|

|

|

5 = trauma |

|

|

|

|

|

9 = information not available |

15 |

Admission Source |

|

Required |

|

Use NUBC taxonomy tables |

|

|

|

|

|

for acceptable values |

16 |

Discharge Hour |

|

Required on inpatient |

|

Use NUBC taxonomy tables |

|

|

|

where bill type end is a 1, |

|

for acceptable values: 00 |

|

|

|

2, 3, or 4. |

|

through 23 to define the hour |

|

|

|

Optional on outpatient |

|

|

17 |

Discharge Status |

|

Required on inpatient |

|

Use NUBC taxonomy tables |

|

|

|

|

|

for acceptable values |

|

|

|

Not Used on outpatient |

|

|

Condition Codes |

|

Situational, but required |

|

Use NUBC taxonomy tables |

|

|

|

|

where the condition code |

|

for acceptable values |

Page 2 of 9 |

|

|

Version 1.1 dated |

||

Required = Mandatory |

Optional = used at discretion of provider |

||||

Preferred = if available, please provide |

Situational = required when applicable |

||||

Not Used = information not used by DCHP in processing the claim, data placed here will be ignored during claim adjudication

Field Requirements for

For Driscoll Children’s Health Plan

Field |

Description |

|

Required/Optional |

|

|

Remarks |

|

|

|

|

|

|

|

|

|

|

applies to the bill |

|

|

|

29 |

Accident State |

|

Situational, but required |

|

Use the |

|

|

|

|

where applicable. Always |

|

abbreviation to designate the |

|

|

|

|

required when |

|

State in which the accident |

|

|

|

|

ICD9 codes are used. |

|

occurred. |

|

30 |

Unassigned |

|

Not Used |

|

|

|

31 a & b |

Occurrence Code and Date |

|

Situational, but required |

|

Use NUBC taxonomy tables |

|

through |

|

|

where the occurrence code |

|

for acceptable values |

|

34 a & b |

|

|

applies to the bill |

|

|

|

35 a & b |

Occurrence Span Code and |

|

Situational, but required |

|

Use NUBC taxonomy tables |

|

through |

Dates |

|

where the occurrence code |

|

for acceptable values |

|

36 a & b |

|

|

and span dates apply to the |

|

|

|

|

|

|

bill |

|

|

|

37 |

Unassigned |

|

Not Used |

|

|

|

38 |

Responsible Party Name and |

|

Not Used |

|

Providers may complete this |

|

|

Address |

|

|

|

|

field, but it will not be used |

|

|

|

|

|

|

for claims processing and this |

|

|

|

|

|

|

information will not be |

|

|

|

|

|

|

reported back. |

|

|

|

|

|

|

If used: |

|

|

|

|

|

|

Name |

|

|

|

|

|

|

Address |

|

|

|

|

|

|

City/State/Zip |

|

|

|

|

|

|

If a |

|

|

|

|

|

|

be formatted as |

|

|

|

|

|

|

with hyphen displayed. |

39a,b,c,d |

Value Codes and Amounts |

|

Situational, but required |

|

Use NUBC taxonomy tables |

|

through |

|

|

where the occurrence code |

|

for acceptable values |

|

41a,b,c,d |

|

|

and span dates apply to the |

|

|

|

|

|

|

bill |

|

|

|

42 |

Revenue Code |

|

Required on both inpatient |

|

Use NUBC taxonomy tables |

|

|

|

|

and outpatient claims |

|

for acceptable values |

|

43 |

Description |

|

Required on paper claims |

|

Use the Standard |

|

|

|

|

|

|

|

Abbreviation as determined |

|

|

|

|

|

|

by NUBC UB04 |

|

|

|

|

|

|

specifications |

44 |

HCPCS Code or Rate |

|

REQUIRED as shown to |

|

Inpatient: |

|

|

|

|

the right |

|

Rev Codes 0100 through 0219 |

|

|

|

|

|

|

|

and the 100X series must |

|

|

|

|

|

|

show the unit room rate. |

|

|

|

|

|

|

Outpatient: |

|

|

|

|

|

|

Revenue Codes 0450 through |

|

|

|

|

|

|

0459 must be HCPCS coded |

|

|

|

|

|

|

with the applicable level of |

|

|

|

|

|

|

care describing the visit. |

|

|

|

|

|

|

99281 – Level 1 |

|

|

|

|

|

|

99282 – Level 2 |

Page 3 of 9 |

|

Version 1.1 dated |

||||

Required = Mandatory |

Optional = used at discretion of provider |

|||||

Preferred = if available, please provide |

Situational = required when applicable |

|

||||

Not Used = information not used by DCHP in processing the claim, data placed here will be ignored during claim adjudication

Field Requirements for

For Driscoll Children’s Health Plan

Field |

Description |

Required/Optional |

|

Remarks |

|

|

|

|

|

|

|

|

|

99283 – Level 3 |

|

|

|

|

99284 – Level 4 |

|

|

|

|

99285 – Level 5 |

|

|

|

|

See Appendix A below for a |

|

|

|

|

list of all UB Rev Codes that |

|

|

|

|

must be |

|

|

|

|

Outpatient UB04 form. |

45 |

Service Date |

Inpatient: Do not Use |

|

MMDDYY |

|

|

Outpatient: Required |

|

|

46 |

Service Units |

REQUIRED as shown to |

|

Inpatient: |

|

|

the right |

|

Rev Codes 0100 through 0219 |

|

|

|

|

and the 100X series must |

|

|

|

|

show the number of days |

|

|

|

|

billed for each |

|

|

|

|

accommodation. |

|

|

|

|

Outpatient: |

|

|

|

|

UB Rev Code 0762 requires |

|

|

|

|

number of hours not to exceed |

|

|

|

|

23. Other codes may be |

|

|

|

|

populated at provider’s |

|

|

|

|

discretion. |

47 |

Total Charges |

Required |

|

|

48 |

Situational, this |

|

Inpatient Claims: The charges |

|

|

|

information is required if |

|

represented in field 47 that |

|

|

some of the charges |

|

fall on dates of service that |

|

|

shown in field 47 are not |

|

were denied by utilization |

|

|

covered or if some dates |

|

management, must be |

|

|

of services reflected in the |

|

reflected in this column. |

|

|

charges in field 47 have |

|

|

|

|

been denied by DCHP |

|

|

|

|

utilization management. |

|

|

49 |

Unassigned |

Not Used |

|

|

50 |

Payer Name |

Required |

|

Use multiple lines (a,b,c) if |

|

|

|

|

there is more than one payer. |

|

|

|

|

DCHP will always be the |

|

|

|

|

payer of last resort. Providers |

|

|

|

|

must bill other insurance and |

|

|

|

|

reflect the payment and denial |

|

|

|

|

on the bill send to DCHP. |

51 |

Health Plan ID |

Not required for STAR or |

|

NOTE: This field may |

|

|

CHIP claims |

|

become mandatory once |

|

|

|

|

health plans are assigned their |

|

|

|

|

own National Plan Identifier. |

52 |

Release of Information |

Required |

|

Y = Yes |

|

|

|

|

N = No |

53 |

Benefits Assigned |

Required |

|

Y = Yes |

|

|

|

|

|

Page 4 of 9 |

Version 1.1 dated |

Required = Mandatory |

Optional = used at discretion of provider |

Preferred = if available, please provide |

Situational = required when applicable |

Not Used = information not used by DCHP in processing the claim, data placed here will be ignored during claim adjudication

Field Requirements for

For Driscoll Children’s Health Plan

Field

Description

Required/Optional

Remarks

|

|

|

|

|

All CHIP and STAR claims |

|

|

|

|

|

must indicate YES. |

54 |

Prior Payments |

|

Situational |

|

Enter any dollar amount paid |

|

|

|

|

|

by the payer on this claim |

55 |

Estimated Amount Due |

|

Not Required |

|

|

56 |

NPI |

|

Required |

|

The |

|

|

|

|

|

the BILLING PROVIDER |

|

|

|

|

|

identified in field 1 on the |

|

|

|

|

|

UB04 |

57 |

Other Billing Provider |

|

Not Required |

|

|

58 |

Insured Name |

|

Required |

|

Name of the insured person |

|

|

|

|

|

for the insurance shown in |

|

|

|

|

|

field 50. |

|

|

|

|

|

For STAR and CHIP this will |

|

|

|

|

|

always be the PATIENT. |

59 |

Insured Relationship to Patient |

|

Required |

|

Use NUBC taxonomy tables |

|

|

|

|

|

for acceptable values |

|

|

|

|

|

For STAR and CHIP this will |

|

|

|

|

|

always = 18 |

60 |

Insured’s Unique ID |

|

Required |

|

Insurance ID# assigned by the |

|

|

|

|

|

health plan of payer to the |

|

|

|

|

|

insured person |

|

|

|

|

|

CHIP: |

|

|

|

|

|

starting with a alpha character |

|

|

|

|

|

and followed by 8 numeric |

|

|

|

|

|

characters |

|

|

|

|

|

STAR: |

61 |

Group Name |

|

Required for other |

|

Enter the name of group, |

|

|

|

insurance |

|

which is will usually be the |

|

|

|

|

|

employer through which the |

|

|

|

Not Required for STAR |

|

insurance is received. |

|

|

|

and CHIP |

|

|

|

|

|

|

|

For STAR and CHIP, this |

|

|

|

|

|

field can be left blank or can |

|

|

|

|

|

be populated with “DCHP”. |

62 |

Insurance Group Number |

|

Required for other |

|

Enter the group ID# assigned |

|

|

|

insurance |

|

by the applicable payer. |

|

|

|

Not Required for STAR |

|

For STAR and CHIP this field |

|

|

|

and CHIP |

|

can be left blank. |

63 |

Treatment Authorization Codes |

|

Situational |

|

If prior authorization code |

|

|

|

|

|

was given for the services |

|

|

|

|

|

represented in the claim, enter |

|

|

|

|

|

than number in this space. |

64 |

Document Control Number |

|

Situational |

|

If |

|

|

|

|

|

was previously adjudicated, |

Page 5 of 9 |

|

|

Version 1.1 dated |

||

Required = Mandatory |

Optional = used at discretion of provider |

||||

Preferred = if available, please provide |

Situational = required when applicable |

||||

Not Used = information not used by DCHP in processing the claim, data placed here will be ignored during claim adjudication

Field Requirements for

For Driscoll Children’s Health Plan

Field |

Description |

|

Required/Optional |

|

|

Remarks |

|

|

|

|

|

|

|

|

|

|

Required only for a claim |

|

|

enter the Internal Control |

|

|

|

|

|

Number shown on the DCHP |

|

|

|

|

|

|

|

Explanation of Payment |

|

|

|

|

|

|

(EOP) form. |

65 |

Employer Name |

|

Required for other |

|

|

Enter the name of the |

|

|

|

insurance |

|

|

employer who provides the |

|

|

|

|

|

|

insurance to the person shown |

|

|

|

Not Required for STAR |

|

|

in field 58 |

|

|

|

and CHIP |

|

|

|

66 |

Diagnosis Code Qualifier |

|

Required |

|

|

Should always = 9 to indicate |

|

|

|

|

|

|

ICD9 code. |

For all codes entered in field 67 through 74 decimals are assumed and should not be stated. |

||||||

67 |

Principal or Present on |

|

Required |

|

|

Inpatient: Enter the principal |

|

Admission Code |

|

|

|

|

diagnosis as defined by CMS |

|

|

|

|

|

|

Outpatient: Enter the |

|

|

|

|

|

|

diagnosis code that describes |

|

|

|

|

|

|

the reason for the visit |

67 |

Other Diagnosis Codes |

|

Situational |

|

|

Enter all other final diagnosis |

|

|

|

|

|

|

codes applicable to the visit or |

|

|

|

|

|

|

addressed in the visit or that |

|

|

|

|

|

|

explain why the services |

|

|

|

|

|

|

being billed were performed. |

69 |

Admit Diagnosis |

|

Inpatient: Required |

|

|

Enter the applicable ICD9 |

|

|

|

|

|

|

codes representing the reason |

|

|

|

Outpatient: Not Required |

|

|

for admission |

70 |

Patient’s Reason for Visit |

|

Inpatient: Not Used |

|

|

Enter the applicable ICD9 |

|

|

|

|

|

|

codes. |

|

|

|

Outpatient: Required for |

|

|

|

|

|

|

Emergency Room, not |

|

|

|

|

|

|

required otherwise |

|

|

|

71 |

PPS Code |

|

REQUIRED for DRG- |

|

|

Enter the applicable DRG |

|

|

|

based hospitals, otherwise |

|

|

code determined by the |

|

|

|

this field in not required. |

|

|

provider that applies to this |

|

|

|

|

|

|

claim. |

72 |

External Cause of Injury Code |

|

Situational |

|

|

Enter the applicable |

|

|

|

|

|

|

ICD9 code if the treatment |

|

|

|

|

|

|

was related to an accident |

73 |

Unassigned |

|

Not Used |

|

|

|

74 |

Principal Procedure |

|

Situational |

|

|

Input the ICD9 surgical |

|

|

|

|

|

|

procedure code and the date |

|

|

|

|

|

|

of the surgery applicable to |

|

|

|

|

|

|

the treatment represented on |

|

|

|

|

|

|

the claim |

74 |

Other Procedure |

|

Situational |

|

|

Input the ICD9 surgical |

|

|

|

|

|

|

procedure code and the date |

|

|

|

|

|

|

of the surgery applicable to |

|

|

|

|

|

|

the treatment represented on |

|

|

|

|

|

|

the claim |

75 |

Unassigned |

|

Not Used |

|

|

|

Page 6 of 9 |

|

|

Version 1.1 dated |

|||

Required = Mandatory |

Optional = used at discretion of provider |

|||||

Preferred = if available, please provide |

Situational = required when applicable |

|||||

Not Used = information not used by DCHP in processing the claim, data placed here will be ignored during claim adjudication

Field Requirements for

For Driscoll Children’s Health Plan

Field |

Description |

|

Required/Optional |

|

|

Remarks |

|

|

|

|

|

|

|

76 |

Attending Provider Name and |

|

Required |

|

NPI |

|

|

Identifiers |

|

|

|

|

Attending provider’s NPI |

|

|

|

|

|

|

number |

|

NOTE: There are 4 distinct |

|

|

|

|

|

|

fields within this box. Each |

|

|

|

|

QUAL |

|

field must be completed as |

|

|

|

|

Enter the qualifier of 1D |

|

shown in the far right column. |

|

|

|

|

followed by Attending |

|

|

|

|

|

|

Provider’s TPI # |

|

|

|

|

|

|

LAST |

|

|

|

|

|

|

Last name of Attending |

|

|

|

|

|

|

Provider |

|

|

|

|

|

|

FIRST |

|

|

|

|

|

|

First name of Attending |

|

|

|

|

|

|

Provider |

77 |

Operating Provider Name and |

|

Situational |

|

NPI |

|

|

Identifiers |

|

|

|

|

Operating provider’s NPI |

|

|

|

|

|

|

number |

|

NOTE: There are 4 distinct |

|

|

|

|

|

|

fields within this box. Each |

|

|

|

|

QUAL |

|

field must be completed, if |

|

|

|

|

Enter the qualifier of 1D |

|

applicable, as shown in the far |

|

|

|

|

followed by Operating |

|

right column. |

|

|

|

|

Provider’s TPI # |

|

|

|

|

|

|

LAST |

|

|

|

|

|

|

Last name of Operating |

|

|

|

|

|

|

Provider |

|

|

|

|

|

|

FIRST |

|

|

|

|

|

|

First name of Operating |

|

|

|

|

|

|

Provider |

78 |

Other Provider Name and |

|

Situational – if applicable |

|

NPI |

|

|

Identifiers |

|

use this field for |

|

Referring provider’s NPI |

|

|

|

|

REFERRING PROVIDER |

|

number |

|

|

NOTE: There are 4 distinct |

|

|

|

|

|

|

fields within this box. Each |

|

|

|

|

QUAL |

|

field must be completed, if |

|

|

|

|

Enter the qualifier of 1D |

|

applicable, as shown in the far |

|

|

|

|

followed by Referring |

|

right column. |

|

|

|

|

Provider’s TPI # |

|

|

|

|

|

|

LAST |

|

|

|

|

|

|

Last name of Referring |

|

|

|

|

|

|

Provider |

|

|

|

|

|

|

FIRST |

|

|

|

|

|

|

First name of Referring |

|

|

|

|

|

|

Provider |

79 |

Other Provider Name and |

|

Situational |

|

NPI |

|

|

Identifiers |

|

|

|

|

Other provider’s NPI number |

Page 7 of 9 |

|

Version 1.1 dated |

||||

Required = Mandatory |

Optional = used at discretion of provider |

|||||

Preferred = if available, please provide |

Situational = required when applicable |

|

||||

Not Used = information not used by DCHP in processing the claim, data placed here will be ignored during claim adjudication

Field Requirements for

For Driscoll Children’s Health Plan

Field |

Description |

Required/Optional |

|

Remarks |

|

|

|

|

|

|

NOTE: There are 4 distinct |

|

|

QUAL |

|

fields within this box. Each |

|

|

Enter the qualifier of 1D |

|

field must be completed. If |

|

|

followed by Other Provider’s |

|

applicable, as shown in the far |

|

|

TPI # |

|

right column. |

|

|

|

|

|

|

|

LAST |

|

|

|

|

Last name of Other Provider |

|

|

|

|

FIRST |

|

|

|

|

First name of Other Provider |

80 |

Remarks Field |

Situational |

|

Used when in the judgment of |

|

|

|

|

the provider, the information |

|

|

|

|

is needed to substantiate the |

|

|

|

|

medical treatment and it is not |

|

|

|

|

supported elsewhere within |

|

|

|

|

the claim data set. |

81 |

Situational |

|

Used in accordance with the |

|

|

|

|

|

NUBC taxonomy set forth in |

|

|

|

|

the NUBC UB04 |

|

|

|

|

specifications manual and |

|

|

|

|

published by the American |

|

|

|

|

Hospital Association. |

Change Log:

Date |

Version |

Changes |

1.0 |

Initial DRAFT version, posted on website but also used internally to vet |

|

|

|

requirements. |

1.1 |

Updated as discussed internally. Most critical changes were to the |

|

|

|

following fields 44 and 46. In addition, Appendix A was added at the end |

|

|

of this document. |

|

|

|

|

|

|

|

|

|

Page 8 of 9 |

Version 1.1 dated |

Required = Mandatory |

Optional = used at discretion of provider |

Preferred = if available, please provide |

Situational = required when applicable |

Not Used = information not used by DCHP in processing the claim, data placed here will be ignored during claim adjudication

Field Requirements for

For Driscoll Children’s Health Plan

Field

Description

Required/Optional

Remarks

APPENDIX A: UB Rev Code That Required HCPCS Coding for all Outpatient Bill Types

(Revenue Codes not applicable to an outpatient claim or that do not require HCPCS coding on an outpatient claims are

omitted from the following list)

Disclaimer: Inclusion in the following does not imply that the Revenue Code is a covered service.

Please refer to applicable Medicaid regulations and to the UB04 Manual published by the American

Hospital Association for details.

CODES |

CODES |

CODES |

CODES |

CODES |

CODES |

029X |

035X |

045X |

056X |

077X |

098X |

030X |

040X |

046X |

057X |

090X |

210X |

031X |

041X |

047X |

061X |

091X |

|

032X |

042X |

048X |

073X |

092X |

|

033X |

043X |

054X |

074X |

096X |

|

034X |

044X |

055X |

075X |

097X |

|

All providers that use the UB04 form are strongly encouraged to subscribe the UB04 Manual published by the American Hospital Association. To the fullest extent possible, Driscoll Children’s Health Plan uses these specifications in processing claims.

Page 9 of 9 |

Version 1.1 dated |

Required = Mandatory |

Optional = used at discretion of provider |

Preferred = if available, please provide |

Situational = required when applicable |

Not Used = information not used by DCHP in processing the claim, data placed here will be ignored during claim adjudication

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Title | The UB-94 form is officially known as the CMS-1450 Claims Form. |

| Usage | This form is used for submitting claims for medical services provided to patients under the Driscoll Children’s Health Plan. |

| Required Fields | Key fields like Billing Provider Information and Patient ID# are mandatory for submission. |

| Date Format | All dates must be entered in MMDDYY format, without hyphens or spaces. |

| Federal Tax ID | Providers must enter the Tax ID number without hyphens to avoid payment issues. |

| Governing Law | This form is governed by federal regulations and state-specific laws relevant to healthcare billing. |

Guidelines on Utilizing Ub 94

Completing the UB 94 form is a critical step in the claims process for Driscoll Children’s Health Plan. Ensure to fill it out carefully, as accurate information will expedite the processing of claims.

- Gather billing provider information, including name, physical address (no P.O. Box), city, state, zip code, and phone number.

- If applicable, obtain pay-to provider information. Use a P.O. Box if the address differs from the billing provider.

- Enter the patient control number if available; this is optional.

- Include the medical/health record number if you have it; this field is also optional.

- Select the proper bill type based on NUBC taxonomy tables; this information is required.

- Input the federal tax ID number without hyphens; this is mandatory.

- For statement covers, enter the date range when services were provided in the format MMDDYY, without any dashes, slashes, or spaces.

- Fill in the patient ID# in field 8a, ensuring it is 9 numeric characters or 9 alphanumeric characters starting with a letter.

- Complete the patient name in field 8b, formatted as Last, First Middle.

- Provide the patient’s complete address, city, state (2-letter abbreviation), and zip code.

- Enter the patient’s county code if applicable; this field is optional.

- Provide the date of birth in field 10, formatted as MMDDYYYY without any hyphens, slashes, or spaces.

- Indicate the sex of the patient in field 11: M for male, F for female, or U for unknown.

- Fill out the admission or start of care date in field 12; use the MMDDYY format without hyphens or spaces.

- Record the admission hour in field 13 using the NUBC taxonomy tables (00-23).

- In field 14, specify the admission type if applicable, using the required codes.

- Indicate the admission source for inpatient claims using the relevant NUBC taxonomy codes.

- For inpatient claims, enter the discharge hour using acceptable NUBC values in field 16; this is mandatory.

- Complete the discharge status using the necessary codes for inpatient claims.

- Use condition codes for fields 18-28 if applicable, referring to NUBC taxonomy tables for guidance.

- If the accident state is necessary, provide the 2-digit state abbreviation in field 29.

- Input occurrence codes and dates in fields 31 and 32 as necessary.

- Specify occurrence span codes and dates in fields 35 and 36 where applicable.

- Though unassigned for some fields, provide value codes and amounts in fields 39-41 as required.

- Fill in revenue codes in field 42, ensuring they are based on NUBC guidelines.

- Provide a description in field 43 that corresponds to standard abbreviations as per NUBC specifications.

- Include the appropriate HCPCS code or rate in field 44 based on inpatient or outpatient guidelines.

- For service dates, use the correct format in field 45 (MMDDYY) for outpatient claims.

- Document service units and total charges according to the instructions in fields 46 and 47.

- If applicable, note any non-covered charges for inpatient claims in field 48.

- Identify the payer name using multiple lines if there is more than one payer in field 50.

- Enter the Health Plan ID in field 51 if it becomes necessary based on regulations.

- Mark the release of information in field 52 (Y for yes, N for no).

- Indicate benefits assigned in field 53, marking Y for yes for STAR and CHIP claims.

- Document any prior payments in field 54 if applicable.

- Fill in the estimated amount due, if necessary, in field 55.

- Enter the 10-digit NPI number of the billing provider in field 56; this is mandatory.

- Complete additional billing provider information in field 57 if applicable.

- Insert the insured's name and their relationship to the patient in fields 58 and 59.

- Provide the insured’s unique ID in field 60 based on the health plan guidelines.

- Complete the group name in field 61 as required, unless dealing with STAR and CHIP claims.

- Document the group number in field 62 if necessary; this is not needed for STAR and CHIP.

- If there were treatment authorization codes, enter them in field 63.

- Lastly, if resubmitting a claim, include the document control number in field 64.

What You Should Know About This Form

What is the purpose of the UB 94 form?

The UB 94 form, officially known as the CMS-1450, is used to bill Medicare, Medicaid, and other insurance programs for healthcare services. It provides detailed information about the patient, services rendered, and billing provider, facilitating accurate payment processing and ensuring compliance with federal regulations.

What information do I need to provide in the Billing Provider Information section?

This section requires four lines of information. You must include the billing provider's name, physical address (not a P.O. Box), city, state, and ZIP code. Additionally, provide a contact phone number. Accurate details are crucial because they determine where payments will be sent and help avoid delays in processing your claim.

Are all fields on the UB 94 form mandatory?

No, not all fields are required. Some fields are optional or situational, meaning they only need to be completed if certain conditions apply. For instance, fields like the Patient Control Number and Medical/Health Record Number are optional, while essential fields must be filled to ensure claim processing. It's important to refer to the guidelines for each specific field to understand its requirement.

What happens if I make a mistake on the UB 94 form?

Errors on the UB 94 form can lead to claim rejections or delays in payment. For example, entering incorrect values in crucial fields like Bill Type or Federal Tax ID can result in inaccuracies during claim adjudication. If you realize you've made an error after submission, you may need to resubmit the claim with the corrected information.

How does the UB 94 form differ from other claim forms?

The UB 94 form is specifically designed for institutional providers, such as hospitals and skilled nursing facilities, while other forms, like the CMS-1500, are used for individual healthcare providers. The UB 94 encompasses a broader range of information required for the services provided in an institutional setting, reflecting the complexity of those services.

Common mistakes

Filling out the UB 94 form can be a straightforward process, but there are common mistakes that people often make. Recognizing these errors can help avoid delays in claim processing and ensure accurate payments. The first mistake to avoid is providing an incorrect or incomplete Billing Provider Information. This section requires the full address where services were provided. If a PO Box address is used instead of a physical address, the claim may be denied or delayed. Additionally, missing any of the required details could lead to processing issues.

Another common error is failing to enter the Federal Tax ID correctly. It is crucial to input the tax ID without any hyphens. If a hyphen is included, it may cause the claim to be rejected or the payment to be inaccurate. Accuracy in this section is essential, as the tax ID is used for identification and payment purposes.

The Service Date section frequently presents challenges as well. It is important to use the correct date format, MMDDYY, and to ensure that dates are not entered with hyphens, slashes, or other symbols. A mistake in this area can lead to confusion about the service period, which can result in claim denials. Paying close attention to the format and details in this section is vital.

Lastly, many people overlook the requirement for the NPI number. This 10-digit number of the billing provider must be correctly entered. Omitting it or making a mistake can cause processing delays and payment issues. Be meticulous when entering this information, as it plays a key role in identifying the provider responsible for the claim.

Documents used along the form

The UB-94 form is a critical document used for medical billing and submitting claims to Medicare and Medicaid. Several other forms and documents support or accompany the UB-94 to facilitate the billing process and ensure compliance. Below are key documents commonly associated with the UB-94 form.

- CMS-1500 Form: This is used for outpatient claims. It covers services provided by individual practitioners or non-institutional providers and is typically used in addition to UB-94 for accurate billing.

- Claim Adjustment Request Form: This form allows providers to formally request an adjustment to a claim already processed. It is crucial for correcting errors or discrepancies in payments received.

- Coordination of Benefits (COB) Form: When a patient has multiple insurance policies, this form is used to coordinate the payment responsibilities between the different payers.

- Patient Encounter Form: This document captures all the services rendered during a patient's visit. It serves as a detailed record to ensure accurate billing on the UB-94.

- Authorization Request Form: Prior authorization may be needed for certain services. This form requests permission from the payer before treatments are rendered, ensuring coverage and payment.

- Payment Notification Letter: Issued by the payer, this letter outlines the payment made on a claim. It is useful for providers to reconcile accounts and follow up on unpaid claims.

- Notice of Non-Coverage (NNC): When a service is not covered by insurance, this document informs the patient. It is essential in avoiding confusion regarding billing and payment responsibilities.

These documents, along with the UB-94 form, aid in creating a streamlined billing process. Proper use and understanding of these forms ensure that healthcare providers receive timely and accurate payments.

Similar forms

-

CMS-1500 Form: This form is used for billing outpatient services provided by healthcare professionals. Like the UB-94, it collects essential billing information, including patient demographics, service dates, and provider information, albeit tailored for individual healthcare services instead of hospital claims.

-

HCFA-1450: Essentially, this is an earlier version of the UB-94 form. It includes many of the same fields for hospital billing. Over time, the UB-94 evolved from the HCFA-1450 to reflect updated billing practices and data requirements.

-

UB-04 Form: This is the updated version of the UB-94 and serves the same purpose. It maintains similar field requirements and is used for institutional healthcare billing, fulfilling the same role in processing claims for hospital services.

-

ANSI X12 837 Institutional: This electronic format is used for submitting institutional claims. It shares many data elements with the UB-94, including patient information and service details, adhering to electronic health record standards.

-

CMS-1450 (Version 5010): This is another electronic claim submission format that retains the structure of the UB-94 while expanding to fit the requirements of modern health claims processing. It includes similar data fields for billing and coding.

-

Medicare Secondary Payer (MSP) Claim Form: This form is used when Medicare is not the primary payer. It requires similar claim details as the UB-94, capturing relevant patient and provider information for proper claim processing.

-

State Medicaid Claim Forms: Each state may have its own version of a claim form for Medicaid billing. However, these forms typically mirror the UB-94 in structure and requirements, ensuring comprehensive documentation of services provided.

Dos and Don'ts

When filling out the UB 94 form, it is important to carefully consider the information you provide. Below are four essential tips and pitfalls to avoid during this process.

- Do ensure all required fields are completed. Incomplete forms can lead to claim denials or delays.

- Don’t use a Post Office Box for the billing provider’s address. This must be the physical location where services were rendered.

- Do input dates in the correct format (MMDDYY) without any hyphens or spaces. This minimizes the risk of errors during processing.

- Don’t forget to double-check the Federal Tax ID. It should be entered without a hyphen, as incorrect formatting can affect claim accuracy.

Misconceptions

- Misconception 1: The UB 94 form is only used by hospitals.

- Misconception 2: All fields on the form are mandatory.

- Misconception 3: P.O. Box addresses cannot be used.

- Misconception 4: The patient control number is required for all claims.

- Misconception 5: Dates must always be written with slashes or hyphens.

- Misconception 6: The NPI number is not necessary when billing.

- Misconception 7: Revenue codes are optional.

- Misconception 8: An incorrect Bill Type won't affect adjudication.

- Misconception 9: The UB 94 form is outdated and irrelevant.

- Misconception 10: Only the healthcare provider needs to understand this form.

This form is versatile. While it is commonly associated with hospital billing, it can also be used by outpatient providers and various healthcare facilities for billing purposes.

Not every field requires completion. Some fields are optional or situational. Understanding which fields are essential for particular claims is crucial for effective billing.

Although the billing provider's physical address must be accurate, a P.O. Box is acceptable for the pay-to provider address if necessary. Clarity about the address type is important.

This number is optional. If a provider has one, it should be included for reference, but omitting it won’t invalidate the claim.

In fact, the format requires that dates be entered without any separators. Using the correct format helps prevent processing delays.

The National Provider Identifier (NPI) is a required field for billing providers. It’s essential for ensuring proper processing of claims.

Revenue codes are required for both inpatient and outpatient claims. Incorrectly completing this field can lead to claim rejection or payment inaccuracies.

This field significantly influences how claims are processed. An error here can result in improper payments, making accuracy vital.

The UB 94 form is still in use, particularly for specific types of claims. Understanding its relevance helps healthcare providers navigate billing effectively.

Patients may benefit from understanding certain aspects of the UB 94 form, especially in relation to their billing process and insurance claims. Knowledge fosters transparency in healthcare transactions.

Key takeaways

Understanding how to properly complete the UB-94 form is crucial for health care providers submitting claims for services provided. Here are some key takeaways:

- Accuracy in Provider Information: Ensure the billing provider information is correct. Use the physical address, not a P.O. Box.

- Bill Type Matters: Select the correct bill type from the NUBC taxonomy tables; errors may lead to payment issues.

- Hyphen-Free Tax ID: Enter the Federal Tax ID without hyphens to avoid electronic processing errors.

- Service Dates Format: Format service dates as MMDDYY without dashes, slashes, or spaces for both inpatient and outpatient claims.

- Patient Identification: Collect and record the patient control number, medical record number, and patient ID as applicable.

- HCPCS Coding: Accurate HCPCS coding is required for outpatient services, correlating with the appropriate revenue codes.

- Claims Must Highlight Uncovered Charges: Clearly indicate any non-covered charges in the appropriate sections as required.

- Mandatory Signatures: Confirm authorization for release of information and benefits assignment; both should be marked as required.

- Prior Payments Info: Document any payments made by other insurers if applicable to ensure accurate claims processing.

Following these guidelines will help in the efficient handling of claims, reducing the chance for denial due to clerical errors.

Browse Other Templates

Soap Notes for Massage Therapy - Duration of each modality is logged to manage time effectively during sessions.

Florida Nursing License - Providing an email address for updates can enhance communication regarding application status.

Bmo Harris Payment - Direct deposit helps you access your funds instantly on payday.