Fill Out Your Ubh Eap Claim Form

The UBH EAP Claim Form is an essential document used by individuals seeking reimbursement for certified Employee Assistance Program (EAP) visits. This form is specifically designed for mental health and substance abuse treatment claims, ensuring that only eligible visits are processed for payment. To successfully complete the form, users must provide detailed patient and employee information, including the member's name, birth date, and the employee's relationship to the insured. Additionally, the form requires a medical and payment authorization section, in which the patient or their representative must consent to share necessary clinical information with UBH and authorize payment to the provider. The provider completes the clinical and claim information, detailing the problems presented, dates of service, and their professional credentials. The form also features specific codes to classify the nature of the problems encountered and the level of job impact, which helps UBH assess the claim accurately. Moreover, it includes warnings about the legal ramifications of submitting false information, reflecting the serious nature of insurance fraud. Overall, understanding the components of the UBH EAP Claim Form is crucial for ensuring that claims are submitted accurately and efficiently.

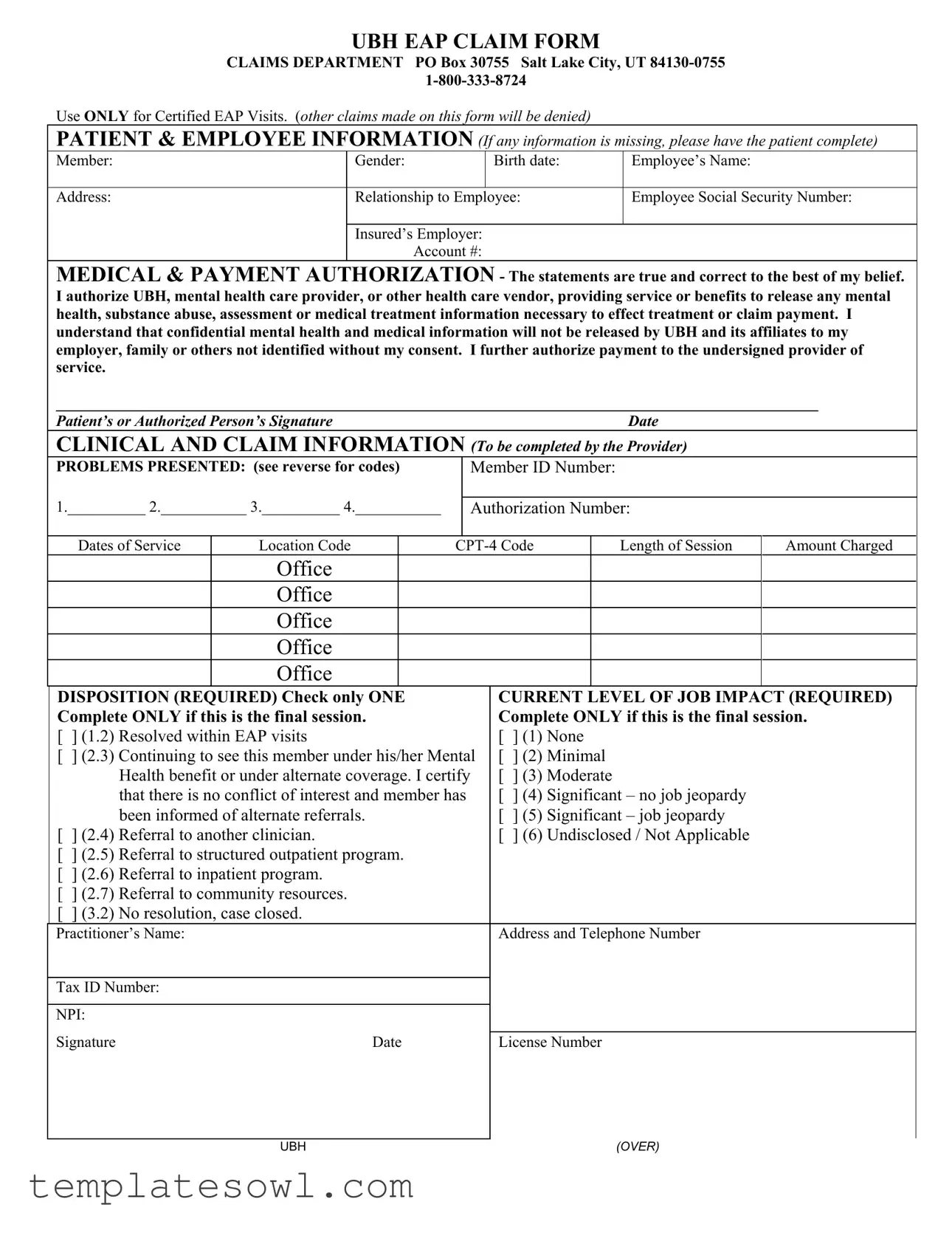

Ubh Eap Claim Example

UBH EAP CLAIM FORM

CLAIMS DEPARTMENT PO Box 30755 Salt Lake City, UT

Use ONLY for Certified EAP Visits. (other claims made on this form will be denied)

PATIENT & EMPLOYEE INFORMATION (If any information is missing, please have the patient complete)

Member: |

Gender: |

Birth date: |

Employee’s Name: |

|

|

|

|

Address: |

Relationship to Employee: |

Employee Social Security Number: |

|

|

|

|

|

Insured’s Employer:

Account #:

MEDICAL & PAYMENT AUTHORIZATION - The statements are true and correct to the best of my belief. I authorize UBH, mental health care provider, or other health care vendor, providing service or benefits to release any mental health, substance abuse, assessment or medical treatment information necessary to effect treatment or claim payment. I understand that confidential mental health and medical information will not be released by UBH and its affiliates to my employer, family or others not identified without my consent. I further authorize payment to the undersigned provider of service.

__________________________________________________________________________________________________

Patient’s or Authorized Person’s SignatureDate

CLINICAL AND CLAIM INFORMATION (To be completed by the Provider)

PROBLEMS PRESENTED: (see reverse for codes) |

Member ID Number: |

1.__________ 2.___________ 3.__________ 4.___________

Authorization Number:

Dates of Service |

Location Code |

Length of Session |

Amount Charged |

Office

Office

Office

Office

Office

DISPOSITION (REQUIRED) Check only ONE Complete ONLY if this is the final session.

[ ] (1.2) Resolved within EAP visits

[] (2.3) Continuing to see this member under his/her Mental Health benefit or under alternate coverage. I certify that there is no conflict of interest and member has been informed of alternate referrals.

[ ] (2.4) Referral to another clinician.

[] (2.5) Referral to structured outpatient program.

[] (2.6) Referral to inpatient program.

[] (2.7) Referral to community resources.

[] (3.2) No resolution, case closed.

CURRENT LEVEL OF JOB IMPACT (REQUIRED) Complete ONLY if this is the final session.

[ ] (1) None

[] (2) Minimal

[] (3) Moderate

[] (4) Significant – no job jeopardy

[] (5) Significant – job jeopardy

[] (6) Undisclosed / Not Applicable

Practitioner’s Name:

Tax ID Number:

NPI:

Signature |

Date |

Address and Telephone Number

License Number

UBH |

(OVER) |

|

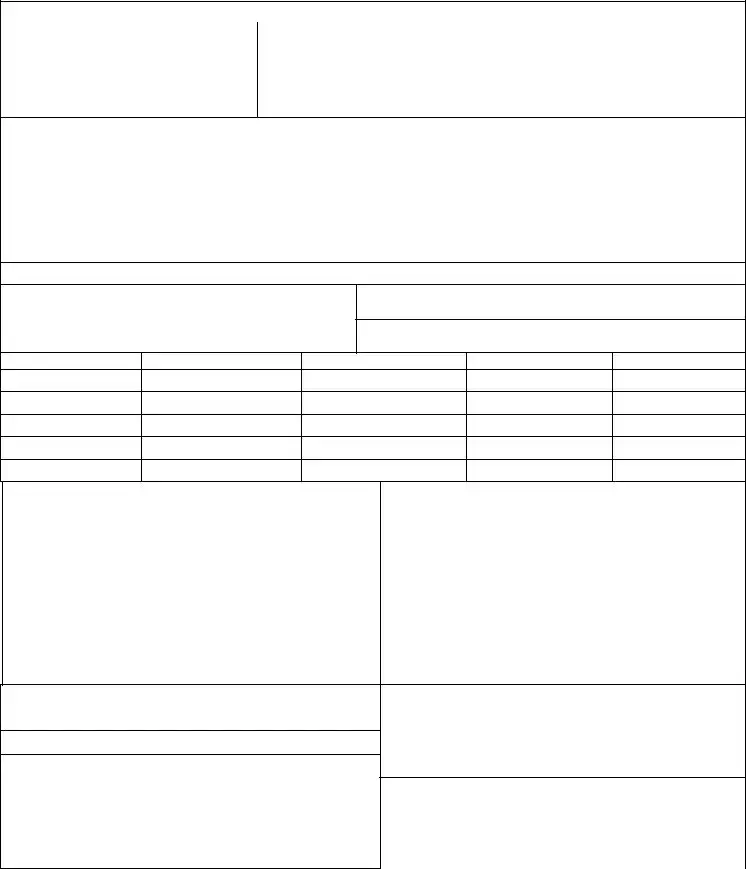

UBH EAP PROBLEM CODES |

Code |

Description |

1A |

Medical |

1B |

Medical - Other Person |

2G |

Personal/Psychological – Conduct/Anger Mgmt |

2H |

Personal/Psychological – Eating Disorders |

2K |

Personal/Psychological – Compulsive Gambling |

2M |

Personal/Psychological – Learning/ADHD |

2Q |

Personal/Psychological – Emotional |

2R |

Personal/Psychological – Other Person |

2S |

Personal/Psychological – Abuse/Neglect |

3A |

Substance Abuse – Alcohol |

3G |

Substance Abuse – Not Specified |

3J |

Substance Abuse – Prescription Meds |

3L |

Substance Abuse – Illicit Drugs |

3M |

Substance Abuse – Other Person |

4A |

Interpersonal – Marital/Primary |

4B |

Interpersonal – Parent/Child |

4D |

Interpersonal – Caregiver |

4H |

Interpersonal – General |

5B |

Occupational – Manager Conflict |

5C |

Occupational – |

5D |

Occupational – Job Stress |

5G |

Occupational – Career Direction |

6A |

Situational – Financial |

6B |

Situational – Housing |

6C |

Situational – Legal |

6E |

Situational – Social Services |

6F |

Situational – Childcare |

6G |

Situational – Eldercare |

Allowable CPT Codes: |

90804, 90806, 90846, 90847, 90853 |

WARNING: Any person who knowingly files a statement of claim containing any misrepresentations or any false, incomplete or misleading information may be guilty of a criminal act punishable under law and may be subject to civil penalties.

Alaska Residents: A person who knowingly and with intent to injure, defraud, or deceive an insurance company files a claim containing false, incomplete, or misleading information may be prosecuted under state law.

Arizona Residents: For your protection Arizona law requires the following statement to appear on this form. Any person who knowingly presents a false or fraudulent claim for payment of a loss is subject to criminal and civil penalties.

Arkansas Residents: Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

California Residents: For your protection California law requires the following to appear on this form: Any person who knowingly presents a false or fraudulent claim for the payment of a loss is guilty of a crime and may be subject to fines and confinement in state prison.

Colorado Residents: It is unlawful to knowingly provide false, incomplete, or misleading facts or information to an insurance company for the purpose of defrauding or attempting to defraud the company. Penalties may include imprisonment, fines, denial of insurance, and civil damages. Any insurance company or agent of an insurance company who knowingly provides false, incomplete, or misleading facts or information to a policyholder or claimant for the purpose of defrauding or attempting to defraud the policyholder or claimant with regard to a settlement or award payable from insurance proceeds shall be reported to the Colorado Division of Insurance within the department of regulatory agencies.

Delaware Residents: Any person who knowingly, and with intent to injure, defraud or deceive any insurer, files a statement of claim containing any false, incomplete or misleading information is guilty of a felony. District of Columbia Residents: WARNING: It is a crime to provide false or misleading information to an insurer for the purpose of defrauding the insurer or any other person. Penalties include imprisonment and/or fines. In addition, an insurer may deny insurance benefits if false information materially related to a claim was provided by the applicant.

Florida Residents: Any person who knowingly and with intent to injure, defraud, or deceive any insurer files a statement of claim or an application containing any false, incomplete, or misleading information is guilty of a felony of the third degree.

Hawaii Residents: For your protection, Hawaii law requires you to be informed that presenting a fraudulent claim for payment of a loss or benefit is a crime punishable by fines or imprisonment, or both.

Idaho Residents: Any person who knowingly, and with intent to defraud or deceive any insurance company, files a statement of claim containing any false, incomplete, or misleading information is guilty of a felony. Indiana Residents: A person who knowingly and with intent to defraud an insurer files a statement of claim containing any false, incomplete, or misleading information commits a felony.

Kentucky Residents: Any person who knowingly, and with intent to defraud any insurance company or other person files an application for insurance or a statement of claim containing any materially false information or conceals, for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime.

Louisiana Residents: Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

Maine Residents: It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the purpose of defrauding the company. Penalties may include imprisonment, fines or a denial of insurance benefits.

Maryland Residents: Any person who knowingly and willfully presents a false or fraudulent claim for payment of a loss or benefit or who knowingly and willfully presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

Minnesota Residents: A person who files a claim with intent to defraud or helps commit a fraud against an insurer is guilty of a crime.

Nevada Residents: Any person who knowingly files a statement of claim containing any misrepresentation or any false, incomplete or misleading information may be guilty of a criminal act punishable under state or federal law, or both, and may be subject to civil penalties.

New Hampshire Residents: Any person who, with a purpose to injure, defraud or deceive any insurance company, files a statement of claim containing any false, incomplete or misleading information is subject to prosecution and punishment for insurance fraud, as provided in RSA 638:20.

New Jersey Residents: Any person who knowingly files a statement of claim containing any false or misleading information is subject to criminal and civil penalties.

New Mexico Residents: Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in an application for insurance is guilty of a crime and may be subject to civil fines and criminal penalties.

New York Residents: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false information, or conceals for the purpose of misleading, information concerning any material fact, commits a fraudulent insurance act, which is a crime, and shall also be subject to a civil penalty not to exceed $5,000 and the stated value of the claim for each such violation.

Ohio Residents: Any person who, with intent to defraud or knowing that he is facilitating a fraud against an insurer, submits an application or files a claim containing a false or deceptive statement is guilty of insurance fraud.

Oklahoma Residents: WARNING: Any person who knowingly, and with intent to injure, defraud or deceive any insurer, makes any claim for the proceeds of an insurance policy containing any false, incomplete or misleading information is guilty of a felony.

Pennsylvania Residents:

Oregon Residents: Willfully falsifying material facts on an application or claim may subject you to criminal penalties.

Pennsylvania Residents: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false information or conceals for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime and subjects such person to criminal and civil penalties.

Tennessee Residents: It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the purpose of defrauding the company. Penalties include imprisonment, fines and denial of insurance benefits.

Texas Residents: Any person who knowingly presents a false or fraudulent claim for the payment of a loss is guilty of a crime and may be subject to fines and confinement in state prison.

Virginia Residents: It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the purpose of defrauding the company. Penalties include imprisonment, fines and denial of insurance benefits.

Washington Residents: It is a crime to knowingly provide false, incomplete, or misleading information to an insurance company for the purpose of defrauding the company. Penalties include imprisonment, fines, and denial of insurance benefits.

West Virginia Residents: Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The UBH EAP Claim Form is specifically designated for certified Employee Assistance Program (EAP) visits. Any claims not related to certified EAP services may be denied. |

| Confidentiality Notice | The form contains a medical and payment authorization section, emphasizing that mental health and medical information will not be shared with unauthorized individuals without patient consent. |

| Warning on Fraud | All states have laws that impose serious penalties for knowingly submitting false, incomplete, or misleading claims. Such actions may result in criminal charges and civil penalties. |

| State-Specific Laws | Each state has unique regulations governing insurance claims. For instance, California law mandates that presenting a fraudulent claim may result in penalties, including fines and confinement. |

| Required Information | The form requires detailed patient and employee information, including dates of service, the nature of problems presented, and the clinician's details to support the claim process. |

| Claim Denial Risks | Submitting claims that do not meet the certification criteria or lack required information can lead to denial. Adhering to the form's guidelines is essential for successful claim processing. |

Guidelines on Utilizing Ubh Eap Claim

Completing the UBH EAP Claim form involves careful attention to detail and accuracy. This step-by-step guide simplifies the process, ensuring that all necessary information is correctly provided to avoid delays in claim processing.

- Begin by entering the patient's name in the "Member" field. Include the gender and birth date.

- Fill in the employee’s name and address of the patient.

- Indicate the relationship to employee and provide the employee social security number.

- List the insured’s employer along with the account number.

- In the medical and payment authorization section, ensure the patient or authorized person signs and indicates the date.

- For the clinical and claim information, input the Member ID Number, problems presented, authorization number, dates of service, and the location code.

- Enter the CPT-4 code, and provide the length of session and amount charged for each session.

- Select one item under DISPOSITION. Only check one option related to the treatment outcome.

- For the CURRENT LEVEL OF JOB IMPACT, check the applicable level based on the final session evaluation.

- Complete the practitioner's information by filling in their name, tax ID number, NPI, address, telephone number, and license number.

After completing the form, review everything to ensure accuracy. Once verified, submit the claim to the appropriate UBH EAP claims department address for processing. Timely and complete submissions can help facilitate faster handling of your claim, so double-check all entries before sending.

What You Should Know About This Form

What is the purpose of the UBH EAP Claim form?

The UBH EAP Claim form is specifically designed for submitting claims related to certified Employee Assistance Program (EAP) visits. If you have received mental health services through your EAP, you need to use this form to request reimbursement or payment. It's important to note that claims not related to certified EAP visits will be denied.

What information do I need to provide on the claim form?

You must fill out several details on the form, including patient information, employee information, and clinical details. This includes the patient's name, date of birth, the relationship to the employee, and the employee's Social Security number. Additionally, the provider must specify the problems presented, session details, and the outcomes of the sessions. Missing any information can delay the processing of your claim.

How do I submit the UBH EAP Claim form?

Submission is straightforward. After completing the claim form, send it to the UBH Claims Department at the address provided: PO Box 30755, Salt Lake City, UT 84130-0755. You can also call the claims department using the number 1-800-333-8724 if you have questions about the submission process or need assistance.

What happens if my claim is denied?

If your claim is denied, you will receive a notice explaining the reason for the denial. Common reasons include submitting claims that don’t pertain to certified EAP visits or missing required information. You can appeal the decision by providing additional details or correcting any errors. It's vital to understand the reason for the denial to ensure successful resubmission.

Common mistakes

Filling out the UBH EAP Claim form correctly is crucial to ensure that your claim is processed without delays. However, many people make common mistakes that can lead to denials or complications. Understanding these pitfalls can save you time and frustration.

One frequent mistake is incomplete patient and employee information. Every field in the patient and employee sections must be filled out accurately. If details such as the member’s gender or birth date are missing, it can cause delays in processing. Always double-check this section before submission.

Another common error involves the medical and payment authorization section. It’s critical to ensure that the patient’s or authorized person’s signature is included, along with the date. Omitting these details can lead to outright denials of claims. Always confirm that this section is properly completed.

Many claimants also neglect the clinical and claim information section. This is where provider details, problem codes, and session information are required. Missing codes or incorrectly entered dates of service can cause confusion during processing. Make sure you reference the problem codes correctly and provide complete and accurate dates for the services rendered.

Another significant mistake occurs in the disposition and job impact sections. Failing to check just one box in these areas can lead to processing issues, especially since these sections are required. Provide clear information, and make sure you select only one option for each section. This ensures that the claim’s intent is clear.

Lastly, be cautious of submitting claims for non-certified EAP visits. The UBH EAP Claim form is strictly for certified visits; submitting any other type of claim on this form will lead to denial. Familiarizing yourself with what qualifies as a certified visit can prevent unnecessary complications.

Being attentive to these details can make a significant difference in the outcome of your claim. Double-check your form before submission, and seek clarification when in doubt. Taking the time to do it right will speed up the process and lead to a smoother experience.

Documents used along the form

Submitting an UBH EAP Claim Form is only one part of the process when seeking reimbursement or benefits through the Employee Assistance Program (E

Similar forms

- Insurance Claim Form: Like the UBH EAP Claim Form, an insurance claim form is used to request payment for services received. Both require detailed information about the patient and the care provided. Each form aims to ensure proper processing of claims to prevent denials.

- Health Care Provider Billing Form: This document serves a similar purpose, requesting payment from insurance for medical services rendered. Both forms include patient information, treatment details, and signatures, ensuring that healthcare providers are reimbursed accurately.

- Referral Form: A referral form, like the UBH EAP Claim Form, is crucial for continuity of care. It provides necessary patient information and specifies the type of services needed. Both documents help facilitate the patient's journey through the healthcare system.

- Authorization Form: This form confirms that the patient agrees to treatment and understands the related costs. Much like the UBH EAP Claim Form, it emphasizes the importance of patient consent in the claims process and assures that care is delivered in compliance with patient preferences.

Dos and Don'ts

When filling out the UBH EAP Claim form, it is crucial to be thorough and precise. Here is a list of essential dos and don'ts to ensure an efficient and accurate submission.

- Do carefully read the instructions provided on the form.

- Do provide all required patient and employee information accurately.

- Do sign and date the form where indicated, ensuring all signatures are from authorized individuals.

- Do check for any missing details before submission to avoid delays.

- Don't submit the form for claims outside of certified EAP visits; they will be denied.

- Don't provide incomplete information without confirming all required fields are filled.

- Don't attempt to falsify or misrepresent information in any part of the claim.

Misconceptions

Understanding the UBH EAP Claim form is critical for ensuring a smooth claims process. However, several misconceptions can lead to confusion. Here are four common misunderstandings:

- This form can be used for any type of claim. Many believe that the UBH EAP Claim form is intended for various claims. In reality, it is specifically designed for certified Employee Assistance Program (EAP) visits. Submissions related to other services will be denied.

- Completing the form accurately is optional. Some individuals think that they can submit the form with missing information or incomplete sections. This is not the case; missing information can result in delays or denials.

- Authorization from UBH is not necessary. There's a misconception that claims can be filed without your authorization. On the contrary, your consent is essential for the release of mental health or medical information necessary to process the claim.

- The claim process is the same across all states. Many assume that the rules governing the UBH EAP Claim form apply uniformly in all states. However, various jurisdictions have specific regulations concerning fraudulent claims, which can result in criminal penalties.

Addressing these misconceptions can lead to a more efficient claims experience. Take the time to familiarize yourself with the requirements and ensure all necessary steps are followed.

Key takeaways

- The UBH EAP Claim Form is specifically designed for certified EAP visits only. Claims that do not meet this requirement will be denied.

- Ensure all patient and employee information is complete, including the member's name, gender, birth date, and relationship to the employee, as missing details can delay processing.

- Accurate medical and payment authorization is crucial. The patient or authorized person must sign and date the form.

- The clinical and claim information section must be filled out by the provider, including the problems presented, authorization number, and session details.

- Check only one box in the disposition section to indicate the outcome of the EAP sessions. This section must be completed only if it's the final session.

- The current level of job impact must also be specified if this is the last session. Options range from 'None' to 'Significant – job jeopardy'.

- Pay attention to the warning regarding false claims. Misrepresentations may lead to criminal charges and civil penalties.

Browse Other Templates

Fake Bail Bond Paperwork - This form is essential for securing a bail bond agreement in the United States.

Declaration of Mailing - This serves as a verification that legal documents were sent as prescribed by law.

Child Custody Agreement,Parental Time Allocation,Family Time Schedule,Co-Parenting Plan,Childcare Arrangement Document,Custodial Responsibilities Outline,Shared Parenting Arrangement,Parenting Time Framework,Dual Custody Schedule,Child Visitation Agr - The form seeks to minimize conflict and focus on the child's best interests.