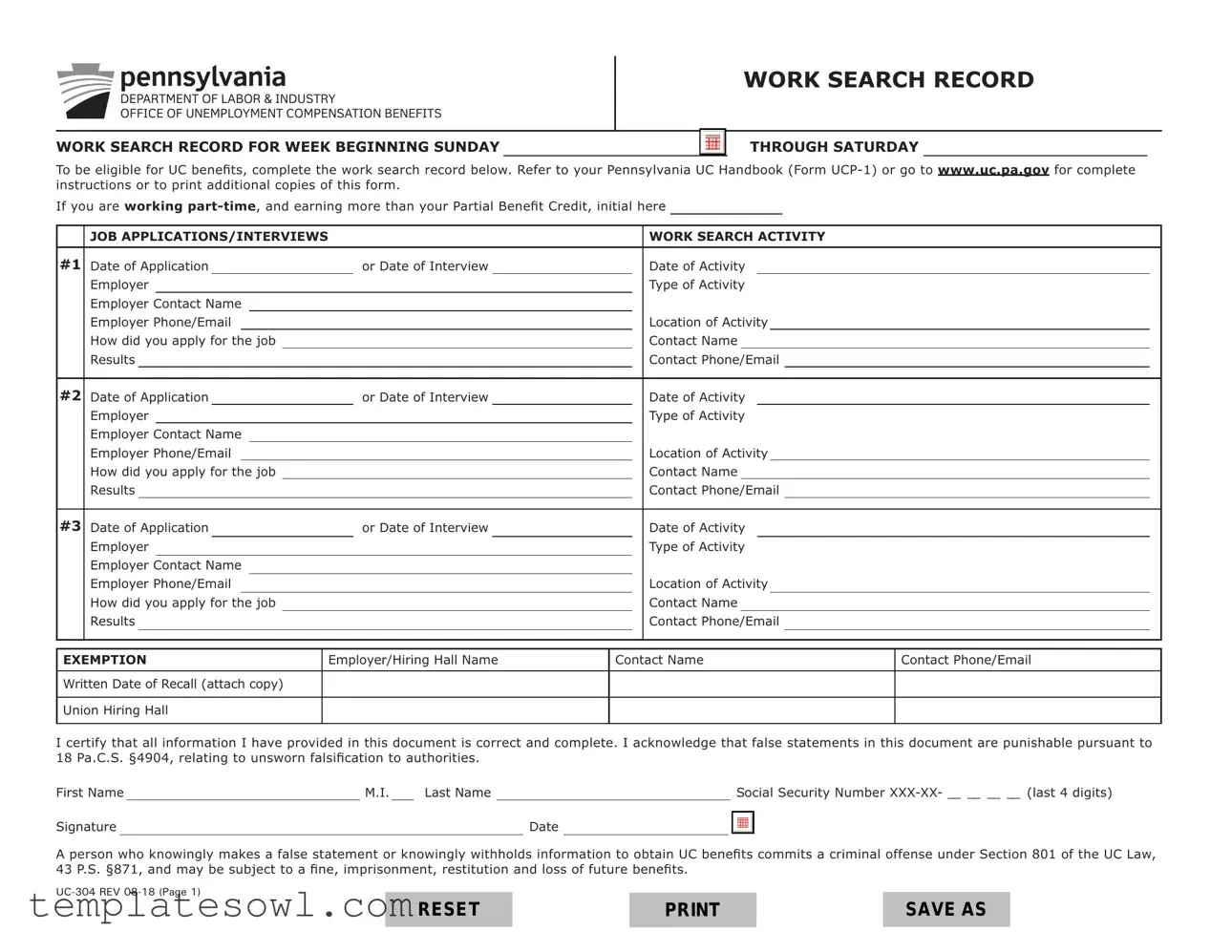

Fill Out Your Uc 304 Form

The UC 304 form serves as an essential accountability tool for individuals seeking unemployment compensation benefits in Pennsylvania. This work search record must be completed weekly to verify that claimants are actively searching for employment. Simple yet critical, this form prompts users to document their job applications or interviews, detailing the dates, employers, contact information, and methods of application. By doing so, it ensures recipients remain proactive in their job searches while receiving benefits. This form emphasizes accuracy and honesty, as any misrepresentation can lead to serious consequences, including potential criminal charges. Additionally, the UC 304 includes a section for those who may qualify for exemption from the work search requirement. For anyone navigating these waters, being informed of the UC 304's components is key to maintaining compliance and securing benefits during challenging times.

Uc 304 Example

DEPARTMENT OF LABOR & INDUSTRY

DEPARTMENT OF LABOR & INDUSTRY

OFFICE OF UNEMPLOYMENT COMPENSATION BENEFITS

WORK SEARCH RECORD

WORK SEARCH RECORD FOR WEEK BEGINNING SUNDAY

THROUGH SATURDAY

To be eligible for UC benefits, complete the work search record below. Refer to your Pennsylvania UC Handbook (Form

If you are working

|

JOB APPLICATIONS/INTERVIEWS |

|

|

|

|

|

WORK SEARCH ACTIVITY |

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

#1 |

Date of Application |

|

|

or Date of Interview |

|

|

|

Date of Activity |

|

|

|

|||||||||

|

Employer |

|

|

|

|

|

|

Type of Activity |

|

|

||||||||||

|

Employer Contact Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Employer Phone/Email |

|

|

|

|

|

|

Location of Activity |

|

|

|

|||||||||

|

How did you apply for the job |

|

|

|

|

|

|

Contact Name |

|

|

|

|||||||||

|

Results |

|

|

|

|

|

Contact Phone/Email |

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

#2 |

Date of Application |

|

|

or Date of Interview |

|

|

|

Date of Activity |

|

|

|

|||||||||

|

Employer |

|

|

|

|

|

|

Type of Activity |

|

|

||||||||||

|

Employer Contact Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Employer Phone/Email |

|

|

|

|

|

|

Location of Activity |

|

|

|

|||||||||

|

How did you apply for the job |

|

|

|

|

|

|

Contact Name |

|

|

|

|||||||||

|

Results |

|

|

|

|

|

Contact Phone/Email |

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

#3 |

Date of Application |

|

|

or Date of Interview |

|

|

|

Date of Activity |

|

|

|

|||||||||

|

Employer |

|

|

|

|

|

|

Type of Activity |

|

|

||||||||||

|

Employer Contact Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Employer Phone/Email |

|

|

|

|

|

|

Location of Activity |

|

|

|

|||||||||

|

How did you apply for the job |

|

|

|

|

|

|

Contact Name |

|

|

|

|||||||||

|

Results |

|

|

|

|

|

Contact Phone/Email |

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

EXEMPTION |

|

Employer/Hiring Hall Name |

Contact Name |

Contact Phone/Email |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Written Date of Recall (attach copy) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Union Hiring Hall |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I certify that all information I have provided in this document is correct and complete. I acknowledge that false statements in this document are punishable pursuant to 18 Pa.C.S. §4904, relating to unsworn falsification to authorities.

First Name |

|

M.I. |

|

Last Name |

|

|

|

|

Social Security Number |

||||

|

|

|

|

|

|

|

|

|

|

||||

Signature |

|

|

|

|

|

|

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

A person who knowingly makes a false statement or knowingly withholds information to obtain UC benefits commits a criminal offense under Section 801 of the UC Law, 43 P.S. §871, and may be subject to a fine, imprisonment, restitution and loss of future benefits.

RESET |

SAVE AS |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The UC 304 form is used to document job search activities for individuals seeking unemployment compensation in Pennsylvania. |

| Eligibility | To be eligible for unemployment benefits, individuals must complete the work search record accurately and submit it as required. |

| Governing Law | This form is governed by the Pennsylvania Unemployment Compensation Law, specifically 43 P.S. §871. |

| Submission | The completed UC 304 form must be submitted to the Pennsylvania Department of Labor & Industry as part of the benefits application process. |

| Accuracy and Honesty | Providing false information on the UC 304 can lead to penalties, including fines, imprisonment, and loss of benefits. |

| Attachments | If applicable, individuals must attach documentation for exemptions, such as recall letters from employers. |

| Contact Information | The form requires detailed contact information for each job search activity, including employer details and results of applications. |

Guidelines on Utilizing Uc 304

After obtaining the UC-304 form, the next steps involve carefully filling it out to document your work search activities. It is essential to provide accurate and complete information to ensure that you meet the eligibility requirements for unemployment compensation benefits in Pennsylvania. The following steps outline how to effectively complete the form.

- Begin by filling in the week for which you are recording your work search activities, specifically noting the date range from Sunday through Saturday.

- In the Work Search Activity #1 section, enter the Date of Application or Interview and the Date of Activity.

- Provide the Employer name and specify the Type of Activity (e.g., job application, interview).

- List the Employer Contact Name and their Phone/Email information.

- Detail the Location of Activity and describe How you applied for the job (e.g., online, in person).

- Include the Contact Name for follow-up and the Results of your application, along with their Phone/Email information.

Repeat steps 2 through 6 for Work Search Activity #2 and #3, ensuring that you document each activity meticulously.

- If applicable, fill in the Exemption section with the Employer/Hiring Hall Name, Contact Name, and Contact Phone/Email. Attach any necessary documents as proof.

- Provide a Written Date of Recall, if relevant, and note whether you are affiliated with a Union Hiring Hall.

- At the bottom of the form, certify that all information provided is correct by signing your First Name, M.I., Last Name, and entering the last four digits of your Social Security Number.

- Finally, date the form to complete the submission process.

Once the form is filled out, ensure that it is submitted according to the instructions provided in your Pennsylvania UC Handbook or available online at www.uc.pa.gov.

What You Should Know About This Form

What is the UC 304 form?

The UC 304 form is a work search record you need to complete to qualify for unemployment compensation (UC) benefits in Pennsylvania. It helps the Department of Labor and Industry track your job search activities during a specific week. Completing this form accurately is essential to ensure you remain eligible for benefits.

How do I fill out the UC 304 form?

To fill out the UC 304 form, start by listing your job applications and interviews. You need to note the date of each activity, the name of the employer, and the type of activity (like an interview or an online application). Include contact details for the employer, such as their name and phone number. Describe how you applied for the job and the results of your application. Do this for at least three job search activities during the specified week.

Why is it important to report my work search activities?

Reporting your work search activities is crucial because it demonstrates your effort to find employment. The state requires this information to ensure that you are actively seeking work while receiving benefits. Not showing sufficient job search efforts may result in a denial of your unemployment benefits.

What happens if I make a mistake on the UC 304 form?

If you realize you've made a mistake after submitting the UC 304 form, it’s important to correct it as soon as possible. You can do this by contacting the Office of Unemployment Compensation. Provide them with the correct information and explain the error. Being unsure can complicate your benefits, so it’s best to address mistakes promptly.

Are there exemptions from completing the UC 304 form?

Yes, some individuals may be exempt from completing the UC 304 form. For example, if you are recalling to work from a union hiring hall or have specific documented circumstances, you might not need to fill it out. Make sure to attach any required documentation when claiming an exemption to support your case.

What are the consequences of providing false information on the UC 304 form?

Filling out the UC 304 form with false information can lead to serious consequences. It is considered a crime under Pennsylvania law, and you could face fines, imprisonment, or loss of future benefits. Honesty is key, so always provide accurate and complete information.

Common mistakes

Filling out the UC 304 form can be a vital step in obtaining unemployment benefits in Pennsylvania. However, people often make mistakes that can hinder the process. One common error is incomplete information. Failure to fill in all required fields can lead to delays or denials. Ensure that every section is completed thoroughly, including employer contact details and methods of job applications.

Another mistake is not keeping accurate records of job applications. Individuals sometimes forget the specifics of each job application or interview. This can result in inaccurate reporting. Keeping a detailed log can help track applications and provide accurate information when needed.

Additionally, providing incorrect contact information for employers is a frequent oversight. If an employer cannot be reached using the provided information, it may raise doubts about the legitimacy of the job search. Double-check employer names, phone numbers, and email addresses before submitting the form.

A fourth common error involves neglecting the certification statement. It is crucial to read and understand the certification statement at the bottom of the form before signing. Misunderstanding what is being certified can lead to unintentional false statements, which may have serious legal consequences.

Lastly, some fail to attach necessary documentation. If there are any exemptions or recalls from employment, attach appropriate documents as instructed. Omitting these can cause complications. It’s best to ensure all relevant documents are included with the UC 304 form to support your claims effectively.

Documents used along the form

The UC 304 form is an essential document in Pennsylvania's unemployment compensation (UC) process, primarily serving as a work search record for individuals seeking benefits. However, there are several other forms and documents that often accompany it, ensuring a complete and accurate application for benefits. Below is a list of these forms, along with a brief description of each.

- UC Benefit Application (UC-1): This is the initial application form for unemployment compensation benefits. Individuals must fill it out to apply for UC, providing necessary personal information and work history.

- UC Handbook (UCP-1): The UC handbook offers guidance on eligibility, benefits, and the application process. It’s an essential resource for applicants to understand their rights and responsibilities.

- Work Search Job Log (UC-304A): This document is utilized separately to keep track of job applications and interviews, serving as an adjunct to the UC 304 for more detailed work search activity documentation.

- Partial Benefit Credit Form (UC-305): When earning partial income while receiving UC benefits, this form helps individuals report their earnings. It is necessary for determining eligibility for partial benefits.

- Direct Deposit Authorization Form: This form allows applicants to request their unemployment benefits be deposited directly into their bank accounts. This can expedite the receipt of funds.

- Appeal Form (UC-460): If an applicant disagrees with a decision regarding their benefits, this form is used to file an appeal. It must be completed and submitted within a specific time frame.

- Social Security Number Verification: While not a formal form, providing proof of a Social Security Number may be necessary to verify identity when applying for benefits.

- Employer Response to Request for Information: After an unemployment claim is filed, this document is sent to the last employer, asking for details regarding the separation. The employer's response can impact the applicant's benefits eligibility.

Understanding these additional forms can help streamline the unemployment compensation application process. Each document plays a crucial role in ensuring that applicants receive the benefits they deserve while complying with legal requirements. Seek assistance if needed to ensure all information is accurate and complete.

Similar forms

- UC-1 Form: Similar to the UC-304, the UC-1 form serves as a general application for unemployment compensation benefits. Both require details about the applicant's recent work history and eligibility for assistance.

- Form UCP-1: This handbook provides comprehensive instructions for completing the UC-304. It also elaborates on the requirements for eligibility, mirroring the UC-304's focus on documenting job search efforts.

- UC-38 Form: The UC-38 is a work history form that, like the UC-304, gathers information about past employment and the reasons for job loss. It focuses on employment details rather than the job search.

- UC-860 Form: This form is used to review eligibility for continued benefits. Similar to the UC-304, it requires information about job search activities and employment status to assess ongoing qualification.

- UC-314 Form: The UC-314 is a report of job contacts made during a specified period. This form is similar to the UC-304 in that both require detailed reporting of job search activities and employer interactions.

- Employer Verification Form: This document is used to verify employment and job search efforts with prospective employers. While the UC-304 documents activities, the Employer Verification Form provides confirmation from the employers themselves.

Dos and Don'ts

When completing the UC-304 form, it is essential to follow certain guidelines to ensure that the application is accurate and complete. Here are eight things you should and shouldn't do:

- Do read the instructions carefully before starting to fill out the form.

- Do provide accurate and truthful information.

- Do include all required details for each work search activity, including dates and employer information.

- Do keep copies of the completed form for your records.

- Don't leave any sections of the form blank; fill in all applicable fields.

- Don't falsify information or misrepresent your job search efforts.

- Don't forget to sign and date the form before submission.

- Don't submit the form late; adhere to all deadlines set by the unemployment office.

Misconceptions

The UC 304 form serves as a vital part of the unemployment compensation process in Pennsylvania. However, various misconceptions persist about its purpose and requirements. Clarifying these misunderstandings is crucial for anyone navigating unemployment benefits.

- Misconception 1: The UC 304 form is optional if you are receiving benefits.

- Misconception 2: You only need to submit the form once.

- Misconception 3: Any job search activity can be reported.

- Misconception 4: You do not need to keep records of your job search.

- Misconception 5: You can leave sections blank if there's no response from employers.

- Misconception 6: The form is only for people actively seeking full-time positions.

- Misconception 7: Once you find a job, you no longer need to fill out the form.

- Misconception 8: Failure to report job search activities will not have consequences.

This is incorrect. Completing the UC 304 form is a requirement to remain eligible for unemployment benefits. It documents your job search efforts, which is essential for compliance.

In truth, this form must be filled out weekly. Each new submission reflects your ongoing job search activities during that week.

Not all activities qualify. The form specifically asks for job applications and interviews. Casual inquiries or networking efforts do not count unless tied to a formal application.

On the contrary, it’s essential to maintain records. Documentation may be required in the event of an audit or if your eligibility is questioned.

Leaving sections incomplete can create issues. It’s vital to fill out each part accurately, even if the result was an absence of response.

This is a misunderstanding. Part-time job seekers are also required to submit the UC 304 form, along with other relevant information regarding their job search.

Even after securing employment, you may need to complete the form until you have officially stopped receiving benefits. This includes any transitional or part-time work.

In reality, neglecting to fill out the UC 304 form accurately can lead to loss of benefits, penalties, or even legal repercussions for fraud.

Key takeaways

Here are key takeaways when filling out and using the UC-304 form:

- Complete Accuracy: Ensure all information provided on the form is correct and complete. Any inaccuracies may lead to penalties.

- Documentation Required: Bring necessary documentation to support your application, including the names and contact details of potential employers.

- Weekly Requirement: This form must be filled out for each week you are claiming unemployment benefits to demonstrate job search efforts.

- Multiple Activities: Record each job application or interview separately. Include details such as date, employer name, and type of activity.

- Contact Information: Provide employer contact names and phone/email details for follow-up or verification purposes.

- Understand Exemptions: Be aware of any exemptions related to hiring halls or unions. Documentation may be required.

- Signature and Date: Don't forget to sign and date the form. This confirms that the information is truthful and complete.

Browse Other Templates

Notice of Intent to Lien Florida Pdf - It specifies that the contractor intends to file a lien if payment issues are not resolved.

Costco Zyn - Ensure that the information entered is legible and accurate.