Fill Out Your Ucc 1 Financing Statement Form

The UCC 1 Financing Statement form plays a crucial role in securing interests in personal property and establishing a public record for creditors. By filing this form, a secured party can give notice to other parties regarding a debtor's obligations. This statement captures essential information, including the names and addresses of both the debtor and the secured party, as well as a description of the collateral that secures the debt. Care must be taken to ensure the accuracy of the debtor's name, as any mistakes can lead to complications. Additionally, the form provides space for specifying whether the financial transaction involves unique circumstances, such as public finance transactions or agricultural liens. It's important to note that if the principal debtor has multiple names, additional debts or secured party names can be added using the accompanying addenda. Understanding the nuances of the UCC 1 Financing Statement is vital for anyone involved in lending or borrowing, as it establishes a legal framework that protects the rights of all parties involved.

Ucc 1 Financing Statement Example

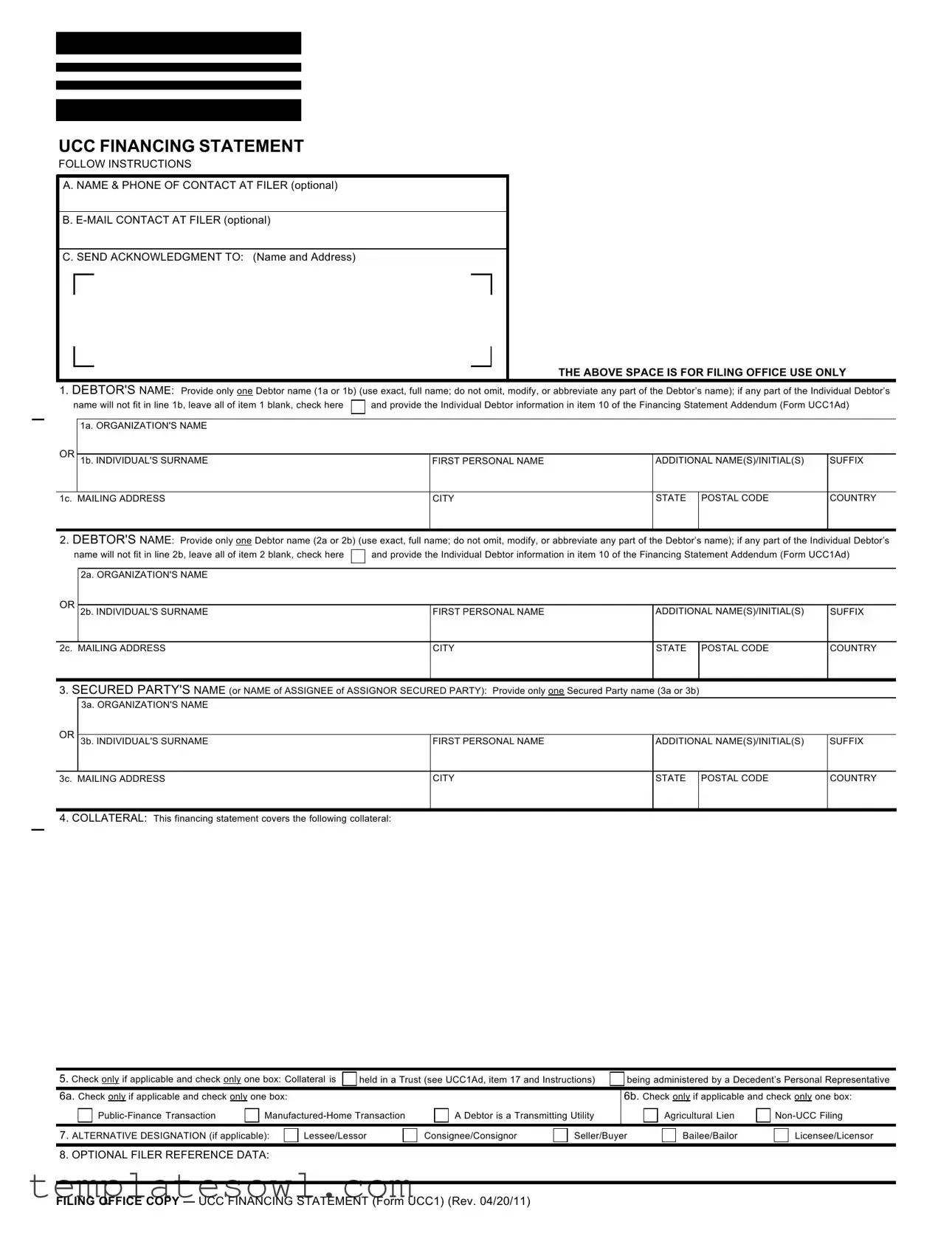

UCC FINANCING STATEMENT

FOLLOW INSTRUCTIONS

A. NAME & PHONE OF CONTACT AT FILER (optional)

B.

C.SEND ACKNOWLEDGMENT TO: (Name and Address)

THE ABOVE SPACE IS FOR FILING OFFICE USE ONLY

1.DEBTOR'S NAME: Provide only one Debtor name (1a or 1b) (use exact, full name; do not omit, modify, or abbreviate any part of the Debtor’s name); if any part of the Individual Debtor’s

name will not fit in line 1b, leave all of item 1 blank, check here |

|

and provide the Individual Debtor information in item 10 of the Financing Statement Addendum (Form UCC1Ad) |

OR

1a. ORGANIZATION'S NAME

1b. INDIVIDUAL'S SURNAME |

FIRST PERSONAL NAME |

ADDITIONAL NAME(S)/INITIAL(S) |

SUFFIX |

1c. MAILING ADDRESS

CITY

STATE

POSTAL CODE

COUNTRY

2.DEBTOR'S NAME: Provide only one Debtor name (2a or 2b) (use exact, full name; do not omit, modify, or abbreviate any part of the Debtor’s name); if any part of the Individual Debtor’s

name will not fit in line 2b, leave all of item 2 blank, check here |

|

and provide the Individual Debtor information in item 10 of the Financing Statement Addendum (Form UCC1Ad) |

OR

2a. ORGANIZATION'S NAME

2b. INDIVIDUAL'S SURNAME |

FIRST PERSONAL NAME |

ADDITIONAL NAME(S)/INITIAL(S) |

SUFFIX |

2c. MAILING ADDRESS

CITY

STATE

POSTAL CODE

COUNTRY

3.SECURED PARTY'S NAME (or NAME of ASSIGNEE of ASSIGNOR SECURED PARTY): Provide only one Secured Party name (3a or 3b) 3a. ORGANIZATION'S NAME

OR |

|

|

|

|

3b. INDIVIDUAL'S SURNAME |

FIRST PERSONAL NAME |

ADDITIONAL NAME(S)/INITIAL(S) |

SUFFIX |

3c. MAILING ADDRESS

CITY

STATE

POSTAL CODE

COUNTRY

4.COLLATERAL: This financing statement covers the following collateral:

5. Check only if applicable and check only one box: Collateral is |

|

held in a Trust (see UCC1Ad, item 17 and Instructions) |

|

|

being administered by a Decedent’s Personal Representative |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6a. Check only if applicable and check only one box: |

|

|

|

|

|

|

|

|

|

|

|

6b. Check only if applicable and check only one box: |

||||||||||||||

|

|

|

|

|

A Debtor is a Transmitting Utility |

|

|

|

|

|

Agricultural Lien |

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

7. ALTERNATIVE DESIGNATION (if applicable): |

|

Lessee/Lessor |

|

Consignee/Consignor |

|

Seller/Buyer |

|

|

|

|

Bailee/Bailor |

|

|

|

Licensee/Licensor |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. OPTIONAL FILER REFERENCE DATA: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

FILING OFFICE COPY — UCC FINANCING STATEMENT (Form UCC1) (Rev. 04/20/11)

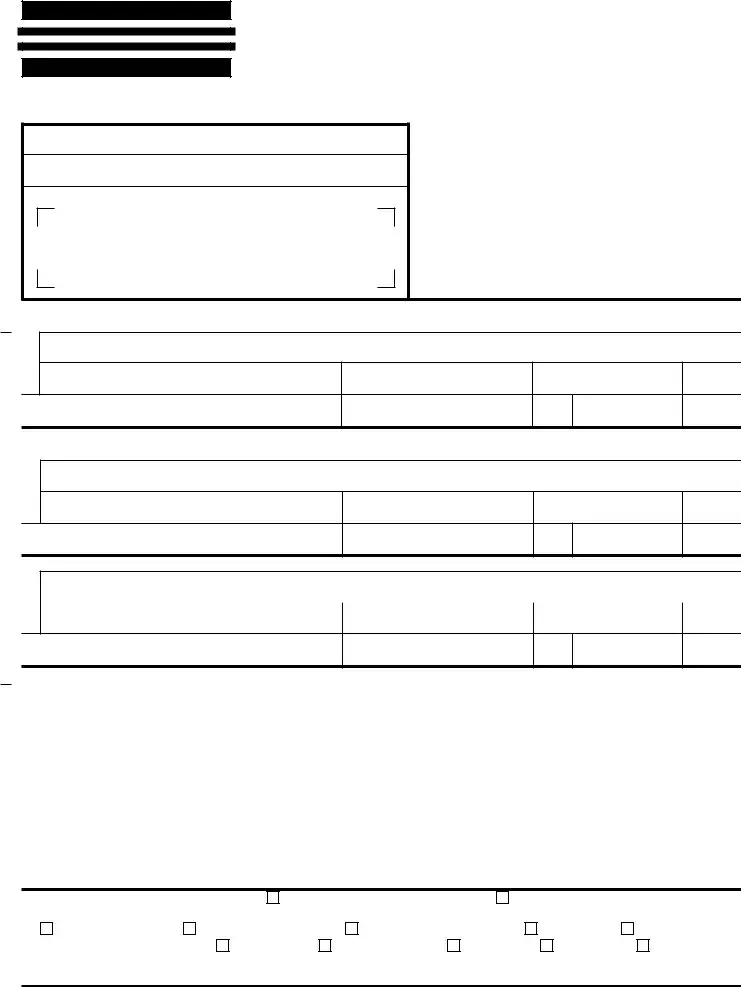

UCC FINANCING STATEMENT ADDENDUM

FOLLOW INSTRUCTIONS

9.NAME OF FIRST DEBTOR: Same as line 1a or 1b on Financing Statement; if line 1b was left blank because Individual Debtor name did not fit, check here

OR

9a. ORGANIZATION'S NAME

9b. INDIVIDUAL'S SURNAME

FIRST PERSONAL NAME

ADDITIONAL NAME(S)/INITIAL(S) |

SUFFIX |

THE ABOVE SPACE IS FOR FILING OFFICE USE ONLY

10.DEBTOR'S NAME: Provide (10a or 10b) only one additional Debtor name or Debtor name that did not fit in line 1b or 2b of the Financing Statement (Form UCC1) (use exact, full name; do not omit, modify, or abbreviate any part of the Debtor’s name) and enter the mailing address in line 10c

OR

10a. ORGANIZATION'S NAME

10b. INDIVIDUAL'S SURNAME

INDIVIDUAL’S FIRST PERSONAL NAME

INDIVIDUAL’S ADDITIONAL NAME(S)/INITIAL(S)

SUFFIX

10c. MAILING ADDRESS

CITY

STATE

POSTAL CODE

COUNTRY

11.

OR

ADDITIONAL SECURED PARTY'S NAME or |

ASSIGNOR SECURED PARTY'S NAME: Provide only one name (11a or 11b) |

|

|

|

|

|

|

11a. ORGANIZATION'S NAME |

|

|

|

|

|

|

|

11b. INDIVIDUAL'S SURNAME |

FIRST PERSONAL NAME |

ADDITIONAL NAME(S)/INITIAL(S) |

SUFFIX |

|

|

|

|

11c. MAILING ADDRESS

CITY

STATE

POSTAL CODE

COUNTRY

12. ADDITIONAL SPACE FOR ITEM 4 (Collateral):

13. |

This FINANCING STATEMENT is to be filed [for record] (or recorded) in the |

14. This FINANCING STATEMENT: |

|

|

|

REAL ESTATE RECORDS (if applicable) |

covers timber to be cut |

covers |

is filed as a fixture filing |

|

|

|||

|

|

|

|

|

15. Name and address of a RECORD OWNER of real estate described in item 16 |

16. Description of real estate: |

|

|

|

|

(if Debtor does not have a record interest): |

|

|

|

|

|

|

|

|

17. MISCELLANEOUS:

FILING OFFICE COPY — UCC FINANCING STATEMENT ADDENDUM (Form UCC1Ad) (Rev. 04/20/11)

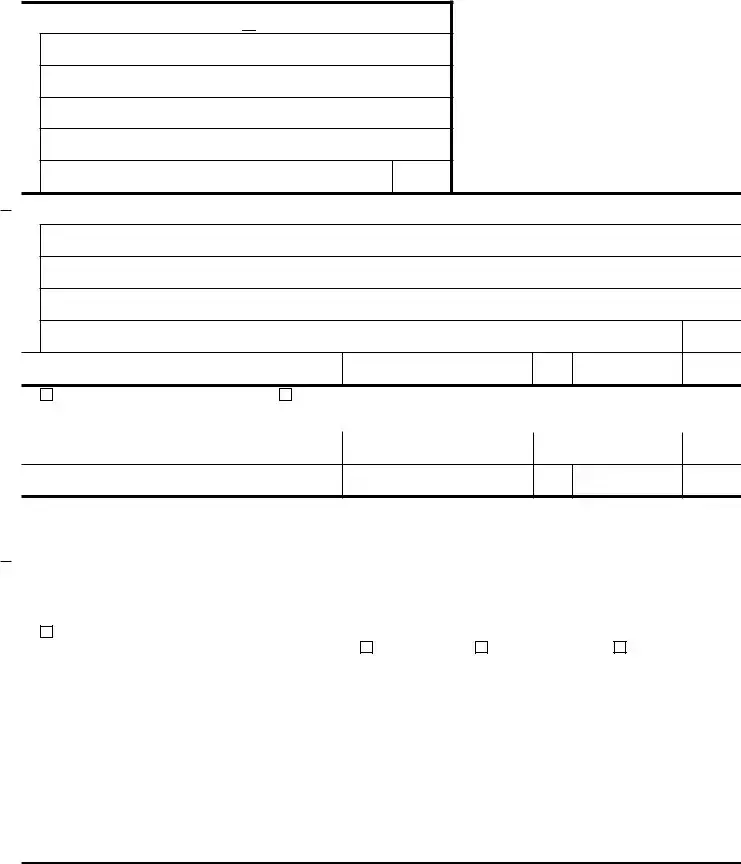

UCC FINANCING STATEMENT ADDITIONAL PARTY

FOLLOW INSTRUCTIONS

18.NAME OF FIRST DEBTOR: Same as line 1a or 1b on Financing Statement; if line 1b was left blank because Individual Debtor name did not fit, check here

18a. ORGANIZATION'S NAME

OR 18b. INDIVIDUAL'S SURNAME |

|

FIRST PERSONAL NAME |

|

ADDITIONAL NAME(S)/INITIAL(S) |

SUFFIX |

THE ABOVE SPACE IS FOR FILING OFFICE USE ONLY

19.ADDITIONAL DEBTOR'S NAME: Provide only one Debtor name (19a or 19b) (use exact, full name; do not omit, modify, or abbreviate any part of the Debtor’s name) 19a. ORGANIZATION'S NAME

OR |

|

|

|

|

19b. INDIVIDUAL'S SURNAME |

FIRST PERSONAL NAME |

ADDITIONAL NAME(S)/INITIAL(S) |

SUFFIX |

19c. MAILING ADDRESS

CITY

STATE POSTAL CODE

COUNTRY

20. ADDITIONAL DEBTOR'S NAME: Provide only one Debtor name (20a or 20b) (use exact, full name; do not omit, modify, or abbreviate any part of the Debtor’s name)

OR

20a. ORGANIZATION'S NAME

20b. INDIVIDUAL'S SURNAME |

FIRST PERSONAL NAME |

ADDITIONAL NAME(S)/INITIAL(S) |

SUFFIX |

20c. MAILING ADDRESS

CITY

STATE POSTAL CODE

COUNTRY

21. ADDITIONAL DEBTOR'S NAME: Provide only one Debtor name (21a or 21b) (use exact, full name; do not omit, modify, or abbreviate any part of the Debtor’s name)

OR

21a. ORGANIZATION'S NAME

21b. INDIVIDUAL'S SURNAME |

FIRST PERSONAL NAME |

ADDITIONAL NAME(S)/INITIAL(S) |

SUFFIX |

21c. MAILING ADDRESS

CITY

STATE POSTAL CODE

COUNTRY

22.

OR

ADDITIONAL SECURED PARTY'S NAME or |

ASSIGNOR SECURED PARTY'S NAME: Provide only one name (22a or 22b) |

|

|

|

|

|

|

22a. ORGANIZATION'S NAME |

|

|

|

|

|

|

|

22b. INDIVIDUAL'S SURNAME |

FIRST PERSONAL NAME |

ADDITIONAL NAME(S)/INITIAL(S) |

SUFFIX |

|

|

|

|

22c. MAILING ADDRESS

CITY

STATE POSTAL CODE

COUNTRY

23.

OR

ADDITIONAL SECURED PARTY'S NAME or |

ASSIGNOR SECURED PARTY'S NAME: Provide only one name (23a or 23b) |

|

|

|

|

|

|

23a. ORGANIZATION'S NAME |

|

|

|

|

|

|

|

23b. INDIVIDUAL'S SURNAME |

FIRST PERSONAL NAME |

ADDITIONAL NAME(S)/INITIAL(S) |

SUFFIX |

|

|

|

|

23c. MAILING ADDRESS

CITY

STATE POSTAL CODE

COUNTRY

24. MISCELLANEOUS:

FILING OFFICE COPY — UCC FINANCING STATEMENT ADDITIONAL PARTY (Form UCC1AP) (Rev. 08/22/11)

Instructions for UCC Financing Statement (Form UCC1)

Please type or

Fill in form very carefully; mistakes may have important legal consequences. If you have questions, consult your attorney. The filing office cannot give legal advice.

Send completed form and any attachments to the filing office, with the required fee.

ITEM INSTRUCTIONS

A and B. To assist filing offices that might wish to communicate with filer, filer may provide information in item A and item B. These items are optional.

C.Complete item C if filer desires an acknowledgment sent to them. If filing in a filing office that returns an acknowledgment copy furnished by filer, present simultaneously with this form the Acknowledgment Copy or a carbon or other copy of this form for use as an acknowledgment copy.

1.Debtor’s name. Carefully review applicable statutory guidance about providing the debtor’s name. Enter only one Debtor name in item 1

1a. Organization Debtor Name. “Organization Name” means the name of an entity that is not a natural person. A sole proprietorship is not an organization, even if the individual proprietor does business under a trade name. If Debtor is a registered organization (e.g., corporation, limited partnership, limited liability company), it is advisable to examine Debtor’s current filed public organic records to determine Debtor's correct name. Trade name is insufficient. If a corporate ending (e.g., corporation, limited partnership, limited liability company) is part of the Debtor’s name, it must be included. Do not use words that are not part of the Debtor’s name.

1b. Individual Debtor Name. “Individual Name” means the name of a natural person; this includes the name of an individual doing business as a sole proprietorship, whether or not operating under a trade name. The term includes the name of a decedent where collateral is being administered by a personal representative of the decedent. The term does not include the name of an entity, even if it contains, as part of the entity’s name, the name of an individual. Prefixes (e.g., Mr., Mrs., Ms.) and titles (e.g., M.D.) are generally not part of an individual name. Indications of lineage (e.g., Jr., Sr., III) generally are not part of the individual’s name, but may be entered in the Suffix box. Enter individual Debtor’s surname (family name) in Individual’s Surname box, first personal name in First Personal Name box, and all additional names in Additional Name(s)/Initial(s) box.

If a Debtor’s name consists of only a single word, enter that word in Individual’s Surname box and leave other boxes blank.

For both organization and individual Debtors. Do not use Debtor’s trade name, DBA, AKA, FKA, division name, etc. in place of or combined with Debtor’s correct name; filer may add such other names as additional Debtors if desired (but this is neither required nor recommended).

1c. Enter a mailing address for the Debtor named in item 1a or 1b.

2.Additional Debtor’s name. If an additional Debtor is included, complete item 2, determined and formatted per Instruction 1. For additional Debtors, attach either Addendum (Form UCC1Ad) or Additional Party (Form UCC1AP) and follow Instruction 1 for determining and formatting additional names.

3.Secured Party’s name. Enter name and mailing address for Secured Party or Assignee who will be the Secured Party of record. For additional Secured Parties, attach either Addendum (Form UCC1Ad) or Additional Party (Form UCC1AP). If there has been a full assignment of the initial Secured Party’s right to be Secured Party of record before filing this form, either (1) enter Assignor Secured Party‘s name and mailing address in item 3 of this form and file an Amendment (Form UCC3) [see item 5 of that form]; or (2) enter Assignee’s name and mailing address in item 3 of this form and, if desired, also attach Addendum (Form UCC1Ad) giving Assignor Secured Party’s name and mailing address in item 11.

4.Collateral. Use item 4 to indicate the collateral covered by this financing statement. If space in item 4 is insufficient, continue the collateral description in item 12 of the Addendum (Form UCC1Ad) or attach additional page(s) and incorporate by reference in item 12 (e.g., See Exhibit A). Do not include social security numbers or other personally identifiable information.

NOTE: If this financing statement covers timber to be cut, covers

5.If collateral is held in a trust or being administered by a decedent’s personal representative, check the appropriate box in item 5. If more than one Debtor has an interest in the described collateral and the check box does not apply to the interest of all Debtors, the filer should consider filing a separate Financing Statement (Form UCC1) for each Debtor.

6a. If this financing statement relates to a

6b. If this is an Agricultural Lien (as defined in applicable state’s enactment of the Uniform Commercial Code) or if this is not a UCC security interest filing (e.g., a tax lien, judgment lien, etc.), check the appropriate box in item 6b and attach any other items required under other law.

7.Alternative Designation. If filer desires (at filer's option) to use the designations lessee and lessor, consignee and consignor, seller and buyer (such as in the case of the sale of a payment intangible, promissory note, account or chattel paper), bailee and bailor, or licensee and licensor instead of Debtor and Secured Party, check the appropriate box in item 7.

8.Optional Filer Reference Data. This item is optional and is for filer's use only. For filer's convenience of reference, filer may enter in item 8 any identifying information that filer may find useful. Do not include social security numbers or other personally identifiable information.

Instructions for UCC Financing Statement Addendum (Form UCC1Ad)

Please type or

legal advice.

ITEM INSTRUCTIONS

9.Name of first Debtor. Enter name of first Debtor exactly as shown in item 1 of Financing Statement (Form UCC1) to which this Addendum relates. The name will not be indexed as a separate debtor. The Debtor name in this section is intended to

If the box in item 1 of the Financing Statement (Form UCC1) was checked because Individual Debtor name did not fit, the box in item 9 of this Addendum should be checked.

10.Additional Debtor’s name. If this Addendum adds an additional Debtor, complete item 10 in accordance with Instruction 1 of Financing Statement (Form UCC1). For additional Debtors, attach either an additional Addendum or Additional Party (Form UCC1AP) and follow Instruction 1 of Financing Statement (Form UCC1) for determining and formatting additional names.

11.Additional Secured Party’s name or Assignor Secured Party’s name. If this Addendum adds an additional Secured Party, complete item 11 in accordance with Instruction 3 of Financing Statement (Form UCC1). For additional Secured Parties, attach either an additional Addendum or Additional Party (Form UCC1AP) and complete applicable items in accordance with Instruction 3 of Financing Statement (Form UCC1). In the case of a full assignment of the Secured Party’s interest before the filing of this financing statement, if filer has provided the name and mailing address of the Assignee in item 3 of Financing Statement (Form UCC1), filer may enter Assignor Secured Party’s name and mailing address in item 11.

12.Additional Collateral Description. If space in item 4 of Financing Statement (Form UCC1) is insufficient or additional information must be provided, enter additional information in item 12 or attach additional page(s) and incorporate by reference in item 12 (e.g., See Exhibit A). Do not include social security numbers or other personally identifiable information.

17.Miscellaneous. Under certain circumstances, additional information not provided on the Financing Statement (Form UCC1) may be required. Also, some states have

Instructions for UCC Financing Statement Additional Party (Form UCC1AP)

Please type or

legal advice.

Use this form (multiple copies if needed) to continue adding additional Debtor or Secured Party names as needed when filing a UCC Financing Statement (Form UCC1).

ITEM INSTRUCTIONS

18.Name of first Debtor. Enter name of first Debtor exactly as shown in item 1 of Financing Statement (Form UCC1) to which this Additional Party relates. The name will not be indexed as a separate Debtor. If line 1b of the Financing Statement (Form UCC1) was left blank because the Individual Debtor name did not fit, check the box in item 18 and enter as much of the Individual Debtor name from item 10 that will fit. The Debtor name in this section is intended to

24.Miscellaneous. Under certain circumstances, additional information not provided on the Financing Statement (Form UCC1) may be required. Also, some states have

Form Characteristics

| Fact Title | Fact Description |

|---|---|

| Purpose of UCC-1 | The UCC-1 Financing Statement is a legal form used to secure interest in collateral for a loan or credit arrangement. |

| Governing Law | UCC-1 forms are governed by the Uniform Commercial Code, which varies by state. Each state has specific requirements for filing. |

| Debtor Name Requirement | Only one Debtor name must be provided on the UCC-1 form. The debtor's name must be the exact legal name without any abbreviations. |

| Secured Party Details | The name and contact details of the Secured Party must be included. This person or organization has the interest in the collateral. |

| Collateral Description | This form requires the specification of the collateral that secures the debt. Accurate descriptions are critical. |

| Filer Information | Although optional, the filer may include contact details such as a phone number and email on the form for communication purposes. |

| State-Specific Addenda | Some states may require additional information or forms, like the UCC1Ad or UCC1AP addenda, for completeness. |

| Importance of Accuracy | Accuracy is paramount when filling out the UCC-1; errors can affect the enforceability of the security interest. |

| Filing Fees | Filing the UCC-1 form typically incurs a fee, which may vary by state. Ensure to check the specific requirements for your jurisdiction. |

Guidelines on Utilizing Ucc 1 Financing Statement

Filling out the UCC-1 Financing Statement form accurately is essential for creating a public record of a secured party's rights in the collateral of a debtor. Once the form is completed, it can be submitted to the appropriate filing office, where it becomes part of the public record. Below are detailed steps to assist you in filling out the form correctly.

- Optional: If desired, provide your name and phone number in section A, and email contact in section B.

- If you wish to receive an acknowledgment, fill in section C with the name and address where the acknowledgment should be sent.

- In section 1, enter the Debtor's name. Choose either 1a for an organization's name or 1b for an individual’s name, providing the full name and removing any abbreviations.

- Complete the mailing address for the Debtor in section 1c, including the city, state, postal code, and country.

- If there’s an additional Debtor, fill in section 2 using the same format provided in section 1.

- In section 3, provide the Secured Party's name, selecting either 3a for an organization or 3b for an individual. Include the mailing address in section 3c.

- Describe the collateral covered by this financing statement in section 4. If more space is needed, you can continue your description in item 12 of the addendum.

- If applicable, check the box in section 5 if the collateral is held in a trust or managed by a decedent’s personal representative.

- In section 6, check any applicable boxes that describe the type of transaction, such as a Public-Finance Transaction or if the Debtor is a Transmitting Utility.

- If desired, indicate any alternative designations in section 7, such as seller-buyer or lessee-lessor.

- For the filer's reference data, you may include any optional information in section 8 that may help you identify this filing later.

Once you have completed these steps, ensure that all information is accurate and clearly legible before submitting the form. It's crucial to review the form for any mistakes, as errors can lead to legal complications.

What You Should Know About This Form

What is a UCC-1 Financing Statement?

A UCC-1 Financing Statement is a legal document used to file a public record of a secured transaction. It establishes a secured creditor's interest in the collateral of a debtor. This form is crucial as it provides notice to third parties that a lender has a security interest in specific personal property of the debtor.

Who needs to file a UCC-1 Financing Statement?

Any business or individual who is providing a loan or credit secured by collateral should file a UCC-1 Financing Statement. This includes banks, credit unions, or any operational business that offers financing for goods or services. The filing protects the creditor's interest in their collateral against claims from other creditors.

How do I fill out the UCC-1 Financing Statement?

To complete the UCC-1 form, you must provide accurate details regarding the debtor, secured party, and collateral. Enter the full legal names without abbreviations or nicknames. If the debtor is an organization, ensure that the name matches the records filed in your state. Follow the instructions carefully, especially regarding sections for mailing addresses and descriptions of collateral.

Why is it important to provide the correct debtor name?

The correct debtor name is essential to avoid issues with enforceability and priority rights. If a name is misspelled or abbreviated, it could be grounds for the filing to be deemed ineffective. The law states that using the exact legal name is necessary when establishing a security interest.

Can I amend or withdraw a UCC-1 Financing Statement after filing?

Yes, you can amend or withdraw a UCC-1 Financing Statement. To amend, you must file a UCC-3 form stating the changes. If you wish to withdraw the statement altogether, you can also use a UCC-3 form for that purpose. This is important to maintain clear and accurate records regarding security interests.

How long does a UCC-1 Financing Statement remain effective?

A UCC-1 Financing Statement typically remains effective for five years from the date of filing. However, it can be continued for another five-year period by filing a UCC-3 continuation statement before the expiration of the original filing. Ensuring timely continuation can protect the secured party's interest in the collateral long-term.

What happens if the UCC-1 Financing Statement is not filed?

If a UCC-1 Financing Statement is not filed, a secured party may lose their legal priority and interest in the debtor's collateral. Without this filing, other creditors may have the right to collect the collateral in the event of debtor default, as they would not be aware of any prior claims against it.

Where should I file the UCC-1 Financing Statement?

The UCC-1 Financing Statement must be filed in the appropriate state office, usually the Secretary of State's office, based on the debtor's location. It is advisable to verify the specific filing requirements for your state beforehand to ensure compliance.

Is there a filing fee for the UCC-1 Financing Statement?

Yes, there is typically a filing fee associated with submitting a UCC-1 Financing Statement. Fees may vary by state, so it is essential to check the relevant state office for specific costs. Payment is usually required at the time of filing, along with the completed form.

Common mistakes

Filing the UCC Financing Statement is a crucial step in securing interests, but mistakes can undermine its effectiveness. One common error is providing an incorrect Debtor name. It is essential to use the full and exact name for either an organization or an individual. Abbreviations or omissions can lead to inadequate filing and potential legal issues.

Another frequent oversight is failing to check the box in item 1 if the individual Debtor's name does not fit. This can result in a misunderstanding about the identity of the Debtor. Following the proper procedure ensures that the name is recorded correctly in the subsequent addendum.

Moreover, confusion often arises in item 3 concerning the Secured Party’s details. Not providing a complete and accurate name for the Secured Party can create complications. Additional secured parties should also be documented carefully to ensure that their interests are recognized and protected.

Collaterals, described in item 4, are another area where errors frequently occur. If the description is vague or incomplete, it may cause problems during enforcement. Be sure to follow up with any necessary details in item 12 or attach additional pages where needed.

Equally important is checking the appropriate boxes in items 5, 6a, and 6b. Misclassification of the transaction type can lead to issues later on. It is crucial to carefully consider which boxes to check, as this affects the nature of the transaction.

Omitting a mailing address or failing to format the addresses correctly is yet another misstep. Properly including mailing addresses for all involved parties, including Debtors and Secured Parties, is mandatory for clear communication and future correspondence.

Finally, neglecting optional references or additional contact information in section 8 can lead to future complications. While not mandatory, providing reference data can streamline communication significantly. Ensure every section is filled out correctly to avoid delays or misunderstandings down the line.

Documents used along the form

When filing a UCC-1 Financing Statement, several additional forms may be necessary or helpful to ensure that the filing fully represents the nature of the secured transaction. Each of these documents serves distinct purposes that complement the UCC-1 form. Below is a list of commonly used forms and documents that often accompany the UCC-1 Financing Statement.

- UCC-1 Addendum (Form UCC1Ad): This form allows for the inclusion of additional debtors, secured parties, or collateral descriptions when the information cannot fit on the UCC-1 form itself. It is essential for comprehensive representation of all parties involved.

- UCC-1 Additional Party (Form UCC1AP): When there are multiple secured parties or debtors that were not included in the original UCC-1 form, this document enables their names and details to be added efficiently, ensuring all parties are acknowledged.

- UCC-3 Amendment (Form UCC3): This form is used to amend or update any information previously recorded in a UCC-1 statement. Whether it's adding new collateral or changing a debtor's name, this form keeps the information current and legally valid.

- UCC-5 Amendment (Form UCC5): If there’s a need to request the termination of a UCC-1 filing or declare that a secured obligation has been satisfied, this form is utilized. It formally announces the end of a security interest.

- Trust Documents: In situations where collateral is held in a trust, the relevant trust agreement may be necessary to clarify the terms under which the collateral is held and the obligations of the trustee, ensuring all legal protocols are observed.

- Security Agreement: This document outlines the terms between the debtor and the secured party and details what collateral is being secured. It acts as the foundational contract that gives rise to the security interest and is often referenced alongside the UCC-1 form.

- Real Estate Record Information: If the collateral involves real property, additional documentation may be required that describes the real estate in detail, including its location and ownership. This ensures clarity in what is being used as collateral.

Understanding these forms and documents can significantly impact the effectiveness of the secured transaction process. Properly completing and filing the UCC-1 Financing Statement along with the appropriate additional documents helps protect the interests of all parties involved. Always consult with a professional or perform thorough research before proceeding with filings to ensure compliance with applicable laws.

Similar forms

- UCC Financing Statement Addendum (Form UCC1Ad): This document is used to provide additional information or names that do not fit in the primary UCC Financing Statement. It essentially serves to supplement the original form, ensuring that all relevant parties and collateral details are clearly recorded.

- UCC Financing Statement Additional Party (Form UCC1AP): Similar to the addendum, this form allows for the inclusion of additional debtors or secured parties. It provides a structured way to ensure that all necessary parties are recognized in the financing statement.

- Articles of Incorporation: When a business is formed, Articles of Incorporation are filed with the state. These documents establish the existence of the corporation, just as the UCC Financing Statement establishes a security interest. Both involve important names and details pertaining to ownership and roles.

- Loan Agreement: A written contract between a borrower and a lender. This agreement clarifies the terms under which the loan is granted, including collateral often listed in the UCC Financing Statement. Both documents help outline interests and obligations in a financial transaction.

- Mortgage Agreement: This document is a specific type of loan agreement secured by real property. Similar to the UCC Financing Statement, it establishes a claim against collateral, offering protection to the lender in the event of default.

- Promissory Note: This is a written promise to pay a specified sum at a certain time. Like the UCC Financing Statement, it often accompanies a secured transaction, identifying obligations that both parties must adhere to, including descriptions of collateral.

- Security Agreement: A contract that provides a lender or seller the rights to take collateral if the borrower defaults. Like the UCC Financing Statement, it outlines the terms and defines the collateral, thereby formalizing the lender's security interest.

- Corporate Resolution: When an organization decides to enter into agreements, a corporate resolution is often drafted to authorize action. Just as a UCC Financing Statement requires proper naming and identification of parties, this resolution documents the authorization of such agreements.

- Bankruptcy Filing Documentation: In the event of bankruptcy, various forms are filed with much attention to debtors and creditors. Like the UCC Financing Statement, these documents delineate interests among parties, determining who has priority and which claims are valid.

Dos and Don'ts

Filling out the UCC-1 Financing Statement form requires careful attention to detail. To ensure a smooth filing process, here are five important dos and don'ts:

- Do: Use the correct and complete name of the debtor. Abbreviations or modifications can lead to issues later.

- Do: Review the form for legibility. A clear, typed document helps avoid misunderstandings and errors.

- Do: Check each box carefully to ensure the correct options are selected, especially regarding collateral types and debtor designations.

- Do: Provide a complete mailing address for all parties involved, as missing information might delay processing.

- Do: Consult with legal professionals to clarify any uncertainties before filing. Getting it right the first time is always the best approach.

- Don't: Leave any sections blank when they require completion. Missing information can complicate the record.

- Don't: Use trade names, DBAs, or abbreviations if they do not match the legal name of the debtor. This can result in filing errors.

- Don't: Include personal information such as Social Security numbers in the form. This protects privacy and reduces potential risks.

- Don't: Submit the form without double-checking all information for accuracy. Simple mistakes can have serious consequences.

- Don't: Assume that filing office staff can provide legal advice regarding your form. They can assist with filing but not with legal interpretations.

Misconceptions

Misconception 1: The UCC-1 Financing Statement can include multiple names for a Debtor.

In reality, the form requires only one Debtor name per line. This means you must choose either the name of an organization or an individual's name, ensuring it is accurate and complete without abbreviations or modifications.

Misconception 2: Any name or title related to the Debtor can be used on the form.

This is incorrect. You must use the exact, legal name without any trade names or designations such as "DBA" or "FKA." This adherence to formal naming reduces the risk of complications in enforcing security interests.

Misconception 3: Completing the form is a straightforward process with few consequences for errors.

Filling out the UCC-1 accurately is crucial. Any mistakes can lead to significant legal repercussions, including the invalidation of the security interest. Each section must be approached with full attention to detail.

Misconception 4: A UCC-1 Financing Statement does not need to be filed with a specific office.

Contrary to this belief, the statement must be filed with the appropriate filing office for it to be effective. The jurisdiction in which the Debtor is located will dictate where the form needs to be filed. Ensure you are aware of the correct office to avoid filing issues.

Key takeaways

- Accurate Information is Essential: When completing the UCC-1 Financing Statement form, ensure that the debtor's name is entered in its entirety. Abbreviations or modifications can lead to legal complications.

- Single Debtor Rule: You should include only one debtor's name per section. If you need to report more than one debtor, use additional forms as required.

- Collateral Description: Clearly describe the collateral being financed. If the space on the form is not enough, you may continue your description on an addendum or additional page.

- Trusts and Estates: If the collateral is held in a trust or managed by a deceased person’s representative, this should be indicated on the form. Make sure to follow the guidelines for such cases.

- Filing Fees are Required: When submitting the completed form, you will need to include any necessary fees. Keep in mind these fees may vary by filing office.

- Mailing Addresses: Include accurate mailing addresses for all parties involved. This is important not only for communication but also for the validity of the filing.

- Legibility Matters: Make sure the form is completed in a legible manner. Typing or laser printing is preferred to avoid confusion in writing.

- Legal Advice: If you have any uncertainties regarding how to fill out the form or its implications, consult a legal professional for guidance. The filing office can provide information but cannot offer legal advice.

Browse Other Templates

60-day Notice of Intent to Sell - Failure to comply with timelines may hinder the recovery process.

Can You Get a Medical License With a Misdemeanor - Citizenship and immigration status must also be indicated, adhering to federal requirements.

How to Get Child Care License in California - Your sketches should facilitate a quick assessment by licensing authorities.