Fill Out Your Uct 6491 Form

In the realm of business and employment, accurate record-keeping is essential for compliance with state regulations, and the UCT 6491 form serves a critical purpose in this process. Whenever there are changes in a business's employment status or structural organization, this form must be filled out and submitted to the appropriate state agency. Notably, the UCT 6491 requires users to report a variety of modifications, including updates to contact information, legal names, trade names, and employment structures. If a business ceases operations or undergoes a sale, a transfer, or reorganization, the form also mandates specific disclosures within a thirty-day window. This requirement underscores the importance of timely communication with state authorities to maintain compliance with Wisconsin's unemployment insurance laws. Individuals filling out this form need to provide clear, updated details along with the respective sections dedicated to various changes. For those lacking employees or no longer operating within Wisconsin, the form must still be completed while clarifying the business’s current status. By understanding the various components of the UCT 6491, business owners can better navigate the administrative responsibilities associated with their operations and avoid potential pitfalls related to non-compliance.

Uct 6491 Example

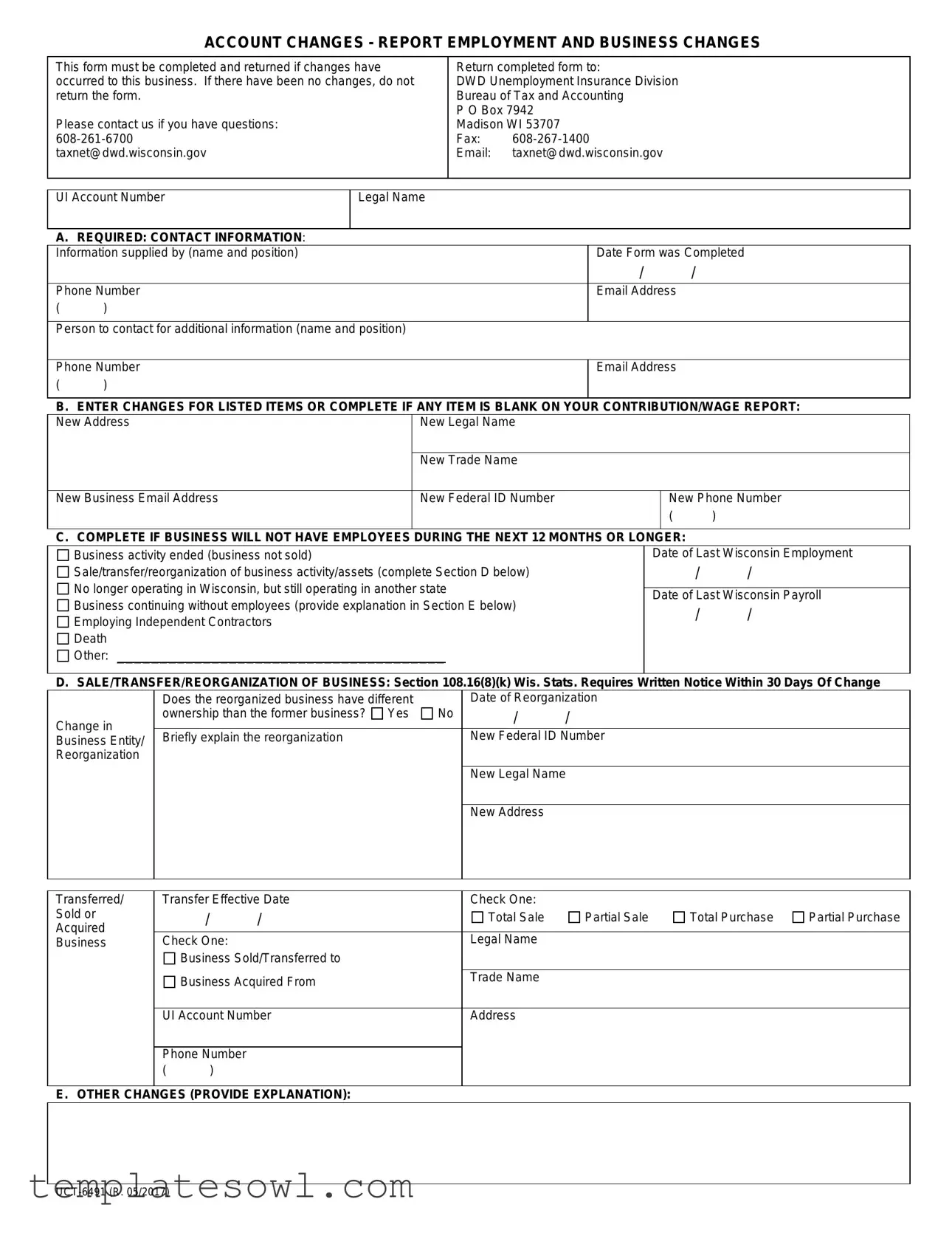

ACCOUNT CHANGES - REPORT EMPLOYMENT AND BUSINESS CHANGES

This form must be completed and returned if changes have occurred to this business. If there have been no changes, do not return the form.

Please contact us if you have questions:

Return completed form to:

DWD Unemployment Insurance Division Bureau of Tax and Accounting

P O Box 7942 Madison WI 53707

Fax:

Email: taxnet@dwd.wisconsin.gov

UI Account Number

Legal Name

A. REQUIRED: CONTACT INFORMATION: |

|

|

|

|

|

|

Information supplied by (name and position) |

|

Date Form was Completed |

||||

|

|

|

/ |

/ |

|

|

Phone Number |

|

Email Address |

|

|||

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Person to contact for additional information (name and position) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Phone Number |

|

Email Address |

|

|||

( |

) |

|

|

|

|

|

|

|

|

|

|

||

B. ENTER CHANGES FOR LISTED ITEMS OR COMPLETE IF ANY ITEM IS BLANK ON YOUR CONTRIBUTION/WAGE REPORT: |

||||||

New Address |

New Legal Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New Trade Name |

|

|

|

|

|

|

|

|

|

||

New Business Email Address |

New Federal ID Number |

|

|

New Phone Number |

||

|

|

|

|

|

( |

) |

|

|

|

|

|

||

C. COMPLETE IF BUSINESS WILL NOT HAVE EMPLOYEES |

DURING THE NEXT 12 MONTHS OR LONGER: |

|

||||

|

Business activity ended (business not sold) |

|

|

Date of Last Wisconsin Employment |

||

|

Sale/transfer/reorganization of business activity/assets (complete Section D below) |

|

/ |

/ |

||

|

No longer operating in Wisconsin, but still operating in another state |

|

|

|

|

|

|

|

Date of Last Wisconsin Payroll |

||||

|

Business continuing without employees (provide explanation in Section E below) |

|

||||

|

|

/ |

/ |

|||

|

Employing Independent Contractors |

|

|

|||

|

|

|

|

|

|

|

|

Death |

|

|

|

|

|

|

Other: ______________________________________ |

|

|

|

|

|

D. SALE/TRANSFER/REORGANIZATION OF BUSINESS: Section 108.16(8)(k) Wis. Stats. Requires Written Notice Within 30 Days Of Change

|

Does the reorganized business have different |

|

Date of Reorganization |

|

Change in |

ownership than the former business? Yes |

No |

/ |

/ |

Briefly explain the reorganization |

|

New Federal ID Number |

||

Business Entity/ |

|

|||

Reorganization |

|

|

|

|

|

|

|

New Legal Name |

|

|

|

|

|

|

|

|

|

New Address |

|

|

|

|

|

|

Transferred/ |

Transfer Effective Date |

Check One: |

|

|

|

||

Sold or |

|

/ |

/ |

Total Sale |

Partial Sale |

Total Purchase |

Partial Purchase |

Acquired |

|

|

|

|

|

|

|

Business |

Check One: |

|

Legal Name |

|

|

|

|

|

|

Business Sold/Transferred to |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Acquired From |

Trade Name |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

UI Account Number |

Address |

|

|

|

||

|

|

|

|

|

|

|

|

|

Phone Number |

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

||

E. OTHER CHANGES (PROVIDE EXPLANATION): |

|

|

|

|

|||

|

|

|

|

|

|

|

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The UCT-6491 form is used to report employment and business changes for a specific business. |

| Submission Requirement | This form must be submitted only if there have been changes to the business. If no changes exist, do not submit it. |

| Contact Information | The form requires the submitter's contact information, including name, position, phone number, and email address. |

| Governor Law | This form is governed by Section 108.16(8)(k) of the Wisconsin Statutes. |

| Reporting Deadline | A written notice must be provided within 30 days of any relevant changes. |

| Business Status | Specific sections of the form must be completed if the business will not have employees for the next 12 months or longer. |

| Reorganization Details | If applicable, the form asks for details about any reorganization, including new legal or trade names. |

| Contact for Questions | For questions regarding the form, individuals can contact the Wisconsin Department of Workforce Development at 608-261-6700 or via email at taxnet@dwd.wisconsin.gov. |

| Completion Date | The form must include the completion date and the date of any changes reported. |

Guidelines on Utilizing Uct 6491

The UCT 6491 form is essential when there are changes to your business that need to be reported. It’s important to follow the instructions carefully to ensure that all updates are accurately submitted. Below are the steps to help you fill out the form correctly.

- Gather Required Information: Collect all necessary details such as your UI account number, legal name, and contact information.

- Contact Information: Fill in the required fields, including the name and position of the person supplying information, date completed, phone number, and email address.

- Contact Person: If different from the information provider, add the name, position, phone number, and email address of the person to contact for further information.

- Enter Changes: Update all applicable fields about your business, such as new address, legal name, trade name, email address, federal ID number, and phone number.

- Business Activity Section: If your business will have no employees for the next 12 months or longer, check appropriate options and provide relevant dates. Include details if you no longer operate in Wisconsin or about employing independent contractors.

- Sales/Transfer/Reorganization Details: If applicable, indicate if there was a sale or transfer of the business. Provide the date of the reorganization, details on ownership changes, and other necessary explanations.

- Additional Information: Complete Section E if there are other changes. Provide clear explanations as needed.

- Review: Carefully review all information for accuracy before submission. Ensure no fields are left blank unless specified.

- Submit the Form: Return the completed form to the provided address or via fax or email. Make sure it’s sent to the DWD Unemployment Insurance Division.

What You Should Know About This Form

What is the purpose of the UCT 6491 form?

The UCT 6491 form is used to report any changes to your business related to employment and business operations. If something in your business has changed, this form must be filled out and submitted. It's crucial for maintaining accurate records with the Department of Workforce Development in Wisconsin.

Who needs to fill out the UCT 6491 form?

How do I submit the UCT 6491 form?

You can return the completed form to the Department of Workforce Development’s Unemployment Insurance Division. There are several ways to submit it: by mail, fax, or email. Use the following contact details for submission:

Mail: DWD Unemployment Insurance Division, Bureau of Tax and Accounting, PO Box 7942, Madison, WI 53707

Fax: 608-267-1400

Email: taxnet@dwd.wisconsin.gov

What should I do if I have questions about the form?

If you have any questions regarding the UCT 6491 form or the information required, you can reach out to the Department of Workforce Development at 608-261-6700 or via email at taxnet@dwd.wisconsin.gov. They can provide assistance and clarification.

What information do I need to provide on the UCT 6491 form?

You will need to fill out contact information, including your name, position, phone number, and email address. Additionally, you should provide details about the specific changes to your business, such as a new legal name, address, or trade name. You may also need to indicate if your business will not have employees for an extended period.

What happens if I don’t submit the UCT 6491 form?

Failing to submit this form when required can lead to inaccuracies in your business’s tax records. This may result in penalties or complications with your unemployment insurance account. It is important to keep all information up to date to avoid potential issues.

Is there a deadline for submitting the UCT 6491 form?

While the form should be submitted as soon as possible after any changes occur, Section 108.16(8)(k) of the Wisconsin Statutes requires written notice within 30 days of a business change. Thus, it's best to act promptly to ensure compliance.

Common mistakes

When filling out the UCT-6491 form, individuals often make common mistakes that can lead to delays or complications in processing. One frequent error is omitting required contact information. The form specifies that both the person completing the form and a contact for additional information must provide their names, positions, phone numbers, and email addresses. Failure to include these details can result in unnecessary back-and-forth communication.

An additional mistake involves inaccuracies in reporting changes. Whether updating the legal name, trade name, or contact details, it is crucial to ensure that the information reflects the most current data. Inaccuracies can lead to confusion and may require further clarification, impeding the updating process.

Another common oversight occurs in Section C, where businesses indicate they will not have employees for the next 12 months or longer. Many forget to provide essential dates related to their last employment or payroll period. Incomplete information in this section can cause issues with compliance, as it is vital for establishing the status of the business.

Section D, related to the sale, transfer, or reorganization of the business, is often filled out incorrectly. Respondents may fail to clarify whether the business has changed ownership or to indicate the effective date of any transaction. Not providing this information can lead to legal complications, as the state requires written notice of such changes within 30 days.

Lastly, not providing an explanation for other changes listed in Section E can present difficulties. This section allows for any additional remarks that may be pertinent to the business’s status, and it is advisable to be as thorough as possible. Simply leaving this section blank can lead to questions that could have easily been addressed at the outset.

Documents used along the form

The UCT 6491 form is important for reporting any changes related to employment and business for your unemployment insurance account. To ensure that all updates are accurately reflected, you may need to submit additional documents alongside the UCT 6491 form. Below is a list of forms and documents that are often used in conjunction with this form, each described briefly for better understanding.

- UCT 6490 Form: This form is used to report the initial setup of a business account for unemployment insurance. It includes details about your business structure and ownership, which help establish your account with the state.

- W-9 Form: This document is the Request for Taxpayer Identification Number and Certification. It is used by businesses to provide their tax identification information to other entities, ensuring proper tax reporting.

- Federal Employment Tax Forms: These forms, like the IRS Form 941, report employment taxes withheld from employees' wages. They are essential for maintaining accurate records of your payroll and tax obligations.

- Notice of Business Reorganization: If your business underwent a reorganization, this notice details the changes in ownership or structure. It's essential for keeping tax and legal documents updated.

- Employer's Quarterly Report (UI-3): This report is for employers to summarize their payroll and report unemployment insurance contributions every quarter, providing vital data for unemployment insurance purposes.

- Business Sale Agreement: If a business is sold or transferred, this document outlines the terms and conditions of the sale, ensuring that both parties are clear about the transaction details and liabilities.

- Independent Contractor Agreement: If your business hires independent contractors, this agreement sets the terms of their service. It’s crucial for clarifying the nature of the working relationship and tax responsibilities.

Using the correct forms and documents will help you maintain compliance with state and federal requirements. Each piece of information ensures your business operates smoothly and avoids potential issues later on. It’s always recommended to keep accurate records and consult a professional if you have questions regarding these processes.

Similar forms

The UCT 6491 form plays a crucial role in reporting changes regarding employment and business status. Several other forms share similar functionalities, each serving specific purposes. Here’s a list of eight forms similar to the UCT 6491 form:

- Form SS-4: This form is applied for obtaining an Employer Identification Number (EIN). Like the UCT 6491, it is essential for businesses to update their information with the IRS if their circumstances change.

- Form 941: This quarterly tax form requires employers to report income taxes, Social Security tax, or Medicare tax withheld from employee paychecks. It also needs updates if there are changes in employment status.

- Form W-4: Employees use this form to establish their tax withholding for income. Changes like marital status or number of dependents must be reported, similar to how the UCT 6491 requires reporting business changes.

- Form 1099-MISC: Issued to independent contractors, this form reports income outside of traditional employment. Any changes related to the contractor's status or payment must be documented, paralleling the UCT 6491's requirements.

- Form W-2: Employers report annual wages paid to employees and the taxes withheld using this form. Changes in employer information or employee status must be accurately reported, reflecting the necessity of the UCT 6491.

- Form 1065: Partnerships use this tax form to report income and expenses. If there are changes in partnership structure or ownership, these must be filed, similarly echoing the UCT 6491's reporting requirements.

- Form 990: Nonprofit organizations use this form to provide annual financial information. Changes in organization details must be updated, akin to the UCT 6491’s focus on business updates.

- Form 2553: Small business corporations use this to elect S corporation status. If there are changes in business structure or ownership, updates are crucial, just as with the UCT 6491.

Each of these forms emphasizes the importance of keeping accurate and updated records with relevant authorities. Compliance reduces errors and helps maintain business integrity.

Dos and Don'ts

When filling out the UCT 6491 form, it is important to follow specific guidelines to ensure accuracy and compliance. Here is a list of things to do and avoid while completing the form.

- Do verify that all information is current and accurate before submission.

- Do use the correct contact information for the person submitting the form.

- Do complete all sections of the form; provide explanations where required.

- Do submit the form in a timely manner, especially if changes have occurred.

- Do check for any missing or blank items on your contribution/wage report.

- Don’t return the form if there have been no changes; only return it when necessary.

- Don’t forget to include your UI Account Number and legal name for proper identification.

- Don’t provide information for unrelated business changes—stick to what is required on the form.

- Don’t send the form via an unsecured method; use the provided fax or email options for submission.

By adhering to these guidelines, individuals can ensure a smooth process when reporting employment and business changes, minimizing the risk of delays or issues with their forms.

Misconceptions

- Misconception 1: The UCT-6491 form is only for businesses with employees.

- Misconception 2: You must submit the UCT-6491 form every year.

- Misconception 3: It's okay to wait indefinitely to report changes.

- Misconception 4: You can't file the form electronically.

- Misconception 5: Completing the form is complicated and time-consuming.

- Misconception 6: You don’t need to provide contact information.

- Misconception 7: You don't need to indicate the effective date of changes.

- Misconception 8: The legal name and trade name must be the same.

- Misconception 9: If a business ends, there’s no need to file the UCT-6491.

- Misconception 10: The form is only for internal record-keeping.

This form is necessary for all business changes, regardless of whether the business currently has employees. If there are any changes to business information, this form must be completed.

You only need to return this form if there are specific changes to report. If no changes have occurred, do not submit it.

The UCT-6491 form can be submitted via fax or email, making it more convenient to report changes quickly.

The form is straightforward, requiring only essential information about the business changes. Filling it out typically takes a short amount of time.

Providing contact information is crucial for follow-up questions or clarifications. This helps ensure that the changes are accurately processed

Clearly stating the date of changes is essential. It ensures the records are updated accurately and in accordance with regulations.

The legal name of the business may differ from the trade name. Both can be submitted on the form without issue.

If a business no longer has employees or is entering a new phase, it still needs to be reported via the UCT-6491 form. Failure to do so could lead to compliance issues.

The UCT-6491 form is an official document for the Wisconsin Department of Workforce Development. It ensures the accuracy of the state's employment records and may have legal implications.

Key takeaways

Understanding the UCT 6491 form is essential for businesses experiencing changes in their employment structure or operational status. Here are five key takeaways to keep in mind:

- Timeliness is Crucial: If changes occur, be sure to complete and return the form promptly. Delays could lead to possible compliance issues.

- Contact Information is Required: The form mandates that you provide complete contact information. This facilitates communication should any questions arise.

- Various Changes to Report: You must indicate any changes in your business address, legal name, trade name, and federal ID number, along with any adjustments in employment status.

- Specific Sections for Unique Situations: The form includes sections for unique circumstances, such as when a business no longer has employees or when there is a sale or reorganization. Be prepared to provide detailed explanations.

- Submit Correctly: Ensure you return the completed form to the designated address or email it to the provided contact. Proper submission helps avoid unnecessary complications.

Browse Other Templates

How to Fight a Ticket in Michigan - Keep a copy of your completed form and any documentation for your records.

60-day Notice of Intent to Sell - Know your rights under Wisconsin lien laws to safeguard your interests.

California LLC Information Statement,California Limited Liability Company Report,Statement of LLC Information,Form LLC Disclosure Statement,California LLC Filing Requirement Form,California LLC Status Update Form,Limited Liability Company Two-Year Re - It's necessary to disclose if any manager or member has an outstanding final judgment related to labor violations.