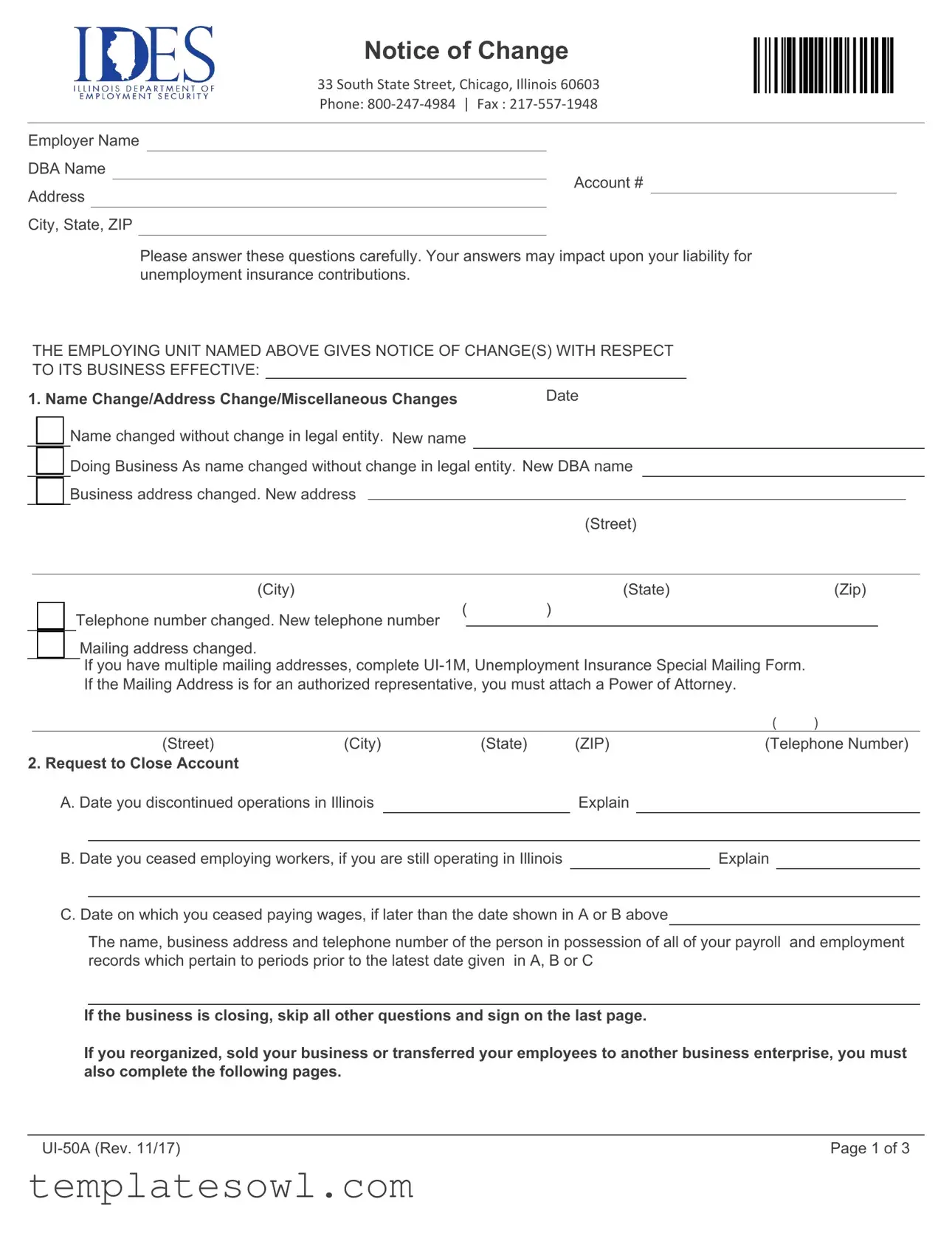

Fill Out Your Ui 50A Form

The UI 50A form serves as a critical tool for employers in Illinois, enabling them to formally communicate significant changes regarding their business operations to the state. This notice is essential, as it directly impacts the employer's obligations related to unemployment insurance contributions. Within this form, employers can ensure that all relevant modifications are captured, including name changes, business address updates, and alterations to their organizational structure. When submitting the form, businesses must provide accurate details about specific changes that may have occurred, such as discontinuation of operations or sale of the enterprise. Furthermore, employers need to disclose essential information about payroll and employment records, especially for changes that may involve new ownership or restructuring. This form is not just a bureaucratic requirement; it helps maintain accurate records, ensuring compliance with state regulations while protecting the employer’s interests. Additionally, failure to complete or submit the UI 50A can lead to liabilities or penalties related to unemployment insurance. The process may seem daunting, but following the guidelines can simplify the transition for any business undergoing changes.

Ui 50A Example

Notice of Change

33 South State Street, Chicago, Illinois 60603

Phone:

Employer Name

DBA Name

Account #

Address

City, State, ZIP

Please answer these questions carefully. Your answers may impact upon your liability for unemployment insurance contributions.

THE EMPLOYING UNIT NAMED ABOVE GIVES NOTICE OF CHANGE(S) WITH RESPECT

TO ITS BUSINESS EFFECTIVE:

1. Name Change/Address Change/Miscellaneous Changes |

Date |

|

Name changed without change in legal entity. New name

Doing Business As name changed without change in legal entity. New DBA name

Doing Business As name changed without change in legal entity. New DBA name

Business address changed. New address

Business address changed. New address

|

|

|

|

(Street) |

|

|

|

|

|

|

|

|

|

|

|

(City) |

(State) |

(Zip) |

||

|

|

) |

|

|

||

|

|

( |

|

|

||

|

|

Telephone number changed. New telephone number |

|

|

|

|

|

|

|

|

|

|

|

Mailing address changed.

If you have multiple mailing addresses, complete

|

|

|

|

( |

) |

(Street) |

(City) |

(State) |

(ZIP) |

(Telephone Number) |

|

2. Request to Close Account

A. Date you discontinued operations in Illinois |

|

Explain |

|||||

|

|

|

|

|

|

|

|

B. Date you ceased employing workers, if you are still operating in Illinois |

|

|

|

Explain |

|

||

C. Date on which you ceased paying wages, if later than the date shown in A or B above

The name, business address and telephone number of the person in possession of all of your payroll and employment records which pertain to periods prior to the latest date given in A, B or C

If the business is closing, skip all other questions and sign on the last page.

If you reorganized, sold your business or transferred your employees to another business enterprise, you must also complete the following pages.

Page 1 of 3 |

Notice of Change

33 South State Street, Chicago, Illinois 60603

Phone:

3.Reorganization, Sale or Other Organizational Change. Check all items that apply to you. If any item in this section is checked, please complete numbers 4 & 5 below.

|

Sale of enterprise: |

|

|

Entirely; |

|

|

In part (Explain) |

|

|

|

|

|

||||||||||||||||

|

|

Lease of enterprise: |

|

|

Entirely; |

|

|

In part (Explain) |

|

|

|

|

|

|||||||||||||||

|

|

Change in type of business structure |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

From: |

|

|

Sole Proprietorship |

|

|

Partnership |

|

|

Corporation |

|

|

Other (Explain, e.g., Limited Liability Company, |

|||||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trust, Association, Receivership) |

|

|

|

|

|

|

|

|

|

|

FEIN |

|

||||||||

To: |

|

|

Sole Proprietorship |

|

|

Partnership |

|

Corporation |

|

Other (Explain, e.g., Limited Liability Company, |

||||||||||||||||||

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

Trust, Association, Receivership) |

|

|

|

|

|

|

|

|

|

|

FEIN |

|

||||||||

|

|

|

|

Partnership reorganization (Explain in detail) |

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

Corporate merger, consolidation or reorganization (Explain in detail) |

|

|

|

|

|||||||||||||||||||||

|

Foreclosure; |

|

|

Receivership; |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Type of bankruptcy |

|

|

|

|

||||

Death of: |

|

|

|

|

|

|

|

|

|

|

Owner; |

|

Partner |

|

|||||

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

Bankruptcy; |

|

|

|

Assignment for benefit of creditors |

|||||

Date |

|

/ |

|

/ |

|

Case Number |

|

||

|

|

Name of deceased |

|

|

|||||

4. If any of the items in #3 above are checked, furnish the following information:

Date of transaction Name of new owner Doing business as (if known)

Illinois U.I. account number (if known) Address:

Fed. ID. Number (if known)

5.Furnish the following information with respect to your Illinois operations if you disposed of or leased only a portion of your business enterprise:

|

|

|

|

|

|

|

|

(If No, skip to E.) |

||

A. Did you operate at more than one location in Illinois? |

|

|

Yes |

|

|

No |

|

|||

|

|

|

|

|

|

Yes |

|

No |

||

B. Did the new owner acquire all of your business locations in Illinois? |

|

|

|

|

||||||

|

|

|

|

|||||||

C. What number of locations did the new owner acquire? |

|

|

|

|

|

|

|

|

|

|

D. List the name and address of the Illinois business locations you retained or continued to operate: |

||||||||||

(If necessary, attach an additonal sheet of paper.) |

|

|

|

|

|

|

|

|

|

|

Name and address |

City/Town |

|

|

State |

|

|

|

Zip |

County |

|

Location 1

Location 2

Location 3

Location 4

Location 5

Location 6

Page 2 of 3 |

Notice of Change

33 South State Street, Chicago, Illinois 60603

Phone:

E. Is the Illinois business still owned, |

managed or controlled in any way by the same interests that owned, managed or |

|||||||||||||||||||||

controlled the former business? |

|

|

Yes |

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

F. Did the new owner acquire all of the Illinois operations? |

|

|

|

Yes |

|

|

|

No |

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

If No, what is the percentage acquired by the new entity? |

|

|

|

|

% |

|

|

|

|

|

|

|

|

|||||||||

Percent of operations retained by you |

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

G. Is the new owner employing all of the same people that you did on the last day of business? |

|

|

Yes |

|

|

No |

||||||||||||||||

|

|

|

|

|||||||||||||||||||

If No, how many people were employed by you?

How many of them does the new owner employ?

H. Did the new owner acquire any of your assets? |

|

|

Yes |

|

|

|

|

No |

|

If yes, what %? |

|

|

||||||

Percent of assets retained by you |

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

I. Did the new owner acquire any of your Illinois trade or business? |

|

|

|

Yes |

|

|

No |

If yes, what %? |

|

|||||||||

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

J. What was your trade or business ?

K. Is the new owner conducting the Illinois business which the new owner acquired? |

|

|

Yes |

|

|

No |

|||||

If No, are you conducting the business? |

|

Yes |

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

If neither you nor the new owner, who is conducting the business? Name

Address |

|

|

|

|

|

|

|

|

|

|

|

Phone Number |

||

L. Is this business a franchise? |

|

|

|

Yes |

|

|

|

|

No |

|||||

|

|

|

|

|

|

|

||||||||

If Yes, were you the |

|

|

|

|

|

|

|

|

|

|

|

|

||

Franchisee or the |

|

|

|

Franchisor? |

||||||||||

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

||||||||

CERTIFICATION: I HEREBY CERTIFY THAT THE FOREGOING INFORMATION AND THAT CONTAINED IN ANY ATTACHED SHEETS SIGNED BY ME IS TRUE AND CORRECT. THIS REPORT MUST BE SIGNED BY OWNER, PARTNER, OFFICER OR AUTHORIZED AGENT WITHIN THE EMPLOYING ENTERPRISE. IF SIGNED BY ANY OTHER PERSON, A POWER OF ATTORNEY MUST BE ON FILE.

BUSINESS NAME |

|

|

DATE SIGNED AND SUBMITTED |

|

||||

SIGNED BY |

|

|

TITLE |

|

||||

HOME ADDRESS OF OFFICIAL |

|

|

|

|

|

|

||

HOME TELEPHONE NUMBER ( |

) |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

This state agency is requesting information that is necessary to accomplish the statutory purpose as outlined under 820 ILCS

Page 3 of 3 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The UI 50A form is used to notify the Illinois Department of Employment Security about changes related to a business's employment status or structure. |

| Governing Law | This form is governed under the Illinois Employment Security Act, specifically under 820 ILCS 405. |

| Information Required | Employers must provide details about name changes, address changes, account closure, and any reorganizations or business transfers. |

| Submission Guidelines | After completing the form, employers must sign it and submit it to the listed address or fax number. |

| Consequences of Non-Compliance | Failure to submit accurate information may lead to penalties, interest, or other liabilities under the law. |

Guidelines on Utilizing Ui 50A

Completing the UI 50A form is an important step for businesses undergoing changes. After you gather the necessary information, you can begin filling it out. The instructions below will guide you through each section of the form, ensuring that you provide accurate and complete information.

- Start by entering the Employer Name and Doing Business As (DBA) Name. Include the Account Number associated with your business.

- Fill in the Address, along with City, State, and ZIP Code for your business.

- Answer the questions that follow carefully. If applicable, indicate if there is a Name Change, Address Change, or Miscellaneous Changes. Provide the new details where prompted.

- If your business is closing, specify the Date you discontinued operations in Illinois. If you have any outstanding payroll records, write down the name, address, and phone number of the person who holds these records.

- Indicate whether you are reporting a Reorganization, Sale, or Other Organizational Change. Check all relevant boxes, and if necessary, provide explanations for sales, leases, or changes in business structure.

- If you checked any items in the previous step, fill out the information requested in Section 4. This includes the Date of transaction and the Name of new owner.

- Move to Section 5. Answer whether the new owner acquired all business locations or just a part of your business. If applicable, detail the locations you retained.

- Indicate if the Illinois business is still managed by the same owners. Also, specify if the new owner has retained employees or assets and provide information about the trade or business conducted.

- Complete the certification section. This requires an authorized signature. Be sure to include your name, title, date, and home address.

After completing the form, review it for accuracy. Ensure that all required signatures are in place before submitting it to the appropriate office. Following these steps will help ensure that your business changes are properly documented and recognized.

What You Should Know About This Form

What is the purpose of the UI 50A form?

The UI 50A form is used to notify the Illinois Department of Employment Security (IDES) about changes in a business's operations. This includes changes such as a name or address change, discontinuation of operations, or any reorganization, sale, or transfer of ownership. Accurate reporting is crucial as it affects the employer's liability for unemployment insurance contributions.

Who needs to fill out the UI 50A form?

Any employer in Illinois who experiences changes that affect their business status or operations should complete this form. This includes businesses that have changed their name or address, ceased operations, or undergone any structural changes like mergers or sales. It is essential to fill this out to ensure compliance with state laws.

How do I complete the UI 50A form?

To complete the UI 50A form, enter the employer name, any new names, the account number, and the business address. Answer all relevant questions thoroughly, especially regarding any changes that have occurred, such as discontinuing operations or reorganizing. Ensure you provide detailed information wherever applicable, sign the form, and submit it to the appropriate IDES office.

What happens if I do not submit the UI 50A form?

Failing to submit the UI 50A form can lead to penalties, including potential liabilities for unemployment insurance contributions. The Illinois Department of Employment Security may impose sanctions for not disclosing necessary information. It’s crucial to keep your business information up-to-date to avoid complications.

Can I submit the UI 50A form electronically?

Currently, the UI 50A form must be submitted through traditional means, either by mail or fax, as specified at the top of the form. Always check the latest guidelines from the IDES for any potential updates regarding electronic submissions.

What is the deadline for submitting the UI 50A form?

There is no specific deadline stated on the UI 50A form itself, but it should be submitted as soon as changes occur. Immediate reporting ensures that you stay compliant with unemployment insurance requirements and minimizes the risk of penalties.

What should I do if I'm closing my business?

If you are closing your business, you need to notify IDES by completing the UI 50A form. You won't need to complete other sections unless your business has been sold or transferred to another entity. Fill in the closure details accurately and sign off at the bottom of the form.

Where do I send the completed UI 50A form?

Once completed, send the UI 50A form to the address listed on the form: 33 South State Street, Chicago, Illinois 60603. Alternatively, you can fax it to 217-557-1948. Ensure that it is sent to the correct location to avoid delays in processing.

Common mistakes

Filling out the Ui 50A form may seem straightforward, but many people stumble in various ways. Here are nine common mistakes that can lead to complications. Understanding these pitfalls can facilitate a smoother submission process.

One frequent oversight is not updating the business name. If a legal name change has occurred but is not reflected on the form, it can create confusion and lead to potential legal issues later on. Be sure to double-check that both the legal name and any "Doing Business As" (DBA) names are accurate.

Similarly, many individuals neglect to provide a complete mailing address. Missing or incorrect street numbers, city names, or zip codes can cause significant delays in correspondence from the state. If multiple mailing addresses are involved, ensure all necessary forms are filled out correctly.

In the section regarding closing an account, some people forget to provide the dates of operations. Specifically, detailing the last day of business operations and when payroll ceased can be critical. Failing to answer these inquiries comprehensively may affect future liability assessments.

Consideration of organizational change often trips up applicants. It's essential not to skip over the details in the reorganization or sale section. If changes have taken place, participants need to comprehensively check off all relevant items. Failing to do so may indicate incomplete information, potentially leading to further inquiries.

Another common error is neglecting to include a certification signature. This section must be signed by an owner, partner, officer, or an authorized agent. If it’s signed by someone else, having the Power of Attorney on file is crucial. Without the proper signature, the state may reject the submission.

Individuals should also be cautious about the percentage of operations retained. Errors in reporting what percentage of the business was sold or retained can have financial implications. Clear communication of these percentages assists in accurate assessment and reporting.

Some applicants fail to note the acquisition of assets or business locations correctly. If the new owner acquires only partial assets, this should be accurately represented. Misleading information here can lead to further scrutiny from the state agency.

Many make the mistake of inadequately addressing the question of whether the new business is a franchise. Your response should clarify whether you were the franchisee or franchisor. Incomplete information can raise additional questions that complicate the process.

Finally, failing to keep a copy of the submitted form for personal records is, unfortunately, quite common. Retaining a copy is a best practice. It allows for easy reference should any questions arise after submission, ensuring that you can address any issues promptly.

By understanding these common mistakes, applicants can improve their chances of a successful submission and avoid unnecessary follow-up inquiries. Accuracy and completeness when filling out the Ui 50A form can save considerable time and resources.

Documents used along the form

The UI 50A form, known as the Notice of Change, is important for businesses notifying the state of any changes in their operations or structure. Along with this form, several other documents may be needed to ensure compliance with state regulations. Here are some of those commonly used forms.

- UI-1M: Unemployment Insurance Special Mailing Form - This form is for businesses that have multiple mailing addresses. It allows you to provide your special mailing address for unemployment insurance correspondence.

- Power of Attorney - If an authorized representative is completing the UI 50A on behalf of the business owner, a Power of Attorney form must be attached. This document grants the representative the legal authority to act on the owner's behalf.

- Notice to Employees - If your business undergoes significant changes such as a sale or merger, this notice informs employees about their rights and any changes that may affect their employment status.

- Corporate Resolution - If a corporation is making changes, a corporate resolution may be required. This document records the decisions made by the company's board regarding changes in business structure or ownership.

Gathering these forms along with the UI 50A ensures that your business stays compliant and minimizes confusion during changes. Proper documentation is essential to maintain transparency and safeguard both the business and its employees.

Similar forms

UI-1M Form: Similar to the UI 50A form, the UI-1M is used to notify the state about any changes in special mailing addresses for unemployment insurance purposes. It also requires the disclosure of business information that can impact unemployment tax responsibilities.

UI-1 Form: The UI-1 form serves as a general report of a business's unemployment insurance activities. It includes details about the business, similar to the UI 50A, and affects unemployment contributions based on changes made during the reporting period.

UI-5 Form: This form is used to report any wage records and employment details. Much like the UI 50A, it ensures that the state has up-to-date information that directly impacts a business's unemployment insurance obligations.

UI-6 Form: The UI-6 form deals with the termination of a business. It parallels the UI 50A in that both documents require detailed reasons and timelines surrounding the closure of a business and how it may impact unemployment insurance.

Business Registration Form (BREG): This form is necessary for officially registering a business. It echoes aspects of the UI 50A by requiring information about the business structure and name, which can affect status regarding taxes and insurance.

Form 941: The IRS Form 941 is used to report income taxes withheld from employees and FICA taxes. Its purpose aligns with the UI 50A in maintaining accurate records that affect both employment and tax reporting.

Change of Address Form: This form is typically used by businesses to update their registered address. It shares similarities with the UI 50A, which also allows for changing business addresses, thereby impacting business operations and compliance.

Notice of Resignation/Termination Form: This form is used to notify about staff changes. The information such as dates and reasons, outlined in both forms, can directly influence unemployment claims and contributions.

Employer Identification Number Application (Form SS-4): This form is utilized to obtain an EIN from the IRS. It connects to the UI 50A as businesses must often provide their EIN when making important changes to ensure proper tax reporting.

Power of Attorney Form: If a business appoints someone to represent them for specific transactions, this form comes into play. Similar to the UI 50A requiring a POA for certain actions, it ensures that the appropriate individuals are signing on behalf of the business.

Dos and Don'ts

When filling out the UI 50A form, it is important to follow specific guidelines to ensure the form is completed accurately. Below is a list of dos and don'ts:

- Do read all instructions carefully before starting the form.

- Do provide accurate information regarding your business changes.

- Do complete all relevant sections of the form fully.

- Do use legible handwriting or type the information to ensure clarity.

- Do sign the form before submitting it; the signature is required for validation.

- Don't leave any mandatory fields blank; this can delay processing.

- Don't provide false or misleading information; this may lead to penalties.

- Don't forget to attach any necessary documents, such as a Power of Attorney.

- Don't submit the form if there are corrections needed; make sure everything is accurate first.

- Don't neglect to keep a copy of the completed form for your records.

Misconceptions

- Misconception: The Ui 50A form is only for business closures. This form is used for various changes, including name changes and address adjustments, not just account terminations.

- Misconception: You do not need to notify if the business name changes. Changes in the business name must be reported using this form, regardless of whether the legal entity remains the same.

- Misconception: Only one form is necessary for multiple changes. Different changes, such as name and address modifications, may require specific details to be filled out separately within the form.

- Misconception: The form must be submitted immediately after changes occur. While timely updates are important, there is usually a specified grace period to submit this form after changes take place.

- Misconception: The form can be signed by anyone in the organization. Only the owner, partner, officer, or authorized agent can sign the form. Other individuals will need a Power of Attorney to sign.

- Misconception: You can ignore the form if your business structure remains unchanged. Any change, even if the structure is the same, must be reported, especially if it relates to ownership or operational status.

- Misconception: You don't need to attach anything when closing a business account. If the account is closed and there are remaining records, the name and contact information for the person holding those records should be provided.

- Misconception: Providing incorrect information is acceptable. All information reported on the Ui 50A form must be accurate. Providing false information may result in penalties or legal issues.

- Misconception: There are no consequences for failing to file the form. Not filing, or filing late, can lead to penalties, increased liability, and issues with unemployment insurance contributions.

- Misconception: You do not need to update the address for all business communications. It is crucial to ensure that the mailing address is updated, especially if it has changed, to avoid miscommunication with state agencies.

Key takeaways

Filling out the UI 50A form is an important process for any employer who is making changes to their business status in Illinois. Here are some key takeaways to keep in mind:

- The form is essential for notifying the state about significant changes such as business name, address, or ownership, influencing your unemployment insurance obligations.

- Be thorough and precise when answering each question. Inaccurate responses can lead to complications with your unemployment insurance contributions.

- If the business is closing, it is critical to skip further questions and simply sign at the end of the form to confirm that closing status.

- For any organizational changes, providing detailed explanations will help ensure that the state fully understands the nature of the changes being reported.

Browse Other Templates

Can I Get My Drivers License Online - We encourage you to express any relevant skills or experiences you possess.

Ocwen Home Salvage Application,Ocwen Property Relief Package,Ocwen Distressed Property Assistance Form,Ocwen Financial Hardship Submission,Ocwen Short Sale Request Form,Ocwen Property Disposition Documents,Ocwen Mortgage Resolution Package,Ocwen Owne - Communication via fax or email is the recommended method for submission.