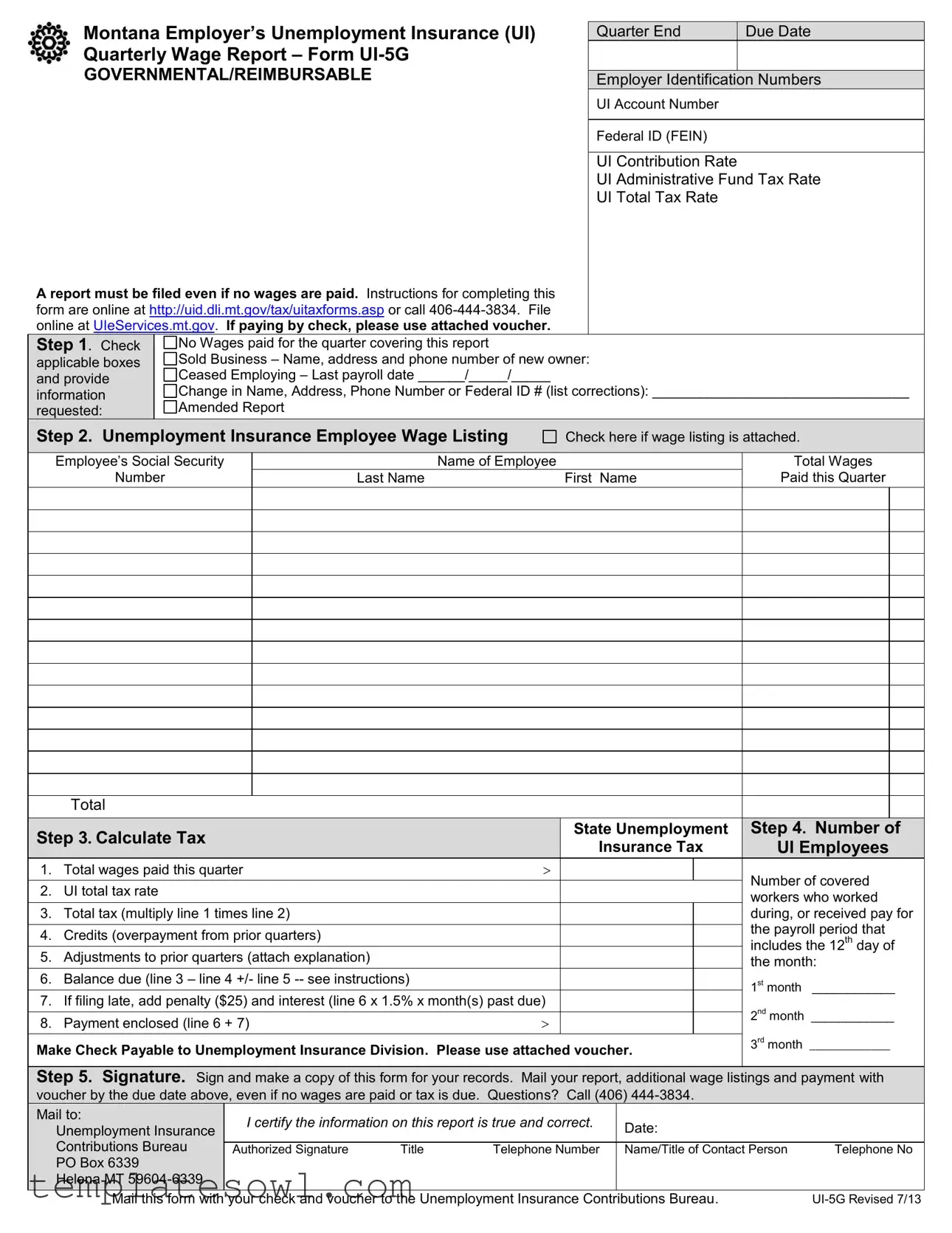

Fill Out Your Ui 5G Form

Filing the Montana Employer's Unemployment Insurance (UI) Quarter End Due Date Quarterly Wage Report, known as Form UI-5G, is a critical requirement for employers in Montana. This form serves multiple purposes, including reporting wages, calculating taxes, and maintaining compliance with state unemployment insurance laws. Employers must check applicable boxes, provide necessary information, and answer questions about their business operations during the quarter. Even if no wages were paid, the report must still be filed. Additionally, if there are changes in the business, such as name or ownership, those updates need to be documented. Each submission includes a detailed employee wage listing, which captures the total wages paid, along with Social Security numbers and names of employees. Employers calculate their unemployment insurance tax based on wages paid, applying any credits or adjustments as necessary. The form requires a signature to certify the accuracy of the information provided, and employers must submit their reports and payments by the due date. Further guidance and submission options are available through online resources or by reaching out to the Unemployment Insurance Contributions Bureau.

Ui 5G Example

Montana Employer’s Unemployment Insurance (UI) |

|

|

Quarter End |

Due Date |

|

Quarterly Wage Report – Form |

|

|

|

|

|

GOVERNMENTAL/REIMBURSABLE |

|

|

|

|

|

|

|

Employer Identification Numbers |

|

||

|

|

|

UI Account Number |

|

|

|

|

|

|

|

|

|

|

|

Federal ID (FEIN) |

|

|

|

|

|

|

|

|

|

|

|

UI Contribution Rate |

|

|

|

|

|

UI Administrative Fund Tax Rate |

|

|

|

|

|

UI Total Tax Rate |

|

|

A report must be filed even if no wages are paid. Instructions for completing this form are online at http://uid.dli.mt.gov/tax/uitaxforms.asp or call

No Wages paid for the quarter covering this report

Sold Business – Name, address and phone number of new owner: Ceased Employing – Last payroll date ______/_____/_____

Change in Name, Address, Phone Number or Federal ID # (list corrections): _________________________________

Amended Report

|

Step 2. Unemployment Insurance Employee Wage Listing |

|

Check here if wage listing is attached. |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employee’s Social Security |

|

Name of Employee |

|

Total Wages |

|||||

|

|

Number |

|

Last Name |

|

First Name |

|

Paid this Quarter |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Step 3. Calculate Tax |

|

|

State Unemployment |

|

Step 4. Number of |

|

||||

|

|

|

|||||||||

|

|

|

Insurance Tax |

|

UI Employees |

|

|||||

|

|

|

|

|

|

|

|

||||

1. |

Total wages paid this quarter |

|

|

|

|

|

Number of covered |

||||

|

|

|

|

|

|

|

|

|

|||

2. |

UI total tax rate |

|

|

|

|

|

|||||

|

|

|

|

|

workers who worked |

||||||

|

|

|

|

|

|

|

|

|

|||

3. |

Total tax (multiply line 1 times line 2) |

|

|

|

|

|

during, or received pay for |

||||

|

|

|

|

|

|

|

|

|

the payroll period that |

||

4. |

Credits (overpayment from prior quarters) |

|

|

|

|

|

|||||

|

|

|

|

|

includes the 12th day of |

||||||

|

|

|

|

|

|

|

|

|

|||

5. |

Adjustments to prior quarters (attach explanation) |

|

|

|

|

||||||

|

|

|

|

the month: |

|||||||

|

|

|

|

|

|

|

|

|

|||

6. |

Balance due (line 3 – line 4 +/- line 5 |

|

|

|

|

1st month ____________ |

|||||

7. |

If filing late, add penalty ($25) and interest (line 6 x 1.5% x month(s) past due) |

|

|

|

|||||||

|

|

|

2nd month ____________ |

||||||||

|

|

|

|

|

|

|

|

|

|||

8. |

Payment enclosed (line 6 + 7) |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

3rd month |

||

|

Make Check Payable to Unemployment Insurance Division. Please use attached voucher. |

|

|||||||||

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

Step 5. Signature. Sign and make a copy of this form for your records. Mail your report, additional wage listings and payment with voucher by the due date above, even if no wages are paid or tax is due. Questions? Call (406)

|

|

|

|

|

|

|

|

|

Mail to: |

|

I certify the information on this report is true and correct. |

Date: |

|

||

|

Unemployment Insurance |

|

|

||||

|

|

|

|

|

|

||

|

Contributions Bureau |

|

|

|

|

|

|

|

|

Authorized Signature |

Title |

Telephone Number |

Name/Title of Contact Person |

Telephone No |

|

|

PO Box 6339 |

|

|

|

|

|

|

|

Helena MT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mail this form with your check and voucher to the Unemployment Insurance Contributions Bureau. |

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The UI-5G form is used by Montana employers to report quarterly wages and calculate unemployment insurance taxes. |

| Filing Requirement | Employers must file the form even if no wages were paid during the quarter. |

| Governing Law | This form is governed by Montana state unemployment insurance laws. |

| Online Resources | Instructions for completing the form are available at the Montana Department of Labor website. |

| Contact Information | For assistance, call 406-444-3834, the number provided for inquiries about the form. |

| Payment Method | Employers can file online or send a check along with a payment voucher to the designated address. |

| Record Keeping | Employers should sign and keep a copy of the completed form for their records. |

| Late Filing Penalty | Filing late incurs a $25 penalty plus interest calculated on the balance due. |

Guidelines on Utilizing Ui 5G

Completing the UI 5G form is essential for Montana employers to report their unemployment insurance information accurately. Follow the steps below to ensure every section is filled out properly. Accuracy is important, as even small mistakes can delay processing. Be sure to keep a copy of the completed form for your records.

- Start by checking all applicable boxes and entering the required information for your organization. This includes:

- Montana Employer's Unemployment Insurance (UI) Quarter End Due Date

- Form UI-5G details such as Governmental/Reimbursable status

- Employer Identification Numbers

- UI Account Number

- Federal ID (FEIN)

- UI Contribution Rate

- UI Administrative Fund Tax Rate

- UI Total Tax Rate

- Indicate if you had no wages paid for the quarter, if the business has sold or ceased employing, or if there have been changes to name, address, phone number, or Federal ID.

- If you have employee wages to report, check the box indicating that a wage listing is attached and fill out the employee information:

- Social Security Number

- Name (Last and First)

- Total Wages Paid this Quarter

- Proceed to calculate the total UI tax by completing the following:

- Total wages paid this quarter

- Determine the UI total tax rate

- Calculate the total tax by multiplying total wages by the UI total tax rate

- Account for any credits from overpayment in prior quarters

- Add or subtract adjustments to prior quarters as necessary

- Determine the balance due

- If you are filing late, include any penalties and interest calculations

- Indicate whether payment is enclosed

- Lastly, sign and date the form. Make sure to include your title and contact information. Don't forget to keep a copy for yourself.

- Send your report, along with any additional wage listings and payment using the voucher, to the Unemployment Insurance Contributions Bureau by the specified due date.

For any questions or clarifications regarding the form, you can reach out at (406) 444-3834. It’s important to adhere to the filing timelines to avoid penalties.

What You Should Know About This Form

What is the purpose of the UI-5G form?

The UI-5G form, known as the Quarterly Wage Report, is used by employers in Montana to report wages paid to employees and to calculate the unemployment insurance tax owed for each quarter. It ensures that all employers comply with state requirements, even if no wages were paid during the reporting period.

Who needs to file the UI-5G form?

All employers who pay wages to employees in Montana must file the UI-5G form. This includes both governmental and reimbursable employers. Even if no wages were paid in a quarter, a report is still required to maintain compliance.

When is the due date for submitting the UI-5G form?

The due date for filing the UI-5G form is the last day of the month following the end of the quarter. For example, reports for the first quarter, which ends on March 31, are due by April 30.

What should I do if I have not paid any wages for the quarter?

You still need to file the UI-5G form. Indicate that no wages were paid on the form. It is important to submit this report even if there is no tax due.

How can I file the UI-5G form?

The UI-5G form can be filed online through UIeServices.mt.gov. Alternatively, you can complete a paper form and mail it, along with any payment and attached vouchers, to the Unemployment Insurance Contributions Bureau at the provided address.

What information do I need to provide on the UI-5G form?

You must provide your Employer Identification Numbers, UI Account Number, Federal ID, UI Contribution Rate, and tax amounts. Additionally, you need to list employee wages, corrections in business information, and any adjustments from prior quarters.

What if I made an error on a previous UI-5G form?

If you discover an error, you can file an amended report. Make sure to mark the appropriate box on the form indicating that it is an amended report and provide an explanation of the changes made. It is crucial to ensure accurate reporting to avoid penalties.

Are there penalties for late filing of the UI-5G form?

Yes, if you file the form late, a penalty of $25 will be added. Additionally, interest will accrue based on the amount due and the number of months past due, calculated at a rate of 1.5% per month.

What should I do if I have questions about completing the UI-5G form?

If you have questions while filling out the form, you can consult the online instructions or call the Unemployment Insurance Contributions Bureau at (406) 444-3834. They can provide assistance and clarification on any part of the form.

Is it necessary to keep a copy of the UI-5G form?

Yes, it is important to sign the form, make a copy for your records, and keep it in case of future inquiries or audits. Record-keeping helps ensure you have the necessary documentation related to your employment tax filings.

Common mistakes

Filling out the UI 5G form can be straightforward, but there are common mistakes that applicants often make. Awareness of these errors is key to ensuring accuracy. One significant mistake occurs when individuals fail to check all applicable boxes or provide essential information. Each section requires careful attention. Missing a box can lead to delays or even rejection of the report.

Another frequent error involves the employee wage listing portion. Applicants sometimes forget to attach the wage listing when required. This omission may complicate the filing process and lead to unnecessary inquiries from the unemployment office. Always double-check to make sure all attachments are included.

People often miscalculate their total tax due. In Step 3, it’s crucial to properly multiply total wages by the UI total tax rate. Miscalculations can result in underpayment or overpayment, which must then be corrected through adjustments later. Make sure to follow the calculation steps closely to avoid discrepancies.

Many also forget to document adjustments from prior quarters. This oversight can create confusion and affect the balance due. If there are any adjustments, they must be clearly stated and accompanied by an explanation as instructed. Clarifying adjustments is vital for accurate reporting.

In Step 6, items such as credits and penalties for late filing should be calculated carefully. Some filers ignore the penalties or miscalculate the interest due. It’s critical to remember that penalties accumulate over time, so calculate them accurately to avoid additional costs.

Another common mistake is failing to sign the form. The signature serves as a declaration that all information provided is truthful and correct. Submitting a form without a signature not only delays processing but may also be viewed as incomplete.

Finally, many individuals neglect to keep a copy of the completed form for their records. This step is essential for tracking future correspondence and maintaining personal records. Filing paperwork can become complicated, and having a copy on hand provides a helpful point of reference.

Documents used along the form

The Ui 5G form is a crucial document for employers in Montana, primarily used for reporting unemployment insurance wages and calculating taxes. When filing this form, there are additional documents and forms that may also be required. Below is a list of some common forms that often accompany the Ui 5G form.

- UI-1: This is the Employer's Registration form. It allows employers to register for unemployment insurance and provides essential details like the business name, address, and contact information. It's important for setting up an account with the state's unemployment insurance agency.

- UI-5: This form is the Quarterly Wage Report that details all wages paid to employees during the reporting period. Employers must submit this to report employee earnings, which is used to calculate unemployment insurance contributions.

- UI-5C: The Unemployment Insurance Claim is submitted in cases where an employee files for unemployment benefits. This form provides necessary information about the employee’s work history, wages, and the reason for unemployment, allowing for an accurate assessment of benefit eligibility.

- Payment Voucher: When submitting payments for unemployment insurance taxes, this voucher enables employers to provide payment information clearly. It ensures that payments are attributed correctly to the employer's account and reflects the amounts owed.

While the Ui 5G is essential for reporting, understanding these additional forms will help ensure that all necessary obligations are met. Properly completing each of these documents will support smooth interactions with the unemployment insurance system.

Similar forms

- Form 940: This is the annual Employer's Federal Unemployment (FUTA) Tax Return. Like the UI 5G form, it provides a summary of wages and unemployment taxes owed for the year. Both forms require accurate reporting of wages and calculation of tax owed.

- Form 941: This form is the Employer's Quarterly Federal Tax Return. Similar to the UI 5G, it requires reporting of wages paid each quarter, along with the federal withholding tax calculations that must be submitted even if no tax is due.

- Form W-2: This document reports an employee's annual wages and the taxes withheld from their paycheck. Both the W-2 and UI 5G require information about employee earnings and are essential for tax reporting purposes.

- Form W-3: This is the Transmittal of Wage and Tax Statements, which summarizes the information reported on all W-2 forms. It aligns with the UI 5G’s requirement for comprehensive wage reporting.

- State Quarterly Wage Report: Similar to the UI 5G, many states mandate a quarterly report of wages paid to employees. They require detailed earnings information and help calculate state unemployment contributions.

- Form 1099-MISC: This form is used to report payments made to non-employees, such as independent contractors. While it focuses on different types of payments, like the UI 5G, it also mandates accurate accounting of earnings for reporting purposes.

- Form 1096: This form is a summary of the information reported on all 1099 forms and is akin to the reporting features found in the UI 5G. It consolidates the data submitted for better clarity in tax filings.

- Employer's Annual Unemployment Insurance Report: This report compiles a year’s worth of wages and formulates contributions due for unemployment insurance, paralleling the purpose of the UI 5G in reporting wages and calculating liabilities.

- State Tax Identification Number Application: While this is an application rather than a report, it is necessary to establish an account for withholding taxes, which involves similar foundational information as captured in the UI 5G.

Dos and Don'ts

When filling out the UI 5G form, it’s important to follow certain guidelines to ensure accuracy and compliance. Here’s a list of things to do and avoid:

- Do check all applicable boxes before submitting.

- Do provide accurate information regarding your business, including your Employer Identification Numbers.

- Do report even if no wages were paid during the quarter.

- Do complete the employee wage listing if applicable.

- Do calculate your total tax correctly and include any adjustments.

- Don't forget to sign the form before mailing it.

- Don't leave any sections blank that are relevant to your business status and earnings.

By adhering to these points, you can help ensure a smooth process when filing the UI 5G form.

Misconceptions

- Misconception 1: The UI-5G form is only for employers who have paid wages.

- Misconception 2: Businesses can skip filing if they have ceased operations.

- Misconception 3: The form is optional for governmental employers.

- Misconception 4: Corrections to information can be made later without any issues.

- Misconception 5: There are no penalties for late filings.

- Misconception 6: It is unnecessary to keep a copy of the submitted form.

- Misconception 7: Payment can be processed later after filing the form.

- Misconception 8: Instructions for the UI-5G form are not readily available.

This is not true. A report must be filed even if no wages are paid during the reporting period. Failing to file can lead to penalties.

Even if a business has ceased operations, it is still required to file the form, indicating the last payroll date and other relevant information.

For governmental and reimbursable employers, filing the UI-5G form is mandatory and helps maintain compliance with unemployment insurance requirements.

Corrections to the UI-5G form should be made promptly. Amended reports should be submitted to ensure accurate records are maintained.

Penalties do apply for late filings. A $25 penalty and interest may be added for late submissions, affecting your total balance due.

Employers should always keep a copy of the completed UI-5G form for their records. This helps in reference and accountability.

Payment is due at the time of filing. Employers should ensure that payments are enclosed along with the form to avoid additional penalties.

Clear instructions for completing the form are available online, ensuring that employers have the resources needed to comply correctly.

Key takeaways

Filling out the Ui 5G form can seem daunting at first, but understanding the key elements can simplify the process. Here are some essential takeaways to keep in mind:

- Start by checking the right boxes and supplying all requested information about your business, including your Employer Identification Numbers and tax rates.

- Even if no wages were paid during the quarter, a report must still be filed.

- For guidance, visit the Montana Department of Labor and Industry’s website or call their helpful staff—do not hesitate to reach out.

- When calculating your taxes, be sure to include all wages paid, the number of employees, and applicable credits and adjustments from prior quarters.

- It's crucial to sign the form and create a copy for your records. This ensures you have proof of submission.

- Mail the completed form, any additional documents, and payment on time to avoid penalties and interest costs.

By following these steps, you can ensure compliance and make the process much smoother.

Browse Other Templates

Greenwich Residential Lease Agreement,Greenwich Rental Contract,Greenwich Tenancy Agreement,Greenwich Lease Document,Greenwich Housing Lease,Greenwich Rental Lease Form,Greenwich Property Lease Agreement,Greenwich Lease for Residential Property,Green - The type of dwelling being rented, whether an apartment, condominium, or house, is specified within the lease.

Us and Australia - Appropriately filling out this form can lead to easier customs clearance in Australia.

New York State Certificate of Authority - Tax preparer information is optional and can be included if applicable.