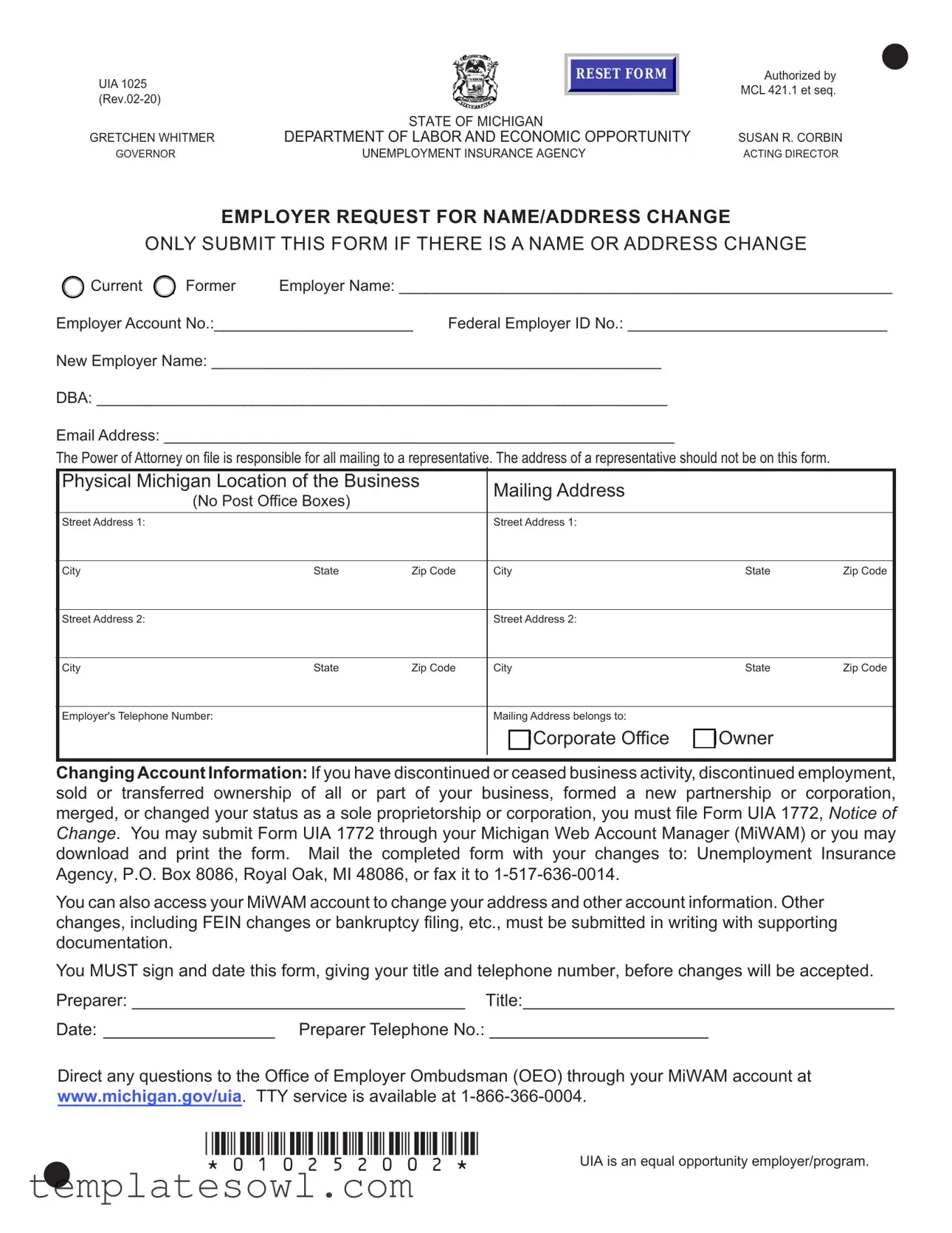

Fill Out Your Uia 1025 Form

The UIA 1025 form, specifically designed for employers in Michigan, serves a critical purpose: to facilitate name and address changes in your business account with the Unemployment Insurance Agency. When a business undergoes a name change or relocates, this form needs to be submitted to ensure that all information remains current. The form collects essential details, such as the current and new employer names, the employer account number, and the federal employer ID number. It's important to note that this form should be used strictly for name or address changes—other significant changes, like ownership transfers or business status alterations, require a different form (UIA 1772). Proper submission of the UIA 1025 involves providing a physical address for the business, along with an email address for correspondence. It's also crucial that the employer signs and dates the form, confirming their authority to make the changes. This straightforward process ensures that the Unemployment Insurance Agency can maintain accurate records, ultimately helping businesses stay compliant and facilitating communication with state agencies.

Uia 1025 Example

UIA 1025

RESET FORM

Authorized by |

• |

MCL 421.1 et seq. |

|

TE OF MICHIGAN |

|

GRETCHEN WHITMER |

DEPARTMENT OF LABOR AND ECONOMIC OPPORTUNITY |

SUSAN R. CORBIN |

GOVERNOR |

UNEMPLOYMENT INSURANCE AGENCY |

ACTING DIRECTOR |

EMPLOYER REQUEST FOR NAME/ADDRESS CHANGE

ONLY SUBMIT THIS FORM IF THERE IS A NAME OR ADDRESS CHANGE

Current

Current

Former |

Employer Name: _________________________________________________________ |

Employer Account No.:_______________________ |

Federal Employer ID No.: ______________________________ |

|||||

New Employer Name: ____________________________________________________ |

|

|

||||

DBA: __________________________________________________________________ |

|

|

||||

Email Address: ___________________________________________________________ |

|

|

||||

The Power of Attorney on file is responsible for all mailing to a representative. The address of a representative should not be on this form. |

|

|||||

Physical Michigan Location of the Business |

|

Mailing Address |

|

|

||

|

(No Post Office Boxes) |

|

|

|

|

|

|

|

|

|

|

|

|

Street Address 1: |

|

|

|

Street Address 1: |

|

|

|

|

|

|

|

|

|

City |

State |

Zip Code |

City |

State |

Zip Code |

|

|

|

|

|

|

|

|

Street Address 2: |

|

|

|

Street Address 2: |

|

|

|

|

|

|

|

|

|

City |

State |

Zip Code |

City |

State |

Zip Code |

|

|

|

|

|

|

|

|

Employer's Telephone Number: |

|

|

Mailing Address belongs to: |

|

|

|

|

|

|

|

Corporate Office |

Owner |

|

|

|

|

|

|

|

|

Changing Account Information: If you have discontinued or ceased business activity, discontinued employment, sold or transferred ownership of all or part of your business, formed a new partnership or corporation, merged, or changed your status as a sole proprietorship or corporation, you must file Form UIA 1772, Notice of Change. You may submit Form UIA 1772 through your Michigan Web Account Manager (MiWAM) or you may download and print the form. Mail the completed form with your changes to: Unemployment Insurance Agency, P.O. Box 8086, Royal Oak, MI 48086, or fax it to

You can also access your MiWAM account to change your address and other account information. Other changes, including FEIN changes or bankruptcy filing, etc., must be submitted in writing with supporting documentation.

You MUST sign and date this form, giving your title and telephone number, before changes will be accepted.

Preparer: ___________________________________ Title:_______________________________________

Date: __________________ Preparer Telephone No.: _______________________

Direct any questions to the Office of Employer Ombudsman (OEO) through your MiWAM account at www.michigan.gov/uia. TTY service is available at

• |

*010252002* |

UIA is an equal opportunity employer/program. |

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | This form is for employers to request a name or address change. |

| Governing Law | The form is authorized by MCL 421.1 et seq. |

| Submission Guidelines | Only submit this form if there is a name or address change. |

| Required Information | Employers must provide current and former names, account numbers, and contact details. |

| Mailing Instructions | Completed forms should be mailed to the Unemployment Insurance Agency in Royal Oak, MI. |

| Alternative Submission Method | Forms can also be submitted via fax at 1-517-636-0014. |

| Account Management | Employers can update their information through the Michigan Web Account Manager (MiWAM). |

| Additional Changes | Significant changes require filing Form UIA 1772 with supporting documents. |

| Contact Information | For questions, employers may contact the Office of Employer Ombudsman through their MiWAM account. |

Guidelines on Utilizing Uia 1025

Upon completing the UIA 1025 form, it’s important to ensure that the document is submitted accurately to officially update your employer name or address. This form serves as a formal request for changes, and any errors may lead to delays or complications. Follow these steps carefully to provide the necessary information.

- Begin by entering the current former employer name in the designated space.

- Input the employer account number associated with your business.

- Enter the federal employer ID number (FEIN) in the appropriate field.

- Specify the new employer name you wish to use.

- Fill in the DBA (Doing Business As) name if applicable.

- Provide a valid email address for communication regarding this request.

- Complete the section for physical Michigan location of the business by filling out the street address, city, state, and zip code.

- Repeat the previous step for the mailing address, ensuring you do not use a P.O. box.

- List your employer's telephone number for direct contact.

- Indicate whether the mailing address belongs to the corporate office or owner.

- If changes are made, remember to sign and date the form at the bottom.

- Include the title and telephone number of the preparer.

Once all sections of the UIA 1025 form are filled out, mail the completed form to the specified address or fax it to the provided number. Ensure all details are accurate to prevent any issues with your submission. Questions may be directed to the Office of Employer Ombudsman for further assistance.

What You Should Know About This Form

What is the purpose of the UIA 1025 form?

The UIA 1025 form is used to request a name or address change for an employer registered with the Unemployment Insurance Agency in Michigan. This specific form is solely for updating name or address details. If an employer has changed their business structure or discontinued operations, they need to use a different form, specifically the UIA 1772.

Who should fill out the UIA 1025 form?

This form should be completed by employers who need to change their business name or address. You must be an authorized representative of the company. Ensure that you sign and date the form to validate the request. The form must include the current employer information as well as the new details to be processed.

Where do I send the completed UIA 1025 form?

Once you have completed the UIA 1025 form, mail it to the Unemployment Insurance Agency at P.O. Box 8086, Royal Oak, MI 48086. Alternatively, you can fax the form to 1-517-636-0014. Make sure to double-check all entries for accuracy before submission to prevent delays.

What if my business structure has changed?

If your business has ceased operations, changed ownership, or altered its business structure (for instance, forming a new partnership or corporation), the UIA 1025 form is not appropriate. Instead, you must fill out Form UIA 1772, which is intended for these kinds of changes. You can submit UIA 1772 through your Michigan Web Account Manager (MiWAM) or download and print it for mailing.

Common mistakes

Completing the UIA 1025 form accurately is crucial for ensuring that an employer's name or address changes are processed smoothly. However, there are common mistakes that can hinder the application process.

One frequent error is forgetting to include the current employer name and the employer account number. These fields are essential for the Unemployment Insurance Agency to locate the correct account. Without this information, processing may be delayed, as the agency will not have the necessary identifiers to link the change to the correct business record.

Another mistake occurs when individuals mistakenly enter a post office box instead of a physical address for the mailing address. The form explicitly states that post office boxes cannot be accepted. This oversight can result in the application being returned, causing further delays in updates to the employer's records.

Additionally, some individuals neglect to sign and date the form. A signature is not just a formality; it is legally required for the form to be valid. If this step is omitted, the submission may be rejected, prolonging the process of updating crucial information.

People often use a representative's address on the form, which can create confusion with the agency. The representative's address should not be included, as it can lead to miscommunication regarding which entity is being identified for changes. The form should clearly reflect the employer's details only.

Furthermore, not indicating whether the mailing address belongs to the corporate office or the owner can result in additional queries from the agency. Providing this information helps to streamline the updating process and ensures clarity about who is making the request.

Lastly, failing to review the form for accuracy before submission can lead to errors that may complicate future interactions with the agency. Double-checking all fields for correct entries and completeness is a necessary step. Taking the time to ensure accuracy can save a significant amount of hassle down the line.

Documents used along the form

The UIA 1025 form is an essential document used by employers in Michigan to officially request a change in their business name or address with the Unemployment Insurance Agency. However, there are several other forms and documents that may be utilized in conjunction with the UIA 1025, each serving a specific purpose related to business changes and compliance.

- Form UIA 1772: Notice of Change - This form needs to be filed when there are significant changes to a business, such as selling or transferring ownership, discontinuing business activity, or changing the organization's structure. It informs the agency of necessary updates related to unemployment insurance accounts.

- Form UIA 1050: Request for Reinstatement - If a business stops operations but later resumes, this document can be submitted to request reinstatement of the unemployment insurance account. It provides essential information for the agency to reactivate records.

- Form UIA 1003: Employer's Quarterly Wage/Tax Report - This report is required for employers to summarize wages paid and taxes submitted quarterly. It is crucial for maintaining accurate unemployment tax records and ensuring compliance with state regulations.

- Form UIA 1080: Annual Employer's Report - Employers complete this form to report total taxable wages and calculate the unemployment insurance contributions for the year. It serves as a summary report for the agency.

- Form UIA 1536: Account Closure Request - When an employer permanently ceases operations, this document should be filed to officially close the unemployment insurance account. It communicates intent to terminate the account to the agency.

- Power of Attorney Documentation - This document allows a designated representative to act on behalf of the employer regarding unemployment insurance matters. It must be filed with the agency to facilitate communication and actions taken by an agent.

These additional forms and documents play a critical role in ensuring that employers maintain compliance with state requirements. Proper handling of changes is essential to avoid penalties and ensure that employee benefits are accurately administered.

Similar forms

The UIA 1025 form is designed to facilitate an employer's request for a name or address change within the Unemployment Insurance Agency's records. Its streamlined purpose makes it similar to several other important forms. Here are four documents that share similarities with the UIA 1025:

- UIA 1772 - Notice of Change: This form addresses more significant changes in business operations, such as discontinuing business or transferring ownership. Like UIA 1025, it must be filled out correctly and submitted for processing, but it covers a broader scope of changes beyond just name or address alterations.

- UIA 5101 - Employer Registration: When a new business is established, this document is crucial. It registers the employer with the Unemployment Insurance Agency. Like UIA 1025, this form seeks to accurately reflect the current status of an employer's business, although it initiates registration rather than amend existing records.

- UIA 1028 - Wage Report: Employers submit this form to report wages paid to employees. While it focuses on wage information, both UIA 1025 and UIA 1028 play critical roles in maintaining accurate employer records with the agency. Correct information is essential for the processing of veteran records and ensuring compliance with state regulations.

- UIA 1040 - Employer's Quarterly Wage Report: Similar to the UIA 1025, this document ensures that the state has the most current information regarding an employer's payroll each quarter. Both forms require accuracy and consistency in reporting, helping the agency maintain effective communication with employers.

Understanding these forms and their similarities can help ensure that your records with the Unemployment Insurance Agency stay up to date and compliant with state requirements.

Dos and Don'ts

When filling out the UIA 1025 form, it is essential to follow certain guidelines to ensure that your submission is processed smoothly. Below is a list of dos and don’ts to keep in mind:

- Do provide the current name and address of your business as accurately as possible.

- Do include your Employer Account Number and Federal Employer ID Number.

- Do make sure to sign and date the form before submission.

- Do submit the form through the appropriate channels, either by mail or fax.

- Don’t submit this form if there is no name or address change; it is for changes only.

- Don’t provide a representative’s address on this form; it should be excluded.

- Don’t forget to indicate if the mailing address belongs to a corporate office or the owner.

- Don’t use a Post Office Box for the mailing address; a physical address is required.

By adhering to these guidelines, you can help prevent delays and ensure your information is updated accurately. If you have further questions, reach out to the appropriate office for assistance.

Misconceptions

- Misconception 1: The UIA 1025 form is used for all changes related to unemployment insurance.

- Misconception 2: Anyone can submit the UIA 1025 form for a business.

- Misconception 3: The mailing address can be a P.O. Box.

- Misconception 4: The UIA 1025 form can be submitted without a signature.

- Misconception 5: Changes can be made at any time without restrictions.

- Misconception 6: You can also change the FEIN on this form.

- Misconception 7: This form can be used to notify the UIA about discontinuing business.

This form is specifically for name or address changes only. Other types of changes require a different form.

Only authorized individuals or representatives can submit this form. Ensure you have proper authorization.

The form requires a physical mailing address. P.O. boxes are not accepted.

A signature is mandatory. The form will not be processed without it.

Changes must be made according to specific guidelines. Check eligibility before submitting.

Changes to the FEIN must be submitted in writing with supporting documentation, not on the UIA 1025.

This form does not cover discontinuation of business activities. Use Form UIA 1772 for that purpose.

Key takeaways

Here are key takeaways for filling out and using the UIA 1025 form:

- This form is used specifically for changing the employer's name or address.

- Ensure that you only submit the form if there is an actual change in name or address.

- Include both the current and new employer names along with the necessary details.

- Do not include the address of a representative on the form; it is only for the employer.

- Mailing addresses must not include Post Office Boxes; only physical addresses are accepted.

- Remember that significant business changes require a different form (UIA 1772).

- Make sure to sign and date the form before submission; it will not be processed without this.

- For any questions, utilize the Office of Employer Ombudsman via your MiWAM account.

Browse Other Templates

What Is a Fire Watch - It reflects a commitment to upholding fire safety standards in healthcare settings.

How to Cancel Business License - The Dor 126 form is used to update business tax information in Missouri.