Fill Out Your Uitl 100 Form

The UITL 100 form is an essential application for businesses in Colorado seeking to establish an unemployment insurance account. This form serves as a starting point for employers to register their business for unemployment insurance coverage or to make required updates if the business structure changes. It asks for detailed information about the business, including its legal name, type of organization, and contact details. Employers must indicate their first date of payroll and the reasons for filing the application, which could range from setting up a new account to reinstating an existing one. Various types of businesses, from corporations to sole proprietorships, are eligible to apply. Furthermore, the form requires employers to provide specifics about their payroll practices, potential employee leasing arrangements, and the nature of their business activities in Colorado. Completing the UITL 100 form accurately is crucial for compliance and ensures that employees receive the necessary unemployment benefits if needed. For those new to the process or uncertain about their obligations, guidance is available through the Colorado Department of Labor and Employment.

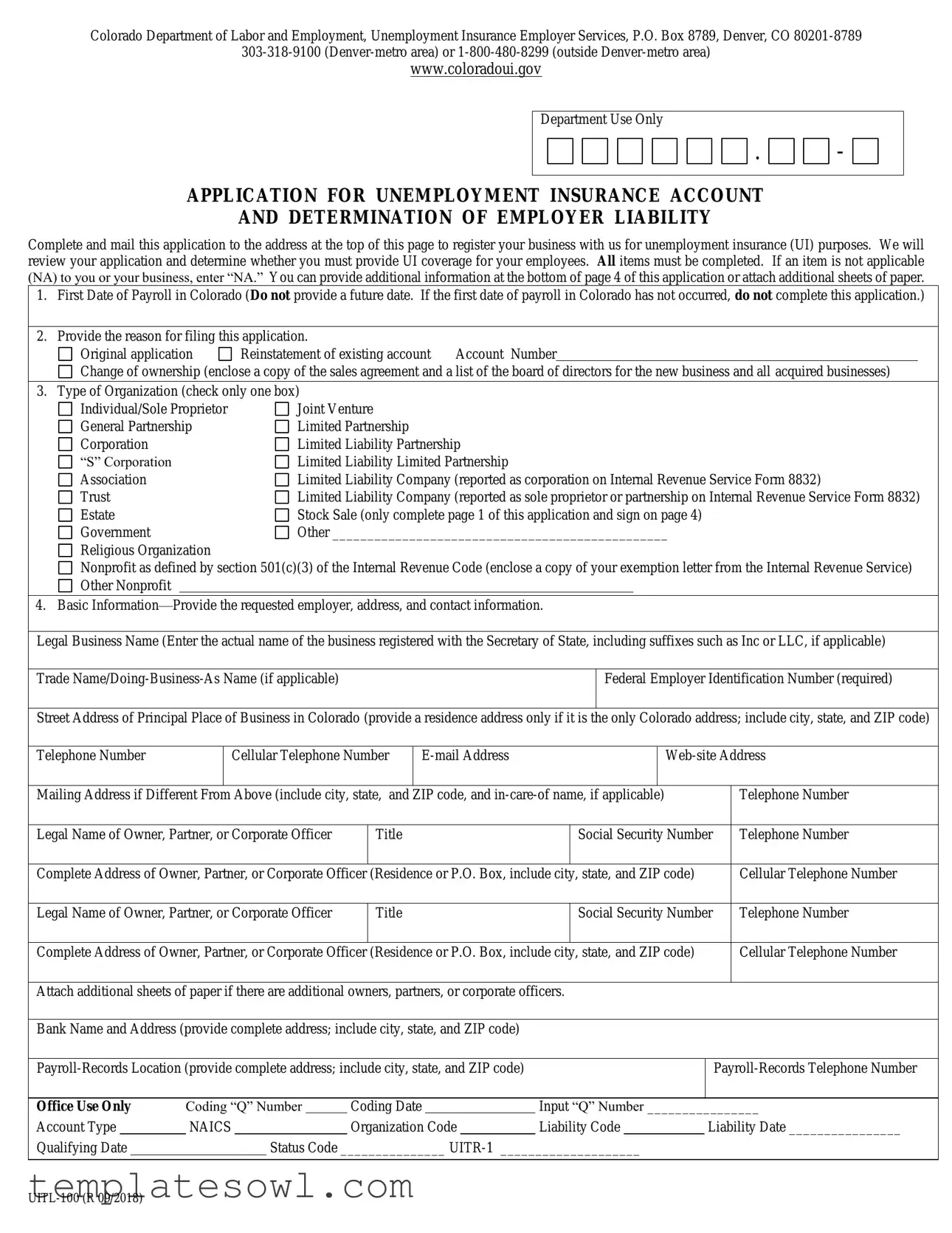

Uitl 100 Example

Colorado Department of Labor and Employment, Unemployment Insurance Employer Services, P.O. Box 8789, Denver, CO

www.coloradoui.gov

Department Use Only

.

.

-

-

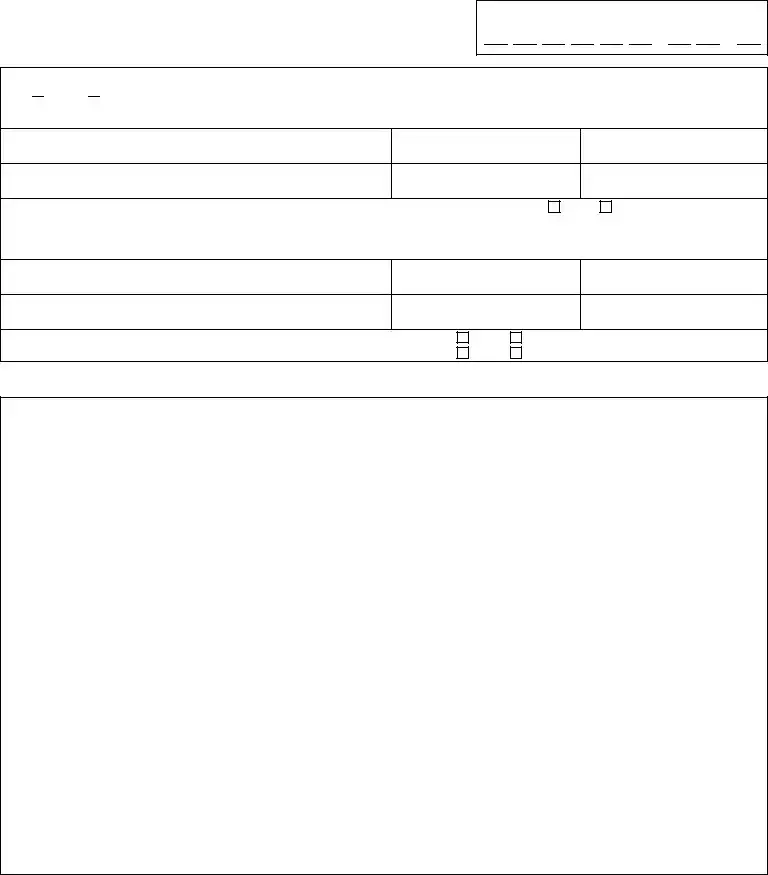

APPLICATION FOR UNEMPLOYMENT INSURANCE ACCOUNT

AND DETERMINATION OF EMPLOYER LIABILITY

Complete and mail this application to the address at the top of this page to register your business with us for unemployment insurance (UI) purposes. We will review your application and determine whether you must provide UI coverage for your employees. All items must be completed. If an item is not applicable (NA) to you or your business, enter “NA.” You can provide additional information at the bottom of page 4 of this application or attach additional sheets of paper.

1.First Date of Payroll in Colorado (Do not provide a future date. If the first date of payroll in Colorado has not occurred, do not complete this application.)

2.Provide the reason for filing this application.

Original application |

Reinstatement of existing account |

Account Number |

|

|

Change of ownership (enclose a copy of the sales agreement and a list of the board of directors for the new business and all acquired businesses) |

||||

3. Type of Organization (check only one box) |

|

|

|

|

Individual/Sole Proprietor |

Joint Venture |

|

|

|

General Partnership |

Limited Partnership |

|

|

|

Corporation |

Limited Liability Partnership |

|||

“S” Corporation |

Limited Liability Limited Partnership |

|||

Association |

Limited Liability Company (reported as corporation on Internal Revenue Service Form 8832) |

|||

Trust |

Limited Liability Company (reported as sole proprietor or partnership on Internal Revenue Service Form 8832) |

|||

Estate |

Stock Sale (only complete page 1 of this application and sign on page 4) |

|||

Government |

Other ________________________________________________ |

|||

Religious Organization

Nonprofit as defined by section 501(c)(3) of the Internal Revenue Code (enclose a copy of your exemption letter from the Internal Revenue Service) Other Nonprofit

4. Basic

Legal Business Name (Enter the actual name of the business registered with the Secretary of State, including suffixes such as Inc or LLC, if applicable)

Trade

Federal Employer Identification Number (required)

Street Address of Principal Place of Business in Colorado (provide a residence address only if it is the only Colorado address; include city, state, and ZIP code)

Telephone Number

Cellular Telephone Number

Mailing Address if Different From Above (include city, state, and ZIP code, and

Telephone Number

Legal Name of Owner, Partner, or Corporate Officer

Title

Social Security Number

Telephone Number

Complete Address of Owner, Partner, or Corporate Officer (Residence or P.O. Box, include city, state, and ZIP code)

Cellular Telephone Number

Legal Name of Owner, Partner, or Corporate Officer

Title

Social Security Number

Telephone Number

Complete Address of Owner, Partner, or Corporate Officer (Residence or P.O. Box, include city, state, and ZIP code)

Cellular Telephone Number

Attach additional sheets of paper if there are additional owners, partners, or corporate officers.

Bank Name and Address (provide complete address; include city, state, and ZIP code)

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Office Use Only |

Coding “Q” Number |

|

|

Coding Date |

|

Input “Q” Number ________________ |

||||||||

Account Type |

|

NAICS |

|

|

|

Organization Code |

|

|

Liability Code |

|

Liability Date ________________ |

|||

Qualifying Date |

|

|

Status Code _______________ |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

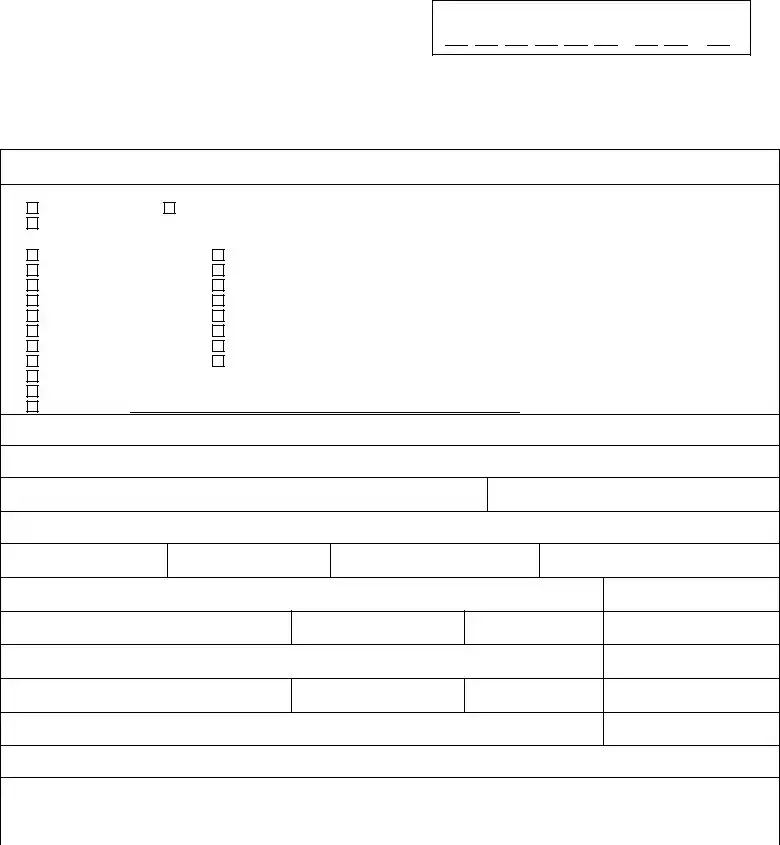

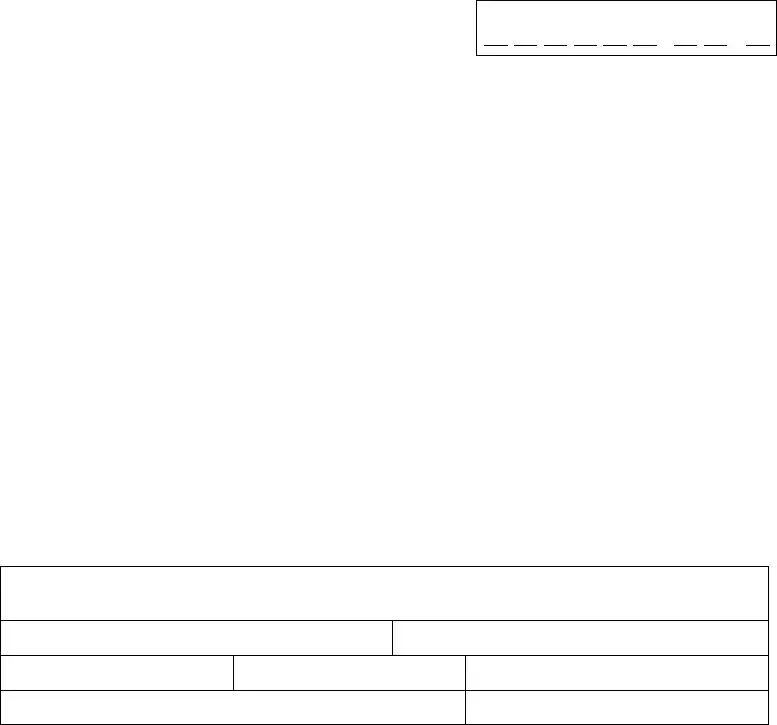

Department Use Only

.

.

-

-

5.Has this business paid wages or paid other remuneration in lieu of wages such as dividends (“S” corporation only), bonuses, draws, or disbursements?

Yes

Yes  No

No

NOTE: Wages include payments made to corporate officers performing any services in Colorado.

If Yes, provide the federal employer identification number (FEIN) if different than the FEIN provided in Item 4 or the UI account number if different than the account number provided in Item 2 if applicable. ___________________________________________________________

6. |

Has this business paid any individual who is considered to be a contractor or subcontractor? |

Yes |

No |

|

|

|

|

7. |

Has the business issued or does it intend to issue IRS Form |

Yes |

No |

|

|

|

|

|

If Yes to Item 6 or 7, describe the type of work performed_____________________ |

|

|

|

|

|

|

|

|

|

|

|

|

||

8. |

Is this business an |

Yes |

No |

||||

|

|

|

|

|

|

||

9. |

Are the employees of this business hired through an |

Yes |

No |

|

|

||

|

If Yes: Provide the name of the |

|

|

|

|

|

|

Provide the FEIN and/or UI account number_______________________________________________________________

10. |

Is this business an individual/sole proprietor? |

Yes |

No |

|

|

|

|

|

If Yes, are there any employees other than the individual, his or her spouse, or his or her children under the age of 21? |

Yes |

No |

||||

|

|

|

|

|

|

|

|

11. |

Is this business a partnership or limited liability organization? |

Yes |

No |

|

|

|

|

|

If Yes, are there any employees other than the partners or members of the limited liability organization? |

Yes |

No |

|

|||

12.Select the item that best describes the business’s activity in Colorado (check only one box) and provide specific detail below. For additional information regarding these industry descriptions, call Labor Market Information (LMI) at

Agricultural (list crops, animals, and/or services provided) |

|||

Mining (list product being mined and/or services performed) |

Residential |

||

Utilities (list type and services performed) |

Single Family |

||

Transportation, Communication, or Public Utilities (list type) |

Multiple Family |

||

Retail Trade (list type of product sold and to whom) |

Commercial |

||

Wholesale Trade (list type of product sold and to whom) |

Industrial/Warehouse |

||

Service (list type and explain in detail) |

Other Commercial |

||

Finance, Insurance, or Real Estate (list type and explain in detail) |

Speculative Builder/For Sale by Owner |

||

Manufacturing and Assembly (list materials used and products rendered) |

Subcontractor (explain in detail) |

||

Government (list type of agency) |

Heavy Construction |

||

Household/Domestic |

Highway and Steel Construction |

||

Other |

Bridge, Tunnel, and/or Elevated Highway |

||

|

|

|

Water, Sewer, Pipeline, and/or Communication |

|

|

|

Other Heavy Construction |

Provide specific detail regarding the business’s activity in Colorado. If more than one service is provided, indicate which is predominant.

NOTE: If the business’s entire activity is seasonal or if it has seasonal occupations, a request for seasonal designation can be made by completing and returning Form

13.Worksite

Complete Physical Street Address of Worksite (include city, state, and ZIP code)

Worksite Telephone Number

Worksite Contact Person

Average Number of Employees in a Typical Month

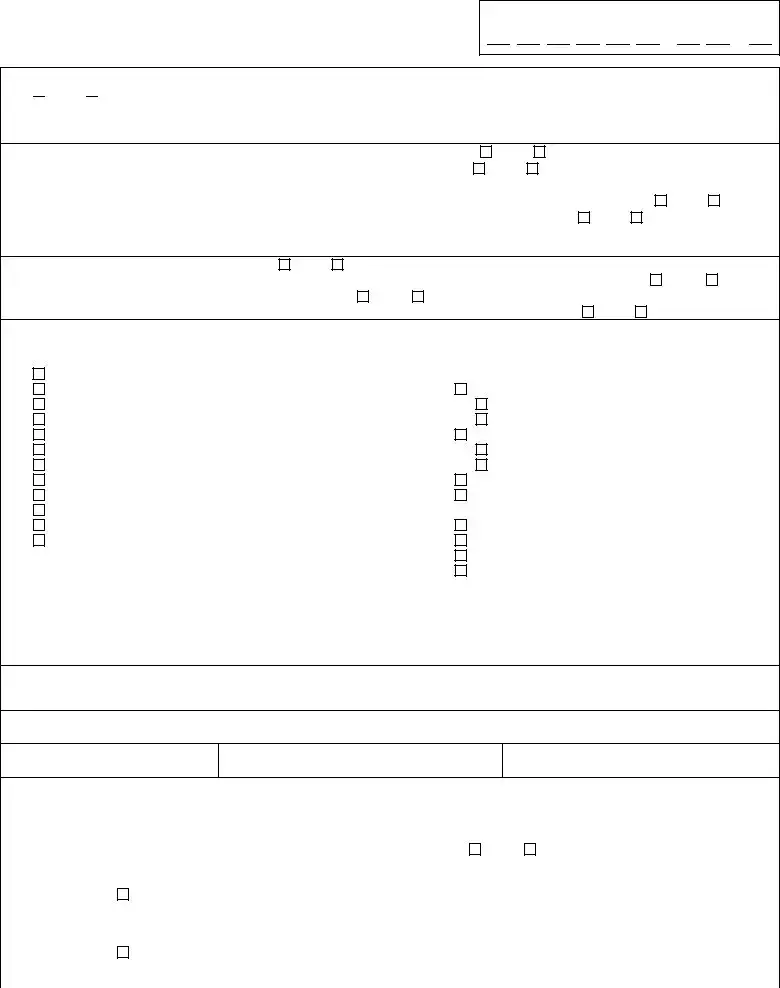

14.Business

Is the business entity completing this application as a result of a business acquisition? |

Yes |

No |

If No, skip to Item 17. |

|

If Yes: Provide the date of acquisition |

|

|

|

|

Check one of the boxes below to indicate the type of acquisition and complete Items 15 and 16. |

|

|||

Total Business Acquisition or Employee |

||||

all of the assets of at least one employer or utilizes the services of 90 percent or more of the total number of employees from another |

||||

employer. |

|

|

|

|

NOTE: This can include a reorganization of a current business. |

|

|

|

|

Partial Business Acquisition or Employee |

||||

at least one employer or utilizes the services of less than 90 percent of the total number of employees from another employer. |

||||

NOTE: This can include a reorganization of a current business. |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

Department Use Only |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

15. Did the business entity acquire or hire any workers from the prior business who are now employed with the new business? |

|

|

|

Yes |

|

No |

|

|

||||||||||||||||||||

If Yes: How many employees were acquired? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

How many employees did the prior business have during its last four pay periods? |

|

Last Pay Period |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

16. Provide the following information regarding the prior employer. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Prior Legal Business Name |

|

|

|

|

|

|

|

|

|

Prior FEIN or UI Account Number |

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

Name of Prior Owner |

|

|

|

|

|

|

|

|

|

Current Telephone Number of Prior Owner |

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Complete Current Address of Prior Owner (include city, state, and ZIP code) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

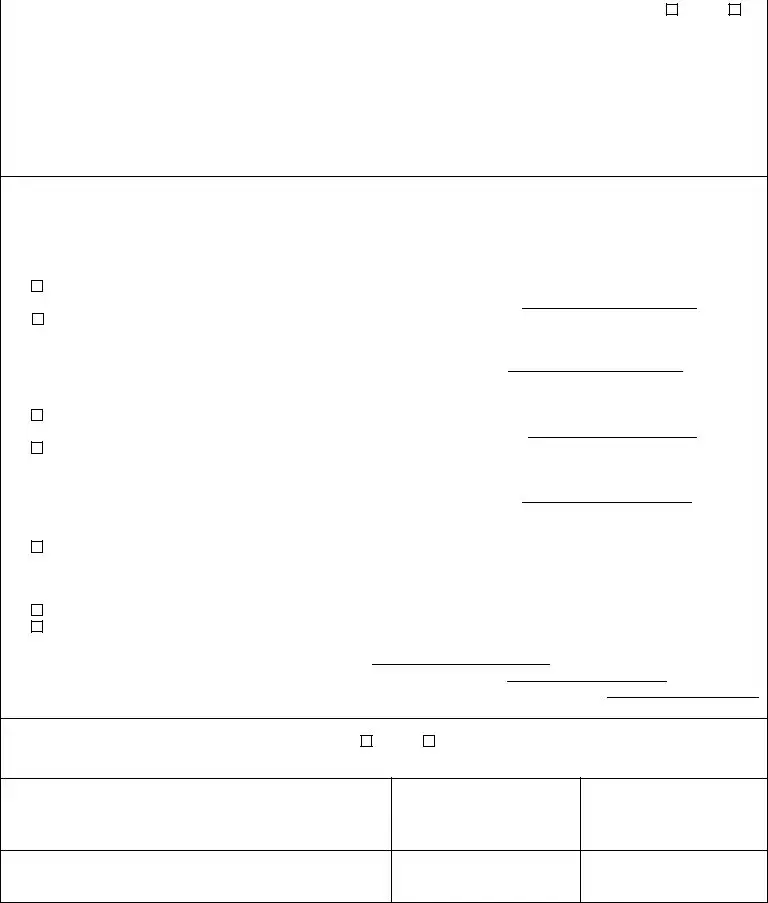

17.In accordance with the Colorado Employment Security Act (CESA), employers are required to provide UI coverage if one of the following conditions are met. Employers can meet these conditions through the employment of

NOTE: Calendar quarters are defined as

Check the appropriate box and provide the corresponding information that is requested.

Commercial, Industrial, or Professional Organization (as defined in CESA

Paid one or more workers a total of $1,500 in gross wages during any calendar quarter in the current or preceding calendar year Date on which you paid $1,500 in gross wages during a calendar quarter to meet this requirement

Employed one or more workers for some portion of a day in 20 different calendar weeks during the current or preceding calendar year (all 20 calendar weeks must occur within the same calendar year)

NOTE: The services do not have to be performed in consecutive weeks or by the same employee. Date on which you first employed a worker for some portion of a day to meet this requirement

Date on which you employed a worker for some portion of a day in the 20th calendar week to meet this requirement ______________________

Agricultural Employer (as defined in CESA

Paid one or more agricultural workers a total of $20,000 in gross wages during any calendar quarter in the current or preceding calendar year Date on which you paid $20,000 in gross wages during a calendar quarter to meet this requirement

Employed ten or more workers for some portion of a day in 20 different calendar weeks during the current or preceding calendar year (all 20 calendar weeks must occur within the same calendar year)

NOTE: The services do not have to be performed in consecutive weeks or by the same ten employees. Date on which you first employed ten workers for some portion of a day to meet this requirement

Date on which you employed ten workers for some portion of a day in the 20th calendar week to meet this requirement _____________________

Paid one or more workers performing domestic services in a private home, local college club, or local chapter of a fraternity or sorority a total of $1,000 in gross wages during any calendar quarter in the current or preceding calendar year

Date on which you paid one or more workers $1,000 in gross wages during a calendar quarter to meet this requirement _____________________

Nonprofit Organization, Including Political Subdivision (exempt under section 501(c)(3) of the Internal Revenue Code and as defined in CESA

Political Subdivision/Government

Had four or more workers employed anywhere in the U.S. in any calendar quarter in the current calendar year or preceding calendar year NOTE: The services do not have to be performed in consecutive weeks or by the same four employees.

Date on which you first employed at least one worker in Colorado

Date on which you first employed four workers anywhere in the U.S. to meet this requirement

Date on which you employed four workers anywhere in the U.S. in the 20th calendar week to meet this requirement

Type of services provided ____________________________________________________________________________

18. Has the owner, partner, or corporate officer of this business entity owned or operated any business in Colorado or does the owner, partner, or corporate

officer currently own or operate any other business in Colorado? |

Yes |

No |

If Yes, provide the information requested below for each business regardless of whether it is still in operation or related to this business entity. In addition, provide the requested information for all affiliated businesses. Attach additional sheets of paper if necessary.

Legal Business Name |

UI Account Number |

FEIN |

Legal Business Name

UI Account Number

FEIN

Department Use Only

.

.

-

-

19.Will the business entity file a consolidated federal tax return, including Internal Revenue Service Form 851, with any other business or entity?

Yes

Yes

No

No

If Yes, provide the information requested below for each business or entity included in the consolidated tax return. Attach additional sheets of paper if necessary.

Legal Business Name |

UI Account Number |

FEIN |

Legal Business Name

UI Account Number

FEIN

20. Is this business entity the result of a reorganization of a previously existing business entity or entities? |

Yes |

No |

If Yes, provide the information requested below for all business entities. Attach additional sheets of paper if necessary.

NOTE: Attach a copy of your reorganization plan. Provide the names of all corporate officers for all entities, a statement explaining the reason for the reorganization, and any

Legal Business Name |

UI Account Number |

FEIN |

Legal Business Name

UI Account Number

FEIN

21.Was this business entity purchased as a franchise from a corporation or franchisor? Was this business entity purchased as a franchise from a corporation or franchisee?

Yes Yes

No No

22.Please provide additional information or comments in the space provided below. If you are providing information relative to a question above, please note the question number.

Information/Comments

Department Use Only

.

.

-

-

The classification of a worker as an independent contractor or exempt employee has significant implications. Section

a.An employer has improperly classified an individual when an

b.An

c.A person shall not knowingly incorporate or form, or assist in the incorporation or formation of, a corporation, partnership, limited liability corporation, or other entity, or pay or collect a fee for use of a foreign or domestic corporation, partnership, limited liability corporation, or other entity for the purpose of facilitating, or evading detection of, a violation of this section.

d.A person shall not knowingly conspire with, aid and abet, assist, advise, or facilitate an employer with the intent of violating the provisions of this chapter.

Further, in the event that any employer is found to violate Section

(III)Upon a finding that the employer, with willful disregard of the law, misclassified employees, the director may:

(A)Impose a fine of up to $5,000 per misclassified employee for the first misclassification with willful disregard, and for a second or subsequent misclassification with willful disregard, a fine of up to $25,000 per misclassified employee; and

(B)Upon a second or subsequent misclassification with willful disregard, issue an order prohibiting the employer from contracting with, or receiving any funds for the performance of contracts from the state for up to two years after the date of the director's order. Upon the issuance of such order, the director shall notify state departments and agencies as necessary to ensure enforcement of the order.

I, _______________________________________________________________, (company officer) have read and understood the

prohibitions and penalties set forth above.

I certify under penalty of perjury that the above information is true, accurate, and complete to the best of my knowledge. I understand that there are severe penalties for providing false statements and willfully misrepresenting information in order to reduce UI rates.

Name of Company Officer (please print)

Title

Telephone Number

Alternate Telephone Number

Signature of Company Officer

Date

NOTE: The completion of this application is for UI purposes only. If you need to register your business in Colorado for other purposes such as establishing wage withholding, applying for a state sales tax license, or registering a trade name, complete Form CR 0100, Colorado Business Registration. The Colorado Business Registration is available at www.colorado.gov/revenue.

Form Characteristics

| Fact Name | Details |

|---|---|

| Governing Authority | The UITL 100 form is managed by the Colorado Department of Labor and Employment. |

| Purpose | This form is used to apply for an unemployment insurance account and to determine employer liability. |

| Submission | Applicants must complete all sections of the form and mail it to the specified address in Denver, Colorado. |

| Contact Information | For assistance, individuals can contact the department at 303-318-9100 or 1-800-480-8299. |

| Applicable Businesses | All types of organizations, including partnerships, corporations, and sole proprietorships can apply using this form. |

| Seasonal Designation | Businesses may request seasonal designation if their activities are seasonal by completing Form UITL-5. |

| Wage Reporting | Employers must report wages paid to workers, including contractors, who are essential for determining unemployment insurance coverage. |

| Penalties for Misrepresentation | Providing false information can lead to severe penalties, including fines. |

Guidelines on Utilizing Uitl 100

Completing the UITL 100 form is essential for registering your business with the Colorado Department of Labor and Employment for unemployment insurance purposes. Make sure to provide all necessary information accurately. Once your application is submitted, it will be reviewed to determine your UI coverage obligations.

- Obtain the UITL 100 form from the Colorado Department of Labor and Employment website.

- Fill out the first date of payroll in Colorado, ensuring it is not a future date.

- Indicate the reason for filing the application by selecting the appropriate option.

- Select your type of organization by checking the corresponding box.

- Provide basic information such as your legal business name, trade name (if applicable), and Federal Employer Identification Number.

- Enter the principal place of business address in Colorado, including telephone and email details.

- List the legal names, titles, and Social Security numbers of any owners, partners, or corporate officers, as well as their addresses.

- Indicate your bank name and address along with the payroll records location.

- Answer the questions regarding previous payment of wages and contracts.

- Provide worksite information for each location in Colorado where employees work.

- If applicable, state whether the application is due to a business acquisition and complete relevant sections.

- Check the conditions that apply to your obligation to provide UI coverage and fill in the required dates.

- Complete any additional information regarding previous business operations as requested.

- Review all entries for accuracy and completeness.

- Sign and date the form, ensuring the signature belongs to a company officer.

- Mail the completed form to the address listed at the top of the application.

What You Should Know About This Form

What is the UITL 100 form?

The UITL 100 form is an application used by businesses to register for unemployment insurance (UI) coverage in Colorado. It helps determine employer liability for providing UI to employees. Employers must complete this form, including all necessary information about their operations, ownership, and compensation practices.

Who needs to complete the UITL 100 form?

This form is required for any business that has started operations in Colorado, plans to pay wages, or has acquired another business. If a business meets certain criteria related to employee wages or the number of employees, it must file this application to ensure compliance with state unemployment insurance laws.

What information is required to fill out the UITL 100?

The UITL 100 requires detailed information about the business, including legal name, contact details, type of organization, first date of payroll in Colorado, and reasons for application. Additionally, details about ownership, tax identification numbers, and information regarding any past business operations in Colorado must be provided. Ensure all applicable fields are filled accurately.

How should the UITL 100 be submitted?

The completed UITL 100 form must be mailed to the Colorado Department of Labor and Employment at the address indicated at the top of the form. It is also advisable to keep a copy of the application for your records. If the business has complex ownership structures or operations, consult with a professional to ensure accuracy before submission.

What happens after I submit the UITL 100 form?

After submission, the Colorado Department of Labor and Employment will review the application. They will determine whether the business is required to maintain unemployment insurance coverage for its employees. If additional documentation is needed, the department will contact the applicant. Employers should expect to receive notification regarding their UI account shortly after processing is complete.

What are the consequences of not filing the UITL 100?

Failure to file the UITL 100 can lead to penalties, including the inability to properly comply with Colorado’s unemployment insurance laws. This may result in fines or increased rates for employers who are later deemed liable for unpaid UI coverage. It is crucial for businesses to highlight when they start operations and begin compensating employees.

Can I amend my UITL 100 form after submission?

Yes, if you need to make changes to your UITL 100 form after submission, you should contact the Colorado Department of Labor and Employment directly. They can guide you on the appropriate procedures to amend your registration, whether through an additional form or other methods to ensure your business records are correct and up to date.

Common mistakes

When filling out the UITL 100 form, individuals often encounter several common challenges that can lead to mistakes. One frequent error involves omitting necessary information. All sections of the form must be completed, and each item that does not apply needs to be marked as "NA." Failure to do so may result in delays in processing the application.

Another mistake arises from providing inaccurate business names or addresses. It is crucial to enter the legal business name exactly as registered with the Secretary of State, including any suffixes. Misrepresentation or typographical errors could complicate future interactions with the Department of Labor and Employment.

Additionally, some applicants neglect to report previous or existing unemployment insurance accounts. When filling out Item 2, it is critical to include accurate account numbers to avoid confusion or rejection of the application. This step is essential for establishing clear communication with the department regarding the intent to reinstate or register a new account.

Individuals sometimes also fail to indicate accurately their organization type. The form requires checking only one box under Item 3. Misclassifying the type of organization can complicate the determination of employer liability and the requirements for unemployment insurance coverage.

Another common issue is with the handling of contractor information. Some applicants do not provide necessary details regarding payments made to contractors or subcontractors as outlined in Items 6 and 7. Incomplete or absent information about the nature of these relationships can raise red flags in the review process.

Some users overlook the importance of the payroll records location. When completing Item 4, it is vital to provide an accurate address for where payroll records are maintained. This can simplify future audits and inquiries from the department.

Moreover, applicants often misjudge what constitutes employment for unemployment insurance purposes. Understanding the thresholds for liability—such as the payment of $1,500 in gross wages—must be clearly documented as per Item 17. A misunderstanding here may lead to significant complications in fulfilling the UI coverage requirements.

Finally, applicants frequently disregard the acquisition sections of the form. When completing Items 14 through 16, it is important to clarify if the business was acquired or if services are being transferred from a predecessor. Missing this information can cause difficulties in tying the new entity to prior obligations or liabilities.

In conclusion, careful attention to detail is paramount when completing the UITL 100 form. By avoiding these common errors, individuals can facilitate a smoother registration process and ensure compliance with Colorado's unemployment insurance regulations.

Documents used along the form

When filing the UITL 100 form for unemployment insurance in Colorado, several other documents may be required to ensure compliance with state regulations. Each document serves a unique purpose and is typically used in conjunction with the UITL 100 form. Familiarizing yourself with these forms can streamline the application process and support your business's compliance efforts.

- UITL-5: Request for Seasonal Determination — This form is designed for businesses that operate seasonally. It allows employers to request a seasonal designation, which can affect their unemployment insurance obligations based on the nature and timing of their employment practices.

- CR 0100: Colorado Business Registration — This registration form is necessary for businesses in Colorado seeking to establish various protections and registrations for activities like wage withholding or sales tax licensing. It should be completed in conjunction with the UITL 100 if multiple registrations are needed.

- IRS Form 1099-MISC — This form is important for documenting income paid to independent contractors. If your business engages contractors, knowing when to issue this form is crucial for reporting purposes and can affect unemployment insurance requirements.

- Sales Agreement — If your business acquisition involves the purchase of assets or transfers of employees from another organization, including a sales agreement is necessary. This document verifies the legitimacy of the acquisition.

- List of Board of Directors — This list may need to be submitted if the ownership structure of your business changes. It establishes the new governing body, which is essential for maintaining transparency in ownership transitions.

- Reorganization Plan — If your company has undergone a reorganization, submitting a detailed plan can clarify the new structure and operational intents. A thorough explanation allows for better understanding by regulatory authorities.

Understanding these documents can facilitate a smoother filing process for your unemployment insurance account. By ensuring all necessary paperwork accompanies the UITL 100 form, you position your business to meet state requirements efficiently.

Similar forms

-

Form UITL-5: Request for Seasonal Determination - This document is used when a business seeks to clarify its seasonal employment status. Similar to the UITL 100 form, it requires specific information about the business's activities within Colorado, and whether they are engaged in seasonal work. Completing this form could lead to an exemption or special status regarding Unemployment Insurance (UI) contributions.

-

Form CR 0100: Colorado Business Registration - This form is necessary for registering a business in Colorado for various purposes, including wage withholding and sales tax. While the UITL 100 is specific to unemployment insurance, the CR 0100 provides a broader registration framework but also requires detailed business information similar to that of the UITL 100.

-

IRS Form SS-4: Application for Employer Identification Number - This federal form must be completed to obtain an Employer Identification Number (EIN). The UITL 100 also requests the Federal Employer Identification Number, establishing a connection between federal and state requirements for businesses seeking unemployment insurance.

-

IRS Form 941: Employer's Quarterly Federal Tax Return - Employers use this form to report income taxes, social security tax, or Medicare tax withheld from employee paychecks. Like the UITL 100, it involves the reporting of payroll information, helping ensure compliance with tax regulations and employee benefits.

Dos and Don'ts

Things to Do When Filling Out the UITL 100 Form:

- Enter the actual name of your business as registered with the Secretary of State.

- Provide a valid Federal Employer Identification Number (FEIN).

- Complete all items; use “NA” for anything not applicable.

- Attach additional sheets if needed for more owners or officers.

- Ensure contact information is correct and up to date.

Things to Avoid When Filling Out the UITL 100 Form:

- Do not leave any fields blank; every item must be filled out.

- Avoid using future dates for the first date of payroll.

- Refrain from providing P.O. Box addresses for physical work locations.

- Do not submit a sales agreement without including a list of directors.

- Do not misrepresent information to evade penalties; it’s illegal.

Misconceptions

Understanding the UITL 100 form is important for businesses in Colorado. However, there are several misconceptions surrounding it. Below is a list of common misunderstandings:

- The UITL 100 is only for new businesses. Many believe that only startups need to file the UITL 100 form. This is incorrect. Existing businesses undergoing changes, such as ownership changes, must also submit this application.

- Filing the UITL 100 guarantees unemployment insurance coverage. Completing the form does not automatically ensure that the business will provide unemployment insurance. The department reviews the application and makes a determination based on provided information.

- All sections of the form must be completed even if they are not applicable. This is a common misconception. If a section does not apply, simply write "NA" in that item. Leaving sections blank is not acceptable.

- The form can be submitted with incomplete information. It is essential to fully complete all required sections of the UITL 100 before submission. Incomplete applications will delay processing and may lead to rejection.

- Only large companies need unemployment insurance. This is not true. Any business that meets specific criteria, including those with part-time employees or contractors, may be required to provide unemployment insurance.

- The UITL 100 is only needed if the business has already paid wages. This form must be filed regardless of whether wages have been paid. If you plan to hire employees in the future, you still need to complete the application.

- Once submitted, the UITL 100 cannot be modified. This is false. If additional information becomes available or corrections need to be made after submission, businesses can submit updates to the department.

Addressing these misconceptions can help ensure that your business complies with state requirements effectively. For any specific questions, contact the appropriate department for guidance.

Key takeaways

Accurately complete the UITL 100 form to register your business for unemployment insurance (UI) in Colorado. This registration is crucial for complying with state regulations.

Submit the application to the designated address at the top of the form, ensuring all required fields are filled. Leaving fields blank may cause delays.

Provide a precise first date of payroll in Colorado. This date must not be in the future. If payroll has not commenced, the application should not be submitted.

Indicate the reason for filing the application clearly. Options include an original application, account reinstatement, and ownership changes.

Check only one box under the Type of Organization section. This classification determines your responsibilities and potential liabilities regarding UI.

All necessary employer information must be included, such as your legal business name, contact details, and federal employer identification number (FEIN). Omitting any of this information could lead to processing setbacks.

If applicable, provide details about employee-leasing situations and contractor relationships. Understanding how your workforce is structured is vital for UI determinations.

Attach additional sheets if the form does not accommodate all necessary details, especially concerning owners or locations. Thoroughness ensures clarity and facilitates the review process.

Browse Other Templates

Who Is Exempt From Workers' Compensation Insurance California - Each submitted form is reviewed to ensure compliance with state laws before approval.

Cdph 612 - School administrators must ensure they use the correct HHA school code on the form.

Real Estate Commission in Texas - The TREC 1 form facilitates the transfer, release, and change of status for licensees in Tennessee.