Fill Out Your Ultimate Health Insurance Claim Form

When it comes to navigating the complexities of health insurance, the Ultimate Health Insurance Claim form plays a crucial role in ensuring that individuals can effectively process their claims and receive reimbursement for covered medical expenses. This form is designed to streamline the submission of claims, making it easier for members to receive the financial support they need. Key elements include the policyholder's details and the primary insured's information, such as date of birth and social security number. It's essential to accurately fill out the claim information, especially when detailing the type of service received—whether it’s medical, dental, or vision care. Additionally, the form requires an Explanation of Benefits (EOB) from primary insurance to validate the claim, so it's important to have all relevant supporting documentation attached in the order that the claims are listed. Limiting claims to five per form helps keep the submission process organized. Finally, knowing how to submit the completed form, either online for quicker processing or via fax or mail, can make a significant difference in the speed of reimbursement. Understanding these components not only empowers individuals to complete their claims accurately but also fosters confidence in managing health-related expenses.

Ultimate Health Insurance Claim Example

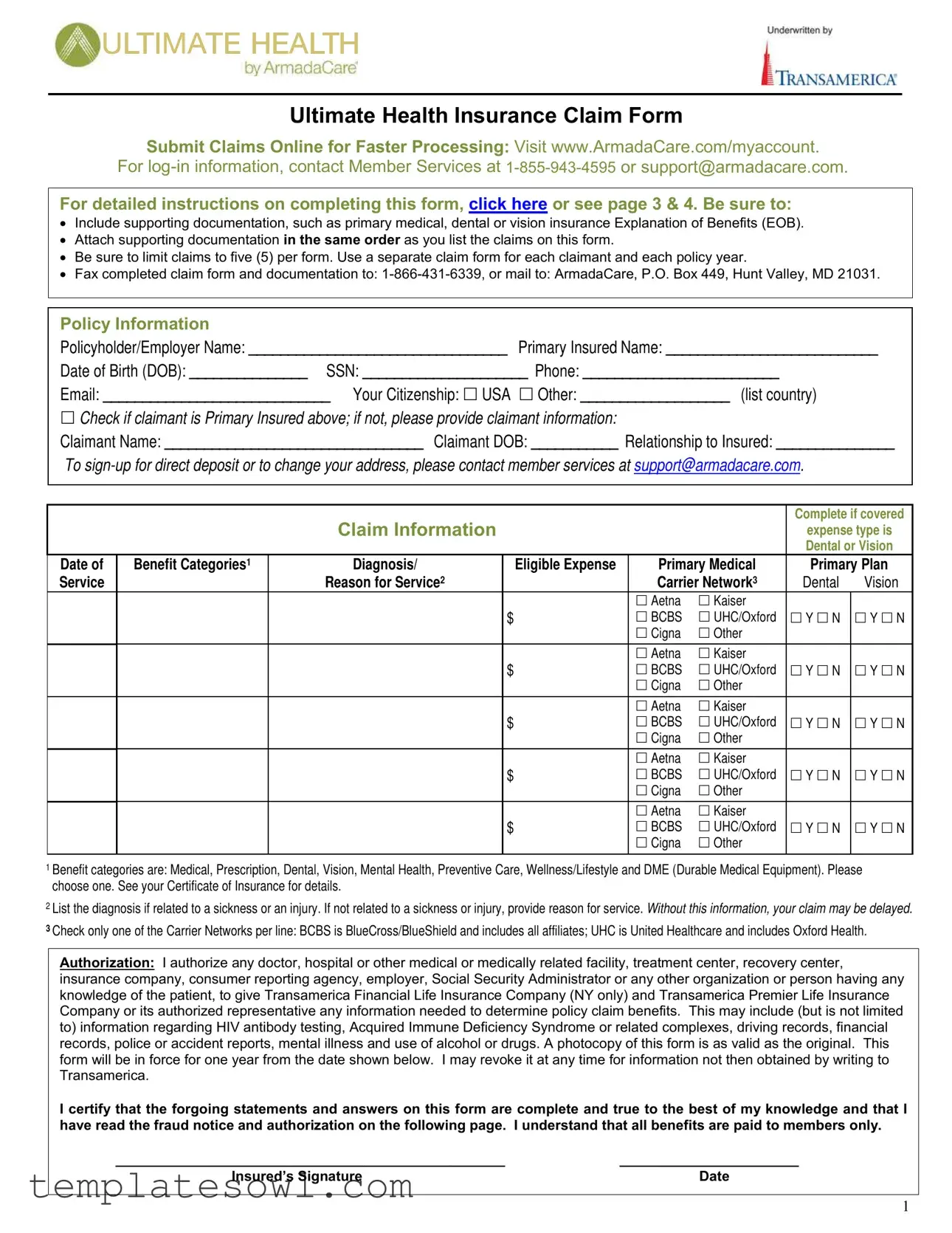

Ultimate Health Insurance Claim Form

Submit Claims Online for Faster Processing: Visit www.ArmadaCare.com/myaccount. or support@armadacare.com.

For detailed instructions on completing this form, click here or see page 3 & 4. Be sure to:

•Include supporting documentation, such as primary medical, dental or vision insurance Explanation of Benefits (EOB).

•Attach supporting documentation in the same order as you list the claims on this form.

•Be sure to limit claims to five (5) per form. Use a separate claim form for each claimant and each policy year.

•Fax completed claim form and documentation to:

Policy Information

Policyholder/Employer Name: _________________________________ Primary Insured Name: ___________________________

Date of Birth (DOB): _______________ SSN: _____________________ Phone: _________________________

Email: _____________________________ Your Citizenship: USA Other: ___________________ (list country)

Check if claimant is Primary Insured above; if not, please provide claimant information:

Claimant Name: _________________________________ Claimant DOB: ___________ Relationship to Insured: _______________

To

Claim Information

Complete if covered

expense type is Dental or Vision

Date of Service

Benefit Categories1 |

Diagnosis/ |

Eligible Expense |

Primary Medical |

Primary Plan |

||

|

Reason for Service2 |

|

Carrier Network3 |

Dental |

Vision |

|

|

|

|

Aetna |

Kaiser |

|

|

|

|

$ |

BCBS |

UHC/Oxford |

Y N |

Y N |

|

|

|

Cigna |

Other |

|

|

|

|

|

|

|

|

|

|

|

|

Aetna |

Kaiser |

|

|

|

|

$ |

BCBS |

UHC/Oxford |

Y N |

Y N |

|

|

|

Cigna |

Other |

|

|

|

|

|

|

|

|

|

|

|

|

Aetna |

Kaiser |

|

|

|

|

$ |

BCBS |

UHC/Oxford |

Y N |

Y N |

|

|

|

Cigna |

Other |

|

|

|

|

|

|

|

|

|

|

|

|

Aetna |

Kaiser |

|

|

|

|

$ |

BCBS |

UHC/Oxford |

Y N |

Y N |

|

|

|

Cigna |

Other |

|

|

|

|

|

|

|

|

|

|

|

|

Aetna |

Kaiser |

|

|

|

|

$ |

BCBS |

UHC/Oxford |

Y N |

Y N |

|

|

|

Cigna |

Other |

|

|

|

|

|

|

|

|

|

1Benefit categories are: Medical, Prescription, Dental, Vision, Mental Health, Preventive Care, Wellness/Lifestyle and DME (Durable Medical Equipment). Please choose one. See your Certificate of Insurance for details.

2List the diagnosis if related to a sickness or an injury. If not related to a sickness or injury, provide reason for service. Without this information, your claim may be delayed.

3Check only one of the Carrier Networks per line: BCBS is BlueCross/BlueShield and includes all affiliates; UHC is United Healthcare and includes Oxford Health.

Authorization: I authorize any doctor, hospital or other medical or medically related facility, treatment center, recovery center, insurance company, consumer reporting agency, employer, Social Security Administrator or any other organization or person having any knowledge of the patient, to give Transamerica Financial Life Insurance Company (NY only) and Transamerica Premier Life Insurance Company or its authorized representative any information needed to determine policy claim benefits. This may include (but is not limited to) information regarding HIV antibody testing, Acquired Immune Deficiency Syndrome or related complexes, driving records, financial records, police or accident reports, mental illness and use of alcohol or drugs. A photocopy of this form is as valid as the original. This form will be in force for one year from the date shown below. I may revoke it at any time for information not then obtained by writing to Transamerica.

I certify that the forgoing statements and answers on this form are complete and true to the best of my knowledge and that I have read the fraud notice and authorization on the following page. I understand that all benefits are paid to members only.

__________________________________________________ |

_______________________ |

Insured’s Signature |

Date |

1

Claim Fraud Warning

Your state may require the following notice: Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

State Specific Notices:

Alabama: Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or who knowingly presents false information in an application for insurance is guilty of a crime and may be subject to restitution fines or confinement in prison, or any combination thereof.

Alaska: A person who knowingly and with intent to injure, defraud, or deceive an insurance company files a claim containing false, incomplete, or misleading information may be prosecuted under state law.

Arizona: For your protection, Arizona law requires the following statement to appear on this form. Any person who knowingly presents a false or fraudulent claim for payment of a loss is subject to criminal and civil penalties.

Arkansas, District of Columbia, Louisiana, Rhode Island, Texas, West Virginia: Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

California: For your protection, California law requires the following to appear on this form. Any person who knowingly presents false or fraudulent claim for the payment of a loss is guilty of a crime and may be subject to fines and confinement in state prison.

Colorado: It is unlawful to knowingly provide false, incomplete, or misleading facts or information to any insurance company for the purpose of defrauding or attempting to defraud the company. Penalties may include imprisonment, fines, denial of insurance and civil damages. Any insurance company or agents of an insurance company who knowingly provides false, incomplete, or misleading facts or information to a policyholder or claimant for the purpose of defrauding or attempting to defraud the policyholder or claimant with regard to a settlement or award payable from insurance proceeds shall be reported to the Colorado Division of Insurance within the Department of Regulatory Agencies.

Delaware, Idaho, Indiana: Any person who knowingly, and with intent to injure, defraud or deceive any insurer, files a statement of claim containing any false, incomplete or misleading information is guilty of a felony.

Florida: Any person who knowingly and with intent to injure, defraud, or deceive any insurer files a statement of claim or an application containing any false, incomplete, or misleading information is guilty of a felony of the third degree.

Kentucky, Pennsylvania:Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false information or conceals for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime and subjects such person to criminal and civil penalties.

Maine, Tennessee, Virginia, Washington: It is a crime to knowingly provide false, incomplete, or misleading information to an insurance company for the purpose of defrauding the company. Penalties include imprisonment, fines, and denial of insurance benefits.

Maryland: Any person who knowingly or willfully presents a false or fraudulent claim for payment of a loss or benefit or who knowingly or willfully presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

Minnesota: A person who files a claim with intent to defraud or helps commit a fraud against an insurer is guilty of a crime.

New Hampshire: Any person who, with a purpose to injure, defraud or deceive any insurance company, files a statement of claim containing any false, incomplete or misleading information is subject to prosecution and punishment for insurance fraud, as provided in RSA 638:20.

New Jersey: Any person who knowingly files a statement of claim containing any false or misleading information is subject to criminal and civil penalties.

New York: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false information, or conceals for the purpose of misleading, information concerning any fact material thereto, commits a fraudulent insurance act, which is a crime, and shall also be subject to a civil penalty not to exceed five thousand dollars and the stated value of the claim for each such violation.

Ohio: Any person that knowingly presents false information in an application for insurance or life settlement contract is guilty of a crime and may be subject to fines and confinement in prison.

Oklahoma: WARNING: Any person who knowingly, and with intent to injure, defraud or deceive any insurer, makes any claim for the proceeds of an insurance policy containing any false, incomplete or misleading information is guilty of a felony.

2

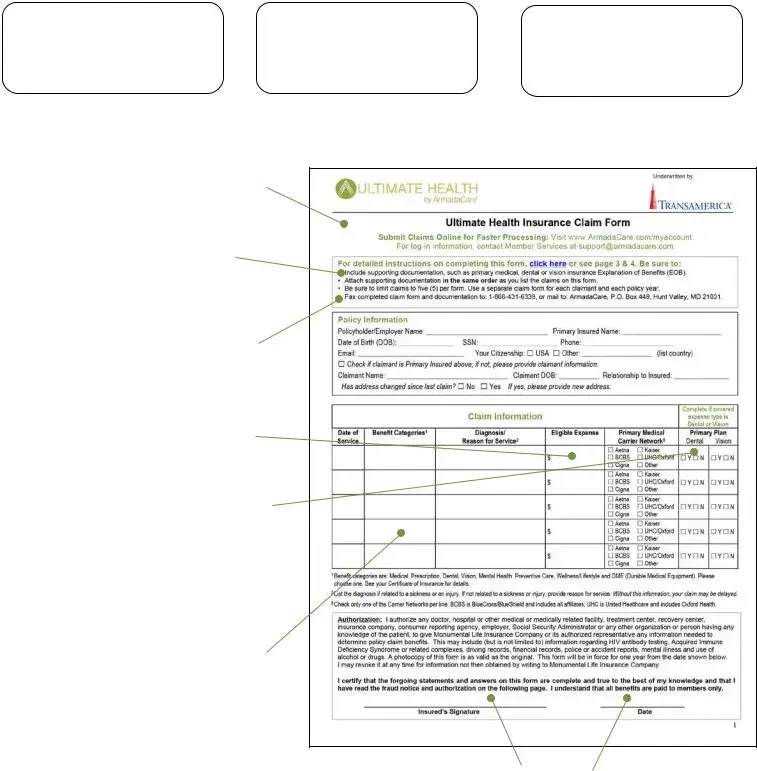

How to Complete the Ultimate Health Claim Form

Submit to Primary

1 Insurance First & Get Explanation of Benefits (EOB) Back

2 |

Submit Ultimate |

Get Reimbursed |

Health Claim with |

via Direct Deposit |

|

Documentation |

3 or By Check |

File online instead of using the form for faster processing. Visit www.ArmadaCare.com/myaccount. Your initial username is your first initial and last 5 digits of your SSN. Your initial password is the word password. If you forget your username or password, call Member Services.

Use one form per member and policy year. The primary member and spouse/dependent(s) cannot list claims on the same form. Policy year isn’t necessarily the same as calendar year. If you are not sure what your policy year is for Ultimate Health, ask your HR administrator or contact Member Services.

Either mail or fax your paper claim

Write the claim amount (amount that you owe) under Eligible Expense. This is the amount you are responsible

Tell us if you have primary dental or vision insurance if the Benefit Category is dental or vision. Do you have primary dental coverage, and is the expense a dental expense? Check “Y” under Dental, and attach a dental EOB. Do you have primary vision coverage and is the expense a vision expense? Check “Y” under Vision and attach a vision EOB. Otherwise, check “N” to indicate no primary dental or vision coverage.

Be sure to indicate the Benefit Category. Some examples of items that are generally eligible under Wellness/Lifestyle may include chiropractic treatment, acupuncture and prescribed massage therapy. Preventive Care typically may include Executive Physical tests, routine exams and lab screenings. Examples of durable medical equipment (DME) items generally eligible for reimbursement are wigs, hearing aids and orthotics. Your primary resource for what is covered under each category is your Certificate of Insurance provided to you by your employer. Do not write “See Attached.”

Be sure to sign with an actual signature, not your name in a “signature font”. Be sure to date the claim as well.

3

What Documentation Do I Need?

|

» Submit an Explanation of Benefits (EOB) from your primary insurance as |

|

|

documentation for most all claims. Include all EOB pages (with footnotes and YTD |

|

|

deductible summary) even if denied by your primary plan. |

|

All Claims |

» Exceptions where a detailed receipt can be submitted in replace of an EOB are noted in |

|

this chart. Detailed receipts must show date service provided, description of service and |

||

|

||

|

amount owed, provider name and patient name. See example below. |

|

|

» Do not submit statements that are not itemized and say “Balance Forward,” “Previous |

|

|

Balance Due,” or “Paid on Account” or |

|

|

|

|

Doctor |

» Submit detailed receipt (no EOB required). |

|

|

|

|

» Submit balance bill invoice along with primary plan’s EOB and indicate OON on claim |

||

(OON) Provider |

form. |

»Submit Rx receipt that includes patient name, drug name, filled date and charged amount.

Prescriptions

»No cash or credit card receipts or cancelled checks accepted.

»Do not black out the name of the drug on the Rx receipt.

» Prescription required; submit prescription and detailed receipt. |

|

Medications |

|

|

|

Massage Therapy |

» Prescription required; submit prescription and detailed receipt. |

|

|

Vision |

» Submit EOB if you have primary vision insurance; if not, submit detailed receipt. |

|

|

Dental |

» Submit EOB if you have primary dental insurance; if not, submit detailed receipt. |

|

|

Executive |

» If |

|

|

Physicals |

» If accepted (even partially) by primary insurance, submit EOB. |

|

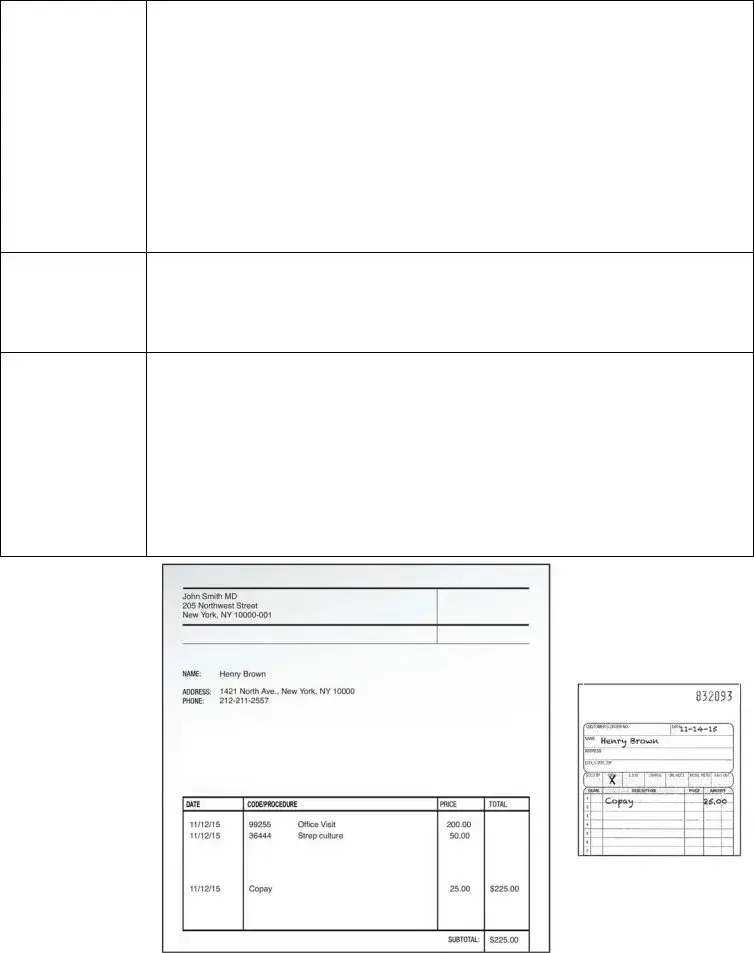

Good Receipt

Example

Shows:

»Date Service Provided

»Description of Service and Amount Owed

»Provider Name and Patient Name

Bad Receipt

Example

4

02/2016

1270276a

Form Characteristics

| Fact Name | Description |

|---|---|

| Claim Submission Methods | Claims can be submitted online for faster processing at www.ArmadaCare.com/myaccount, via fax at 1-866-431-6339, or by mailing to ArmadaCare, P.O. Box 449, Hunt Valley, MD 21031. |

| Supporting Documentation | It is crucial to include supporting documentation, such as the Explanation of Benefits (EOB) from primary insurance. Attach all documents in the order claims appear on the form. |

| Claim Limit | A maximum of five claims can be submitted per form. Each claimant and policy year requires a separate claim form. |

| Direct Deposit Setup | To sign up for direct deposit or update your address, contact Member Services at support@armadacare.com. |

| Fraud Warning | Filing a false claim is considered a crime in all states. Each state has specific laws regarding penalties for insurance fraud. |

| Authorization Clause | The form includes an authorization section that allows healthcare providers to share necessary information with Transamerica to process the claim. |

| Policy Information Requirement | Policyholder information, including the name, Social Security Number (SSN), and date of birth, must be filled out accurately on the claim form. |

Guidelines on Utilizing Ultimate Health Insurance Claim

Filling out the Ultimate Health Insurance Claim form requires careful attention to detail. Follow these steps to ensure everything is filled in correctly and submitted efficiently.

- Begin by gathering necessary documents, including any Explanation of Benefits (EOB) from your primary insurance provider.

- Complete all sections for policy information. This includes the policyholder's name, the primary insured's name, date of birth, Social Security number, phone number, email, and citizenship status.

- If the claimant is not the primary insured, provide the claimant’s name, date of birth, and relationship to the insured.

- Fill out the claim information for each service. Specify the date of service, benefit category, diagnosis, and eligible expense. Select the relevant insurance carrier network for each entry.

- Attach all supporting documentation in the same order as the claims listed on the form. Include EOBs or detailed receipts as required.

- Limit your claims to five per form. If you have more claims, use another claim form.

- Sign the form using your actual signature and date it. Do not use a signature font.

- Submit your completed claim form along with all attachments either by faxing to 1-866-431-6339 or mailing it to ArmadaCare at P.O. Box 449, Hunt Valley, MD 21031. Ensure you do not use both methods.

- If you prefer faster processing, consider submitting claims online at www.ArmadaCare.com/myaccount.

After submitting the form, you may want to follow up with Member Services at 1-855-943-4595 if you have questions or need assistance with your claim status. The form is valid for one year, so keep a copy for your records.

What You Should Know About This Form

What is the Ultimate Health Insurance Claim form used for?

The Ultimate Health Insurance Claim form is designed for policyholders to submit claims for reimbursement of covered medical, dental, and vision expenses. By completing this form, members can request reimbursement for services rendered after any applicable primary insurance has processed the claim. Submitting claims through this form ensures that members can recover costs associated with their health services in an efficient manner.

How do I submit the Ultimate Health Insurance Claim form?

You can submit your claim by either faxing or mailing the completed claim form along with all necessary documentation. Fax the form and supporting documents to 1-866-431-6339. Alternatively, mail everything to ArmadaCare at P.O. Box 449, Hunt Valley, MD 21031. For faster processing, consider submitting your claim online at www.ArmadaCare.com/myaccount.

What supporting documentation do I need to include with my claim?

It’s important to include an Explanation of Benefits (EOB) from your primary insurance whenever applicable. Make sure to attach your EOB pages, including any footnotes and year-to-date deductible summaries. If an EOB isn’t available, you may submit a detailed receipt instead. Detailed receipts must clearly show the date of service, a description of the service, provider name, and amount owed.

Can I list multiple claims on the same form?

No, you should limit claims to five per form. If you have more than five claims, file additional forms. Additionally, separate forms are required for each claimant and each policy year. This structured approach helps streamline the processing of each individual claim.

What if I forget my online login information for claim submissions?

If you forget your username or password for online submissions, you can call Member Services at 1-855-943-4595. They will assist you in recovering access to your account so you can proceed with your claims more efficiently.

Where can I find detailed instructions for completing the claim form?

Detailed instructions for completing the Ultimate Health Insurance Claim form can be found by clicking the provided link on the form itself or by reviewing pages 3 and 4 of the printed document. These pages offer clarity on each required section to ensure your claim is processed correctly.

Is there a deadline for submitting claims?

What should I do if my claim is denied?

If your claim is denied, you will receive an EOB or notice detailing the reason for denial. Review this documentation carefully. If you believe the denial was in error, you may appeal the decision by contacting Member Services for guidance on the appeals process and any necessary steps to take for re-evaluation of your claim.

Common mistakes

When filling out the Ultimate Health Insurance Claim form, several common mistakes can affect the processing time and ultimately delay reimbursement. One major error is failing to provide sufficient supporting documentation. It is crucial to include the primary medical, dental, or vision insurance Explanation of Benefits (EOB). Neglecting this step can result in an automatic denial of the claim. Remember, adequate documentation helps clarify any ambiguity surrounding the claim.

Another frequent mistake occurs when individuals do not attach supporting documentation in the same order as they list the claims. The form requires strict adherence to the order of expenses listed. When the documentation does not match the order on the claim form, reviewers may struggle to connect the dots, leading to potential delays. Therefore, organizing documents correctly is essential.

Limiting claims to five per form is another critical requirement that many overlook. Submitting more than five claims can result in the form being returned for correction. A separate claim form should be used for each claimant and each policy year to avoid confusion and facilitate a smoother review process.

People often make the mistake of submitting claims for services without clearly indicating their eligibility. For example, if you are claiming dental or vision expenses, it is vital to provide the date of service, benefit category, and diagnosis. Without this information, the claim may experience unnecessary delays. Furthermore, it is recommended to include the reason for the service to ensure clarity.

Submitting the claim without a proper signature is another issue that can hinder the process. The form must bear an actual signature, not just a printed name. This small but crucial detail can lead to complications when verifying the claim, causing potential delays in reimbursement. Additionally, making sure to date the claim is equally important—this validates the submission timeline.

Furthermore, many individuals fail to ask for clarification on the policy year. Since policy years do not necessarily align with calendar years, it's advisable to confirm your specific policy year to complete the form accurately. Not verifying this detail may lead to submitting claims for the wrong period, complicating the processing procedure.

Lastly, some claimants mistakenly think they can file claims through both mail and fax. It is important to remember that only one method should be used for submission. This preference minimizes confusion and streamlines the processing of claims. Simply put, following the outlined procedures diligently can significantly enhance the chances of prompt reimbursement.

Documents used along the form

The Ultimate Health Insurance Claim Form is essential for submitting health claims. Several other documents often accompany this form to ensure a smooth processing experience. Below is a list of these common documents, each serving a specific purpose in the claims process.

- Explanation of Benefits (EOB): This document details the medical services provided, the amount billed, and what your primary insurance has paid. It must be included for most claims.

- Itemized Bill: This receipt shows the specific charges for services rendered. It must list the date of service, description, provider’s name, and amount owed if an EOB is not available.

- Claimant Information Form: This form collects information about the claimant if they are different from the policyholder. It includes details like name, relation to insured, and DOB.

- Prescription Receipts: These are necessary for claims related to prescription medications. The receipt should include the patient’s name, drug name, and charged amount.

- Direct Deposit Form: This form is used to set up or change direct deposit information for claim reimbursements. It simplifies the payment process.

- Condition Documentation: Documents such as medical records or letters from medical professionals may be required to substantiate a claim for specific conditions or treatments.

- Wellness Documentation: If claiming for wellness-related services like chiropractic care or acupuncture, proof of service, such as a detailed receipt or EOB, is necessary.

Ensuring that these documents are completed and included with the Ultimate Health Insurance Claim Form enhances the likelihood of a quick and efficient claims review. Always double-check the requirements to avoid delays.

Similar forms

- Health Insurance Claim Form: Like the Ultimate Health Insurance Claim Form, this document is designed for covered individuals to request payment or reimbursement for healthcare services. It typically requires personal information, service details, and any necessary supporting documents, such as an Explanation of Benefits (EOB) from primary insurance.

- Auto Insurance Claim Form: This form serves a similar purpose in the auto insurance context. It collects information on the incident, the insured vehicle, and damages incurred. Supporting documents like police reports or repair estimates are often necessary, mirroring the claim submission process found in health insurance forms.

- Property Damage Claim Form: Similar to the Ultimate form, this document is used to claim compensation for damages to personal property. It asks for details about the incident, descriptions of damage, and necessary documentation such as photographs or repair estimates, reflecting the need for supporting evidence in health claims.

- Workers’ Compensation Claim Form: This form is for employees seeking reimbursement or coverage for work-related injuries. It gathers similar personal and incident details while emphasizing the importance of documentation, such as medical records or employer notifications, akin to health insurance claims.

- Life Insurance Claim Form: In the event of a policyholder's death, this document is filed by beneficiaries to claim benefits. It requires identification information, the insured’s details, and any necessary documentation, serving a similar role as the Ultimate Health Insurance Claim Form in claiming eligible benefits.

- Travel Insurance Claim Form: This form enables travelers to claim costs related to travel disruptions or medical emergencies abroad. It often requires travelers to provide detailed information about the incident, supporting documents, and proof of expenses, paralleling the documentation requirements of health claims.

- Disability Insurance Claim Form: This form allows individuals to request benefits for total or partial disability. Required information includes personal identification, the nature and cause of the disability, and accompanying medical documentation to establish eligibility, much like health insurance claim submissions.

- Short-Term Insurance Claim Form: This variation specifically handles claims under short-term health insurance policies. It gathers personal information, covered services, and necessary documentation similar to that of the Ultimate Health Care Claim Form, ensuring thoroughness in the claim process.

Dos and Don'ts

- Do: Include all supporting documentation, such as your primary medical, dental, or vision insurance Explanation of Benefits (EOB).

- Do: Attach your supporting documents in the same order as the claims listed on the form.

- Do: Limit the number of claims to five (5) per form.

- Do: Use one form for each claimant and policy year to ensure clarity.

- Do: Submit the claim form via fax or mail, but do not use both methods.

- Do: Sign and date your claim form with an actual signature.

- Don't: Mention “See Attached” for any details; provide all necessary information directly on the form.

- Don't: Write the total amount charged; only include the amount you are responsible for under Eligible Expense.

- Don't: Use statements that are not itemized; balance forward or previous balances will not be accepted.

- Don't: Submit cash or credit card receipts for prescription medications; a detailed receipt is required.

- Don't: Forget to indicate the Benefit Category and the appropriate coverage status for dental or vision expenses.

- Don't: Use a signature font; an actual signature is essential for processing your claim.

Misconceptions

- All claims can be submitted on one form. Many believe they can list multiple claims on a single submission. In fact, each claim form can only include five claims at most. For additional claims or different claimants, separate forms are required.

- Faxing and mailing the same claim is acceptable. Some assume that they can fax a claim while also mailing it for faster processing. However, only one method is allowed. Choose either fax or mail, not both.

- Any form of documentation can suffice. Many individuals think they can submit any receipt or statement for their claims. Yet, only specific documents, like Explanation of Benefits (EOB) or detailed invoices, are valid for claims processing.

- Claims will be processed even without supporting documents. Some people are under the impression that submissions without all necessary documentation will still be processed. This is not the case. Supporting documentation is essential.

- Submitting after the policy year is acceptable. It’s a common myth that claims can be submitted at any time. However, each policy has a defined year, and claims should be submitted accordingly. Verify your policy year to ensure timely submissions.

- Signatures can be electronically generated. There is a misconception that electronic signatures or font-generated names are acceptable. Claims require a handwritten signature on the form, along with a date.

- You can submit just a primary insurance EOB. Some believe it’s sufficient just to include the primary insurance EOB for every type of claim. In reality, different types of claims might require additional documentation, such as prescriptions for over-the-counter medications.

- Claim amounts should reflect total charges. There’s a belief that the claim amount must reflect the full total charged by the provider. Instead, it should represent only what the claimant owes after any insurance adjustments or coverage.

Key takeaways

When utilizing the Ultimate Health Insurance Claim form, it is crucial to follow specific guidelines to ensure a smooth submission process. Here are key takeaways to consider:

- Contact Member Services for log-in help at 1-855-943-4595.

- Submit claims online for quicker processing at www.ArmadaCare.com/myaccount.

- Always include supporting documentation, such as the primary medical Explanation of Benefits (EOB).

- Organize supporting papers in the same order as they appear on the claim form.

- Limit the claims to a maximum of five per form. Each claimant and policy year requires a separate claim form.

- Fax your completed form and documentation to 1-866-431-6339 or mail to ArmadaCare, P.O. Box 449, Hunt Valley, MD 21031.

- For direct deposit setup or address changes, reach out to Member Services at support@armadacare.com.

- Ensure you complete the claimant information accurately by including the relationship to the insured.

- Use your Certificate of Insurance as a primary resource to determine eligible expenses under each benefit category.

- Always provide actual signatures and include the date on the claim form; electronic signatures are not acceptable.

Following these steps will enhance the likelihood of a successful and timely claim submission. Familiarize yourself with the process to avoid common pitfalls and ensure you receive the benefits to which you are entitled.

Browse Other Templates

Nf3 Form - A fraud charge can lead to fines or civil penalties as specified in the form.

Superbill Template Pdf - Patients are identified by unique patient numbers for better tracking and management.

Checkbook Register Template Pdf - Avoid surprises in your account balance by recording every transaction promptly.