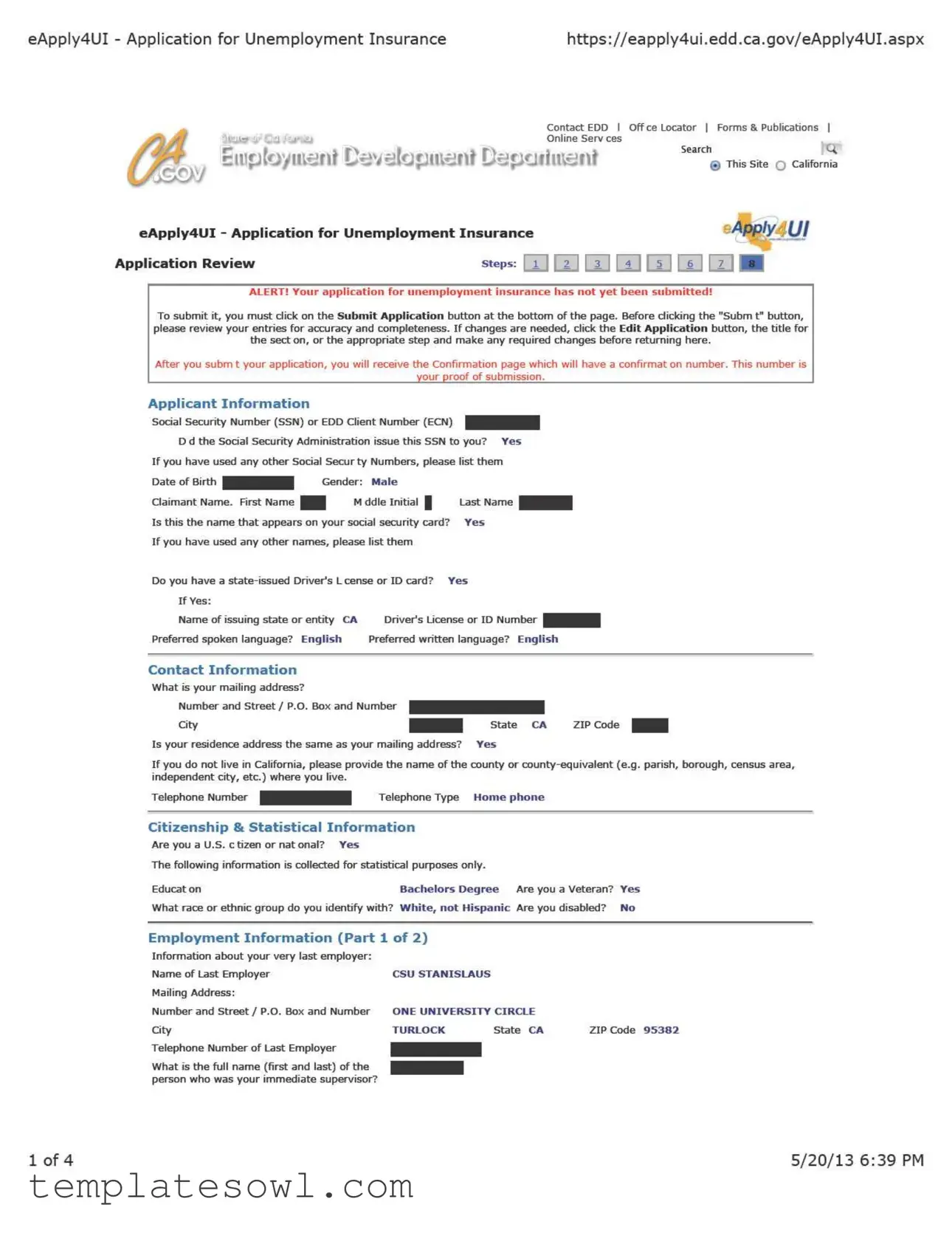

Fill Out Your Unemployment Application Form

Applying for unemployment benefits can seem overwhelming, but understanding the Unemployment Application form is the first step in navigating this process. This important document collects essential information about your employment history, reasons for separation, and financial details necessary for determining your eligibility. Key sections include your last employer's physical and mailing address, the last date you worked, and your gross wages from your final week of employment. Accurate reporting is crucial; you will need to detail any additional payments you may have received, such as holiday or vacation pay, separately from your regular wages. Furthermore, the application requires a comprehensive account of your work over the past 18 months, including part-time or temporary positions that might impact your claim. Correctly filling out these sections ensures that your benefits are reviewed without unnecessary delays. Providing complete and precise information, such as your usual occupation and any relevant skills, allows the Employment Development Department to make an informed decision quickly. Ultimately, your diligence in completing the form can facilitate a smoother transition during an unexpected period of unemployment.

Unemployment Application Example

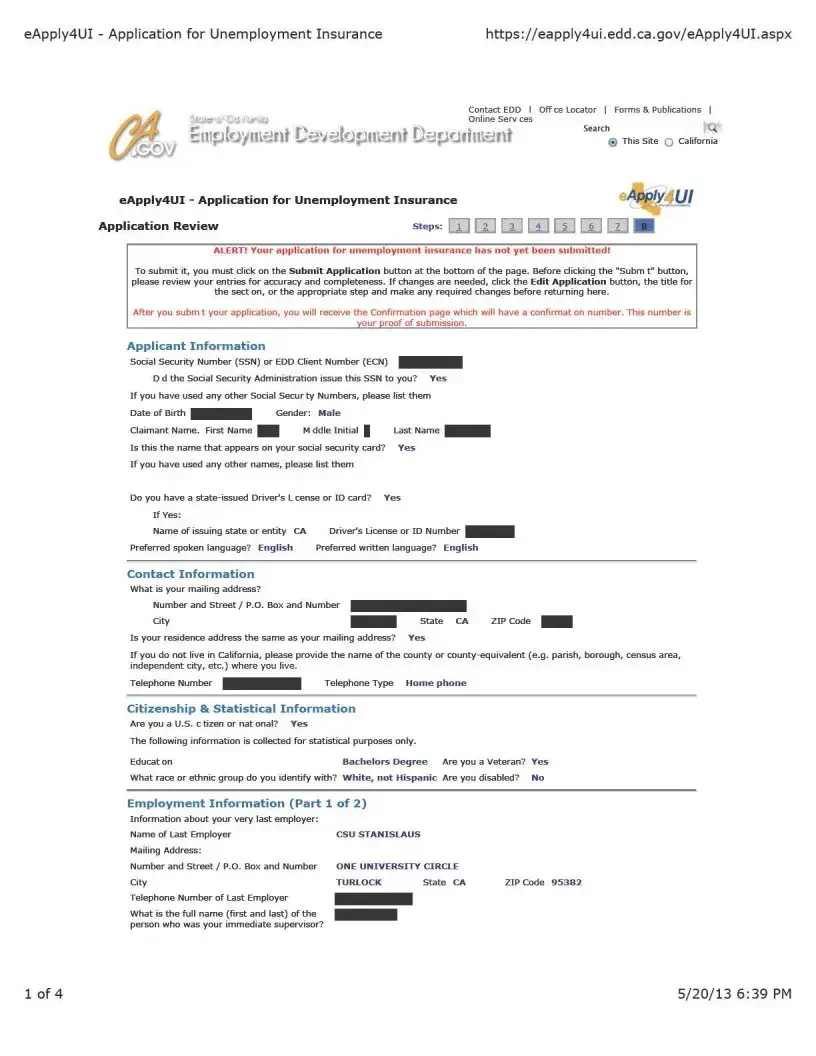

eApply4UI - Application for Unemployment Insurance |

https://eapply4ui.edd.ca.gov/eApply4UI.aspx |

Is the location or physical address of your very last employer the same as their mailing address? Yes

Last Date Worked |

05/18/2013 |

What are your gross wages for your last week of work (regular pay only)? $1,446.13

For UI purposes, a week begins on Sunday and ends the following Saturday. Whether you have been paid or not, report your total gross wages for your regular pay for the hours worked in the last week you worked, beginning w th Sunday and ending w th your last day of work as reported in question 3.

To calculate your total gross wages for your last week of work, multiply your hourly rate of pay by the total hours you worked from Sunday through the last day you worked (add piece work pay, if applicable).

Important!

If you were paid or if you will be pa d Holiday Pay, Vacation Pay, Severance Pay,

Reason No Longer Working: Laid Off/Lack of Work

Please provide a brief explanation (Maximum 150 characters):

If you received, or if you expect to receive, any payments from your very last employer or any other employer other than you regular salary, report the payment below.

From Date |

To Date |

(mm/dd |

(mm/dd |

Amount /yyyy) |

/yyyy) |

Holiday Pay

Vacation Pay

Severance Pay

Other Pay

Please explain Other Pay, if any (Maximum 150 characters):

Employment Information (Part 2 of 2)

Prov de your employment history for the past 18 months, including your very last employer. If you worked for a temporary agency, a labor contractor, an agent for actors, or an employer where wages are reported under a corporate name, your wages may have been reported under that employer name. You may want to refer to your check stub(s) or

Note: Failure to report all employers, periods of employment, and total wages may result in your benefits being delayed or denied. Provide as much accurate information as possible for each employer.

|

|

|

|

|

|

|

|

|

|

|||

|

a. Employer Name |

|

|

CSU STANISLAUS |

|

|

|

|

||||

|

b. Mailing Address |

|

|

ONE UNIVERSITY CIRCLE |

||||||||

|

c. City |

|

|

|

TURLOCK |

|

|

|

|

|||

|

d. State |

|

|

|

CA |

|

|

|

|

|

|

|

|

e. ZIP Code |

|

|

|

95382 |

|

|

|

|

|

|

|

|

f. First day you worked for this employer |

|

01/28/2013 |

|

|

|

|

|||||

|

g. Last day you worked for this employer |

|

05/18/2013 |

|

|

|

|

|||||

|

h. D d you work full time or part time? |

|

Part Time |

|

|

|

|

|||||

|

i. How much d d you earn per hour? |

|

$94.83 |

|

|

|

|

|

|

|||

|

j. How many hours did you work per week? |

15 |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross wages |

Gross wages |

Gross wages |

Gross wages |

Gross wages |

Gross wages |

|

|||||

|

earned from |

earned from |

earned from |

earned from |

earned from |

earned from |

|

|||||

|

1/1/2012 to |

4/1/2012 to |

7/1/2012 to |

10/1/2012 to |

1/1/2013 to |

4/1/2013 to |

|

|||||

|

3/30/2012 |

6/30/2012 |

9/30/2012 |

12/30/2012 |

|

3/30/2013 |

6/30/2013 |

|

||||

|

$5,121.00 |

$6,543.00 |

$4,979.00 |

$5,690.00 |

|

$13,015.00 |

$8,677.00 |

|

||||

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|||

a. Employer Name |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|||

b. Mailing Address |

|

|

|

|

|

|

|

. |

|

|

||

c. City |

|

|

|

|

|

|

|

|

|

|

|

|

d. State |

|

|

|

CA |

|

|

|

|

|

|

||

e. ZIP Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

f. First day you worked for this employer |

|

11/11/2011 |

|

|

|

|

||||||

g. Last day you worked for this employer |

|

5/20/2013 |

|

|

|

|

||||||

h. D d you work full time or part time? |

|

Part Time |

|

|

|

|

||||||

$0.00 |

|

|

|

$60.00 |

|

|

|

|

|

|

||

j. How many hours did you work per week? |

1 |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

2 of 4 |

5/20/13 6:39 PM |

eApply4UI - Application for Unemployment Insurance |

https://eapply4ui.edd.ca.gov/eApply4UI.aspx |

|

|

|

|

|

|

|

|

|

Gross wages |

Gross wages |

Gross wages |

Gross wages |

Gross wages |

Gross wages |

|

|

earned from |

earned from |

earned from |

earned from |

earned from |

earned from |

|

|

1/1/2012 to |

4/1/2012 to |

7/1/2012 to |

10/1/2012 to |

1/1/2013 to |

4/1/2013 to |

|

|

3/30/2012 |

6/30/2012 |

9/30/2012 |

12/30/2012 |

3/30/2013 |

6/30/2013 |

|

|

$140.00 |

$2,132.00 |

$300.00 |

$2,132.00 |

$2,332.00 |

$0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

During the past 18 months, did you work for any other employers not listed above in quest on 1? No

In the past 18 months, which employer did you work for the longest? |

CSU STANISLAUS |

How long did you work for that employer? |

Years 13 Months 6 |

What type of business did that employer operate? (For example: retail furn ture HIGHER EDUCATION |

|

sales, legal services, software manufacturing, road construction, etc.) |

|

What kind of work did you do for that employer? |

|

Are you currently working for or do you expect to work for any school or |

|

educational institution or a public or nonprofit employer performing |

No |

work? |

|

|

|

Availability Information

What is your usual occupat on? |

UNIVERSITY LECTURER |

What other |

COMPUTER SKILLS |

Is your usual occupation seasonal? |

Yes |

If Yes: |

|

When does the season begin? |

08/22/2013 |

When does the season end? |

12/11/2013 |

Do you expect to return to work for a former employer? |

No |

Do you have a date to start work? |

No |

Are you available for immediate |

Yes |

Are you currently

If Yes:

Please explain (Maximum 150 characters):

Are you a member of a union? Yes |

|

If Yes: |

|

Union Name |

CALIFORNIA FACULTY ASSOCIATION |

Union Number |

1983 |

Telephone number of Union |

(916) |

Does your union look for work for you? |

No |

Does your union control your hiring? |

No |

Are you registered with your union as out of work? No |

|

Are you going to receive strike benef ts? |

No |

|

|

Additional Information

In the past 2 years did you file a claim for Unemployment Insurance (UI) or Disability Insurance (DI)? Yes

If Yes: provide the most recent type(s) of claim(s) and date(s)

Claim Type |

Month |

Year |

Unemployment Insurance |

December |

2012 |

Are you receiving, or will you receive in the next year, a pension other than Social Security or Railroad Retirement, which is based on your own work or wages? No

Are you receiving or do you expect to receive Workers' Compensation? No

Are you currently attending or are you planning to attend school or training? No

Are you now or have you been in the last 18 months an officer of a corporat on or union or the sole or major stockholder of a corporation? No

D d you serve as elected publ c official or

If the EDD finds that you do not have sufficient wages in the Standard Base Period to establish a valid UI claim, do you want to attempt to establish a claim using the Alternative Base Period? Yes

3 of 4 |

5/20/13 6:39 PM |

eApply4UI - Application for Unemployment Insurance |

https://eapply4ui.edd.ca.gov/eApply4UI.aspx |

Back to Top | Contact EDD | Conditions of Use | Privacy Policy | Equal Opportunity Notice | Site Map

The Employment Development Department is an equal opportunity employer/program. Auxiliary aids and services are available upon request to individuals with disabilities.

Copyright © 2010 State of California

4 of 4 |

5/20/13 6:39 PM |

Form Characteristics

| Fact Name | Details |

|---|---|

| Application Purpose | The form is used to apply for Unemployment Insurance (UI) benefits in California. |

| Application Link | You can complete the application online at eApply4UI. |

| Gross Wages Reporting | Applicants must report their total gross wages from the last week of work, excluding certain types of pay. |

| Reason for Unemployment | Common reasons for applying include being laid off or lacking work. |

| Governing Law | This application is governed by provisions in the California Unemployment Insurance Code, specifically sections 1253.3. |

Guidelines on Utilizing Unemployment Application

After completing the Unemployment Application form, you will be able to submit your application for consideration. This application is essential for determining your eligibility for unemployment benefits. Following the submission, the Employment Development Department (EDD) will review your information and guide you through any next steps required.

- Start by visiting the EDD website and locate the Unemployment Application form.

- Provide your personal information, including your name, Social Security number, and contact details.

- Indicate if the physical address of your last employer matches their mailing address, and answer “Yes” if it does.

- Enter the last date you worked for your employer (e.g., 05/18/2013).

- Report your gross wages for the last week worked, only including regular pay (e.g., $1,446.13), ensuring you follow the week definition provided.

- State the reason you are no longer working (e.g., Laid Off/Lack of Work). Provide a brief explanation within the character limit specified.

- Detail any other payments expected from your last employer, such as Holiday Pay or Vacation Pay, if applicable.

- Document your employment history for the past 18 months. Start with your most recent employer and include all necessary details like name, address, and wages.

- For each employer, specify your role, earnings per hour, and weekly work hours.

- Answer questions about your availability for work and whether you have been self-employed, including your work schedule.

- Provide any additional information regarding past claims for Unemployment Insurance or any potential pension you may be receiving.

- Finally, review your entries for accuracy before submitting the application.

What You Should Know About This Form

What is the purpose of the eApply4UI application form?

The eApply4UI application form is used to apply for Unemployment Insurance (UI) benefits in California. It collects information about the applicant's work history, wages, and reasons for unemployment to determine eligibility for benefits.

How do I calculate my gross wages for the last week of work?

To calculate gross wages for your last week of work, multiply your hourly pay rate by the number of hours worked from Sunday through your last day of employment. Include only regular pay and do not report any payments such as holiday pay, vacation pay, or severance pay in this section.

What do I do if I have not received my last paycheck?

If you have not received your last paycheck, you should still report what you would have earned for that week based on your usual hours and pay rate. It is important to accurately reflect your employment situation, as benefits may rely on this information.

What is considered "Other Pay" in the application?

"Other Pay" refers to any payments received from your last employer other than your regular salary. This can include holiday pay, vacation pay, severance pay, and bonus pay. You must report these payments separately from your gross wages when filling out the application.

What happens if I forget to mention a previous employer in my application?

If you fail to report all employers, employment periods, and total wages, there may be a delay or denial of your benefits. It is crucial to provide complete and accurate employment history to avoid complications.

How does the EDD determine eligibility for unemployment benefits?

The Employment Development Department (EDD) evaluates your eligibility for unemployment benefits based on your work history, wages, and the reason for unemployment. Factors such as the length of your employment and available earnings will be taken into account in the decision process.

Can I still receive benefits if I am self-employed?

What should I do if I have been laid off?

If you have been laid off, you should indicate this reason on the application form. Provide any necessary details about your employment status and specify the reason for separation as “Laid Off/Lack of Work." This information is critical in establishing your claim.

How important is it to answer all questions accurately on the application?

It is very important to answer all questions accurately. Incomplete or incorrect information can lead to delays in processing your application or a possible denial of benefits. Take the time to review your responses before submitting the application.

Common mistakes

Completing the Unemployment Application form can be a straightforward process, but several common mistakes may lead to complications in receiving benefits. One frequent error is inaccurately reporting gross wages. Applicants sometimes include holiday pay or severance pay when responding to the wage question. It is essential to only report regular salary, as other types of compensation should be detailed separately in the designated section. Failure to adhere to this guideline may result in delays or the denial of benefits.

Another mistake involves the omission of relevant employment history. When filling out the application, individuals must provide complete details about all employers over the past 18 months. Many people forget to include temporary positions or contracts, thinking they are not significant. However, this information is crucial for the review process. Incomplete or incorrect reporting can hinder the application and cause unnecessary complications.

A third mistake often occurs in the reason provided for no longer working. Applicants sometimes use vague terminology that does not clearly explain their situation. While it's crucial to stay concise, it is equally important to offer enough detail that accurately describes the circumstances of employment termination. Using clear and direct language can aid in the processing of the application.

Finally, miscommunication regarding availability for work can create issues. Some applicants misunderstand the question about immediate job availability. A common error is stating they are available for part-time work while the form specifically asks about full-time availability. Clear communication about one's willingness and capability to accept work is necessary, as it can impact eligibility for benefits.

Documents used along the form

When applying for unemployment benefits, there are several forms and documents you might need to submit alongside the Unemployment Application Form. These helping documents can provide essential information and support your claim. Here’s a brief overview of the most commonly used forms:

- W-2 Form: This form details your annual earnings and the amount of taxes withheld. It's essential for verifying your income and employment history.

- Pay Stubs: Recent pay stubs can show your status and pay rate before unemployment. They help establish your earnings quickly.

- Employment Verification Letter: This letter, usually from your last employer, confirms your employment dates and job title, adding credibility to your application.

- Records of Other Income: Any documents showing other income sources such as freelance work or side jobs can support your financial situation accurately.

- Severance Agreement: If you received severance pay, this agreement outlines the terms and can help clarify your financial status during your claim.

- Disability Insurance Documentation: If you’ve filed for disability, include records to show how it affects your unemployment eligibility.

- Job Search Logs: Keeping a record of jobs you’ve applied for demonstrates your active job search efforts, which may be required to maintain benefits.

- Claim History: If you've made previous unemployment claims, providing this history can help inform your current application.

- Tax Returns: Recent tax returns give a complete picture of your financial standing and validate your earnings over the past year.

- Union Affiliation Confirmation: If you're a union member, documentation that confirms your membership may be necessary, especially if your union offers assistance in job placement.

Having these documents ready can smooth the application process and enhance your chances of receiving benefits promptly. Make sure to check with your local unemployment office for any specific requirements related to your situation.

Similar forms

- Job Application Form: Like the Unemployment Application, job application forms require personal information, past employment details, and reasons for leaving previous positions.

- Tax Return (1040): Both documents request information about income, employment status, and any deductions or credits relevant to your financial situation.

- Social Security Disability Application: Both require detailed employment history, income information, and reasons for inability to work.

- Workers' Compensation Claim Form: Like the Unemployment Application, it requires information about your employer, job duties, and reasons for seeking benefits.

- State Benefits Application: Both documents ask for personal information and the reasons why individuals are seeking state support.

- Rental Assistance Application: Both forms collect information about income, employment status, and any recent changes in financial circumstances.

- Basic Financial Aid Application (FAFSA): Similar to the Unemployment Application, it gathers financial and employment history to determine eligibility for assistance.

- Food Assistance Application: This document also collects personal and income information to assess eligibility for benefits.

- Credit Application: Both require detailed employment and income information to determine eligibility for service or assistance.

Dos and Don'ts

When filling out the Unemployment Application form, consider the following dos and don'ts:

- Do provide accurate employment history for the past 18 months.

- Do report all sources of income separately, such as Holiday Pay and Vacation Pay.

- Do review your application for mistakes before submission.

- Do specify the last date you worked and reason for unemployment clearly.

- Don’t include severance pay in gross wages; report it separately.

- Don’t omit any employers or periods of employment; this can delay your benefits.

Misconceptions

- Misconception 1: You need to report all forms of pay in your gross wages.

- Misconception 2: You can enter inaccurate information without consequences.

- Misconception 3: Your mailing address must match your employer's location.

- Misconception 4: You need to have been employed full-time to qualify.

- Misconception 5: You don’t have to report any previous employer if you’ve only worked part-time.

- Misconception 6: Seasonal work disqualifies you from benefits.

- Misconception 7: You should report your total wages from the entire year.

- Misconception 8: The unemployment application form is only relevant to laid-off workers.

Only report your regular pay and exclude any holiday, vacation, or severance pay. These should be recorded separately under "Other Payments."

Providing incorrect or incomplete information can delay or deny your benefits. It’s crucial to report as much accurate information as possible.

It is not necessary for your employer’s mailing address to match their physical location. Focus on accurately providing the required addresses as listed on your documents.

You can qualify for unemployment benefits even if you were employed part-time. Report all relevant employment information.

Regardless of hours worked, you must report all employers from the past 18 months. Omission can lead to problems with your claim.

Seasonal work does not disqualify you. If your occupation is seasonal, make sure to provide the relevant dates.

Only report gross wages from your last week of work as determined by the specified reporting period. Do not include wages from prior weeks or months.

The form applies to anyone who has lost work, including those whose contracts completed, like part-time lecturers. Explain your situation when prompted.

Key takeaways

Filling out the Unemployment Application form can be quite straightforward if you keep a few key points in mind. Here are some vital takeaways to ensure a smooth application process:

- Gather your documentation ahead of time. Before you begin the application, it’s helpful to have your employment history, pay stubs, and any other relevant information handy.

- Use accurate dates. Always make sure the start and end dates of your employment are correct to avoid any issues with your claim.

- Report gross wages accurately. You should report your total gross wages for your last week of work, including only regular pay. Exclude any holiday, vacation, or severance pay from this amount.

- Be honest about your work history. It's essential to report all employers and periods of employment from the past 18 months. Missing even one could delay or deny your benefits.

- Clarify any additional payments. If you received payments outside your regular salary, like bonuses or commissions, report them separately as instructed.

- Check your availability. Make sure to indicate if you are available for full-time work right away. This information can impact your claim’s processing.

- Reach out for help if you need it. If you’re having trouble understanding any part of the application, don’t hesitate to contact a representative for guidance.

Staying organized and attentive while filling out the form can enhance your chances of a successful claim. Good luck!

Browse Other Templates

How to Check Status of Tsa Precheck - Use black ink only when filling out Form 2811.

American Nurses Credentialing Center - Inaccuracies in the form can lead to complications, so careful accuracy is necessary.