Fill Out Your Unemployment Commission Form

The Unemployment Commission form is a vital document in the unemployment insurance process. Specifically, it is used by the Division of Employment Security to gather necessary information from employers when an individual files a claim for unemployment benefits. Employers are identified as the last employer of the claimant and are required to provide detailed responses to several key questions within the form. Timeliness and clarity are crucial; a prompt and complete reply can significantly influence the outcome of the claimant's eligibility for benefits. Employers must disclose whether the individual remains employed, the reason for separation, and any payments made to the claimant, like wages, severance, or vacation pay. Importantly, if a person is unemployed because of a lack of work, the separation details may not be further scrutinized. Employers are encouraged to respond via mail or fax and provide contact information for further inquiries. Thoroughness in completing the form can not only affect the claimant's benefits but might also impact the employer's tax rate, making understanding this document essential.

Unemployment Commission Example

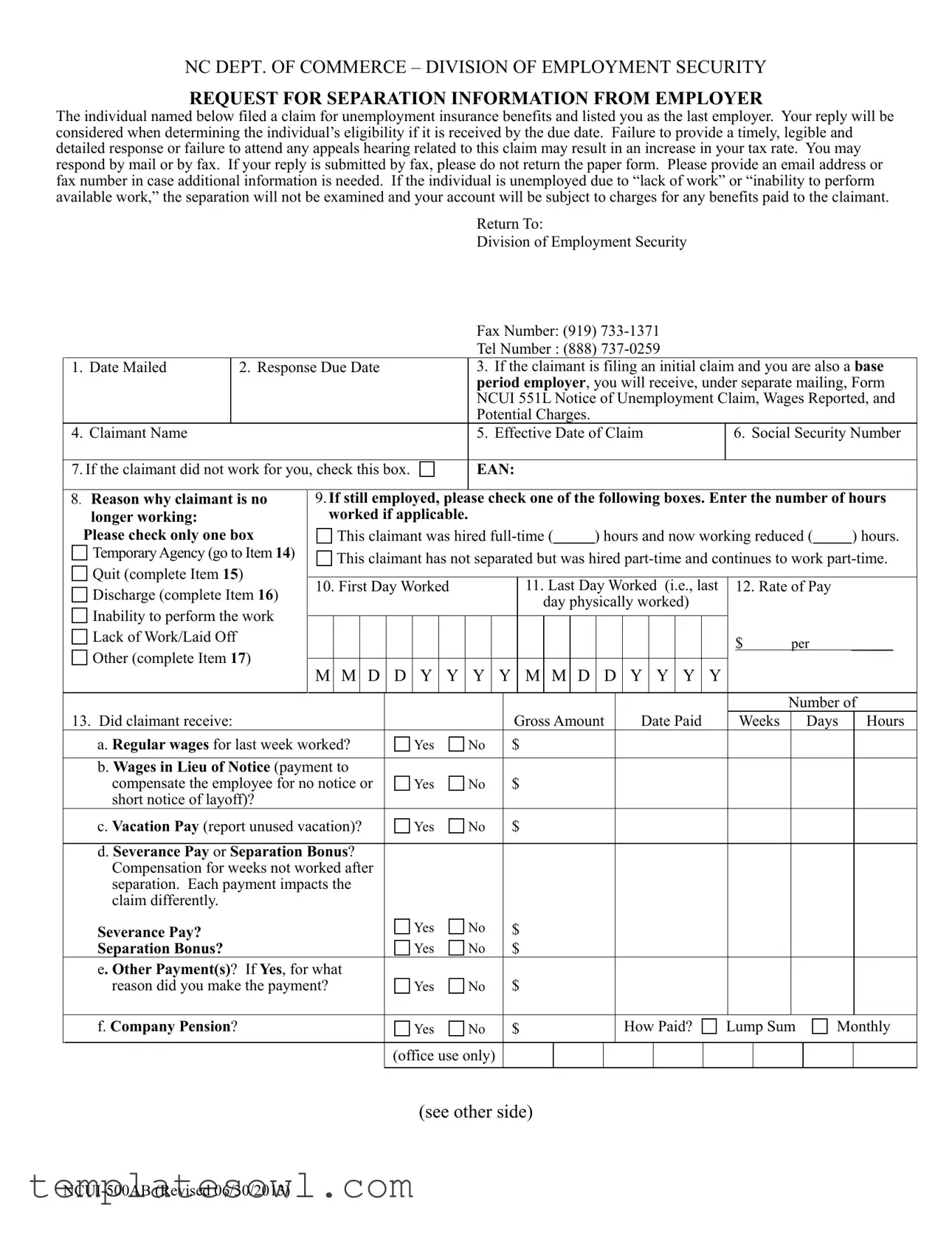

NC DEPT. OF COMMERCE – DIVISION OF EMPLOYMENT SECURITY

REQUEST FOR SEPARATION INFORMATION FROM EMPLOYER

The individual named below filed a claim for unemployment insurance benefits and listed you as the last employer. Your reply will be considered when determining the individual’s eligibility if it is received by the due date. Failure to provide a timely, legible and detailed response or failure to attend any appeals hearing related to this claim may result in an increase in your tax rate. You may respond by mail or by fax. If your reply is submitted by fax, please do not return the paper form. Please provide an email address or fax number in case additional information is needed. If the individual is unemployed due to “lack of work” or “inability to perform available work,” the separation will not be examined and your account will be subject to charges for any benefits paid to the claimant.

Return To:

Division of Employment Security

|

|

|

Fax Number: (919) |

|

|

|

|

Tel Number : (888) |

|

1. |

Date Mailed |

2. Response Due Date |

3. If the claimant is filing an initial claim and you are also a base |

|

|

|

|

period employer, you will receive, under separate mailing, Form |

|

|

|

|

NCUI 551L Notice of Unemployment Claim, Wages Reported, and |

|

|

|

|

Potential Charges. |

|

4. |

Claimant Name |

|

5. Effective Date of Claim |

6. Social Security Number |

|

|

|

||

7. If the claimant did not work for you, check this box. |

EAN: |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

8. Reason why claimant is no |

9. If still employed, please check one of the following boxes. Enter the number of hours |

|||||||||||||||||||||||||||||||||

longer working: |

worked if applicable. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Please check only one box |

|

This claimant was hired |

|

|

) hours and now working reduced ( |

|

|

) hours. |

||||||||||||||||||||||||||

Temporary Agency (go to Item 14) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

This claimant has not separated but was hired |

|||||||||||||||||||||||||||||||||

Quit (complete Item 15) |

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. First Day Worked |

|

|

|

11. Last Day Worked (i.e., last |

|

12. Rate of Pay |

|

|

|

|

|

|||||||||||||||||||||||

Discharge (complete Item 16) |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

day physically worked) |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Inability to perform the work |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lack of Work/Laid Off |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

per |

|

______ |

|

|||||

Other (complete Item 17) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

M |

M |

D |

D |

Y |

Y |

Y |

Y |

M |

M |

D |

|

D |

Y |

|

Y |

Y |

Y |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

13. Did claimant receive: |

|

|

|

|

|

|

|

|

|

Gross Amount |

|

Date Paid |

|

|

|

Number of |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

Weeks |

|

|

Days |

|

|

Hours |

|||||||||||||||||

a. Regular wages for last week worked? |

|

Yes |

No |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

b. Wages in Lieu of Notice (payment to |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

compensate the employee for no notice or |

|

Yes |

No |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

short notice of layoff)? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

c. Vacation Pay (report unused vacation)? |

|

Yes |

No |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

d. Severance Pay or Separation Bonus? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Compensation for weeks not worked after |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

separation. Each payment impacts the |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

claim differently. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Severance Pay? |

|

|

|

|

Yes |

No |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Separation Bonus? |

|

|

|

|

Yes |

No |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

e. Other Payment(s)? If Yes, for what |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

reason did you make the payment? |

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

f. Company Pension? |

|

|

|

|

Yes |

No |

$ |

|

|

|

|

|

|

How Paid? |

Lump Sum |

Monthly |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

(office use only) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(see other side)

Claimant:SSN:DD:

14. COMPLETE THIS SECTION IF YOU ARE A TEMPORARY EMPLOYMENT SERVICES EMPLOYER:

The individual is not separated, is eligible for suitable work assignments, but no suitable work assignments are currently available.

The individual is not separated, is eligible for suitable work assignments, but no suitable work assignments are currently available.

Was claimant offered a new assignment? |

Yes |

No |

If yes, did he/she accept? |

Yes |

No |

If the questions above do not apply to this claimant, please respond to either Item 15 or 16.

Please provide the following information regarding work refused:

Date offered Type of work |

Pay Rate: $ |

|

|

|

Days Hours Distance |

Reason |

|

HR WK |

MO |

YR |

to site |

refused |

|

|

|

|

|

|

|

Go to #17 |

The following questions refer to the claimant’s last assignment:

Employer name and location:

Claimant’s job: |

|

|

|

|

First day worked: |

Last day worked: |

|

|

|

|

|

|

|

|

|

Pay rate: $ |

|

|

|

|

|

Work hours: |

Days worked: |

HR WK |

MO |

YR |

|

|

|||

|

|

|

|

|

|

|

|

15.COMPLETE THIS SECTION IF THE CLAIMANT QUIT.

a. What reason did the claimant give for quitting? (If you need more space, continue in Item 17.)

b. Did claimant give prior notification of resignation? |

Yes |

No If yes, please provide date: |

|

If claimant gave notification was it: |

Oral |

Written |

(Please provide copy) |

16.COMPLETE THIS SECTION IF THE CLAIMANT WAS DISCHARGED. a. When you informed the claimant of the discharge, what reason did you provide?

Was this a policy violation? ? |

Yes |

No |

If Yes, please provide documented proof as necessary. |

||||||

b. Was the claimant warned regarding this behavior? |

? |

Yes |

No |

|

|

||||

Date(s) of warnings for this behavior? |

|

|

|

|

|

|

|||

The warning(s) was: |

Oral |

|

Written |

|

Both |

|

|

|

|

(Provide details regarding the nature of the warnings in Item 17. Attach documentation.) |

|||||||||

c. Did the reason for discharge involve tardiness or attendance? ? |

Yes |

No If Yes, please provide the dates and reasons |

|||||||

regarding incidents. |

|

|

|

|

|

|

|

|

|

17. COMPLETE THIS SECTION OR A SEPARATE SHEET FOR ADDITIONAL INFORMATION.

Name of the individual to contact for additional information: |

|

Contact Telephone Number: |

||||||

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature |

Name Printed |

|

|

Title |

|

Date Signed |

||

|

|

|

|

|

|

|

|

|

Email address: |

|

|

|

Fax number: ( |

) |

|

|

|

(Please fax both front and back sides to DES)

NCUI500AB (Revised 06/30/2013)

Form Characteristics

| Fact Name | Description |

|---|---|

| Governing Body | The form is governed by the North Carolina Division of Employment Security. |

| Purpose | Employers use this form to provide separation information for employees claiming unemployment benefits. |

| Response Requirement | Timely and legible responses are crucial to avoid increased tax rates for employers. |

| Submission Method | Responses can be submitted by mail or fax; fax submissions do not require sending the paper form. |

| Claimant Information | Includes crucial details such as the claimant's name, social security number, and employment dates. |

| Employer Notification | Employers may receive additional documentation if the claimant is a base period employer. |

| Separation Categories | Employers must indicate reasons for separation, including lack of work or resignation. |

Guidelines on Utilizing Unemployment Commission

Once you have the Unemployment Commission form in front of you, the next steps involve carefully filling out each section. It's important to provide accurate and complete information as it directly impacts the claimant's eligibility for benefits. Make sure to have any necessary documents and details at hand to ensure a smooth process.

- Write the Date Mailed in the designated space.

- Provide the Response Due Date.

- If the claimant has filed an initial claim and is a base period employer, note that you will receive Form NCUI 551L separately.

- Fill in the Claimant Name.

- Write the Effective Date of Claim.

- Enter the Social Security Number.

- If the claimant did not work for you, check the appropriate box.

- Provide the Employer Account Number (EAN).

- Indicate the Reason why the claimant is no longer employed.

- If the claimant is still employed, check the relevant box and fill in the number of hours worked.

- State the First Day Worked and the Last Day Worked.

- Fill in the Rate of Pay.

- Answer whether the claimant received regular wages, wages in lieu of notice, vacation pay, severance pay, or other payments, providing the required details for each.

- If you are a temporary employment services employer, complete the section for the claimant's work assignments.

- If the claimant quit, explain the reason for quitting, indicate if prior notification was given, and provide specifics as necessary.

- If the claimant was discharged, detail the reason provided at the time of discharge and note any warnings given.

- In Item 17, either complete the section or provide additional information on a separate sheet if necessary.

- Designate a contact person for further inquiries and include their telephone number.

- Sign the form, print your name, and include your title and the date.

- Provide an email address and fax number for further communication.

What You Should Know About This Form

What is the purpose of the Unemployment Commission form?

This form is used by the North Carolina Department of Commerce’s Division of Employment Security to collect important separation information from employers after a claim for unemployment benefits has been filed by an employee. The information provided helps the agency determine the eligibility of the individual for benefits. If you are the last employer listed by the claimant, your detailed response is crucial.

What happens if I do not respond to the form?

If you fail to provide a timely and legible response to the form, it could result in negative consequences for your business. Specifically, your tax rate may increase. It is in your best interest to reply accurately and on time to avoid these penalties.

How should I submit my response to the form?

Your response can be submitted by either mail or fax. If you choose to send your reply by fax, do not send back the paper form. It is also helpful to include an email address or fax number so that the Unemployment Commission can reach you for any follow-up information if needed.

What information do I need to provide if the claimant is still employed?

You will need to indicate the number of hours the individual is working if they are still employed but under different circumstances, such as reduced hours or part-time status. Choose only the appropriate option that best reflects the claimant's situation at the time of your response.

What types of payments should I report on the form?

You must report various types of payments that the claimant may have received, including regular wages for the last week worked, wages in lieu of notice, vacation pay, severance pay, and any bonuses. Each type of payment has different implications for the claim and can affect the eligibility of the individual for unemployment benefits.

What should I do if the claimant quit their job?

If the claimant quit, you are required to provide a detailed explanation for their resignation. The form will ask specific questions regarding whether the employee gave prior notification and whether that notification was written or oral. This information aids in assessing the claimant's situation accurately.

How do I handle situations where the claimant was discharged?

If a claimant was discharged, you should include the reason for the discharge when notifying the Unemployment Commission. You might also need to provide details about any previous warnings related to the behavior that led to the discharge. This information can be important during the claims process.

Who should I contact if I have questions about completing the form?

If you have questions or need clarification while filling out the form, it is advisable to reach out to the individual whose name is listed on the form for additional information. Providing a contact number will facilitate effective communication regarding the claim.

Common mistakes

When filling out the Unemployment Commission form, individuals often make several common mistakes that can impact the outcome of their claims. One prevalent error is not providing all necessary personal information. This includes the claimant's full name, social security number, and effective date of the claim. Omitting or incorrectly entering this information can lead to delays in processing the application or even denials of benefits.

Another frequent oversight occurs when individuals fail to respond to all questions thoroughly. The form contains specific queries about the employment history of the claimant, including the reason for separation. Skipping these questions or providing vague answers can hinder the evaluation process. It's crucial to be clear and detailed, as the lack of adequate information can lead to misunderstandings regarding the claimant's eligibility.

Additionally, many people neglect to check the appropriate boxes that indicate the status of the claimant’s employment. Properly indicating whether the claimant was discharged, quit, or is still working part-time is vital. Misclassification can result in an improper assessment and a denial of benefits. Every selection on the form plays a role in illustrating the claimant's situation accurately.

Completing the form under pressure can lead to hasty mistakes, such as entering the wrong dates. For example, writing the wrong last day worked or initial date of employment can create confusion during the review process. Ensuring that all dates are correct is essential, as discrepancies can raise red flags or prolong the claims evaluation.

Poor legibility is another mistake that can affect the submission. Filling out the form by hand may result in unclear handwriting, which can make it difficult for the reviewers to read essential information. To avoid this problem, individuals should consider typing their responses or ensuring that their handwriting is as clear as possible to promote understanding.

Lastly, failing to provide contact information for follow-up can lead to complications in the process. Including a phone number, email address, or fax number is crucial for the Unemployment Commission to reach the claimant if additional information is required. Without this information, delays become inevitable, which can leave claimants without benefits for longer periods than necessary.

Documents used along the form

When filing for unemployment benefits, it’s essential to have various forms and supporting documents ready to submit alongside the Unemployment Commission form. Each document plays a crucial role in ensuring a smooth application process and determining eligibility for benefits. Here’s a list of commonly used forms and documents:

- W-2 Form: This form provides detailed information about an employee's annual wages and the taxes withheld. It is essential for verifying income during the specified base period.

- Pay Stubs: Recent pay stubs can show current income levels and employment status, helping to clarify any discrepancies in wages claimed on the unemployment application.

- Separation Notice: This document outlines the circumstances of the individual's departure from their last job and is often required to assess eligibility for unemployment benefits.

- Confirmation of Employment: A letter from the previous employer confirming the dates of employment and the reasons for separation may be required to support the claim.

- Claimant’s ID: A government-issued identification, like a driver’s license or state ID, helps verify the identity of the claimant in the unemployment filing process.

- Direct Deposit Enrollment Form: This form allows for the direct deposit of unemployment benefits into the claimant's bank account, facilitating quicker access to funds.

- Appeal Form: If the unemployment claim is denied, an appeal form outlines the basis for contesting that decision and is essential for challenging the outcome.

- Employer Response Form: Employers are often required to complete a response form regarding the claimant’s separation, providing necessary details about their employment status.

- Medical Documentation: If applicable, documents like medical records can support claims related to inability to work due to health-related issues.

- Training Program Registration: If the claimant enrolls in a training program designed to enhance employability, this documentation may be beneficial for their unemployment claim.

Gathering these documents ahead of time can help streamline the unemployment claims process, ensuring that all necessary information is provided to support eligibility for benefits. Always check your specific state's requirements, as they may vary, and having everything ready will make the process less stressful.

Similar forms

When dealing with unemployment claims and separation notices, the Unemployment Commission form shares similarities with several other documents. Here’s a list of eight such forms that are often used in similar contexts:

- W-2 Form (Wage and Tax Statement): This form summarizes an employee's annual wages and taxes withheld. Like the Unemployment Commission form, it requires accurate records from the employer about the employee's wages and employment status.

- Form 1099-MISC: Often used for independent contractors, this form reports payments made to individuals not classified as employees. Both forms require clear details about the worker and the nature of their compensation.

- Employer Separation Certificate: This document provides information regarding an employee's separation from work, including reasons for termination. It aligns closely with the Unemployment Commission form as both focus on separating employee details and employment status.

- Form I-9 (Employment Eligibility Verification): This form verifies the identity and employment eligibility of individuals hired in the U.S. While the purposes differ, both forms require detailed information from employers about their staff.

- Notice of Layoff/Job Termination: This document informs employees about layoffs or termination, similar to the communication facilitated by the Unemployment Commission form regarding employee status and separation reasons.

- Claim for Unemployment Benefits: Similar to the Unemployment Commission form, this claim must provide detailed personal information and employment history to assess eligibility for benefits.

- Severance Agreement: This document outlines the terms of an employee's severance package, including compensation and benefits. Both forms address the conditions under which an employee exits a company.

- Release of Claims Agreement: This legal document allows an employee to waive the right to sue the employer in exchange for some form of compensation. Like the Unemployment Commission form, it involves the details of employment and separation.

Each of these documents serves a critical function in managing the complexities surrounding employment relationships, especially during separations. Ensuring accurate completion and timely submission of these forms is vital in maintaining compliance and facilitating efficient processes.

Dos and Don'ts

When filling out the Unemployment Commission form, there are several important steps to ensure accurate and timely submission. Below is a list of what to do and what to avoid.

- Do double-check all information for accuracy before submitting.

- Do provide all necessary documentation as requested.

- Do respond by the due date to avoid penalties.

- Do use a clear and legible format for your responses.

- Don’t leave any sections blank unless instructed.

- Don’t submit additional papers if responding by fax; only send the completed form.

By following these guidelines, you can help facilitate the processing of the unemployment claim.

Misconceptions

The Unemployment Commission form is an important document, yet there are several misconceptions surrounding it. Understanding these misconceptions can help individuals and employers navigate the claims process more effectively.

- The form is only for employers. Many believe the form's purpose is strictly for employer use. In reality, it is also vital for employees who are seeking benefits. Their eligibility hinges on the information provided by their former employer.

- Responses are optional. Some think providing a response is optional. However, timely and detailed responses are crucial. Failing to respond on time can lead to increased tax rates for employers.

- The client does not need to be notified. It is a common misconception that claimants should not be informed when the form is submitted. Employers should keep their former employees updated on any actions taken regarding their claim, as this fosters transparency.

- Information can be submitted in any format. Many assume that the information can be provided in any manner, but the form specifies submission by mail or fax only. Email communication is not accepted unless requested.

- The time limit is flexible. Some believe they have a flexible deadline to respond. In fact, each form specifies a due date, and missing it could have financial implications for the employer.

- Any reason for separation will be examined. It is often thought that all reasons for a claimant's separation will be scrutinized. However, if the separation is due to lack of work or inability to perform available work, this issue will not be examined.

- Incomplete forms can be submitted. Some individuals believe that they can submit incomplete forms and it won’t matter. However, a detailed response is essential for proper assessment of the claim. Incomplete forms may delay processing.

- All payments to the claimant negatively impact the employer. While it is understood that some payments may affect a claim, not all will lead to negative consequences. Understanding how different types of payments impact benefits is essential for employers.

By clearing up these misconceptions, employers and claimants can engage more effectively with the Unemployment Commission process. It is beneficial for all parties involved to be well-informed and proactive.

Key takeaways

When filling out and using the Unemployment Commission form, keep these key takeaways in mind:

- Timeliness is crucial. Your response must be submitted by the due date to avoid negative consequences for your tax rate.

- Choose your submission method wisely. You can respond by mail or fax, but avoid returning the paper form if you fax your response.

- Provide contact details for follow-up. Include an email address or fax number for any additional information requests.

- Understand the separation reasons. If the claimant's unemployment falls under "lack of work" or "inability to perform available work," your account will be charged for benefits paid.

- Be aware of the forms involved. If you are also a base period employer, expect to receive a separate form detailing wages reported and potential charges.

- Document all relevant dates. Include the dates for the claimant’s first and last day worked, and any important notifications about their employment status.

- Record earnings accurately. Report regular wages, severance pay, and any additional payments clearly, as each type affects the claim differently.

- Respond accurately if the claimant quit or was discharged. The form specifically asks for reasons and documentation regarding these statuses.

- Provide a contact for further information. Include a name and contact number for anyone following up on the submitted information.

Browse Other Templates

Receipt Format - Finally, this form serves as a helpful reminder of the rental obligations.

Hazmat Bol - This new regulation reflects the evolving standards in hazardous materials management.

Pos 010 - Using the correct addresses for service reduces the likelihood of unsuccessful service attempts.