Fill Out Your Uniform Assistance Form

Facing financial hardship can be an overwhelming experience, but the Uniform Borrower Assistance Form is designed to provide the needed support for homeowners navigating these tough times. This form is essential for borrowers who seek mortgage relief due to temporary or long-term difficulties. To begin the process, homeowners must fill out this form and submit it with necessary documentation that demonstrates their financial situation. The form requires borrowers to share personal information, intentions regarding their property, and the current status of their financial obligations, such as real estate taxes and homeowner’s insurance premiums. Additionally, it addresses bankruptcy concerns and other liens on the property. On the second page, detailed income, expenses, and assets must be outlined. This section is crucial as it guides lenders in understanding the borrower’s financial landscape. The third page includes a Hardship Affidavit where individuals explain their specific challenges and the impact on their ability to make mortgage payments. By signing this form, borrowers certify the accuracy of their information and affirm that their hardship has prompted their request for assistance. To complete the Borrower Response Package, participants must also submit the signed form, income documentation, IRS Form 4506-T, and hardship documentation. This comprehensive approach aims to facilitate access to mortgage relief options, easing some of the burdens of financial distress.

Uniform Assistance Example

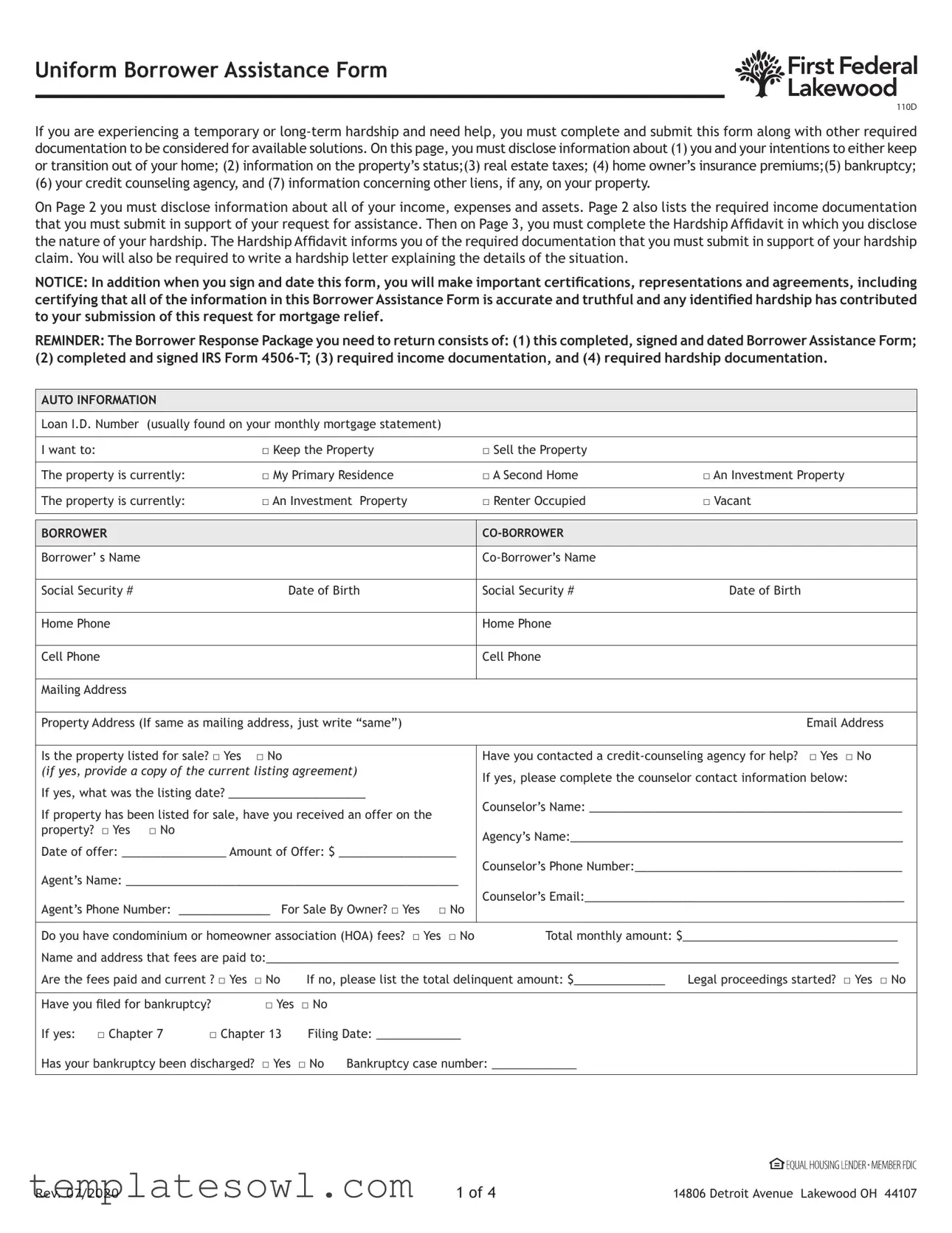

Uniform Borrower Assistance Form

110D

If you are experiencing a temporary or

(6) your credit counseling agency, and (7) information concerning other liens, if any, on your property.

On Page 2 you must disclose information about all of your income, expenses and assets. Page 2 also lists the required income documentation that you must submit in support of your request for assistance. Then on Page 3, you must complete the Hardship Affidavit in which you disclose the nature of your hardship. The Hardship Affidavit informs you of the required documentation that you must submit in support of your hardship claim. You will also be required to write a hardship letter explaining the details of the situation.

NOTICE: In addition when you sign and date this form, you will make important certifications, representations and agreements, including certifying that all of the information in this Borrower Assistance Form is accurate and truthful and any identified hardship has contributed to your submission of this request for mortgage relief.

REMINDER: The Borrower Response Package you need to return consists of: (1) this completed, signed and dated Borrower Assistance Form;

(2) completed and signed IRS Form

AUTO INFORMATION

Loan I.D. Number |

(usually found on your monthly mortgage statement) |

|

|

||

|

|

|

|

|

|

I want to: |

|

□ Keep the Property |

□ Sell the Property |

|

|

|

|

|

|

||

The property is currently: |

□ My Primary Residence |

□ A Second Home |

□ An Investment Property |

||

|

|

|

|

||

The property is currently: |

□ An Investment Property |

□ Renter Occupied |

□ Vacant |

||

|

|

|

|

|

|

|

|

|

|

|

|

BORROWER |

|

|

|

||

|

|

|

|

|

|

Borrower’ s Name |

|

|

|

||

|

|

|

|

|

|

Social Security # |

|

Date of Birth |

Social Security # |

Date of Birth |

|

|

|

|

|

|

|

Home Phone |

|

|

Home Phone |

|

|

|

|

|

|

|

|

Cell Phone |

|

|

Cell Phone |

|

|

|

|

|

|

|

|

Mailing Address |

|

|

|

|

|

|

|

|

|||

Property Address (If same as mailing address, just write “same”) |

|

Email Address |

|||

|

|

|

|||

Is the property listed for sale? □ Yes |

□ No |

Have you contacted a |

|||

(if yes, provide a copy of the current listing agreement) |

If yes, please complete the counselor contact information below: |

||||

|

|

|

|||

If yes, what was the listing date? _____________________ |

Counselor’s Name: ________________________________________________ |

||||

If property has been listed for sale, have you received an offer on the |

|||||

|

|

||||

property? □ Yes |

□ No |

|

Agency’s Name:___________________________________________________ |

||

|

|

|

|||

Date of offer: ________________ Amount of Offer: $ __________________ |

|

|

|||

Agent’s Name: ___________________________________________________ |

Counselor’s Phone Number:_________________________________________ |

||||

|

|

||||

Agent’s Phone Number: ______________ For Sale By Owner? □ Yes □ No |

Counselor’s Email:_________________________________________________ |

||||

|

|

||||

|

|

||||

Do you have condominium or homeowner association (HOA) fees? □ Yes □ No |

Total monthly amount: $_________________________________ |

||||

Name and address that fees are paid to:_________________________________________________________________________________________________

Are the fees paid and current ? □ Yes |

□ No |

If no, please list the total delinquent amount: $______________ |

Legal proceedings started? □ Yes □ No |

|||

|

|

|

|

|

||

Have you filed for bankruptcy? |

□ Yes |

□ No |

|

|

||

If yes: |

□ Chapter 7 |

□ Chapter 13 |

Filing Date: _____________ |

|

||

Has your bankruptcy been discharged? |

□ Yes |

□ No |

Bankruptcy case number: _____________ |

|

||

Rev. 07/2020 |

1 of 4 |

14806 Detroit Avenue Lakewood OH 44107 |

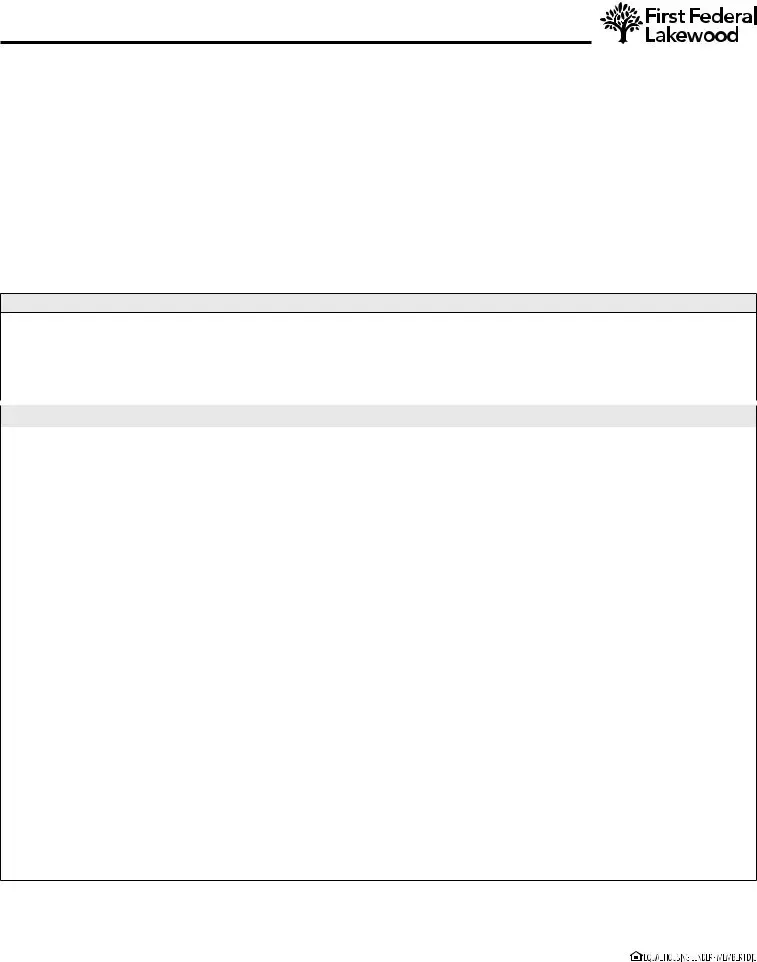

Uniform Borrower Assistance Form

110D

MONTHLY HOUSEHOLD INCOME |

MONTHLY HOUSEHOLD EXPENSES/DEBT |

HOUSEHOLD ASSETS |

||||

(associated with the property and/ or borrower(s) |

||||||

|

|

|

|

|||

|

|

|

|

|

|

|

Monthly Gross Wages |

$ |

First Mortgage Payment |

$ |

Checking Account(s) |

$ |

|

|

|

|

|

|

|

|

Overtime |

$ |

Second Mortgage Payment |

$ |

Checking Account(s) |

$ |

|

|

|

|

|

|

|

|

Child Support / Alimony* |

$ |

Homeowner’s Insurance |

$ |

Savings/Money Market |

$ |

|

|

|

|

|

|

|

|

$ |

Property Taxes |

$ |

401k/ lRA/403B/Keogh/ |

$ |

||

ESPO Accounts |

||||||

|

|

|

|

|

||

|

|

|

|

|

|

|

Taxable SS benefits or other |

|

Credit Cards/Installment |

|

|

|

|

|

Loan(s)(total minimum |

|

|

|

||

monthly income from annu- |

$ |

$ |

Stocks/Bonds/CDs |

$ |

||

payment |

||||||

ities or retirement plans |

|

|

|

|

||

|

per month) |

|

|

|

||

|

|

|

|

|

||

|

|

|

|

|

|

|

Tips, commissions, bonus and |

$ |

Alimony, child support |

$ |

Other Cash on Hand |

$ |

|

|

payments* |

|

|

|

||

Rents Received |

$ |

Car lease Payments |

$ |

Other Real Estate |

$ |

|

(estimated value) |

||||||

|

|

|

|

|

||

|

|

|

|

|

|

|

Unemployment Income |

$ |

HOA/Condo Fees/Property |

$ |

Cars/Vehicles |

$ |

|

Maintenance |

#____________________ |

|||||

|

|

|

|

|||

|

|

|

|

|

|

|

Food Stamps/Welfare |

$ |

Mortgage Payments on |

$ |

Life Insurance |

$ |

|

other properties (PITI) |

(Whole Life not Term) |

|||||

|

|

|

|

|||

|

|

|

|

|

|

|

Other |

$ |

Other |

$ |

Other |

$ |

|

|

|

|

|

|

|

|

Total (Gross Income) |

$ |

Total Debt / Expenses |

$ |

Total Assets |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lien Holder’s Name |

|

Balance/Interest Rate |

|

Loan Number |

|

|

|

|

|

|

|

||

|

|

|

|

|

||

|

|

REQUIRED INCOME DOCUMENTATION |

|

|

||

|

|

|

|

|

|

|

□Do you earn a wage?

For each borrower who is a salaried employee, include the most recent pay stubs that reflects at least 30 days of

□Are you

For each borrower who receives

□ Do you have any additional sources of income? Provide for each borrower as applicable as well as 1 full month of bank statements:

“Other Earned Income” such as bonuses, commissions, housing allowance, tips, or overtime:

□ Reliable third

Social Security, disability or death benefits, pension, public assistance, or adoption assistance:

□Documentation showing the amount and frequency of the benefits, such as letters, exhibits, disability policy or benefits statements from the provider, and

□Documentation showing the receipt of payment, such as copies of the two most recent bank statements showing deposit amounts.

Rental Income:

□Copy of the most recent filed federal tax return with all schedules,including Schedule

□If rental income is not reported on Schedule E- Supplement Income and Loss, provide a copy of the current lease/rental agreement with either bank statements or canceled rent checks demonstrating receipt of rent.

Investment Income:

□ Copies of the two most recent investment statements or bank statements supporting receipt of this income.

Alimony, child support, or separation maintenance payments as qualifying income:*

□Copy of divorce decree, separation agreement, or other written legal agreement filed with a court, or court decree that states the amount of the alimony, child support, or separation maintenance payments and the period of time over which the payments will be received, and

□Copies of your two most recent bank statements or other

*Notice: Alimony, child support or separate maintenance income need not be revealed if you do not choose to have it considered for repaying this loan.

Rev. 07/2020 |

2 of 4 |

14806 Detroit Avenue Lakewood OH 44107 |

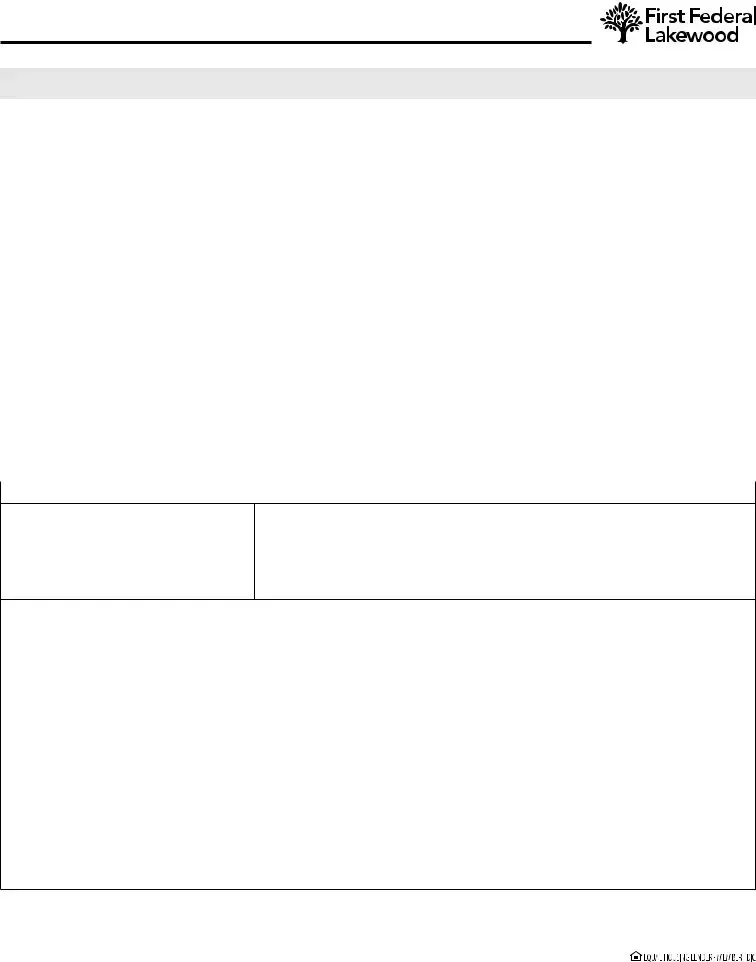

Uniform Borrower Assistance Form

110D

HARDSHIP AFFIDAVIT

(provide a written explanation with this request describing the specific nature of your hardship)

I am requesting review of my current financial situation to determine whether I qualify for temporary or

Date Hardship Began is: _____________________

I believe that my situation is: □ Short term (under 6 months) □ Medium term

I am having difficulty making my monthly payment because of reason set forth below: (Please check all that apply and submit required documentation demonstrating your hardship)

IF YOUR HARDSHIP IS: |

THEN THE REQUIRED HARDSHIP DOCUMENTATION IS: |

|

|

□ Unemployment |

□ Unemployment filing/unemployment benefit information showing file |

|

date and duration of benefits |

|

□ Bank statements (1 month) showing deposits showing weekly payment amount |

|

□ Termination letter (if applicable) |

|

|

□ Underemployment |

□ Pay stubs (1 mo) from previous position complete with year to date information |

|

□ Pay stubs (1 mo) from current position complete with year |

|

to date information |

|

□ Federal Tax Returns from previous year complete with all schedules |

|

□ |

|

|

□ Income reduction (e.g., elimination of overtime, reduction in regular |

□ Pay stubs from previous position, Federal Income Tax returns from last |

working hours, or a reduction in base pay) |

year, |

|

and/or offer letter demonstrating the new pay rate |

|

|

□ Divorce or legal separation; Separation of Borrowers unrelated by marriage, |

□ Divorce decree or separation agreement signed by the court AND |

civil union or similar domestic partnership under applicable law |

□ Current credit report evidencing divorce, separation, or |

|

|

|

□ Recorded quitclaim deed evidencing that the |

|

Borrower or |

|

|

□ Death of a borrower or death of either the primary or secondary wage |

□ Death certificate OR |

earner in the household |

□ Obituary or newspaper article reporting the death |

|

|

□ |

□ Doctor’s certificate of illnessor disability OR |

□ Medical bills OR |

|

|

□ Proof of monthly insurance benefits or government assistance |

|

(if applicable) |

|

|

□ Disaster (natural or |

□ Insurance claim OR |

Borrower ‘s place of employment |

□ Federal Emergency Management Agency grant or Small Business |

|

Administration loan OR |

|

□ Borrower or Employer property located in a federally declared disaster area |

|

|

□ Distant employment transfer |

□ Letter from employer stating date of transfer |

|

□ Documentation supporting any changes to income as a result of transfer |

|

(e.g. letter from employer, pay stubs, etc) |

|

|

□ Business failure |

□ Tax return from the previous year (including all schedules) AND |

|

□ Proof of business failure supported by one of the following: |

|

• Bankruptcy filling for the business; or |

|

• Two months recent bank statements for the business account evidencing |

|

cessation of business activity; OR |

|

• Most recent signed and dated quarterly or |

|

statement |

|

|

Rev. 07/2020 |

3 of 4 |

14806 Detroit Avenue Lakewood OH 44107 |

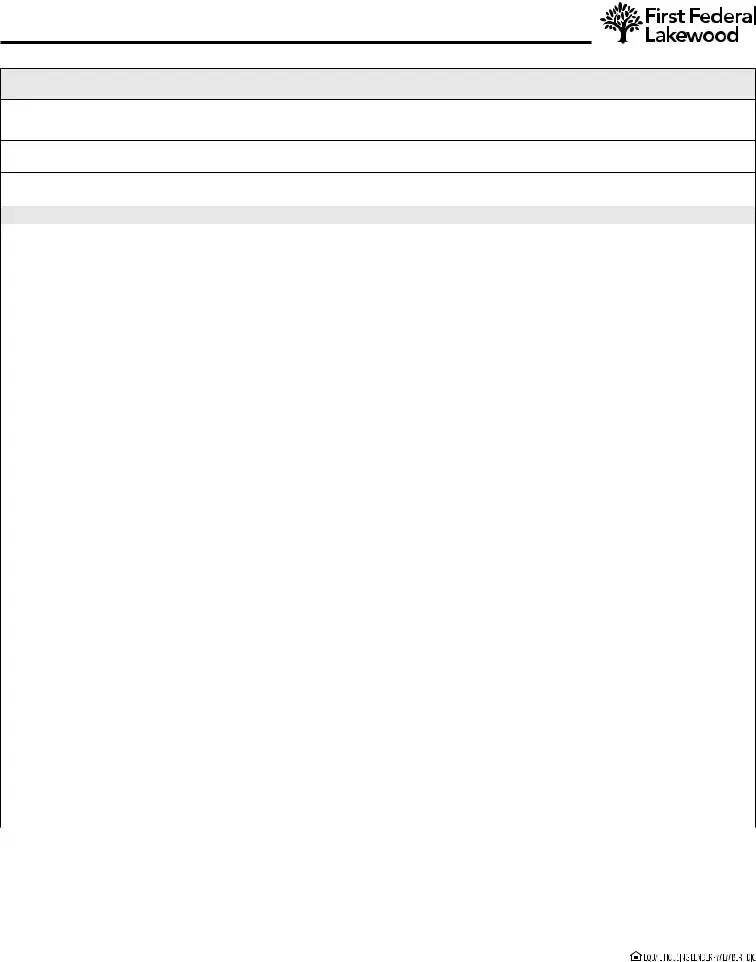

Uniform Borrower Assistance Form

110D

1.I certify that all of the information in this Borrower Assistance Form is truthful and the hardship(s) identified above has contributed to submission of this request for mortgage relief.

2.I understand and acknowledge that the Servicer, owner or guarantor of my mortgage, or their agent(s) may investigate the accuracy of my statements, may require me to provide additional supporting documentation, and that knowingly submitting false information may violate Federal and other applicable law.

3.I understand the Servicer will obtain a current credit report on all borrowers obligated on the Note.

4.I understand that if I have intentionally defaulted on my existing mortgage, engaged in fraud or misrepresented any fact(s) in connection with this request for mortgage relief or if I do not provide all required documentation, the Servicer may cancel any mortgage relief granted and may pursue foreclosure on my home and/or pursue any available legal remedies.

5.I certify that my property has not received a condemnation notice.

6.I certify that I am willing to provide all requested documents and to respond to all Servicer communications in a timely manner.

I understand that time is of the essence.

7.I understand that the Servicer will use this information to evaluate my eligibility for available relief options and foreclosure alternatives, but the Servicer is not obligated to offer me assistance based solely on the representations in this document or other documentation submitted in connection with my request.

8.If I am eligible for a repayment plan, forbearance plan, workout option and/or modification and I accept and agree to all terms of such plan, I also agree that the terms of this Acknowledgment and Agreement are incorporated into such plan by reference as if set forth in such plan in full. My first timely payment following my Servicer’s determination and notification of my eligibility or prequalification for a modification, repayment plan or forbearance plan (when applicable) or other workout option will serve as acceptance of the terms set forth in the notice sent to me that sets forth the terms and conditions of the workout option, modification repayment plan or forbearance plan.

9.I agree that when the Servicer accepts and posts a payment during the term of any repayment plan, modification,forbearance plan or other workout option, it will be without prejudice to, and will not be deemed a waiver of, the acceleration of my loan or foreclosure action and related activities and shall not constitute a cure of my default under my loan unless such payments are sufficient to completely cure my entire default under my loan.

10.I agree that any prior waiver as to my payment of escrow items to Servicer in connection with my loan has been revoked.

11.If I qualify for and enter into a repayment plan, forbearance plan, modification and/or other workout option I agree to the establishment of an escrow account and the payment of escrow items if an escrow account never existed on my loan.

12.I understand that Servicer will collect and record personal information that I submit in this Borrower Response Package and during the evaluation process, including, but not limited to, my name, address, telephone number, social security number, credit score, income, payment history, and information about my account balances and activity. I understand and consent to the Servicer’s disclosure of my personal information and the terms of any relief or foreclosure alternative that I receive to any investor, insurer, guarantor, or servicer that owns, insures, guarantees, or services my first lien or subordinate lien (if applicable) mortgage loan(s) or to any HUD certified housing counselor.

13.I consent to being contacted concerning this request for mortgage assistance at any cellular or mobile telephone number I have provided to the Lender. This can include text messages and telephone calls to my cellular or mobile telephone

Name (print) |

Signature |

Date |

|

|

|

Name (print) |

Signature |

Date |

*Before mailing, make sure you have signed and dated the form and attached copies of the appropriate documentation*

Rev. 07/2020 |

4 of 4 |

14806 Detroit Avenue Lakewood OH 44107 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Uniform Borrower Assistance Form is designed for individuals experiencing financial hardship to request mortgage relief options. |

| Information Disclosure | Borrowers must disclose personal information, property status, tax obligations, and any liens attached to their property. |

| Required Documentation | All requests must include supporting documentation, such as income verification, hardship letters, and relevant financial statements. |

| Hardship Affidavit | A specific section requires the completion of a Hardship Affidavit detailing the nature and duration of the financial hardship. |

| Legal Acknowledgments | Upon signing, borrowers certify that all information is accurate and truthful, acknowledging the potential legal consequences of misinformation. |

| Borrower Response Package | Completion of the form is part of a package that includes additional required forms, such as the IRS Form 4506-T. |

| State-Specific Guidelines | The form follows federal regulations but may also be governed by state-specific laws regarding mortgage relief. |

| Hardship Types | Acceptable hardship types include unemployment, medical emergencies, divorce, and natural disasters. |

| Processing Time | The evaluation process for hardship relief options may take time, requiring prompt communication and submission of additional information if requested. |

Guidelines on Utilizing Uniform Assistance

Filling out the Uniform Borrower Assistance Form is a crucial step if you’re seeking mortgage relief due to hardship. It’s important to gather all necessary information and supporting documents before you start. Here is a clear, organized guide to help you complete the form efficiently.

- Begin with the borrower and co-borrower information. Include names, social security numbers, and contact details for both parties.

- Indicate whether your intention is to keep or sell the property by checking the appropriate box for your decision.

- Specify the current status of the property as your primary residence, a second home, or an investment property.

- Fill out details related to whether the property is renter occupied, vacant, or an investment property.

- Provide information on any existing liens and the financial obligations associated with the property.

- State if the property is listed for sale and, if applicable, include realtor contact details and offer amounts received.

- Complete the monthly household income section. List all forms of income, including wages, child support, and any assistance.

- List your monthly household expenses and debts, making sure to capture all payments made on loans, mortgages, and credit lines.

- Disclose any household assets, such as cash on hand, checking and savings accounts, retirement accounts, and real estate.

- On the second page, complete the income documentation checklist, ensuring you have the required supporting documents ready.

- On the third page, write a description of your hardship in the Hardship Affidavit section. Mark the nature and duration of the hardship appropriately.

- Ensure you sign and date the form at the end, confirming the accuracy and truthfulness of all information provided.

- Finally, gather the completed document package, which should include the signed Borrower Assistance Form, a completed IRS Form 4506-T, income documentation, and hardship evidence, and submit it all together.

By following these steps, you’ll be well on your way to submitting the necessary documents for review. Prepare your materials carefully to ensure a smooth process as you seek the assistance you need.

What You Should Know About This Form

1. What is the Uniform Assistance Form?

The Uniform Assistance Form is a document that individuals can use to apply for mortgage relief when facing a financial hardship. It helps lenders assess your situation, collecting vital information about your income, expenses, and the nature of your hardship. Completing this form, along with required paperwork, is the first step toward finding possible solutions to your mortgage issues.

2. Who should fill out the Uniform Assistance Form?

Anyone experiencing temporary or long-term financial challenges that affect their ability to pay their mortgage should complete this form. Whether you intend to keep your property or transition out of it, this form allows you to share your circumstances and request assistance.

3. What information do I need to provide?

You’ll need to disclose several key details. This includes personal information, the status of your property, your income and expenses, and any relevant documents. Specifically, you will provide information about your income sources, debts, and any existing liens on your property. Additionally, you’ll need to complete a Hardship Affidavit detailing your specific situation.

4. How do I demonstrate my hardship?

To show your hardship, you’ll fill out the Hardship Affidavit, which requires you to describe the nature of your financial difficulties. You’ll also need to submit supporting documentation that backs up your claims. This could include unemployment letters, medical bills, or any other proofs related to your specific hardship, such as divorce papers or bankruptcy filings.

5. What documents should I prepare before filling out the form?

Before completing the form, gather personal documents that reflect your current financial condition. This may include recent pay stubs, tax returns, bank statements, and any relevant correspondence related to your hardship. For example, if you're self-employed, you’ll need your business tax returns and profit/loss statements. Having these in hand will facilitate a smoother application process.

6. Can I still apply if I’ve filed for bankruptcy?

Yes, you can apply even if you are currently in bankruptcy proceedings. However, you will need to disclose this information within the form. The process may be more complicated if you are under bankruptcy protection, but assistance options may still be available to you.

7. What happens after I submit the Uniform Assistance Form?

Once you submit the form, including all required documentation, the lender will review your application to evaluate your eligibility for relief options. You may be contacted for additional information or clarification regarding your situation. It's important to respond promptly to any requests as delays could hinder your application process.

8. How can I ensure my application is successful?

To enhance your chances of success, be thorough when filling out the form, ensuring that all provided information is complete and accurate. Attach all necessary documentation to support your claims and communicate clearly about your hardship. Demonstrating your willingness to cooperate can also make a positive impression on your lender.

9. What if my situation changes after I submit the form?

If your circumstances change after you’ve submitted the form—whether for better or worse—it’s crucial to inform your lender. Changes in your financial situation may alter your eligibility for assistance programs. Keeping open lines of communication with your lender is key to navigating your options effectively.

Common mistakes

Filling out the Uniform Borrower Assistance Form can be a critical step for those facing financial challenges. However, several common mistakes can hinder the process. Understanding these missteps is essential to ensure that all necessary information is accurately captured.

One common mistake is incomplete contact information. Applicants often fail to provide valid phone numbers or email addresses. Without this information, communication with lenders could be delayed, potentially stalling assistance. It is crucial to double-check that the details are current and accurate.

Another frequent error involves incorrect selection of property status. Applicants may misidentify their property as a primary residence when it is, in fact, a rental or investment property. This can lead to inappropriate assistance programs being applied. Carefully reviewing and confirming the property details helps avoid complications later in the process.

Many people neglect to include all required income documentation. Some may submit only partial forms, which prevents lenders from adequately assessing financial situations. Completing every section concerning income, whether through wages, self-employment, or other means is vital. This thoroughness can significantly affect the outcome.

Additionally, inaccuracies related to hardship documentation are also common. Applicants must explain the nature of their hardship clearly and provide all necessary substantiating documents. This information must be truthful and consistent with other sections of the form. Omitting details or offering vague explanations can cause significant delays or rejection.

Having a hardship letter that lacks sufficient detail poses another significant problem. This letter should clearly outline the circumstances leading to the request for assistance. Vague descriptions can result in confusion or misunderstanding. Writing a clear, detailed letter can substantially strengthen a request.

Finally, many applicants forget to sign and date the form. This simple oversight can eliminate the entire application, forcing individuals to restart the process. It is imperative to ensure that all required signatures are present before submission.

By being aware of these mistakes and taking the time to verify all information, applicants increase the chances of a smooth process and can focus on finding the assistance they need to alleviate their financial burdens.

Documents used along the form

When seeking assistance with mortgage relief, it is essential to provide a complete set of documents to support your request. Along with the Uniform Borrower Assistance Form, you may need to submit additional forms and documentation that help clarify your financial situation. Below is a list of commonly required documents that can accompany your application for assistance.

- IRS Form 4506-T: This form allows the lender to request your tax return transcripts directly from the IRS. It verifies your income and helps the lender assess your financial condition accurately.

- Hardship Letter: A personal letter that outlines your current financial struggles and the reasons for seeking assistance. This letter should explain your circumstances in detail and provide context for your application.

- Income Documentation: Evidence of your income sources, which could include pay stubs, tax returns, or bank statements. This documentation supports the claims you make regarding your financial position.

- Proof of Hardship: Documentation that substantiates the claim of hardship you mentioned in the Uniform Borrower Assistance Form. This may include medical records, termination letters, or other relevant evidence.

- Credit Counseling Certificate: If you've sought help from a credit counseling agency, you may need to provide a certificate confirming your engagement. This document shows that you are actively looking for solutions and not ignoring your financial obligations.

- Bank Statements: Recent bank statements that reflect your financial activity. They provide a view of your income and expenses, helping to clarify your monetary situation over the past few months.

Completing these forms and gathering the necessary documentation may feel overwhelming, but each piece serves to compile a comprehensive understanding of your financial landscape. You are not alone in this process, and taking each step thoughtfully can lead to a viable solution for your housing concerns.

Similar forms

- Loan Modification Application: Similar to the Uniform Assistance form, a Loan Modification Application also requires the homeowner to provide detailed financial information and documentation regarding their income, expenses, and hardship. Both documents seek to establish eligibility for assistance in altering the terms of a mortgage to make payments more manageable.

- Hardship Letter: This letter accompanies the Uniform Assistance form and serves as a detailed explanation of the homeowner's financial difficulties. Like the hardship affidavit in the Uniform Assistance form, a hardship letter outlines the specific circumstances leading to the request for assistance, allowing the lender to understand the applicant's situation better.

- Income Verification Form: This document asks for similar income details as those required in the Uniform Assistance form. Both forms aim to verify income sources and amounts to assess the borrower’s financial capability to manage mortgage payments.

- Request for Mortgage Relief Form: This form is closely related to the Uniform Assistance form, as both are intended to request help for those struggling with mortgage payments. Details regarding income, hardship, and property status are required in both documents to determine eligibility for various relief options.

- Credit Counseling Agency Statement: This statement may be requested along with the Uniform Assistance form when individuals seek help from credit counseling organizations. Similar to the information requested in the Uniform Assistance form, it includes details about the homeowner’s debts, income, and efforts to manage those finances.

Dos and Don'ts

When filling out the Uniform Assistance form, consider the following dos and don'ts to ensure accuracy and completeness in your application.

- Do provide complete and accurate information about your hardship, including all required documentation.

- Do keep a copy of your completed form and all documents submitted for your records.

- Don’t omit any relevant income, expenses, or asset details; this could delay your application.

- Don't forget to sign and date the form, as failure to do so may lead to processing delays.

Misconceptions

Understanding the Uniform Borrower Assistance Form is crucial for anyone facing financial hardships. However, misconceptions can create confusion during this already stressful time. Here are four common misconceptions about this form:

- It’s Only for People Facing Foreclosure: Many believe that the form is strictly for those who are at risk of losing their homes. In reality, this form is designed for anyone encountering temporary or long-term financial difficulties, whether that involves foreclosure or just a need for payment assistance.

- All Information Must Be Perfectly Accurate: Some individuals think that if their information isn't flawless, their request will be automatically denied. While accuracy is important, the result often depends more on the overall situation and provided documentation than on having everything perfect.

- You Can’t Change Your Mind After Submission: There’s a belief that once the form is submitted, you are locked into a particular decision. However, if your circumstances change or you believe you need to modify your request, communication with your servicer can lead to adjustments in your submission.

- Submitting the Form Guarantees Assistance: It’s a common misconception that completing and sending the form ensures that relief options will be granted. Submission only kicks off the review process, and approval will depend on your individual financial circumstances and the type of assistance for which you qualify.

Key takeaways

- Completing the Uniform Assistance form is essential for those facing financial hardship—it’s your gateway to potential mortgage relief.

- All information disclosed must be accurate, as it impacts your eligibility for assistance. Misrepresentation may lead to denial of relief.

- Provide detailed information about your hardship. You will need to complete the Hardship Affidavit, which outlines the nature of your situation.

- Documentation is crucial. Include all required income documentation to support your claims, ensuring you follow the guidelines for employment or alternative income sources.

- Clearly outline your financial circumstances on Page 2 of the form, covering income, expenses, and assets. Be thorough—every detail counts.

- Submit additional supporting documentation as required, particularly related to your hardship claim. This enhances your chances of approval.

- After filling out the form, remember to sign and date it. This certification holds legal weight, affirming your commitment to honesty.

- It’s important to include the complete Borrower Response Package, which consists of this form, IRS Form 4506-T, and all required documentation, to avoid delays in processing your request.

Browse Other Templates

Prentice Hall Algebra 1 Textbook - Teacher resources provide structured support for both classroom and individual learning.

Letter for Court Hearing - This form is vital for those appealing decisions related to disability or other claims.