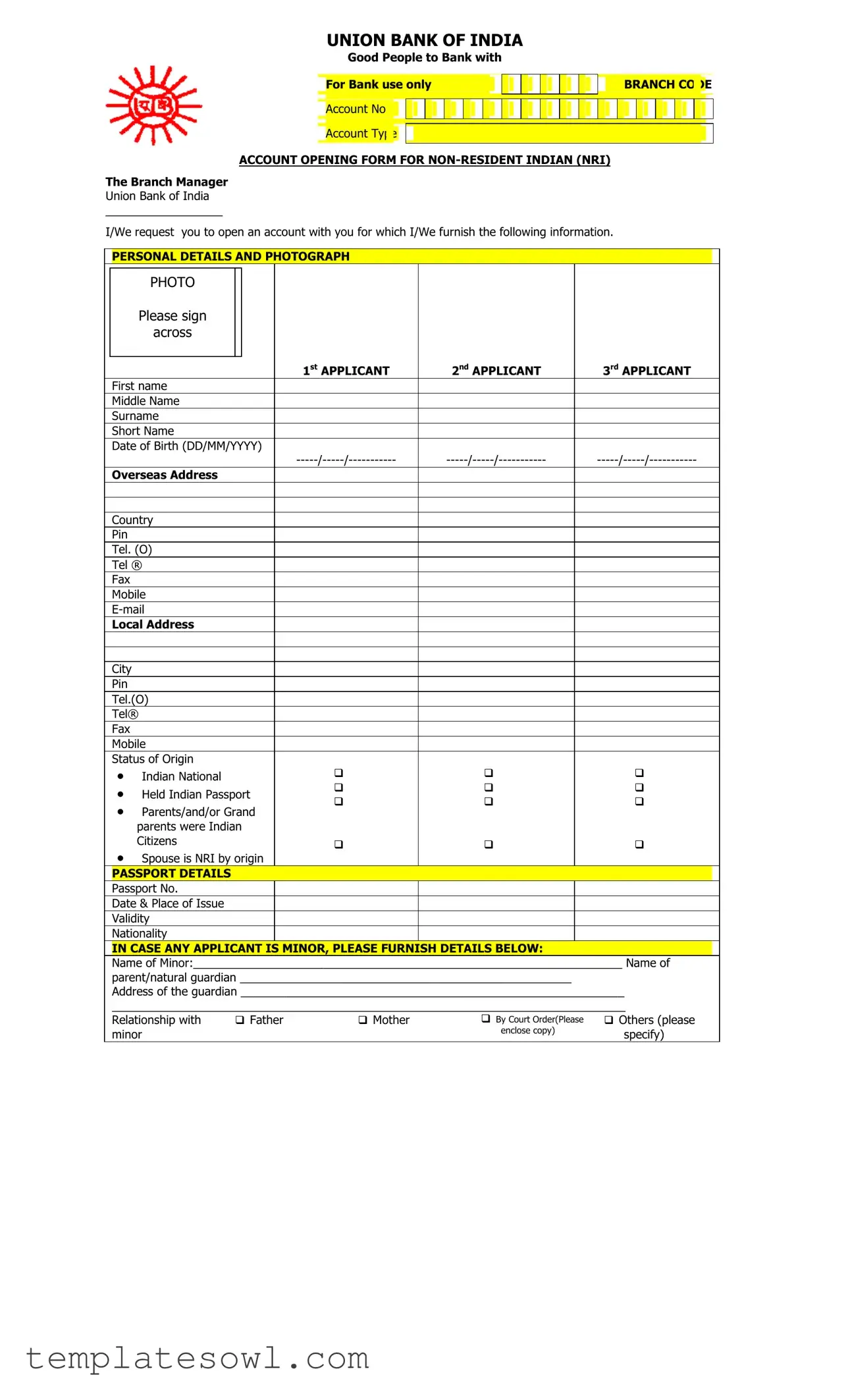

Fill Out Your Union Bank Form

The Union Bank form serves as a crucial document for individuals and businesses engaging with the bank, encapsulating essential information needed for various banking processes. This form requires personal identification details, contact information, and specifics related to the banking services sought—be it opening a new account, applying for a loan, or managing existing accounts. Properly completing the Union Bank form ensures that the bank can efficiently process requests and cater to the client's needs accurately. Moreover, understanding each section of the form can prevent potential delays and complications during the banking process. As such, it is imperative for customers to pay close attention to any requirements specified in the form, as missing or incorrect information could result in setbacks that could affect financial plans. Timeliness and accuracy are key, as completing the Union Bank form not only facilitates banking transactions but also helps in establishing a reliable banking relationship. With an engaging structure and straightforward language, this article will explore the intricacies of the Union Bank form, guiding individuals on how to navigate its requirements effectively.

Union Bank Example

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

! "# $ !%&

!'"(

$) !)$!

|

|

|

*0++ |

|

|

|||||

|

|

|

|

|

||||||

|

|

|

|

|

|

|||||

|

|

|

* |

|

|

|||||

|

|

|

|

|

||||||

|

|

|

|

|

||||||

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

||||

|

|

|

|

*)! |

+)! |

,)! |

||||

|

! |

|||||||||

|

" |

|||||||||

|

# |

|

|

|

||||||

|

# |

|||||||||

|

$%$$""&&&&' |

|||||||||

|

|

|

|

|

|

|

((((((((((((((((((((( |

((((((((((((((((((((( |

((((((((((((((((((((( |

|

|

||||||||||

|

|

|

|

|

||||||

|

|

|

|

|

||||||

|

) |

|

|

|

||||||

|

* |

|

|

|

|

|||||

|

%+' |

|

|

|

||||||

|

, |

|

|

|

||||||

|

|

|

|

|||||||

|

". |

|

|

|

||||||

/( |

|

|

|

|||||||

|

)' |

|||||||||

|

|

|

|

|

||||||

|

|

|

|

|

||||||

|

) |

|

|

|

||||||

|

* |

|

|

|

|

|||||

|

%+' |

|

|

|

||||||

|

, |

|

|

|

||||||

|

|

|

|

|||||||

|

". |

|

|

|

||||||

|

#+ |

|||||||||

|

|

|

|

|

||||||

|

|

|

|

|

||||||

|

|

0* |

||||||||

|

|

|

|

|

||||||

|

|

*1 |

||||||||

|

|

|||||||||

|

|

|

||||||||

|

|

|

||||||||

|

|

|

)2 |

|||||||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

||||

|

|

#3. |

|

|

|

|

||||

|

$$! !)$ |

|

|

|

|

|||||

|

* |

|||||||||

|

$4* |

|||||||||

|

5 |

|

|

|

||||||

|

||||||||||

|

$ .)!$"/) $ $ !)$ )01 |

|

|

|||||||

|

"6 |

|||||||||

3 |

! |

" |

)+%* |

+% |

|

||||

|

|

' |

' |

|

|

|

|

!

|

!2'' |

|

''3 |

|

|

45 |

|

! |

|||||

|

|

|

|

|

%' |

|

|

' |

|

|

|

|

|

|

3/7#!8/$$3)!8/$ |

|

|

|

|

|

|

||||||

|

3+7#!8/$$3)!8/$ |

|

|

|

|

|

|

||||||

|

!)3%'7!8/$$3) |

|

|

|

|

|

|

||||||

|

+#"3 |

|

|

|

|

|

|

||||||

|

!9/8$/*+# |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|||||||

|

." ! !)$ |

|

|

|

|

|

|

|

|

|

|

||

|

)#$1*/3 |

|

|

|

|

|

|

|

|

||||

|

)$): |

|

|

|

|

||||||||

|

3$ |

|

|

|

|

||||||||

|

#;) |

|

|

|

|

|

|

|

|

||||

|

"! ! ! |

|

|

|

|

|

|

|

|

||||

|

# |

|

/;; |

|

|

! |

;; |

|

|

||||

|

;; |

|

<. |

|

|

+%#' |

|

|

|||||

|

$0 $!!$ |

|

|

|

|

|

|

|

|

|

|

||

|

. #;: |

||||||||||||

|

. #; . . |

|

|

$ |

|||||||||

|

|

|

|

|

|

|

|

|

|||||

|

6 6 7 |

|

|

. |

|

|

|

|

|

|

|

||

|

! $!." !$!!$%!.' |

|

|||||||||||

|

* .$" ; |

|

|

|

|

||||||||

|

|

|

|||||||||||

|

) 3/3+%.' |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$!! " ! 6 . |

|

|

|

|

|

|

|

|

|

|

||

|

= |

|

" |

|

|

! |

|

|

|

|

|||

|

" $! |

|

/( |

|

|

)* |

|

|

|

|

|||

|

. >:; |

|

|

||||||||||

|

") |

|

|

+; |

|

|

9 |

|

|

|

|

||

|

"! 6 7 |

|

|

& |

|

|

|

|

|

|

|

||

|

)! $ 6 7 |

|

|

|

|

|

|

|

|

|

|

||

|

") |

|

|

|

|

(! |

|

|

|||||

|

* |

|

|

|

|

|

|

|

|

||||

|

)!5 ! |

|

|

|

|

|

|

|

|

|

|

||

|

. (%' |

|

|

|

|

||||||||

|

.;%'.. |

. |

|||||||||||

.

:. .

. .

. . ; ! ) %(3'

(3

#

;

:

.;.

;.!) . 3

. ;

) ; ; .

3;

;;:3....

:;%'

;;

. ").

. |

. ; |

||||

. . |

; |

||||

. |

|

|

|

|

|

. .;. |

|||||

;.. . |

|||||

;3;?# |

|||||

. |

: |

||||

;

;

%*'

|

|

429:9' |

''3 |

' |

4 |

||

|

|||||||

|

|||||||

|

50'508'2'953 |

|

|||||

|

|

|

|

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

*';$( +';$( ,';$(

!!5< !$!

..;

%.'

6

*

#

6. ./ .0) |

) |

*.* |

|

)!$ "!

..

. %

' .;

|

|

@ .; |

||||||

|

. |

|

|

|||||

|

|

|

|

|||||

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

#1 |

|

|

|

|

|

|

|

|

|

|

|

43 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

9 |

. |

2. |

|

|

|

6 |

41 |

|

|

|

|||

|

|

|||

|

|

$( |

$( |

|

|

)$!" !$ |

|

|

|

|

*) |

* / 5 |

3*(2* |

|

|

|

|

|

|

|||||||

|

$)"!%!929'=(& |

|

|

||||||||

|

$;; & |

|

|

|

|||||||

|

|

|

|

|

|

|

|

||||

|

$; |

& |

|

|

|

||||||

|

|

$ |

|

|

|

|

|

|

|||

|

"$ |

|

|

|

" |

|

# |

|

|

||

|

|

# |

* |

) |

|

||||||

|

|

|

1 |

*1 |

$ |

* |

|

||||

|

")." ! !)$1 |

|

|

|

|

|

|

||||

|

'' |

|

# |

#; |

" |

|

|||||

|

|

|

|

||||||||

|

2 |

|

$ |

) |

/ |

# |

|

||||

|

|

|

9 |

< |

) |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

*.9) |

*;9) |

1;# |

" |

+ |

|

|||

|

%$& |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

||

|

|

|

#; |

<" |

"" |

#" |

|

||||

|

/ |

? |

|

|

|

|

|

; |

|

|

|

|

/ |

? |

|

|

|

|

|

|

|||

|

$!"! " |

|

|

3 |

|

|

|

||||

|

!)$! $ $" .7 |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

) |

|

ABCC:CCC |

BCC:CCC( |

DCC:CCC( |

EC:CC:CCC(BD |

BD4 |

|

|||

|

$ ) |

|

|

|

DCC:CCC |

EC:CC:CCC |

.; |

|

|||

|

" |

|

|

|

|

|

|

|

|

|

|

|

!)$ ! $<$! ! )$!! |

. $ |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

$$ !0 $ |

|

|

|

|

|

|

||||

|

|

) |

)* |

0 |

) |

9 |

|

||||

|

|

|

|

|

|

|

|

|

* |

|

|

|

5 |

|

) |

%)4' |

|

|

|||||

|

) |

|

"6 |

|

|

|

&*6 |

|

|||

|

3 |

|

# |

! |

) |

3 |

* |

|

|||

|

|

|

|

|

|

3 |

*; |

|

|

||

|

$!"! <) $$ !$13 |

|

|

|

|

||||||

|

5< $!" !!<! $ |

|

|

|

|

||||||

|

+. |

2 |

*;# |

)(; |

! |

|

|||||

|

"6 |

|

|

|

|

|

|

|

|

|

|

|

* |

|

) $ |

# |

$ |

* |

|

||||

|

; |

|

"! |

|

|

1 |

**! |

|

|||

|

)$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

) |

|

0 |

$. |

9 |

|

|||||

|

|

|

|

|

|

|

|

|

|

||

|

)>4 |

|

|

|

|

|

|

||||

|

!$5$ < $<) |

|

|

|

|

||||||

|

) |

" |

3 |

0 |

|

|

|||||

|

# |

|

|

|

1 |

) |

# |

|

|

||

|

)" |

#; |

0 |

# |

$/"#; |

|

|||||

|

|

|

|

|

|

|

|||||

|

! ! $$2 |

|

0 |

|

+ |

|

|

||||

|

"!! ! ! |

|

|

|

|

||||||

|

|

+(" |

|

||||||||

|

*;" |

) |

|

|

|

||||||

|

$$ !)$ |

|

|

! !)$ |

|

|

|||||

|

6 |

|

|

|

|

|

6 |

|

|

|

|

|

+6 |

|

|

|

|

|

)6"5$ |

|

|

||

|

/( |

$6 |

|

|

|

|

|

)9 6 |

|

|

|

|

.< " ) |

|

& |

|

|

|

|||||

|

$ 7 |

|

|

|

|

|

|

|

|

|

|

+"+% $(E'

#FDG3:EHFHB%')

% '3:EHID.

% 4'

3@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@'

|

|

|

$ |

|

|

|

|

$ |

|

|

|

: |

|

|

|

|

4 |

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

:$ |

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

$: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

J |

; |

|

|||||||||||||||||||||||||||||||

|

. |

; |

K |

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

*6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

$6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

#%' |

. |

$%'L |

|

|

|

|||||||

|

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

#%'M |

|

|

|

|

||||

|

L : .. |

|

|

|||||||||||||||||||||||||||||||

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

J# |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

M . |

%'.. |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

0) " ! |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

3; |

|

|

|

|

|

$(E |

|

||||||||||||||||||||||||||

% $0'% '

$ |

|

|

|

|

|

|

|

|

|

||

$6 |

|

|

|

|

|

|

|

|

|

!$ $!. |

|

$('

@@@@@@@@@@@@@@@@@@@@' |

''3 |

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

42''5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2''5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

||||||||||

*)! |

+)! |

|

|

|

|

,)! |

||||||||||||

$(2'' |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

"2'' |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

# |

/;; |

|

! |

;; |

||||||||||||||

;; |

<. |

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|||||||||||||||

# |

#. |

|

#;. |

|||||||||||||||

Form Characteristics

| Fact Name | Description |

|---|---|

| Governing Law | This form is subject to the laws of the State of California. |

| Purpose | The Union Bank form is used for account applications and related banking services. |

| Signature Requirement | A signature is required from the account holder for validation purposes. |

| Information Collection | The form collects personal and financial information from applicants. |

| Submission Method | Applicants may submit the form online or in person at a bank branch. |

| Fees | There may be fees associated with account maintenance as outlined in the terms. |

Guidelines on Utilizing Union Bank

Once you have obtained the Union Bank form, you will need to provide accurate information as required. Carefully follow the steps outlined below to fill it out correctly. After completing the form, ensure that you review all entries before submission to avoid any errors.

- Begin by entering your full name on the designated line at the top of the form.

- Provide your current address in the space provided below your name.

- Next, fill in your contact number, ensuring it's a number where you can be reached easily.

- Indicate your email address clearly in the specified field.

- Enter your account number if applicable.

- Complete the section regarding your financial information as requested. Be precise with figures.

- If there are any checkboxes, mark the appropriate options based on your situation.

- Review all information to confirm accuracy before signing the form.

- Sign and date the form in the designated areas at the bottom.

What You Should Know About This Form

What is the Union Bank form used for?

The Union Bank form is designed for various banking needs, including account applications, loan requests, and other financial transactions. It helps gather the necessary information from the customer to process their requests efficiently. Completing this form accurately ensures that transactions can be handled smoothly and without delays.

How do I access the Union Bank form?

You can access the Union Bank form online through the official Union Bank website or by visiting a local branch. There, you will find the necessary forms available for download or physical copies to fill out. If you prefer a digital version, ensure you have a stable internet connection to avoid technical issues.

What information do I need to provide on the form?

The Union Bank form typically requires personal information such as your name, address, contact details, Social Security number, and financial information regarding your income and expenses. Depending on the specific use of the form, additional information may be needed. It’s important to complete the form in full to avoid processing delays.

Are there any fees associated with submitting the form?

Generally, there are no fees specifically associated with submitting the Union Bank form. However, certain transactions that may involve the form, such as loan applications, could incur fees. It's best to check with Union Bank for specifics regarding any applicable fees before submitting your form.

How long does it take to process the form?

Processing times for the Union Bank form can vary based on the type of transaction and the volume of requests being handled. Typically, you can expect a response within a few business days. For loan applications, the process may take longer as additional documentation and verification may be necessary.

What if I make a mistake on the form?

If you notice an error after you’ve submitted the Union Bank form, contact Union Bank as soon as possible. They can guide you on how to correct any mistakes, whether that involves submitting a corrected form or providing additional information. Timely communication can help mitigate any issues that arise from errors on the form.

Common mistakes

When filling out the Union Bank form, individuals frequently make several common mistakes that can lead to delays or complications in processing their applications. Awareness of these pitfalls may improve the submission process significantly.

One prevalent mistake is failing to read the instructions carefully. The form often includes specific guidance regarding required fields or documentation. Skipping over these can result in incomplete submissions. Thoroughly reviewing the form's instructions can save time and prevent unnecessary follow-ups.

Another mistake occurs when applicants provide incorrect personal information. This includes errors in names, addresses, or contact details. Such discrepancies can create confusion and hinder communication. Double-checking all entries before submission is important to ensure accuracy.

Failure to sign the form properly is a third common error. Without a signature, the form may be deemed invalid. It's beneficial for individuals to confirm that they have signed in the designated areas and understand any implications associated with their signature.

A fourth mistake involves not providing all required attachments. Many applications necessitate supporting documents, such as identification or financial records. Missing these can slow down the review process. Keeping a checklist of required documents can help ensure completeness.

Some individuals do not keep a copy of their submitted form, which can complicate troubleshooting if issues arise. Retaining a copy allows applicants to reference what was submitted, facilitating clearer communication with bank representatives if questions come up later.

Additionally, many struggle with formatting issues. Improperly formatted entries, such as unclear handwriting or incorrect file types for electronic submissions, can lead to misunderstandings. Paying attention to submission methods and ensuring clarity in entries is crucial.

Lastly, neglecting to follow up after submission is a common oversight. Applicants should consider monitoring the status of their application to address potential issues quickly. Checking in can also provide reassurance that their application is progressing as expected.

Documents used along the form

When dealing with financial transactions or agreements, various forms and documents complement the Union Bank form. Each of these documents plays a specific role, ensuring that parties have a clear understanding of their obligations and rights. Below is a list of commonly used documents alongside the Union Bank form.

- Loan Agreement: This document outlines the terms of a loan between a lender and a borrower, including interest rates, repayment schedule, and collateral, if applicable.

- Promissory Note: A legally binding document in which the borrower promises to pay back a specified sum to the lender, along with any interest, by a set due date.

- Credit Application: This form collects information from a potential borrower to assess their creditworthiness and eligibility for a loan or credit line.

- Disclosure Statement: A document that provides important information about the terms and conditions of a financial product, including fees and rates, usually required by law.

- Financial Statement: An official record that summarizes the financial status of an individual or business, helping lenders understand the applicant's financial situation.

- Security Agreement: This document details the specific assets pledged as collateral for a loan, providing the lender legal rights to those assets if the borrower defaults.

- Power of Attorney: A legal document that permits one person to act on another’s behalf, particularly in financial matters, which may include signing documents related to the loan.

- Escrow Agreement: This contract outlines the terms under which funds will be kept in escrow until certain conditions are met, typically used in real estate transactions.

- Title Insurance Policy: This insurance protects lenders from potential defects in a property’s title that might arise after a transaction, ensuring their investment is secure.

- Closing Disclosure: A form that summarizes the final details of a mortgage loan, including terms, final costs, and all required disclosure information before closing a loan.

Each of these documents serves to establish clarity and protect the interests of all parties involved in a financial transaction. Understanding their individual purposes can facilitate smoother interactions and reduce the risk of misunderstandings.

Similar forms

-

Loan Application Form: Similar to the Union Bank form, a loan application form collects personal and financial information from the applicant to determine their eligibility for a loan. Both forms require details such as employment status, income, and debts.

-

Credit Card Application: Like the Union Bank form, the credit card application is designed to gather essential information to evaluate a person's creditworthiness. Applicants must provide personal identification, income details, and any existing debts.

-

Mortgage Application: This form shares characteristics with the Union Bank form as it assesses an individual's financial history and current situation. Each application aims to establish whether the applicant qualifies for a mortgage loan, including specific questions about assets and liabilities.

-

Bank Account Opening Form: Both the Union Bank form and the account opening form collect personal and financial information. The goal is to verify the identity of the individual and assess their suitability for opening an account with the bank.

-

Insurance Application Form: An insurance application shares similarities with the Union Bank form in that it requires detailed personal information, including health and financial details. Both forms have the shared purpose of evaluating the risks associated with insuring a potential client.

-

Investor Information Form: Much like the Union Bank form, this document gathers information related to an individual's financial status, investment experience, and goals. Both forms seek to understand the applicant's capacity to undertake financial commitments.

-

Student Loan Application: This application resembles the Union Bank form by focusing on the financial background of the applicant. It includes questions about income, existing debts, and education level to assess eligibility for student aid.

-

Personal Financial Statement: The personal financial statement is akin to the Union Bank form as it compiles details about assets, liabilities, and net worth. The document serves to present a comprehensive picture of an individual's financial health.

-

Business Loan Application: This form closely mirrors the Union Bank form by requiring detailed information on the business's financial health, including income, expenses, and future projections. Both aim to evaluate the ability of the applicant to repay the requested funds.

Dos and Don'ts

When filling out the Union Bank form, there are specific guidelines to follow to ensure your application is processed smoothly. Here’s a compiled list of things you should and shouldn't do:

- Do: Review the form carefully before starting to fill it out.

- Do: Provide accurate information in all fields.

- Do: Use legible handwriting if filling the form by hand.

- Do: Keep a copy of the completed form for your records.

- Do: Ask for help if you do not understand any part of the form.

- Don't: Leave any required fields blank.

- Don't: Submit the form without reviewing it for errors.

- Don't: Use correction fluid to fix mistakes on the form.

- Don't: Provide false information or exaggerate your circumstances.

Following these guidelines will significantly improve your chances of a successful application. Take your time, and ensure everything is accurate and complete to avoid delays. Good luck!

Misconceptions

Understanding the Union Bank form can be challenging. Here are some common misconceptions:

- It's just a standard form. Many people believe that the Union Bank form is generic. In reality, it contains specific requirements tailored to various transactions.

- All fields are mandatory. Some individuals think every field on the form must be filled out. However, many fields are optional and depend on the nature of the request.

- Submitting the form guarantees approval. There’s a misconception that completing the form means the request will be approved. Approval depends on multiple factors beyond just form submission.

- Help is not available. Some may feel that they have to navigate the form alone. In fact, assistance is available through customer service or online resources.

Key takeaways

- Complete all required fields to ensure your application is processed without delays.

- Double-check your information before submitting to prevent errors that could affect your eligibility.

- Sign and date the form in the designated areas to validate your application.

- Understand the documentation needed; make sure to include any necessary attachments.

- Keep a copy of your submission for your records. It’s helpful for tracking your application status.

- Submit the form by the specified deadline to avoid missing out on your opportunity.

- Contact Union Bank customer service if you have questions or need assistance during the process.

Browse Other Templates

Ozempic Insurance Approval - Providers are encouraged to include lab reports when appropriate, supporting the medical necessity of the drug request.

Quicktax Kcmo - A penalty may apply for delinquent filings, computed monthly up to 25 percent.