Fill Out Your United Health Care Form

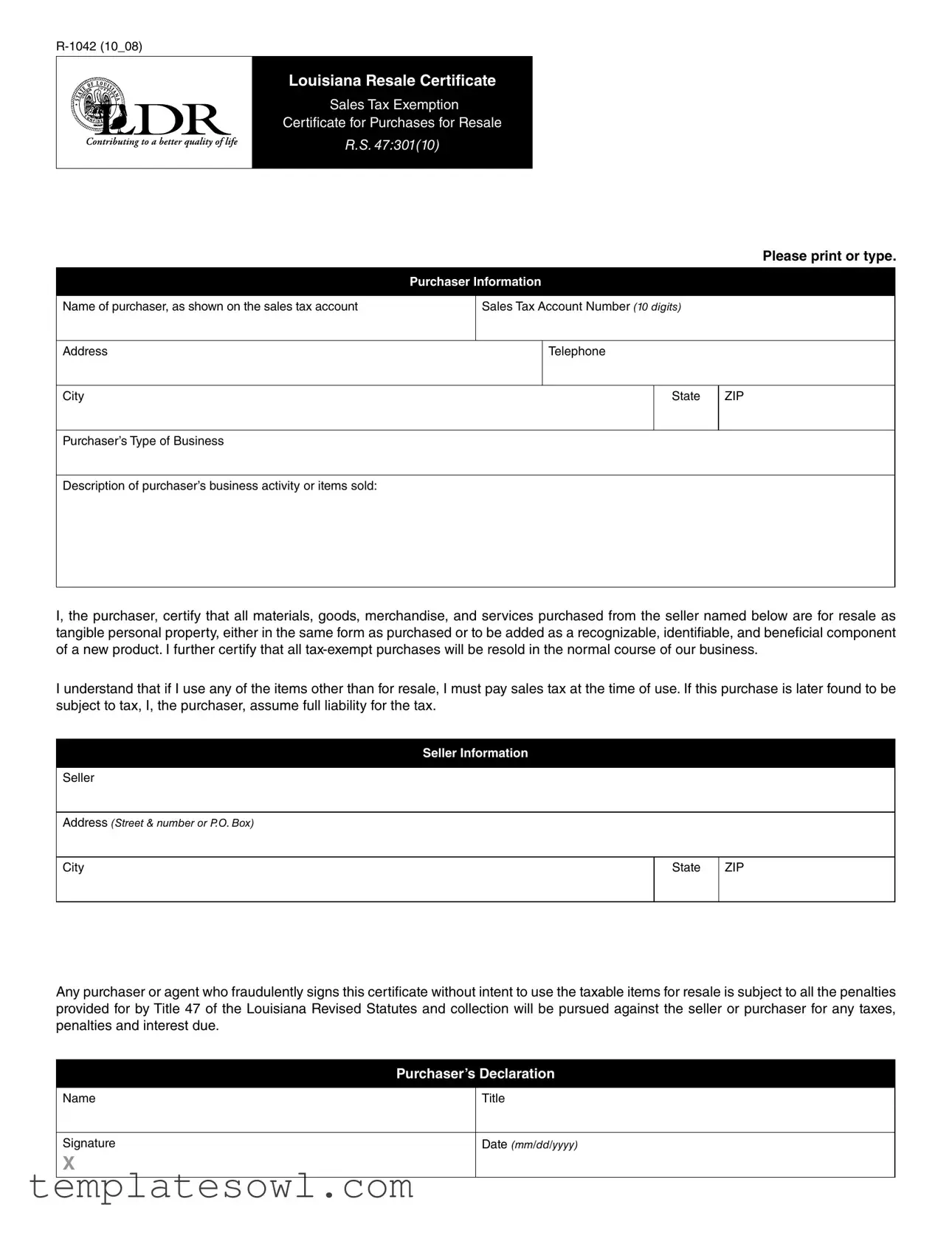

The United Health Care form, specifically the R-1042 Louisiana Resale Certificate Sales Tax Exemption Certificate, is an essential document designed to facilitate tax-exempt purchases for businesses involved in reselling goods or services. This form simplifies the process of obtaining resale tax exemptions, allowing businesses to acquire materials, goods, and merchandise without being burdened by sales tax at the point of purchase. Key components of the form include information about the purchaser, such as their name, sales tax account number, address, and type of business, as well as a declaration confirming that the items bought are intended for resale. The purchaser must certify that all purchases will be resold either in their original form or as part of a new product. An important aspect of the form is the acknowledgment of liability; if any of the purchased items are used for purposes beyond resale, the purchaser is responsible for paying the applicable sales tax at that time. Additionally, the seller's information is required to ensure accountability. Fraudulent use of the form is taken seriously, with potential penalties outlined in Louisiana Revised Statutes. To complete the process, the form must include the purchaser's declaration, including their signature and title, establishing a formal commitment to the stipulations set forth in the document.

United Health Care Example

Louisiana Resale Certificate

Sales Tax Exemption

Certificate for Purchases for Resale

R.S. 47:301(10)

Please print or type.

|

Purchaser Information |

|

|

|

||

|

|

|

|

|

|

|

Name of purchaser, as shown on the sales tax account |

|

Sales Tax Account Number (10 digits) |

|

|||

|

|

|

|

|

|

|

Address |

|

|

Telephone |

|

||

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

State |

ZIP |

|

|

|

|

|

|

|

Purchaser’s Type of Business

Description of purchaser’s business activity or items sold:

I, the purchaser, certify that all materials, goods, merchandise, and services purchased from the seller named below are for resale as tangible personal property, either in the same form as purchased or to be added as a recognizable, identifiable, and beneficial component of a new product. I further certify that all

I understand that if I use any of the items other than for resale, I must pay sales tax at the time of use. If this purchase is later found to be subject to tax, I, the purchaser, assume full liability for the tax.

Seller Information

Seller

Address (Street & number or P.O. Box)

City

State

ZIP

Any purchaser or agent who fraudulently signs this certificate without intent to use the taxable items for resale is subject to all the penalties provided for by Title 47 of the Louisiana Revised Statutes and collection will be pursued against the seller or purchaser for any taxes, penalties and interest due.

Purchaser’s Declaration

Name

Signature

X

Title

Date (mm/dd/yyyy)

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Identification | This form is known as the R-1042, specifically designed for Louisiana as a Resale Certificate Sales Tax Exemption Certificate for Purchases for Resale. |

| Governing Law | The use of this form is governed by Louisiana Revised Statutes, specifically R.S. 47:301(10). |

| Purchaser's Certification | The purchaser certifies that all items purchased are for resale and understands the penalty for fraudulent use of the certificate. |

| Liability | The purchaser assumes full liability for any tax owed if items are used other than for resale, ensuring compliance with tax regulations. |

Guidelines on Utilizing United Health Care

Completing the United Health Care form requires careful attention to detail, as it ensures that the necessary information is accurately captured. This process helps facilitate the management of sales tax exemption for resale purposes. Follow these steps to fill out the form correctly.

- Gather your information: Before starting, ensure you have all relevant information on hand, including your business details and sales tax account number.

- Fill out the Purchaser Information:

- Enter the name of the purchaser as shown on the sales tax account.

- Input the ten-digit Sales Tax Account Number.

- Provide the complete address, including street, city, state, and ZIP code.

- Include a contact telephone number.

- Indicate the type of business you operate.

- Describe the business activity or the items sold.

- Review the Certification Statement: Read the certification statement carefully. You are confirming that all items bought will be resold and understanding your tax obligations.

- Complete the Seller Information:

- Input the seller's name and address, including street and number or P.O. Box, city, state, and ZIP code.

- Sign and Date the Form: The purchaser must sign and indicate their title. Fill in the date using the format (mm/dd/yyyy).

Once the form is filled out, review all entries for accuracy before submitting it. Proper completion aids in the processing of your exemption certificate, ensuring compliance with applicable regulations.

What You Should Know About This Form

What is the purpose of the United Health Care form?

The United Health Care form is used to certify that certain purchases are exempt from sales tax because they are intended for resale. This form helps businesses in Louisiana manage their tax obligations when buying goods or services that will be resold to customers.

Who should complete the form?

The form should be completed by the purchaser, who must be registered for a sales tax account in Louisiana. It is necessary for anyone intending to buy items for resale, rather than personal use. Accurate information about the purchaser’s business and tax account is essential.

What information is required on the form?

The form requires the name of the purchaser, the 10-digit sales tax account number, contact details, and a description of the business activity. The seller's information, including address and location, must also be included for clarity.

What does the purchaser certify by signing the form?

By signing the form, the purchaser certifies that all items purchased will be for resale. This includes goods sold in the same form or as part of a new product. The purchaser acknowledges that if items are used for any other purpose, sales tax must be paid at that time.

What are the consequences of providing false information?

Providing false information on the form is considered fraud. The responsible parties may face penalties as outlined in Title 47 of the Louisiana Revised Statutes. Additionally, tax authorities may pursue collection of any owed taxes, penalties, and interest from both the seller and purchaser.

How should the form be submitted?

Typically, the completed form should be presented to the seller at the time of purchase. It is important to keep a copy for the purchaser's records in case of future inquiries or audits regarding tax-exempt status.

Is the form valid indefinitely?

No, the validity of the form is not indefinite. It must be completed and signed for each transaction where resale is intended. Businesses should be aware of the rules surrounding the use of such exemptions to remain compliant with tax laws.

What should I do if I have questions about the form?

If you have questions or need clarification about filling out the United Health Care form, consider consulting with a tax professional or reaching out to the Louisiana Department of Revenue for guidance. They can provide detailed assistance tailored to your specific situation.

Common mistakes

Filling out the United Health Care form can be straightforward, but some common mistakes can cause delays or complications. Many individuals forget to complete the Sales Tax Account Number. This field requires a precise 10-digit number and omitting it may lead to issues with tax exemption validation.

Another frequent error involves the purchase information section. Users may enter their name incorrectly, which must match the name on the sales tax account. Discrepancies can lead to the rejection of the certificate, requiring re-submission.

Incomplete or incorrect address information is also a common mistake. The form asks for a full address, including street, city, state, and ZIP code. Providing an incomplete address can cause confusion and possible delays in processing the form.

People sometimes forget to describe their type of business adequately. It is crucial to outline what kind of products are sold or what services are provided. A vague description may not fulfill the requirements and can result in further questions from authorities.

Finally, many overlook the importance of the signature and date sections. All purchasers must sign and date the form to certify its accuracy. Without these, the form may be considered invalid and may not be accepted. Double-checking all fields before submission can help avoid these common pitfalls.

Documents used along the form

In the process of utilizing the United Health Care form, there are several other documents that individuals or businesses often encounter. Each plays a significant role in ensuring compliance and providing necessary information for various transactions. Below are some of these commonly used forms and documents.

- Sole Proprietorship Business Registration Form: This document is essential for individuals operating a business under their own name. It serves to officially register the business with the appropriate state or local authority, and it ensures that the business operates legally while providing a pathway for taxes and other regulations.

- Sales Tax Permit Application: This application is necessary for businesses that sell taxable goods or services. It allows them to collect sales tax from customers and remit it to the state. The permit must be prominently displayed at the business location.

- IRS Form W-9: This form is used to request a taxpayer identification number (TIN) and certification. Businesses and freelancers often need to complete this form for tax purposes, allowing clients or employers to report payments made to them to the IRS.

- Certificate of Good Standing: This is an official document issued by a state, confirming that a business is legally registered and compliant with state regulations. It is often requested for various business transactions, including loans and partnerships, to prove the business’s credibility.

Understanding the role of these documents ensures that all parties involved in a transaction or business operation maintain compliance and protect their interests. By carefully managing these forms, individuals and businesses can navigate regulatory obligations more effectively.

Similar forms

The United Health Care form exhibits similarities with several other documents primarily designed for tax exemption or resale purposes. Below is a list of seven documents that share characteristics with the United Health Care form, along with brief explanations of how they are comparable:

- Resale Certificate: Similar to the United Health Care form, a resale certificate allows purchasers to buy goods without paying sales tax, given that these goods are intended for resale. Both documents require details about the purchaser and the purpose of the purchase.

- Sales Tax Exemption Certificate: This document is used by organizations to claim exemption from sales tax when purchasing items for specific exempt purposes. Like the United Health Care form, it requires a declaration by the purchaser regarding the intended use of the purchase.

- Form ST-3 (New York State Resale Certificate): Just as with the United Health Care form, Form ST-3 is employed by New York businesses to purchase items tax-free for resale. Both forms necessitate identifying information about the purchaser and a certification statement.

- IRS Form W-9: While primarily used for tax identification, Form W-9, like the United Health Care form, collects essential information about the purchaser and their business. Certain transactions may require completing both forms for tax exemption validation.

- Tax Exempt Organization Certificate (California): This is applicable for organizations that do not pay sales tax on qualifying purchases. It parallels the United Health Care form by indicating that the items purchased will not be used in a taxable manner.

- Form ST-2 (Connecticut Resale Certificate): This certificate allows businesses in Connecticut to purchase goods tax-free for resale. Similar to the United Health Care form, it serves as a formal declaration for the intended use of purchased items.

- Food and Food Products Resale Certificate: This specific certificate allows for the resale of food items without incurring sales tax. It mirrors the United Health Care form's function of certifying that the purchased items will be resold rather than consumed.

Understanding these similarities helps clarify the purpose and function of the United Health Care form within the broader context of tax-exempt transactions.

Dos and Don'ts

When filling out the United Health Care form, there are several key practices to keep in mind. Here’s a helpful list to ensure accuracy and compliance:

- Do print or type clearly to avoid any misunderstandings.

- Do double-check that all information matches the details on your sales tax account.

- Do provide your complete address, including street, city, state, and ZIP code.

- Do carefully read all sections before signing to ensure you understand your responsibilities.

- Do keep a copy of the form for your records after submission.

- Don’t leave any optional fields blank; it’s better to provide as much information as possible.

- Don’t attempt to use this form if you do not intend to resell the items.

- Don’t forget to sign and date the form before submitting it.

- Don’t provide false information, as there are penalties for fraudulent claims.

Misconceptions

Misconceptions often arise regarding the United Health Care form, particularly the Louisiana Resale Certificate Sales Tax Exemption Certificate. Understanding these misconceptions can promote better compliance and informed usage.

- All items purchased with this certificate are tax-free forever. This isn’t true. The certificate allows for tax-exempt purchases as long as those items are intended for resale. If you decide to use the item for personal purposes instead of resale, sales tax must be paid at that time.

- You can use the resale certificate for any type of purchase. In reality, the resale certificate is specific to purchases of tangible personal property intended for resale. It does not apply to services or items not meant for resale.

- As the purchaser, I can ignore tax implications if I claim a resale exemption. This is a critical error. If items purchased under the exemption are later deemed taxable, you, as the purchaser, are responsible for paying that tax. Ignoring this obligation can lead to serious penalties.

- Verbal agreements about tax exemptions are sufficient. This misconception can be risky. The resale exemption must be documented through the form. Verbal agreements won’t protect purchasers or sellers in the event of an audit or tax dispute.

Key takeaways

When filling out the United Health Care form, it is essential to ensure accuracy and compliance. Here are some key takeaways:

- Purchase Information: Clearly provide your name, sales tax account number, address, and contact information. Ensure the sales tax account number contains 10 digits.

- Business Description: Include a detailed description of your business activities and the items you sell to establish your eligibility for the resale exemption.

- Certification Statement: Acknowledge that all items purchased are for resale. Misuse of this certificate will lead to tax liability.

- Seller Information: Fill out the seller's details accurately, including their address. This information is necessary for record-keeping and potential audits.

- Signature and Date: Sign and date the form to validate it. Remember that signing under false pretenses is subject to legal penalties.

Browse Other Templates

Fair Rental Value Calculator 2023 - Using this worksheet ensures that families make informed decisions about their housing options.

Addendums - The FHA/VA Financing Addendum is a supplemental document attached to the main sales contract that outlines specific financing conditions.