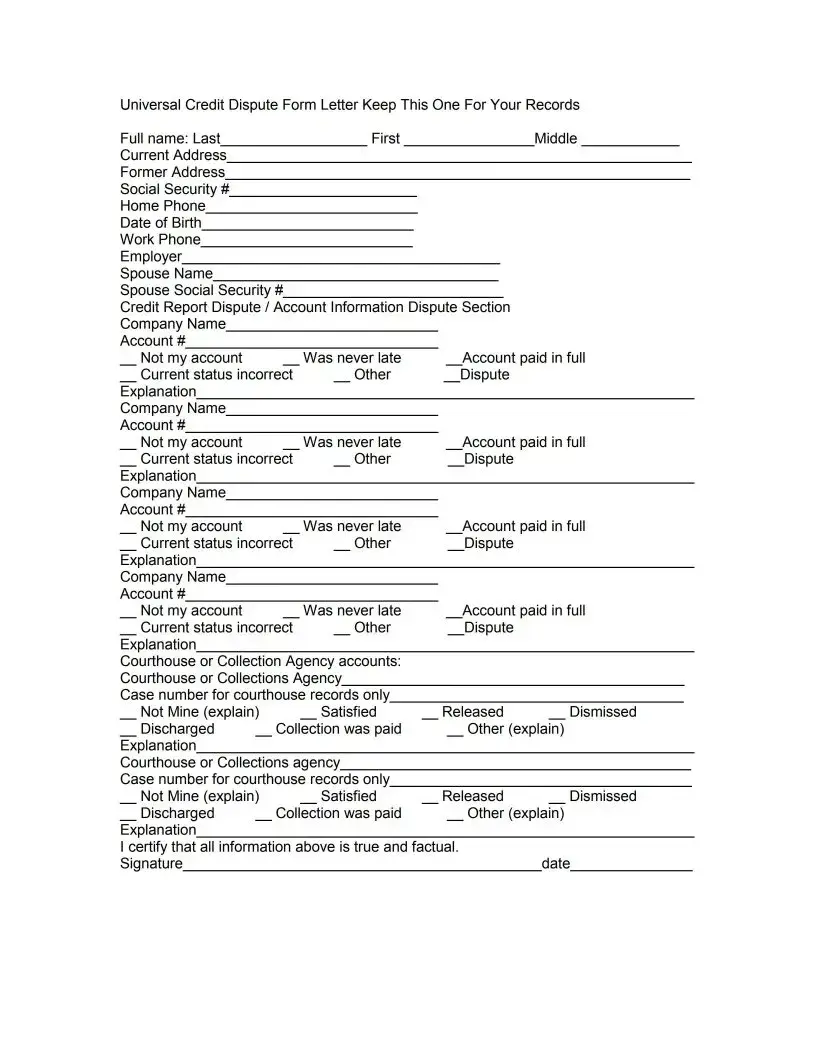

Fill Out Your Universal Data Form

The Universal Data form plays a vital role in helping individuals manage and correct inaccuracies in their credit reports. It is designed for those who wish to dispute erroneous information reported by credit bureaus or collection agencies such as Experion, Equifax, and TransUnion. Key sections of the form include personal identification fields, such as names, addresses, and Social Security numbers, which ensure that credit reporting agencies can accurately match the dispute with the correct individual. The form allows users to specify the nature of their disputes, detailing issues including whether an account is not theirs, if it was never paid late, or if the current status of an account is incorrect. Additional space is provided for explanations related to any inaccuracies in courthouse or collection agency accounts. To solidify the dispute, users must certify that all information provided is factual by signing and dating the form. This comprehensive approach not only streamlines the dispute process but also holds credit bureaus accountable for correcting errors, contributing to more accurate credit reports for consumers.

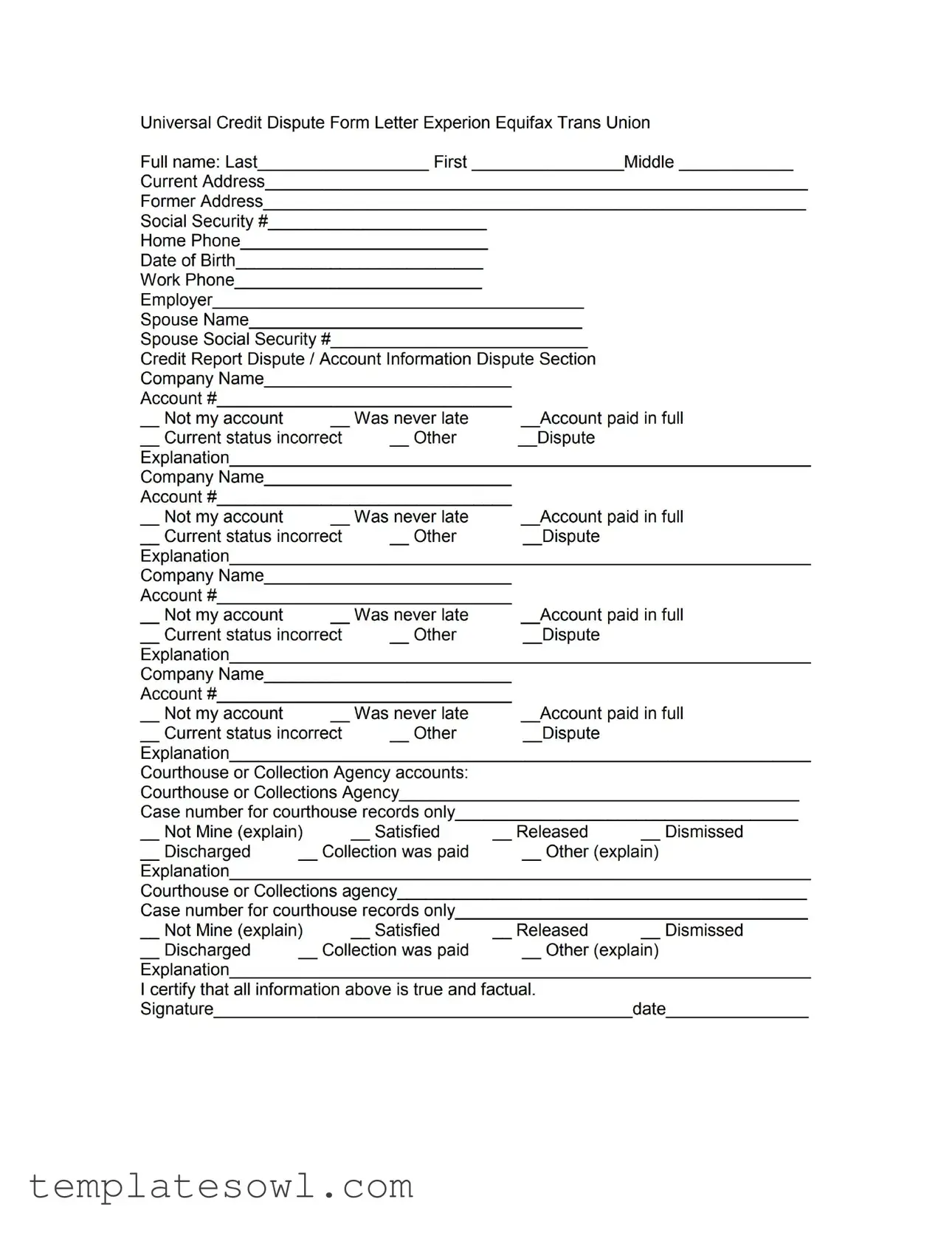

Universal Data Example

Universal Credit Dispute Form Letter Experion Equifax Trans Union

Full name: Last |

First |

Middle |

Current Address |

|

|

Former Add ress |

|

|

Social Security # |

|

|

Home Phone |

|

|

Date of Birth |

|

|

Work Phone |

|

|

E m pIoyer_______________________________________

Spouse Name

Spouse Social Security #

Credit Report Dispute / Account Information Dispute Section

Company Name

Account #

Not my account |

|

Was never late |

Account paid in full |

|

Current status incorrect |

Other |

Dispute |

|

|

Explanation |

|

|

|

|

Company Name |

|

|

|

|

Account # |

|

|

|

|

Not my account |

|

Was never late |

Account paid in full |

|

Current status incorrect |

Other |

Dispute |

|

|

Explanation |

|

|

|

|

Company Name |

|

|

|

|

Account # |

|

|

|

|

Not my account |

|

Was never late |

Account paid in full |

|

Current status incorrect |

Other |

Dispute |

|

|

Explanation |

|

|

|

|

Company Name |

|

|

|

|

Account # |

|

|

|

|

Not my account |

|

Was never late |

Account paid in full |

|

Current status incorrect |

Other |

Dispute |

|

|

Explanation |

|

|

|

|

Courthouse or Collection Agency accounts: |

|

|

||

Courthouse or Collections Agency |

|

|

||

Case number for courthouse records only |

|

|

||

Not Mine (explain) |

|

Satisfied |

Released |

Dismissed |

Discharged |

Collection was paid |

Other (explain) |

|

|

Explanation |

|

|

|

|

Courthouse or Collections agency |

|

|

||

Case number for courthouse records only |

|

|

||

Not Mine (explain) |

|

Satisfied |

Released |

Dismissed |

Discharged |

Collection was paid |

Other (explain) |

|

|

Explanation |

|

|

|

|

I certify that all information above is true and factual.

Signaturedate

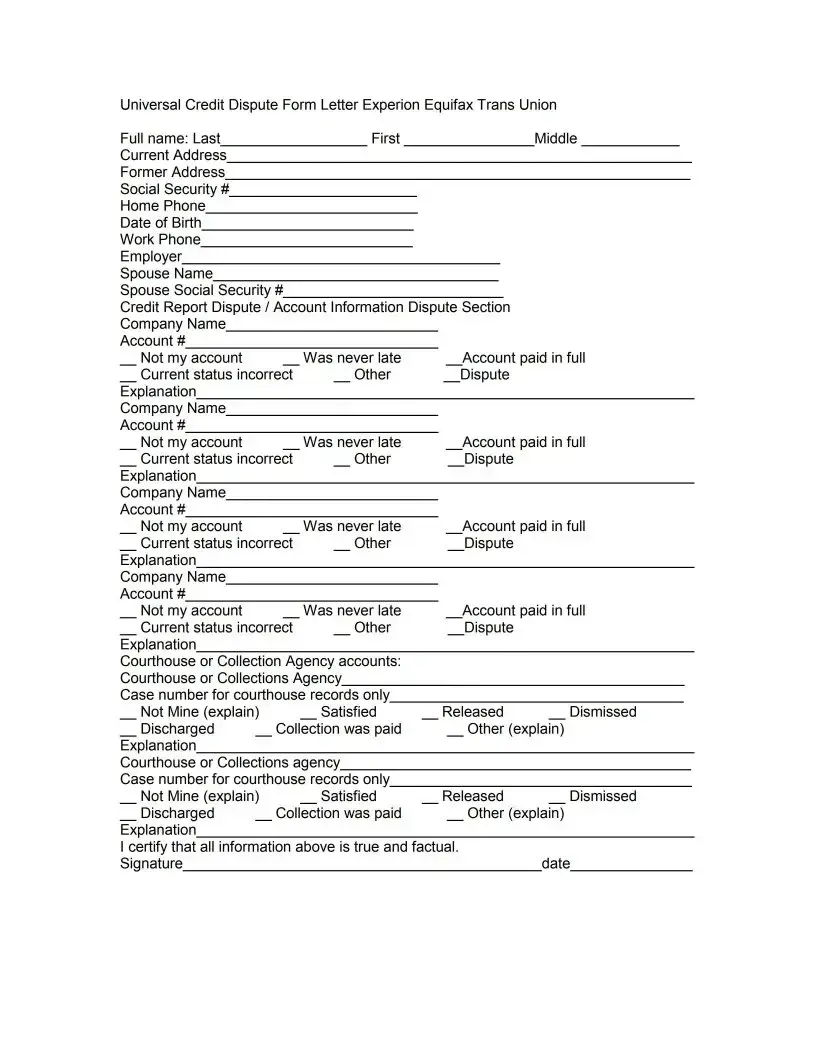

Universal Credit Dispute Form Letter Experion Equifax Trans Union

Full name: Last |

First |

Middle |

Current Address |

|

|

Former Add ress |

|

|

Social Security # |

|

|

Home Phone |

|

|

Date of Birth |

|

|

Work Phone |

|

|

E m pIoyer_______________________________________

Spouse Name

Spouse Social Security #

Credit Report Dispute / Account Information Dispute Section

Company Name

Account #

Not my account |

|

Was never late |

Account paid in full |

|

Current status incorrect |

Other |

Dispute |

|

|

Explanation |

|

|

|

|

Company Name |

|

|

|

|

Account # |

|

|

|

|

Not my account |

|

Was never late |

Account paid in full |

|

Current status incorrect |

Other |

Dispute |

|

|

Explanation |

|

|

|

|

Company Name |

|

|

|

|

Account # |

|

|

|

|

Not my account |

|

Was never late |

Account paid in full |

|

Current status incorrect |

Other |

Dispute |

|

|

Explanation |

|

|

|

|

Company Name |

|

|

|

|

Account # |

|

|

|

|

Not my account |

|

Was never late |

Account paid in full |

|

Current status incorrect |

Other |

Dispute |

|

|

Explanation |

|

|

|

|

Courthouse or Collection Agency accounts: |

|

|

||

Courthouse or Collections Agency |

|

|

||

Case number for courthouse records only |

|

|

||

Not Mine (explain) |

|

Satisfied |

Released |

Dismissed |

Discharged |

Collection was paid |

Other (explain) |

|

|

Explanation |

|

|

|

|

Courthouse or Collections agency |

|

|

||

Case number for courthouse records only |

|

|

||

Not Mine (explain) |

|

Satisfied |

Released |

Dismissed |

Discharged |

Collection was paid |

Other (explain) |

|

|

Explanation |

|

|

|

|

I certify that all information above is true and factual. |

|

|||

Signature |

|

|

date |

|

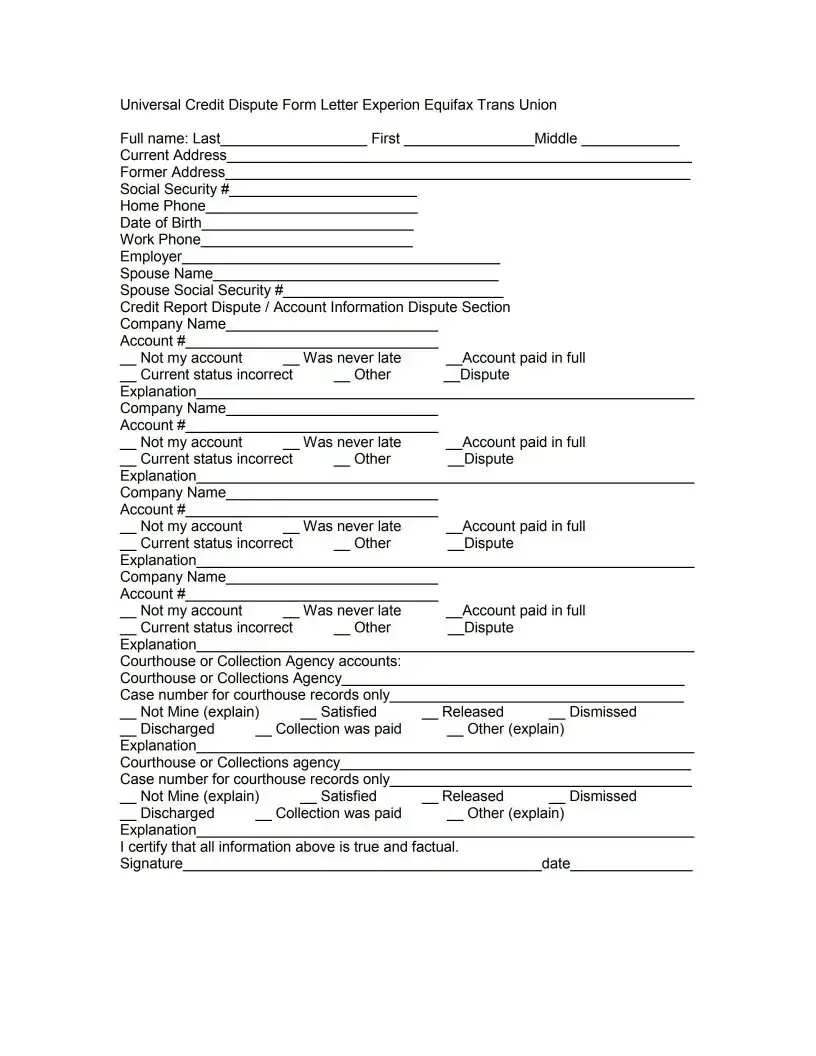

Universal Credit Dispute Form Letter Experion Equifax Trans Union

Full name: Last |

First |

Middle |

Current Address |

|

|

Former Add ress |

|

|

Social Security # |

|

|

Home Phone |

|

|

Date of Birth |

|

|

Work Phone |

|

|

E m pIoyer_______________________________________

Spouse Name

Spouse Social Security #

Credit Report Dispute / Account Information Dispute Section

Company Name

Account #

Not my account |

|

Was never late |

Account paid in full |

|

Current status incorrect |

Other |

Dispute |

|

|

Explanation |

|

|

|

|

Company Name |

|

|

|

|

Account # |

|

|

|

|

Not my account |

|

Was never late |

Account paid in full |

|

Current status incorrect |

Other |

Dispute |

|

|

Explanation |

|

|

|

|

Company Name |

|

|

|

|

Account # |

|

|

|

|

Not my account |

|

Was never late |

Account paid in full |

|

Current status incorrect |

Other |

Dispute |

|

|

Explanation |

|

|

|

|

Company Name |

|

|

|

|

Account # |

|

|

|

|

Not my account |

|

Was never late |

Account paid in full |

|

Current status incorrect |

Other |

Dispute |

|

|

Explanation |

|

|

|

|

Courthouse or Collection Agency accounts: |

|

|

||

Courthouse or Collections Agency |

|

|

||

Case number for courthouse records only |

|

|

||

Not Mine (explain) |

|

Satisfied |

Released |

Dismissed |

Discharged |

Collection was paid |

Other (explain) |

|

|

Explanation |

|

|

|

|

Courthouse or Collections agency |

|

|

||

Case number for courthouse records only |

|

|

||

Not Mine (explain) |

|

Satisfied |

Released |

Dismissed |

Discharged |

Collection was paid |

Other (explain) |

|

|

Explanation |

|

|

|

|

I certify that all information above is true and factual. |

|

|||

Signature |

|

|

date |

|

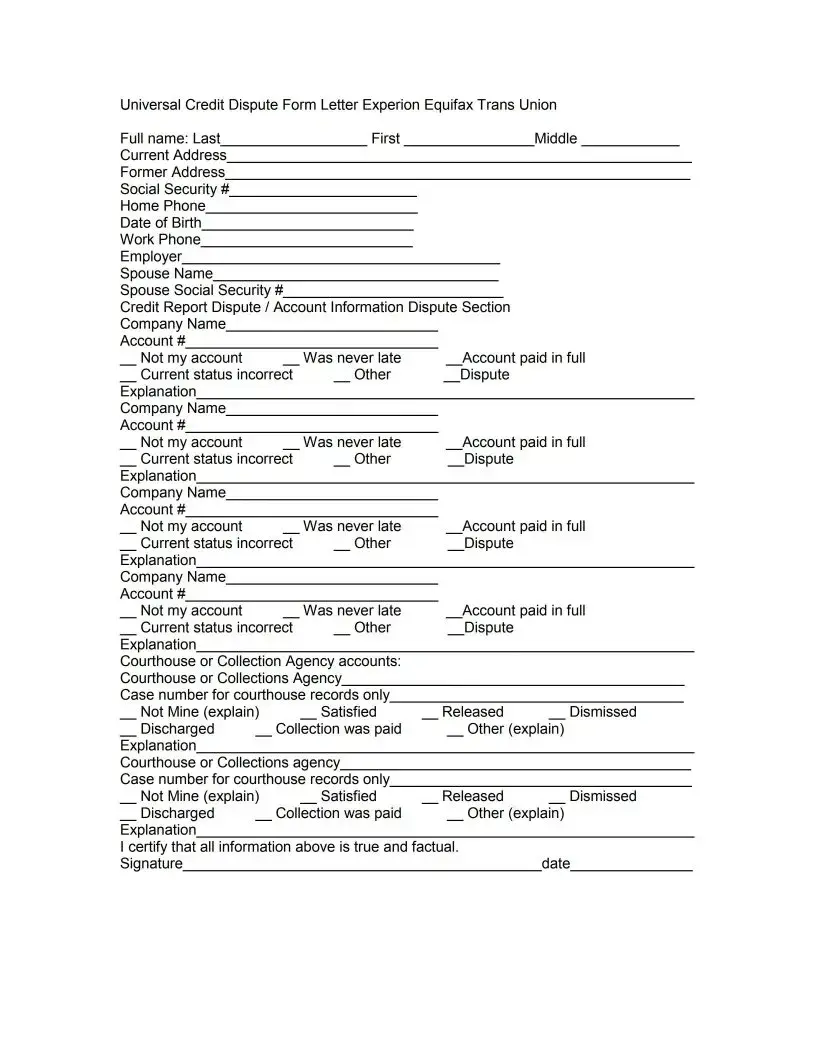

Universal Credit Dispute Form Letter Keep This One For Your Records

Full name: Last |

First |

Middle |

Current Address |

|

|

Former Add ress |

|

|

Social Security # |

|

|

Home Phone |

|

|

Date of Birth |

|

|

Work Phone |

|

|

E m pIoyer_______________________________________

Spouse Name

Spouse Social Security #

Credit Report Dispute / Account Information Dispute Section

Company Name

Account #

Not my account |

|

Was never late |

Account paid in full |

|

Current status incorrect |

Other |

Dispute |

|

|

Explanation |

|

|

|

|

Company Name |

|

|

|

|

Account # |

|

|

|

|

Not my account |

|

Was never late |

Account paid in full |

|

Current status incorrect |

Other |

Dispute |

|

|

Explanation |

|

|

|

|

Company Name |

|

|

|

|

Account # |

|

|

|

|

Not my account |

|

Was never late |

Account paid in full |

|

Current status incorrect |

Other |

Dispute |

|

|

Explanation |

|

|

|

|

Company Name |

|

|

|

|

Account # |

|

|

|

|

Not my account |

|

Was never late |

Account paid in full |

|

Current status incorrect |

Other |

Dispute |

|

|

Explanation |

|

|

|

|

Courthouse or Collection Agency accounts: |

|

|

||

Courthouse or Collections Agency |

|

|

||

Case number for courthouse records only |

|

|

||

Not Mine (explain) |

|

Satisfied |

Released |

Dismissed |

Discharged |

Collection was paid |

Other (explain) |

|

|

Explanation |

|

|

|

|

Courthouse or Collections agency |

|

|

||

Case number for courthouse records only |

|

|

||

Not Mine (explain) |

|

Satisfied |

Released |

Dismissed |

Discharged |

Collection was paid |

Other (explain) |

|

|

Explanation |

|

|

|

|

I certify that all information above is true and factual. |

|

|||

Signature |

|

|

date |

|

The dispute process goes like this. I see my report and notice errors that I dispute with the

bureaus by mail. The credit bureaus contact creditors about my dispute and respond back to the bureaus. The bureaus respond to me in writing. I need writing for legal issues and security.

I fill out the credit dispute form and include a copy of my driver’s license and "copies" of any documents I may have to help with my credit dispute claim. Each company is unique and separate, so I dispute credit files with each bureau. IF I've been turned down for credit in the last 60 days, I'm unemployed and plan to look for a job within 60 days, I'm on welfare, My report is inaccurate due to fraud, or if I live in the USA.

I Mail these 3 forms to the addresses below

The 3 credit bureau official and legal mailing addresses

Trans Union

P.O. Box 1000

Chester, PA 19022

Equifax

P.O. Box 740241

Atlanta, GA

Experian

P.O. Box 2104

Allen, TX

I include a copy of my driver’s license and copies of any documents that may help with my credit dispute claim. Each company is unique and separate, so dispute credit files with each bureau. IF I've been turned down for credit in the last 60 days, I'm unemployed and plan to look for a job within 60 days, or if I'm on welfare, or if my report is inaccurate due to fraud or if I have not had a copy of my credit report this year I can mail a letter to each of the bureaus above and get a free copy of my credit report

Correcting Errors

Under the FCRA, both the CRA and the organization that provided the information to the CRA, such as a bank or credit card company, have responsibilities for correcting inaccurate or incomplete information in my report. To protect all my rights under the law, contact both the CRA and the information provider.

First, tell the CRA in writing what information I believe is inaccurate. Include copies (NOT originals) of documents that support m position. In addition to providing m complete name and address, my letter should clearly identify each item in my report I dispute, I state the facts and explain why I dispute the information, and request deletion or correction. I may want to enclose a copy of my report with the items in question circled. I send my letter by certified mail, return receipt requested, so I can document what the CRA received. Keep copies of m dispute letter and enclosures.

CRAs must reinvestigate the items in

Disputed information that cannot be verified must be deleted from my file and never replaced.

If my report contains erroneous information, the CRA must correct it.

If an item is incomplete, the CRA must complete it. For example, if my file showed that I was were late making payments, but failed to show that I am no longer delinquent; the CRA must show that I'm current.

If my file shows an account that belongs only to another person, the CRA must delete it.

When the reinvestigation is complete, the CRA must give me the written results and a free copy of my report if the dispute results in a change. If an item is changed or removed, the CRA cannot put the disputed information back in my file unless the information provider verifies its accuracy and completeness, and the CRA gives me a written notice that includes the name, address, and phone number of the provider.

Also, if I request, the CRA must send notices of corrections to anyone who received my report in the past six months. Job applicants can have a corrected copy of their report sent to anyone who received a copy during the past two years for employment purposes. If a reinvestigation does not resolve my dispute, ask the CRA to include my statement of the dispute in my file and in future reports.

Second, in addition to writing to the CRA, tell the creditor or other information provider in writing that I dispute an item. Again, include copies (NOT originals) of documents that support my position. Many providers specify an address for disputes. If the provider then reports the item to any CRA, it must include a notice of my dispute. In addition, if I am

Information about criminal convictions may be reported without any time limitation.

Bankruptcy information may be reported for 10 years.

Credit information reported in response to an application for a job with a salary of more than $75,000 has no time limit.

Credit information reported because of an application for more than $150,000 worth of credit or life insurance has no time limit.

Information about a lawsuit or an unpaid judgment against me can be reported for seven years or until the statute of limitations runs out, whichever is longer. Criminal convictions can be reported without any time limit.

Adding Accounts to MY File

My credit file may not reflect all my credit accounts. Although most national department store and

Credit Report help Outline by Bo Majors

I MAKE A CHOICE TO NEVER DEFAULT OR BE LATE ON ANY PAYMENTS FOREVERMORE SO HELP ME. I pay before 30 days elapse and if I can't, I make arrangements to pay as quickly as possible and I call them before they call me. I ask forgiveness in a humble manner.

I check my credit report and look for old, unfamiliar, duplicate, merged, inacurate or out dated and fraudulent accounts or creditor practices. When bureaus return my dispute form reply in 14 to 40 days, either the item is removed or I get a phone number and address where I ask forgiveness and pay include fees for accurate records. I have rights to dispute any unfamiliar items I feel are inaccurate.

FTC.com. Report negligent practices

Overlap past or 2 yr old inaccurate credit with present (within 2yrs) good credit. Use credit cards, car or personal loans to do so. Mail in $200 dollars with an app and ask to open a new account or

I pay loan balances down to less than 80% against my high credit limit. Over 80% on balances kill my good credit score.

Creditors are calling, my score is falling and I choose to get a debt company to stop my bleeding here.

I wait

Not all bad credit can be removed legally. BK's, Judgments, Collections, Late payments. Some can. More Details Here

My credit is so bad I will try anything to get a better score. I will even let a company bilk me to get a new credit identity! It's illegal! Do not do it! Bo Majors

I got this, read this, this & this then printed and mailed this!

Do you still feel like the bureaus or creditors are not helping you by the law OR you are too busy to fight improper reporting? Use this Law firm. Contact BBB

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Universal Data Form serves to dispute inaccuracies on credit reports across major bureaus: Experian, Equifax, and TransUnion. |

| Required Information | To complete the form, individuals must provide personal details, including full name, address, social security number, phone numbers, and employment information. |

| Dispute Details | Individuals can specify multiple accounts, detailing issues such as accounts that are not theirs or incorrect payment statuses. Clear explanations for each dispute are essential. |

| Certification | A declaration at the end of the form ensures that the information provided is true and factual, requiring a signature and date from the individual. |

| Mailing Addresses | Completed forms must be sent to the specific addresses of credit bureaus: Experian, Equifax, and TransUnion, ensuring each bureau receives its unique filing. |

| Legal Framework | This process is governed by the Fair Credit Reporting Act (FCRA), which mandates that both credit reporting agencies and information providers address disputes responsibly. |

Guidelines on Utilizing Universal Data

Once you have gathered the necessary documents, the next step involves properly filling out the Universal Data form. This form serves as a crucial tool in the process of disputing inaccuracies in your credit report. Following the steps outlined below will help ensure that your dispute is articulated clearly and submitted correctly.

- Personal Information: Fill in your full name, including your last, first, and middle names.

- Current Address: Clearly provide your current address. Also, remember to include your former address if applicable.

- Contact Details: Enter your Social Security number, home phone number, work phone number, date of birth, and employer details.

- Spouse Information: If applicable, provide your spouse's name and Social Security number.

- Dispute Section: For each dispute, list the company name and account number. Indicate the nature of your dispute such as "Not my account," "Was never late," or other valid reasons. Provide any further explanations needed.

- Court or Collection Agency Accounts: For each account, enter the case number, if applicable. Indicate whether it is not yours, satisfied, or any other relevant status, and provide explanations where required.

- Certification: Read the statement certifying that the information you provided is true and factual. Sign and date the form.

After completing the form, you will need to send it, along with any supporting documents, to the appropriate credit bureaus. Doing so helps initiate the dispute process, allowing the bureaus to investigate and respond accordingly. Each bureau has its unique requirements, so ensure you address your submissions properly.

What You Should Know About This Form

What is the Universal Data Form?

The Universal Data Form is a document designed to help individuals dispute inaccuracies on their credit reports. It requests essential personal information and details about the accounts in question. By using this form, consumers can formally notify credit reporting agencies about errors and initiate the dispute process.

Who should use the Universal Data Form?

Anyone who identifies inaccuracies on their credit report should consider using the Universal Data Form. This includes individuals who have been denied credit, those who are unemployed and seeking work, or anyone whose report contains errors due to fraud or negligence. It's a vital tool for maintaining accurate credit records.

What information is required on the form?

Users will need to provide several pieces of personal information, including their full name, current and former addresses, Social Security number, date of birth, and contact numbers. Additionally, details about the disputed accounts, such as company names, account numbers, and the nature of the disputes, must be included. This comprehensive data helps ensure that the dispute process runs smoothly.

How do I submit the Universal Data Form?

The completed Universal Data Form should be mailed to each of the three major credit bureaus: Experian, Equifax, and TransUnion. Including a copy of your driver’s license and any supporting documentation related to your dispute enhances the chances of a successful review. Recommendations suggest sending your disputes via certified mail, which provides a record of your submission.

What happens after I submit the form?

Once the Universal Data Form is submitted, the credit bureaus will investigate the dispute. This process typically takes 14 to 40 days. They will contact the creditor involved and gather the necessary information before responding to you in writing. It is important to keep copies of everything submitted and received during this process.

What if my dispute is not resolved?

If the credit bureaus do not resolve the dispute to your satisfaction, you have the option to provide additional information or request that your statement of dispute be included in your credit file. Consumers are entitled to know what is contained in their credit reports, and ongoing inaccuracies can be further escalated through formal complaints with regulatory agencies.

How can I protect my rights during this process?

To protect your rights, it's important to document everything throughout the dispute process, including your letters and any correspondence received. Under the Fair Credit Reporting Act (FCRA), both the credit reporting agency and the information provider must act responsibly to correct inaccuracies. Keeping thorough records ensures that you have a solid foundation for any further action you may need to take.

Common mistakes

When filling out the Universal Data form, individuals frequently make several mistakes that can lead to processing delays or complications in addressing their disputes. These mistakes can hinder the overall effectiveness of the dispute process.

One common error is providing incomplete personal information. It is essential to include your full name and complete current address. Missing even a single detail, such as the middle name or prior address, can result in confusion and misidentification of your case, affecting the outcome of your dispute.

Another mistake occurs when individuals do not clearly specify their dispute reasons. The form provides options, but failing to elaborate on issues, like incorrect account status or asserting that the account is not theirs, can lead to insufficient evidence for the credit bureaus to take action.

Omitting critical documentation is also a frequent issue. Submitting only the form without including copies of identification or supporting materials, such as payment receipts, can weaken your position. To facilitate your dispute, always include a copy of your driver’s license and any relevant correspondence that supports your claim.

Inaccuracies in account information can arise when individuals misidentify companies or provide incorrect account numbers. Double-checking this information before submission is vital to ensure that the credit bureaus are addressing the correct account, thereby minimizing potential delays in your case.

Some people forget to sign and date the form. Certification that all information is true and factual is critical for the legitimacy of the document. Failure to do so could lead to the rejection of the dispute process.

Lastly, a common mistake relates to submitting the form to an incorrect address or not following up. Each of the credit bureaus has specific mailing addresses. Ensure that your form reaches the correct bureau to prevent unnecessary setbacks.

By being vigilant about these mistakes, individuals can enhance their chances of a successful and timely resolution of their credit disputes.

Documents used along the form

When dealing with credit disputes, various forms and documents support and facilitate the process. These documents provide necessary information and help ensure that your dispute is handled efficiently. Below is a list of commonly used forms that complement the Universal Data Form. Understanding these will help you navigate the dispute process effectively.

- Credit Dispute Letter: A formal letter sent to credit reporting agencies detailing the specific inaccuracies in your credit report. It requests an investigation into the disputed items and provides evidence supporting your claim.

- Proof of Identity Document: Typically a copy of your driver’s license or passport. This serves to verify your identity while disputing inaccuracies in your credit report.

- Supporting Documentation: Any relevant paperwork that substantiates your claim, such as bank statements, payment receipts, or correspondence with creditors. These records reinforce your argument for why the disputed items are incorrect.

- Fraud Affidavit: This document is filled out if you suspect your identity has been stolen. It outlines the fraudulent activity and helps in clearing your credit report of inaccuracies caused by identity theft.

- Debt Validation Letter: A letter sent to a debt collector requesting validation of the debt owed. It’s used to ensure that the collector has the right to collect the debt listed on your credit report.

- CEASE AND DESIST Letter: If you wish to stop communication from a debt collector, this letter explicitly instructs them to cease contacting you regarding the debt.

- Credit Monitoring Reports: Regular reports from credit monitoring services that provide updates on your credit status. These documents can help you track any new changes or errors that may arise post-dispute.

- Request for Free Credit Report: A letter sent to the credit reporting agencies requesting a free copy of your credit report. This might be necessary to assess and confirm any errors after submitting your dispute.

Using these documents in conjunction with the Universal Data Form ensures a comprehensive approach to resolving inaccuracies in your credit report. Prepare these documents carefully, and keep copies for your records as you move forward in the dispute process.

Similar forms

-

Credit Report Dispute Form: Like the Universal Data form, the Credit Report Dispute Form is used to challenge incorrect entries on credit reports. Both forms require personal information such as your name, address, and Social Security number, and allow the user to specify accounts and reasons for dispute.

-

Fair Credit Reporting Act (FCRA) Dispute Letter: This letter, similar to the Universal Data form, serves as a formal request to correct inaccuracies in a credit report. It necessitates the inclusion of your identification details and a clear account of the disputed information, just as seen in the Universal Data form.

-

Identity Theft Complaint Form: When identity theft is suspected, individuals use this form to report fraudulent accounts. It shares a commonality with the Universal Data form in that it gathers personal data and specifics about disputed accounts, making it essential for preventing continued credit abuse.

-

Credit Repair Request Form: The Credit Repair Request Form is designed to assist individuals in rectifying their credit. Both it and the Universal Data form require users to list inaccurate or unverifiable accounts and provide a justification for the correction.

-

Collection Agency Dispute Form: Similar to the Universal Data form, this document is specifically used to dispute debts collected by agencies. It involves detailing the account in question and reasons for the dispute. This parallels the detailed account dispute section present in the Universal Data form.

Dos and Don'ts

- Do: Provide accurate and complete information throughout the form.

- Don't: Skip any sections or leave them blank unless instructed to do so.

- Do: Include copies of any supporting documents relevant to your dispute.

- Don't: Submit original documents; keep those for your records.

- Do: Use certified mail to send your dispute to document your submission.

- Don't: Send multiple disputes on the same issue to different bureaus simultaneously.

- Do: Check that your contact information is current and easy to read.

- Don't: Forget to sign and date the form before mailing it.

- Do: Keep copies of everything you send, including the form and any attachments.

Misconceptions

- Misconception: The Universal Data Form is just for major credit bureaus.

In fact, the Universal Data Form can be helpful for a variety of disputes, not just with major credit reporting agencies. It's applicable to different contexts, including collections and courthouse records.

- Misconception: You can only file one dispute per form.

This is not true. You can list multiple disputes on a single Universal Data Form. Each entry allows for distinct company names and account information.

- Misconception: Credit bureaus automatically fix errors upon submission.

Credit bureaus do not automatically fix issues. They will investigate the claims, and this process can take 14 to 40 days for a response.

- Misconception: Providing a Social Security number is mandatory.

While many credit disputes ask for a Social Security number, it’s not always mandatory. You can choose to provide alternate identifier information or omit it if privacy is a concern.

- Misconception: Disputing an error ensures it's corrected.

Disputing an error doesn’t guarantee it will be corrected. If the information can be verified as accurate, it will remain on your credit report.

- Misconception: You must always send original documents.

Do not send original documents when disputing. Always send copies to ensure that your originals remain safe.

- Misconception: There’s no need to document your dispute.

Documentation is crucial. Keep copies of your dispute letters and any related correspondence to support your claim in case further action is needed.

- Misconception: Only individuals with poor credit can use the form.

The form is for anyone who perceives an error, regardless of their credit status. Even those with good credit should verify their reports for accuracy.

- Misconception: The dispute process is always straightforward.

The process can be complicated and varies based on the situation. Each case is unique, and challenges may arise.

- Misconception: You can’t dispute information if you made a late payment.

Even if you owe a late payment, you can still question inaccuracies in how that payment is reported. It's important it reflects the correct information.

Key takeaways

Understanding how to effectively fill out and utilize the Universal Data form is essential for anyone seeking to dispute inaccuracies in their credit report. Here are some key takeaways that can guide you through the process:

- Accuracy Matters: Ensure that all personal information, such as your name, address, and Social Security number, is accurate. Mistakes can lead to delays in processing your dispute.

- Detailed Disputes: Clearly outline the nature of your dispute for each account. Specify whether the account is not yours, was never late, or has incorrect current status information.

- Documentation is Key: Include copies of relevant documentation, like your driver's license and any other supporting documents. This helps verify your identity and strengthens your claim.

- Mailing Instructions: After completing the form, mail it to each of the credit bureaus individually. Use certified mail with a return receipt to confirm that they received your dispute.

- Follow Up: Keep records of your dispute submissions and expect a response within 30 days. If your dispute is deemed frivolous, be prepared to follow up and provide additional evidence.

By adhering to these guidelines, individuals can navigate the dispute process more effectively and work towards correcting inaccuracies in their credit reports.

Browse Other Templates

Tax Clearance Certificate Nj - The total sales price listed on the form should accurately represent the transaction to ensure tax compliance.

Keiser University Transcripts - Check the box for certified mail if selecting that option.