Fill Out Your Us Australia Trade Agreement Form

The Australia-United States Free Trade Agreement (AUSFTA) fosters a robust economic partnership, and one of its essential components is the completion of the US Australia Trade Agreement form. This document serves as a declaration of the origin of goods imported from the United States to Australia, supporting the trade interests of both nations. By confirming that the goods supplied are indeed "US originating" as defined by the relevant provisions of the Customs Act, businesses can take advantage of favorable tariffs and other trading conditions. The form requires specific information about the goods, including a description, model or product number, and the corresponding Harmonized Tariff Classification. Importantly, it outlines a checklist for the type of goods that may qualify—ranging from minerals and plants to live animals and certain marine life. The signing company not only asserts the American origin of these goods but also agrees to maintain documentation supporting this claim, ensuring accountability and transparency. Key details such as the names of the importing parties, contact information, and the precise date of supply are also necessary for compliance. Additionally, it is vital for Australian importers to accurately quote Preference Rule Type “WO” on their Import Declaration to complete the process effectively.

Us Australia Trade Agreement Example

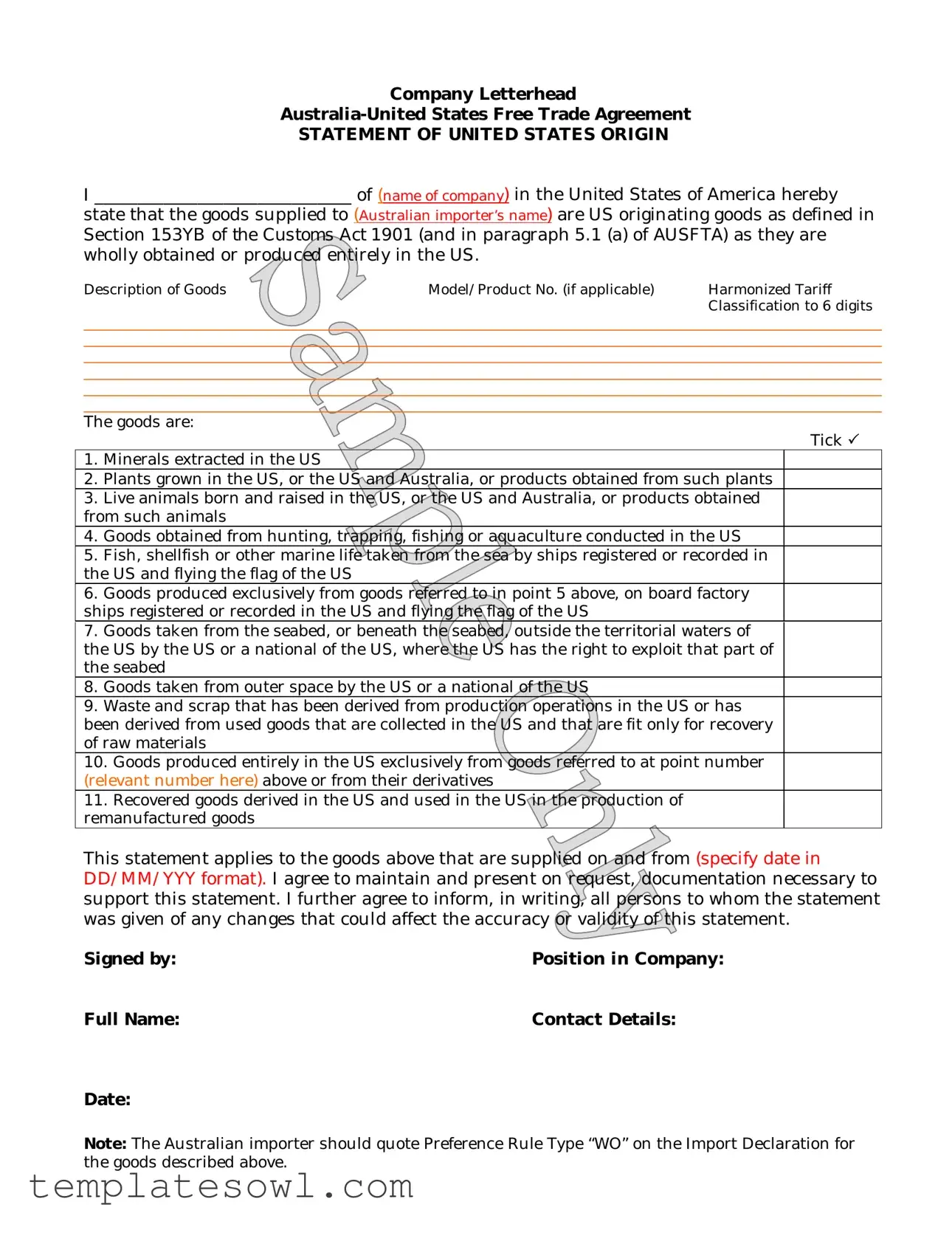

Company Letterhead

STATEMENT OF UNITED STATES ORIGIN

I ______________________________ of (name of company) in the United States of America hereby

state that the goods supplied to (Australian importer’s name) are US originating goods as defined in Section 153YB of the Customs Act 1901 (and in paragraph 5.1 (a) of AUSFTA) as they are wholly obtained or produced entirely in the US.

Description of Goods |

Model/Product No. (if applicable) |

Harmonized Tariff |

|

|

Classification to 6 digits |

__________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________

__________________________________________________________________________________________________________________

The goods are:

Tick 3

1.Minerals extracted in the US

2.Plants grown in the US, or the US and Australia, or products obtained from such plants

3.Live animals born and raised in the US, or the US and Australia, or products obtained from such animals

4.Goods obtained from hunting, trapping, fishing or aquaculture conducted in the US

5.Fish, shellfish or other marine life taken from the sea by ships registered or recorded in the US and flying the flag of the US

6.Goods produced exclusively from goods referred to in point 5 above, on board factory ships registered or recorded in the US and flying the flag of the US

7.Goods taken from the seabed, or beneath the seabed, outside the territorial waters of the US by the US or a national of the US, where the US has the right to exploit that part of the seabed

8.Goods taken from outer space by the US or a national of the US

9.Waste and scrap that has been derived from production operations in the US or has been derived from used goods that are collected in the US and that are fit only for recovery of raw materials

10.Goods produced entirely in the US exclusively from goods referred to at point number (relevant number here) above or from their derivatives

11.Recovered goods derived in the US and used in the US in the production of remanufactured goods

This statement applies to the goods above that are supplied on and from (specify date in DD/MM/YYY format). I agree to maintain and present on request, documentation necessary to support this statement. I further agree to inform, in writing, all persons to whom the statement was given of any changes that could affect the accuracy or validity of this statement.

Signed by: |

Position in Company: |

Full Name: |

Contact Details: |

Date:

Note: The Australian importer should quote Preference Rule Type “WO” on the Import Declaration for the goods described above.

Form Characteristics

| Fact Name | Details |

|---|---|

| Origin Statement | The statement confirms that the goods supplied to Australia originate from the United States. |

| Definition | US originating goods are defined in Section 153YB of the Customs Act 1901 and AUSFTA paragraph 5.1(a). |

| Goods Description | Suppliers must accurately describe their goods, including model and Harmonized Tariff classification. |

| Eligibility Criteria | Goods must fall into specific categories, such as minerals, plants, or live animals. |

| Date Requirement | The statement is applicable to goods supplied from a clearly specified date. |

| Documentation | Suppliers must maintain documentation to support the claims made in the statement. |

| Importer Declaration | The Australian importer must quote Preference Rule Type “WO” on the Import Declaration for these goods. |

Guidelines on Utilizing Us Australia Trade Agreement

Completing the US Australia Trade Agreement form requires careful attention to detail. Follow the steps outlined below to ensure accurate submission. Properly filling out this form will help facilitate trade between the United States and Australia.

- Begin by writing the company name on the line provided at the top of the form.

- In the first blank space, enter your full name as the representative of the company.

- Provide the name of the Australian importer in the next blank space.

- Next, describe the goods being supplied. Include model or product numbers if applicable.

- Fill in the Harmonized Tariff Classification with the correct six-digit code.

- Tick the relevant boxes that apply to the nature of the goods you are supplying. You may select more than one option.

- Specify the date on which the goods are being supplied. Use the format DD/MM/YYYY.

- Sign the form where indicated, and include your full name, position in the company, and contact details.

Once this form is completed, it serves as a statement confirming the origin of the goods. Ensure that you keep copies and be prepared to present documentation if requested, as this will support the information provided in the statement. With everything in place, you are ready to proceed with the trade process.

What You Should Know About This Form

What is the purpose of the U.S.-Australia Trade Agreement form?

The U.S.-Australia Trade Agreement form is designed to certify that certain goods supplied from the U.S. to Australia meet specific origin criteria. This certification is essential for ensuring that the goods can benefit from preferential tariff treatment, which can reduce or eliminate duties on imports. By accurately completing this form, businesses help facilitate smoother trade between the two countries, promoting economic benefits for both.

Who needs to fill out this form?

This form must be completed by U.S. exporters when shipping goods to an Australian importer. It serves as an official declaration that the goods in question comply with the origin conditions set forth in the Australia-United States Free Trade Agreement (AUSFTA). Both the exporter and importer can benefit from reduced tariffs by ensuring accuracy in this documentation.

What goods qualify as U.S. originating goods?

Goods are considered U.S. originating if they are wholly obtained or produced entirely within the United States. This includes a wide array of items, such as minerals extracted in the U.S., plants grown in the U.S. or in collaboration with Australia, and certain types of goods derived from hunting or fishing that occur within U.S. jurisdiction. It is essential to tick the appropriate category listed in the form to specify which classification applies to the goods being shipped.

What if the goods do not meet the origin requirements?

If the goods do not meet the origin requirements outlined in the AUSFTA, the exporter cannot claim preferential tariff treatment. This situation may result in higher duties being applied when the goods enter Australia. It’s crucial for businesses to ensure compliance with the origin criteria to avoid unexpected costs and complications during the import process.

What documentation should be maintained alongside this form?

Exporters are required to maintain documentation that supports their claim of U.S. origin for the goods. This may include invoices, production records, and shipping documents. Importantly, these documents must be readily available for presentation upon request by customs authorities. Keeping thorough records can provide crucial evidence of compliance and help prevent disputes related to duties and tariffs.

How should changes to the information on the form be handled?

If there are any changes that could impact the accuracy or validity of the statement of origin, the exporter must inform all parties who received the form in writing. This includes notifying the Australian importer about any modifications that might affect the eligibility for preferential tariff treatment, ensuring that all involved parties are kept up to date with the most accurate information.

What should U.S. exporters do to ensure compliance when exporting to Australia?

U.S. exporters should carefully review the definition of U.S. origin under AUSFTA, ensuring that goods meet all necessary criteria before shipment. Completing the form accurately is essential. Additionally, maintaining comprehensive records related to the goods and remaining informed about any changes in trade regulations will assist exporters in staying compliant and ensuring smooth movement of their products across borders.

Common mistakes

Filling out the US Australia Trade Agreement form correctly is crucial for ensuring compliance and smooth transactions. Mistakes can lead to unnecessary delays and complications. Here are ten common errors made during the process.

1. Providing Incomplete Information: One of the most frequent mistakes is not filling out all required sections of the form. It is vital to include the complete name of the company, along with accurate descriptions of the goods. Missing even minor details may render the form invalid.

2. Incorrectly Identifying Goods: When selecting the classification of goods, care must be taken to choose the correct option from the provided list. Mislabeling the nature of the goods can lead to significant trade hurdles and compliance issues.

3. Ignoring Harmonized Tariff Codes: Failing to provide the correct Harmonized Tariff Classification number is another common error. This code is essential for customs clearance, and inaccuracies can cause unforeseen delays or penalties.

4. Missing Signature and Date: Many individuals overlook the necessity of signing and dating the form. Without a signature, the statement lacks authenticity, and the form cannot be processed.

5. Not Specifying the Date of Supply: Leaving the date field blank or incorrectly formatted can create confusion. The form should specify the exact date in the required DD/MM/YYYY format to maintain clarity regarding when the goods will be supplied.

6. Failing to Tick Relevant Boxes: In the section detailing the nature of the goods, it is crucial to tick the appropriate boxes. Omitting this step may lead to misunderstandings about the goods' origin.

7. Misunderstanding US Origin Requirements: A common misconception lies in the origin requirements of goods. It's essential to understand the definition provided in the Customs Act and ensure the goods adhere to the standards set forth.

8. Inadequate Documentation: Agreement to maintain supporting documentation is a critical element often underestimated. Failing to prepare the necessary documents can undermine the credibility of the statement and hinder potential audits.

9. Lacking Communication of Changes: This form requires the supplier to inform all pertinent parties regarding any changes impacting the goods' validity. Many individuals neglect this responsibility, which can lead to confusion down the line.

10. Overlooking the Preference Rule Type: Lastly, the requirement for the Australian importer to quote Preference Rule Type “WO” on the import declaration often goes unnoticed. This is crucial for ensuring the correct classification and eligibility for preferential treatment under the agreement.

Awareness of these common mistakes when filling out the US Australia Trade Agreement form is key to ensuring compliance and avoiding complications in international trade. Careful attention will streamline the process, paving the way for successful trade relations.

Documents used along the form

The Australia-United States Free Trade Agreement (AUSFTA) facilitates trade between the two nations. To support trade activities, various forms and documents assist in the process. Below is a list of essential documents often used alongside the US Australia Trade Agreement form.

- Certificate of Origin: This document verifies the country of origin of goods. It is crucial for determining tariffs and ensuring compliance with trade agreements.

- Commercial Invoice: A detailed billing document that itemizes the goods sold. It includes information such as quantity, price, and the terms of sale.

- Packing List: This list provides details about the contents of each package shipped. It helps in verifying shipments and facilitates customs clearance.

- Bill of Lading: This is a legal document between the shipper and carrier, outlining the details of the cargo being transported. It serves as proof of receipt and freight agreement.

- Import Declaration: A form submitted to customs that provides information about the goods being imported. It is essential for assessing duties and compliance.

- Annual Compliance Report: This report outlines the importer’s compliance with trade regulations over the year. It is necessary for demonstrating adherence to AUSFTA criteria.

- Trade Compliance Application: A form used to apply for specific trade compliance programs. It ensures that trading practices align with trade agreements.

- Export License: Certain goods require an export license to ensure legality before shipping. This document verifies that the goods meet export regulations.

- Tariff Classification Ruling: This ruling determines how goods will be classified under the Harmonized Tariff Schedule. It ensures correct duty assessments.

- Customs Bond: A bond guaranteeing that duties and taxes on imported goods will be paid. This document protects customs against financial loss.

These documents work together to streamline processes, ensure compliance, and maintain transparency in trade between the US and Australia. Proper preparation and submission of these forms can significantly enhance the efficiency of international shipping and trade operations.

Similar forms

The US-Australia Trade Agreement form shares similarities with several other trade-related documents. Below is a list of ten such documents, each highlighting the common features they share:

- Certificate of Origin: This document serves to verify that products are sourced from a specific country, similar to how the US-Australia Trade Agreement confirms the origin of goods as strictly from the United States.

- NAFTA Certificate of Origin: Like the US-Australia Agreement, this form indicates that goods qualify as originating under the North American Free Trade Agreement, addressing similar criteria for country of origin.

- EU Free Trade Agreement Certificate: This document certifies that goods meet specific origin requirements, which is comparable to the US-Australia agreement’s requirement of goods being wholly obtained or produced in the US.

- Customs Declaration: Both documents are used during import/export processes, detailing the goods’ origin and classification to facilitate customs procedures and verify compliance with trade agreements.

- Tariff Classification Form: Just like the US-Australia Trade Agreement, tariff classification forms specify the Harmonized Tariff Classification, which helps determine duties applied on imported goods.

- Affidavit of Origin: This is a sworn statement similar to the US-Australia Trade Agreement form, where the exporter affirms the origin of the goods, thereby assisting in determining eligibility for preferential tariff treatment.

- Export Declaration: This document can outline the origin and value of goods for customs purposes, sharing the objective of providing transparency in international trade similar to the US-Australia Trade Agreement.

- International Chamber of Commerce (ICC) Rules for Origin: These rules define how the origin of goods is established, paralleling the principles laid out in the US-Australia agreement for determining the origin of products.

- Regional Trade Agreement Documentation: Documents arising from other regional trade agreements often include similar information related to goods’ origins, comparable to the requirements stated in the US-Australia form.

- Trade Preference Program Application: This application enables businesses to claim preferences based on the origin of goods, akin to how the US-Australia Trade Agreement allows for preferential treatment for US originating goods.

Dos and Don'ts

When filling out the US-Australia Trade Agreement form, it is essential to approach the task with care and precision. The following list provides guidance on what to do and what to avoid:

- Do ensure that all company information is accurate and up-to-date.

- Do provide a clear description of the goods being supplied.

- Do appropriately tick the relevant boxes for the categories of goods listed.

- Do maintain supporting documentation to validate your claims about the goods.

- Do clearly state the date from which the goods are supplied.

- Don't leave any sections of the form blank; incomplete forms can lead to delays.

- Don't make false statements regarding the origin of the goods.

- Don't ignore the requirement to inform all relevant parties of any changes affecting the statement.

- Don't forget to follow up with the Australian importer to confirm that they are citing the correct Preference Rule Type on their Import Declaration.

Misconceptions

Misconceptions often arise regarding the Australia-United States Free Trade Agreement (AUSFTA) and the related documentation required for importing goods. Here are nine common misconceptions clarified:

- All goods are automatically exempt from tariffs. Many people think that simply because goods are imported from the U.S., they qualify for tariff exemptions. This is not true; specific criteria must be met for goods to be considered U.S. originating.

- The statement of origin is a one-time requirement. Some believe that signing a statement of origin is sufficient for all future transactions. However, it needs to be provided for each shipment of goods.

- Only certain products qualify as U.S. originating goods. Many assume that only manufacturers qualify, but various categories apply, including agricultural products and minerals.

- Australian importers do not need to understand the U.S. classification system. In reality, Australian importers must be familiar with Harmonized Tariff Codes to correctly classify goods during importation.

- The AUSFTA automatically guarantees trade benefits. Some individuals may think that the agreement itself guarantees benefits without fulfilling specific requirements. However, compliance with the terms of the agreement and accurate documentation are essential for enjoying benefits.

- Documentation is not necessary if the goods are manufactured in the U.S. There is a misconception that U.S.-made goods require no supporting documents. On the contrary, documentation must be maintained to prove eligibility.

- Trade agreements are static and do not change. Some believe that once a trade agreement is established, it won’t change. In fact, trade agreements can evolve, impacting the requirements and processes over time.

- Goods sourced from both the U.S. and Australia can be labeled as U.S. originating. Many mistakenly think that if a product involves both countries, it qualifies. However, for a product to be labeled as U.S. originating, it must meet specific criteria set forth in the AUSFTA.

- Exporters are not responsible for verifying the accuracy of their statements. Some exporters think they can merely sign the statement without follow-through. However, accurate verification and timely updates on any changes are the exporter's responsibility.

Understanding these misconceptions is crucial for complying with the Australia-United States Free Trade Agreement and ensuring a smooth import process. Proper adherence to guidelines can mitigate potential risks and enhance trade benefits.

Key takeaways

Understanding the nuances of the US-Australia Trade Agreement (AUSFTA) form is crucial for any business engaged in trade between the two countries. Below are key takeaways to ensure you navigate the form effectively.

- Identify Your Company: Clearly state the name of your company and ensure that it is branded properly to reflect your official company letterhead.

- Detail the Goods: When describing your goods, be precise. Include the model or product number when applicable.

- Harmonized Tariff Classification: Provide the correct 6-digit Harmonized Tariff Classification to streamline customs processes.

- Define Origin: The goods must be verified as originating from the US. Ensure compliance with the definitions outlined in Section 153YB of the Customs Act 1901.

- Correctly Tick Applicable Options: There are specific categories—like minerals or live animals. Tick all that apply to your goods accurately.

- Specify Date of Supply: Write the date in the required format (DD/MM/YYYY) to indicate when the goods were supplied.

- Document Maintenance: Be prepared to present supporting documentation if requested. This includes records demonstrating the origin of the goods.

- Notify of Changes: If any changes occur that may affect the accuracy of this statement, inform all relevant parties in writing.

- Signature Requirements: Ensure that the statement is signed by an authorized representative of the company. Include their position and contact details.

- Import Declaration Reference: Remind the Australian importer to quote the Preference Rule Type “WO” on their Import Declaration.

These takeaways will help ensure that you fill out the AUSFTA form accurately, thus facilitating smoother international trade operations and compliance. Proper attention to each detail enhances clarity and reduces potential issues with customs or import authorities.

Browse Other Templates

Who Is Pennsylvania Named After - For Specialists, state your specific area of expertise.

Abf Bol - Any changes or corrections related to the shipment must be documented appropriately.

How Old Do You Have to Be to Get a Driver's License in California - A personal statement on the accuracy of provided information ensures reliability in the application.