Fill Out Your Us Bank Property Damage Form

When dealing with property damage, having the right documentation is crucial for a smooth repair process. The U.S. Bank Property Damage form serves as a comprehensive tool in this regard. It collects essential information about the contractor hired for repairs, including their business name, contact details, and the exact nature of the damage being addressed. This form also captures the U.S. Bank Home Mortgage account number, helping establish a direct link to the homeowner’s loan file. One of its key features is the requirement for contractors to specify their total bid for repairs, ensuring that both parties have a clear understanding of costs upfront. Additionally, the form includes important sections where the borrower must acknowledge and accept the contractor’s proposal, along with consent for information sharing, which governs communication about the claim. Overall, the U.S. Bank Property Damage form not only outlines the responsibilities of both the contractor and homeowner but also streamlines the entire insurance claim process, making it an indispensable tool for effective communication and accountability in resolving property damage issues.

Us Bank Property Damage Example

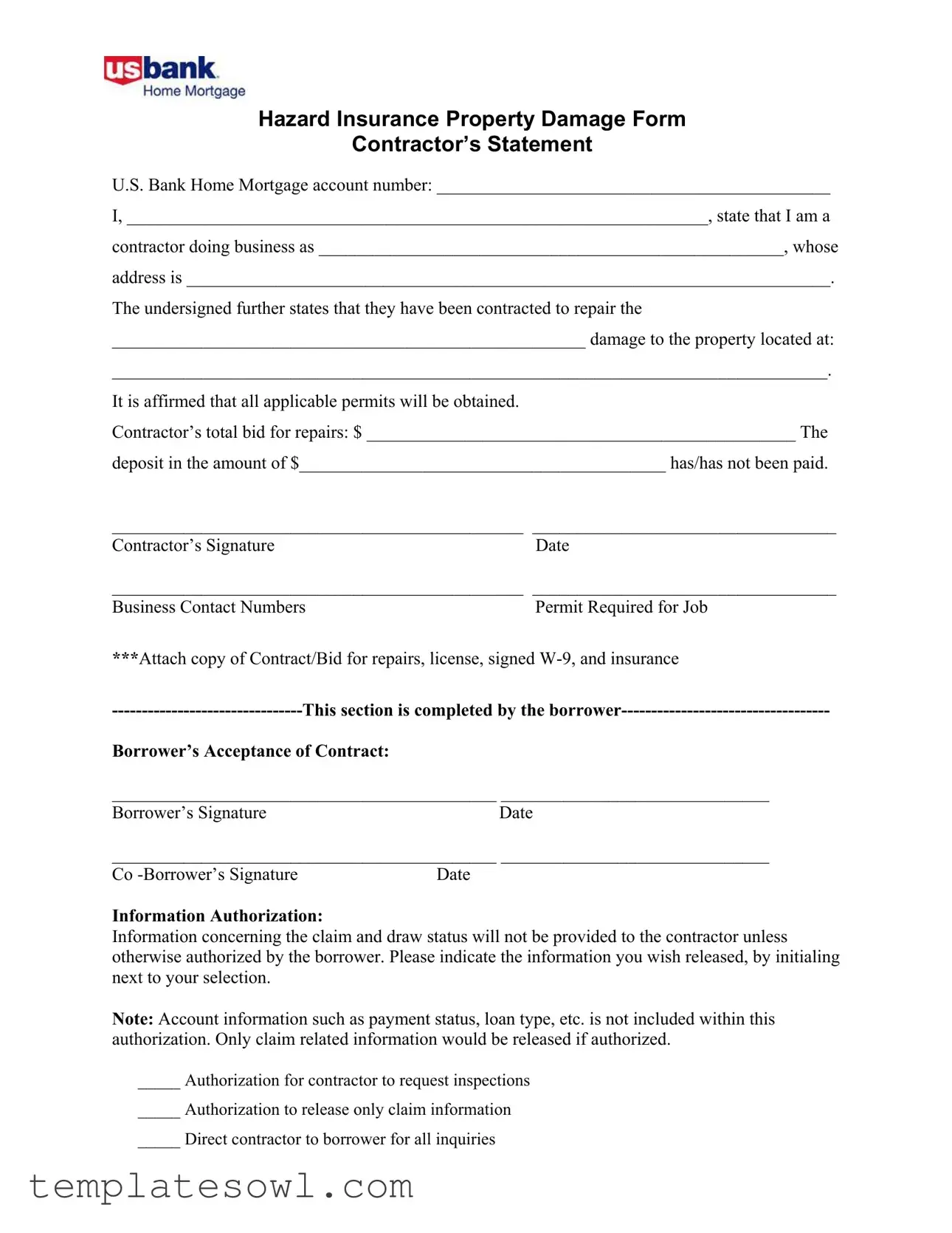

Hazard Insurance Property Damage Form

Contractor’s Statement

U.S. Bank Home Mortgage account number: ____________________________________________

I, _________________________________________________________________, state that I am a

contractor doing business as ____________________________________________________, whose

address is ________________________________________________________________________.

The undersigned further states that they have been contracted to repair the

_____________________________________________________ damage to the property located at:

________________________________________________________________________________.

It is affirmed that all applicable permits will be obtained.

Contractor’s total bid for repairs: $ ________________________________________________ The

deposit in the amount of $_________________________________________ has/has not been paid.

______________________________________________ __________________________________

Contractor’s SignatureDate

______________________________________________ __________________________________

Business Contact NumbersPermit Required for Job

***Attach copy of Contract/Bid for repairs, license, signed

Borrower’s Acceptance of Contract:

___________________________________________ ______________________________

Borrower’s SignatureDate

___________________________________________ ______________________________

Co |

Date |

Information Authorization:

Information concerning the claim and draw status will not be provided to the contractor unless otherwise authorized by the borrower. Please indicate the information you wish released, by initialing next to your selection.

Note: Account information such as payment status, loan type, etc. is not included within this authorization. Only claim related information would be released if authorized.

_____ Authorization for contractor to request inspections

_____ Authorization to release only claim information

_____ Direct contractor to borrower for all inquiries

Form Characteristics

| Fact Title | Description |

|---|---|

| Form Purpose | The U.S. Bank Property Damage form is used to document property damage claims and repair estimates for properties under U.S. Bank Home Mortgage. |

| Required Information | Contractors must provide their business name, address, and license details to validate their qualifications for the repair work requested. |

| Repair Bid | Contractors are required to submit a total bid for repairs, which should include specifics on any deposits paid and the scope of the damage being addressed. |

| Borrower’s Role | Borrowers must review and sign the contract, confirming acceptance of the repairs outlined by the contractor. |

| Information Authorization | Borrowers can choose to authorize contractors to access specific claim-related information or inspect the property directly, ensuring they maintain control over sensitive information. |

| Supporting Documents | Along with the completed form, attachments such as contracts, bids, licenses, signed W-9 forms, and insurance proof should be provided to process the claim effectively. |

Guidelines on Utilizing Us Bank Property Damage

Filling out the U.S. Bank Property Damage form requires careful attention to detail. Start with the specific information needed from both the contractor and borrower. Ensure you have all necessary documents ready, as attachments are required to fully process the form.

- Begin with the U.S. Bank Home Mortgage account number. Enter the account number clearly.

- In the contractor's statement section, write the contractor's full name.

- Next, list the name of the business that the contractor operates.

- Provide the full address of the contractor’s business.

- Describe the specific damage that needs repair.

- Enter the complete address of the property where the damage occurred.

- Affirm that all necessary permits will be obtained by checking the appropriate option.

- Fill in the total bid amount for the repairs.

- Indicate whether a deposit has been paid by checking the corresponding option.

- Have the contractor sign and date the form in the designated area.

- Record the contractor’s business contact numbers for any follow-ups.

- Attach all required documents: the copy of contract/bid for repairs, contractor's license, signed W-9, and proof of insurance.

- Move to the borrower’s section and have the borrower sign to accept the contract.

- If applicable, have the co-borrower complete their signature as well.

- Decide on the information authorization preferences by initialing next to each option you wish to authorize.

What You Should Know About This Form

What is the purpose of the U.S. Bank Property Damage Form?

This form is used for reporting property damage related to hazard insurance claims. It gathers necessary information from contractors who are hired to perform repairs. Completing this form ensures that all relevant details about the damage and the repair process are documented, which can help facilitate your claim with U.S. Bank.

Who needs to fill out this form?

Both the contractor performing the repairs and the borrower (property owner) are required to complete sections of the form. The contractor provides details about the repair bid and their credentials, while the borrower indicates their acceptance of the contract and provides any necessary authorizations.

What information do I need to provide as a contractor?

Contractors must provide their name, business name, address, details about the damage being repaired, and a total bid for the repairs. Additionally, any upfront deposit amount needs to be indicated, and the contractor must sign the form to affirm the accuracy of the statements made.

What does the borrower need to do with this form?

Borrowers must review and accept the contractor’s proposal by signing the form. They also need to provide authorizations regarding what information can be released to the contractor about the insurance claim. This includes deciding whether the contractor may request inspections or receive specific claim-related details.

What additional documents should be attached to the form?

To complete the submission, contractors should attach a copy of the contract or bid for repairs, their business license, a signed W-9 form, and proof of insurance. These documents help U.S. Bank verify the contractor’s qualifications and legitimacy.

What happens if the repairs require permits?

The contractor must affirm that all necessary permits will be obtained for the repair work. As the borrower, it's essential to ensure that the contractor is following local regulations regarding permits, as failure to do so could lead to additional issues during the repair process.

Can the contractor obtain information about the claim status?

Generally, contractors cannot access information about the claim status unless the borrower authorizes it. Borrowers must clearly indicate their preferences regarding information release by initialing next to the appropriate selections on the form. This ensures that sensitive information is only shared when permitted.

Common mistakes

Filling out the U.S. Bank Property Damage form requires attention to detail. One common mistake is leaving the account number blank. This information is crucial for identifying the correct mortgage account. Without it, the processing of the claim could be delayed.

Another frequent error is failing to accurately complete the contractor’s information. The contractor's name and business details should be clear and precise. Misreading or misspelling these details can lead to confusion and complications in communication.

People often overlook the total bid for repairs section. It’s vital to fill this out correctly, as it determines how much funding will be allocated for the repairs. Leaving this blank or miscalculating the total may result in insufficient funds or a denial of the claim.

Additionally, the section regarding the deposit can be problematic. Individuals sometimes mark the deposit as paid when it hasn’t been or fail to provide proper documentation. Clear communication about the deposit status is essential for accurate processing.

Finally, the authorization section can create issues. Borrowers should clearly indicate what information can be released regarding the claim. Failing to complete this part can lead to unauthorized inquiries, which complicates the claims process.

Documents used along the form

When dealing with property damage claims, it's essential to have the right forms in place. Along with the U.S. Bank Property Damage form, there are additional documents that can help streamline the process and ensure clarity. Below are some commonly used forms that may accompany the property damage claim.

- Insurance Claim Form: This form is used to formally request compensation from an insurance company for damage or loss. It details the specifics of the incident and outlines the damages incurred. This is often the first step in securing funds for repair.

- Repair Estimate Form: This document provides a detailed breakdown of the costs associated with repairs. It helps in helping both parties understand the scope of the work and the financial commitment required. This form aids in establishing a clear understanding of expected expenses.

- Authorization to Release Information Form: This form allows the borrower to specify what information can be shared with the contractor or other third parties. This is crucial for maintaining privacy while ensuring necessary details can be disclosed for claim processing.

- Contractor’s License and Insurance Verification: It’s important to verify that any contractor hired is properly licensed and insured. This document is submitted to show proof of compliance with state regulations and protect the borrower from potential liabilities.

Using these additional forms alongside the U.S. Bank Property Damage form can simplify the claim process and minimize potential misunderstandings. Each document plays a vital role in ensuring that all parties are informed and protected during property repairs.

Similar forms

-

Insurance Claim Form: Similar to the U.S. Bank Property Damage form, the insurance claim form provides essential details about damages and requests compensation from an insurance company. Both documents require clear identification of the property owner and a detailed description of the damage incurred.

-

Repair Authorization Form: This form authorizes a contractor to begin repairs on a property. It parallels the U.S. Bank Property Damage form in that both documents confirm details regarding the work to be performed and often outline the cost estimates involved.

-

Estimation of Repairs Form: The estimation form offers a breakdown of the anticipated costs for repairs, similar to the contractor's total bid mentioned in the U.S. Bank Property Damage form. Both documents serve to provide clarity on financial expectations before repairs commence.

-

Permission to Enter Premises Form: This document grants contractors access to a property for repair work. Like the U.S. Bank Property Damage form, it ensures that the necessary permissions are formally granted, establishing clear communication and consent between parties.

-

Service Agreement: A service agreement outlines the terms and conditions of a contractor’s engagement. This is similar to the U.S. Bank Property Damage form in that both documents formalize the relationship between the property owner and the contractor while detailing the scope of the work to be completed.

-

Warranty for Services Provided: A warranty document holds similarities in that it guarantees the quality and duration of repair work completed, which is often mentioned alongside the contractor’s obligations in the U.S. Bank Property Damage form.

-

Work Completion Certificate: This certificate verifies that all repairs have been completed satisfactorily. It aligns with the U.S. Bank Property Damage form by confirming that the agreed work, as stated in the contract, has been executed properly.

-

Inspection Report: An inspection report details the condition of the property before and after repairs. Similar to the U.S. Bank Property Damage form, it provides important documentation regarding the assessment of the damages and the effectiveness of the repairs made.

Dos and Don'ts

When filling out the U.S. Bank Property Damage form, it is important to take specific steps to ensure that the process goes smoothly. Below are recommendations on what to do and what to avoid.

- Do read the entire form carefully before you begin. Understanding each section will help you provide accurate information.

- Do provide complete and accurate contractor information. This includes your name, business name, and contact details.

- Do attach all required documents. Ensure you include the contract, bid for repairs, signed W-9, and proof of insurance.

- Do indicate whether a deposit has been paid. This information is crucial for processing your request.

- Don't leave any blank fields. Missing information can lead to delays in the processing of the claim.

- Don't forget to sign and date the form. An unsigned form will be considered incomplete and may not be processed.

By following these guidelines, you can help facilitate a more efficient handling of your property damage claim.

Misconceptions

Misconceptions about the US Bank Property Damage Form

- Misconception 1: The form can be completed by anyone.

- Misconception 2: Submitting the form guarantees payment for repairs.

- Misconception 3: Borrower’s authorization isn't necessary for contractor communication.

- Misconception 4: All information regarding the loan can be shared with contractors.

Many people assume that anyone can fill out the US Bank Property Damage form. However, it is specifically designed for contractors working on property repairs. Only those with a legitimate business relationship to the repairs being conducted can legally complete this form.

Some individuals believe that once the form is submitted, payment for repairs is guaranteed. This is not the case. The form is just a request for funds and does not ensure that payment will be processed. Approval is contingent upon reviewing the details and assessing the claim.

It is a common misconception that contractors can automatically obtain information about the claim. In reality, the borrower must provide explicit authorization for the contractor to receive any information regarding the claim status. Without this authorization, the contractor is limited in what they can access.

Many believe that contractors can access all loan-related information. This is incorrect. The form clearly states that only claim-related information may be released to the contractor if authorized by the borrower. Any account information, like payment status or loan type, remains confidential.

Key takeaways

Filling out and using the U.S. Bank Property Damage form requires attention to detail. Here are some key takeaways for effective completion and use of the form:

- Accurate Information: Ensure that all sections of the form are filled out accurately. This includes your name, business information, and a description of the damage.

- Contractor's Bid: Clearly state the total bid for repairs. This will inform the bank about the expected costs related to the property damage.

- Deposit Status: Indicate whether a deposit has been paid. This is crucial for tracking financial commitments between the borrower and the contractor.

- Authorization Process: Be aware that authorization is necessary for the contractor to obtain certain information. The borrower must specify what information can be released.

Browse Other Templates

California Workmans Comp - Claims administrators rely on accurate information from the DWC 1 to make timely decisions.

Firm Mailing Book - Restricted Delivery service requires appropriate markings to ensure compliance.

Temporary Coaching Permit Application,Emergency Coaching Credential Form,Connecticut Coaching Permit Request,Application for Interim Coaching Certification,Coaching Permit Application Form,Provisional Emergency Coaching Permit Request,Emergency Coach - Part VIII is reserved for the employing agent's verification and approval of the application.