Fill Out Your Us Chile Certificate Of Origin Form

The US-Chile Certificate of Origin form plays a vital role in facilitating trade between the United States and Chile under the Free Trade Agreement (FTA). Designed for exporters, producers, and importers, this document ensures that goods qualify for preferential tariff treatment when crossing borders. To properly fill out the form, several key fields must be completed, including details about the exporter and producer, as well as the specific goods being shipped. Essential information such as tax identification numbers and full addresses are necessary to establish clear ownership and responsibility. The form requires a description of the goods along with their Harmonized System (HS) classification numbers, which helps customs officials identify and assess products accurately. Additionally, it includes fields for certifying the origin of the goods, confirming compliance with FTA requirements, and asserting the truthfulness of the information provided. Each trade item must be properly categorized according to specific criteria outlined in the agreement to guarantee that it meets the necessary standards. Ultimately, the US-Chile Certificate of Origin serves to streamline customs processes and promote transparency in international trade.

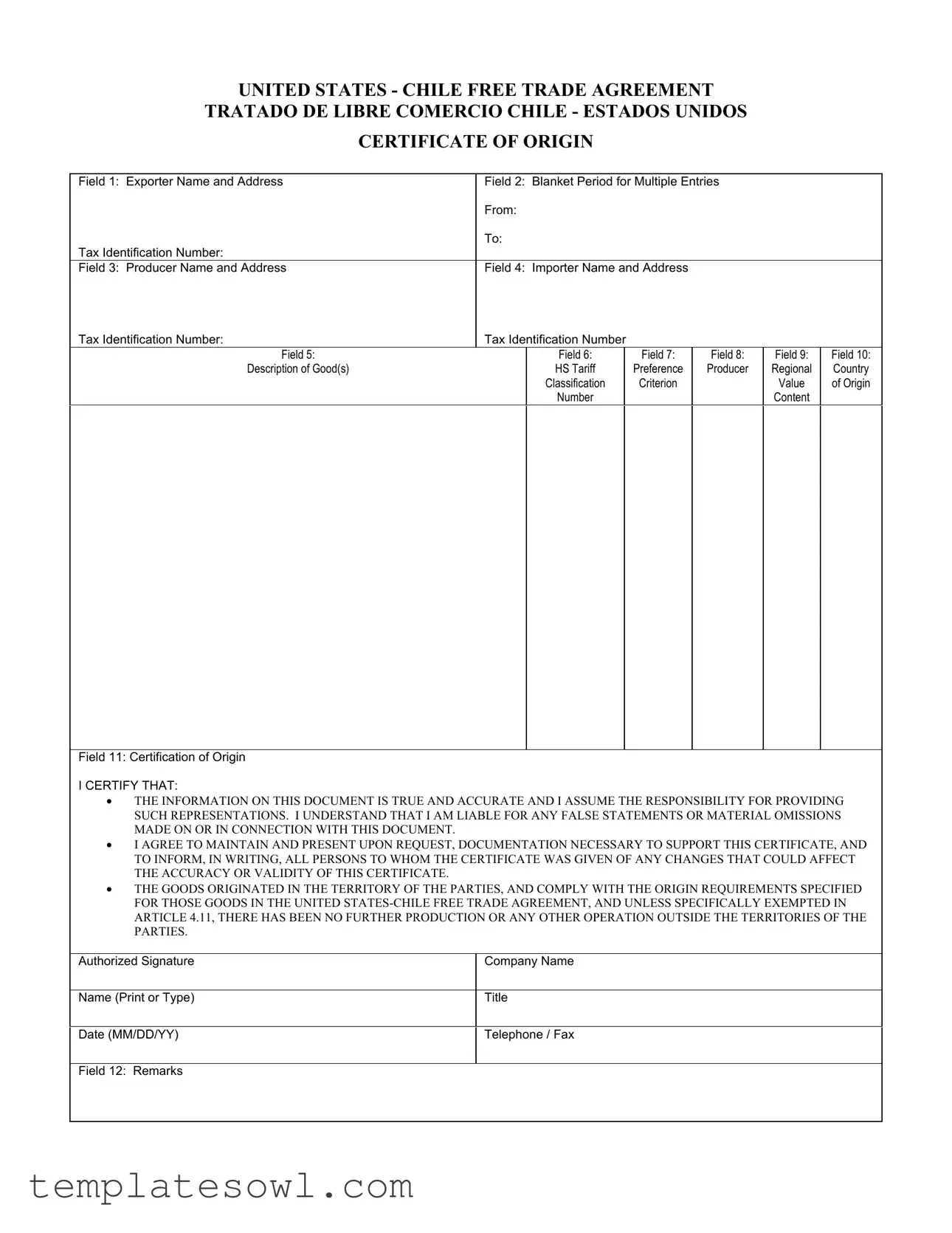

Us Chile Certificate Of Origin Example

UNITED STATES - CHILE FREE TRADE AGREEMENT

TRATADO DE LIBRE COMERCIO CHILE - ESTADOS UNIDOS

CERTIFICATE OF ORIGIN

Field 1: Exporter Name and Address |

Field 2: Blanket Period for Multiple Entries |

|

|

||||

|

From: |

|

|

|

|

||

Tax Identification Number: |

To: |

|

|

|

|

||

|

|

|

|

|

|

|

|

Field 3: Producer Name and Address |

Field 4: Importer Name and Address |

|

|

|

|||

Tax Identification Number: |

Tax Identification Number |

|

|

|

|

||

Field 5: |

|

Field 6: |

|

Field 7: |

Field 8: |

Field 9: |

Field 10: |

Description of Good(s) |

|

HS Tariff |

|

Preference |

Producer |

Regional |

Country |

|

|

Classification |

|

Criterion |

|

Value |

of Origin |

|

|

Number |

|

|

|

Content |

|

|

|

|

|

|

|

|

|

Field 11: Certification of Origin

I CERTIFY THAT:

• THE INFORMATION ON THIS DOCUMENT IS TRUE AND ACCURATE AND I ASSUME THE RESPONSIBILITY FOR PROVIDING SUCH REPRESENTATIONS. I UNDERSTAND THAT I AM LIABLE FOR ANY FALSE STATEMENTS OR MATERIAL OMISSIONS MADE ON OR IN CONNECTION WITH THIS DOCUMENT.

• I AGREE TO MAINTAIN AND PRESENT UPON REQUEST, DOCUMENTATION NECESSARY TO SUPPORT THIS CERTIFICATE, AND TO INFORM, IN WRITING, ALL PERSONS TO WHOM THE CERTIFICATE WAS GIVEN OF ANY CHANGES THAT COULD AFFECT THE ACCURACY OR VALIDITY OF THIS CERTIFICATE.

• THE GOODS ORIGINATED IN THE TERRITORY OF THE PARTIES, AND COMPLY WITH THE ORIGIN REQUIREMENTS SPECIFIED FOR THOSE GOODS IN THE UNITED

Authorized Signature |

Company Name |

|

|

Name (Print or Type) |

Title |

|

|

Date (MM/DD/YY) |

Telephone / Fax |

|

|

Field 12: Remarks |

|

INSTRUCTIONS FOR COMPLETING A CERTIFICATE OF ORIGIN TO CLAIM PREFERENTIAL TARIFF TREATMENT UNDER THE

UNITED

As provided by the National Customs Service of Chile, in Oficio Circular No. 343, Anexo 1

In order to obtain the preferential tariff treatment established in the FTA, the certificate of origin should be completed legibly and in full by the importer, exporter or producer of the merchandise, according to the following process.

Pursuant to article 4.13(1) of the FTA, and to number 4 of the Oficio Circular No. 333 published on December 18, 2003, by Chilean Customs, the certificate of origin should comply with the following instructions:

1.The format of the certificate may follow the same format of the certificates of origin established for the

2.If the format utilized is based on an official certificate used for either of the aforementioned agreements, the contents of the certificate should follow the instructions contained in this Annex and not the instructions created for the

3.The certificate of origin should include the following data fields and information:

Field 1: Indicate complete name, address (including country), and tax identification number of the exporter.

Field 2: Complete field if the certificate covers multiple shipments of identical goods, as described in Field #5, that are imported into Chile or the United States for a specified period (the blanket period). “FROM” is the date upon which the certificate becomes applicable to the good covered by the blanket certificate. “TO” is the date upon which the blanket period expires. The importation of a good for which preferential treatment is claimed based on this certificate must occur between these dates. It is suggested that the length of the blanket period covered by the certificate should not exceed one year.

Field 3: Indicate complete name, address (including country), and tax identification number of the producer. If the producer and exporter are the same person, state “SAME” in this field. If the producer is not known, state “UNKNOWN.”

Field 4: Indicate complete name, address (including country), and tax identification number of the importer.

Field 5: Provide a full description of each good. The description should be sufficiently detailed such that it can be related to the invoice description and to the Harmonized System (H.S.) description of the good. If the certificate covers only one shipment of goods, indicate the number of the commercial invoice. If the invoice number is not known, use another unique reference number, such as the waybill number, purchase order number, or any other number that can be used to identify the goods.

Field 6: For each good described in Field 5, identify the H.S. classification number to 6 digits. (Note: If the good is subject to a specific rule of origin requiring eight or ten digits, identify the good to the relevant

number of digits using the H.S. tariff classification of the country into whose territory the good is imported.)

Field 7: For each good described in Field 5, state which preference criterion has been used to confer origin (A, B, or C). As stated in Article 4.1.1 of the

(A)the good is wholly obtained or produced entirely in the territory of one or both of the Parties;

(B)the good is produced entirely in the territory of one or both of the Parties and

(i)each of the

(ii)the good otherwise satisfies any applicable regional value

content or other requirements specified in Annex 4.1,

and the good satisfies all other applicable requirements of this Chapter; or

(C)the good is produced entirely in the territory of one or both of the Parties exclusively from originating materials.

Field 8: If you are the producer of the good, state “YES” in this field. If you are not the producer of the good, state “NO” followed by a reference to Article 4.13 (2a) if the certificate is based upon a completed and signed certificate of origin provided by the producer, or Article 4.13 (2b) if the certificate of origin is based upon your knowledge of whether the good qualifies as an originating good.

Field 9: For each good described in Field 5, if the good is not subject to a Regional Value Content (RVC) requirement, state “NO.” Otherwise, indicate which method was used to calculate the RVC by stating either “BUILDUP” or “BUILDDOWN.”

Field 10: Identify the name of the country: State “US” for all goods originating in the United States and exported to Chile or state “CL” for all goods originating in Chile for export to the United States.

Field 11: This field should be completed, signed and dated by the party declaring origin (importer, exporter, or producer) indicating the name, title, and company. The signer must also certify to the following suggested text:

I CERTIFY THAT:

•THE INFORMATION ON THIS DOCUMENT IS TRUE AND ACCURATE AND I ASSUME THE RESPONSIBILITY FOR PROVING SUCH REPRESENTATIONS. I UNDERSTAND THAT I AM LIABLE FOR ANY FALSE STATEMENTS OR MATERIAL OMISSIONS MADE ON OR IN CONNECTION WITH THIS DOCUMENT;

•I AGREE TO MAINTAIN, AND PRESENT UPON REQUEST, DOCUMENTATION NECESSARY TO SUPPORT THIS CERTIFICATE, AND TO INFORM, IN WRITING, ALL PERSONS TO WHOM THE CERTIFICATE WAS GIVEN OF ANY CHANGES THAT COULD AFFECT THE ACCURACY

OR VALIDITY OF THIS CERTIFICATE;

•THE GOODS ORIGINATED IN THE TERRITORY OF ONE OR MORE OF THE PARTIES, AND COMPLY WITH THE ORIGIN REQUIREMENTS SPECIFIED FOR THOSE GOODS IN THE UNITED STATES - CHILE FREE TRADE AGREEMENT, AND UNLESS SPECIFICALLY EXEMPTED IN ARTICLE 4.11, THERE HAS BEEN NO FURTHER PRODUCTION OR ANY OTHER OPERATION OUTSIDE THE TERRITORIES OF THE PARTIES.

Field 12: Provide any additional or necessary remarks.

Form Characteristics

| Fact Name | Details |

|---|---|

| Agreement Basis | This certificate is utilized under the United States-Chile Free Trade Agreement, enabling preferential tariff treatment. |

| Exporter Information | Field 1 requires the complete name, address, and tax identification number of the exporter. |

| Blanket Period | Field 2 allows for a blanket period covering multiple entries, with specified start and end dates for its validity. |

| Producer Details | Field 3 necessitates the producer's name, address, and tax identification number, or the term "SAME" if identical to the exporter. |

| Importer Information | Field 4 also requires the complete name, address, and tax identification number of the importer. |

| Description of Goods | Field 5 demands a detailed description of goods, aligned with the invoice and Harmonized System classification. |

| HS Classification | Field 6 must specify the H.S. classification number corresponding to the goods, detailed to 6 digits or more if relevant. |

| Certification of Origin | Field 11 contains a declaration confirming the accuracy of information, which must be signed and dated by the responsible party. |

| Liability Acknowledgment | Signers of the certificate acknowledge liability for any false statements in connection with the certification. |

| Governing Law | The certificate is governed by U.S. laws and the specific provisions within the U.S.-Chile Free Trade Agreement. |

Guidelines on Utilizing Us Chile Certificate Of Origin

Filling out the US Chile Certificate of Origin form requires attention to detail and a clear understanding of the information needed. This document plays a crucial role in ensuring that goods qualify for preferential tariff treatment under the United States-Chile Free Trade Agreement. To navigate the process efficiently, follow these steps closely, making sure each field is populated correctly.

- Field 1: Enter the complete name, address, and tax identification number of the exporter.

- Field 2: Fill in the dates for the blanket period if applicable, including the start date (“From”) and end date (“To”). This should cover the specific period during which the imports will occur.

- Field 3: Provide the name, address, and tax identification number of the producer. If the producer is the same as the exporter, write “SAME.” If unknown, indicate “UNKNOWN.”

- Field 4: Input the name, address, and tax identification number of the importer.

- Field 5: Write a detailed description of each good to ensure it matches the invoice. Include the commercial invoice number if applicable.

- Field 6: List the Harmonized System (H.S.) classification number for each good to 6 digits, or more if required for specific rules of origin.

- Field 7: Specify which preference criterion applies (A, B, or C) based on the origin rules of the agreement.

- Field 8: Indicate “YES” if you are the producer. If not, respond “NO” and reference either Article 4.13 (2a) or (2b).

- Field 9: If the good has no Regional Value Content requirement, write “NO.” If there is a requirement, state whether you used “BUILDUP” or “BUILDDOWN” for calculation.

- Field 10: Identify the country of origin as “US” for goods from the United States or “CL” for goods from Chile.

- Field 11: Complete, sign, and date this field, including your name, title, and company. Certify the truthfulness of the information provided as noted in the instructions.

- Field 12: Add any additional remarks that may be necessary for clarity or compliance.

Once these steps are completed, ensure a final review of the form for accuracy. It’s essential to keep copies of this document and any supporting materials on hand, as you may need to present them if requested. This process helps in claiming the appropriate tariff treatment, thus facilitating smoother trade operations between the United States and Chile.

What You Should Know About This Form

What is the purpose of the US Chile Certificate of Origin?

The US Chile Certificate of Origin serves as a key document in claiming preferential tariff treatment under the United States-Chile Free Trade Agreement. When correctly filled out, it confirms that goods have originated from the territories of the parties involved and meet specified origin requirements. This helps to ensure that products are eligible for reduced tariffs upon importation into either country.

What information do I need to provide on the certificate?

The certificate requires several important details. You must include the names, addresses, and tax identification numbers of the exporter, producer, and importer. Additionally, you will describe the goods being shipped, including their HS classification numbers and the criteria used to establish their origin. Providing accurate and complete information is crucial for the validity of the certificate.

How do I certify the information on the certificate?

To certify the information, the designated party—whether the exporter, producer, or importer—must sign and date the document. The certification must affirm that the information is true and accurate, and that the signer assumes responsibility for any false statements or omissions. It also requires the signer to agree to keep necessary supporting documentation available upon request and to notify any recipients of changes affecting the certificate's accuracy.

What happens if I do not comply with the requirements of the certificate?

If you fail to comply with the requirements outlined in the certificate, you and your company could face significant consequences. These may include liability for any false statements, potential fines, and denial of preferential tariff treatment on imports. It's important to ensure that all information provided is accurate and adheres to the requirements established by the US-Chile Free Trade Agreement to avoid these issues.

Common mistakes

Completing the US Chile Certificate of Origin form can be complex, and mistakes often occur. One common error is the absence of complete and accurate information in Field 1, which requires the full name, address, and tax identification number of the exporter. Omitting even a single detail could lead to the rejection of the certificate. Therefore, ensuring that all requested information is present and correctly formatted is essential.

Another frequent mistake involves Field 2, where individuals may neglect to fill in either the "From" or the "To" date accurately for blanket shipments. This field specifies the period during which the certificate is valid. Errors in these dates can create confusion about eligibility for preferential tariffs, leading to potential financial repercussions.

In Field 3, incorrect entry of the producer's information often occurs. Some individuals mistakenly indicate "SAME" or "UNKNOWN" when they should provide detailed information about the producer. Accurate identification of the producer is critical to meeting trade agreement requirements.

People frequently misinterpret Field 5, which calls for a detailed description of the goods. Descriptions that are vague or not aligned with the invoice can complicate acceptance and processing. To avoid issues, descriptions should match both the commercial invoice and the Harmonized System classification.

Field 6 requires the precise HS classification number, but many individuals enter an incorrect or incomplete code. This detail is vital to determining tariff rates and compliance. Therefore, checking and ensuring the accuracy of this classification is paramount.

Misidentification of the preference criterion in Field 7 is yet another error. Individuals may select an incorrect option from the available choices (A, B, or C) without fully understanding the requirements each choice entails. It is essential to carefully review the definitions related to efficacy and origin to select appropriately.

The failure to answer Field 8 correctly is also common. Individuals may forget to indicate “YES” or “NO” regarding their role as the producer, leading to potential discrepancies. This clarification is necessary for the validation process.

Another misstep occurs in Field 9, where the need to identify whether the good is subject to a Regional Value Content (RVC) requirement can lead to confusion. Miscommunication around stating "YES" or "NO" and accurately calculating the RVC method can result in compliance issues.

In Field 10, the omission of the correct country designator (US or CL) can happen frequently. This designation is integral to processing and verifying the origins of the goods, thus careful attention is necessary.

Lastly, in Field 11, the signature must be completed correctly, including the signer’s name, title, and company. Errors here may cause a complete rejection of the document, leading to delays in the import-export process. Ensuring all required fields are filled with precision is the best approach to avoid these frequent mistakes.

Documents used along the form

The US-Chile Certificate of Origin form is typically accompanied by several other documents that facilitate international trade. Each document plays a crucial role in ensuring compliance with trade regulations and confirming the details of the transaction. Below is a list of additional forms and documents commonly used in conjunction with the Certificate of Origin.

- Commercial Invoice: This document details the sale between the exporter and importer. It lists the goods sold, their prices, and payment terms, serving as a key reference during customs inspection.

- Packing List: This document provides information about the contents of each package being shipped. It includes details such as weight, dimensions, and a description of the goods, facilitating easier customs clearance.

- Bill of Lading: Issued by a carrier, this document serves as a receipt for the shipment and includes details about the goods being transported. It is essential for both proving ownership and facilitating the transfer of goods during transit.

- Import/Export License: Depending on the nature of the goods, a license may be required to legally import or export items. This document helps verify compliance with trade regulations.

- Insurance Certificate: This document provides evidence of insurance coverage for the goods during transit. It outlines the terms of the insurance policy, offering protection against loss or damage.

- Customs Declaration: Required by customs authorities, this form outlines the particulars of the goods being imported or exported. It ensures that proper duties and tariffs are assessed.

- Trade Agreement Certificate: This document confirms eligibility for tariff preferences under the US-Chile Free Trade Agreement, ensuring compliance with specific trade criteria.

- Health and Safety Certificates: For certain products, these certificates verify that the goods meet health and safety regulations. They may be required for food, pharmaceuticals, and other regulated items.

Understanding the purpose and requirements of these documents is vital for smooth international trade processes. Proper preparation and submission reduce the likelihood of delays and ensure adherence to trade agreements.

Similar forms

- NAFTA Certificate of Origin: Similar to the US-Chile Certificate of Origin, the NAFTA Certificate is used to claim preferential tariff treatment under the North American Free Trade Agreement. It includes details about the exporter, the importer, and the goods, as well as a certification that the information provided is true. Both documents serve the same purpose of establishing the origin of goods to qualify for trade benefits.

- Chile-Canada Certificate of Origin: This document serves a similar function under the Chile-Canada Free Trade Agreement. Like the US-Chile Certificate, it requires information about the exporter, the importer, and the details of the goods, including their classification and origin. Both certificates aim to simplify trade processes and offer tax benefits when the goods meet specified criteria.

- EU-Australia Certificate of Origin: The EU-Australia Certificate shares key similarities with the US-Chile version. Both certificates are designed to determine the goods' eligibility for preferential trade tariffs by confirming that the products originated from the respective countries. The required information includes names, addresses, and tax identification numbers, alongside detailed descriptions of the goods.

- Panama Free Trade Agreement Certificate of Origin: This certificate is used to establish the origin of goods traded between the US and Panama. Its structure is comparable to the US-Chile Certificate, requiring detailed information about the exporter, goods, and a declaration of accuracy regarding the provided information. This ensures compliance with trade agreements for tariff concessions.

Dos and Don'ts

When completing the US Chile Certificate of Origin form, attention to detail is crucial. Below are guidelines to help ensure that the form is filled out correctly.

- Do fill out the form completely and legibly, ensuring every required field is addressed.

- Do provide accurate and truthful information, as any false statements may result in liability.

- Do indicate the blanket period if applicable, making sure to include clear starting and ending dates.

- Do include a detailed description of the goods that corresponds with invoice and H.S. classification.

- Do maintain supporting documentation and be ready to present it upon request to validate your claims.

- Don’t leave any sections blank. Completing all fields is vital for the certificate’s validity.

- Don’t use outdated or incorrect formats that don't align with the specified requirements of the US-Chile Free Trade Agreement.

- Don’t forget to provide the tax identification numbers for the exporter, producer, and importer.

- Don’t submit the certificate without signature and date, as it must be formally certified.

- Don’t ignore changes that could impact the accuracy of the certificate; communicate any updates in writing.

Misconceptions

Misunderstandings about the US-Chile Certificate of Origin form can lead to errors in international trade documentation. Here are eight common misconceptions:

- The Certificate of Origin is optional. Many believe that this document is not necessary when exporting goods under the Free Trade Agreement. However, it is required to claim preferential tariff treatment.

- Any format can be used for the Certificate of Origin. While some flexibility exists, the format must meet specific guidelines. It should distinctly identify that it is for the US-Chile Free Trade Agreement.

- The certificate can only be filled out by the exporter. In fact, it can also be completed by the producer or the importer of the goods. All parties involved have the responsibility to provide accurate information.

- A single certificate can cover any exports without limitations. The certificate often covers a blanket period for multiple entries, but it is still bound by specific start and end dates that must be adhered to.

- It is sufficient to provide a vague description of the goods. The description must be detailed enough to correlate with invoices and recognized classifications, ensuring clarity about the goods being exported.

- The tax identification number is optional. On the contrary, it is essential to include the tax identification numbers for all parties involved to comply with the agreement's requirements.

- Material omissions on the certificate do not carry significant consequences. Any omissions or false statements can result in liability and potential penalties, highlighting the need for accuracy and honesty.

- Field completion is not important if the goods are known to qualify. Every field must be completed as specified, even if the origin of the goods is evident. Failure to do so can invalidate the preferential treatment claim.

Understanding these misconceptions can help ensure compliance with the requirements for the US-Chile Certificate of Origin and facilitate smoother international trade operations.

Key takeaways

Key Takeaways for Filling Out the US Chile Certificate of Origin Form:

- Exporter Information: Provide complete details for the exporter in Field 1, including name, address, and tax identification number. This ensures accurate identification for tax and customs purposes.

- Blanket Period: If claiming for multiple entries, clearly fill out Field 2 with the “FROM” and “TO” dates. The blanket period should typically not exceed one year.

- Producer Details: In Field 3, include the producer's complete information. If the exporter and producer are the same, simply state “SAME.” If unknown, indicate “UNKNOWN.”

- Description of Goods: Field 5 should contain a full and detailed description of the goods. The description must align with invoice details and the Harmonized System (H.S.) classification.

- H.S. Classification: Each good must be assigned a 6-digit H.S. classification number in Field 6. Ensure accuracy here, especially if specific rules apply requiring more digits.

- Certification Requirement: Field 11 mandates a signature certifying the truth of the information provided. This declaration outlines the responsibilities regarding any false statements or omissions.

- Additional Remarks: Use Field 12 for any necessary comments. This can help clarify particular points or provide context about the goods being shipped.

Browse Other Templates

Cif Full Form Bank - Indicate your sex to assist in the demographic data collection process.

Hazmat Bill of Lading Pdf - The form covers joint liability for hazardous goods between shippers and carriers.

What Is a P11 - Keep personal information confidential and secure at all times.