Fill Out Your Usaa Transfer Form

The USAA Transfer Form serves as a key document for members looking to manage their banking activities efficiently. By completing this form, individuals can add accounts for future transactions, set up automatic funds transfers, and ensure the proper authorization for both withdrawals and deposits. It is crucial for account holders to be aware that only accounts they own or have signature authority on can be added for these purposes. The form captures essential account details, such as account numbers and routing numbers, and provides options for naming the accounts for easy identification. Additionally, members must comply with authorization requirements that allow USAA to verify account ownership. This verification process may involve temporary deposits for accounts not already on file with USAA. Once the authorization is established, automatic funds transfers can be scheduled according to the member's preferences, although the first transfer will only be initiated after successful verification. Members should also understand that transactions involving accounts outside of USAA may take additional time to process. Overall, completing this form is an essential step for members seeking to streamline their banking transactions and manage their accounts effectively.

Usaa Transfer Example

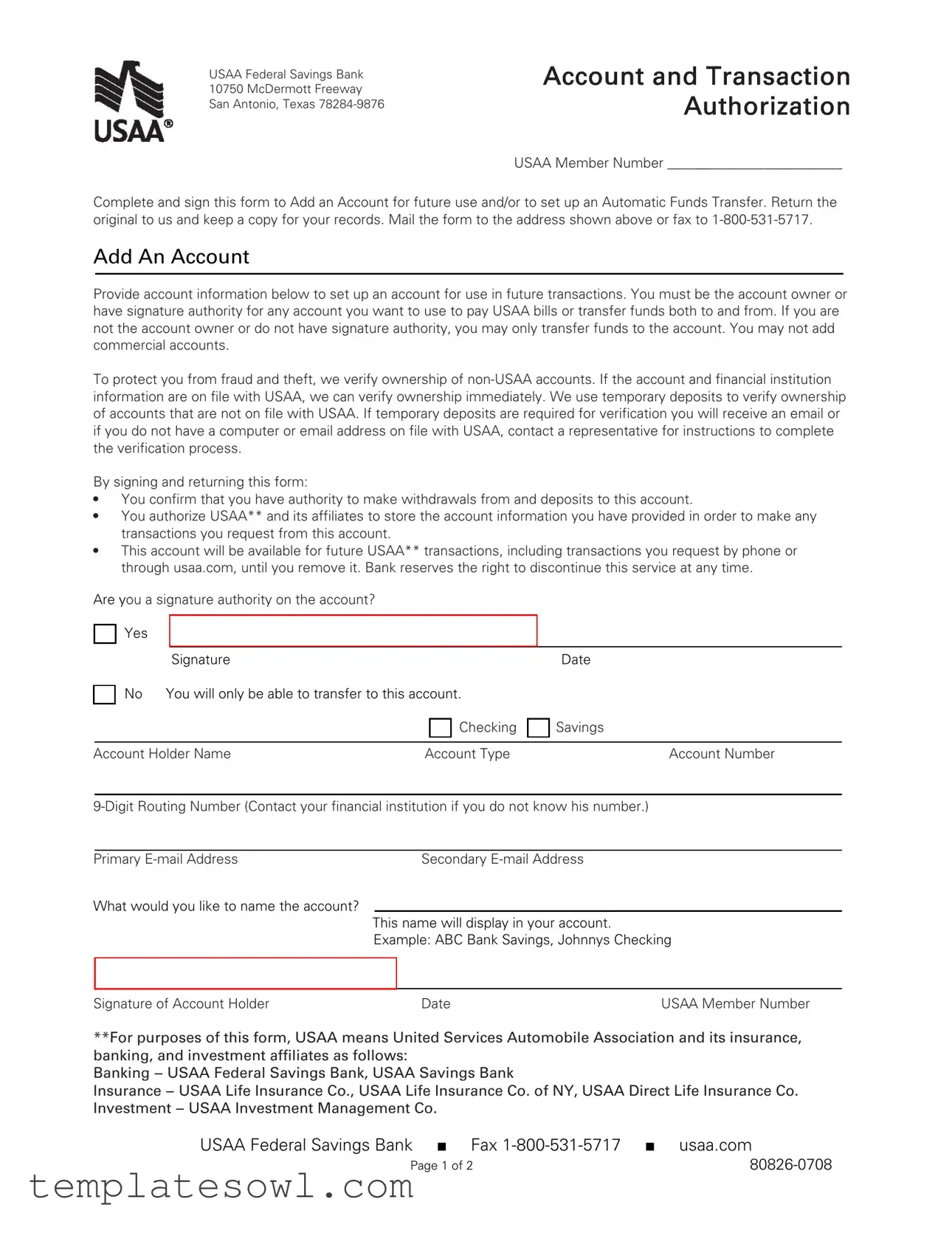

USAA Federal Savings Bank

10750 McDermott Freeway

San Antonio, Texas

Account and Transaction Authorization

USAA Member Number _________________________

Complete and sign this form to Add an Account for future use and/or to set up an Automatic Funds Transfer. Return the original to us and keep a copy for your records. Mail the form to the address shown above or fax to

Add An Account

Provide account information below to set up an account for use in future transactions. You must be the account owner or have signature authority for any account you want to use to pay USAA bills or transfer funds both to and from. If you are not the account owner or do not have signature authority, you may only transfer funds to the account. You may not add commercial accounts.

To protect you from fraud and theft, we verify ownership of

By signing and returning this form:

•You confirm that you have authority to make withdrawals from and deposits to this account.

•You authorize USAA** and its affiliates to store the account information you have provided in order to make any transactions you request from this account.

•This account will be available for future USAA** transactions, including transactions you request by phone or through usaa.com, until you remove it. Bank reserves the right to discontinue this service at any time.

Are you a signature authority on the account?

Yes

|

Signature |

|

Date |

|

No You will only be able to transfer to this account. |

|

|

|

|

Checking |

Savings |

|

|

|

|

Account Holder Name |

Account Type |

Account Number |

|

Primary |

Secondary |

What would you like to name the account?

This name will display in your account. Example: ABC Bank Savings, Johnnys Checking

Signature of Account Holder |

Date |

USAA Member Number |

**For purposes of this form, USAA means United Services Automobile Association and its insurance, banking, and investment affiliates as follows:

Banking

Insurance

USAA Federal Savings Bank ■ Fax |

■ usaa.com |

Page 1 of 2 |

Automatic Funds Transfer Request

Provide account information below to set up automatic funds transfers on a schedule you establish. You must be the account owner or have signature authority for the account you want to transfer funds from.

By signing and returning this form:

•You confirm that you have authority to make withdrawals from and deposits to these accounts.

•You authorize USAA** to initiate electronic transactions to, from, or between the accounts listed below, including transactions that may be necessary to correct any errors.

•You understand that ACH (Automated Clearing House) transactions must comply with US laws.

•You understand that this authorization will remain in effect until you cancel it and USAA** has time to act.

$

Amount |

Start Date |

|

End Date |

|

||

|

|

Weekly |

Every 2 Weeks |

Monthly |

1st & 15th |

Every 2 Months |

|

|

|

|

|

|

|

Frequency |

|

|

|

|

||

FROM: |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Account Number |

Routing Number |

|

|

|

|

|

|

|

|

Checking |

Savings |

|

|

|

|

|

|

|

|

|

Account Holder |

|

|

Bank Account Type |

|

TO: |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Account Number |

Routing Number |

|

|

|

|

|

|

|

|

Checking |

Savings |

|

|

|

|

|

|

|

|

|

Account Holder |

|

|

Bank Account Type |

|

Automatic funds transfers scheduled for a holiday or weekend will generally occur on the previous business day. We will not complete your first transfer until we have completed the account verification process. Transactions involving

Signature of Account Holder |

Date |

USAA Member Number |

**For purposes of this form, USAA means United Services Automobile Association and its insurance, banking, and investment affiliates as follows:

Banking

Insurance

USAA Federal Savings Bank ■ Fax

Page 2 of 2 |

Made Fillable by eForms |

|

Form Characteristics

| Fact Name | Description |

|---|---|

| Transfer Requirements | To authorize a transfer, you must be the account owner or have signature authority over the accounts used for transactions. |

| Verification Process | USAA verifies ownership of non-USAA accounts through methods such as temporary deposits and email communication. |

| Service Conditions | Transactions may take up to 2 business days for non-USAA accounts, and USAA reserves the right to discontinue this service at any time. |

| Governing Laws | ACH transactions must comply with US laws, ensuring secure and regulated fund transfers. |

Guidelines on Utilizing Usaa Transfer

To complete the USAA Transfer form, it’s important to ensure you have all your relevant account information handy. After filling it out, you need to return the signed form to USAA and keep a copy for your records. The next step is straightforward: just mail the original form to the specified address or fax it to the toll-free number provided.

- Write your USAA Member Number at the top of the form.

- In the Add An Account section, indicate if you are a signature authority on the account by checking “Yes” or “No.”

- Provide the account details:

- Account Holder Name

- Account Type (Checking or Savings)

- Account Number

- 9-Digit Routing Number (Contact your financial institution if you do not know this number.)

- Enter your Primary Email Address and Secondary Email Address.

- Choose a name for the account that will display in your records.

- Sign and date the section for Signature of Account Holder.

- In the Automatic Funds Transfer Request section, specify the following:

- From:

- Account Number

- Routing Number

- Account Holder

- Account Type

- To:

- Account Number

- Routing Number

- Account Holder

- Account Type

- From:

- Fill in the Amount for the transfer and the Schedule (frequency: Weekly, Every 2 Weeks, Monthly, etc.).

- Sign and date the section for Signature of Account Holder again.

- Make sure to double-check all entered information for accuracy.

- Send the completed form to the address provided or fax it to 1-800-531-5717.

What You Should Know About This Form

What is the purpose of the USAA Transfer Form?

The USAA Transfer Form allows members to add new bank accounts for future transactions and set up automatic funds transfers. By completing this form, members confirm their authority over the accounts listed and authorize USAA to initiate transfers and store their account information for future use. It's essential to return the original completed form to USAA to process any requests.

Who can add an account using this form?

Only individuals who are the account owner or have signature authority on the account can add it to their USAA member profile. If you do not have signature authority, you can only transfer funds to that account without adding it for future transactions. It’s also worth noting that commercial accounts cannot be added.

How does USAA verify ownership of non-USAA accounts?

USAA verifies ownership of non-USAA accounts for fraud protection. If the account information is not already on file with USAA, the bank will use a process involving temporary deposits. After you submit the form, you will receive an email regarding the verification or, if you don’t have an email address on file, you may need to contact a USAA representative for guidance on completing the verification process.

What happens if I need to cancel the automatic funds transfer?

If you choose to cancel the automatic funds transfer, you can do so by notifying USAA. The cancellation request will be processed, but it’s important to allow USAA sufficient time to act on your cancellation before the next transfer is scheduled. Be mindful of the termination conditions to ensure there are no unintended transfers after your cancellation.

Common mistakes

Completing the USAA Transfer form can be straightforward, but many individuals make mistakes that can delay their transactions. One common error is not providing an accurate USAA Member Number. This number is essential for processing your form. If it is left blank or entered incorrectly, you may experience significant delays in your requests.

Another frequent oversight is failing to indicate whether you are a signature authority on the account. If you check “No” when you actually have authority, it restricts your ability to transfer funds. Conversely, if you claim authority without having it, you might run into issues later.

Inaccurate account information is also a mistake that many make. It is crucial to double-check the account type, account number, and routing number. If any of these are incorrect, your transfers could fail, leading to frustration. When in doubt, reach out to your financial institution to confirm these details before submitting the form.

People often overlook the importance of setting a clear naming convention for the accounts they are adding. The name you choose will display in your account, so it should be clear and not too similar to other accounts. This helps prevent confusion as you manage different funds.

Another issue arises with leaving out the frequency of the automatic funds transfer or failing to specify an amount. If these details are not filled in, your request cannot be processed. Take the time to select the right schedule and fill in the correct dollar amount for both the “FROM” and “TO” sections.

It is important to sign and date the form. A signature is your confirmation of authority over the accounts listed. If this is missing, your application could be rejected. Always remember to sign at the designated spot and ensure the date is correctly marked.

Additionally, some individuals may not account for the verification process required by USAA. If you are adding a non-USAA account, temporary deposits will be necessary for verification. Be prepared to check your email and follow any instructions promptly to avoid delays.

Finally, not keeping a copy of the completed form for your records can lead to complications later on. It’s always a good idea to retain a copy for your personal records. This can be a reference point should any issues arise.

Documents used along the form

When you're looking to transfer funds or manage your accounts with USAA, several other forms and documents can be invaluable. Each of these documents plays a crucial role in ensuring all transactions are authorized and processed smoothly. Here's a brief overview of commonly used documents alongside the USAA Transfer form.

- Account Verification Form: This form allows USAA to confirm your identity and ownership of accounts at other financial institutions. It typically requires account holder's information and signature.

- Automatic Funds Transfer Request: This document is used to set up scheduled fund transfers between your accounts. You specify the amount, frequency, and duration of the transfers.

- Direct Deposit Authorization Form: With this form, you can authorize USAA to deposit your paycheck or other income directly into your USAA account, making your finances more efficient.

- Change of Address Form: If you've moved, this form notifies USAA of your new address to ensure you receive important communications without delay.

- Account Closure Request Form: Use this when you decide to close your USAA account. It outlines the account information and requires a signature to authorize the closure.

- Beneficiary Designation Form: This document allows you to specify who will receive your account funds in the event of your passing, providing peace of mind for you and your loved ones.

- Statement of Account Form: This form can be requested to get a detailed summary of your transactions and account balances, helping you keep track of your financial life.

Each of these documents serves a purpose in managing your relationships with your financial accounts effectively. It's essential to have the right paperwork in order, so everything flows seamlessly when you're making important transactions with USAA.

Similar forms

Bank Account Application: Similar to the USAA Transfer form, this document solicits personal and financial information required to open a new account. It typically requires signatures confirming the applicant's authority over the account.

Direct Deposit Authorization Form: This form authorizes an employer or other payer to deposit funds directly into a specified bank account. Like the USAA form, it confirms account ownership and requires signatures.

Automatic Payment Authorization Form: This document allows recurring payments to be deducted from an account automatically. It shares similarities in that it verifies account ownership and specifies the payment amounts and schedule.

Wire Transfer Authorization Form: This form is used to authorize a wire transfer from one account to another. It requires accurate account details and signatures, aligning with the need for authorization in the USAA Transfer form.

Account Change Request Form: Similar to the USAA Transfer form, this document is used to update account information, such as adding or removing account holders, which also necessitates signatures and verification.

Transfer of Funds Request Form: This form allows users to transfer money between their own accounts or to other accounts, requiring proof of authority similar to the USAA Transfer form.

Beneficiary Designation Form: This document allows account holders to designate beneficiaries for their accounts. It similarly requires account details and signatures to confirm the account holder's authority.

Credit Card Authorization Form: Like the USAA Transfer form, this document is used to authorize credit card transactions. It includes account information and requires valid signatures for processing.

Loan Application Form: This form is used to apply for a loan and includes specifics about the borrower's account and authority. Proper identification and authorization are similarly essential.

Account Verification Request Form: Used by banks to verify account ownership when people request changes or transfers. It aligns closely with the verification process outlined in the USAA Transfer form.

Dos and Don'ts

When filling out the USAA Transfer form, certain practices can lead to a smoother experience. Conversely, some actions may cause delays or complications. Below is a list of essential do's and don'ts to consider.

- Do check that you are the account owner or have signature authority before completing the form.

- Do ensure all information is accurate, including account numbers and routing numbers.

- Do sign and date the form in the required fields to validate your request.

- Do keep a copy of the completed form for your records.

- Don't attempt to add commercial accounts, as they are not permitted.

- Don't leave any blank fields on the form that are required, as this may delay processing.

Being mindful of these guidelines will help ensure that your transaction requests are processed smoothly and without unnecessary delays.

Misconceptions

Misconceptions about the USAA Transfer form can lead to confusion and errors. Here are some common misunderstandings:

- Anyone Can Add Any Account: Not all accounts can be added using this form. You must be the account owner or hold signature authority for the account intended for transfers.

- Verification Is Instantaneous: While some accounts can be verified immediately if they are already on file with USAA, others may require temporary deposits. This can delay the account verification process.

- Automatic Transfers Will Always Start Immediately: The first transfer will not take place until the account verification process is complete. This could take a couple of days if the accounts are not previously established with USAA.

- All Transfers Occur on Requested Dates: Transfers scheduled for holidays or weekends typically process on the previous business day. It is essential to plan your schedule accordingly.

- USAA Cannot Discontinue Services: USAA reserves the right to discontinue the transfer services at any time. Users should be aware that this can happen and have alternative plans in place.

Key takeaways

Filling out the USAA Transfer form is a process that can help streamline your banking needs. Here are key points to consider:

- The form allows you to add an account or set up automatic funds transfers.

- Ensure you are the account owner or have signature authority for any account listed.

- Commercial accounts cannot be added using this form; personal accounts only.

- To prevent fraud, USAA verifies ownership of non-USAA accounts.

- If ownership verification is needed, you may receive temporary deposits to confirm your account.

- Keep a copy of the completed form for your records after submitting the original.

- Mail the completed form to USAA at the address provided or fax it to the designated number.

- Automatic funds transfers can be scheduled based on your preferences, including weekly or monthly options.

- All transactions must comply with U.S. laws regarding ACH (Automated Clearing House) transactions.

- Understand that the authorization for automatic transfers remains in effect until you cancel it.

These takeaways highlight the essential aspects of using the USAA Transfer form, ensuring a smooth and secure banking experience.

Browse Other Templates

Form Rd 3555-21 - Failure to comply with loan requirements can lead to disqualification from loan guarantees.

Marriott Explore Program - A comprehensive brochure provides a general overview of Medicare-approved drug discount cards and their benefits.

Aws Meaning Welding - Documents the test date for reference purposes.