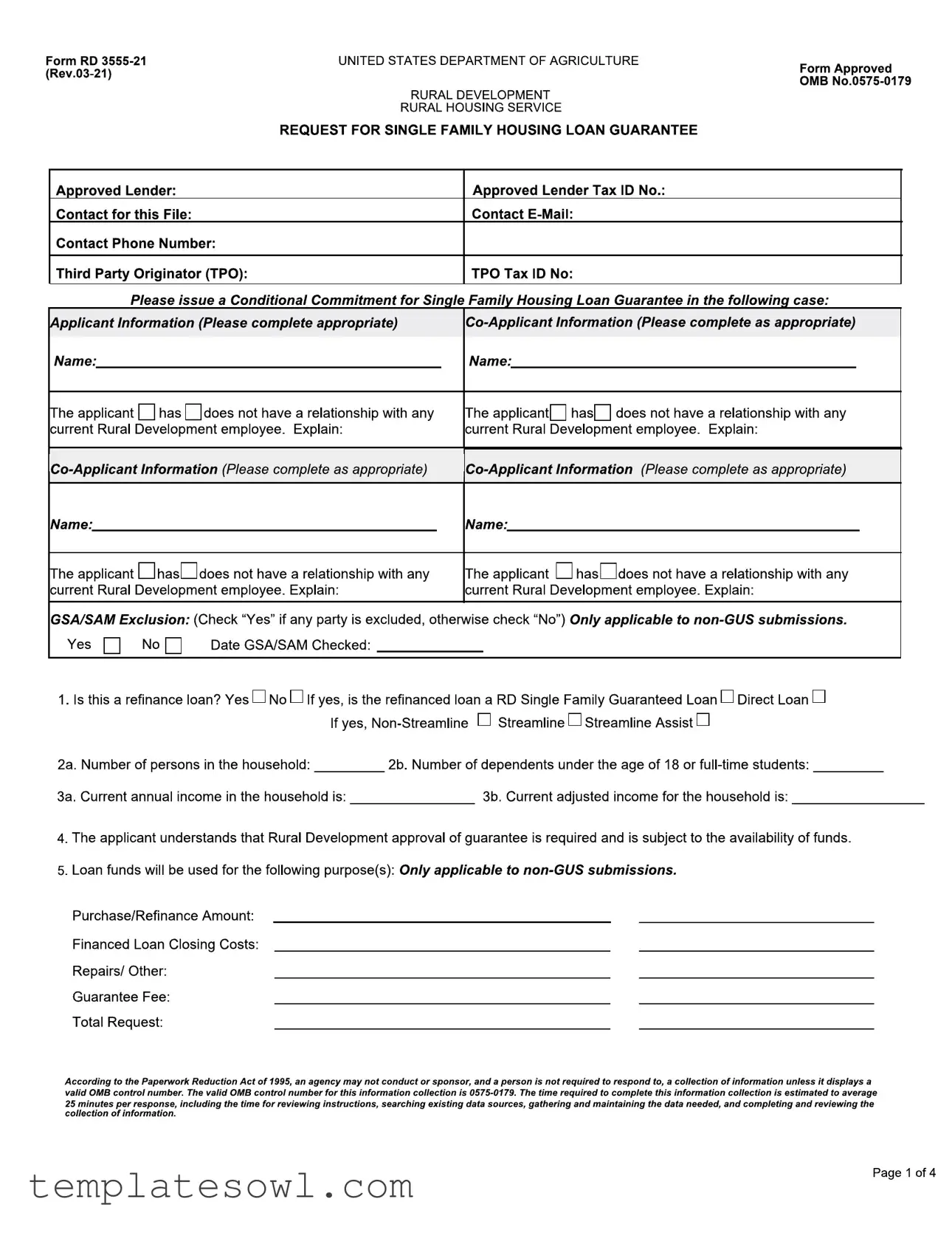

Fill Out Your Usda 3555 21 Form

The USDA Form RD 3555-21 serves as a pivotal document in the context of securing a Single Family Housing Loan Guarantee through the United States Department of Agriculture (USDA) Rural Development program. This form must be completed by applicants seeking financial support, either for purchasing a home or refinancing an existing loan. The document incorporates essential applicant information, including details about any co-applicants, current relationships with USDA employees, and specific loan parameters. It requires the submission of household composition data, annual income figures, and the intended use of loan funds. Applicants must testify to various eligibility criteria, thereby ensuring that all required certifications and acknowledgments are presented accurately and truthfully. The form also contains provisions for lender certification, emphasizing compliance with USDA loan requirements. Additionally, it outlines the implications of an annual fee that may apply to borrowers, contingent upon the agreement with the lender. Overall, this form is integral to the loan application process and serves as a verification tool to help potential homeowners access necessary funding within the USDA’s guidelines. The process affiliated with the USDA Form RD 3555-21 underscores the commitment to providing assistance to those in need of housing solutions, fostering opportunities for families across rural America.

Usda 3555 21 Example

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | The USDA Form RD 3555-21 is used to request a guarantee for single-family housing loans. It helps applicants access affordable housing options through the Rural Housing Service. |

| Approval Requirement | Applicants must understand that approval of the loan guarantee is contingent upon the availability of funds from the USDA. |

| Loan Types | The form accommodates various loan types, including refinance loans, both streamline and non-streamline options. |

| OMB Control Number | The official OMB control number displayed on the form is 0575-0179, which must be referenced for compliance with the Paperwork Reduction Act of 1995. |

| Estimated Completion Time | Completing the form is estimated to take approximately 25 minutes, which includes gathering necessary information and reviewing it. |

| State-Specific Laws | Certain states may have additional laws governing the use of this form. For instance, California follows the California Code of Regulations Title 25, Section 5400. |

Guidelines on Utilizing Usda 3555 21

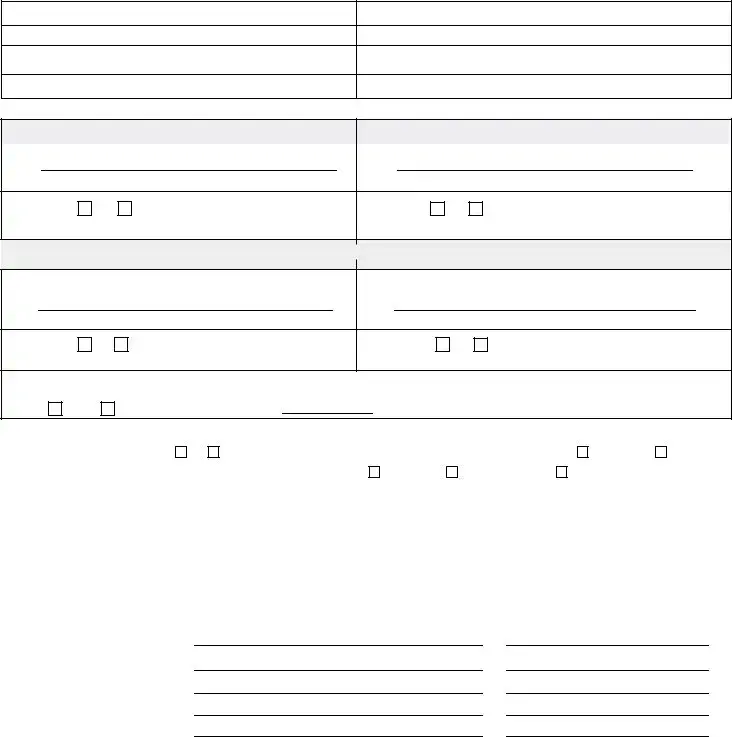

Completing the USDA Form 3555-21 is an important step in requesting a loan guarantee for single-family housing. After filling out this form correctly, it will be submitted to the lender for processing. It’s important to ensure that all information is accurate to prevent delays in the approval process.

- Begin by entering the details of the approved lender, including the lender's name and Tax ID number.

- Provide the contact information for the lender’s representative, including their name, email address, and phone number.

- If applicable, fill in the information for any third-party originator (TPO) and their Tax ID number.

- In the applicant information section, input the name of the primary applicant and, if applicable, the name of the co-applicant.

- Indicate whether the applicant has a relationship with any current Rural Development employee.

- If the applicant has a co-applicant, repeat the previous two steps for their information.

- Check the box for GSA/SAM exclusion and provide the date it was checked.

- Answer the question regarding whether the request is for a refinance loan and specify the type of loan.

- Provide the number of individuals in the household and the number of dependents under 18 or full-time students.

- List the current annual income and the current adjusted income for the household.

- Signify the applicant's understanding that approval is contingent on the availability of funds.

- Detail the loan funds' intended uses, including purchase/refinance amount, closing costs, repairs, other expenses, guarantee fee, and total request.

- Complete the certifications section, signing and dating the form as required.

- Ensure all parties involved in the loan provide their signatures and print their names where indicated.

What You Should Know About This Form

1. What is the purpose of Form RD 3555-21?

The USDA Form RD 3555-21 is specifically designed to request a guarantee for single-family housing loans. This form is essential for applicants seeking financing through USDA Rural Development programs, which aim to provide affordable housing options in rural areas. The form collects information about the borrower, including their financial and household details, to assess eligibility for the loan guarantee.

2. Who should complete this form?

This form should be completed by applicants or co-applicants who are seeking a loan guarantee from USDA Rural Development. Both parties must provide detailed information about their financial status and relationships with current USDA employees. By completing the form, they are initiating the loan guarantee process.

3. What kind of information is required on Form RD 3555-21?

Form RD 3555-21 requires various pieces of information, including the names of the applicant and co-applicant, household income, number of dependents, and purpose of the loan (whether for purchase or refinance). Additionally, the form addresses any relationships with USDA employees and asks about any exclusions related to GSA/SAM. It includes certifications that the information provided is true and accurate.

4. Is this form used for refinancing loans?

Yes, Form RD 3555-21 can be used for refinancing loans. However, if the loan being refinanced is an existing USDA Single Family Guaranteed Loan, the applicant must specify this on the form. Furthermore, there are distinctions made between streamline refinancing and non-streamlined options, which need to be indicated accordingly.

5. What fees are associated with the loan guarantee process?

The USDA charges an annual fee for the loan guarantee, which is initially calculated at closing based on the loan amount. After the first year, this fee is re-evaluated every 12 months according to the average unpaid principal balance of the loan. Borrowers should be aware that the lender may pass these fees on to them.

6. What happens to the information submitted on this form?

All information submitted through Form RD 3555-21 is confidential and used solely for the purpose of evaluating the loan guarantee request. The USDA emphasizes the importance of honest and accurate information. Under U.S. law, providing false information can lead to penalties, including fines and imprisonment.

7. How long should applicants expect to spend filling out this form?

Completing Form RD 3555-21 is estimated to take about 25 minutes on average. This time includes reviewing instructions, gathering necessary data, and completing the information required in the form. Applicants are encouraged to prepare their financial documents and personal details in advance to streamline the process.

Common mistakes

When completing the USDA Form RD 3555-21, several common mistakes can lead to significant delays or even denial of loan approval. Understanding these pitfalls can facilitate a smoother application process.

One frequent error involves providing incomplete or inaccurate information regarding income. Applicants often forget to reflect all sources of household income, including bonuses, side jobs, or alimony. Inaccurate entries can raise red flags during the review process. Furthermore, discrepancies between reported income on this form and the information provided in other financial documents may result in a request for further clarification.

Another misunderstanding occurs with the relationship disclosures. Some applicants fail to fully explain their relationship with current Rural Development employees. If a relationship exists, it must be explicitly stated. Omitting this information can lead to compliance issues and may even jeopardize the loan guarantee.

The section regarding household composition is often mishandled. Applicants occasionally overlook the requirement to report all household members. Failing to include dependents or other individuals living in the residence can affect eligibility calculations. Therefore, it is vital to count everyone currently residing in the property and ensure accuracy.

Additionally, many individuals neglect to check the GSA/SAM Exclusion status accurately. This part of the application requires a simple yes or no, but misunderstanding the criteria can lead to misrepresentation of eligibility. Checking this incorrectly could result in significant delays as the review team investigates further.

In the financial sections of the form, errors in calculating loan amounts and associated costs are common. Applicants must provide precise figures for the purchase price, closing costs, and any repairs or additional expenses. Estimating these amounts rather than providing exact numbers can hinder the approval process.

Lastly, ignoring the acknowledgment of the loan guarantee terms can prove detrimental. Applicants often overlook the necessity of signing the certification section, which confirms their understanding of the financial obligations related to the loan. Without a signature, the application cannot proceed, causing unnecessary setbacks.

By paying close attention to these areas, prospective applicants can greatly enhance their chances of a successful loan application with the USDA Rural Development program.

Documents used along the form

The USDA Form RD 3555-21 is a crucial document for individuals seeking a Single Family Housing Loan Guarantee from the U.S. Department of Agriculture. However, the application process often requires additional forms and documentation to ensure that all necessary information is collected for an informed decision. Below is a list of commonly associated documents that help facilitate the loan application process.

- Form RD 3555-18: Also known as the "Loan Application," this form captures essential details about the applicant's financial status and the property involved. It is specifically designed to provide lenders with a comprehensive overview to assess loan eligibility and requirements.

- Form RD 3555-1: This is the "Single Family Housing Loan Guarantee Program Borrower Eligibility" form. It establishes whether the borrower meets the necessary income and credit criteria for the USDA loan program, thus playing a critical role in the approval process.

- Form RD 3555-22: Known as the "Loan Note Guarantee," this document offers a formal guarantee from the USDA to the lender, insuring that they will be repaid if the borrower defaults. It essentially provides lenders with a safety net.

- Verification of Employment: This document is significant for confirming the applicant's employment status and income. Most lenders require verification from employers to ensure that the applicant has a stable source of income to support loan payments.

- Credit Report: A comprehensive credit report reflects the applicant's credit history, including credit scores and outstanding debts. Lenders rely on this report to assess creditworthiness and determine the risk associated with the loan.

- Form RD 3555-23: This is the "Direct Loan Application" which is utilized when the loan is structured directly through the USDA. It gathers information specific to program requirements, ensuring compliance with USDA guidelines.

In summary, navigating the USDA loan process involves more than just completing the RD 3555-21 form. Familiarity with these additional forms can streamline the application process and enhance the chances of obtaining the loan. Understanding the requirements and documentation needed is essential for anyone looking to secure funding for home ownership under this program.

Similar forms

- Form FHA 92900-A: This form is similar to the USDA 3555-21 as both are used to request loan guarantees for housing. They both gather information about the applicants, including income and dependency status, and require certifications related to eligibility for the respective housing programs.

- Form VA 26-1880: The VA Form 26-1880 is used for veterans seeking a Certificate of Eligibility for a VA loan. Like the USDA form, it assesses the borrower’s qualifications based on income and residency, ensuring the applicant meets the necessary criteria for loan approval.

- Fannie Mae 1003: Known as the Uniform Residential Loan Application, this form is used by many lenders to collect similar information about borrowers. It includes details like employment history, income, and assets, serving to streamline the mortgage approval process.

- Freddie Mac Form 65: This form parallels the Fannie Mae 1003 in that it is also a residential loan application. Both are designed to ensure that lenders have all necessary data to make informed lending decisions, capturing similar elements related to borrower's financial status.

- USDA Form 3555-1: This form is specifically for application processing under the USDA Rural Development Guaranteed Loan Program. It serves a similar purpose to the 3555-21 by gathering borrower information but focuses more on the complete application process for loan guarantees.

- Form 1009: The Mortgage Credit Certificate (MCC) application is utilized by borrowers seeking assistance with home purchase financing. It collects income and household information, much like the USDA form, to determine eligibility for tax credits that alleviate housing costs.

- Form HUD-1: The Settlement Statement is used during the closing of a real estate transaction. Although more focused on financial details surrounding the closing, it is similar in that it helps ensure that both the lender and borrower clearly understand the financial terms of their agreement.

- Form 4506-T: This form requests tax return information and is commonly used in mortgage applications. It is consistent with the USDA 3555-21 in seeking verification of the borrower’s financial status, which is crucial for loan approval.

- IRS Form 1040: Annual tax return information, summarized in this form, supports borrower income verification processes. Both this form and the USDA application aim to present a complete picture of the borrower’s financial position.

- Form 5000-25: The Single Family Housing Direct Home Loans application collects similar applicant information, specifically for direct lending programs offered by USDA. It aligns closely with the USDA 3555-21 in terms of applicant data requirements and eligibility checks.

Dos and Don'ts

When filling out the USDA 3555-21 form, certain best practices can help ensure accuracy and compliance. Below is a list of things you should and shouldn't do.

- Do read the instructions thoroughly before starting to fill out the form.

- Do provide all required information completely and accurately.

- Do double-check your entries for any typos or errors.

- Do use clear and concise language where explanations are required.

- Don't leave any mandatory fields blank.

- Don't submit the form without ensuring all information is up to date.

- Don't provide false information or omit important facts.

- Don't rush through the process; take time to ensure everything is filled out correctly.

Misconceptions

Misconceptions about the USDA Form 3555-21

- It is only for new home purchases. Many believe the form is exclusively for purchasing new homes. However, it is also applicable for refinancing existing loans.

- Only low-income borrowers are eligible. While income limits do apply, the program can benefit a wider range of borrowers, depending on the area and specific circumstances.

- The form is complicated and lengthy. Though it requires detailed information, most sections are straightforward and can be completed without legal assistance.

- Submission guarantees loan approval. Completing this form does not guarantee approval. It simply initiates the loan guarantee process.

- All banks and lenders can handle this form. Only lenders approved by the USDA can process this form. It's crucial to work with an approved lender.

- You must have perfect credit to qualify. While a good credit score helps, the USDA considers various factors, including income and loan purpose.

- Only rural residents can apply. The program is designed for rural areas, but it may apply to some suburban locations as well.

- There are no fees associated with the loan. Applicants should be aware of potential fees, including an annual fee that may be passed on to them by the lender.

- Co-signers are not permitted. Co-signers can be included on the application, broadening the potential for loan approval.

Key takeaways

Filling out and using the USDA RD 3555-21 form is a critical step for those seeking a Single Family Housing Loan Guarantee. Here are key takeaways to ensure a smooth process:

- Complete Information Accurately: Provide all necessary details for both the applicant and co-applicant. This includes names, contact information, and relationships to any Rural Development employees. Inaccurate or incomplete information can delay the approval process.

- Understand Financial Requirements: Be ready to disclose current household income and adjusted income. This information informs the agency's evaluation of financial eligibility for the loan guarantee.

- Specify Loan Purpose: Clarify how the loan funds will be used, whether for a purchase, refinance, or other purposes. Being specific helps the agency understand your financial needs and intentions.

- Certifications are Crucial: The applicant and lender must certify the accuracy of all information provided. This certification includes an acknowledgement of no outstanding debts to the government and compliance with all requirements. Failure to certify correctly could result in penalties and loan denial.

- Awareness of Fees: Understand that lenders may pass on an annual fee to borrowers. This fee is calculated based on the loan amount initially and subsequently on the outstanding balance. Clarity on this aspect is essential to avoid unexpected costs later.

Taking these points into consideration can facilitate a smoother application process and enhance your chances of obtaining the desired loan guarantee.

Browse Other Templates

University of Maryland Global Campus Student Login - A hold can also be placed until your degree officially posts.

Marriott Explore Program - The Drug Discount Card Enrollment Tip Sheet can help guide beneficiaries through the application process.

Veteran Travel Reimbursement Claim Form,Claim for Travel Costs by Veterans,Travel Reimbursement Application for Veterans,Travel Expense Reimbursement Request,Veteran Beneficiary Travel Reimbursement Form,Request for Veteran Travel Expense Refund,Form - Travel expenses other than mileage, like tolls and lodging, can also be submitted for reimbursement with appropriate receipts.