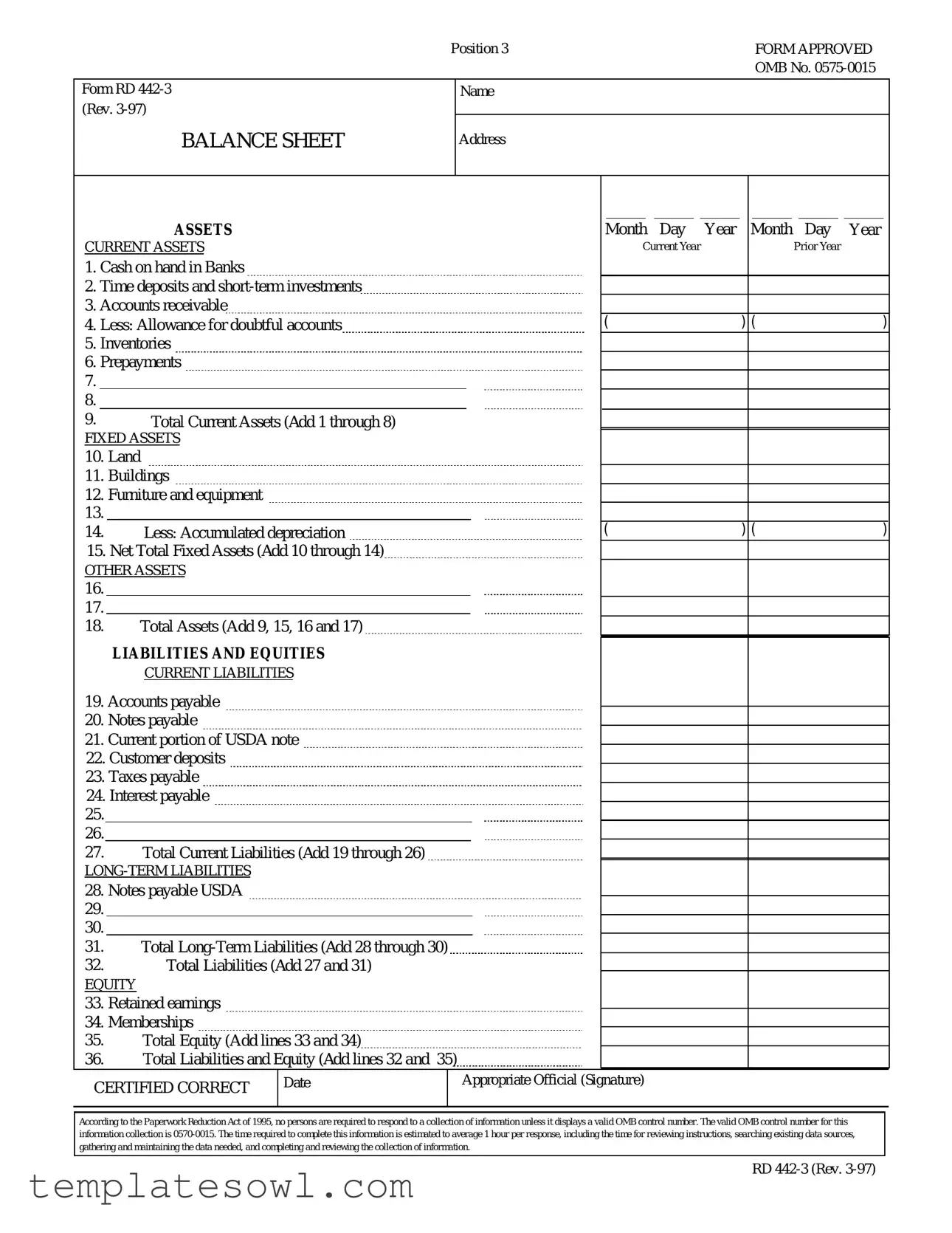

Fill Out Your Usda Rd 442 3 Form

The USDA RD 442-3 form plays an important role in various financial assessments for businesses and organizations seeking assistance from the United States Department of Agriculture. This form provides a comprehensive balance sheet that helps in presenting the financial position of an entity, detailing both assets and liabilities. The document is divided into key sections, including current assets like cash on hand and accounts receivable, as well as fixed assets such as land and buildings. By subtracting allowances for doubtful accounts and depreciation, the form accurately reflects the net worth of the organization. Additionally, it includes vital information about current and long-term liabilities, ensuring that all financial obligations are documented. The equity section further highlights retained earnings and memberships, rounding out the fiscal picture. By thoroughly completing this form, applicants can facilitate the evaluation process for financial aid, ensuring clear and concise communication of their financial status to USDA officials.

Usda Rd 442 3 Example

|

Position 3 |

|

|

|

|

|

|

|

FORM APPROVED |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

OMB No. |

|||||||

Form RD |

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Rev. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BALANCE SHEET |

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSETS

CURRENT ASSETS

1.Cash on hand in Banks

2.Time deposits and

3.Accounts receivable

4.Less: Allowance for doubtful accounts

5.Inventories

6.Prepayments

7.

8.

9.Total Current Assets (Add 1 through 8)

FIXED ASSETS

10.Land

11.Buildings

12.Furniture and equipment

13.

14.Less: Accumulated depreciation

15.Net Total Fixed Assets (Add 10 through 14)

OTHER ASSETS

18.Total Assets (Add 9, 15, 16 and 17)

LIABILITIES AND EQUITIES

CURRENT LIABILITIES

19.Accounts payable

20.Notes payable

21.Current portion of USDA note

22.Customer deposits

23.Taxes payable

24.Interest payable

25.

26.

27.Total Current Liabilities (Add 19 through 26)

28.Notes payable USDA

29.

30.

31.Total

32.Total Liabilities (Add 27 and 31)

EQUITY

33.Retained earnings

34.Memberships

35.Total Equity (Add lines 33 and 34)

36.Total Liabilities and Equity (Add lines 32 and 35)

Month Day |

Year Month Day Year |

Current Year |

Prior Year |

( |

) ( |

) |

( |

) ( |

) |

CERTIFIED CORRECT

Date

Appropriate Official (Signature)

According to the Paperwork Reduction Act of 1995, no persons are required to respond to a collection of information unless it displays a valid OMB control number. The valid OMB control number for this information collection is

RD

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | The USDA RD 442-3 form is used to prepare a balance sheet, detailing the financial position of an organization. |

| Asset Categories | It categorizes assets into current assets, fixed assets, and other assets, providing a comprehensive view of an entity's financial health. |

| Liability Structure | The form differentiates between current liabilities and long-term liabilities, making it easier to assess financial obligations. |

| Equity Calculation | Equity on the form is calculated by summing retained earnings and memberships, reflecting the owners' stake in the business. |

| Regulatory Compliance | This form is governed by the Paperwork Reduction Act of 1995, and requires a valid OMB control number (0570-0015) for completion. |

Guidelines on Utilizing Usda Rd 442 3

Filling out the USDA RD 442-3 form involves providing detailed financial information about assets and liabilities. After you complete the form, you will submit it to the appropriate USDA office for review. Properly completing this form is essential for various USDA programs that require an accurate financial snapshot.

- Beginning the Form: Start by writing the name and address at the top of the form.

- Current Assets: List each current asset, starting with cash on hand, and ending with the total current assets. Make sure to include:

- Cash on hand in banks

- Time deposits and short-term investments

- Accounts receivable (subtract any doubtful accounts)

- Inventories

- Prepayments

- Other current assets if applicable

- Fixed Assets: Enter information on fixed assets, such as land and buildings. Remember to account for depreciation before finding the net total fixed assets. List the following:

- Land

- Buildings

- Furniture and equipment

- Accumulated depreciation

- Other Assets: If applicable, record any additional assets in this section.

- Total Assets: Add the totals from current, fixed, and other assets to arrive at the overall total assets.

- Current Liabilities: Record each current liability step-by-step:

- Accounts payable

- Notes payable

- Current portion of USDA note

- Customer deposits

- Taxes payable

- Interest payable

- Other current liabilities

- Long-Term Liabilities: Document any long-term liabilities:

- Notes payable USDA

- Other long-term liabilities as necessary

- Total Liabilities: Combine the totals from current and long-term liabilities.

- Equity: Indicate retained earnings and memberships, and sum them to find total equity.

- Total Liabilities and Equity: Finally, add total liabilities and total equity to complete the financial picture.

- Date and Signature: Include the appropriate date, and have an official sign the form for certification.

What You Should Know About This Form

What is the USDA RD 442-3 form used for?

The USDA RD 442-3 form is primarily utilized to provide a balance sheet for entities seeking financial assistance from the U.S. Department of Agriculture. It helps in assessing the financial position of the entity by detailing its assets, liabilities, and equity.

Who needs to fill out the USDA RD 442-3 form?

This form must be completed by individuals or organizations applying for USDA financial assistance, including businesses and cooperatives. It is essential for those entities that need to demonstrate their current financial condition to qualify for assistance programs.

What information is required on the USDA RD 442-3 form?

The form requires detailed information regarding current and fixed assets, liabilities, and equity. Applicants must list cash on hand, accounts receivable, inventories, accounts payable, taxes payable, retained earnings, and any outstanding loans. Each section must be accurately filled out to reflect true values.

How is the USDA RD 442-3 form structured?

The USDA RD 442-3 form is organized into several sections: Current Assets, Fixed Assets, Other Assets, Current Liabilities, Long-Term Liabilities, and Equity. Each section has specific line items for reporting detailed financial information, allowing for a comprehensive overview of the entity’s financial standing.

When should the USDA RD 442-3 form be submitted?

It is advisable to submit the USDA RD 442-3 form along with your application for financial assistance. Submission should occur before the deadlines specified by the USDA for the particular program you’re applying to, ensuring sufficient review time.

Is there a fee associated with submitting the USDA RD 442-3 form?

No, there are no fees required for submitting the USDA RD 442-3 form. However, applicants should check with their local USDA office for any additional requirements that may involve costs.

Can the USDA RD 442-3 form be filled out electronically?

Yes, applicants may fill out the USDA RD 442-3 form electronically, depending on the USDA's submission guidelines. It is recommended to check the USDA’s website or contact their office for the latest forms and submission methods.

What happens if I make a mistake on the USDA RD 442-3 form?

If a mistake is made on the USDA RD 442-3 form, it is crucial to correct it before submission. Clearly make any corrections and consider initialing the changes. If submitted incorrectly, it could delay the application process or result in disqualification.

How long does it take to complete the USDA RD 442-3 form?

Completing the USDA RD 442-3 form generally takes around one hour, as estimated by the USDA. This time includes reviewing instructions and gathering necessary documents, so applicants should allocate sufficient time to complete it accurately.

Where can I find the USDA RD 442-3 form?

The USDA RD 442-3 form can typically be found on the official USDA website under the forms section. Additionally, local USDA offices may provide physical copies or web access to the form for applicants.

Common mistakes

Filling out the USDA RD 442-3 form is an important task for many individuals and businesses seeking financial assistance. However, several common mistakes can undermine the accuracy of the submitted information. One frequent error involves miscalculating total current assets. Properly adding items such as cash, accounts receivable, and inventories is crucial. A miscalculation here can significantly misrepresent the financial position.

Another common mistake is neglecting to complete the section for allowances for doubtful accounts. This omission may lead to an inflated view of a business's financial health. Similarly, individuals often forget to include prepayments, which are essential for a comprehensive balance sheet. Missing line items can result in discrepancies that raise red flags during the review process.

In the section regarding fixed assets, listing depreciation correctly is vital. Many people erroneously skip or understate accumulated depreciation, which affects the net total fixed assets value. Additionally, leaving out liabilities, such as taxes payable or notes payable, skews financial reporting. All current and long-term liabilities must be fully accounted for.

Pieces of information such as the total liabilities and equity sections are sometimes filled out incorrectly. Individuals may overlook adding values properly in these segments, leading to errors that could be detrimental. Furthermore, accurate reporting of retained earnings is crucial. Errors in this area can misguide stakeholders regarding a business's future potential.

Another mistake is failing to sign and date the form properly. Certification is important; without a signature, the form may be considered incomplete. Lastly, individuals might submit forms without reviewing them thoroughly for typos or unclear information. Such oversights can lead to unnecessary delays and complications in processing the application.

Documents used along the form

When navigating the intricacies of financing or financial reporting with the USDA, various forms and documents come into play alongside the USDA RD 442-3 form. Understanding these associated documents is crucial for ensuring compliance and clarity in financial matters. Here are six forms that are commonly used in conjunction with the RD 442-3:

- Form RD 1940-1: This document is the "Application for Federal Assistance." It provides necessary details about the applicant's business, including their eligibility for USDA financing. It's essential for establishing the foundation of any funding request.

- Form RD 1940-39: Known as the "Conditional Commitment," this form outlines the conditions under which USDA funding will be provided. It is a critical step in the approval process that indicates the review outcome and any stipulations that must be met.

- Form RD 3550-1: The "Application for Rural Housing Service (RHS) Single Family Housing" form is designed for individuals seeking loans specifically for single-family housing. It collects personal information and details about the intended property.

- Form RD 1942-15: This "Application for Direct Loan" is used by businesses seeking direct loans from the USDA. It collects financial and operational information to assess loan eligibility and repayment capacity.

- Form RD 3555-21: As a "Lender Certification," this document verifies that a lender meets USDA requirements and that the loan has been accurately processed. It confirms the compliance and eligibility of the loan application presented.

- Form RD 1942-37: The "Environmental Assessment" form evaluates the impact of a proposed project on the environment. This assessment is necessary to ensure sustainable practices and adherence to environmental regulations before funding is approved.

These forms play distinct yet complementary roles in the USDA financing process, each contributing to a clearer understanding of the applicant's financial situation, project viability, and compliance with USDA requirements. Familiarity with these documents can facilitate a smoother journey through the complexities of USDA loans and Rural Development programs.

Similar forms

- USDA RD 442-2 Form: Similar to the RD 442-3, this form focuses on financial information for agricultural programs. It provides a structured way to report and assess financial health, especially regarding income and expenses.

- USDA RD 400-1 Form: This document is used for loan applications and is similar in that it gathers financial data regarding assets and liabilities. It helps lenders evaluate the applicant’s overall financial position before approving loans.

- Form 1040: The individual income tax return form may seem different at first, but it also requires a breakdown of assets and liabilities. Both forms aim to give a clear picture of financial status, crucial for assessing financial health.

- Schedule C: This form helps sole proprietors report income and expenses. Like the RD 442-3, it ensures an organized presentation of financial data. Both forms require attention to current and fixed assets.

- Balance Sheet (GAAP): A standard financial statement, often required by businesses, is similar in structure to the RD 442-3. Both present a snapshot of what a business owns versus what it owes, adhering to accepted accounting principles.

- IRS Form 1120: This is used by corporations to report income, gains, losses, and deductions. The focus on assets and liabilities in both the 1120 and RD 442-3 highlights the importance of transparency and accuracy in financial reporting.

- Personal Financial Statement: This document is often used by individuals seeking loans and is created in a similar fashion to the RD 442-3. Both require the identification of assets and liabilities to provide a comprehensive view of financial standing.

Dos and Don'ts

When filling out the USDA RD 442-3 form, careful attention is crucial. To ensure a smooth process, here is a straightforward list of dos and don'ts:

- Do double-check all figures and statements for accuracy before submission.

- Do make sure to clearly label all sections and categories to avoid confusion.

- Do provide complete information for each asset and liability listed.

- Do keep copies of your submitted forms for your records.

- Don't leave any fields blank; if something does not apply, indicate "N/A."

- Don't use abbreviations or unclear terminology that could lead to misunderstandings.

- Don't forget to sign and date the form before submission.

- Don't rush through the process; take the time to review your entries thoroughly.

Misconceptions

Misconceptions about the USDA RD 442-3 form can lead to confusion for users. The following list identifies eight common misconceptions and provides clarification for each.

- The form is only for agricultural businesses. Many believe that the USDA RD 442-3 form is exclusively designed for farmers or agricultural entities. In reality, it is used by a variety of organizations, including non-profits and rural businesses, for financial reporting.

- It is a complicated document requiring legal expertise. Some individuals think that legal knowledge is necessary to fill out the form. While it involves financial data, the form is designed to be straightforward and accessible for anyone familiar with basic accounting principles.

- The USDA RD 442-3 form only focuses on current assets. A common belief is that the form addresses only current assets. However, it encompasses current assets, fixed assets, other assets, liabilities, and equity, providing a comprehensive view of an organization's financial position.

- Only nonprofits need to submit this form. Some mistakenly think that only non-profit organizations are required to fill out the RD 442-3 form. In truth, businesses and various entities that seek USDA funding or support must also complete it.

- Once submitted, the form cannot be amended. Many assume that any mistakes in the RD 442-3 cannot be corrected after submission. In fact, if errors occur, organizations may amend their forms, provided they follow the appropriate procedures.

- The form is irrelevant unless applying for a loan. Some believe the RD 442-3 form is only necessary when seeking loans from the USDA. This form is also needed for compliance and reporting purposes, regardless of whether a loan application is pending.

- There is no deadline for submitting the form. A misconception exists that the form can be submitted at any time without deadlines. In reality, organizations must adhere to specific submission timelines, especially if they are part of a program requiring periodic reporting.

- The information on the form is not kept confidential. Some individuals worry that their submitted information will be publicly accessible. In fact, while the USDA may use the data for oversight and funding decisions, it typically protects sensitive financial information in accordance with privacy regulations.

Understanding these misconceptions can help users navigate the USDA RD 442-3 form more effectively and utilize it to meet their financial reporting needs.

Key takeaways

When dealing with the USDA RD 442-3 form, it’s essential to be organized and thorough. Here are key takeaways to keep in mind:

- Understand the Purpose: This form is a balance sheet designed to present your financial situation clearly, outlining assets, liabilities, and equity.

- Accurate Data Entry: Ensure all financial data, such as cash, receivables, and investments, is correctly entered. Mistakes can lead to delays in processing.

- Current vs. Fixed Assets: Distinguish between current assets (like cash and inventory) and fixed assets (like land and buildings), as this classification is crucial for clarity.

- Liabilities Breakdown: Clearly categorize liabilities into current and long-term. This helps in understanding the financial obligations and timelines associated with them.

- Regular Updates: Keep the form updated yearly or as necessary to reflect the most accurate financial position possible.

- Official Signature Required: Don’t forget to have the appropriate official sign off on the form, certifying its accuracy and completeness.

Keeping these points in mind will help ensure that the USDA RD 442-3 form is completed correctly and serves its intended purpose effectively.

Browse Other Templates

Dwc Form-83 - The DWC 83 form is necessary to clarify the lack of employee status for independent contractors.

What Is 1095 C - Part III tracks the covered individuals under the employer’s health plan, if applicable.