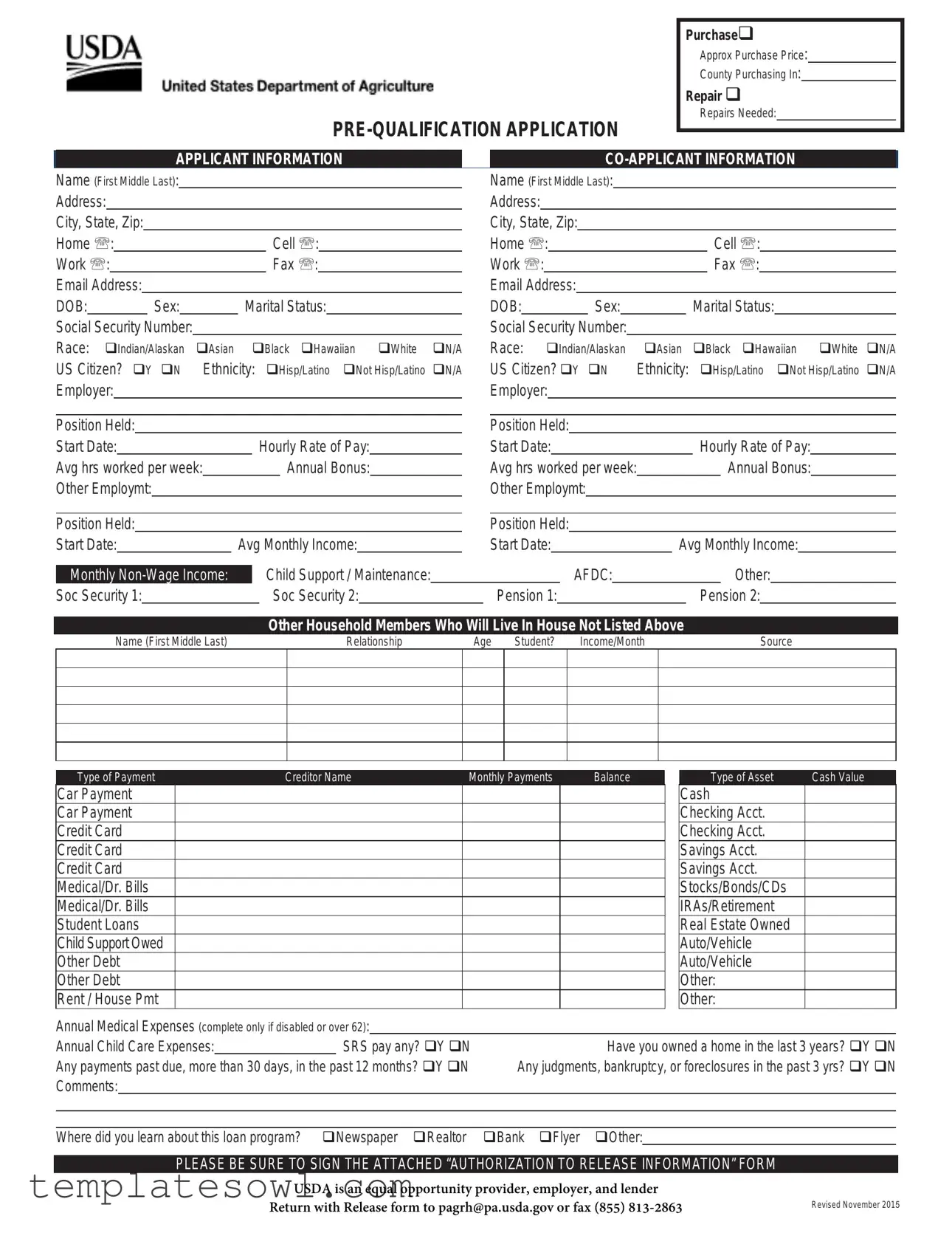

Fill Out Your Usda Pre Qualification Form

The USDA Pre-Qualification Form serves as an essential preliminary step for individuals seeking home financing through the USDA Rural Development Loan Program. This application collects crucial information regarding the applicant and co-applicant, including names, addresses, contact information, dates of birth, and employment details. The form also requires a disclosure of financial statuses, such as existing debts, income from employment and non-wage sources, and assets like cash and real estate owned. Applicants must provide basic demographic information, including race and ethnicity, while certifying their U.S. citizenship status. Special attention is given to expenses related to medical care and childcare, as well as any recent housing history or financial hardships like bankruptcies or foreclosures. The form emphasizes the importance of detailed and accurate information, as it will directly influence eligibility assessments and preliminary credit evaluations. By gathering all necessary details upfront, the USDA aims to streamline the process and set clear expectations for both lenders and borrowers.

Usda Pre Qualification Example

Purchase

Approx Purchase Price: County Purchasing In:

Repair

Repairs Needed:

|

|

|

|

|

|

|

|

|

APPLICANT INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

Name (First Middle Last): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name (First Middle Last): |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

City, State, Zip: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City, State, Zip: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

Home |

: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cell |

: |

|

|

|

|

|

|

Home |

: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cell |

: |

|

|

|

|

||||||||||

|

Work |

: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fax |

: |

|

|

|

|

|

|

|

Work |

: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fax |

: |

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Email Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Email Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

DOB: |

|

|

|

|

|

|

|

Sex: |

|

|

|

|

Marital Status: |

|

|

|

DOB: |

|

|

|

|

|

|

Sex: |

|

|

|

|

Marital Status: |

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Social Security Number: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security Number: |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

Race: |

Indian/Alaskan |

|

Asian |

|

Black |

Hawaiian White |

N/A |

|

|

Race: |

|

Indian/Alaskan |

|

Asian |

Black |

Hawaiian White |

N/A |

||||||||||||||||||||||||||||||||||||||

|

US Citizen? Y N |

|

Ethnicity: Hisp/Latino Not Hisp/Latino |

N/A |

|

US Citizen? Y |

|

N |

Ethnicity: |

Hisp/Latino Not Hisp/Latino |

N/A |

|||||||||||||||||||||||||||||||||||||||||||||

|

Employer: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Position Held: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Position Held: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

Start Date: |

|

|

|

|

|

|

Hourly Rate of Pay: |

|

|

|

Start Date: |

|

|

|

|

|

|

|

|

|

|

Hourly Rate of Pay: |

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

Avg hrs worked per week: |

|

|

|

|

|

Annual Bonus: |

|

|

|

Avg hrs worked per week: |

|

|

|

|

|

|

Annual Bonus: |

|

|||||||||||||||||||||||||||||||||||||

|

Other Employmt: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Employmt: |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Position Held: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Position Held: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

Start Date: |

|

|

|

|

Avg Monthly Income: |

|

|

|

Start Date: |

|

|

|

|

|

|

|

|

Avg Monthly Income: |

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

Child Support / Maintenance: |

|

|

|

|

|

|

|

|

|

|

AFDC: |

|

|

|

|

|

|

Other: |

|

||||||||||||||||||||||||||||||

|

Monthly |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Soc Security 1: |

|

|

|

|

|

|

Soc Security 2: |

|

|

|

|

Pension 1: |

|

|

|

|

|

|

|

|

|

|

Pension 2: |

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Household Members Who Will Live In House Not Listed Above |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

Name (First Middle Last) |

|

|

|

|

|

|

|

|

Relationship |

|

|

Age Student? |

Income/Month |

|

|

|

|

Source |

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Type of Payment |

Creditor Name |

Monthly Payments |

Balance |

Car Payment

Car Payment

Credit Card

Credit Card

Credit Card

Medical/Dr. Bills

Medical/Dr. Bills

Student Loans

Child Support Owed

Other Debt

Other Debt

Rent / House Pmt

Type of Asset |

Cash Value |

Cash

Checking Acct.

Checking Acct.

Savings Acct.

Savings Acct.

Stocks/Bonds/CDs

IRAs/Retirement

Real Estate Owned

Auto/Vehicle

Auto/Vehicle

Other:

Other:

Annual Medical Expenses (complete only if disabled or over 62): |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

Annual Child Care Expenses: |

|

|

SRS pay any? Y N |

Have you owned a home in the last 3 years? Y N |

||||

Any payments past due, more than 30 days, in the past 12 months? Y N |

Any judgments, bankruptcy, or foreclosures in the past 3 yrs? Y N |

|||||||

Comments: |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

||||

Where did you learn about this loan program? |

Newspaper Realtor |

Bank Flyer Other: |

|

|||||

PLEASE BE SURE TO SIGN THE ATTACHED “AUTHORIZATION TO RELEASE INFORMATION” FORM

USDA is an equal opportunity provider, employer, and lender

Return with Release form to pagrh@pa.usda.gov or fax (855)

Revised November 2015

Form RD |

Form Approved |

(Rev. |

0MB No. |

United States Department of Agriculture

Rural Development

Rural Housing Service

AUTHORIZATION TO RELEASE INFORMATION

TO:

RE:

Account or Other Identifying Number

Name of Customer

I, and/or adults in my household, have applied for or obtained a loan or grant from the Rural Housing Service (RHS), part of the Rural Development mission area of the United States Department of Agriculture. As part of this process or in considering my household for interest credit, payment assistance, or other servicing assistance on such loan, RHS may verify information contained in my request for assistance and in other documents required in connection with the request.

I, or another adult in my household, authorize you to provide to RHS for verification purposes the following applicable information:

Past and present employment or income records.

Bank account, stock holdings, and any other asset balances.

Past and present landlord references

Other consumer credit references.

If the request is for a new loan or grant, I further authorize RHS to order a consumer credit report and verify other credit information.

I understand that under the Right to Financial Privacy Act of 1978, 12 U.S.C. 3401, et seq., RHS is authorized to access my financial records held by financial institutions in connection with the consideration or administration of assistance to me. I also understand that financial records involving my loan and loan application will be available to RHS without further notice or authorization, but will not be disclosed or released by RHS to another Government agency or department or used for another purpose without my consent except as required or permitted by law.

This authorization is valid for the life of the loan.

The recipient of this form may rely on the Government's representation that the loan is still in existence.

The information RHS obtains is only to be used to process my request for a loan or grant, interest credit, payment assistance, or other servicing assistance. I acknowledge that I have received a copy of the Notice to Applicant Regarding Privacy Act Information. I understand that if I have requested interest credit or payment assistance, this authorization to release information will cover any future requests for such assistance and that I will not be renotified of the Privacy Act information unless the Privacy Act information has changed conceming use of such information.

A copy of this authorization may be accepted as an original.

Your prompt reply is appreciated.

Signature (Applicant or Adult Household Member) |

|

Date |

According to the Paperwork Reduction Act of 1995, no persons are required to respond to a collection of information unless as displays a valid OMB control number. The valid OMB control number for this information collection is

RHS Is An Equal Opportunity Lender

SEE ATTACHED PRIVACY ACT NOTICE

Rural Development

State Office

359 East Park

Drive, Suite 4 Harrisburg, PA 17111- 2747

Voice 717.237.2299 Fax

TTY/TDD & Voice 711 TDD only 717.237.2261

www.rurdev.usda.gov/pa

Dear Applicant:

Thank you for your interest in USDA Rural Development’s Section 502 Direct Lending Program.

As requested, enclosed is a

To help us determine if you are eligible for the Section 502 program, please complete all applicable sections. Upon receipt of your application and signed Form

Please ensure all adult household members 18 years or older SIGN and

DATE Form

Please submit your completed application to include the

If you have any questions, please contact our state office at (717)

We appreciate the opportunity to serve you.

USDA Rural Development Housing Programs

359 East Park Drive, Suite 4

Harrisburg, PA

Fax:

Email: pagrh@pa.usda.gov

USDA is an equal opportunity provider and employer.

If you wish to file a Civil Rights program complaint of discrimination, complete the USDA Program Discrimination Complaint Form (PDF), found online at http://www.ascr.usda.gov/complaint_filing_cust.html, or at any USDA office, or call (866)

NOTICE TO APPLICANT REGARDING PRIVACY ACT INFORMATION

The information requested on this form is authorized to be collected by the Rural Housing Service (RHS), Rural

Disclosure of information requested is voluntary. However, failure to disclose certain items of information requested, including your Social Security Number or Federal Identification Number, may result in a delay in the processing of an application or its rejection. Information provided may be used outside of the agency for the following purposes:

1 . When a record on its face, or in conjunction with other records, indicates a violation or potential violation of law, whether civil, criminal or regulatory in nature, and whether arising by general statute or particular program statute, or by regulation, rule, or order issued pursuant thereto, disclosure may be made to the appropriate agency, whether Federal, foreign, State, local, or tribal, or other public authority responsible for enforcing, investigating or prosecuting such violation or charged with enforcing or implementing the statute, or rule, regulation, or order issued pursuant thereto, if the information disclosed is relevant to any enforcement, regulatory, investigative, or prosecutive responsibility of the receiving entity.

2. A record from this system of records may be disclosed to a Member of Congress or to a Congressional staff member in response to an inquiry of the Congressional office made at the written request of the constituent about whom the record is maintained.

3. Rural Development will provide information from this system to the U.S. Department of the Treasury and to other Federal agencies maintaining debt servicing centers, in connection with overdue debts, in order to participate in the Treasury Offset Program as required by the Debt Collection Improvement Act, Pub. L.

4. Disclosure of the name, home address, and information concerning default on loan repayment when the default involves a security interest in tribal allotted or trust land. Pursuant to the

5. Referral of names, home addresses, social security numbers, and financial information to a collection or servicing contractor, financial institu- tion, or a local, State, or Federal agency, when Rural Development determines such referral is appropriate for servicing or collecting the borrower's account or as provided for in contracts with servicing or collection agencies.

6. It shall be a routine use of the records in this system of records to disclose them in a proceeding before a court or adjudicative body, when: (a) the agency or any component thereof; or (b) any employee of the agency in his or her official capacity; or (c) any employee of the agency in his or her individual capacity where the agency has agreed to represent the employee, or (d) the United States is a party to litigation or has an interest in such litigation, and by careful review, the agency determines that the records are both relevant and necessary to the litigation, provided; however, that in each case, the agency determines that disclosure of the records is a use of the information contained in the records that is compatible with the purpose for which the agency collected the records.

7. Referral of names, home addresses, and financial information for selected borrowers to financial consultants, advisors, lending institutions, packagers, agents and private or commercial credit sources, when Rural Development determines such referral is appropriate to encourage the borrower to refinance the Rural Development indebtedness as required by title V of the Housing Act of 1949, as amended (42 U.S.C. 1471), or to assist the borrower in the sale of the property .

8. Referral of legally enforceable debts to the Department of the Treasury, Internal Revenue Service (IRS), to be offset against any tax refund that may become due the debtor for the tax year in which the referral is made, in accordance with the IRS regulations at 26 C.F.R.

9. Referral of information regarding indebtedness to the Defense Manpower Data Center, Department of Defense, and the United States Postal Service for the purpose of conducting computer matching programs to identify and locate individuals receiving Federal salary or benefit payments and who are delinquent in their repayment of debts owed to the U.S. Government under certain programs administered by Rural Development in order to collect debts under the provisions of the Debt Collection Act of 1982 (5 U.S.C. 5514) by voluntary repayment, administrative or salary offset procedures, or by collection agencies.

10. Referral of names, home addresses, and financial information to lending institutions when Rural Development determines the individual may be financially capable of qualifying for credit with or without a guarantee.

11.Disclosure of names, home addresses, social security numbers, and financial information to lending institutions that have a lien against the same property as Rural Development for the purpose of the collection of the debt. These loans can be under the direct and guaranteed loan programs.

12.Referral to private attorneys under contract with either Rural Development or with the Department of Justice for the purpose of foreclosure and possession actions and collection of past due accounts in connection with Rural Development.

13.It shall be a routine use of the records in this system of records to disclose them to the Department of Justice when: (a) The agency or any component thereof; or (b) any employee of the agency in his or her official capacity where the Department of Justice has agreed to represent the employee; or (c) the United States Government, is a party to litigation or has an interest in such litigation, and by careful review, the agency deter- mines that the records are both relevant and necessary to the litigation and the use of such records by the Department of Justice is therefore deemed by the agency to be for a purpose that is compatible with the purpose for which the agency collected the records.

NOTICE TO APPLICANT REGARDING PRIVACY ACT INFORMATION- CONTINUED

14Referral of names, home addresses, social security numbers, and financial information to the Department of Housing and Urban Development (HUD) as a record of location utilized by Federal agencies for an automatic credit prescreening system.

15.Referral of names, home addresses, social security numbers, and financial information to the Department of Labor, State Wage Information Collection Agencies, and other Federal, State, and local agencies, as well as those responsible for verifying information furnished to qualify for Federal benefits, to conduct wage and benefit matching through manual and/or automated means, for the purpose of determining compliance with Federal regulations and appropriate servicing actions against those not entitled to program benefits, including possible recovery of improper benefits.

16.Referral of names, home addresses, and financial information to financial consultants, advisors, or underwriters, when Rural Development determines such referral is appropriate for developing packaging and marketing strategies involving the sale of Rural Development loan assets.

17.Rural Development, in accordance with 31 U.S.C. 3711(e)(5), will provide to consumer reporting agencies or commercial reporting agencies information from this system indicating that an individual is responsible for a claim that is current.

18.Referral of names, home addresses, home telephone numbers, social security numbers, and financial information to escrow agents (which also could include attorneys and title companies) selected by the applicant or borrower for the purpose of closing the loan.

19.Disclosures pursuant to 5 U.S.C. 552a(b)(12): Disclosures may be made from this system to consumer reporting agencies as defined in the

Fair Credit Reporting Act (15 U.S.C. 168a(f) or the Federal Claims Collection Act (31U.S.C. 3701(a)(3)).

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of the Form | The USDA Pre-Qualification Form is necessary for determining eligibility for the USDA Rural Development loan program, specifically for homeownership assistance. |

| Applicant Information Required | Applicants must provide detailed personal information, including full names, addresses, contact numbers, social security numbers, and income details. |

| Income Verification | The form requires income verification from various sources such as employment, child support, and social security benefits to assess financial eligibility. |

| State Specific Compliance | The form adheres to federal guidelines, specifically the Housing Act of 1949 (42 U.S.C. 1471 et seq.) and the Consolidated Farm and Rural Development Act (7 U.S.C. 1921 et seq.). |

| Authorization Requirements | Applicants must sign an “Authorization to Release Information” form to allow verification of their financial information during the application process. |

Guidelines on Utilizing Usda Pre Qualification

Completing the USDA Pre-Qualification form is an essential part of your journey toward homeownership. This process involves filling out necessary details about your financial situation and personal information to help determine your eligibility for the USDA loan program. Once your application is submitted, it will undergo a preliminary review, after which you will be notified about your eligibility within two weeks.

- Purchase Information: Begin by specifying whether you are applying for a purchase or repairs. Enter the approximate purchase price and the county where you're seeking to buy.

- Applicant Information: Fill out your full name (first, middle, and last), complete address, city, state, and zip code. Provide your home, cell, and work phone numbers, along with your email address and date of birth.

- Demographics: Indicate your sex, marital status, and social security number. Also, mark your race and ethnicity, and whether you are a U.S. citizen.

- Employment Information: Enter details about your current employer, your position, start date, hourly rate, average hours worked per week, and any annual bonus. Also, include information on any additional employment.

- Income Details: List your average monthly income and any non-wage income like child support or social security.

- Other Household Members: Provide the names, relationships, ages, and income sources for other members living in your household who are not listed above.

- Debt Information: List each creditor, their type of debt, monthly payments, and remaining balances for car payments, credit cards, medical bills, loans, and any other debts.

- Asset Information: Report on your assets including their type, cash value, and account details for checking, savings, stocks, real estate, etc.

- Additional Expenses: Complete annual medical and childcare expenses if applicable, and inform whether you have owned a home in the last three years.

- Credit History: Indicate if you have had any payments past due, judgments, bankruptcies, or foreclosures in the past three years.

- Additional Information: Share where you learned about the loan program and include any comments you may have.

- Authorization: Ensure that all adult household members aged 18 or older sign and date the attached “Authorization to Release Information” form.

After completing these steps, you may submit the form through mail, fax, or email. Make sure your application is well-organized for a smoother review process. The USDA team is eager to assist you on your path to securing a loan for your future home.

What You Should Know About This Form

What is the USDA Pre-Qualification Form?

The USDA Pre-Qualification Form is an application used to assess your eligibility for the USDA Rural Development Loan Program. It collects personal and financial information to help determine your potential for homeownership through this program.

How do I fill out the form?

To complete the form, provide your information, your co-applicant's details, and any necessary financial data. Make sure to include all required fields accurately and completely. If you have questions while filling it out, don't hesitate to ask for assistance.

What information do I need to provide about my income?

You will need to provide details regarding your employment, including the name of your employer, position, start date, and your income. If applicable, include information about other sources of income, such as child support, social security benefits, or any bonuses received.

What documents should I attach to the form?

When submitting the form, please include the signed “Authorization to Release Information” form. This document allows the USDA to verify the information you have provided and assess your financial situation accurately.

How long does it take to process the application?

Once you submit the completed form and the necessary documents, you can expect to receive initial feedback within 14 days. This timeline may vary based on the volume of applications being processed.

What happens if my application is approved?

If your application is approved, you will receive further instructions on the next steps to secure your loan. This might include additional paperwork or information needed to finalize the loan agreement.

Can I apply with a co-applicant?

Yes, you can apply with a co-applicant. Both parties will need to complete their respective sections of the form, providing details about income and other necessary information. This can strengthen your application by combining financial resources.

What if I have past due payments or a bankruptcy?

If you have past due payments, bankruptcies, or foreclosures, you must disclose this information on the form. The USDA will review your application considering your entire financial history, but having issues in the past does not automatically disqualify you.

Where can I send my completed application?

You may submit your completed application by mail, fax, or email. The contact details are typically provided on the application document itself, ensuring that your application reaches the appropriate office for processing.

Is there someone I can contact if I have questions during this process?

If you have questions while filling out the form or about the process, feel free to contact the state office. They can provide guidance and support to ensure your application is completed correctly. Their contact information is usually listed on the application.

Common mistakes

Completing the USDA Pre-Qualification form can be a significant step toward homeownership. However, several common mistakes can hinder the application process. Understanding these pitfalls can help ensure a smoother experience.

One frequent error is providing incomplete or inaccurate personal information. When filling out sections such as names, addresses, and Social Security numbers, it is essential to be thorough. Omitting details or making typographical errors can lead to delays. Each applicant should carefully review all parts of the form to ensure accuracy. Attention to detail is crucial.

Another common mistake involves the financial information section. Applicants may underestimate their average monthly income or fail to include all sources of income, such as child support or pensions. This incomplete financial picture can affect eligibility. It is vital to provide a comprehensive account of all income streams to create a clear financial profile for the lender.

Omitting necessary signatures is yet another error that can complicate the application process. Each adult household member over the age of eighteen must sign the "Authorization to Release Information" form. Without the required signatures, the application may be deemed incomplete, resulting in further delays. Therefore, it is advisable to double-check that all necessary signatures are present before submitting the application.

Many applicants also overlook the importance of providing the correct contact information. For instance, failing to input a valid email address may hinder communication with the USDA office. Providing a reliable method of contact ensures that updates regarding the application can be communicated effectively. Consider verifying that all contact details are accurate and up to date.

Lastly, some individuals neglect to review the specific program requirements outlined in the USDA materials. Each program may have unique criteria that applicants must meet. Ignoring these specifics can lead to disappointment. Comprehensive research and understanding of the prerequisites can empower applicants, allowing them to submit a robust application.

Being aware of these common mistakes can significantly enhance the chances of a successful application. Each applicant is encouraged to approach the USDA Pre-Qualification form with care and diligence. With attention to detail and thoroughness, the path to homeownership can begin on a positive note.

Documents used along the form

The USDA Pre-Qualification form is an essential step in the process of applying for a USDA loan. To ensure a smooth application process, several other documents often accompany this form. Below are six important forms to consider.

- Form RD 3550-1: Authorization to Release Information - This form grants permission for verification of information regarding employment, assets, and past credit to support the loan application process.

- Preliminary Credit Report - Obtained after the submission of the application, this report helps assess the applicant's creditworthiness and is conducted at no cost to the applicant.

- Proof of Income Documents - Applicants must provide documentation such as pay stubs, tax returns, or bank statements to verify their income and financial stability.

- Asset Documentation - This includes records of cash, real estate owned, investment accounts, and other financial resources to evaluate the applicant's assets.

- Debt Information Sheet - Listing existing debts along with monthly payments helps lenders understand the applicant's financial obligations and overall debt-to-income ratio.

- Privacy Act Notice - This document informs applicants about their rights regarding the collection and use of their personal information during the loan process.

By preparing these documents along with the USDA Pre-Qualification form, applicants can facilitate a more efficient review process. It’s crucial to ensure that all information is complete and accurate to enhance the chances of loan approval.

Similar forms

- Loan Application Form: Similar to the USDA Pre-Qualification form, a loan application form collects personal and financial information from an applicant to assess eligibility for a loan. It typically includes details about income, employment, assets, debts, and repayment capability.

- Mortgage Pre-Approval Letter: This document indicates that a lender has assessed an applicant's financial background and deemed them eligible for a specific loan amount prior to formal application, much like the USDA form establishes initial eligibility for loans.

- Credit Report Authorization Form: This form permits lenders to obtain an applicant's credit report. It shares a similar function with the USDA Pre-Qualification form, where consent is needed to validate financial information.

- Financial Statement: A financial statement provides a snapshot of an individual's finances, detailing income, expenses, assets, and liabilities. This is comparable, as the USDA form requires in-depth financial disclosures for qualification purposes.

- Asset Documentation: Documents showcasing an individual's assets—such as bank statements, property deeds, and investment account reports—are similar to the asset requests in the USDA Pre-Qualification form, used to assess overall financial stability.

- Employment Verification Letters: These letters verify employment status and income, similar to the income details requested in the USDA form, establishing credibility and reliability in providing financial information.

- Property Information Sheet: This document includes details about the property being purchased or refinanced, akin to the property-related inquiries in the USDA form, aiding in the assessment of the property's value and suitability for financing.

Dos and Don'ts

Filling out the USDA Pre-Qualification form is an important step toward homeownership. To make the process smoother, here are some key do's and don'ts to keep in mind.

- Do double-check all personal information for accuracy, including names, addresses, and Social Security numbers.

- Do report your complete financial situation, including all sources of income and current debts.

- Do ensure that all household members aged 18 or older sign the authorization form.

- Do submit the application promptly to avoid delays in processing your request.

- Don't omit any required sections of the application, as incomplete forms may be rejected.

- Don't provide false information, as this can lead to serious consequences.

- Don't forget to check for any missing signatures before submitting your form.

- Don't hesitate to ask for clarification on any part of the form that is confusing.

Misconceptions

-

Misconception 1: The USDA Pre-Qualification form guarantees loan approval.

In reality, completing the form is merely a first step in the assessment process. It does not assure that a loan will be granted, as further evaluation of financial details need to occur.

-

Misconception 2: Only rural residents can apply for USDA loans.

This is not true. While USDA loans are commonly associated with rural areas, these loans are available in certain suburban regions as well. Eligibility is determined by location and income, rather than solely by the type of area.

-

Misconception 3: All types of debts will disqualify an applicant.

While outstanding debts are considered during the evaluation process, not all debts will automatically lead to disqualification. The specific nature of the debts, payment history, and overall financial profile are equally important.

-

Misconception 4: The application process is excessively complicated.

The USDA Pre-Qualification form, while comprehensive, is designed to gather important information efficiently. With careful attention to detail, applicants can complete the form without feeling overwhelmed.

-

Misconception 5: You do not need to provide personal income information.

On the contrary, disclosing personal and household income is essential. This information is critical for assessing eligibility for assistance programs and determines the applicant's financial standing.

-

Misconception 6: Submitting the form quickly guarantees faster processing.

While timely submission is important, the completeness and accuracy of the information provided are paramount. Ensuring that all required details are correctly filled out will aid in expediting the review process more effectively than mere speed alone.

Key takeaways

Filling out and using the USDA Pre-Qualification form effectively is essential for potential homebuyers seeking assistance. Below are key takeaways to guide applicants through the process:

- Complete All Sections: Ensure all applicable sections of the form are filled out completely. Missing information may delay processing.

- Include Household Members: List all adult household members. Their information, including signatures, is necessary for authorization.

- Submit Promptly: Return the completed application along with the signed authorization form. Submitting quickly helps expedite the review process.

- Documentation is Key: Be prepared to provide supporting documents, such as income records or bank statements, if requested.

- Understand Your Eligibility: Familiarize yourself with eligibility criteria for the Section 502 program to assess the likelihood of approval.

- Follow Up: After submission, check in if you do not receive a notification within the expected timeline regarding your application status.

Browse Other Templates

Freight Dispatch Document,Transport Order Bill,Shipping Instruction Form,Cargo Transfer Receipt,Delivery Acknowledgment Document,Lading Agreement Form,Freight Movement Bill,Consignment Shipping Paper,Logistics Transport Bill,Goods Shipment Authorizat - It provides space for additional remarks or exceptions regarding the shipment.

Wingstop Careers - Be aware that equal opportunity is provided in all employment practices.