Fill Out Your Usda Ratio Waiver Form

The USDA Ratio Waiver Form serves as a crucial tool for lenders assessing applicants with specific financial circumstances while seeking to secure a mortgage. It becomes essential when applicants find themselves exceeding certain debt ratios, specifically when the PITI (Principal, Interest, Taxes, and Insurance) ratio surpasses 29% or the Total Debt (TD) ratio exceeds 41%. Additionally, it is necessary to document payment shock situations where the new payment amount is at least double the former housing cost, or when an applicant lacks a rental history. Within the form, lenders have the ability to evaluate various compensating factors that may support an applicant's ability to repay the loan despite these risky conditions. These factors can include stable employment history, good credit scores, and accretive savings patterns. Keeping the applicant's financial health in focus, the form also allows for the inclusion of alternative income sources that may not be reflected directly in the repayment calculations. Proper documentation of these aspects helps the underwriter make informed decisions, ensuring that loan approvals are both fair and secure.

Usda Ratio Waiver Example

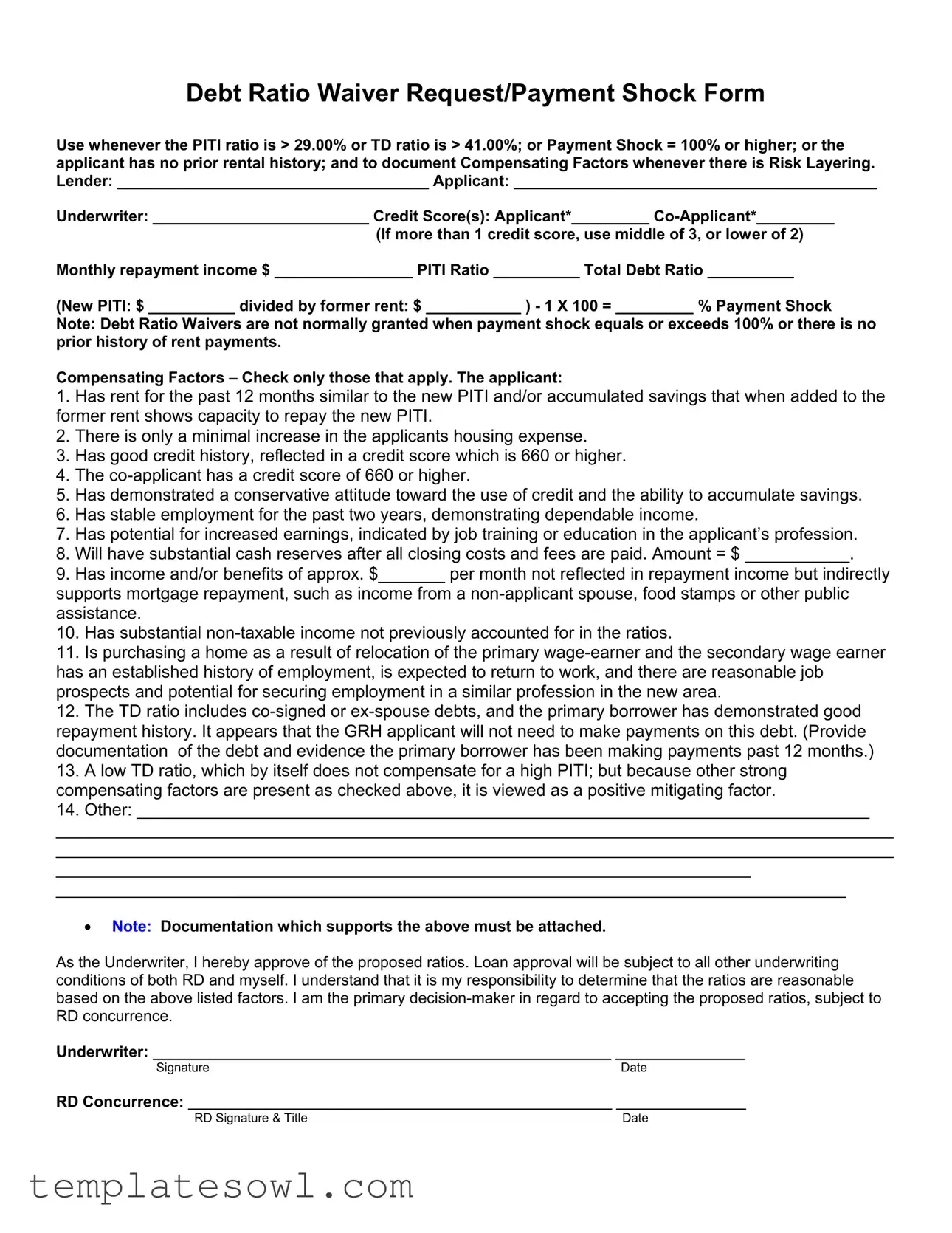

Debt Ratio Waiver Request/Payment Shock Form

Use whenever the PITI ratio is > 29.00% or TD ratio is > 41.00%; or Payment Shock = 100% or higher; or the applicant has no prior rental history; and to document Compensating Factors whenever there is Risk Layering. Lender: ____________________________________ Applicant: __________________________________________

Underwriter: _________________________ Credit Score(s): Applicant*_________

(If more than 1 credit score, use middle of 3, or lower of 2) Monthly repayment income $ ________________ PITI Ratio __________ Total Debt Ratio __________

(New PITI: $ __________ divided by former rent: $ ___________ ) - 1 X 100 = _________ % Payment Shock

Note: Debt Ratio Waivers are not normally granted when payment shock equals or exceeds 100% or there is no prior history of rent payments.

Compensating Factors – Check only those that apply. The applicant:

1.Has rent for the past 12 months similar to the new PITI and/or accumulated savings that when added to the former rent shows capacity to repay the new PITI.

2.There is only a minimal increase in the applicants housing expense.

3.Has good credit history, reflected in a credit score which is 660 or higher.

4.The

5.Has demonstrated a conservative attitude toward the use of credit and the ability to accumulate savings.

6.Has stable employment for the past two years, demonstrating dependable income.

7.Has potential for increased earnings, indicated by job training or education in the applicant’s profession.

8.Will have substantial cash reserves after all closing costs and fees are paid. Amount = $ ___________.

9.Has income and/or benefits of approx. $_______ per month not reflected in repayment income but indirectly supports mortgage repayment, such as income from a

10.Has substantial

11.Is purchasing a home as a result of relocation of the primary

12.The TD ratio includes

13.A low TD ratio, which by itself does not compensate for a high PITI; but because other strong compensating factors are present as checked above, it is viewed as a positive mitigating factor.

14.Other: _____________________________________________________________________________

________________________________________________________________________________________

________________________________________________________________________________________

_________________________________________________________________________

___________________________________________________________________________________

•Note: Documentation which supports the above must be attached.

As the Underwriter, I hereby approve of the proposed ratios. Loan approval will be subject to all other underwriting conditions of both RD and myself. I understand that it is my responsibility to determine that the ratios are reasonable based on the above listed factors. I am the primary

Underwriter: _____________________________________________________ _______________

SignatureDate

RD Concurrence: _________________________________________________ _______________

RD Signature & Title |

Date |

Form Characteristics

| Fact Title | Description |

|---|---|

| Purpose of the Form | This form is used to request a waiver for debt ratios exceeding certain limits, particularly when the PITI ratio is greater than 29% or the total debt ratio exceeds 41%. |

| Payment Shock | If the payment shock equals or exceeds 100%, it often complicates the waiver process. Payment shock is calculated by comparing the new PITI payment against the former rent. |

| Compensating Factors | The form allows lenders to document various compensating factors that may support the approval of a waiver despite high debt ratios. |

| Prior Rental History | The lack of a prior rental history can influence the waiver request. This absence may be considered a risk by the lender. |

| Monthly Repayment Income | The applicant must provide details about their monthly repayment income, which plays a crucial role in calculating the debt ratios. |

| Credit Scores | Credit scores of both applicants are critical. Generally, scores above 660 are favorable for waiver approval. |

| Minimum Documentation | Applicants must attach documentation supporting their claims, particularly regarding their capacity to repay the new PITI. |

| Employment Stability | Stable employment over the past two years can bolster the application, showing dependable income to support the mortgage payment. |

| Underwriter's Role | The underwriter is responsible for determining if the proposed debt ratios are reasonable based on the applicant's circumstances. |

| Regulations and Requirements | Specific state regulations may apply, impacting the approval process for the waiver form, which varies by governing laws in each state. |

Guidelines on Utilizing Usda Ratio Waiver

After obtaining the USDA Ratio Waiver form, please follow these steps to ensure it’s filled out correctly. Completing this process is essential for moving forward with your loan application. Make sure you have all the required information at hand.

- Identify the Lender: Write the name of the lender in the designated space.

- Fill in Applicant Information: Enter the names of the primary applicant and co-applicant as required.

- Document Underwriter Details: Add the underwriter's name in the appropriate box.

- Credit Scores: If multiple credit scores are available, identify the applicable scores for both the applicant and co-applicant, choosing the middle score of three or the lower of two.

- Income Information: Record the monthly repayment income in the specified section.

- Calculate Ratios: Fill in the PITI ratio and Total Debt Ratio based on the formulas provided.

- Payment Shock: Note the payment shock percentage by dividing the new PITI by the former rent and completing the calculation.

- Compensating Factors: Check all applicable compensating factors that apply to the applicant.

- Attach Documentation: Ensure all documentation supporting the checked compensating factors is appended to the form.

- Underwriter Signature: The underwriter must sign and date the form, confirming their approval of the proposed ratios.

- RD Concurrence: The USDA RD representative needs to sign and date the form to finalize the concurrence.

By following these steps, you will ensure that the USDA Ratio Waiver form is completed accurately, allowing for a smoother loan approval process. Once submitted, the underwriter will review the information provided, alongside any supporting documentation. They will determine if the proposed debt ratios are reasonable based on the factors identified.

What You Should Know About This Form

What is the purpose of the USDA Ratio Waiver form?

The USDA Ratio Waiver form allows lenders to request a waiver for applicants whose debt-to-income ratios exceed the standard limits. Specifically, it is used when the PITI (Principal, Interest, Taxes, Insurance) ratio is greater than 29% or the total debt ratio exceeds 41%. Additionally, it can address situations involving payment shock or the absence of rental history.

When should I use the USDA Ratio Waiver form?

This form should be utilized when certain conditions are met, including the PITI ratio being over 29%, the total debt ratio being above 41%, or if the applicant experiences payment shock of 100% or more. It's also applicable if the applicant lacks prior rental history and needs to document compensating factors in cases involving risk layering.

What are compensating factors, and why are they important?

Compensating factors are conditions that can help support a waiver request even when debt ratios exceed the typical thresholds. These factors include stable employment, strong credit history, or substantial cash reserves. Lenders consider these factors to assess the applicant's ability to manage mortgage payments despite higher ratios.

What is payment shock, and how is it calculated?

Payment shock occurs when an applicant's new housing payment significantly exceeds their previous rent payment. It is calculated by comparing the new PITI amount against the former rental payment. The formula involves dividing the new PITI by the former rent, subtracting one, and multiplying by 100 to express this difference as a percentage.

What are the minimum credit score requirements for waiving the ratio?

The form indicates that applicants should have a credit score of at least 660 for both the primary applicant and any co-applicants. A higher credit score demonstrates reliable repayment behavior, which can strengthen a waiver request.

Is there ever a situation where a waiver will not be granted?

Yes, waivers are generally not granted when the payment shock reaches or exceeds 100%, or when there is no prior history of rent payments. These situations pose increased risk for lenders and typically lead to the denial of a waiver request.

What documentation is needed to support the waiver request?

Supporting documentation is crucial and must accompany the waiver request. This can include proof of steady employment, financial statements showing cash reserves, and any documentation that verifies the compensating factors checked on the form. The underwriter must also supply their approval and signature to validate the request.

What happens after the USDA Ratio Waiver form is submitted?

Once the form is completed and submitted, it undergoes review by the underwriter, who assesses the reasonableness of the ratios in light of the listed compensating factors. The underwriter’s signature indicates approval, and the request is then subject to additional underwriting conditions. Final approval will depend on collaboration with USDA Rural Development (RD).

Can the form be modified for specific situations?

While the form has standard sections, there is a provision for additional notes or factors. If the applicant presents unique circumstances not covered by the checklist, details can be added in the designated space at the end of the form. This flexibility allows for a more comprehensive assessment of each individual case.

Common mistakes

Submitting the USDA Ratio Waiver form can be a straightforward process, but mistakes often lead to delays or outright denials. One common mistake is failing to provide accurate credit scores for both the applicant and any co-applicant. The form specifically instructs users to submit the middle score from three available scores or the lower of two. Missing this crucial step can mislead underwriters and adversely affect the loan approval process.

An additional error frequently made involves the monthly repayment income section. Many applicants either miscalculate this figure or underestimate their monthly income, leading to a misleading Total Debt (TD) ratio. Inaccurate income reporting can trigger unnecessary complications, as the TD ratio is a critical component the underwriter assesses when reviewing the request.

Another mistake is overlooking the **Compensating Factors** section of the form. This section allows applicants to provide supporting information that might help bolster their case, especially in situations where the debt ratio is out of the preferred range. Failing to check applicable factors or not providing adequate documentation can leave an application vulnerable to rejection, as providing compelling evidence is essential for justifying a waiver.

Improperly calculated **Payment Shock** figures can lead to serious misunderstandings as well. In this context, Payment Shock refers to a situation where the new Principal, Interest, Taxes, and Insurance (PITI) payment is dramatically higher than the previous rent payment. If this figure exceeds 100% and is not clearly documented, it raises a red flag for underwriting. Thus, careful calculations and clear explanations are vital.

Submitting incomplete documentation can severely hinder an application. The form clearly states that supporting documentation is a prerequisite for approval. Failing to attach the necessary documents can result in a request being sent back or rejected. Each compensating factor noted on the form should have appropriate, verifiable documentation attached.

Finally, neglecting to ensure that all signatures and dates are filled out correctly can render the application invalid. The underwriter’s signature and the RD concurrence are essential final steps. Incomplete signatures or dates can be perceived as a sign of negligence, leading to delays or even denials. Attention to these final details can make a significant difference in the overall review process.

Documents used along the form

The USDA Ratio Waiver form is an important document in the home loan process, especially when applicants face challenges with their debt ratios. However, it's just one part of the larger picture. Other forms and documents commonly used alongside the USDA Ratio Waiver help to ensure a thorough evaluation of the applicant's financial situation. Understanding these can assist both applicants and lenders in making informed decisions.

- Loan Application Form: This is the initial document where applicants provide personal information, including income, assets, and debts. It forms the basis of the lending decision.

- Credit Report: A comprehensive record detailing a borrower's credit history. Lenders use this to assess the applicant's creditworthiness.

- Income Verification Documents: These may include pay stubs, tax returns, or W-2 forms that allow the lender to confirm the applicant's current income level.

- Asset Statements: Bank statements or investment account summaries that show current savings and checking balances. They help demonstrate the applicant’s financial reserves.

- Debt Verification Form: This form lists all the debts the applicant has, such as personal loans and credit card balances, and provides details about each one.

- Property Appraisal Report: An assessment that estimates the value of the property being financed. It ensures the loan amount aligns with the property's market value.

- Loan Estimate Form: Provided by the lender, this document outlines the estimated terms and costs associated with the loan, helping applicants understand what to expect financially.

Incorporating these documents into the loan process can enhance clarity and streamline decision-making. Each unique document plays a vital role in ensuring that lenders and applicants are aligned in their understanding and expectations. By being familiar with these items, applicants can approach the home-buying journey with greater confidence.

Similar forms

The USDA Ratio Waiver form serves a specific purpose in the mortgage lending process, especially when applicants face challenges related to debt ratios and payment history. Several other documents share similarities in function and intent. Here are seven such documents, each marked and explained individually:

- FHA Loan Underwriting Worksheet: Like the USDA form, this worksheet assesses an applicant's capacity to repay a mortgage while considering similar compensating factors related to debt-to-income ratios and credit scores.

- VA Loan Eligibility Verification: This document aids in verifying an applicant's eligibility for a VA loan, much like the USDA form does for USDA loans. Both documents evaluate additional evidence of financial stability and compensating factors to support an approval.

- Conventional Loan Underwriting Guidelines: This set of guidelines contains criteria for approving conventional loans. It mirrors the USDA form by emphasizing debt ratios and includes considerations for compensating factors when the applicant's ratios are not within traditional limits.

- Loan Modification Application: The application for modifying an existing loan looks into an applicant’s financial situation. Just as the USDA form identifies compensating factors for new loans, this document seeks to establish criteria for helping distressed borrowers retain their homes.

- Hardship Exemption Request: This request form evaluates borrowers facing financial difficulties. Similar to the USDA form, it requires documentation to substantiate claims of hardship, illustrating the borrower's capacity to manage new mortgage obligations.

- Self-Employment Income Verification: When a borrower is self-employed, this document probes into income sources and stability. Like the USDA form, it stresses the importance of demonstrating consistent payment ability through supporting documentation and compensating factors.

- CMHC Mortgage Application: Used in Canada, this application parallels the USDA's intention by evaluating applicants' financial status and considering compensating factors to mitigate high debt ratios, although it operates under different regulations.

Each of these documents engages with similar themes of financial evaluation and risk assessment, serving as vital tools in the lending landscape.

Dos and Don'ts

When filling out the USDA Ratio Waiver form, it’s essential to follow specific guidelines to ensure the application is complete and accurate. Here are eight tips to keep in mind:

- Include accurate information about the lender, applicant, and underwriter to avoid confusion later.

- Double-check credit scores for both the applicant and co-applicant. Use the middle score from three or the lower score from two.

- Carefully calculate the PITI and Total Debt Ratios. Mistakes in these calculations can lead to delays in processing.

- Attach all required documentation that supports the compensating factors checked on the form. This information reinforces your case.

On the other hand, there are several pitfalls to avoid:

- Do not leave any fields blank; every section requires completion for thorough assessment.

- Avoid inflating income or any of the figures; this can lead to serious consequences if discovered.

- Do not ignore the instructions regarding payment shock; it could affect the approval process significantly.

- Neglecting to provide detailed explanations for any unusual circumstances can hinder your chances of approval.

Misconceptions

-

Misconception 1: The USDA Ratio Waiver is only for applicants with a poor credit score.

Many people believe that this form is only necessary for those who have low credit scores. However, while having a credit score of 660 or higher is preferred, applicants with good scores can also request a waiver under certain conditions. This form helps evaluate the overall financial scenario, not just the credit score.

-

Misconception 2: If my payment shock exceeds 100%, a waiver is impossible.

It is a common misunderstanding that exceeding a payment shock of 100% automatically disqualifies an applicant from receiving a waiver. While it is true that this scenario poses a significant risk, lenders can still consider compensating factors that indeed support the application. Factors such as stable employment or significant cash reserves may influence the lender's decision positively.

-

Misconception 3: Applicants without rental history cannot qualify for a waiver.

While the absence of rental history can pose challenges, it does not exclude an applicant from receiving a waiver. Other aspects of an applicant's financial situation, such as savings or income stability, can compensate for the lack of prior rent. The evaluation is comprehensive and considers various elements that display the applicant's financial ability.

-

Misconception 4: Compensating factors alone can guarantee a waiver approval.

Some believe that possessing several compensating factors will automatically lead to waiver approval. While these factors are essential in the decision-making process, they do not guarantee a waiver. Each application is reviewed on its merits, and the underwriter ultimately decides if the waiver is reasonable based on the overall situation.

Key takeaways

Applying for a USDA Ratio Waiver can be crucial for individuals seeking a home loan, especially if certain financial criteria are not met. Below are key takeaways to consider when filling out and using the USDA Ratio Waiver form.

- The form is necessary when a borrower’s PITI ratio exceeds 29% or their total debt ratio surpasses 41%. It's also used if there is a payment shock of 100% or higher.

- Documenting compensating factors is essential when there are risks involved. Compensating factors might include a good credit history or stable employment.

- Before submitting the form, ensure that supporting documentation is attached. This helps validate the claims made about income, credit scores, and other relevant factors.

- Debt Ratio Waivers are typically not granted if payment shock reaches 100% or if there is no prior rental history. This could impact the approval process.

- Approval from the underwriter is necessary. They must confirm the proposed ratios are reasonable based on the information provided.

Browse Other Templates

Statement of Facts (reg 256) - Individual sections of the form allow for specific claims related to vehicle transfer circumstances.

Inspection Report - Effective communication of any alarms or releases is expected in the facility operations plan.