Fill Out Your Usps 2976 A Form

When sending items internationally, you must navigate a series of specific requirements to ensure your package arrives smoothly and legally. One vital tool in this process is the USPS 2976-A form, a customs declaration needed for international shipments. This form serves as both a declaration of the contents you are sending and a vital communication tool for customs officials. Completing it accurately is crucial. The sender must provide detailed descriptions of each item, including quantity, weight, and value, as vague descriptions can lead to delays or complications. Notably, this form also includes sections where special conditions or restrictions related to the contents must be indicated. Items that fall into specific categories, like dangerous goods or those subject to quarantine, require additional information to avoid any issues during transit. Furthermore, the form necessitates an Automated Export System (AES) Internal Transaction Number if certain conditions are met, ensuring that your package complies with federal export regulations. Ultimately, correctly filling out the USPS 2976-A form not only helps facilitate customs clearance but also protects both the sender and the recipient from potential fines or penalties.

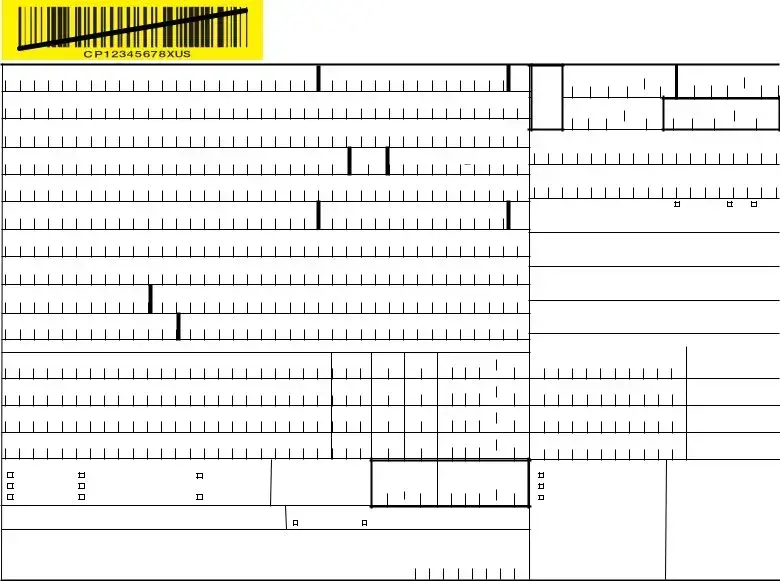

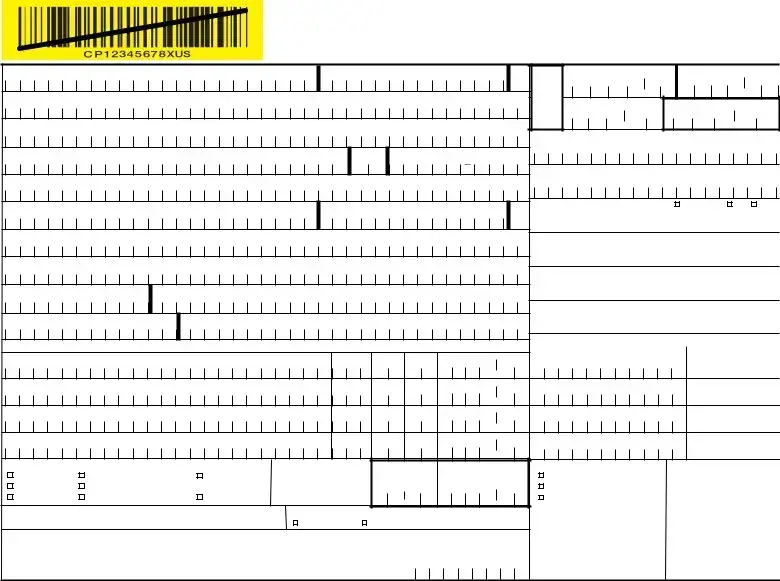

Usps 2976 A Example

INSTRUCTIONS FOR COMPLETING THIS FORM (Remove this page prior to completing form.)

Please print this form in English using blue or black ink, pressing firmly so all information transfers to all copies. Complete the declaration fully and legibly; otherwise, delay and inconvenience may result for the addressee. A false or misleading declaration may lead to a fine or seizure of the item and additional penalties. You may add a translation of the contents in a language accepted in the destination country.

Your goods may be subject to restrictions. It is your responsibility to comply with import and export regulations and restrictions (e.g., quarantine, pharmaceutical, etc.), and to determine what documents (e.g., commercial invoice, certificate of origin, health certificate, license, authorization for goods subject to quarantine such as plant, animal, or food products, etc.), if any, are required in the destinationScountry.ACheck the country Mlistings at pe.usps.com/text/imm/immctryP.htm,Las well as the UPUEList of Prohibited Items available at www.upu.int/customs/en/country list en.pdf.

FROM ( ender information) and TO ( ddressee information) sections: Enter both the sender’s and addressee’s full name and full address in the blocks provided. Incomplete names (e.g., initials) or incomplete address entries may result in delayed handling by Customs and/or the delivery office. Provide the telephone/fax number or email address of the sender, as such information will facilitate customs clearance and delivery.

Block 1: Enter a detailed description of each article — e.g., “men’s cotton shirts.” General descriptions — e.g., “samples,” “food products,” or “toiletries” — are not acceptable. If there is insufficient space on the form to list all articles, use additional forms as needed. Indicate on the first form (to the right of the barcode) the following: “Additional forms enclosed.” Important: Obliterate the tracking number and barcode on subsequent forms and place all the forms into PS Form

Blocks

Block 5: Check the box specifying the category of the item. If the international shipment contains dangerous goods that are approved for mailing, check the box for “Dangerous Goods.” Mailability information for international shipments is available in Publication 52, Hazardous, Restricted, and Perishable Mail (chapter 6), and in International Mail Manual (IMM®) Part 135.

Block 6: Identify if special conditions or restrictions apply to items being mailed.

Block 7: Enter the total weight of the package in pounds and ounces, including packaging, which corresponds to the weight used to calculate the postage.

Block 8: Enter the total value in U.S. dollars.

Block 9: Check the box specifying instructions in case of nondelivery. Items returned to the sender are subject to return charges at the sender’s expense.

PS Form |

See reverse of this page for additional instructions on how to complete this form. |

Block 10: Except for shipments to APO/FPO/DPO addresses, enter an Automated Export System (AES) Internal Transaction Number (ITN), AES Exemption, or if applicable, an AES Downtime Citation. This standard may also apply when mailing items to, from, and between U.S. territories, possessions, and Freely Associated States — see DMM 608.2.5. One of these codes must appear in the “AES/ITN/Exemption” block before the Postal Service will accept a package for mailing. In general, mailpieces containing any type of goods (per Schedule B Export Codes at

AES Exemption. In order to comply with U.S. Census Bureau’s Foreign Trade Regulations, indicate “NOE I § 30.37(a),” if applicable. “NOEEI § 30.37(a)” may be used when the value of each class of goods is $2,500 or less, if an export license is not required. Do NOT use this ES Exemption for items sent to Cuba, Iran, North Korea, Sudan, or Syria. Further information can be found in IMM Parts 526 and 527.

Block 11: Check the box if the contents are subject to quarantine restrictions (plant, animal, food products, etc.).

Block 12: Sign and date the form. Your signature certifies that all entries are correct and the item(s) being mailed contain no undeclared dangerous, prohibited, or restricted contents per postal, customs, or destination country regulations. Your signature also certifies compliance with all applicable federal export licensing and filing regulations and confirms your liability for the item(s) being mailed.

Blocks

Block 15: Enter, if known, the Importer’s telephone number, fax number, or email address, as such information might facilitate customs clearance or delivery.

Blocks

Insert the completed form(s) into PS Form

PS Form |

Reverse of instructions for completing form. |

|

|

|

|

|

|

|

United States Postal Service® |

|||

|

|

|

|

|

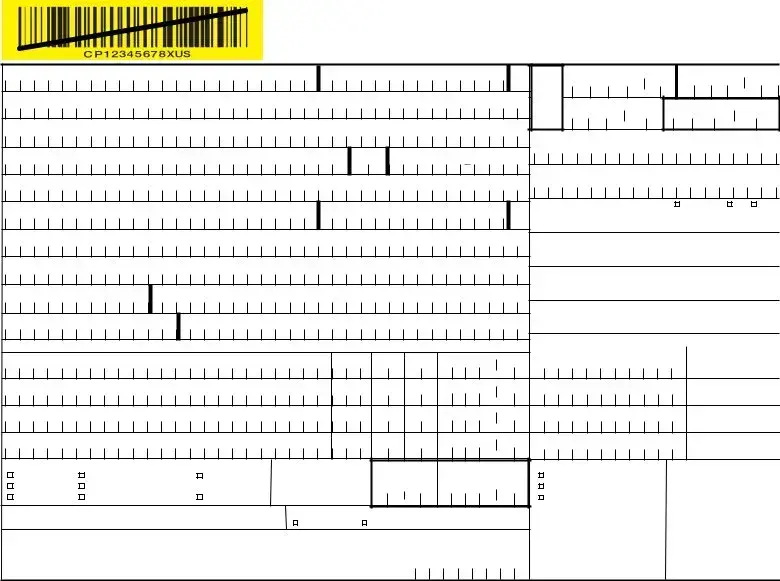

Customs Declaration and Dispatch Note |

— CP 72 |

||||

|

|

|

IMPORTANT: This item may be opened officially. Please print in English, using blue or black ink, and press |

|||||||

|

|

|

firmly; you are making multiple copies. See Privacy Notice and Indemnity Coverage on Sender’s Copy. |

|||||||

FROM: Sender’s Last Name |

|

First |

|

|

MI |

Insured Amount (US $) |

SDR Value |

. |

||

Business |

|

|

|

|

|

|

$ |

0 |

0 |

|

|

|

|

|

|

|

|

. / |

/ |

||

|

|

|

|

|

|

|

Insurance Fees (US $) Total Postage/Fees (US $) |

|||

Address (Number, street, suite, apt., P.O. Box, etc. Residents of Puerto Rico include Urbanization Code preceeded with URB.) |

$ |

. |

$ |

. |

||||||

|

|

|

|

|

|

|

13. Sender’s Customs Reference (If any) |

|

||

City |

|

|

State ZIP+4® |

|

|

|

|

|

|

|

Telephone/Fax or Email |

|

|

|

|

|

14. Importer’s Reference - Optional (If any) |

|

|||

|

|

|

|

|

|

|

|

|

||

TO: Addressee’s Last Name |

|

First |

|

|

MI |

15. Importer’s Contact (select one) Telephone |

Fax Email |

|||

Business |

|

|

|

|

|

|

16. icense No. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address (Number, street, suite, apt., P.O. Box, etc.) |

|

|

|

|

17. Certificate No. |

|

|

|

||

PostcodeS ACity |

|

|

|

|

E |

|

||||

M P L18. Invoice No. |

|

|||||||||

State/Province |

Country |

|

|

|

|

|

|

|

|

|

1. Detailed Description of Contents (enter one item per line) |

2. Qty. |

3. Lbs. Oz. |

4. Value (U.S. $) |

|

For Commercial Senders Only |

|

||||

|

19. HS Tariff Number |

|

20. Country of Origin |

|||||||

|

|

|

|

|

. |

|

|

|

of Goods |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

5. Check All That Apply: |

|

6. Other Restrictions: |

|

. |

|

9. If |

|

Mailing Office Date Stamp |

||

Dangerous |

7. Total Gross |

8. Total Value US $ |

|

|||||||

Gift |

Returned Goods |

(pertains to No. 11) |

Wt: (all items |

(all items) |

|

Treat as Abandoned |

|

|

||

Documents |

Commercial Sample |

Goods |

|

Lbs. & Ozs.) |

|

|

Return to Sender |

|

|

|

Merchandise |

Humanitarian Donation |

Other |

|

. |

. |

|

Redirect to Address Below |

|

|

|

10. AES/ITN/Exemption |

|

11. Restrictions: |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||

|

|

|

Quarantine |

Sanitary or Phytosanitary Inspection |

|

|

|

|

||

12.I certify the particulars given in this customs declaration are correct. This item does not contain any undeclared dangerous

articles, or articles prohibited by legislation or by postal or customs regulations. I have met all applicable export filing requirements

under federal law and regulations. Sender’s Signature and DateMonth Day Year

PS Form |

Do not duplicate this form without USPS® approval. |

1 – Customs Declaration |

|

|

|

|

|

|

|

United States Postal Service® |

|||

|

|

|

|

|

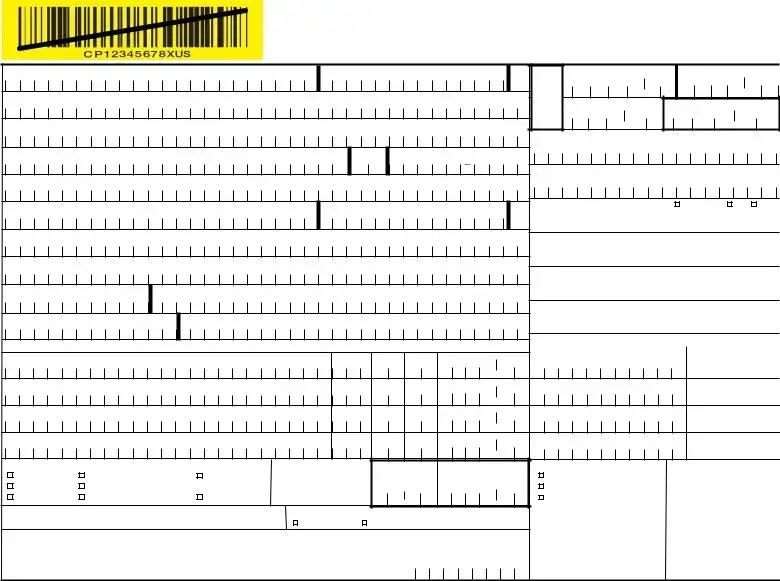

Customs Declaration and Dispatch Note |

— CP 72 |

||||

|

|

|

IMPORTANT: This item may be opened officially. Please print in English, using blue or black ink, and press |

|||||||

|

|

|

firmly; you are making multiple copies. See Privacy Notice and Indemnity Coverage on Sender’s Copy. |

|||||||

FROM: Sender’s Last Name |

|

First |

|

|

MI |

Insured Amount (US $) |

SDR Value |

. |

||

Business |

|

|

|

|

|

|

$ |

0 |

0 |

|

|

|

|

|

|

|

|

. / |

/ |

||

|

|

|

|

|

|

|

Insurance Fees (US $) Total Postage/Fees (US $) |

|||

Address (Number, street, suite, apt., P.O. Box, etc. Residents of Puerto Rico include Urbanization Code preceeded with URB.) |

$ |

. |

$ |

. |

||||||

|

|

|

|

|

|

|

13. Sender’s Customs Reference (If any) |

|

||

City |

|

|

State ZIP+4® |

|

|

|

|

|

|

|

Telephone/Fax or Email |

|

|

|

|

|

14. Importer’s Reference - Optional (If any) |

|

|||

|

|

|

|

|

|

|

|

|

||

TO: Addressee’s Last Name |

|

First |

|

|

MI |

15. Importer’s Contact (select one) Telephone |

Fax Email |

|||

Business |

|

|

|

|

|

|

16. icense No. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address (Number, street, suite, apt., P.O. Box, etc.) |

|

|

|

|

17. Certificate No. |

|

|

|

||

PostcodeS ACity |

|

|

|

|

E |

|

||||

M P L18. Invoice No. |

|

|||||||||

State/Province |

Country |

|

|

|

|

|

|

|

|

|

1. Detailed Description of Contents (enter one item per line) |

2. Qty. |

3. Lbs. Oz. |

4. Value (U.S. $) |

|

For Commercial Senders Only |

|

||||

|

19. HS Tariff Number |

|

20. Country of Origin |

|||||||

|

|

|

|

|

. |

|

|

|

of Goods |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

5. Check All That Apply: |

|

6. Other Restrictions: |

|

. |

|

9. If |

|

Mailing Office Date Stamp |

||

Dangerous |

7. Total Gross |

8. Total Value US $ |

|

|||||||

Gift |

Returned Goods |

(pertains to No. 11) |

Wt: (all items |

(all items) |

|

Treat as Abandoned |

|

|

||

Documents |

Commercial Sample |

Goods |

|

Lbs. & Ozs.) |

|

|

Return to Sender |

|

|

|

Merchandise |

Humanitarian Donation |

Other |

|

. |

. |

|

Redirect to Address Below |

|

|

|

10. AES/ITN/Exemption |

|

11. Restrictions: |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||

|

|

|

Quarantine |

Sanitary or Phytosanitary Inspection |

|

|

|

|

||

12.I certify the particulars given in this customs declaration are correct. This item does not contain any undeclared dangerous

articles, or articles prohibited by legislation or by postal or customs regulations. I have met all applicable export filing requirements

under federal law and regulations. Sender’s Signature and DateMonth Day Year

PS Form |

Do not duplicate this form without USPS® approval. |

2 – Customs Declaration |

|

|

|

|

|

United States Postal Service® |

||||

|

|

|

Customs Declaration and Dispatch Note |

— CP 72 |

|||||

|

|

IMPORTANT: This item may be opened officially. Please print in English, using blue or black ink, and press |

|||||||

|

|

firmly; you are making multiple copies. See Privacy Notice and Indemnity Coverage on Sender’s Copy. |

|||||||

FROM: Sender’s Last Name |

|

First |

|

MI |

Insured Amount (US $) |

|

SDR Value |

. |

|

Business |

|

|

|

|

$ |

0 |

0 |

|

|

|

|

|

|

|

. / |

/ |

|

||

|

|

|

|

|

Insurance Fees (US $) Total Postage/Fees (US $) |

||||

Address (Number, street, suite, apt., P.O. Box, etc. Residents of Puerto Rico include Urbanization Code preceeded with URB.) |

$ |

. |

$ |

|

. |

||||

|

|

|

|

|

13. Sender’s Customs Reference (If any) |

|

|||

City |

|

State |

ZIP+4® |

|

|

|

|

|

|

Telephone/Fax or Email |

|

|

|

|

14. Importer’s Reference - Optional (If any) |

|

|||

|

|

|

|

|

|

|

|

|

|

TO: Addressee’s Last Name |

|

First |

|

MI |

15. Importer’s Contact (select one) |

Telephone |

Fax Email |

||

Business |

|

|

|

|

Declaration by ADDRESS : I have received the parcel |

||||

|

|

|

|

|

described on this note. ADDR SS |

’S Signature and Date |

|||

Address (Number, street, suite, apt., P.O. Box, etc.) |

|

|

|

|

|

|

Month Day Year |

||

M P L18. Invoice No. |

E |

|

|||||||

PostcodeS ACity |

|

||||||||

State/Province |

Country |

|

|

|

|

|

|

|

|

Office of Exchange |

|

|

Customs Stamp |

|

Please affix labels here when required. |

|

|||

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

Customs Duty |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. Check All That Apply: |

Dangerous |

6. Other Restrictions: |

7. Total Gross |

8. Total Value US $ |

9. If |

Mailing Office Date Stamp |

|||||||||

Gift |

Returned Goods |

(pertains to No. 11) |

Wt: (all items |

(all items) |

Treat as Abandoned |

|

|||||||||

Documents |

Commercial Sample |

Goods |

|

. |

|

. |

|

Return to Sender |

|

||||||

|

Lbs. & Ozs.) |

|

|

|

|

|

|

|

|||||||

Merchandise |

Humanitarian Donation |

Other |

|

|

|

|

|

|

|

|

|

|

|

Redirect to Address Below |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. AES/ITN/Exemption |

|

11. Restrictions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarantine |

Sanitary or Phytosanitary Inspection |

|

|

|||||||||

12.I certify the particulars given in this customs declaration are correct. This item does not contain any undeclared dangerous

articles, or articles prohibited by legislation or by postal or customs regulations. I have met all applicable export filing requirements

under federal law and regulations. Sender’s Signature and DateMonth Day Year

PS Form |

Do not duplicate this form without USPS® approval. |

3 – Dispatch Note |

|

|

|

|

|

|

|

United States Postal Service® |

|||

|

|

|

|

|

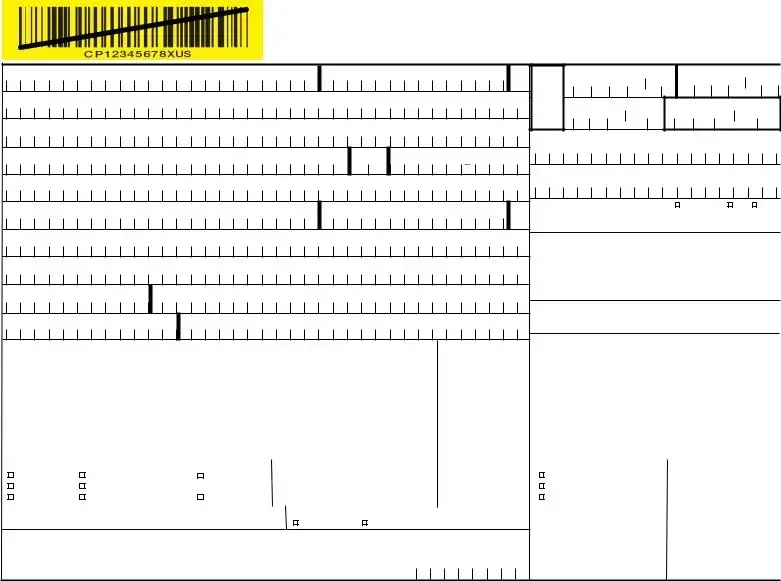

Customs Declaration and Dispatch Note |

— CP 72 |

||||

|

|

|

IMPORTANT: This item may be opened officially. Please print in English, using blue or black ink, and press |

|||||||

|

|

|

firmly; you are making multiple copies. See Privacy Notice and Indemnity Coverage on Sender’s Copy. |

|||||||

FROM: Sender’s Last Name |

|

First |

|

|

MI |

Insured Amount (US $) |

SDR Value |

. |

||

Business |

|

|

|

|

|

|

$ |

0 |

0 |

|

|

|

|

|

|

|

|

. / |

/ |

||

|

|

|

|

|

|

|

Insurance Fees (US $) Total Postage/Fees (US $) |

|||

Address (Number, street, suite, apt., P.O. Box, etc. Residents of Puerto Rico include Urbanization Code preceeded with URB.) |

$ |

. |

$ |

. |

||||||

|

|

|

|

|

|

|

13. Sender’s Customs Reference (If any) |

|

||

City |

|

|

State ZIP+4® |

|

|

|

|

|

|

|

Telephone/Fax or Email |

|

|

|

|

|

14. Importer’s Reference - Optional (If any) |

|

|||

|

|

|

|

|

|

|

|

|

||

TO: Addressee’s Last Name |

|

First |

|

|

MI |

15. Importer’s Contact (select one) Telephone |

Fax Email |

|||

Business |

|

|

|

|

|

|

16. icense No. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address (Number, street, suite, apt., P.O. Box, etc.) |

|

|

|

|

17. Certificate No. |

|

|

|

||

PostcodeS ACity |

|

|

|

|

E |

|

||||

M P L18. Invoice No. |

|

|||||||||

State/Province |

Country |

|

|

|

|

|

|

|

|

|

1. Detailed Description of Contents (enter one item per line) |

2. Qty. |

3. Lbs. Oz. |

4. Value (U.S. $) |

|

For Commercial Senders Only |

|

||||

|

19. HS Tariff Number |

|

20. Country of Origin |

|||||||

|

|

|

|

|

. |

|

|

|

of Goods |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

5. Check All That Apply: |

|

6. Other Restrictions: |

|

. |

|

9. If |

|

Mailing Office Date Stamp |

||

Dangerous |

7. Total Gross |

8. Total Value US $ |

|

|||||||

Gift |

Returned Goods |

(pertains to No. 11) |

Wt: (all items |

(all items) |

|

Treat as Abandoned |

|

|

||

Documents |

Commercial Sample |

Goods |

|

Lbs. & Ozs.) |

|

|

Return to Sender |

|

|

|

Merchandise |

Humanitarian Donation |

Other |

|

. |

. |

|

Redirect to Address Below |

|

|

|

10. AES/ITN/Exemption |

|

11. Restrictions: |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||

|

|

|

Quarantine |

Sanitary or Phytosanitary Inspection |

|

|

|

|

||

12.I certify the particulars given in this customs declaration are correct. This item does not contain any undeclared dangerous

articles, or articles prohibited by legislation or by postal or customs regulations. I have met all applicable export filing requirements

under federal law and regulations. Sender’s Signature and DateMonth Day Year

PS Form |

Do not duplicate this form without USPS® approval. |

4 – Post Office Copy |

|

|

|

|

|

|

|

United States Postal Service® |

|||

|

|

|

|

|

Customs Declaration and Dispatch Note |

— CP 72 |

||||

|

|

|

IMPORTANT: This item may be opened officially. Please print in English, using blue or black ink, and press |

|||||||

|

|

|

firmly; you are making multiple copies. See Privacy Notice and Indemnity Coverage on Sender’s Copy. |

|||||||

FROM: Sender’s Last Name |

|

First |

|

|

MI |

Insured Amount (US $) |

SDR Value |

. |

||

Business |

|

|

|

|

|

|

$ |

0 |

0 |

|

|

|

|

|

|

|

|

. / |

/ |

||

|

|

|

|

|

|

|

Insurance Fees (US $) Total Postage/Fees (US $) |

|||

Address (Number, street, suite, apt., P.O. Box, etc. Residents of Puerto Rico include Urbanization Code preceeded with URB.) |

$ |

. |

$ |

. |

||||||

|

|

|

|

|

|

|

13. Sender’s Customs Reference (If any) |

|

||

City |

|

|

State ZIP+4® |

|

|

|

|

|

|

|

Telephone/Fax or Email |

|

|

|

|

|

14. Importer’s Reference - Optional (If any) |

|

|||

|

|

|

|

|

|

|

|

|

||

TO: Addressee’s Last Name |

|

First |

|

|

MI |

15. Importer’s Contact (select one) Telephone |

Fax Email |

|||

Business |

|

|

|

|

|

|

16. icense No. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address (Number, street, suite, apt., P.O. Box, etc.) |

|

|

|

|

17. Certificate No. |

|

|

|

||

PostcodeS ACity |

|

|

|

|

E |

|

||||

M P L18. Invoice No. |

|

|||||||||

State/Province |

Country |

|

|

|

|

|

|

|

|

|

1. Detailed Description of Contents (enter one item per line) |

2. Qty. |

3. Lbs. Oz. |

4. Value (U.S. $) |

|

For Commercial Senders Only |

|

||||

|

19. HS Tariff Number |

|

20. Country of Origin |

|||||||

|

|

|

|

|

. |

|

|

|

of Goods |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

5. Check All That Apply: |

|

6. Other Restrictions: |

|

. |

|

9. If |

|

Mailing Office Date Stamp |

||

Dangerous |

7. Total Gross |

8. Total Value US $ |

|

|||||||

Gift |

Returned Goods |

(pertains to No. 11) |

Wt: (all items |

(all items) |

|

Treat as Abandoned |

|

|

||

Documents |

Commercial Sample |

Goods |

|

Lbs. & Ozs.) |

|

|

Return to Sender |

|

|

|

Merchandise |

Humanitarian Donation |

Other |

|

. |

. |

|

Redirect to Address Below |

|

|

|

10. AES/ITN/Exemption |

|

11. Restrictions: |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||

|

|

|

Quarantine |

Sanitary or Phytosanitary Inspection |

|

|

|

|

||

12.I certify the particulars given in this customs declaration are correct. This item does not contain any undeclared dangerous

articles, or articles prohibited by legislation or by postal or customs regulations. I have met all applicable export filing requirements

under federal law and regulations. Sender’s Signature and DateMonth Day Year

PS Form |

Do not duplicate this form without USPS® approval. |

5 – Sender’s Copy |

IMPORTANT: Save this receipt and present it when making an inquiry.

PARCEL INDEMNITY COVERAGE: Indemnity for Priority Mail International® parcels, including insured and ordinary (uninsured) parcels, is provided only in accordance with Postal Service™ regulations in the Domestic Mail Manual (DMM®) and the International Mail Manual (IMM®). The DMM and IMM are available online at http://pe.usps.com. The addressee must report damage or missing contents to the delivering Post Office™ immediately.

Ordinary (uninsured) Priority Mail International parcels include indemnity coverage against loss, damage, or missing contents. Indemnity is limited to the lesser of the actual value of the contents or the maximum indemnity based on the weight of the article. Priority Mail International Flat Rate Envelopes and Priority Mail International Small Flat Rate Boxes are

Insured mail service is available for a fee and replaces indemnity on ordinary parcels. Insurance coverage varies by country and is not availableSto some countries. AIndemnity coverage isMsubject to both U.S. PostalPService® regulationsLand the domestic Eregulations of the destination country. Insurance for loss, damage, or missing contents covers the actual (depreciated) value of the contents.

Claims for lost ordinary and insured parcels may be payable only to the sender, and claims for damage and missing contents may be payable only to the addressee. The sender or addressee may waive the right of payment in favor of the other.

FILING CLAIM : To initiate an inquiry for loss, damage, or missing contents, call the International Inquiry Center at

Evidence of mailing (e.g., original mailing receipts or wrapper), evidence of insurance, and evidence of value (e.g., sales receipt or repair estimate) must be submitted in support of all claims. For complete regulations, see the IMM at http://pe.usps.com.

EXCEPTIONS: No coverage is provided for consequential losses, delay, concealed damage, spoilage of perishable items, articles improperly packaged, articles too fragile to withstand normal handling in the mails, or prohibited articles. See the DMM and the IMM for the specific types of losses that are covered, the limitations on coverage, the terms of insurance or indemnity, and the conditions of payment.

IMPORTANT: Indemnity coverage is not paid for Priority Mail Express International™ or ordinary (uninsured) Priority Mail International parcels

containing the following: coins; banknotes; currency notes, including paper money; securities of any kind payable to the bearer; traveler’s checks; platinum, gold, and silver; precious stones; jewelry; watches; and other valuable or prohibited articles. See the IMM for complete regulations.

PRIVACY ACT STATEMENT: Your information will be used to satisfy reporting requirements for customs purposes. Collection is authorized by

39 U.S.C. 401, 403, 404, and 407; 13 U.S.C.

PS Form |

Reverse of Page 5 of 5, Sender’s Copy |

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The USPS 2976-A form is used for customs declarations on international shipments from the U.S. |

| Information Requirement | It requires detailed descriptions of each item being mailed, along with quantities, weights, and values. |

| Sender and Addressee Details | Both the sender's and recipient's full names and addresses must be provided to avoid delays. |

| Completeness | Incomplete forms can lead to customs delays or seizure of the items being shipped. |

| Export Compliance | Shippers must comply with U.S. export laws and check for any import restrictions in the destination country. |

| AES Requirements | For items valued over $2,500, an Automated Export System (AES) Internal Transaction Number (ITN) is required. |

| Signatory Responsibility | By signing the form, the sender certifies the accuracy of the information and compliance with all regulations. |

| Important Restrictions | Certain items may be subject to quarantine restrictions or prohibitions based on destination country regulations. |

Guidelines on Utilizing Usps 2976 A

Once you have gathered your information, it’s important to fill out the USPS 2976 A form accurately to ensure efficient processing of your shipment. Each section must be completed thoughtfully, as missing or incorrect information can lead to delays or complications. Take your time to follow the steps outlined below, which will guide you through the completion of the form.

- Start with the Sender Information: In the *FROM* section, fill in your full name, address, and contact details. Ensure this is complete to facilitate customs processing.

- Input the Addressee Information: In the *TO* section, provide the recipient’s full name and accurate address. Double-check for any missing components.

- Describe Each Article: Block 1 requires a detailed description of each item being sent. Avoid general terms; specificity is critical.

- Record Quantity and Weight: Fill out Blocks 2 to 4 to indicate the quantity, net weight (both pounds and ounces), and monetary value in U.S. dollars for each article.

- Select Item Category: In Block 5, check the appropriate box that best describes the contents, including if “Dangerous Goods” are included.

- Note Special Conditions: In Block 6, indicate if the items have any special mailing conditions or restrictions.

- Enter Total Weight: Specify the total weight of the package in Block 7, ensuring this includes packaging.

- Enter Total Value: In Block 8, document the total value of the items being sent in U.S. dollars.

- Indicate Nondelivery Instructions: For Block 9, check the box that corresponds to your preference if the item cannot be delivered.

- Provide Export Information: In Block 10, enter an AES ITN if applicable, which is required for certain shipments, including those over $2,500.

- Confirm Quarantine Restrictions: If applicable to your items, check the box in Block 11 to indicate quarantine restrictions.

- Sign and Date: In Block 12, you must sign and date the form. This certifies that the information provided is accurate and compliant with regulations.

- Additional References: Fill in Blocks 13 to 20 for any additional customs or importer references, including license numbers and country of origin if applicable.

- Prepare for Submission: Place the completed forms into the PS Form 2976-E envelope. Make sure the entire barcode is visible and affix this envelope securely to the package.

Follow these steps carefully to ensure your package is processed smoothly. Each detail matters, and diligence in completing the USPS 2976 A form can prevent unnecessary delays or complications during shipping.

What You Should Know About This Form

What is the USPS 2976-A form used for?

The USPS 2976-A form is a customs declaration required for international shipments. It provides information about the contents of a package, including details such as the sender’s and recipient's information, a description of the items being shipped, their value, and weight. This form is crucial for ensuring that items clear customs smoothly and comply with international shipping regulations.

How do I complete the USPS 2976-A form?

To complete the form, print clearly in English using blue or black ink. Start by entering the details in the “From” and “To” sections, ensuring that names and addresses are complete. Describe each article in detail, avoiding vague terms. Include the quantity, net weight, and value for every item. Finally, add your signature to certify the accuracy of your provided information. Remember to check for any special conditions or restrictions that apply to your items.

What happens if I provide incomplete information on the form?

Providing incomplete information can lead to delays in customs processing or delivery. Customs officials rely on accurate data to assess packages, so any missing details could slow down the entire shipping process. It’s crucial to ensure that every section of the form is filled out thoroughly to avoid inconveniences for both the sender and recipient.

Can I ship restricted items using the USPS 2976-A form?

Some items are subject to restrictions when shipping internationally. When using the 2976-A form, it’s your responsibility to check if the items you wish to send are allowed in the destination country. Certain goods, like plant and animal products, pharmaceuticals, and other regulated materials, may require additional documentation or may even be prohibited entirely.

Who is responsible for ensuring compliance with import/export regulations?

The responsibility for ensuring that all items comply with import and export regulations lies with the sender. This includes understanding any restrictions, determining if additional documentation is necessary, and confirming that all items listed on the form are permissible for shipment. Failure to comply can result in fines or the seizure of the package.

What is the significance of the AES/ITN section on the form?

The AES/ITN section must be completed for certain shipments, especially those valued over $2,500 or requiring an export license. This information is essential for tracking purposes and to confirm that the package complies with U.S. export requirements. Be sure to check the specific guidelines related to the destination country, as exemptions may apply in some cases.

Should I include commercial documents with my package?

Yes, if there are any commercial documents that are relevant to your shipment, you must include them with the completed 2976-A form. Place these documents inside the PS Form 2976-E, Customs Declaration Envelope. This ensures that customs officials have all necessary information to properly process your parcel without delays.

Why is my signature important on the USPS 2976-A form?

Your signature certifies that all information provided is accurate and that you have complied with all applicable regulations. By signing, you confirm that the package does not contain any undeclared dangerous or prohibited goods. This step is essential as it holds you liable for the item being mailed and its adherence to postal and customs regulations.

Common mistakes

Completing the USPS 2976-A form properly is essential for a smooth mailing experience. One common mistake individuals make is failing to provide complete sender and addressee information. Incomplete names, initials, or addresses can lead to delays in delivery or issues with customs. It’s crucial to fill in the full name and complete address for both the sender and recipient. This simple step can save time and ensure that items reach their intended destination without unnecessary complications.

Another frequent error is using vague descriptions of the contents being mailed. In Block 1, it is essential to provide a detailed description of each item. Phrases like “samples” or “food products” are not acceptable. Instead, specify the exact items being sent, such as “men’s cotton shirts.” If there is not enough room on the form, additional forms can be used. Writing accurately and thoroughly in this section can prevent misunderstandings with customs officials.

Individuals often overlook the importance of including the correct codes in Block 10. This section requires the Automated Export System (AES) Internal Transaction Number (ITN), or an appropriate exemption code. Failing to include a valid code may result in your package being returned or delayed. Understanding when an ITN is needed and ensuring its inclusion is key to preventing customs issues.

Furthermore, many do not check necessary restrictions related to the items being mailed. Block 11 asks if the contents are subject to quarantine restrictions, such as plants, animals, or food products. Omitting this information might lead to significant repercussions, including fines or confiscation of the package. Being aware of restrictions based on the type of items can foster compliance with regulations and protect against unwanted fallout.

Lastly, the significance of signing and dating the form cannot be overstated. Individuals sometimes forget to do this, which is a requirement. Your signature verifies that all information provided is accurate and that you understand the responsibilities involved in mailing goods internationally. Neglecting this final step not only affects the validity of the form but may also result in additional penalties. Ensuring that the form is complete and properly signed will lead to a more efficient postal process.

Documents used along the form

The USPS 2976-A form serves as a customs declaration for packages being sent internationally. When mailing items, several additional forms and documents may be required to ensure compliance with import and export regulations. Understanding these documents can streamline the shipping process and help avoid delays.

- Commercial Invoice: This document provides detailed information about the shipment, including descriptions, quantities, and values of the items being sent. It supports customs clearance, particularly for commercial shipments, by serving as proof of sale and indicating whether any taxes or duties are owed.

- Certificate of Origin: This document attests to the country in which the goods were produced. It may be required by customs authorities to apply preferential duty rates and verify the goods' origins, thereby avoiding trade disputes.

- Health Certificate: Commonly needed for perishable goods and live animals, this certificate ensures that the products meet the health standards of the destination country. It mainly applies to food products, ensuring they are safe for consumption.

- AES Filing: The Automated Export System (AES) filing may be required for shipments valued over $2,500 or those requiring an export license. This electronic system reports export information to help U.S. government agencies enforce export regulations.

- Declaration of Dangerous Goods: If the shipment contains items classified as dangerous, this declaration is essential. It identifies the nature of the hazardous materials and outlines safety protocols for handling and shipping them.

Being aware of these relevant forms and documents enhances preparedness when shipping internationally with USPS. These steps contribute to ensuring that packages arrive safely and in compliance with regulations, reducing the likelihood of delays or penalties.

Similar forms

-

PS Form 2976 (Customs Declaration): This is similar to the USPS 2976-A form, as both are used for international shipments. The 2976 form is a general customs declaration that does not require as much detailed information about the items being sent and can be used for less formal mailings. In contrast, the 2976-A provides a more thorough breakdown of each item, including specifics like weight and value.

-

PS Form 2976-E (Customs Declaration Envelope): This form serves as a protective envelope for the customs declaration forms accompanying an international shipment. Like the 2976-A, it ensures that important shipping information is visible and contained properly. However, it primarily focuses on safeguarding the declarations rather than providing item details.

-

Commercial Invoice: This document is essential for commercial shipments and provides a detailed account of goods being shipped and their value, much like the 2976-A. Both require specific information about the contents, but the commercial invoice is more suited for transactions with monetary exchanges, while the 2976-A is for general customs purposes.

-

Certificate of Origin: Similar to the USPS 2976-A in that it verifies the origin of goods, a Certificate of Origin is often required for trade and customs purposes. While the 2976-A outlines shipping specifics, the Certificate of Origin primarily confirms where goods were manufactured or processed.

-

Health Certificate: This document is frequently necessary when shipping food products or certain agricultural items across borders. Similar to the 2976-A, it verifies compliance with health regulations, although the health certificate typically includes information regarding inspections and safety standards, rather than shipping details alone.

-

Import License: Required for certain types of goods when entering a country, an import license serves a similar purpose to some aspects of the 2976-A. It ensures that the contents comply with regulations of the destination country. However, while the 2976-A focuses on providing detailed item information, the import license is a regulatory requirement that permits the transfer of specific goods.

Dos and Don'ts

When filling out the USPS 2976-A form, there are several important dos and don'ts to keep in mind. This will ensure that your package is processed smoothly and to avoid any unnecessary complications.

- DO print the form in English using blue or black ink.

- DO complete all sections clearly and legibly.

- DO provide a detailed description for each item being sent.

- DO check the appropriate boxes for item categories and restrictions.

- DO include the total weight of the package, including packaging materials.

- DON'T use incomplete names or addresses; this may cause delays.

- DON'T use vague descriptions like "samples" or "toiletries".

- DON'T forget to sign and date the form to certify its accuracy.

- DON'T affix the form in a way that obscures the barcode or tracking numbers.

Misconceptions

Clarifying the misconceptions surrounding the USPS 2976-A form is essential for individuals engaged in international shipping. Many people may misunderstand the requirements and implications of this form. Below are common misconceptions and explanations to help clear up the confusion.

- The USPS 2976-A form is optional for international shipping. This form is required for all international shipments, as it serves as a customs declaration.

- Only items with high value require a USPS 2976-A form. Any item shipped internationally, regardless of its value, requires this form.

- General descriptions of items are sufficient when completing the form. Detailed descriptions are mandatory. Using vague terms like "samples" or "clothes" can lead to shipping delays.

- Customs will not review my form unless there is a problem. Customs examines all forms to ensure compliance with regulations. Inaccuracies can lead to fines or seizures.

- If I make a mistake on the form, I can correct it later. Any errors should be corrected before mailing. Incorrect information can result in significant delays.

- The sender's telephone number is not necessary. Providing a phone number helps facilitate customs clearance and delivery, so it should be included.

- It is okay to fold or wrap the completed form around my package. The entire form must remain visible and should not be folded; it needs to be inserted into the labeled customs envelope.

- Only dangerous goods require special markings on the form. All items being shipped internationally may require specific markings based on their nature, including restrictions on certain goods.

- I can use the same form for multiple items without additional documentation. If listing multiple items, use additional forms and indicate that on the first form to ensure proper processing.

- Signatures on the form are not important. The sender's signature certifies that all information is correct and verifies compliance with all regulations, making it a critical component of the form.

Understanding these misconceptions about the USPS 2976-A form helps to ensure smoother transactions in international shipping. By adhering to the requirements and providing thorough and accurate information, senders can reduce delays and potential fines.

Key takeaways

- Use blue or black ink when completing the USPS Form 2976-A. Make sure to print clearly, as all copies must be legible.

- Provide detailed descriptions of each item being shipped. Avoid vague terms like “samples” or “food products.”

- Enter both the sender’s and recipient’s full names and addresses accurately to prevent delays with customs or delivery.

- If your shipment includes items over $2,500 in value, obtain an Internal Transaction Number (ITN) from the U.S. Census Bureau.

- Indicate any special conditions or restrictions that apply to the items being mailed in the appropriate blocks.

- Your signature on the form certifies that all entries are accurate and that the package complies with regulations regarding dangerous or restricted items.

Browse Other Templates

Axis Support Email - If goods or services received were not as advertised, this form is your remedy.

Dhs Forms Oregon - Failure to comply with registration requirements can affect property management rights.