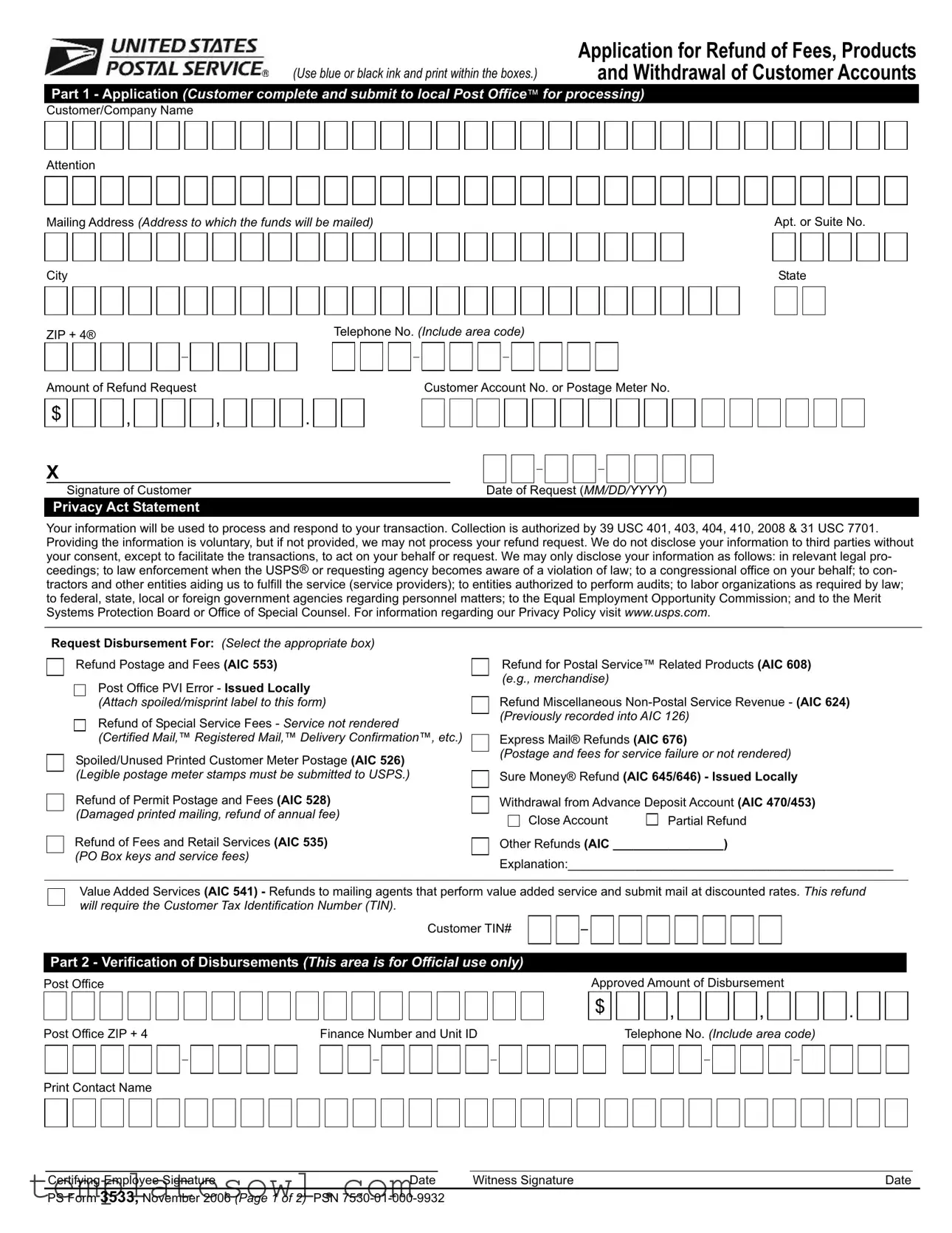

Fill Out Your Usps 3533 Form

The USPS Form 3533, also known as the Application for Refund of Fees and Products, serves as an essential tool for customers seeking reimbursement for a variety of postal services and fees. Whether the need arises from an overcharge, an unused postage meter stamp, or a service failure, this form provides the structured way to initiate a refund request. The application process requires customers to complete several sections, including providing their personal or company details and specifying the nature of the refund they are seeking. The various reasons for requesting a refund range from postage and fees to special service fees and even withdrawals from advance deposit accounts. Once completed, the form is submitted to the local Post Office for processing. Additionally, users must be aware of the Privacy Act Statement, which assures that their personal information will be used solely for processing transactions while safeguarding their privacy. Completing the USPS Form 3533 accurately ensures that all necessary information is captured, allowing for an efficient and timely processing of refund requests, ultimately enhancing customer satisfaction and trust in postal services.

Usps 3533 Example

|

ApplicationforRefundofFees,Products |

(Useblueorblackinkandprintwithintheboxes.) |

andWithdrawalofCustomerAccounts |

Part 1

Customer/Company Name

Attention |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

MailingAddress (Address to which the funds will be mailed) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Apt. or Suite No. |

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ZIP+ 4® |

|

|

|

|

|

|

|

|

|

|

|

|

|

Telephone No. (Include area code) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amount of Refund Request |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CustomerAccount No. or Postage Meter No. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

$

,

,

.

X

Signature of Customer |

Date of Request (MM/DD/YYYY) |

PrivacyAct Statement

Your information will be used to process and respond to your transaction. Collection is authorized by 39 USC 401, 403, 404, 410, 2008 & 31 USC 7701. Providing the information is voluntary, but if not provided, we may not process your refund request. We do not disclose your information to third parties without your consent, except to facilitate the transactions, to act on your behalf or request. We may only disclose your information as follows: in relevant legal pro- ceedings; to law enforcement when the USPS® or requesting agency becomes aware of a violation of law; to a congressional office on your behalf; to con- tractors and other entities aiding us to fulfill the service (service providers); to entities authorized to perform audits; to labor organizations as required by law; to federal, state, local or foreign government agencies regarding personnel matters; to the Equal Employment Opportunity Commission; and to the Merit Systems Protection Board or Office of Special Counsel. For information regarding our Privacy Policy visit www.usps.com.

Request Disbursement For: (Select the appropriate box)

Refund Postage and Fees (AIC 553)

Post Office PVI Error - Issued Locally

Post Office PVI Error - Issued Locally

(Attach spoiled/misprint label to this form)

Refund of Special Service Fees - Service not rendered

Refund of Special Service Fees - Service not rendered

(Certified Mail,™ Registered Mail,™ Delivery Confirmation™, etc.)

Spoiled/Unused Printed Customer Meter Postage (AIC 526) (Legible postage meter stamps must be submitted to USPS.)

Refund of Permit Postage and Fees (AIC 528) (Damaged printed mailing, refund of annual fee)

Refund of Fees and Retail Services (AIC 535) (PO Box keys and service fees)

Refund for Postal Service™ Related Products (AIC 608) (e.g., merchandise)

Refund Miscellaneous

Express Mail® Refunds (AIC 676)

(Postage and fees for service failure or not rendered)

Sure Money® Refund (AIC 645/646) - Issued Locally

Withdrawal fromAdvance DepositAccount (AIC 470/453)

CloseAccount |

Partial Refund |

Other Refunds (AIC ________________)

Explanation:_______________________________________________

ValueAdded Services (AIC 541) - Refunds to mailing agents that perform value added service and submit mail at discounted rates. Thisrefund will require the Customer Tax Identification Number (TIN).

Customer TIN#

Part 2 - Verification of Disbursements (This area is for Official use only)

Post Office |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ApprovedAmount of Disbursement |

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

, |

|

|

|

|

|

, |

|

|

|

|

|

|

|

||||||||||||||||

Post Office ZIP+ 4 |

Finance Number and Unit ID |

Telephone No. (Include area code) |

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.

Print Contact Name

Certifying Employee Signature |

Date |

Witness Signature |

Date |

PS Form 3533,November 2006 (Page 1 of 2) PSN

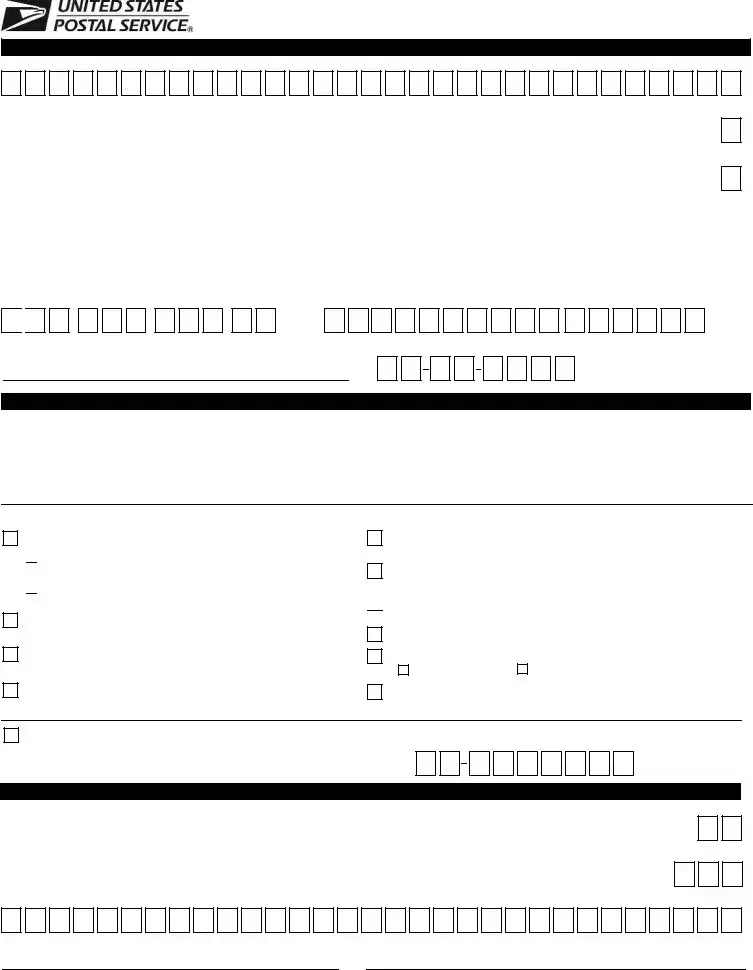

Part 3 - Postage or Meter Stamps (excluding PCPostage®) |

(For Official Use Only) |

|

|

The customer's meter must be licensed at the refunding office, and complete, legible, and valid unused meter stamps must be submitted by the licensee within 60 days from the dates shown on the indicia. Those produced by PC Postage systems are not refundable at the window. Charges are assessed at 10% off the face value of the indicia, if the total is $350 or less. If the total face value is more than $350, a charge of $35 per hour is assessed for the actual hours to process the refund; the minimum charge is $35.

Meter Manufacturer |

|

Meter Serial No. |

|

|

Meter License |

|

(Group and list by postage units or value) |

|

(Group and list by postage units or value) |

|

|||

Number of Pieces |

Amount Each |

Postage Value |

Number of Pieces |

|

Amount Each |

Postage Value |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Postage Value |

|

|

|

Total Postage Value |

|

|

|

|

|

|

|

|

|

|

|

Grand Total of Postage Value |

$ |

|

|

|

|

|

|

|

|

|

|

Less Charges |

_ |

|

(10% of face value or $35 per hour if over $350. Minimum charge is $35.) |

|

|||

Post Offices must destroy customer meter stamps to prevent reuse. The manager and |

|

Total To Be Refunded |

$ |

||

|

|||||

a witness must sign to certify that the meter impressions listed above were destroyed. |

|

||||

|

|

|

|

|

|

Supervisor/Manager Signature |

|

Date |

|

Witness Signature |

Date |

|

|

|

|

|

|

Part 4 - Special Services and Other Refunds (Note: Fees for registered, insured, and COD services are not ordinarily refundable.)

Explain the reason for the requested refund:

Amount of Refund to Which Claimant is Entitled (In accordance with USPS policy)

$

Part 5 - Disbursements for Refunds (Issued Locally)

1)Postal Service official and witness must verify this claim and enter the approved amount in the “ApprovedAmount of Disbursement”.

2)Certifying Postal Service official and witness are required to print and sign as authorization for payment or withdrawal of trust account.

3)Ensure the proper accounting entries are performed on PSForm 1412.

4)For cash refund issued, obtain payee’s signature below. For money order refund issued enter the money order serial number below.

5)DO NOT SUBMIT PS Form 3533 to Scanning and Imaging Center if a refund is issued locally.

Payee Signature or Money Order Serial Number: |

Date |

|

|

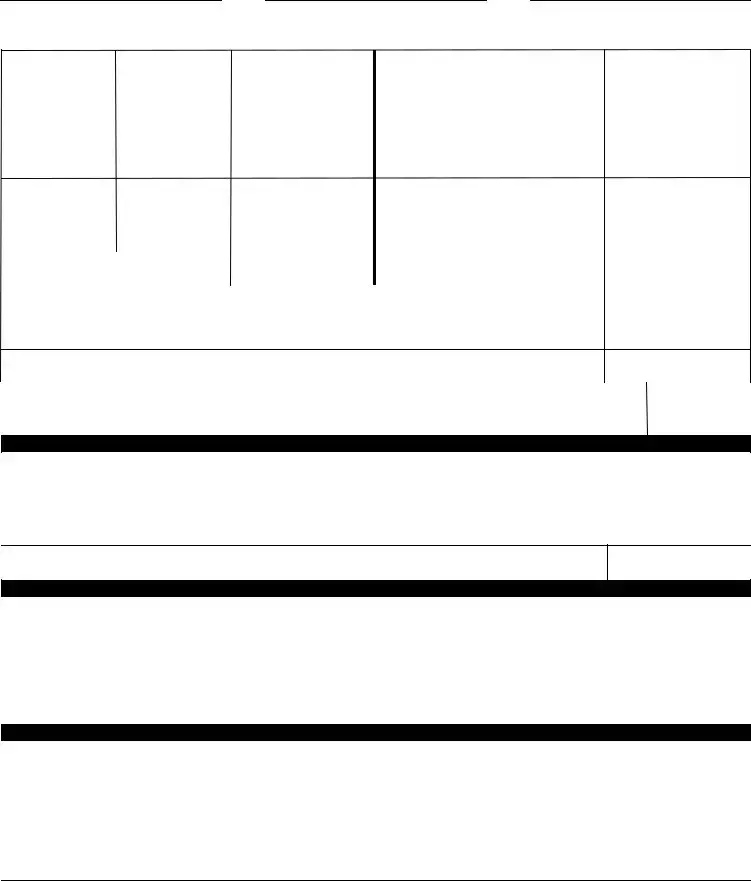

Part 6 - Disbursements Processed by theAccounting Service Center (ASC)

1)Postal Service official and witness must verify this claim and enter the approved amount in the “ApprovedAmount of Disbursement”.

2)Certifying Postal Service official and witness are required to print and sign as authorization for payment or withdrawal of trust account.

3)Ensure the proper accounting entries are performed:

a)If this is a refund, use the appropriateAIC for the refund. (See “Request Disbursement For” section.)

b)If this is a withdrawal from an advance deposit account, use the appropriateAIC 453 for BRM/Postage Due orAIC 470 for permit.

c)Ensure the offset toAIC 280, Disbursement Sent toASC, is performed either in Form 1412 or Postal One!® system.

d)Attach the supportingAIC 280 documentation (PS Form 3544 or

4)SUBMIT PS Form 3533 with attachedAIC 280 supporting documentation to the USPS Scanning and Imaging Center.

5)Customer will receive the payment from USPS. NOTE: Maintain a copy of the PSForm 3533 locally for 90 days.

PS Form 3533,November 2006 (Page 2 of 2)

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | The USPS 3533 form serves as an official application for refunds of postage, fees, or withdrawal from customer accounts. It is vital for ensuring accurate financial transactions between customers and USPS. |

| Submission Process | Customers must complete the form and submit it to their local Post Office for processing. This step is crucial for initiating the refund request. |

| Privacy Compliance | The collection of personal information is supported by various laws, including 39 USC 401, 403, 404, 410, 2008, and 31 USC 7701. Customers are informed about their rights regarding the handling of their data. |

| Special Services Refunds | Certain refunds, like those for registered or insured services, typically are not refundable. Customers need to explain the reason for any requested refund, adhering to USPS policies. |

Guidelines on Utilizing Usps 3533

Completing the USPS Form 3533 is a crucial step to request a refund for various postal services. Ensuring that the form is filled out correctly and submitted promptly will facilitate the processing of your request. Follow these steps carefully to make sure you provide all necessary information in a clear way.

- Obtain the form: You can get the USPS Form 3533 from your local post office or download it from the USPS website.

- Use appropriate ink: Fill out the form using a blue or black pen. Ensure that your handwriting is clear and legible.

- Complete Part 1: This section requires you to provide your information. Fill in your name, mailing address (including apt or suite number), city, state, ZIP code, and telephone number.

- Indicate the refund amount: Specify the amount for which you are requesting a refund. Make sure this number is accurate.

- Account information: Include your customer account number or postage meter number.

- Signature and date: Sign the form and date your request in the appropriate fields.

- Select the type of refund: In the designated section, check the box that best represents the reason for your refund request.

- Provide an explanation: If needed, include a brief explanation of your refund request under the relevant section.

- Submit the form: Take your completed form to your local post office for processing. Ensure you keep a copy for your records.

Follow these steps carefully to complete the form. After submission, your request will be processed, and you will receive updates regarding your refund. It is essential to keep a copy of your form for your own records, as this may be required for future reference.

What You Should Know About This Form

What is the USPS Form 3533?

The USPS Form 3533, known as the Application for Refund of Fees, Products, and Withdrawal of Customer Accounts, is a form used to request refunds for various postal services. Individuals can use this form for multiple purposes, including refunds for postage and fees, special services, and other postal products. It is essential to complete the form accurately and submit it to the local post office for processing.

Who should complete the USPS Form 3533?

The form should be completed by the customer requesting a refund. This could be an individual or a company that has used USPS services and believes they are entitled to a refund due to various reasons, such as service failure or unused postage. It’s important that the customer provides all requested information to ensure timely processing of their request.

What information is required on the USPS Form 3533?

To complete Form 3533, you need to provide various details. These include your name or company name, mailing address (where the refund should be sent), telephone number, amount of refund requested, and your customer account number or postage meter number. You will also need to sign the form and date your request. Additional information may be required depending on the specific type of refund you are claiming.

How do I submit the USPS Form 3533?

Once you have completed the form, submit it to your local post office. It is important to do this in person, as they will review your application and process it as needed. Keep a copy of the completed form for your records. This can be helpful should any follow-up be necessary regarding your refund request.

What happens after I submit the USPS Form 3533?

After submission, the local post office will verify the claim and determine whether the refund is justified. If approved, they will process the refund according to USPS procedures. The customer will then receive the refund at the address provided. Tracking the status of a refund may be difficult, so it’s advisable to maintain communication with the post office if your refund does not arrive within a reasonable time.

Are there any fees associated with the refund process?

Yes, there can be fees associated with processing refunds under certain conditions. For instance, if the total face value of the postage is more than $350, a processing fee of $35 per hour will apply. However, a minimum charge of $35 is set. Also, refunds for some services, like registered or insured services, are not ordinarily refundable, so it's essential to understand the specific terms related to your refund request.

Where can I find more information about the USPS Form 3533?

For further details and to understand the refund policies fully, you can visit the USPS website. The site contains comprehensive information about various forms and services as well as the USPS privacy policy, which explains how personal information is handled during the refund process.

Common mistakes

Filling out the USPS Form 3533 can be straightforward, but many people make common mistakes that can delay their refund requests. One significant error occurs when individuals fail to use blue or black ink as specified in the instructions. This requirement ensures clarity and uniformity. Using other ink colors can lead to the form being deemed invalid or improperly processed, causing unnecessary delays in refunds.

Another frequent mistake is neglecting to provide complete information. Each section of the form must be filled out accurately. For instance, leaving out the customer account number or postal meter number can hinder the processing of the request. Incomplete forms are often returned for additional information, which can add to the waiting time for a refund.

People also sometimes forget to sign and date the form. The signature serves as an affirmation that the information provided is true and correct. Without this essential piece, the form cannot be processed. Additionally, customers should ensure the date is correctly formatted in MM/DD/YYYY, as any errors may further complicate the process.

Finally, it's crucial to select the appropriate box for the type of refund being requested. Options include refunds for postage fees, special services, and more. Failing to select the correct box can lead to delays or even the denial of the refund request. Careful attention to detail in this area is vital, as it directly affects the successful outcome of the application.

Documents used along the form

The USPS 3533 form is a crucial document used for requesting refunds for various postal services, fees, and products. Often, additional forms accompany it to facilitate processing and document various requests. Here are four other commonly used forms and documents associated with the USPS 3533 form:

- PS Form 1412: This form is used to document postal service accounting transactions. It tracks the financial activity related to refunds and ensures proper accounting entries are made, especially when refunds are processed by the Accounting Service Center.

- PS Form 3544: This is a supporting documentation form used to verify transactions related to refunds. It provides necessary details that accompany the main refund request, helping to clarify the basis for the claim.

- PS Form 3533-X: Used for tracking specific refunds and any supporting details required for accounting practices. This form acts as an amendment or additional documentation to the PS Form 3533, ensuring comprehensive verification.

- Money Order Tracking Form: When a refund is issued via money order, a specific tracking form may be used to follow the money order's status. This assists in confirming that the funds were received by the claimant.

These forms help streamline the refund process with USPS and ensure that claims are documented correctly. Each plays a distinct role in maintaining clear records and supporting the request made through the USPS 3533 form.

Similar forms

- IRS Form 1040: This form allows individuals to apply for tax refunds based on overpayment during the year. Like the USPS 3533 form, it requires personal information and details about the amount being refunded.

- Form I-191: This application is submitted for a refund of application fees in immigration matters. It is similar in that it also seeks a financial return for fees paid that were not fully utilized.

- Form SS-8: Used to request a formal determination of worker classification for employment tax purposes, it allows for the correction of overpayments. This document shares the similarity of initiating a refund process for incorrect charges.

- Form 843: This is a claim for refund or abatement for various tax types. It parallels the USPS 3533 form by allowing claimants to request refunds for overpayments made to the government.

- Form 8862: This form is for claiming the Earned Income Credit after a disqualification. Like the USPS 3533, it requires information about the taxpayer's circumstances and relates to financial refunds from government agencies.

Dos and Don'ts

When filling out the USPS 3533 form, it is essential to approach the task thoughtfully. Here are five recommendations on what to do and what to avoid:

- Use blue or black ink: Ensure that all information is legibly filled out using blue or black ink to maintain clarity.

- Print clearly: Complete the form by printing within the designated boxes. This will help prevent errors in processing.

- Include full contact information: Provide accurate details for the customer or company name, address, and telephone number to ensure a smoother transaction.

- Keep copies for your records: Maintain a copy of the completed form for at least 90 days in case you need to refer back to it.

- Specify the reason for the refund: Clearly indicate the specific nature of the refund request to facilitate the processing of your claim.

- Do not leave fields blank: Failing to fill every applicable field can lead to delays in processing your request.

- Avoid using colored ink other than blue or black: Using any other color may make it difficult for staff to read the information.

- Do not neglect to sign the form: A signature is required to validate your request. Without it, your application may be rejected.

- Do not submit without reviewing: Ensure that all entries are accurate and complete before submitting the form to prevent any processing issues.

- Do not ignore the privacy statement: Familiarize yourself with how your information will be used and stored, as indicated in the form.

Misconceptions

Misconceptions about the USPS 3533 form can lead to misunderstandings regarding refund processes. Here are eight common misconceptions, accompanied by clarifications:

- Only large businesses can use the USPS 3533 form. Many individuals and small businesses can utilize this form. It allows any customer seeking refunds for postage and fees to apply.

- The form can be submitted electronically. Currently, the USPS 3533 form must be filled out by hand and submitted in person at the local post office for processing.

- Refund requests can be made at any time without limits. There are specific timeframes for submitting requests. For example, refund requests for unused postage meter stamps must be submitted within 60 days.

- Completing the form guarantees a refund. While the form is necessary to apply, receiving a refund depends on the validity of the claim and USPS policies.

- All fees related to postal services are refundable. Not all fees are refundable. Fees for services such as registered or insured mail typically are not refunded.

- The form can be submitted to any USPS location. It is vital to submit the form to the appropriate post office that services your account or manages the refund request.

- ATM-style refunds are available immediately. Refund processes can take time. Customers should be prepared for potential delays in receiving their funds.

- Privacy concerns are nonexistent when submitting the form. Personal information is required for processing. However, USPS has strict privacy policies to protect customer information.

Understanding these misconceptions can facilitate a smoother experience when applying for refunds through the USPS 3533 form. Clarity about the process is essential for all customers.

Key takeaways

- Form Purpose: The USPS Form 3533 is used to request refunds for various postal services, including postage fees and customer accounts.

- Fill Out Carefully: Ensure you use blue or black ink and print within the designated boxes when completing the form to avoid processing issues.

- Submission Process: After filling out Part 1, submit the form to your local Post Office for further processing. This is a crucial step for your request to be considered.

- Refund Types: Identify the specific type of refund you are requesting by selecting the appropriate box on the form. Various categories cover postage and service fees.

- Sensitive Information: Be aware that the information you provide will be used to process your refund request. While sharing personal details is voluntary, failure to provide them may lead to non-processing of your request.

- Documentation Required: If applicable, attach any necessary documentation, such as spoiled labels or meter stamps. This evidence is critical to support your claim.

- Verification: A postal service official must verify and approve your claim; without this verification, the request cannot proceed.

- Refund Timeframe: When submitting a cash refund request, ensure to sign the designated line. Keep in mind that refunds are subject to certain time limitations.

- Record Keeping: It is advisable to maintain a copy of the completed USPS Form 3533 for your records for at least 90 days after submission.

Browse Other Templates

Florida State Tax Form - Leasing company information is needed when reporting leased employees.

Warrant Quashed - A new warrant may be issued if the defendant fails to appear.

Mn New Hire Form - Submitting reports promptly supports the enforcement of child and spousal support orders.