Fill Out Your Usps 3624 Form

The USPS Form 3624 serves as a crucial document for nonprofit organizations seeking to obtain special mailing rates under the Nonprofit Standard Mail prices. This application is designed specifically for those organizations that meet the eligibility criteria as established by the United States Postal Service. It requires detailed information about the organization, including its complete name, address, and the type of organization it represents, along with contact information for the applicant. This form must be filled out accurately to ensure that the records reflect the correct information about the organization. Notably, certain categories of nonprofits qualify for these reduced rates, and organizations must provide supporting documentation confirming their status, such as IRS exemption letters. The checklist included with the application aids in ensuring compliance with the submission requirements. The completed form, signed by an authorized representative of the organization, must then be submitted to the relevant Post Office for approval. Understanding the nuances of Form 3624 is essential for nonprofits looking to maximize their resources and better serve their communities.

Usps 3624 Example

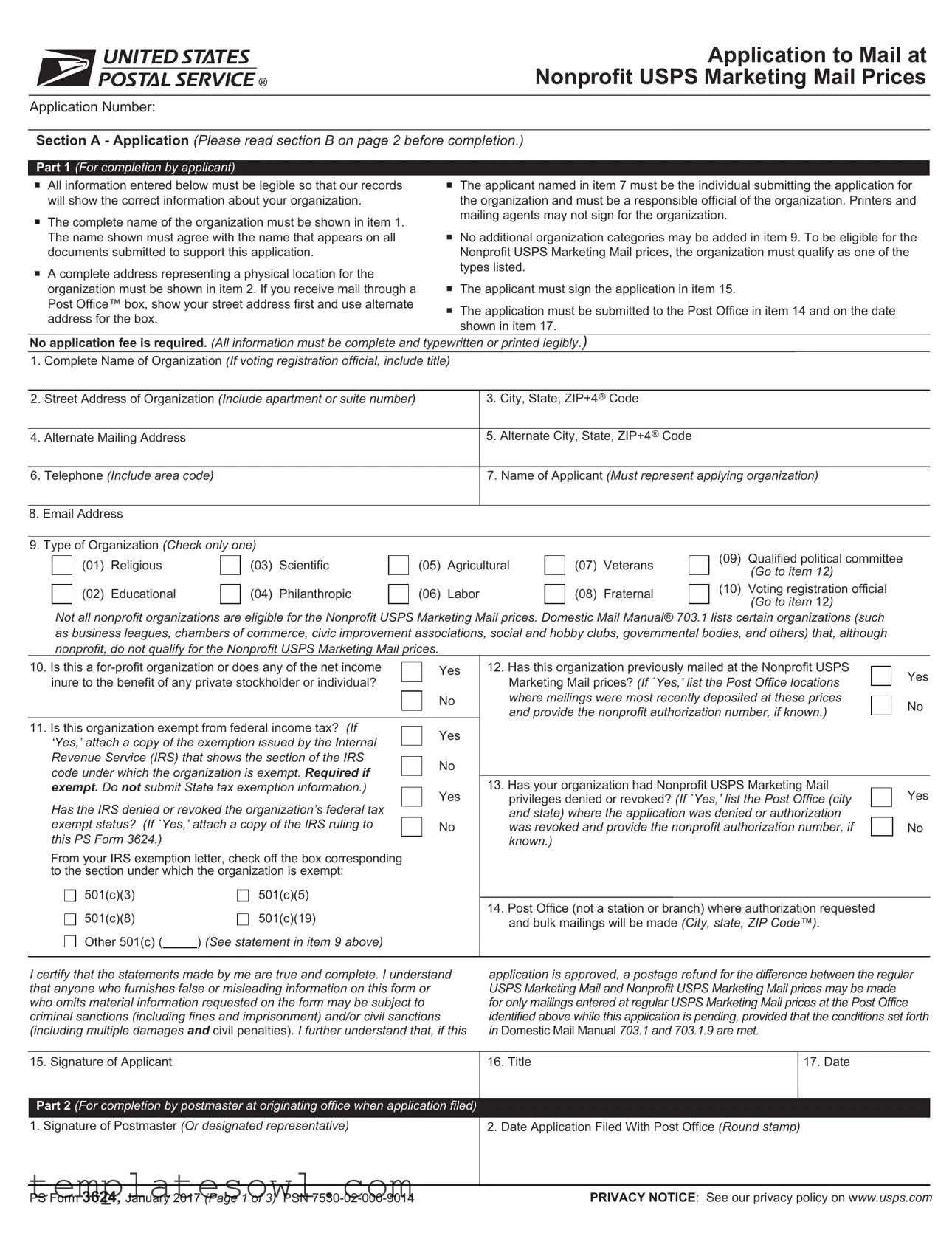

Application to Mail at

Nonprofit USPS Marketing Mail Prices

Application Number:

Section A - Application (Please read section B on page 2 before completion.)

Part 1 (For completion by applicant)

All information entered below must be legible so that our records

will show the correct information about your organization.

The complete name of the organization must be shown in item 1.

The name shown must agree with the name that appears on all

documents submitted to support this application.

A complete address representing a physical location for the

organization must be shown in item 2. If you receive mail through a Post Office™ box, show your street address first and use alternate

address for the box.

The applicant named in item 7 must be the individual submitting the application for

the organization and must be a responsible official of the organization. Printers and

mailing agents may not sign for the organization.

No additional organization categories may be added in item 9. To be eligible for the

Nonprofit USPS Marketing Mail prices, the organization must qualify as one of the

types listed.

The applicant must sign the application in item 15.

The application must be submitted to the Post Office in item 14 and on the date shown in item 17.

No application fee is required. (All information must be complete and typewritten or printed legibly.)

1.Complete Name of Organization (If voting registration official, include title)

2. |

Street Address of Organization (Include apartment or suite number) |

3. City, State, ZIP+4® Code |

|

|

|

|

|

4. |

Alternate Mailing Address |

5. Alternate City, State, ZIP+4® Code |

|

6.Telephone (Include area code)

7.Name of Applicant (Must represent applying organization)

8. Email Address

9. Type of Organization (Check only one)

(01) Religious |

|

(03) Scientific |

(05) Agricultural

(07) Veterans

(09)Qualified political committee

(Go to item 12)

(02) Educational

(04) Philanthropic

(06) Labor

(08) Fraternal

(10)Voting registration official

(Go to item 12)

Not all nonprofit organizations are eligible for the Nonprofit USPS Marketing Mail prices. Domestic Mail Manual® 703.1 lists certain organizations (such as business leagues, chambers of commerce, civic improvement associations, social and hobby clubs, governmental bodies, and others) that, although nonprofit, do not qualify for the Nonprofit USPS Marketing Mail prices.

10. Is this a |

|

|

Yes |

||

|

|

||||

inure to the benefit of any private stockholder or individual? |

|

|

No |

||

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

11. Is this organization exempt from federal income tax? (If |

|

Yes |

|||

|

|||||

‘Yes,’ attach a copy of the exemption issued by the Internal |

|

||||

|

|

||||

Revenue Service (IRS) that shows the section of the IRS |

|

No |

|||

|

|||||

code under which the organization is exempt. Required if |

|

||||

|

|

||||

exempt. Do not submit State tax exemption information.) |

|

Yes |

|||

|

|||||

Has the IRS denied or revoked the organization’s federal tax |

|

||||

|

|

||||

exempt status? (If `Yes,’ attach a copy of the IRS ruling to |

|

No |

|||

this PS Form 3624.) |

|

|

|

|

|

|

|

|

|

|

|

From your IRS exemption letter, check off the box corresponding |

|

||||

to the section under which the organization is exempt: |

|

||||

501(c)(3) |

|

501(c)(5) |

|

||

501(c)(8) |

|

501(c)(19) |

|

||

Other 501(c) ( |

|

) (See statement in item 9 above) |

|

||

|

|

|

|

|

|

12. Has this organization previously mailed at the Nonprofit USPS |

|

Yes |

|

||

Marketing Mail prices? (If `Yes,’ list the Post Office locations |

|

|

|

|

|

where mailings were most recently deposited at these prices |

|

No |

|

||

and provide the nonprofit authorization number, if known.) |

|

|

|

|

13. Has your organization had Nonprofit USPS Marketing Mail |

|

Yes |

privileges denied or revoked? (If `Yes,’ list the Post Office (city |

|

|

and state) where the application was denied or authorization |

|

|

was revoked and provide the nonprofit authorization number, if |

|

No |

known.) |

|

|

|

|

14.Post Office (not a station or branch) where authorization requested and bulk mailings will be made (City, state, ZIP Code™).

I certify that the statements made by me are true and complete. I understand that anyone who furnishes false or misleading information on this form or who omits material information requested on the form may be subject to criminal sanctions (including fines and imprisonment) and/or civil sanctions (including multiple damages and civil penalties). I further understand that, if this

application is approved, a postage refund for the difference between the regular USPS Marketing Mail and Nonprofit USPS Marketing Mail prices may be made for only mailings entered at regular USPS Marketing Mail prices at the Post Office identified above while this application is pending, provided that the conditions set forth in Domestic Mail Manual 703.1 and 703.1.9 are met.

15. Signature of Applicant |

16. Title |

17. Date |

Part 2 (For completion by postmaster at originating office when application filed)

1. Signature of Postmaster (Or designated representative) |

2. Date Application Filed With Post Office (Round stamp) |

|

|

PS Form 3624, January 2017 (Page 1 of 3) PSN |

PRIVACY NOTICE: See our privacy policy on www.usps.com |

Section

Organization Eligibility

The Nonprofit USPS Marketing Mail prices may be granted only to:

1.The eight categories (01 through 08) of nonprofit organizations specified on page 1 in section A, item 9.

2.Qualified political committees (category 09), including the national and state committees of political parties as well as certain named congressional committees.

3.Voting registration officials (category 10), including local, state, and District of Columbia voting registration officials.

These organizations are defined in Domestic Mail Manual (DMM®) 703.1, available for review at pe.usps.com.

To qualify, a nonprofit organization must be both organized and operated for a primary purpose that is consistent with one of the types of organizations in DMM 703.1. Organizations that incidentally engage in qualifying activities do not qualify for the Nonprofit USPS Marketing Mail prices.

Application Procedures

1.Only organizations may apply. Individuals may not apply (except voting registration officials).

2.Only the one category in item 9 that best describes the primary purpose of the organization may be checked.

3.The application must be signed by someone in authority in the organization, such as the president or treasurer. It must not be signed by a printer or mailing agent.

4.The completed PS Form 3624 must be submitted to the Post Office where Nonprofit USPS Marketing Mail mailings will be deposited. If the application is approved, the authorization will apply nationwide. Use PS Form 3623, Request for Confirmation of Authorization (or Pending Application) to Mail at Nonprofit USPS Marketing Mail Prices, to deposit at a Post Office location that does participate in PostalOne!.

Supporting Documentation

The documents listed in 1 and 2 below must be submitted with the completed applications for nonprofit organizations. The documents listed in 3 must be submitted for qualified political committees and, in 4, for voting registration officials.

1.Evidence that the organization is nonprofit and that none of its net income inures to the benefit of any private stockholder or individual. Acceptable evidence includes:

An Internal Revenue Service (IRS) letter of exemption from payment of federal income tax.

If an IRS exemption letter is not available, a complete financial statement from an independent auditor (such as a certified public accountant) substantiating that the organization is nonprofit. A statement from a member of the organization is not sufficient. (Do not submit State tax exemption information.)

2.Documents describing the organization’s primary purpose, such as:

Organizing instruments that state the purpose for which the group is organized, such as the constitution, articles of incorporation, articles of association, or trust indenture. The organizing instrument, including all amendments to the original, should bear the seal, certification, or signature of the Secretary of State or other appropriate state official. If one or more of these documents are not sealed, certified, or signed by state officials, an officer or other person authorized to sign for the applicant should submit a written declaration certifying that the documents are complete and accurate copies of the originals.

Materials showing how the organization actually operated during the previous 6 to 12 months and how it will operate in the future. Bulletins, financial statements, membership forms, publications produced by the organization, minutes of meetings, or a list of its activities may be used.

3.For qualified political committees (category 09), organizational or other documents substantiating that the applicant is the state or national committee of the political party.

4.For voting registration officials (category 10), a copy of the statute, ordinance, or other authority establishing responsibility for voter registration.

Mail Eligibility

An organization authorized to mail at the Nonprofit USPS Marketing Mail prices may mail only its own matter at those prices. It may not delegate or lend the use of its Nonprofit USPS Marketing Mail authorization to any other person

or organization. Cooperative mailings may be made at the Nonprofit USPS Marketing Mail prices only if each of the cooperating organizations is individually authorized to mail at those prices.

DMM 703.1 discusses the specific restrictions against the mailing of certain advertising materials and products.

PS Form 3624, January 2017 (Page 2 of 3)

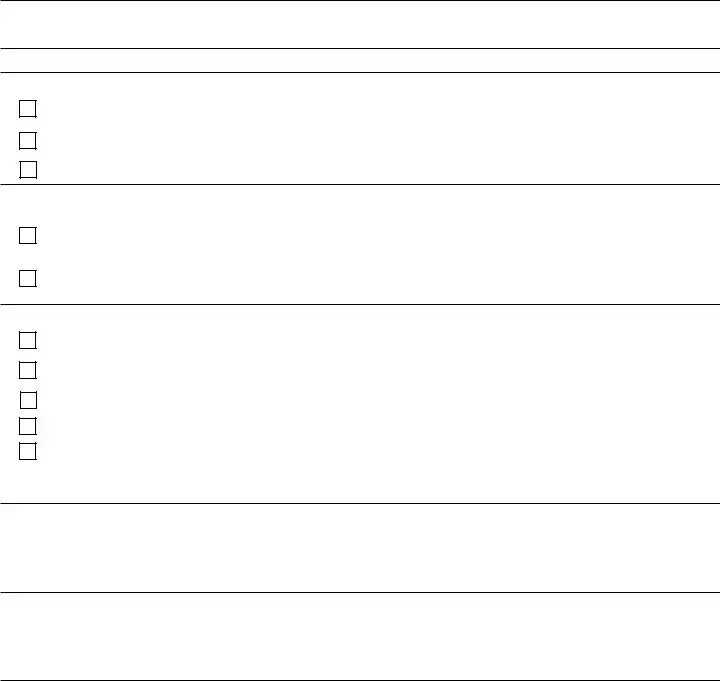

Postal Service™ Checklist for PS Form 3624,

Application to Mail at Nonprofit USPS Marketing Mail Prices

Name of Organization

The organization above provided the following evidence of eligibility for Nonprofit USPS Marketing Mail prices.

1.Nonprofit Status (Select at least one)

IRS letter of exemption from payment of federal income tax

Financial statement prepared by an independent auditor substantiating organization’s nonprofit status (statement must include balance sheets, notes, etc.)

Place of Worship

2.Organization (One complete copy; check all that apply. Must select at least one.)

Articles of Incorporation |

|

Articles of Association |

|

Charter |

|

Constitution |

Enabling Legislation |

|

Trust Indenture |

|

Other (Explain): |

|

|

|

|

|

|

3.Operation (Several samples of each; check types of information included with application)

Bulletins |

|

Brochures |

|

Financial statements |

|

Listing of activities for past 6 to |

|

|

|

|

|

|

12 months |

|

|

|

|

|

|

|

|

|

|

|

|

||

Membership applications |

|

Minutes of meetings |

|

Newsletters |

|

|

Organizational or other documents substantiating that the applicant is the state or national committee of the political party

A copy of the statute, ordinance or other authority establishing responsibility for voter registration

Other (Explain):

The name on all the documents presented as evidence must match the name on the application. If they do not match, please explain.

Postmaster: PostalOne! offices must enter the information from the application into the PostalOne! system.

I certify that the applicant has completed all the items on the application and that each item is legible.

Signature of Postmaster (Or designated representative) |

Date |

|

|

|

|

Telephone (Include area code) |

Post Office (City, state, ZIP Code™) |

|

|

|

|

Date Application Returned to Organization for Correction |

Date Application and Documentation Sent to Pricing and Classification |

|

|

Service Center |

|

|

|

|

PS Form 3624, January 2017 (Page 3 of 3) PSN |

PRIVACY NOTICE: See our privacy policy on www.usps.com |

|

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Application Purpose | The USPS 3624 form is used to apply for Nonprofit Standard Mail prices, which provide reduced mailing rates for eligible nonprofit organizations. |

| Applicant Requirements | The form must be completed by an official representative of the organization, and it requires a complete organization name and physical address to ensure proper processing. |

| Eligibility Criteria | Eligible organizations include religious, educational, philanthropic, and certain other types, as listed in Domestic Mail Manual 703.1. Only specific nonprofit organizations can qualify for these prices. |

| Supporting Documents | The application should include necessary documentation, such as an IRS exemption letter or financial statements, to demonstrate the nonprofit status of the organization. |

Guidelines on Utilizing Usps 3624

Filling out the USPS Form 3624 is an important step for nonprofit organizations seeking to apply for Nonprofit Standard Mail prices. Completing this form accurately will help ensure that your application is processed smoothly and in a timely manner. Here are the steps to guide you through the completion of the form.

- Gather necessary information: Collect all pertinent details about your organization, including its full name, physical address, and federal tax exemption status.

- Complete Section A: In Part 1, fill in each item clearly. Include your organization's complete name in item 1, followed by the complete street address in item 2.

- Provide contact details: Enter the city, state, and ZIP+4 code in item 3. If applicable, include an alternate mailing address in items 4 and 5. Also, enter a contact telephone number in item 6.

- Identify the applicant: In item 7, write the name of the individual responsible for submitting the application. This person must represent the organization, not a printer or mailing agent.

- Share additional information: Include an email address in item 8, and check only one type of organization in item 9. Ensure this is the best fit for your nonprofit.

- Answer eligibility questions: Respond to questions 10 through 13 regarding your organization’s profit status and its previous mailing history. Provide any necessary explanations or details as required.

- Complete the post office information: Fill out item 14 with the city, state, and ZIP code of the post office where you will submit your application. This should not be a station or branch.

- Sign the application: The applicant must sign in item 15 to certify that all information is true and complete. Review your entries carefully for accuracy.

- Submit the form: Take your completed application to the designated post office as indicated in item 14. Include any supporting documents, such as IRS exemption letters if applicable.

- Keep records: Maintain a copy of the completed form and any submitted documents for your records.

Once the application is submitted, it will undergo review. You should receive confirmation of your application status from the post office. If additional documentation is needed or if there are any discrepancies, the post office will reach out for clarification. Remember, thoroughness and attention to detail can greatly aid in the approval process.

What You Should Know About This Form

What is the USPS 3624 form used for?

The USPS 3624 form, officially titled "Application to Mail at Nonprofit Standard Mail Prices," is used by organizations seeking to mail items at reduced rates available to qualifying nonprofit entities. This form serves as a formal application to prove eligibility for these nonprofit mailing prices.

Who is eligible to apply using the USPS 3624 form?

Eligibility for the Nonprofit Standard Mail prices is limited to specific types of organizations. These include religious, educational, philanthropic, scientific, agricultural, labor, veterans' organizations, fraternal organizations, qualified political committees, and voting registration officials. Each applicant must ensure that their organization aligns with the characteristics defined in the Domestic Mail Manual 703.1.

What information is required to complete the USPS 3624 form?

Applicants must provide various types of information on the USPS 3624 form. This includes the organization's complete name, physical address, email address, phone number, and information regarding the applicant’s role within the organization. Additionally, information about the organization's structure, income status, and applicable IRS exemption must be documented.

Is there a fee associated with submitting the USPS 3624 form?

No, there is no application fee required for submitting the USPS 3624 form. Organizations can apply without incurring any costs associated with the application process.

What documents must accompany the USPS 3624 form?

Organizations must provide evidence of their nonprofit status when submitting the USPS 3624 form. Acceptable documents include an IRS exemption letter confirming federal tax exemption or a financial statement prepared by an independent auditor. Additional documentation describing the organization's primary purpose, like articles of incorporation or bylaws, is also necessary.

Who must sign the USPS 3624 form?

The form must be signed by a responsible official of the organization, such as the president or treasurer. It cannot be signed by a printer or mailing agent. The individual signing the form must have the authority to act on behalf of the organization.

How does an organization submit the USPS 3624 form?

The completed form must be submitted to the Post Office location where the nonprofit mailings will take place. It is crucial to ensure that all sections of the form are filled out completely and legibly to avoid delays in processing the application.

What should an organization do if its nonprofit status is denied or revoked?

If an organization's nonprofit status is denied or revoked, the applicant must provide information regarding the denial in the application. Documentation related to the previous status and the reasons for the decision should be attached as well.

Can any type of mailing be sent using the nonprofit rates?

No, an organization can only mail its own materials at nonprofit rates. Additionally, it cannot delegate or lend its Nonprofit Standard Mail authorization to another party. Cooperative mailings are only permitted if all cooperating organizations have their own authorization.

Where can I find more detailed information about the nonprofit mailing eligibility criteria?

More detailed information about nonprofit mailing eligibility can be found in the Domestic Mail Manual 703.1. This document outlines the specific qualifications, procedures, and restrictions for organizations interested in applying for nonprofit standard mail pricing.

Common mistakes

Filling out the USPS 3624 form can be straightforward, but there are several common mistakes that organizations often make. Recognizing these pitfalls can save time and ensure a smoother application process.

One frequent error is not using the **complete name** of the organization in Part 1, item 1. It's crucial that the name provided matches exactly with the official documents submitted. If there are discrepancies, this may lead to delays or denials of applications.

Another common mistake is failing to provide a **complete address** in item 2. The physical location of the organization should be clear, and if mail is received through a P.O. box, the street address must still be included. Incomplete or incorrect addresses can result in significant issues regarding correspondence.

Ignoring the signing requirements can also derail applications. The applicant named in item 7 must be a responsible official of the organization. Many applicants mistakenly think that mailing agents or printers can sign the application, but this is not allowed. Without the proper signature, the application may be rejected.

In item 9, organizations should only check the box that reflects their primary purpose. Some may mistakenly check multiple categories, believing it enhances their eligibility. However, only one box should be selected to ensure compliance with the application rules.

Organizations often overlook the necessity of attaching the **IRS exemption letter** when claiming federal income tax exemption. If this documentation is missing, it may result in disqualification from receiving the Nonprofit Standard Mail prices, even if the organization is otherwise eligible.

Additionally, applicants frequently forget to include detailed documentation regarding their activities. Materials outlining past operations—such as bulletins or financial statements—should accompany the application. Inadequate documentation may lead to delays or denial.

Another mistake is misunderstanding the **mail eligibility** rules. The organization can only mail its own materials at Nonprofit Standard Mail prices. For instance, sharing this authorization with another entity is against the regulations, which could lead to compliance issues.

Lastly, failure to ensure that all information is **legible** can lead to administrative headaches. If any part of the form is difficult to read, it may cause misunderstandings during the processing. Clarity and neatness are crucial for a successful application.

By avoiding these common mistakes and carefully reviewing the application requirements, organizations can improve their chances of quickly obtaining the Nonprofit Standard Mail rates they seek.

Documents used along the form

The USPS Form 3624, known as the Application to Mail at Nonprofit Standard Mail Prices, serves as a vital tool for nonprofit organizations looking to reduce mailing costs while ensuring compliance with postal regulations. Along with this form, several other documents are typically needed to support the application. Here’s a brief overview of some of these essential forms and documents, which help validate the nonprofit status and operational purpose of the organization.

- IRS Exemption Letter: A document issued by the Internal Revenue Service confirming that the organization is exempt from federal income tax. This letter is crucial for demonstrating the nonprofit status required for eligible mailing rates.

- Financial Statement: A complete financial report prepared by an independent auditor that provides a detailed account of the organization’s financial status. This document substantiates that the organization operates on a nonprofit basis and verifies its income distribution policies.

- Organizing Instruments: These include foundational documents such as the articles of incorporation, constitution, or trust indenture that clearly articulate the organization's purpose and structure. They help affirm the legitimacy of the nonprofit’s operations.

- Operational Documentation: Materials that showcase the organization’s activities over the past 6 to 12 months. This could include bulletins, newsletters, and minutes from meetings, providing tangible evidence of ongoing operations aligned with its stated nonprofit mission.

- Documents for Political Committees: For political committees applying under category 09, organizational papers substantiating their status as recognized state or national committees are necessary. This provides clarity on their qualifications for the nonprofit mailing rates.

- Statutory Authority Documentation: In cases where individuals are acting as voting registration officials, a copy of the statute or ordinance that grants them such authority is required. This ensures compliance with legal mandates governing voter registration tasks.

By gathering these essential documents alongside the USPS Form 3624, nonprofits can streamline their application process for discounted mailing rates. This not only saves money but also supports the organization's mission of serving the community more effectively. Understanding these requirements can aid in the smooth submission and approval of their nonprofit mailing applications.

Similar forms

-

PS Form 3623, Request for Confirmation of Authorization

This form is also related to Nonprofit Standard Mail prices. Like PS Form 3624, it is designed for organizations to confirm their eligibility before mailing. While PS Form 3624 is an application, PS Form 3623 serves as a follow-up, ensuring that organizations have the necessary authorization in place.

-

IRS Form 1023, Application for Recognition of Exemption

Nonprofit organizations submit this form to the IRS for federal tax-exempt status, similar to how they apply for nonprofit mailing rates with PS Form 3624. Both forms require detailed information about the organization’s purpose and compliance with legal requirements.

-

IRS Form 990, Return of Organization Exempt From Income Tax

Like the USPS 3624 form, the IRS Form 990 provides necessary financial information for the organization. This helps demonstrate compliance with nonprofit regulations, ensuring the organization maintains its exempt status while also being a part of the Nonprofit Standard Mail pricing scale.

-

State Nonprofit Corporation Application

To operate as a recognized nonprofit entity, organizations typically need to file a state-specific application, akin to submitting PS Form 3624. Both processes establish that the organization meets certain standards to be classified as nonprofit.

-

Form 8868, Application for Extension of Time to File an Exempt Organization Return

This form allows nonprofits to request extra time to file essential documents, similar to the timeframe compliance noted in PS Form 3624. Both forms reflect the need for nonprofits to adhere to specific deadlines in order to retain their statuses and pricing privileges.

-

State Charitable Solicitation Registration Forms

Many states require nonprofits to register before soliciting donations. This process mirrors the requirements of the USPS 3624 form to qualify for nonprofit rates, as both ensure organizations adhere to regulations designed to uphold nonprofit integrity.

Dos and Don'ts

When filling out the USPS PS Form 3624, there are several important dos and don’ts that can help ensure your application process is smooth and successful.

- Do make sure all information is legible. Clear handwriting or typed entries will facilitate processing.

- Do provide the complete legal name of your organization as it appears on all supporting documents.

- Do include a physical street address along with any alternate mailing addresses, if applicable.

- Do have a responsible official from your organization sign the application. Avoid signatures from agents or printers.

- Do submit the application at the appropriate Post Office where Nonprofit Standard Mail will be used.

- Don't check more than one category in the type of organization section. Select only the one that best describes your organization.

- Don't provide additional organization categories beyond what is allowed in item 9 on the form.

- Don't forget to attach any required documentation that supports your eligibility, like IRS exemption letters.

- Don't submit incomplete or inaccurate information, as this could lead to delays or rejections.

- Don't submit state tax exemption information; focus solely on federal tax exemption documentation.

Misconceptions

- All nonprofit organizations qualify for Nonprofit Standard Mail prices. This is a common misconception. Not all nonprofit entities are eligible; only those in specific categories outlined by the USPS, such as religious, educational, and philanthropic organizations.

- The USPS 3624 form requires a fee to apply. In fact, there is no application fee for submitting the USPS 3624 form.

- Individuals can submit the form on behalf of nonprofit organizations. Only authorized officials of the organization, such as the president or treasurer, can submit the application. Individuals, except for voting registration officials, cannot apply.

- An IRS exemption letter is optional. For organizations seeking nonprofit rates, an IRS exemption letter is required to prove that the organization is nonprofit and that none of its net income benefits private individuals.

- Organizations can use their Nonprofit Standard Mail authorization for others. This is incorrect. Nonprofit Standard Mail privileges are only for the organization that holds the authorization. Delegating or lending this authority is prohibited.

- Supporting documents are not necessary. This is misleading. Organizations must submit specific supporting documents, like their IRS exemption letter and a detailed description of their primary purpose.

- Any type of mail can be sent using Nonprofit Standard Mail prices. This is false. Nonprofit organizations can only mail their own materials and must follow guidelines on restricted advertising materials.

- The application must be completed by hand. The USPS specifies that the application must be typewritten or printed legibly to ensure all information is clear and readable.

- Once the application is submitted, approval is guaranteed. This is not true. After submission, the application is reviewed, and there is no guarantee it will be approved. Organizations must verify compliance with all qualifying criteria.

Key takeaways

- Complete the USPS Form 3624 with clear and legible information to ensure accurate processing.

- The organization’s name on the application must match all supporting documents exactly.

- Provide a physical address for the organization; include the street address if a P.O. box is used.

- The applicant must be a responsible official of the organization and cannot be a printer or mailing agent.

- Only one category of organization should be selected in Item 9 to describe the primary purpose.

- Documentation confirming nonprofit status is required, such as an IRS exemption letter or an auditor-prepared financial statement.

- Mailings must only include materials that directly relate to the organization itself and cannot be delegated to others.

- Submit the completed form and supporting documents to the Post Office where mailings will be made to finalize the application.

Browse Other Templates

Dd Form 2708 - Proper completion of this form can facilitate continuity of care and support for prisoners during transitions.

Operating Room Competency Checklist - Accurate self-assessment contributes to improved surgical outcomes for patients.