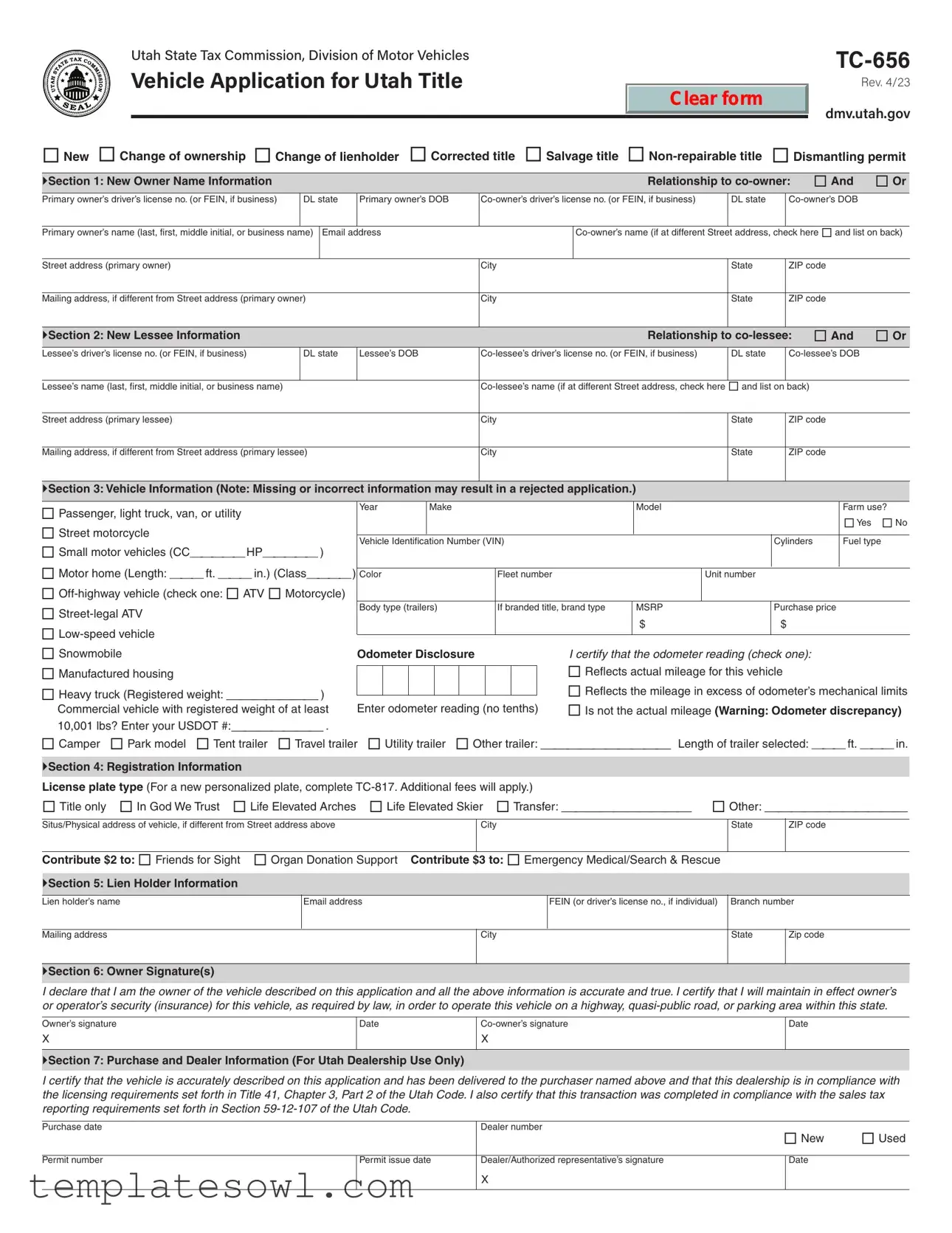

Fill Out Your Utah Dmv Tc 656 Form

If you are navigating the world of vehicle ownership in Utah, understanding the DMV TC 656 form is essential. This comprehensive document serves multiple purposes, including new ownership transfers, lienholder changes, and title corrections. Each section of the form requires specific information, ensuring that all details regarding vehicle ownership are accurately captured. From personal details of new owners and lessees to critical vehicle information like the VIN, make, model, and odometer reading, each entry matters significantly. The form also requires signatures from owners, confirming the accuracy of the provided details and affirming compliance with state insurance laws. Additional information, such as lienholder addresses and options for title branding, must be filled out with clarity to avoid delays. Moreover, the form allows for contributions to various community causes, reflecting a commitment not just to vehicle ownership but also to civic responsibility. Properly completing this form is crucial for a smooth transaction and keeping your vehicle registration compliant with state regulations.

Utah Dmv Tc 656 Example

Clear form

New Change of ownership Change of lienholder Corrected title Salvage title

Section 1: New Owner Name Information |

Relationship to |

Primary owner’s driver’s license no. (or FEIN, if business)

DL state

Primary owner’s DOB

DL state

Primary owner’s name (last, first, middle initial, or business name) |

Email address |

|

|||||||

|

|

|

|

|

|

|

|

|

|

Street address (primary owner) |

|

|

|

City |

State |

ZIP code |

|

||

|

|

|

|

|

|

|

|

|

|

Mailing address, if different from Street address (primary owner) |

|

City |

State |

ZIP code |

|

||||

|

|

|

|

|

|

|

|

|

|

Section 2: New Lessee Information |

|

|

|

|

Relationship to |

And |

Or |

||

Lessee’s driver’s license no. (or FEIN, if business) |

DL state |

Lessee’s DOB |

DL state |

|

|||||

|

|

|

|

|

|

|

|

|

|

Lessee’s name (last, first, middle initial, or business name) |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

Street address (primary lessee) |

|

|

|

City |

State |

ZIP code |

|

||

|

|

|

|

|

|

|

|

|

|

Mailing address, if different from Street address (primary lessee) |

|

City |

State |

ZIP code |

|

||||

|

|

|

|

|

|

|

|

|

|

Section 3: Vehicle Information (Note: Missing or incorrect information may result in a rejected application.)

Passenger, light truck, van, or utility |

Year |

|

Make |

|

|

|

|

Model |

|

|

Farm use? |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes No |

||

Street motorcycle |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Vehicle Identification Number (VIN) |

|

|

|

|

Cylinders |

Fuel type |

|||||||||||||

Small motor vehicles (CC_____HP_____ ) |

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Motor home (Length: ___ ft. ___ in.) (Class____) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Color |

|

|

|

|

|

|

Fleet number |

|

|

Unit number |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Body type (trailers) |

If branded title, brand type |

MSRP |

Purchase price |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

$ |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Snowmobile |

Odometer Disclosure |

|

|

|

I certify that the odometer reading (check one): |

|

|||||||||||||

Manufactured housing |

|

|

|

|

|

|

|

|

|

|

|

Reflects actual mileage for this vehicle |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Heavy truck (Registered weight: _______ ) |

|

|

|

|

|

|

|

|

|

|

|

Reflects the mileage in excess of odometer’s mechanical limits |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Commercial vehicle with registered weight of at least |

Enter odometer reading (no tenths) |

Is not the actual mileage (Warning: Odometer discrepancy) |

|||||||||||||||||

10,001 lbs? Enter your USDOT #:_______ . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Camper |

Park model Tent trailer Travel trailer Utility trailer Other trailer: __________ Length of trailer selected: ___ ft. ___ in. |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Section 4: Registration Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

License plate type (For a new personalized plate, complete |

|

|

|

|

|

|

|

||||||||||||

Title only |

In God We Trust Life Elevated Arches |

Life Elevated Skier |

Transfer: __________ Other: ___________ |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Situs/Physical address of vehicle, if different from Street address above |

|

|

|

|

|

|

City |

|

|

|

State |

|

ZIP code |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Contribute $2 to: Friends for Sight Organ Donation Support |

Contribute $3 to: Emergency Medical/Search & Rescue |

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Section 5: Lien Holder Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lien holder’s name

Mailing address

Email address |

FEIN (or driver’s license no., if individual) Branch number |

|||

|

City |

State |

|

Zip code |

|

|

|||

|

|

|

|

|

Section 6: Owner Signature(s)

I declare that I am the owner of the vehicle described on this application and all the above information is accurate and true. I certify that I will maintain in effect owner’s or operator’s security (insurance) for this vehicle, as required by law, in order to operate this vehicle on a highway,

Owner’s signature

X

Date

X

Date

Section 7: Purchase and Dealer Information (For Utah Dealership Use Only)

I certify that the vehicle is accurately described on this application and has been delivered to the purchaser named above and that this dealership is in compliance with the licensing requirements set forth in Title 41, Chapter 3, Part 2 of the Utah Code. I also certify that this transaction was completed in compliance with the sales tax reporting requirements set forth in Section

Purchase date

Permit number

|

Dealer number |

New |

Used |

|

|

|

|||

Permit issue date |

Dealer/Authorized representative’s signature |

|

Date |

|

|

|

|||

|

X |

|

|

|

|

|

|

|

|

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose of Form | The TC-656 form is utilized for various vehicle transactions in Utah, including new ownership, lienholder changes, and title corrections. |

| Governing Law | This form is governed by Title 41, Chapter 1 of the Utah Code, which outlines motor vehicle registration and titling requirements. |

| Sections Involved | The form consists of six key sections that gather information about the new owner, lessee, vehicle details, registration, lien holder, and signatures. |

| Email Requirement | Applicants are encouraged to provide an email address for communication purposes, enhancing the efficiency of the registration process. |

| Odometer Disclosure | Section 3 contains a critical odometer disclosure, requiring the owner to confirm the accuracy of the vehicle’s mileage. |

| Charitable Contributions | The form allows applicants to contribute to state-supported charities, such as Friends for Sight and Emergency Medical/Search & Rescue. |

| Signature Requirement | Both owner and co-owner must sign the form, affirming the accuracy of the provided information and compliance with insurance laws. |

| Usage by Dealers | Dealers must also fill out the form when completing a sale, certifying adherence to state licensing and tax reporting laws. |

Guidelines on Utilizing Utah Dmv Tc 656

Completing the Utah DMV TC-656 form requires attention to detail. The following steps outline the necessary actions to ensure accurate submission. It is essential to gather all required information and check for completeness before finalizing the form. Errors can lead to delays or rejections, so take your time with each section.

- Select the type of application: At the top of the form, mark the appropriate checkbox for New, Change of ownership, Change of lienholder, Corrected title, Salvage title, Non-repairable title, or Dismantling permit.

- Enter new owner information: In Section 1, provide the primary owner’s details, including their driver’s license number (or FEIN for businesses), date of birth, name, email address, and mailing address. If there is a co-owner, include their information as well, marking the relationship as “And” or “Or.”

- Complete lessee details: If applicable, Section 2 requires the new lessee’s information, including their driver’s license number, date of birth, name, and address, along with any co-lessee details.

- Fill out vehicle information: In Section 3, provide comprehensive details about the vehicle, including its year, make, model, Vehicle Identification Number (VIN), type of fuel, color, odometer reading, and any applicable disclosures.

- Registration information: In Section 4, indicate the desired license plate type. If you wish to contribute, check the relevant boxes to support Friends for Sight, Organ Donation, or Emergency Medical/Search & Rescue.

- Include lien holder details: If there is a lien holder, Section 5 requires their name, mailing address, email address, and FEIN or driver’s license number.

- Signature confirmation: Section 6 must be signed by the owner and co-owner, if applicable. Each must also include the date of their signature, confirming the accuracy of the provided information.

- Dealer information: If applicable, Section 7 should be filled out by a dealership. This includes certification by a dealer/authorized representative, purchase date, and permit details.

After completing the form, review everything for accuracy and completeness. Once satisfied, submit the form according to the Utah DMV’s guidelines, ensuring any required fees are attached. Following these steps will help facilitate a smooth processing of your application.

What You Should Know About This Form

What is the purpose of the Utah DMV TC 656 form?

The Utah DMV TC 656 form is primarily used for various transactions involving vehicle ownership. This includes applying for a new title, changing ownership, updating lienholder information, or obtaining a corrected title. It serves as an essential document for both vehicle owners and the Department of Motor Vehicles to maintain accurate records.

Who needs to fill out the TC 656 form?

Any individual or business that is involved in a vehicle title transaction in Utah will need to complete the TC 656 form. This includes primary owners, co-owners, lessees, and lienholders. Essentially, if you're buying, selling, or modifying the ownership details of a vehicle, this form will likely be necessary.

What information is required in Section 1 of the form?

Section 1 focuses on the new owner name information. Here, the primary owner's and co-owner's names, driver’s license numbers, dates of birth, and contact details are required. If the owners have different mailing addresses, there is an option to provide that information on the back of the form. It's essential to ensure that all information is accurate to avoid delays.

How do I report odometer readings on the TC 656 form?

Odometer readings are reported in Section 3 of the TC 656 form. Applicants must select between several options: whether the mileage reflects actual mileage, exceeds the mechanical limits, or is not the actual mileage. Providing accurate odometer readings helps prevent potential issues related to mileage fraud.

What happens if I make a mistake on the form?

If there's a mistake on the TC 656 form, it may result in your application being rejected. It is crucial to double-check all entries for accuracy before submission. If you notice an error after submitting, you might need to complete a new form to rectify the mistake.

Are there any fees associated with applying using the TC 656 form?

Yes, there may be fees associated with vehicle title transactions. If you request new personalized plates, for example, additional fees will apply. Always confirm the specific fees with the Utah DMV to ensure you come prepared when submitting your form.

How do I designate a lienholder on the TC 656 form?

Section 5 of the TC 656 form is dedicated to lienholder information. This section requires the lienholder's name, mailing address, and either their FEIN or driver’s license number. Clearly providing this information is crucial, especially for those financing their vehicle purchases.

What should I do if I'm co-owning a vehicle?

If you are co-owning a vehicle, both owners must provide their details in Section 1 of the TC 656 form. You will need to indicate the relationship and ensure that signatures from both owners are included at the end of the form. This confirms mutual agreement on the ownership information shared.

Is there a section for charitable contributions on the form?

Yes, the TC 656 form includes optional sections for making contributions to various causes, such as organ donation support and search and rescue missions. You can choose to contribute $2 or $3 towards these initiatives when filling out the form, making it easy to support worthwhile causes as part of your vehicle registration process.

How do I submit the completed TC 656 form?

Once you have completed the TC 656 form, you can submit it in person at a Utah DMV office. In some cases, you may also be able to mail your completed form to the appropriate DMV office. Always check the latest guidelines on the Utah DMV website to determine the best submission method for your specific situation.

Common mistakes

Filling out the Utah DMV TC 656 form can be a straightforward process, but many people make common errors that can delay the application. One of the most frequent mistakes involves omitting essential information. Sections requiring names, addresses, and Vehicle Identification Numbers (VIN) must be completed accurately. Failure to include complete details often leads to rejection of the application. Always double-check every section for clarity and thoroughness.

Another common error is entering incorrect or mismatched information. For instance, the driver’s license number or the Vehicle Identification Number must exactly match the information on official documents. Misalignment in details can trigger complications or lead to further scrutiny by the DMV, causing unnecessary delays. It is vital to verify that every entry corresponds precisely to the corresponding document.

Many applicants also overlook the importance of signatures and dates. All necessary signatures from the owner and co-owner, if applicable, should be provided. Moreover, the dates should accurately reflect when the form is completed. Neglecting this detail not only invalidates the application but may also signify to the DMV that the form was filled out hastily or without proper attention, resulting in further delays.

Additionally, individuals often fail to complete the odometer disclosure correctly. Misrepresenting the odometer reading or neglecting to check the appropriate box can raise red flags. It's critical to acknowledge whether the mileage reflects actual numbers or if it has exceeded mechanical limits, as this can bear serious legal implications.

Finally, not reviewing the mailing address section can lead to complications. If the mailing address differs from the street address, it needs to be clearly indicated. An oversight here may result in failure to receive important documentation or information from the DMV, potentially complicating matters further. Always ensure that every detail is thoroughly reviewed before submitting the form to avoid these common pitfalls.

Documents used along the form

When dealing with vehicle ownership and registration in Utah, certain forms and documents often accompany the Utah DMV TC-656 form. Each of these documents serves a specific purpose, ensuring that your application process is smooth and efficient. Here’s a brief overview of the key documents that may be required.

- TC-817: This form is used to apply for personalized license plates. Specific instructions and additional fees apply when requesting a customized plate.

- TC-661: Required for a lien holder to document the car loan. This form provides necessary details about the lender and the loan agreement.

- TC-880: This application is for requesting a duplicate title. If the original title is lost or damaged, this form helps in obtaining a replacement.

- TC-747: This is the odometer disclosure statement. It's essential when transferring ownership to verify the vehicle's actual mileage.

- Bill of Sale: This document serves as a receipt for the transaction, proving that payment was made for the vehicle. It includes details about the buyer, seller, and vehicle specifics.

- Application for Registration: This is often needed when registering the vehicle for the first time or when renewing registration, capturing essential details about the vehicle and its owner.

- Power of Attorney: If someone else completes the registration on your behalf, this legal document is necessary to grant them the authority to act for you.

When preparing your application, ensure you have all the necessary forms ready to avoid delays. Each form plays a crucial role in facilitating the registration and ownership transfer process, making it essential to understand them well.

Similar forms

The Utah DMV TC 656 form is essential for various vehicle ownership and registration processes. Several other documents serve similar purposes, each related to vehicle ownership, registration, or lienholder changes. Here are five documents that share similarities with the TC 656 form:

- Vehicle Title Application (Form TC-841): This document is required when applying for a new title in Utah. Similar to the TC 656, it collects information about the vehicle and its owners. This application can also address changes in ownership.

- Notice of Sale (Form TC-65): This document informs the DMV about the sale of a vehicle. Like the TC 656, it includes details about the buyer and seller. It ensures that ownership records are updated to reflect the sale.

- Affidavit of Loss (Form TC-125): If a vehicle title is lost, this form allows the owner to request a replacement. Similar to the TC 656, it confirms the ownership status and includes the owner's details for proper identification.

- Application for a Duplicate Title (Form TC-657): This form is used to obtain a duplicate title when the original is misplaced. Much like the TC 656, it requires the owner's personal information and details about the vehicle to facilitate the replacement process.

- Registration Renewal Application (Form TC-650): This document is utilized when renewing a vehicle's registration. Like the TC 656, it captures crucial information about the vehicle and the registered owner, ensuring that records remain current.

Each of these forms plays a vital role in the proper documentation and processing of vehicle transactions in Utah, similar to the TC 656 form, promoting efficient and accurate management of vehicle ownership records.

Dos and Don'ts

When filling out the Utah DMV TC 656 form, there are some important dos and don'ts to keep in mind. These tips will help ensure your application is filled out correctly and processed without delays.

- Do read all instructions carefully before beginning.

- Do provide complete and accurate information in all sections.

- Do use clear and legible handwriting if filling out by hand.

- Do double-check the vehicle information, especially the VIN.

- Do sign and date the application where indicated.

- Don't leave any required fields blank.

- Don't use nicknames or abbreviations for names.

- Don't forget to check the appropriate boxes for ownership types.

- Don't submit the form without the necessary supporting documents.

- Don't make any alterations or corrections without initialing them.

Misconceptions

Understanding the Utah DMV TC 656 form is essential for anyone involved in vehicle ownership changes in the state. However, misconceptions can lead to confusion and delays in processing. Below are ten common misconceptions about this form, along with clarifications to help ensure a smoother experience.

- The TC 656 form is only for new vehicle purchases. Many believe this form is limited to new vehicles, but it's actually used for various reasons, including transferring ownership, correcting titles, and reporting salvage titles.

- You can submit the form without complete information. Some think partial information is acceptable. However, incomplete applications may be rejected, causing unnecessary delays.

- Only the buyer needs to sign the form. It's a common belief that only the new owner must sign. Both the owner and any co-owner need to provide their signatures to validate the transfer.

- The form is only necessary for private sales. This is a misconception. The TC 656 form is also required in dealership transactions and for changes of lienholders.

- All fields must be filled out, even if not applicable. Some may feel obligated to complete every field. However, you can leave sections that don’t apply blank, provided it does not hinder the overall information.

- Submitting the form guarantees immediate ownership change. Many expect the transfer to be instantaneous. Processing times can vary, and some applications may take longer based on government workloads.

- There are no fees associated with the TC 656 form. People often assume it's a free process. While submitting the form might not incur direct fees, additional costs related to title changes and registration may apply.

- The form can be submitted online at any time. Many assume they can fill out and submit the form online whenever they want. Certain conditions apply, and some submissions still require in-person visits.

- You can change ownership without notifying the lienholder. Some think it's acceptable to transfer ownership without informing the lienholder. In most cases, the lender must be updated to prevent legal complications.

- The form is only for personal vehicles. This is incorrect; the TC 656 is applicable to a range of vehicle types, including commercial vehicles, trailers, and off-highway vehicles.

By understanding these misconceptions and the realities about the TC 656 form, individuals can navigate the vehicle registration and transfer processes more effectively.

Key takeaways

Filling out and using the Utah DMV TC 656 form is an important step in managing vehicle ownership and registration in the state. Here are key takeaways to consider:

- Form Purpose: The TC 656 form serves various purposes including new ownership, change of lienholder, and obtaining a salvage title.

- Accurate Information: Ensure all information is accurate. Missing or incorrect details can lead to a rejected application.

- Owner Information: Provide complete information for both primary and co-owners, including names, addresses, and driver’s license numbers.

- Lessee Details: If the vehicle is leased, include accurate information for the lessee and co-lessee, similar to the owner details.

- Vehicle Specs: Include complete vehicle details such as make, model, VIN, and odometer reading to avoid processing delays.

- Registration Choices: Indicate the desired license plate type. Options include personalized plates, standard plates, or specialized designs.

- Signatures Required: Owner and co-owner must sign the form, acknowledging the accuracy of the provided information and certifying insurance coverage.

- Lien Holder Notification: If applicable, provide lien holder information. This must include the name, address, and email, ensuring compliance with ownership claims.

Following these guidelines can simplify the process and enhance the likelihood of a smooth transaction at the DMV.

Browse Other Templates

How to Become a Medicaid Provider in Florida - Access to handbooks and additional resources is facilitated through provided links.

Assessment Evaluation Form,Environment Quality Rating Sheet,Childcare Assessment Tool,Early Childhood Evaluation Scale,Facility Observation Checklist,Learning Environment Rating Form,Child Development Assessment Sheet,Space and Interaction Rating Gui - Health practices are also considered, ensuring the environment supports children's physical well-being.

Jiffy Lube Hiring Near Me - If there are specific hours you cannot work, please list them so we can make arrangements.