Fill Out Your Uti Folios Consolidation Form

The UTI Folios Consolidation form provides a streamlined method for investors to combine multiple folios into a single account, making management of investments easier and more efficient. This form requires accurate information, including existing folio numbers and updated contact details, to ensure a smooth consolidation process. By consolidating folios, investors can reduce the number of accounts they manage, thereby simplifying changes to personal information such as bank account details, email addresses, and mobile numbers. To qualify for consolidation, the folios involved must share identical details regarding the holders, including their names, order, and status. Once submitted, the requested folios will be merged into a target folio, which defaults to one of the listed accounts if not specified. It’s crucial to follow the guidelines provided on the form’s reverse side to avoid any delays in processing. Additionally, the form requires signatures from all unit holders if the investments are held jointly, underscoring the importance of confirming that all the information is accurate and compliant. By taking these steps, investors can enjoy the convenience that comes with a streamlined approach to investment management.

Uti Folios Consolidation Example

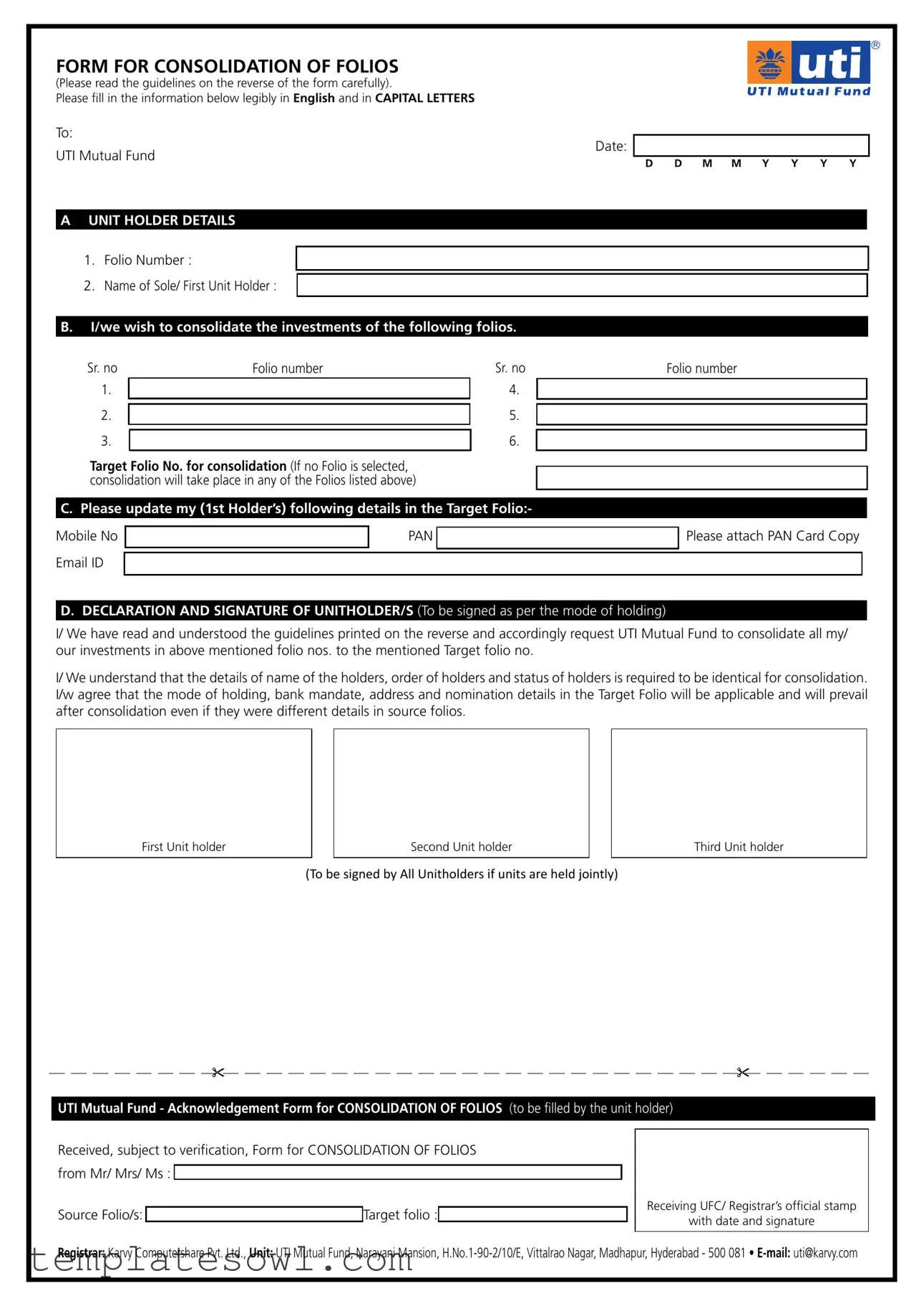

FORM FOR CONSOLIDATION OF FOLIOS

(Please read the guidelines on the reverse of the form carefully).

Please fill in the information below legibly in English and in CAPITAL LETTERS

To:

UTI Mutual Fund

AUNIT HOLDER DETAILS

1.Folio Number :

2.Name of Sole/ First Unit Holder :

Date:

d d m m y y y y

B.I/we wish to consolidate the investments of the following folios.

Sr. noFolio number 1.

2.

3.

Target Folio No. for consolidation (If no Folio is selected, consolidation will take place in any of the Folios listed above)

Sr. noFolio number 4.

5.

6.

C. Please update my (1st Holder’s) following details in the Target Folio:-

Mobile No |

|

PAN |

|

Please attach PAN Card Copy |

|

Email ID |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D. DECLARATION AND SIGNATURE OF UNITHOLDER/S (To be signed as per the mode of holding)

I/ We have read and understood the guidelines printed on the reverse and accordingly request UTI Mutual Fund to consolidate all my/ our investments in above mentioned folio nos. to the mentioned Target folio no.

I/ We understand that the details of name of the holders, order of holders and status of holders is required to be identical for consolidation. I/w agree that the mode of holding, bank mandate, address and nomination details in the Target Folio will be applicable and will prevail after consolidation even if they were different details in source folios.

First Unit holder

Second Unit holder

Third Unit holder

(To be signed by All Unitholders if units are held jointly)

UTI Mutual Fund - Acknowledgement Form for Consolidation of Folios (to be filled by the unit holder)

Received, subject to verification, form for Consolidation of Folios

from Mr/ Mrs/ Ms : ________________________________________________________________

Source Folio/s: _______________________________Target folio :___________________________

Receiving UFC/ Registrar’s official stamp

with date and signature

Registrar: Karvy Computershare Pvt. Ltd., Unit: UTI Mutual Fund, Narayani Mansion,

Guidelines

1)The consolidation of folios will bring convenience of managing less than of folios to investors. This will also have ease of changing any details such as bank account, email ID, mobile number, etc., if any.

2)The folios having identical details of holders such as number of holders, name of the holders, status of holders can be requested for consolidation. Eg. All the folio having single holder of same holder or all folios with Mr A as first holder and Mrs B as second holders can be consolidated.

3)The Folios requested as specified by the unitholders, subject to the conditions of identical holding, shall be consolidated in the folio number requested by the investor as Target folio. In the absence of any such Target Folio specified by the investor, any one folio will be considered as Target Folio by the Registrar. In such case, the details of bank account etc. as prevailing in the target Folio will be applicable after consolidation to all the units.

*********

Check list

The form has been filled up completely.

The form is signed by the holder/s as per the holding basis.

Target folio number has been mentioned.

Holding basis, name of the holders etc. have been checked for the folios requested to be consolidated.

Form Characteristics

| Fact Name | Fact Details |

|---|---|

| Purpose of the Form | The UTI Folios Consolidation form is designed to help investors consolidate multiple folios into a single target folio for easier management. |

| Eligibility for Consolidation | Folios can only be consolidated if they have identical details of holders, including the number of holders and their names. |

| Target Folio Specification | If the investor does not specify a target folio, the registrar will select one of the listed folios to serve as the target. |

| Required Information | Investors must provide their PAN, mobile number, and email ID, along with the target folio number for consolidation. |

| Legal Guidelines | The consolidation process is governed by mutual fund regulations as stipulated by the Securities and Exchange Board of India (SEBI). |

Guidelines on Utilizing Uti Folios Consolidation

The Uti Folios Consolidation form allows you to combine multiple investment accounts into one. This process simplifies the management of your investments and makes it easier to update your personal information in the future. To ensure a smooth consolidation, it's essential to follow the steps below carefully.

- Obtain the Uti Folios Consolidation form and read the guidelines carefully.

- Complete the section labeled "A. UNIT HOLDER DETAILS." Write your Folio Number and your name as the Sole/First Unit Holder in CAPITAL LETTERS. Also, include the date of filling out the form in the format day/month/year.

- In section "B," list all the folios you wish to consolidate. Under "Sr. No," enter each Folio Number you want to combine.

- Identify the Target Folio Number for consolidation. If you do not specify a Target Folio, one of the listed folios will automatically be chosen.

- In section "C," provide your updated contact details, including your Mobile Number, PAN (Permanent Account Number), and Email ID. Don't forget to attach a copy of your PAN Card.

- In section "D," read the declaration carefully. Ensure that you and any other unitholders understand the statements about the consolidation process, especially the requirement for identical details across folios. Sign where indicated, ensuring to do so as per the mode of holding (jointly or individually).

- Lastly, make sure to check the checklist provided at the end of the form. Confirm that the form is completely filled out, appropriately signed, and includes the Target Folio Number.

After completing the form, you can submit it to the designated UTI Mutual Fund office for processing. Keep a copy of the submitted form for your records and ensure you receive an acknowledgment of your request. Your investments will soon be consolidated, leading to better management and ease of access.

What You Should Know About This Form

What is the purpose of the Uti Folios Consolidation form?

The Uti Folios Consolidation form allows investors to combine multiple folios into a single folio. By doing this, individuals can simplify the management of their investments. For example, if you have several folios with identical details, consolidating them helps in streamlining changes to important information like bank accounts or contact details.

Who is eligible to use the consolidation form?

Essentially, any investor holding multiple folios with UTI Mutual Fund can apply for consolidation. However, it’s crucial that the folios you wish to combine have identical holder details—such as the number of holders, names, and their order. If discrepancies exist in those details, consolidation cannot proceed.

What details do I need to provide in the form?

When filling out the form, ensure that you clearly enter your Folio Number, your name (as the first unit holder), and the target Folio Number where the investments should be consolidated. Additionally, you’ll need to update your mobile number and email ID, along with attaching a copy of your PAN card. These steps are essential for processing your request accurately.

What happens if I do not specify a target folio?

If you fail to designate a specific target folio in your request, the registrar will select one from the listed folios. This will be done randomly. It’s important to note that after consolidation, the details—like bank accounts and addresses—of the selected target folio will apply to all your units, even if those details differ in other folios.

How is my request for consolidation acknowledged?

Once you submit the Uti Folios Consolidation form, you will receive an acknowledgment upon verification. This acknowledgment will include your name and the source folios involved in the consolidation, alongside the target folio that will be used. Keep this document safe, as it serves as proof of your request.

Are there any conditions specific to the consolidation process?

Yes, there are important conditions to keep in mind. All folios to be consolidated must exhibit identical holder details, such as the order of names and types of holders. For instance, you can consolidate folios with a single holder or those where Mr. A is the first holder and Mrs. B is the second. If these conditions aren't met, your request may be denied.

What should I check before submitting the form?

Before finalizing your submission, verify that you have completed the form in its entirety. Ensure all required signatures are present, particularly according to the mode of holding. Confirm that you’ve specified a target folio number and that all details regarding the holders are correct and match across the folios outlined in your request. This diligence will facilitate a smoother consolidation process.

Common mistakes

Filling out the UTI Folios Consolidation form can be straightforward, but many people still make crucial mistakes that can delay the consolidation process. One common error is failing to provide the Target Folio Number. This number is essential as it identifies where all other investments will be consolidated. If you neglect to specify a target folio, the registrar will randomly select one from the listed folios, which may not align with your intentions.

Another frequent mistake involves incomplete information. The form requires detailed information including names, folio numbers, and personal contact details. Each section of the form must be filled out completely and legibly in capital letters. Omitting even a single piece of required information could result in processing delays or the rejection of your consolidation request.

It’s also important to remember that all holders’ details must match across the folios you wish to consolidate. This includes the names, order of holders, and status of the holders. If discrepancies exist between the folios, the consolidation request will likely be denied. It is advisable to double-check that everything matches to avoid unnecessary complications.

Another error seen frequently is the misunderstanding of the declaration and signature requirements. If units are held jointly, all holders must sign the form as per the holding basis. Not obtaining all necessary signatures can lead to an incomplete application. Ensure that every required signature is obtained and check that it aligns with how the units are held.

Lastly, many people overlook reviewing the guidelines provided with the form. Ignoring these instructions can lead to mistakes that could otherwise be easily avoided. These guidelines outline essential details about the consolidation process, so taking the time to read them thoroughly can save you from future issues. Always invest a moment to familiarize yourself with the rules before you start filling out the paperwork.

Documents used along the form

Alongside the UTI Folios Consolidation form, there are several important documents that often accompany the consolidation process. Each of these documents plays a crucial role in ensuring that the consolidation is executed smoothly and that all necessary information is accurately provided to the mutual fund.

- PAN Card Copy: A copy of the Permanent Account Number (PAN) card is essential for identity verification. It ensures compliance with tax regulations and helps prevent fraudulent activities.

- Bank Mandate Form: This document provides details of the bank account where dividends or other payments will be credited. It ensures that all transactions post-consolidation are directed to the correct account.

- Nomination Form: A nomination form allows an individual to designate a person who will inherit the mutual fund units in case of death. This helps in ensuring the seamless transfer of assets to the nominee.

- UTI Mutual Fund - Acknowledgement Form: This form is filled out by the receiving office to confirm receipt of the consolidation request. It often includes details such as the name of the unit holder and the folio numbers involved.

Each of these documents complements the UTI Folios Consolidation form by providing essential details and confirmations necessary for the successful consolidation of investments. Properly completing and submitting these forms can create a streamlined experience for investors looking to simplify their portfolio management.

Similar forms

- Change of Address Form: This document allows an individual to update their address within a financial institution's records. Similar to the Uti Folios Consolidation form, both facilitate the management of essential personal information, ensuring that account details are current and accurate.

- Account Transfer Request Form: Used when an individual wants to transfer their account from one financial institution to another. It parallels the consolidation form in that it addresses changes to account holdings, requiring verification of identity and account details before the transition.

- Investment Redemption Form: This document is utilized to withdraw or redeem mutual fund units. Like the consolidation form, it specifies unit details and requires the unit holder's signature, underscoring the importance of holder verification in the management of investment accounts.

- Nomination Form: This form allows the unit holder to designate beneficiaries for their mutual fund investments. It shares a commonality with the consolidation form, as both require precise personal information and encourage the updating of crucial account details to maintain compliance and clarity in beneficiary designations.

- Bank Mandate Form: This document authorizes a financial institution to debit or credit a bank account. It is similar to the Uti Folios Consolidation form in that both address the need for accurate banking information associated with an investment account and require the unit holder’s consent and verification.

Dos and Don'ts

5 Things to Do When Filling Out the Uti Folios Consolidation Form:

- Read the guidelines on the reverse side of the form carefully.

- Fill in the form legibly using CAPITAL LETTERS.

- Ensure that all required information is complete before submission.

- Double-check that the Target Folio number is specified.

- Sign the form according to the mode of holding.

5 Things Not to Do When Filling Out the Uti Folios Consolidation Form:

- Do not leave any sections of the form blank.

- Avoid using lowercase letters or non-English characters.

- Do not forget to attach a copy of your PAN card if required.

- Refrain from submitting the form without verifying the holder details.

- Do not ignore the guidelines regarding identical details of holders.

Misconceptions

Misconception 1: The UTI Folios Consolidation form is only for joint holders.

Many people believe that this form is exclusively for investments held by multiple individuals. However, this is not the case. The form is also beneficial for individual investors. Even if you hold a folio in your name only, you can still consolidate your investments into a single folio for easier management.

Misconception 2: Consolidation will change the ownership details.

Some investors worry that consolidating their folios will alter the ownership information, such as the names of the holders or the order of holders. This concern is unfounded. The guidelines state that the details of the holders must match for consolidation to occur. Therefore, the names and order must remain identical to ensure accurate consolidation.

Misconception 3: The Target Folio must always be specified.

Many individuals think that it is mandatory to fill in a Target Folio number in order to process the consolidation. While it is beneficial to specify one, if no Target Folio is chosen, the Registrar will select one from the list of submitted folios. This means consolidation can still proceed without prior selection.

Misconception 4: The process is overly complicated.

Some people perceive the form and the required guidelines as cumbersome. In reality, the consolidation process is designed to simplify your investment management. Filling out the form and understanding the requirements can streamline your investment portfolio and reduce the number of folios you manage.

Key takeaways

1. Accurate Information is Essential: Fill out the Uti Folios Consolidation form clearly and in CAPITAL LETTERS. This ensures that your requests are processed without delays due to illegible handwriting.

2. Identify Target Folio: Always specify a Target Folio number for consolidation. If you do not select one, the registrar will choose a folio for you, which may not reflect your preferred details.

3. Matching Details Required: Ensure that all the folios you wish to consolidate have identical details. This includes the names, order of holders, and statuses. Inconsistent information can lead to rejection of your request.

4. Signatures Matter: All unit holders must sign the form according to the joint holding agreement. Missing signatures can result in processing delays or issues.

Browse Other Templates

Molina Medicaid Transportation - Fill out the passenger’s first name and last name as registered with Medicaid.

State Residence Verification,Legal Domicile Certification,Military Residency Declaration,Tax Residency Affidavit,Service Member Residence Certification,Home of Record Confirmation,Income Tax Residency Form,Domicile Establishment Certificate,Military - Evaluate your situation carefully before submitting your certification.

Work Order Completion Form - Provide the date of loss to establish a timeline for repairs.